Here’s My Daily Trading Routine That I’ve Used For 10+ Years

I recently watched a documentary about Bill Gates on Netflix and the thing that stuck with me the most from it was that he didn’t become one of the wealthiest people in the world through luck or inheriting huge sums of money. He literally reads like 8 books while traveling, he can read 150 pages an hour, and he ENJOYS learning. One of his close friends said “Bill always knows more about any subject than the person he’s talking to about it”. What does this have to do with trading? Everything…

I recently watched a documentary about Bill Gates on Netflix and the thing that stuck with me the most from it was that he didn’t become one of the wealthiest people in the world through luck or inheriting huge sums of money. He literally reads like 8 books while traveling, he can read 150 pages an hour, and he ENJOYS learning. One of his close friends said “Bill always knows more about any subject than the person he’s talking to about it”. What does this have to do with trading? Everything…

The key to trading success is developing yourself into a profitable trader by learning to trade properly and being consistently disciplined to follow an effective trading routine until it becomes a habit.

Here’s what you need to know about trading routines: Trading routines are the real key to success in the market. There’s no magic indicator or algorithmic trading robot that is going to easily make you a profitable trader. Just like Bill Gate’s routine each and everyday over the course of years, led him to insane financial success, so can your trading routine. However, if you have no routine or the wrong routine, you will never become a successful trader. Could Bill Gates have laid around watching T.V. eating Cheetos all day instead of reading everything he could get his hands on about business and programming? Sure. And you would never know who Bill Gates was if he had done that.

There’s a “fire” inside of Bill Gates; a desire to learn, to grow, to be more, that seemed to be part innate and part developed through his childhood. I cannot provide this for you, you must develop it if you don’t have it. But, I CAN give you the framework, the “keys” to the “kingdom” so to speak, but you have to be in the proper trading mindset to be able to ‘turn’ the key. So, if you’re ready, read on and learn about the daily trading routine that has worked for me for the last 10+ years in the market….

The Main Ingredients of My Daily Trading Routine

- My trading routine involves interacting with the market FAR less than many other traders. This works for me and I firmly believe that it will work for you for the following reasons: Less stress, Less time to mess up your trades by over-involvement, low trade frequency, instills discipline, you control only yourself and don’t try to control the market.

- My overall approach is to focus on end-of-day data, which means I focus on the daily chart time frames and I will typically wait until the market closes each day to really sit down and take a close look at the markets in my watch list. This is what I call a part time trading routine and not only does it have the advantage of less screen-time (so you can do other things) but the very fact that you’re spending less time in front of the charts actually will improve your trading performance over the long-term.

- I take a weekly view first: I check out the weekly chart time frames, draw in the key levels, get a feel for the near-term and long-term trends and make a note of any obvious / large price action reversal signals.

- Next, we are looking at the daily chart time frame. We are mainly looking for key levels of support and resistance, the current and recent market conditions: Trending or sideways? And last but not least, we are looking at the PRICE ACTION; any signals that may have formed near the key levels? Any signals formed after a pull back to a level? Note: Levels can be horizontal levels of support or resistance or EMA – exponential moving averages or even 50% retrace levels.

- Now, since this is just a blog post, I have to “gloss” over some of the more detailed topics like money management, trading psychology, stop loss placement, etc, but you can follow the links I just provided to learn a bit more and of course these topics are discussed much more thoroughly in my professional trading course.

- What is the GLUE of all of this? Of my entire trading process? Simple. It’s routine – discipline – habit or RDH. Let me explain this to you (it’s critical) – Remember my mention of Bill Gates earlier? Bill Gates probably has better habits than you (or me to be honest), Warren Buffet too. The elite of the world, those men and women who have amassed large fortunes or otherwise succeed at their craft, got to that point through Routines that took Discipline which turned into Habits. The dedication is unreal, but honestly, that is what it takes. Bill Gates doesn’t read so many books because he hates it, he does it because he genuinely loves it! So, you really must love trading and you must love the routine and discipline if you hope to turn them into proper trading habits. Proper trading habits are what bring you wealth in the markets, there is no easy way or short-cut other than TRULY loving the process. And remember, I can show you my process, the one that has worked for me, but it’s up to you to LOVE it, to be passionate enough about the process to make it work!

