Listen To The Market’s Hidden Message On Your Charts

Did you ever see those Magic Eye posters that were popular in the 90’s that had a hidden image within the picture and you had to adjust your eyes just right and stand a certain distance away from the picture to see the image?

Did you ever see those Magic Eye posters that were popular in the 90’s that had a hidden image within the picture and you had to adjust your eyes just right and stand a certain distance away from the picture to see the image?

I personally remember loving those as a kid and I really don’t know what happened to them, but when I first started thinking of today’s lesson these pictures came to my mind. That’s because just like those pictures, the market contains a “hidden” message that only those trained in the art and skill of price action trading will be able to see properly. To the average person looking at a price chart, they will see a bunch of seemingly random bars that mean nothing, but the price action trader sees the message that the footprint of money (price action) on the charts is telling them.

In this lesson, we are going to discuss how to start seeing the hidden messages in the market and what they mean.

Listening to The Market and Hearing What It’s ‘Saying’

In order to hear what the market is trying to tell you, you must first know exactly what to listen for. What you’re listening for are price action clues, left behind as the “story” of the market plays out across a chart. And just like reading a book, in order for the current “page” to make sense, you have to know what happened before, so that means you have to know how to analyze the past price action to make sense of the current price action and use that to make an educated prediction about what MIGHT happen next.

You see, any single bar, by itself, really means nothing. It’s the bar COMBINED with the surrounding market structure or context that paints the picture of that market for you. Once you start following a market long enough you will begin to know it intimately and start to get a gut feel for it, this comes with time, but it’s truly what “hearing the market” is all about.

Now, HOW EXACTLY do you listen to the market and “HEAR” what it’s trying to tell you? You do this through price action analysis and I am going to give you some specific examples of this below…

The charts are the market’s way of “speaking” to us, but if you don’t know what to listen for, the message will go right over you head. Let’s take a look at some of the main pieces of the price action language of the market…

Recent Price Behavior and Market Conditions

The first major message you need to learn to hear on the charts is whether or not the market is trending. If it is trending, that’s very, very good for you because trend trading is absolutely the easiest way to make money in the markets. If it’s not trending then it’s probably consolidating either in a large trading range (which can be good to trade) or a very small and more random trading range (choppy and not good to trade usually). This is an important thing to learn to decipher early-on because it really dictates which direction you’re looking to trade and what you’re overall approach should be to that market in that condition.

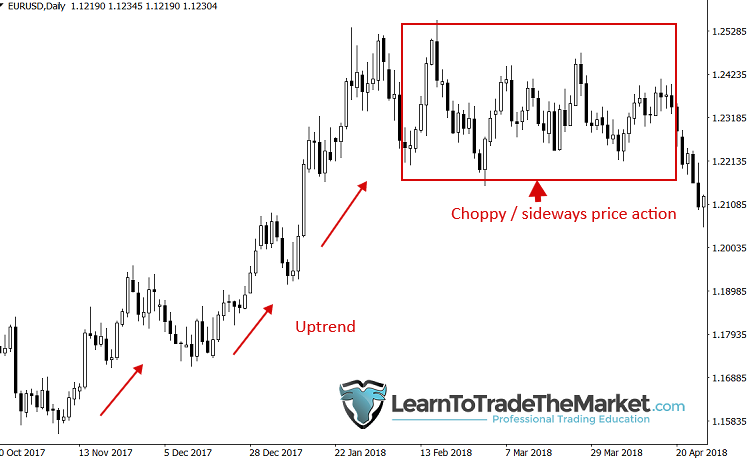

Notice in the chart below that price moved from a period of choppy / sideways (small range) price action to a strong breakout, then a pull back to the trading range midpoint, before an uptrend took hold and carried price higher for months…

In this image, price was trending higher aggressively before pausing and entering a long period of sideways price action. Obviously, the trending periods were much easier to trade and more fruitful. Yet, many traders continue to trade (and lose their money) because they don’t know how to interpret the language of price action properly, which was clearly telling them the market was entering a period of more difficult to trade PA.

Key Levels and “Perfect” vs. “Imperfect” Technical Analysis

Perhaps the next most important “message”the market can send you is HOW price is reacting / behaving around key chart levels. Sometimes, a market will respect nearby levels very, very well (almost exact or even exact in many cases). Sometimes, not so much. I prefer to trade markets that are respecting key levels because that tells me that for whatever reason, this might continue in the near future. Once you identify these levels you can then wait for high-probability price action signals to form at them. However, if price is not respecting levels very well, you may want to avoid that market for now.

