6 Price Action Retracement Entry Types You Need To Know

You’ve probably heard the word “retracement” or “retrace” quite frequently if you’re interested in trading the financial markets. But do you actually know what price retracements are, why they’re so important and how to properly take advantage of them? Perhaps not, but even if you do, today’s lesson is going to shed new light on how to utilize these extremely powerful market events…

You’ve probably heard the word “retracement” or “retrace” quite frequently if you’re interested in trading the financial markets. But do you actually know what price retracements are, why they’re so important and how to properly take advantage of them? Perhaps not, but even if you do, today’s lesson is going to shed new light on how to utilize these extremely powerful market events…

A retracement in a market is a pretty easy concept to define and understand. Simply put, it’s exactly what it sounds like: a period when price retraces back on a recent move, either up or down. Think about “retracing your steps”; going back the same way you came. It’s basically a reversal of a recent price move.

Why are retracements important? For a number of reasons: They are opportunities to enter the market at a “better price”, they allow for optimal stop loss placement, improved risk reward and more. A retrace entry is more conservative than a “market entry” for example and is considered a “safer” entry type. Ultimately, the goal of a trader is obtain the best entry price and manage risk as good as possible whilst also increasing returns; the retracement entry is a tool that allows you to do all three of these things.

This lesson will cover all aspects of trading retracements and will help you understand them better and put them to use to hopefully improve your overall trading performance.

Now, let’s discuss some of the Pros and Cons of retracement trading before we look at some example charts…

Pros of Retracement Trading

Let’s talk about some of the many “Pros” of retracement trading. To be honest, retracement trading is basically how you trade like a sniper, which, if you’ve followed me for any length of time, you know is my preferred method of trading.

- Higher Probability Entries – The very nature of a pull back or retrace means that price is likely to continue moving in the direction of the initial move when the retrace ends. Hence, if you see a strong price action signal at a level following a retracement, it’s very high-probability entry because all signs are pointing to price bouncing from that point. Now, it doesn’t always happen, but waiting for a retrace to a level with a signal, is the highest-probability way you can trade. Markets rotate back to the “mean” or “average” price over and over; this is clear by looking at any price chart for a few minutes. So, when you see this rotation or retrace happen, start looking for an entry point there because it’s a much higher-probability entry point than simply entering “at market” like most traders do.

- Fewer Premature Stop-Outs – A retracement allows more flexibility with stop loss placement. Mainly, in that you can place the stop further away from any area on the chart that is likely to be hit (if the trade you’re taking is to workout at all). Placing stops further away from key levels or moving averages or further away from a pin bar high or low for example, gives the trade a higher chance of working out.

- Better Risk Rewards – Retracement entries theoretically allow you to place a “tighter” stop loss on a trade because you’re entering closer to a key level or you’re entering at a pin bar 50% level on a trade entry trick entry for example. So, should you choose to do so, you can place a stop much closer than if you entered a trade that did not happen after a retrace or if you entered a pin bar trade at the high or low of the pin, for example. Example: a 100 pip stop and 200 pip target can easily become a 50 pip stop and 250 pip target on a retrace entry. Note: you don’t need to place a tighter stop, it’s optional, but the option IS There on a retrace entry if you want it. The alternative, using a standard width stop has the advantage of decreasing the chances of a premature stop out.

- A risk reward can also be slightly increased even if you use a standard stop loss, instead of a “tighter one”. Example: a 100 pip stop and a 200 pip target can easily become a 100 pip stop and a 250 pip target. Why? It’s because a retrace entry lets you enter the market when it has “more room” to run in your direction, as a result of the fact that price has pulled back and it thus has more distance to move before it retraces again as compared to if you entered at a “worse price” further up or down.

Cons of Retracement Trading

Of course I’m going to be honest with you and let you know some of the “cons” of retracement trading, there are a few that you should be aware of. However, this doesn’t mean you shouldn’t try to learn retracement trading and add it to your trading “toolbox”, because the pros FAR outweigh the cons.

- More Missed Trades: Good trades will “get away” sometimes when waiting for a retracement that doesn’t happen, for example. This can test your nerves and trading mindset and will annoy even the best traders. But trust me, missing out on trades is not the worst thing in the world and it’s better to miss out on some trades than to over-trade, that is for sure.