My Daily Trading Process: Chart Analysis and Trade Execution

The first major chart aspect of my trading routine is taking a “bird’s eye” view of the markets on my watch list. That usually means starting with the weekly chart time frame and giving it a good once-over. I am mainly looking for key levels in the market, major turning points, trends and areas of consolidation to make note of. I always mark the key levels on the weekly chart first, here’s an example:

Next, I will drop down to a daily chart time frame and begin analyzing it in a very similar way. The key levels from the weekly may need to be adjusted a bit on the daily, depending on the price action or you may need to draw in additional levels:

Now, I am analyzing the near-term market conditions to decide which direction is the best to trade in and what nearby levels / areas are the most important to watch. I will often use a moving average here, like the 21 EMA or similar, to help see the near-term trend and momentum. You will also want to learn to identify periods of Higher Highs / Higher Lows and Lower Highs / Lower Lows, which you can learn more about it in my article on how to identify trending markets.

Last, but certainly not least, I am looking for price action signals / potential trades. I am especially looking for “clean and obvious” signals that line-up with levels on the chart, in other words, that have confluence.

- What you saw above in the charts is a brief overview of my weekly / daily chart analysis routine that I do for all the markets in my watchlist. If you don’t have a watch list, you should read my article on creating market watch lists for more.

- Markets go through phases. Study the markets you like the most in your watch lists and you will get to know them, get intimate with them. If you see some or most of them are in bad trading phases, or sideways consolidation that’s choppy, just glance at them and walk away or don’t even check them for a few days. The best trading phases or conditions are trending or when markets are trading in very defined and larger trading ranges.

- I cannot pound this into your head enough: MOST TRADERS LOSE BECAUSE THEY LOOK AT THE CHARTS TOO DAMN MUCH! The market is not meant to be a casino so don’t treat it as one. Don’t get addicted to it! View and treat the market as a way for you to show how planned, skilled and disciplined you can be and you will get rewarded handsomely for doing so.

How I Find a Trade, Set it Up and Execute It

Now, once you have done the above steps, let’s say you spot a potential trade. Here is how I will set it up with the entry, stop loss and profit target placement…

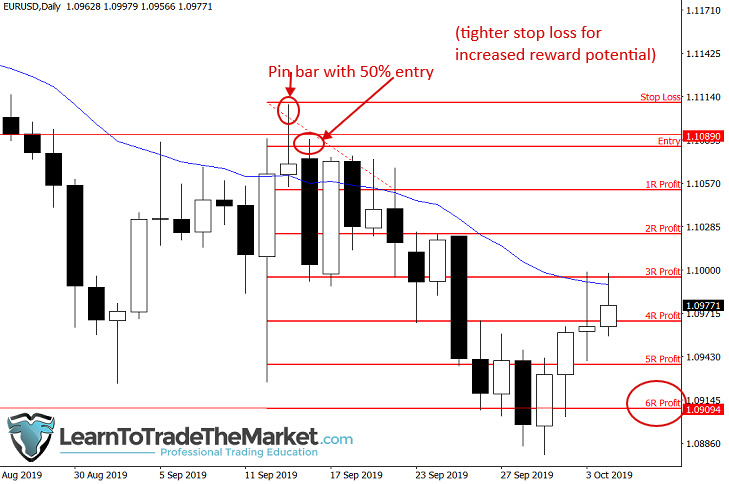

- Notice the “price action signal” in the chart below, this was technically a bearish tailed bar, followed by a pin bar signal that was also an inside bar within that bearish tailed bar. Price consolidated for a few days before ultimately breaking lower with the existing downtrend.

- Price had pulled back to resistance at the 21 EMA (blue line) and the 1.1250 horizontal level, so we had multiple points of confluence: level and trend.

- Traders could have netted 2R profit from this trade had they held on to it for 3-4 weeks after entry. This is why I always preach set and forget trading!

- This example shows a clear pin bar sell signal that formed at resistance (both horizontal and ema) and within a downtrend. This was a very clear and obvious trade for a savvy price action trader. Stop loss was just above the pin bar high and a 2-3R profit was easily achieved if you held the trade for a couple of weeks.

