How To Trade Key Chart Levels in Forex

Today’s Forex trading lesson contains trading strategies that you can put to use immediately in the markets. We are going to discuss how to trade price action from key levels in the Forex market. Key levels occur in a variety of market scenarios, and we can combine these key market levels with simple price action strategies to obtain a high-probability trading strategy.

Today’s Forex trading lesson contains trading strategies that you can put to use immediately in the markets. We are going to discuss how to trade price action from key levels in the Forex market. Key levels occur in a variety of market scenarios, and we can combine these key market levels with simple price action strategies to obtain a high-probability trading strategy.

Key market levels are the core foundation of all technical analysis and price action trading. By focusing on the raw price dynamics and key levels in a market, we can remove the clutter and confusion that so many trading systems and strategies are full of, and instead trade from a clear and objective mindset. I cover all the concepts discussed in today’s article in greater detail in my trading course, as well as a plethora of other simple yet highly effective trading strategies.

Note: All charts in this lesson reflect the daily time frame.

Trading from support and resistance in trending markets

Trading with the dominant daily trend is the primary technique I use to trade the markets. Much of my course is dedicated to trend analysis and teaching traders to trade simple price action strategies in the context of a trending market. We can look for price action signals forming near levels of support and resistance that develop as a result of the natural ebb and flow of a trending market.

In the example chart below we have the daily GBPUSD showing about the last 4 months of data. What I have done here is simply drawn in the obvious key support and resistance levels and then highlighted the valid price action trade setups that formed near these levels. No magic or “robots” here, just simple common-sense trading using the natural dynamics and levels in the market:

Trading from support and resistance in range-bound markets

Unfortunately, the market is not always trending, in fact it’s often said that markets spend more time consolidating and moving sideways than they do in trending conditions. Fortunately, with knowledge of how to trade simple price action setups from key levels, we can effectively trade range-bound markets as well.

In the example chart below we see the daily EURUSD from about the end of May to mid September of this year. We can see an obvious trading range that developed in this period of time and some price action setups that formed off the support of the range. Note that just before the trading range finally broke out lower, a long-tailed pin bar formed that showed rejection of the interior of the range, once the low of this pin bar broke we saw a significant move lower. Trading ranges can be a bit erratic but if you watch the boundaries of them closely you will often see some solid price action signals form at the key support or resistance of the range.

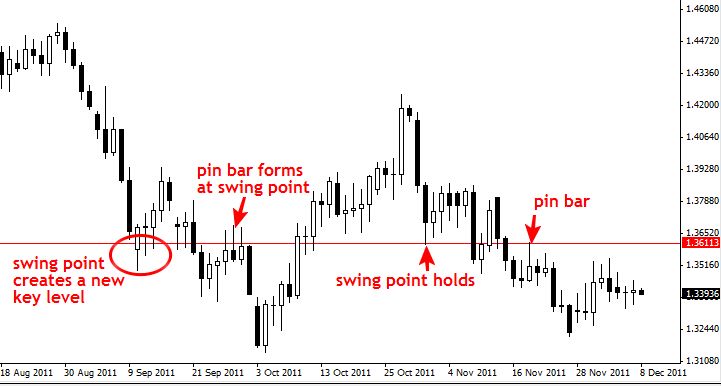

Trading from swing points in trending markets

As a market makes new highs or lows it forms what I call “swing points” in the market, these are very important levels to watch because they essentially create new support or resistance. As such, a swing point does not need to be “confirmed” by multiple rejections of price in order to be considered a valid support or resistance level, rather the actual swing in the opposite direction itself creates a new level of support or resistance.

When we see price approaching a recent swing point we can be on alert for price action setups forming near it. A recent swing high will often act as support in an uptrend, and a recent swing low will often work as resistance in a downtrend. Let’s look at a chart to see this more clearly.

In the example chart below we see the daily EURUSD from about mid-August until now. We can see that price came down and found support near 1.3600 in mid-September. This swing point then became very important for the subsequent price action forming near it, acting both as support and resistance.

Trading from dynamic EMA support and resistance in trending markets

I use exponential moving averages (EMAs) on the daily charts to help with trend analysis and identification of dynamic support and resistance levels. For today’s lesson I am going to discuss how I use the daily 8 and 21 EMAs to highlight key levels in the market to trade price action from.

In the example chart below we have the daily EURUSD showing about the last 4 months of data. I have applied the daily 8 and 21 period EMA’s (applied to close) and then I simply watch for price action setups forming at the EMA levels or in between them, in the EMA “layer”, when the market is trending. When the EMA’s are crossed lower and diverging, we have downward momentum, and when they are crossed higher and diverging we have positive momentum. By simply looking for price action setups forming on the EMA levels or within their support or resistance layer, we can easily identify high-probability key levels to trade from.