- Less Trades in General – A lot of the time, markets simply don’t retrace enough to trigger the more conservative entry that comes with a pull back. Instead, they may just keep going with minimal retracements. This means you will have less chances to trade overall as compared to someone who isn’t primarily waiting for retraces.

- As a result of the above two points, retracement trading can be frustrating and takes incredible discipline. However, if you develop this discipline you’ll be WELL ahead of the masses of losing traders and so retracement trading can help you develop the discipline you must have to succeed at trading no matter what entry method you end up using.

Retracements Provide Flexibility in Stop Loss Placements

Placing your stop loss at the wrong point can get you knocked out of a trade prematurely, that you otherwise were right on. By learning to wait for market pull backs or retracements, you will not only enter the market at a higher-probability point, but you’ll also be able to place your stop loss at a much safer point on the chart.

- Very often, traders get discouraged because they get stopped out of a trade that technically they were right on. Placing a stop loss at the wrong point on a chart can get you taken out of a trade before the market really has a chance to get going in your direction. A retracement offers up a nifty solution to this problem by allowing you to put a safer and wider stop loss on a trade, giving you a better chance at making money on that trade.

- When a market retraces or pulls back, especially within a trending market, it is providing you with an opportunity to place your stop loss at a point on the chart that is a lot less likely to knock you out of a trade. Since most retraces happen into support or resistance levels, you can place the stop loss further beyond that level (safer) which is significantly less likely to be hit than if it was closer to the level. Using what I call a “standard” stop loss (not a tight one) in this instance will give you the best chance at avoiding a premature knock-out of a trade.

The Different Retrace Entry Types: Examples

Next, let’s take a look at some of the different retrace entry types so that you can get a clear look at what they might look like…

- Retrace Entry Without Price Action Signal

In the example below, you can see price retraced or pulled back to the key horizontal level shown in the chart. There was no obvious price action signal here but we can see price quickly sold-off from that level after just barely pushing above it. This provided traders a very high potential risk reward scenario if they entered on a “blind entry” at the level with a tight stop loss…

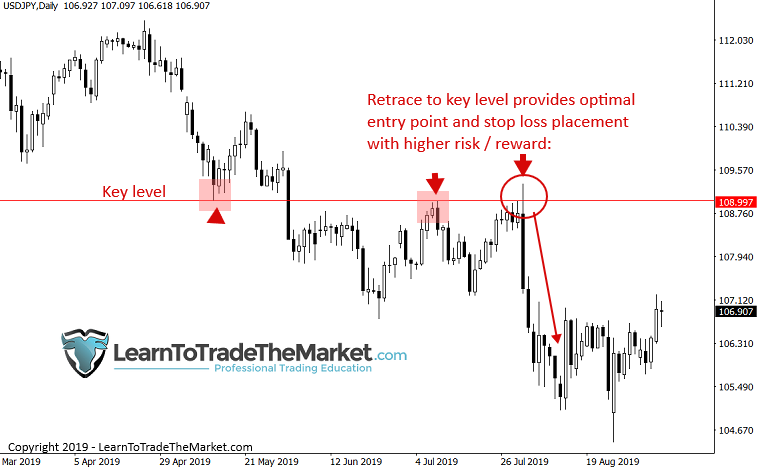

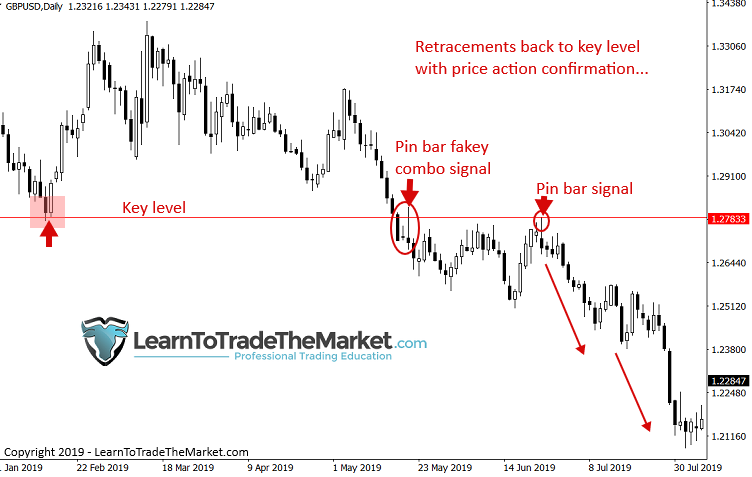

- Retrace to Key Level with Price Action Confluence

Perhaps my favorite trading strategy of all time is the following example: Wait for price to retrace back up or down to an existing key level on the daily chart time frame, then watch for an obvious price action signal to form there. In my opinion, this is the highest-probability way to trade…