- An interesting “twist” on the last trade above is seen below. Notice the entry was made as a 50% retrace entry of the pin bar’s tail.

- This entry allows for either a tighter stop loss and hence increased potential risk / reward OR with a normal width stop you could give the trade more breathing room. In this case, we are showing a tighter stop with increased risk reward, 6R was possible here!

Conclusion

In today’s lesson, I have shown you how I personally analyze the charts each week and day and gave you a ‘peek’ into my own personal trading habits. Hopefully, after reading today’s lesson (and re-reading it) you now have a better understanding of WHY you need a daily trading routine and HOW to develop one.

The above daily trading routine is the core foundation that all of my trades are built on, and it’s my opinion that all aspiring traders need such a foundation to build their trading career on if they want to have a serious chance at making consistent money in the markets.

Many of you know I publish a daily market commentary each day shortly after the daily Forex market close. However, what you may not know is that doing these daily commentaries (similar to above charts) is also part of my daily chart analysis and trading routine. I actually started writing down my thoughts about the markets each day well before I started this website, and it’s something I’ve done continuously every trading day for about the last decade. It’s literally a habitual part of my daily life…if I miss a day of commentary for some odd reason, like travel or a holiday, I literally feel ‘strange’, and like something is ‘missing’. You need to get to that point too.

For on-going help and assistance with learning to trade, analyzing the markets, spotting trades and building your own personal trading plan, my daily commentary and members’ analysis is a great example of how I perform my rolling (ongoing) analysis of the market in real-time conditions. This is something that you can learn from me and mimic on your charts. I encourage you to “watch over my shoulder” each day as I analyze the charts and plan my trades in the members daily chart analysis area and my trade ideas newsletter.

Please Leave A Comment Below With Your Thoughts On This Lesson…

If You Have Any Questions, Please Contact Me Here.

Very informative post. ANy advice to European traders becuase the markets open at 11pm?

Thanks

Hi Nial, excellent post!

I have actually tested your strategy on the 1H on EURUSD, specificall with pin bars and inside bars and they work quite well in that shorter timeframe. I set my TP at a key level or when I see price slowing down considerably. I know you trade on the daily TF, but I like a bit more anxiety in my trading, and I must say that it is quite effective on the shorter TF’s (but not lower than the 1H).

Excellent and I am also going to be doing your professional course soon.

Thanks for sharing

I love this content, straight forward. No, meditate, positive affirmation bla bla. Really straight to what to look for, what time frame…. I am an active trader with small account doing my best to grow and learn,so under the pdt rule, basically I buy now sell on the following day.

Great lesson, good master. Thank you Nial.

More power to your elbows, you really assisting our condition 👍💝

That’s great .Thanks to you to share your knowledge.

Thanks so much Nial. I’m looking forward to fly from Nigeria to Australia just to appreciate the great influence you have in my trading success

Amazing Write-Up!

Thanks, Nial sir,

Its gives clear-cut views about trading with patterns and price actions

Really worth a breakdown of the process.

Very useful ideas. Thanks a million bro.

That was a great read, thanks!

Thanks for the great ideas, maximum respect.

Nial, always is a pleasure to read you and “re-read you” and “read you once again” !!!

Lots of pearls of wisdom. Thank you so much for the time and passion you put into every article.

Stay safe and healthy !!!

Thank you this content is invaluable

Thank you sir. You make my day!

wow thank you sir for this wonderfull post i really appreciate its really help full

I’am very pleased to let you know that this article is blessed from God to me. Thank you dear Nial.

Wow, your strategy is amazing. I could not imagine to be professional like you!

This is amazing. Nial Fuller’s strategy is second to none when profitability is the focus. Am happy to have come in contact with such a tutor. I shall adopt his strategy whenever am ready to start trading.

Thank you for the feedback! Glad you are enjoying the article.

I hope So many helpfuly this strategy for all forex trader – thank you for give us – take a love ????????

Very nice article. Very helpful for me..! Thanks for sharing.

I must confess that since I come across your teaching about forex, I have developed seen a change in me about the market, thanks very much sir, keep the good work moving.