Trading from event-area support and resistance levels

An event-area is a price level or zone that saw a price action signal form and then a large directional move or “event” occurs. These levels are obviously very significant and I discuss different ways to trade them in my price action trading course. But, for today’s lesson I am going to show you how to trade price action setups from event areas.

In the example chart below we have the daily XAUUSD (spot gold) chart showing about the last 4 months of data. We can see a good example here of an obvious event-area that formed through $1700.00 as price rejected this level multiple times forming well-defined pin bar strategies that subsequently set off significant directional moves. When you see an obvious price action signal that sets off a large move, you can then watch the level the price action signal formed at for future entries if price approaches it again, as these levels are obviously quite significant.

As you can see from the examples above, trading does not have to be complicated; you can learn to analyze the market and trade effectively by simply gaining knowledge of how to identify key market levels and price action setups. When we combine these two components we get a very high-probability and simple trading strategy that is also flexible enough to be applied to the ever-changing conditions we see in the Forex market each week.

We cover all the key market levels in the major Forex pairs in our daily members’ commentary each day. These ‘key levels’ are essentially the foundation to what I teach my students in my Forex trading course and members’ materials. I believe price action trade setups have a much higher probability of working out in our favor when we look for them at these confluent key levels in the market.

i just search for trader with legit trading skills and you happens to be one of them …so so impress…..

Great article on trading keychart levels and how to analyse in prepartion for PA set ups

Thank you very much for the powerful article it is indeed enriching my knowledge and making me a much better trader

thanks exchange for sharing

Mr Nial, you deserve more accolades than I can possibly render. Thanks a million times sir.

Hi Nial

Your work is so refreshing. It’s a masterpiece.

Great and comprehensive,,,,,

Thanks mr. Nial. Could you explain the difference between swing point and event area that you given examples in this lesson. That levels looks like same when responding to a certain price. It would be great pleadure if you explain this by a lesson in future.

Please Mr. Nial, how do we know all these inside, fakey, pin bars you refer to? I do not know how to identify them. Please help me.

Mr Alexander, check this link. It should enlighten u a bit.

https://www.learntotradethemarket.com/forex-trading-strategies/price-action-setups-pin-bars-fakeys-inside-bars

thank you Babatope for the referred article. It surely made for a clearer understanding of the key terms.

Hi. Wonderfull. and comprehensive.

How can I find support and resistance levels?

Dear Master,

Good sharing and thanks.

greaat thanks

Great Nial. Thank You So Much.

Hi NIAL,

I have learned a lot from you and succeeded in Trading.

Thank You so much, & keep up the good work.

Hi Nial,

I joined last week and have just read this article and the “how to filter…..” article.

Each article I read makes me progressively more certain that the cost of this course is the best money I’ve ever spent!

The charts you include are excellent.

Both these article have cleared up some big trading problems for me.

I feel very fortunate to be receiving this wisdom.

So thanks for sharing your AWESOME work!

Peter.

Your articles are great! its so simple and easy to understand! God bless and more power!

That was outstanding. Never seen charts taught like that before, would love to learn how to do it.

Dear Nial,

Awesome write up. May God bless you more.

Thank You.

Thanks Nial.

Hi Nial, I would like you to display the sample chart you made mention in this lesson. Please, keep up in your trading analysis as I’ve found your work improving my trading immensely, I do anticipate to sign in to your forex membership trading course. Thanks.

Dear Nial,

A lot of guys have abandoned the scriptures but we who are still believing in them know that giving is more blessed that taking. Niel you are giving so much and as a result your enterprise will flourish greatly.

James.

Wellness trading for wellness life

wow!makes lot of sense sir!

Great article sir…..

may God reward you because you are just beyond human reward for all your limitless effort for newbies.Thanks your lecture is great.

Hello Nial, you are really great!Each time I sight an inside bar in the Daily chart and in the direction of the trend,I normally scroll down to the 4hr chart and wait for a formation of an inside bar and the break of the inside bar before I enter the trade.I do this because it reduces the amount of pips I use as my stop loss.Is this a good practice?Thanks and remain great.

IT’S Excellent

excellent Nial

Thanks Niel for all your post so far.

I am new in the game. Although I have a little experience.

I need to know how to get my key support and resistance regions.

Although, i draw so many resistance and support region on my platform as an intraday trader, but still find it difficult sometimes to identify the key support and resistance regions.