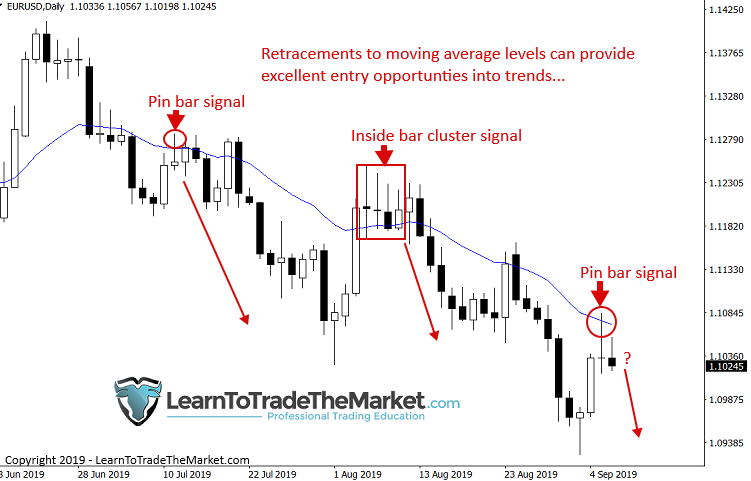

- Retrace to Moving Average (rotation to the mean)

Markets have a tendency to retrace to the mean or average price, which you can see by putting a moving average on your charts. Shown below is the 21 day ema, a solid short-term moving average to see the trend on the daily chart. When price retraces back to this level you should watch closely for price action signals forming there to get a high-probability entry and get in on a trending market…

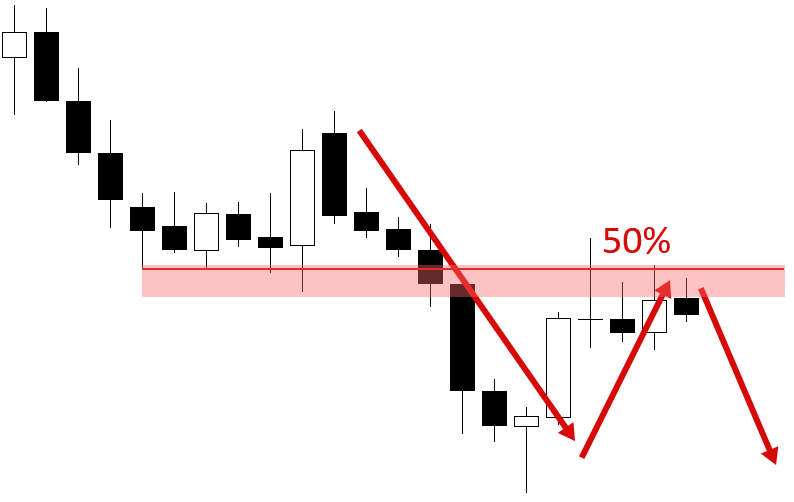

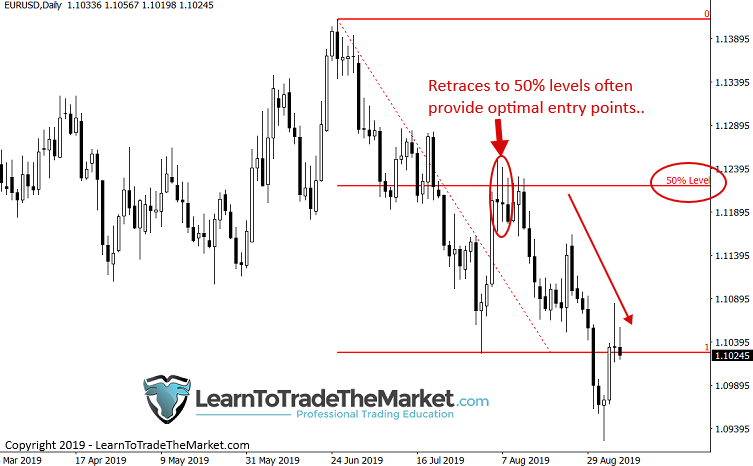

- 50% Area Retracements

Price has a tendency to retrace approximately 50% of any major move and often times even short-term moves. This is a well-documented phenomenon and if you look at any chart you can see it happens, A LOT. Hence, we can watch for pull backs to these 50% areas as they will very often be formidable levels for price to move beyond, and as a result, price moves back in the direction of the initial move from that 50% level. It doesn’t happen EVERY time, but it happens often enough to make it a critical tool in your retracement trading tool box…