How price reacts around obvious key levels is extremely important; are we technically ‘perfect’ at the moment or are the technicals messier and imperfect?

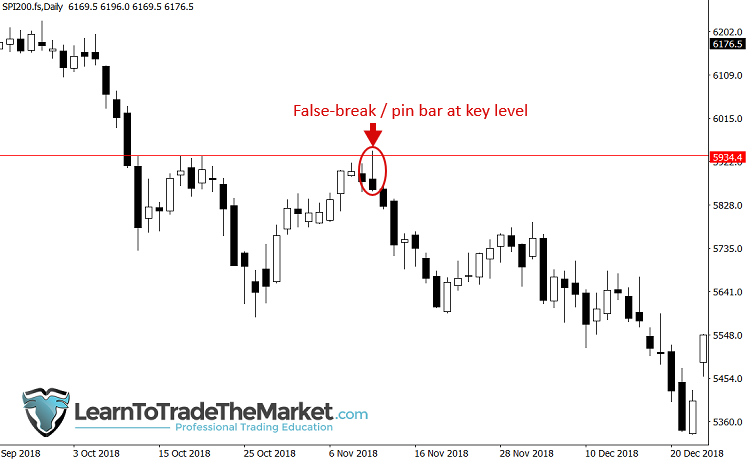

False-Breaks of Key Levels and Contrarian Signals

Human nature and are brain wiring makes most people really, really bad traders. It’s because when we look at a chart and we see it going up, we FEEL like it’s going to keep going up, but this is usually about the time it’s going to go down again, lol. It can be very, very frustrating to the beginner or to the trader who doesn’t yet understand how to listen and HEAR what the price action is telling them. Once thing I’ve written about extensively both on my blog and in my trading courses, is how you have to trade like a contrarian to profit in the market. There are price action clues that tip us off to when a contrarian move is underway and price is about to head back the opposite direction. One of them is a false break of a level and of course there is the fakey trading strategy as well. These are some of my favorite patterns to trade because it shows the underlying market psychology and is a powerful clue as to what might happens next.

Note, in the chart below price made a false-break of resistance before reversing lower again in aggressive fashion.

Failed Price Action Signals Are Awesome. Wait, What?

Ah, the failed price action signal, yes they can be painful and indeed sometimes a trade simply doesn’t work out, that’s a fact of trading you have to deal with through proper risk management. BUT, (you knew a but was coming) sometimes failed price action signals can be very powerful signals themselves. For example, if you see price violate the high or low of a particular signal that you thought was going to have the opposite outcome, ask yourself what is that telling you? What is the MARKET TRYING TO TELL YOU???

Don’t over-think it. If you see a price action signal fail, that is a strong clue that price may keep moving in that same direction…

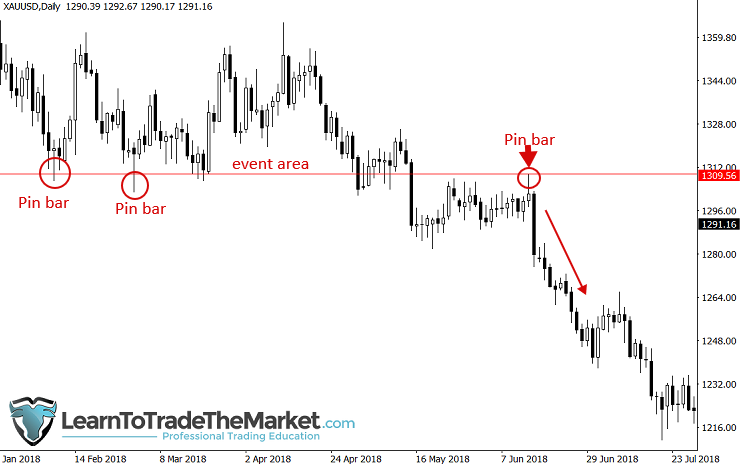

Event Areas and Recent Profitable Price Action Signals

If you don’t know what are event areas, I suggest you read my lesson on the topic, because they are very important message areas that the market wants you to watch. When you see multiple price action signals that worked out coming from the same or similar area, you may have an event area, and if you see another signal at that area, it’s a very strong signal to consider.

Notice the pin bars this level, when the last one on the right formed you missed out on a hugely profitable move if you didn’t know how to interpret the message the market was giving you…

I Need You to Think Beyond the Actual Act of Trading

Technical Analysis is a language and we need to interpret that language if we want to have a chance at long-term, on-going trading success.