Thank you Nial fot this great article

You r grate person as your hard work helps more to became honest, diciplined n habitual trader. Thanks a lot

Thanks nail fuller for your support

Thanks alot you are God sent , very conspecous

Thank you nial for sharing your hard earned routine ,very informative & im looking forward to more-steve

In uk

I am very grateful to you. Thank you.

Thanks Nial.

Yes keep it very simple, just look out for high quality setup on higher time frame and stick to routine. Now i am begin to see a consistent trades. The biggest enemy is our own mind when we begin to wander away from our routine.

The success will come when we have enough patient for setup to present it self in daily chart instead of engaging our self for more trades because of itchy hands. LOL

Cheers

Greatest article ever, such an eye opener.

Hi Nial, very interesting article. Please allow me to ask you a question that relates to my personal trading situation. I am trading forex on MT4 and my watch list consists of 28 currency pairs. If I draw support and resistance lines on the weekly and daily time frames for every currency pair, I will need at least 28 separate charts to be open on my computer screen in order to facilitate this trading routine. That makes the whole operation a mess because 28 charts on a single screen, even with only one maximized and the other 27 minimized, is too much. Can you suggest a different way to follow up all these 28 currency pairs?

Hello, i think u need to start journaling to keep up with all pairs and not look at them all in one time. Just write down some pairs who are near Key levels and check them only. And on new day just look for key levels again. It will be less mess and more productivicy!

Janis S

having 28 currency pair on your watchlist is away to many,you only need to scan through their charts to identify the pairs that are best technically appealing to your understanding,say for example 5 pairs. then diagnose their price chart and research on the fundamental inherence of each currency that make the pair.

hi keith , if you concentrate on one pair the succeed will be increase when you want trade 28 pair surly you can,t get any profit

thank alot with this experiance

Thanks Nial, well written article. If one has a routine, discipline and habit {RDH}, money will follow. Personally I think that is what matters most in the market, sticking to a routine, otherwise noone knows what is going to happen in the market but with proper RDH, one is almost certain to reap the rewards. Thanks ounce again. Best regards.

Great article! Thank you for the lesson!

Dear Nial,

Thanks for very inspire writing. After read it i felt like i was reborn again. You have done very good job to stress how important to have a trading routine and to love it. Thanks again and i cannot wait to read your next articel.

Thanks Nail on this great exposition on your daily trading routine.

Mr. Nial, very good article. Could you reveal your annual average result in RR ratio after a decade of trading? It would be helpful to have the right expectations.

Best Regards,

Dan

Thanks Sir. Really I’m inspired by your articles. Always wait for your post.

Thanks Nial . You are Invincible.

thanks my mentor, its really nice going through your post over and over. Before stumbling upon your articles, losses on trading had been my partner but after some quite articles i read from you, made me a constant profit trader. As a matter of fact i have recovered all my losses. thanks once again Nial.

Thanks for the daily trading routine lesson.i enjoyed the lesson.

I’m very happy to receive your post. It’s well documented. Thank you!

Dear Nial,

I would like to express my thought as a new comer and struggler in this trading platform, this is simply an another Great one to learn! Please Keep sending us sir. I always wait for your article to read and learn to walk in a consistent way.

Thank you very much. God bless you.

Thanks for the article Nial. Learned something new.

Got a question regarding holding trades for weeks for a better RR. I see that most brokers have swap fee (that applied daily). So if I hold some pairs for weeks to get a better RR, I am worried that the swap fee will eat into my profits.

Do you have any suggestions for this? Appreciate your feedback.

Hi Nial,

Once again, you are just paving the way for us traders to follow the path. Great article.

Always look forward to your post.

You have said it all. Truth is always obvious. All I need do is practice it, internalize it and develop into a habit.

Great article! I will surely try this strategy since I have been a loser for a long time.

It all comes down to love. The love for trading. That was very insightful and very inspirational.

Thanks Nail good article

Nial – great article… One amusing exception is your choice off Gates: his fortune came from the 1 clever, somewhat sneaky distribution agreement he did with IBM IN 1981,b facilitated by having . legally gifted parents… The rest of Microsoft’s history has been a fairly simplistic extension forward of system application , until Mr. Nadella took over in 2014.