- Retrace Entry of a Signal Bar or Signal Area

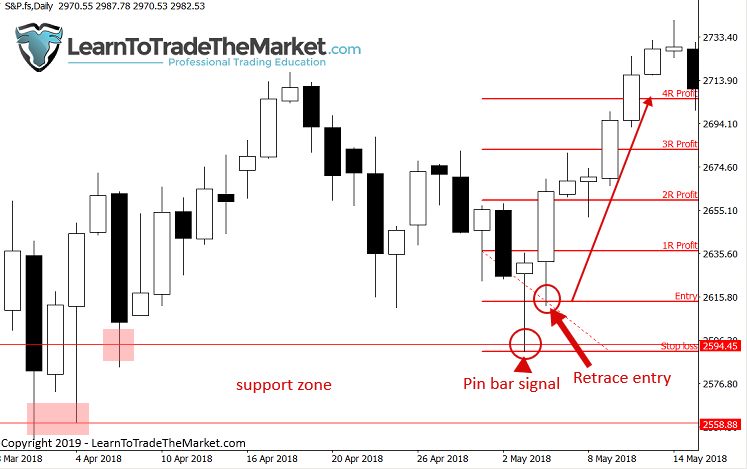

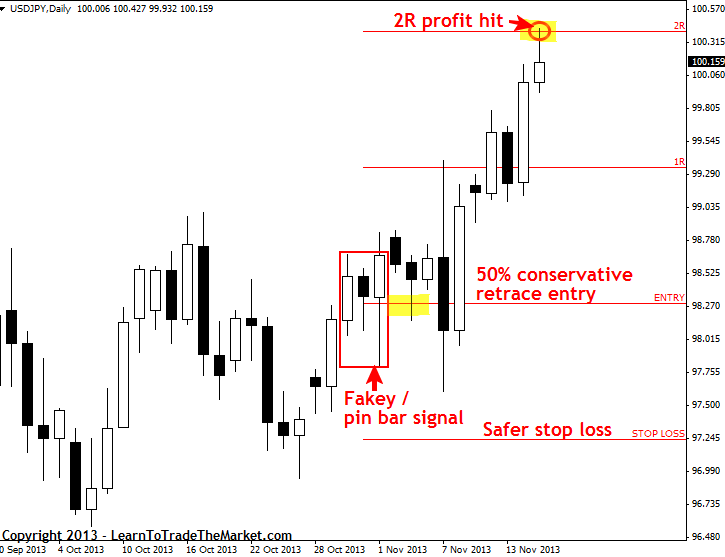

Yet another way we can utilize retracements is also very effective yet a little different than those we have discussed already. What we are looking at below is what I call a “50% pin bar retrace“. Often, on longer-tailed pin bars, you will see price retraces around half the distance from high to low of the signal bar, providing you the potential to enter at a better price and get a safer or tighter stop loss.

Example 1: You can see below how a 4R profit was attainable by waiting for the retrace and entering near the pin’s 50% level.

Example 2: You can see below how a 2R profit was attainable by waiting for the retrace and entering near the fakey patterns 50% area.

- Retrace Entry Back to an Event Area or Prior PA Signal

When price retraces back to what I call an “event area” it’s a very high-probability area to look for trades at. As you can see below, price retraces back to an existing event area where a pin bar signal formed and then forms another (bearish this time) pin bar before a huge sell-off takes place…

Conclusion

You now have a solid introduction and (hopefully) understanding of what price action retracements are, why are they important and how to trade them. Whilst there is a bit more to it than what I discussed here, this lesson gives you a good foundation to build from and provides you with some tools you can start putting to work in your trading routine this week and into the future.