Like most wealthy business people will tell you; a lot of listening, hear what others have to say and gather feedback, then make a decision. It’s often said ‘”Be the last guy in the room to speak”; a cliche business phrase from most business leadership books, but it happens to be true. Translated into the trading world, we can ‘listen’ to the markets message and then let the market show us what it wants to do, then we use that gathered feedback to form our opinion, make a plan and then act accordingly.

However, it’s more than just “listening to the message”, you have to combine the messages the market is sending you (see above examples) and formulate those messages into the ‘story’ being told on the chart from left to right. You want to paint a visual “map” by annotating the technical factors on your charts just like I do in my weekly market commentary.

We use the message to both take trades AND to avoid trades and to develop a general feel of market conditions, much like reading the weather and forming forecasts. You’re not acting on every forecast you make but some of them might prove very useful for planning what you will do next.

In that vein, you want to act on the clearest messages and act on the strongest market forecasts only, the messages we interpret are not simply what I would normally teach as confluence of factors. The concept of “listening to the market’s messages” really is something greater than just spotting a trade setup. We are talking about listening to the message the market is telling us about the smart money, with that info we can decipher many many things, we are going far beyond the idea of “hey I can see 1 + 2 things, so now I must take action.” Once you reach a certain point in your price action mastery, you will being to feel like the market is actually “speaking to you” and telling you what to do rather than you trying to tell it what to do (which never works fyi).

Conclusion

My trading approach is based around watching charts daily and interpreting the messages being broadcast from the market. We need to be there to listen for it, map it and interpret it. Think of it as reading a page in a book every day. In the trading world, that means at the New York close every day Monday to Friday, I am there listening to the message being broadcast (i.e. reading the price action, mapping the charts and deciphering its hidden message). However, that does not mean that I am sitting there ALL day staring at the charts. I have my planned times to check the markets each day and if I am not “hearing” anything from the charts that day then I forget about them until tomorrow. I don’t sit there trying in vain to “force” something that isn’t there

Nine times out of ten I don’t take action, but that one time out of ten that I do take action I am pulling the “trigger” on the trade like a deadly sniper waiting to take the “kill shot” once the proper trade setup is in focus. If you want to learn more about listening to what the market is saying and learning to interpret it effectively, check out my professional trading course for more information.

Please Leave A Comment Below With Your Thoughts On This Lesson…

If You Have Any Questions, Please Contact Me Here.

Your patterns is accurate as real. Won a sell trade this morning on eurusd(30m) with a pattern with great analysis.

U are a teacher by nature keep it up👍💖

Even from your approach to market analysis alone, you are a wizzard in trading.Wish I could trade like you

Thanks for a lesson

I am glad that I actually traded two setups which are on the charts, on the first gold chart and second trade which I took is the last pin bar on wti. I also recognize and remember the patterns because I analysed the charts except spi which I do not trade. That proves that I learned to think in a similar fashion as Nial.

On the first gold chart I would like to know at which point Nial thinks it was best to enter.

If I read this article about trade opportunities and said yes I analysed the charts and did not see any of them, that would be sign that i did not learn how to read the charts as Nial does.

Thank you Nial,

I think in forex trading money management is 99% and all other things are 1%. So you please write an article mentioning that if any body have upto $5,000/ Nobody should not open a trade more than .01 lot. And one trade one pair up to 50 pairs. No stoploss but take profit minimum 200 pips. Tention less trade. 100% traders will make money. Follow daily price action .

Please tell me my comment is acceptable.

Hi Niall, thanks for this hugely important lesson. I am studying the charts using your lesson and want it to sink deep into me so that I can benefit as a trader.

Thanks Nial, Slowly but surely i have started to listen to market. Thanks for such posts Nial. Posts like this acts like nutrition for my trading thought process. Thanks alot!

Thanks Nial I have learn to listen to the market

A good listener always knows how to respond this article is awesome Nial thanks so much

Whenever I feel like trading has become too difficult, almost impossible, I always ask myself what would Nial do? Then I go back to his library and read his work(s) and believe it or not, I find so much peace in the markets as everything becomes clear. Surely, to me this guy is a walking legend and one of the greatest mentors of all times. Well done Nial!

Nial’ s method are sound, the problem is with our selves, after 10 years, its patience waiting for no-brainer trades, that I have trained myself over a long period of time, majority are Pin bars on the daily, at an area of overbought or oversold, sometimes I can go a month without making a single trade.

Patience Patience ….