Mr. Gates’ fortune was essentially insured by the time of the 1986 IPO, which had nothing to do with the activities of the past 33 years… Certainly not his voluminous reading habits…

Even as the company’s part time chief technologist, it’s hard to say that his contributions AFTER the IPO were unique…

But the rest of your piece was excellent…! :)

(And i actually am fan of Mr.Gates’ work, except his Common Core and political nonsense…)

Thanks for the positive feedback on the article. I do however strongly disagree with your view of Gate’s.

Hello,

What trading platform/ brokerage would u recommend for swing trading and position (long-term) trading?:)

Thanks Nial!

Thank you Nial my trading skills have improved because of you. I am making tremendous improvement.

May God bless you and your whole generation.

What a great article !!!

Beautiful. You got it again. God bless you Nial

Thanks Nial, its a great Article it really inspire me

I enjoyed reading it sir,,,you are the best

Thanks for article!

Thank you sir! I will put it in action now! Thanks millions

Thanks Nial Fuller!

This is a good one.

I am a beginner and currently doing demos. Very informative article I want to learn more from you. The gist of it is discipline, and I need a bit of logical whipping which apparently you can administer nicely! Thanks alot Neal.

But I see a lot of your trades are based on the H4 Time Frame, how would you explain that?

An honest, candid and to the point, advise, for the betterment of all those TRADERS, who are struggling to improve their performance in Forex tradings. What really would matter is, to simply, adhere to RDH in a true sense.

NIAL ! Thank you so much,

with Regards

Very Informative…Salamat. God Bless!

Excellent article Nial. Learning more and more everyday by reading them.

A very good advise to traders. Thanks Nail.

Is the Bollinger Band a useful indicator (Daily / H4) ?

Thanks a lot, Mr. Nial.

Dear Nial,

I am a beginner and I am more than willing to learn. I hope to learn much more from you!

I am interested to know how to use Moving average correctly!

Best regards

Thanks Nial for sharing your thoughts.

Great lesson Nial. I love your systematic approach to finding high probability trades. Will definitely adopt your system in my trading plan.

Thanks

Thanks Nial, great as always.

Hello Nill. I am your student. I look at your lessons. I really like your approach, your system. I really want to learn how you trade. I want to thank you very much for your work. Respectfully your student from Russia.

Thank you Nail this is awesome and very strong it’s the real way to succeed consistently. Thanks a million.

Extremely powerful, thanks Nial, I am in your foot print, I will work on your line until I get there.

I appreciate your efforts. Thanks a lot Sir.

Great sharing! Thanks!

Why don’t u use trendlines

They are hindsight tools, look great after it’s already happened, but using them live is haphazard and not reliable.

your rt boss, i total agree with you. i would have gone far in my trading if not that i went and learnt trend line trading strategy, and after that i started trading with it for about 9 months. but it was a total mess, and when i finally discover that horizontal support and resistance line on the higher time frame is the king i wiped every trend line on my chart away and since then my trading took a turn around. your the best mentor and God will keep blessing you for putting in your time to educate up coming traders like us

Dear Nial,

I am always waiting your article for reading..and I getting lot of knowledge and confidence…so pls keep it up ..

Thank you and God bless you and new traders like me

Manohar Nadkar

India

Hi Nial, I like the article, thank you. I have been trying to trade for a while now and I still struggle to identify a good trade that will take me for a good positive journey. In another article you mention the 8 and 21 EMA and the crossover of these lines, is this a strategy that a very time poor over worked person can use to enter trades?

You are right, routine, as boring as it is, focus and commitment combined with a reliable trading method are key to trading success. As for Mr. Gates, you are not entirely correct. He was (is) smart indeed, but he was also extremely lucky and …. a thief. If the documentary you watched was truthful, surely it must have mentioned the many lucky breaks he got especially during his early years when he was still unknown (IBM is just one that comes to mind) and the many software ideas he admittedly stole from other companies which he incorporated in his own software, claiming it as his own. Anyhow, as always great article loaded with great advice. This one in particularly spells out exactly how to attain trading riches.

Thanks for the guidelines. I’m using this strategy presently by checking the weekly chart, look for support and resistance level, then check on daily chart support and resistance level and move to 4H for execution.

Hi, do you have a platform for beginners. I mean folks who know NOTHING of trading but, really want to learn.

Thanks in advance