If you want to learn more about retracement trading and get daily updates on any potential retracement trades, check out my professional trading course and follow my daily trade setups newsletter. This will both deepen your understanding of retracements and also help you apply these concepts to real-time price action signals then you can test and compare the outcomes between aggressive entries (like those in this article) and traditional entries that you’re probably more familiar with. Remember, I am always here to help you and share my knowledge with you, so keep learning and practicing.

Please Leave A Comment Below With Your Thoughts On This Lesson…

If You Have Any Questions, Please Contact Me Here.

Thanks Nial Fuller

I have been reading your great job on forex

since 2016 which is the best ever. I may not understand everything but the little that I know from your strategies worth more than a million Dollars. I can now say that I am a professional trader. Thanks for the useful information.

Great strategy, many thanks

Its worth reading your articles which have proved to be a great eye opener

I like the simple way you discuss topics.

Thank you, it was great

Thank you Nial fot this eye- opening article

Really helpful and make sense ,thank you so much

Thanks Nail my knowledge gained more depth, priceless information.

Many thanks. These sorts of information are rare

I really appreciate Nial fuller. Thank you Nial for the priceless help you provide traders with, thank you.

I’m loving it man, I’m gonna keep reading your stuff, I’m really appreciating it. Thanks ????????

Truly enlightening!

It helps me a lot sir as a newbie trader. Thank you

Many thanks Nial….much appreciated.

Thanks a lot for the very good summary. I needed this reminder and have to go back to some lessons in the course.

Thank you very much for this important article, I did already some trades with the 50% pin bar retrace all of succesfully.Thanks again Horst

wow. so great articles, thank iu so much

Thankyou very much.

Thanks, Nial,

A very helpful lesson. Which I know will improve my Risk Reward.

Really appreciated.

Thank you for a good and helpful article.

I wish I met you earlier on in my trading career. Thanks Nial for this wonderful job for sharing with us such a powerful informaton.

Thanx it was helpful

Brilliant article Niall with excellent examples. Thank you.

I would like to thank you. I have to intent to listen you and receive Nail Fuller because I walk and miss the right wa all the time in the 2-3 past. I lost money, now I come back to learn again.

Thank you very much.

Sunan Suksai

I was waiting for your article eagerly.It is very useful and full blessing. May God bless you and your whole generation.It is very difficult to find such a genuine like you, May God bless you,once again,

Thanks

I really liked this article. It is based on fresh examples. It is very important. Thanks a lot, Neal!

Thanks Nial. This article is an eye opener.

Thank you Nial, great article as always!

Thank you Nial for the article.

A powerful article on retracement and indeed it will improve our trading skills and results. Thank you so much.

Wonderful as usual ..

Thanks alot .. God bless you Boss..

Thanks Mr teacher, it’s inspirational

Thanks, Nial.

Thanks for this wonderful lesson … In my opinion, it is better not to miss out on unrealized trading opportunities by first entering half of the volume and then half by correcting the price.

I give all thanks to you . May God bless your soul

thanks

I trade Pinbars on D1 using the retracement of price to the 50% of the pinbar as entry level. It works perfectly ok if you are patience and don’t loose your temper when price do not retrace.

People should know that even when price retrace at a level on a D1 chart and gives no signal, you can go down to H4 and there you could have a nice pinbar for example. If that pinbar works the risk to reward ratio may increase a lot (you have entered at a pinbar on H4 with TP on some level on the D1 chart).

So if you combine wisely D1 and H4 you can find very good entries, just waiting for your signal on the level where price will retrace to.

Anyway, D1 is enough with this strategy, there are plenty of signals in a portfolio of 20-30 pairs.

Marco!

Nice one here too!! I want to learn pinbar

What is D1 chart? Do you mean Daily chart or?

Thanks Nial for this article. It is a very interesting one. I’m very happy to have discovered this site.

Thanks Nial that,s best price action

The article which I was waiting for a period of time,and the day has come.mean my way to a financial freedom is straight forward

Nial, you are indeed a blessing to our generation, keep up the good works.

Thanks Nial for this brilliant article. You made it simple enough for newbies like me to comprehend. Keep up the good work!

Gr8 write up. thx coach

Nice additional information about retraces, Nial!

Thank’s a lot!

A million thanks are not enough for such an amazing inside in forex trading

An important article! Thank you for your help!

Thanks. It was very insightful