Excellent lesson! Is to what to study! Thanks for article.

Nial, great review of essentially adopting a “helicopter” view. From my own experience I can relate because I just could not make it work on smaller time frames, I work full day and do not have the time to analyse charts hourly or even 4 hourly during the day. This caused a lot of self doubt and stress within myself because I was just not improving and being successful in trading. Since adopting the higher time frames and S/R’s I am more relaxed and more successful. I still have moments where I take the wrong trades and lose 2, 3 ,4 trades in a row. You made a very important statement in your conclusion where you said “you analyse the charts every day”. I think this is key, because I often find that while my initial trades were wrong, I was just too impatient and then the price eventually respected the weekly trend or analysis I made a week or even sometime a month earlier and the price ends up going in the direction that was identified. Once you step away from the charts you lose sight of the opportunities. My goal for this year is to be diligent in looking at the price action at least once per day so that you do not loose sight of the “hidden messages” in the price patterns. Which can take a week and often a month to play out. Great articles, always looking forward to the next one.

Great lesson guide

So educating, as a newbie it’s an eye opener.

More Grace. Thank you

Hello Nial. On the sixth chart, the second gold chart shown in the article, again I see you talking about that pinbar of 06.14.2018, but his tail was not at least 2/3 the size of the candle. In fact, the candle looks a lot like a pinbar, but for some pips it did not hit 2/3. Do you consider as a pinbar if this rule is not respected? In one of your articles you mention that this proportion is a “rule of thumb” for pinbar. Great article, as always. Thank you again for bringing this knowledge to the community. God bless you.

Remember this is theory when we post a lesson so examples won’t be perfect. In real world trading, when we apply common sense filtering to determine if a pin bar signal is valid, the rule of thumb is to ensure we see a clear tail that is much larger than the body. eg: 2/3 tail and 1/3 body (or even less).

Thank you very much for the answer, Nial, I’m very grateful. From now on, I will keep my eyes wideopen to this question. God bless you.

Very good teacher

Great insights!

Always helpful to refocus my mind to what is important, as I always find it difficult to change my bias quickly when the market signals a reversal.

Great article, and your course equips/skills us to do exactly that.

Much appreciated!

great lesson Niall always benefitng from you day by day. Thank you

As powerful as always. I can see that you breathe, walk, eat, sleep, drink the markets…Nial. That is exactly how I am and always will be on the planet EARTH!!! Thank you Nial for being there when I needed you. In fact I should also thank the power of attraction that has proven to be TRUE to me! And daily affirmation that you always talk about.

excellent article, a good review of your course

Thank you so very much Nial, you are just unique. This is revealing. I wish to trade like you.

God bless you.

Wow! what a good lesson, without listening to what the charts says we will miss the point.

Thank you so much about this lesson, may God richly bless you

Thanks my mentor. You’ve summarized the important keys to profitability again for me. Thanks for your continuous guidance

As usual great article!!!!

very good article for us beginners, but Nial why you use the only daily chart for analysis? how about to start top to down mean from month – weekly to daily? help pleas

Thanks Nial,

Have been following your concepts for sometime now and I can confess it works like a magic. I really appreciate your work it has turned my trading to another level. God bless you abundantly.

Always a blessing indeed thanks Nail much appreciation your work shall be my testimony ????

Yeah, Market story. The market tells us story on hourly, daily, weekly and monthly basis. When we listen, it makes us a better trader. Thanks Nial as usual.

Great lesson teacher Nial.

Nial, thanks for this Trading Nugget. It was Awesomely revealing. FAILED SETUP IS A SETUP FOR A HIGH PROBABILITY SETUP.!!!!!!!

Thanks Nial, I have being longing to read the story on price actions and the lessons on pin bar and inside bar has helped . Now with the listening to what price action is telling us is invaluable info thus putting these together are very helpful. Many thanks.

Nial,

very interesting topic that describes how market gives information back to trader. If trader knows how to listen and read the chart he will be profitable.

The problem I see by many traders is that they can hardly focus on this kind of thinking. It really takes time and experience to shift from “standard” trader mind into this kind one. They look into charts as candlesticks moving up/down and waiting for PA to happen. When they see pattern of PA they act.

But when you step back a little bit from you screen you can see bigger picture of the market. Sometimes this step back gives you tremendous information you could incorporate into decision on each trade.

The problem is to have that in mind and to switch yourself into this kind of trader mentality.

Best Regards,

Frano

Thank you, very interesting and useful lesson!

Good week