Trading Price Action and Pin Bar Reversals in the Forex Market

In today’s article, I will be introducing traders to ‘price action signals for Foreign Exchange (FOREX)

Today I am presenting an introduction to what price action is, and then I will provide a basic price action pattern for traders to use in their trading.

Forex candlestick patterns

Before we get started with learning to trade off of price action, we need to understand how to read a basic forex candlestick charts.

Before we get started with learning to trade off of price action, we need to understand how to read a basic forex candlestick charts.

Candlestick charts are my favorite chart type because they vividly show the “force” with which either the bulls or the bears won during the particular time period being analyzed.

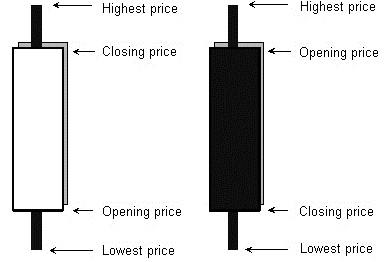

We can see in the image to the right how to read a basic a bull candlestick (the white one) and a bear candlestick (the black one)

In my opinion, learning to trade Forex with candlestick patterns is one of the keys to long term success.

What is price action?

Price action can be simply defined as trading from a naked price chart, with no other inputs. We display a bar or candle chart on time frames such as weekly, daily, 4 hour, etc. The term price action signal will be given to any predetermined pattern/trigger which develops from a single price bar or series of price bars.

Most traders will remember my core philosophy is to KISS, (keep it simple stupid). When you trade with pure price action, you are trading from a first tier data. Our decisions are based on one input i.e. price. Conversely, when we trade from indicators and other fancy trading systems, there are multiple / second tier pieces of data to analyze. Trading price action is trading the ‘here and now’, with no delay and with nothing to cloud our view of the market. Price action trading allows the trader to trade off of the clearest picture of the market, uncluttered by messy overlays, this helps traders remain objective in their analysis of the market.

Price action trading makes a trader’s job a lot easier

When a trader has to make fewer decisions in regards to every trade, his life becomes livable and stress free. Contrary to what most so called experts say, it is very possible to trade with fewer inputs. Inputs would be areas like financial, forex news, world news etc. Another input might also include the number of indicators and charting tools that are used for discovering and managing trades. Another input that could be avoided is listening to friends opinions or the talking heads on CNBC about what to trade or when to make a trade.

When a trader has to make fewer decisions in regards to every trade, his life becomes livable and stress free. Contrary to what most so called experts say, it is very possible to trade with fewer inputs. Inputs would be areas like financial, forex news, world news etc. Another input might also include the number of indicators and charting tools that are used for discovering and managing trades. Another input that could be avoided is listening to friends opinions or the talking heads on CNBC about what to trade or when to make a trade.

Whenever you listen to the news and the opinions of others, you then have to filter that data through your thinking process. You actually have to make some kind of decision concerning all those bits of information you come across. Attempting to understand how all those various inputs will affect the markets is usually difficult to manage. Predicting how traders will react to the plethora of news items is often a haphazard and illogical process to go through. It is really a guessing game that most so called experts are unable to consistently figure out.

In a nutshell, great Forex traders always go back to the very foundation of a market; its naked price chart (a raw blank candle or bar chart), and make most of their critical trading decisions off of it.

The human mind is the best analysis tool of all time

By simply observing the price behavior of the market with our own brains, it can be seen as trending, hitting resistance or support, congesting sideways, etc. No computer or indicator, or news item will provide this information perfectly, except the human brain. In short, in the debate of the human mind vs. computers in Forex trading, the human mind always comes out on top.

How to actually implement price action trading strategies

This article was not designed to teach a complete method of price action entries, but merely introduce you to the concept of trading from raw price charts and to stress the significance of removing all other variables.

The remainder of the article will help you discover one pattern which has a statistical edge in trading.

An example of a price action entry in 3 steps

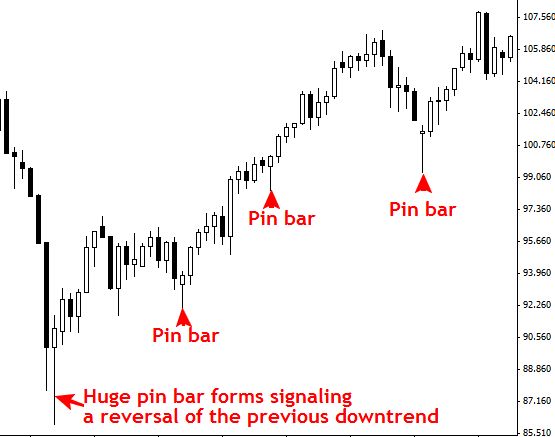

Refer to the daily AUDJPY currency chart below.

Step 1. We have observed price behavior as trending UP. We can see prices had been moving higher and higher. There was clearly low volatility and no trading congestion and the market was in a “runaway” trend.

Step 2. With our assumption that the trend is up , we naturally would be happy to go long (buy), if a price action signal developed. We are now on the look our for a trigger bar, or series of bars.

Step 3. Find an entry trigger – A pin bar reversal is a key reversal candle or price bar on a chart which shows an obvious change in sentiment during that period. The candle typically has an obvious shadow (long tail), with the close near or above the open.

A logical example is when a market opens, moves down 1 percent and then rallies hard to close above the open.

The bar looks like a “Pinocchio Nose”, thus the term “Pin Bar”.

Where to trade a pin bar

• The pin bar is traded best from support or resistance, a key moving average , potentially even a 50% retracement of some form, or from another key chart level.

• Keep a look out for the obvious pin bars, and trade in the opposite direction of the tail. If the price moves up to recent highs and prints a pin bar with tall upper shadow, then the signal is to short (sell signal). The opposite is true for longs (buy signals).

• Pin bars are often created near extremes in price swing, and often occur at false breaks, but that’s another article in itself.

In summary

Price action trading is a golden tool, because we can use it to trade from very simple yet highly effective price action patterns like the pin bar reversal and others.

Try to forward test these pin bar reversal patterns on your daily and 4 hour charts by trading them on your demo-account, do research on them and begin to master them. Continue to learn the art of price action trading and you will surely advance your trading career 10 fold. If you want to gain a thorough understanding of price action, pin bars, and all my Forex trading strategies, be sure to check out my Price Action Trading Course Page Here. If you have any questions or feedback you can contact me here.

Related Videos:

I mean it’s true to feel less stressful to tade with longer time frame

• Keep a look out for the obvious pin bars, and trade in the opposite direction of the tail. If the price moves up to recent highs and prints a pin bar with tall upper shadow, then the signal is to short (sell signal). The opposite is true for longs (buy signals).

Can you explain more detail sir? Because i am just beginner in forex. Thank you sir Nial

Good article Nial …good one to start with to become a price action trader

This is really good stuff Nial. It also seems too simple to be true. Thanks for sharing.

Peace

DR

you have changed my trading with this mind blowing article.

keep the ball rolling……………………

Dunno how good your price action course is ..YET .. but it must be good if this is free..