Thanks

Simply awesome, Nial

Raj

Helpful and informative article Nial, i have a question, can i use this set up in a lower time frame like H4 or H1 please?

I do agree for that simplicity. Thanks nial for your valuable lesson all this time. I always wait for your great lesson. Thanks

Hi Nial your website is great

Good read Nial

Hi Nial,

Hope you are well. Thank you for another fantastic and awesome lesson.

Thank you for all your help

Thanks and Regards

Gurpal

a brilliant effort by our exquisite mentor.Am greatful for your undiluted insight about tradethe market.

Just starting out and learning to “master” one method at a time. Thanks for your help. BTW, which method do you recommend to learn first? I am now trying to learn inside bars, but not sure if I should start there. Thanks again!

what a wonderful lesson for free of charge.May God bless u more

Thanks Nial…make me very clear…

This is amazing, wonderful writup, remaim blessed nial and merry christmas in advance.

Hi Nial,

A very useful and informative e-mail;thanks.

Nial,

Thanks for this Christmas present. Hope Santa is half as nice to me! Larry

Hi Nial Great Lesson as always.

Im starting to use some price action techniques with Fib Levels which have been working well on the long term chart.

Indeed you really go by your vision learnig to Trade the market. since i have been reading your articles it has improved my discipline and knowledge. you are an ICON to be recon with to be successful in Forex trading. thanks

You are a nice man .I like this article

thank you for helping us with our trading

Hi NIAL Your approach to ANALYZE the market is so simple

and logical, that, it has made the whole difference to my

trading.Thank you so much, for your dedicated efforts, to

help TRADERS at large. MAY GOD REWARD YOU!!!

THANKS & REGARDS, AMIN MALIK

Thanks, but i like to see it on video,is easy for me.

Thank you for all the effort you take to educate us Nial.You are a great mentor.

simple and very well explained. thanks Nial.

Thanx Nial, ive been asked to help people set up charts ,now I just give them ur site “well done and many thanx “

thanks n great trading guide.

cheers

Brilliant! Thank you very much, for your dedication, your generosity, your clear way in plotting and explaning the important. Thanks, again.

I am amazed how you always simplfy trading while others try to complicate it!

thanx for ur wonderful support.

You are an exllent teacher

As always Nile…Thank you for the efforts you make on our behalf…I find the instruction most understandable and insightful. I trade a very small acct so have a harder time trading the daily charts, but I find the principles applicable to lower time frames after gleened from the day charts. Again thanks for your investment in our success.

This’s an excellent and unique article,tanks sir Nial for this insightful one.

Its great to read your lessons, they make things so clear, and your course has helped me tremendously.

thanks Nial

Thank you very much for such a simple, comprehensive and easy lesson. From the bottom of my heart, i appreciate your dedication to impart the knowledge of forex trading to the newbi.

Well done

Clear, concise and complete. Super job, Nial!!

Another very good lesson Nial. Simple, concise, clear and realistic/ practical.

Hey Nial another great insight into how you trade. It seems so simple when you put it down like this – clutter free and logical. Since discovering you on you tube I have changed my whole strategy and mind set. Thanks to you I now know i’m on the right path.

Thank you.

Thanks Niall. Although I don’t trade by your exact methods, your price action fundamentals is the basis of my trading philosophy.

Great articles, thankyou.

I also appreciate your dedicated time & efforts in helping us traders excel.

Thanks Nials

hi nial,

just looking up the strategies you post online and the tutorials have change the way i look at trading.i look forword to joining you community very soon.

thank for this lecture.

ken

thanks always on point

I must say there is much learning in just by looking at the charts than placing trading it takes patients for one to know how to spot swing points and entry and exit points and eventually the whole thing becomes a part of you like a religion or something of sort you live breathe dream it until it becomes effortless thanks Nial

Thanks for todays lesson Nial. For as long as I’ve been studying your material I’ve gained knowlege that probably couldn’t been taught a better way not even by a professor from a university. Believe or not this site is actually a life changer for me. I appreciate your dedicated time and effort in helping traders to excel in the fx market.

thanx Nial, an excellent reminder!!!!

Excellent summary Nial

Niall,

This is really the epitomy of successful 4X trading.In a nutshell,very simple,clear positive directions.

I truly believe that you have provided the most successful 4x trading training and i am really proud to be a disciple of your method and because of that my day job is in severe jeopardy.

thanks again for a great course and not to forget the excellent contributions from forum members.

Cheers GrahamD

Comprehensive and excellent, as always. This kind of insights are always needed.