Risk / Reward – Money Management Tool For MetaTrader

In this lesson, I am going to give you a tool that will help you see the potential risk / reward on any trade setup you’re thinking about taking. It’s critical that you not only understand risk / reward, but also that you know how to see the potential risk / reward on a trade before you enter it, because it is not just the trade setup itself that matters, but also whether or not the setup makes sense from a risk / reward perspective, considering the surrounding market structure. If you’re not already doing so, you should be using a trade’s potential risk / reward as the final filter before you decide whether or not to risk your hard-earned money on it.

In this lesson, I am going to give you a tool that will help you see the potential risk / reward on any trade setup you’re thinking about taking. It’s critical that you not only understand risk / reward, but also that you know how to see the potential risk / reward on a trade before you enter it, because it is not just the trade setup itself that matters, but also whether or not the setup makes sense from a risk / reward perspective, considering the surrounding market structure. If you’re not already doing so, you should be using a trade’s potential risk / reward as the final filter before you decide whether or not to risk your hard-earned money on it.

Note, if you don’t yet have the MetaTrader trading platform that we use, you can download it here for free.

Using the risk / reward tool on the MetaTrader platform

If you do not know how to use the risk / reward (RR) tool on MetaTrader then today’s lesson is going to be very important for you. If you do know how to use it, then this lesson will be a good refresher and reference guide to the power of RR and how to make use of it on your charts.

Before we begin…when I say the “MetaTrader risk / reward tool”, it’s slightly tongue-in-cheek, because there is not actually such a tool on MetaTrader by default. You have to make the tool yourself by changing the properties on the Fibonacci tool, which I will show you exactly how to do shortly.

You will use the risk / reward tool to help identify RR targets based on stop loss distance. In other words, you will first place your stop loss on the trade setup and then you’ll use that stop loss placement as the 1R distance on the trade, 1R just means 1 multiplied by R, where R = risk. Thus, if you have a risk / reward ratio of 1:2 it means you have a potential 2R reward on the trade, or the reward is 2 times what you have risked.

Here are the main uses of the risk / reward tool:

- Identify RR targets based on stop loss distance

- To anticipate and plan trades

- Speed up the process of finding potential targets and stop loss placements; estimating potential levels for stops and targets on the chart. Essentially, the RR tool gives you a framework to use for finding the best RR levels on a trade, instead of doing it ‘blindly’

- The RR tool helps you see if a trade makes sense to take. You overlay the tool on the setup you’re considering, measure the stop distance and then find the potential reward levels on the charts. If they don’t make sense based on the surrounding market structure and price action, we might think twice about entering the trade. In other words, the risk / reward tool helps you filter good and bad trade setups.

- The RR tool allows you to play around with different stop loss distances (before you enter the trade of course) and see how they affect the reward areas on the chart, to see if a trade makes sense to take.

These are the main uses of the risk / reward tool on MetaTrader, I will explain each of them more in-depth later in this lesson. Next, let’s discuss how to build the risk / reward tool so that you can begin using it today…

‘Hacking’ the Fibonacci tool in MetaTrader to have risk / reward settings

You can use the following simple step-by-step process to tweak the Fibonacci tool in MetaTrader into a very effective risk / reward tool:

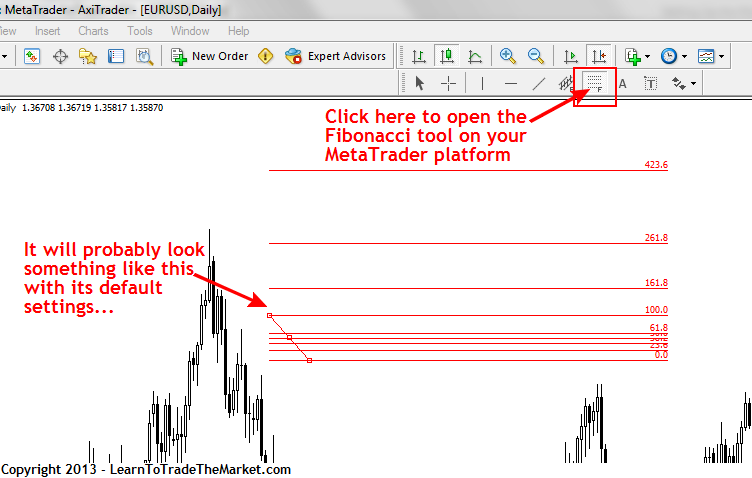

Step 1: Find the Fibonacci tool icon at the top toolbar of your MetaTrader platform, click on your mouse to open it on your chart:

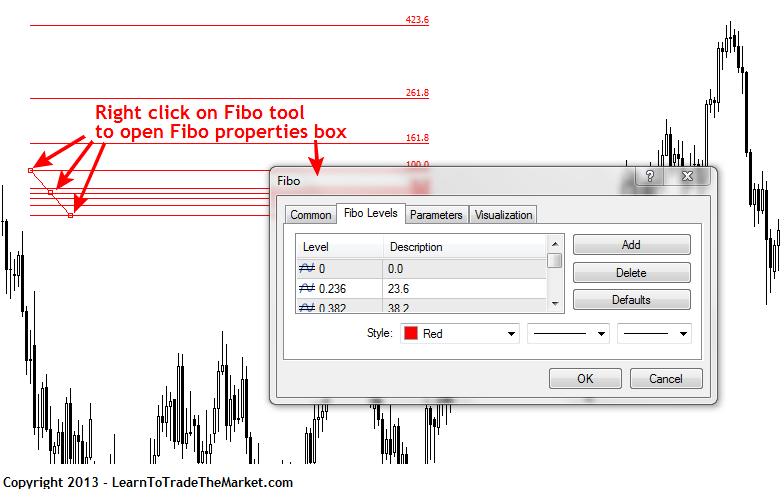

Step 2: Now you need to RIGHT click on the Fibonacci tool and then click on the “Fibo properties…” option:

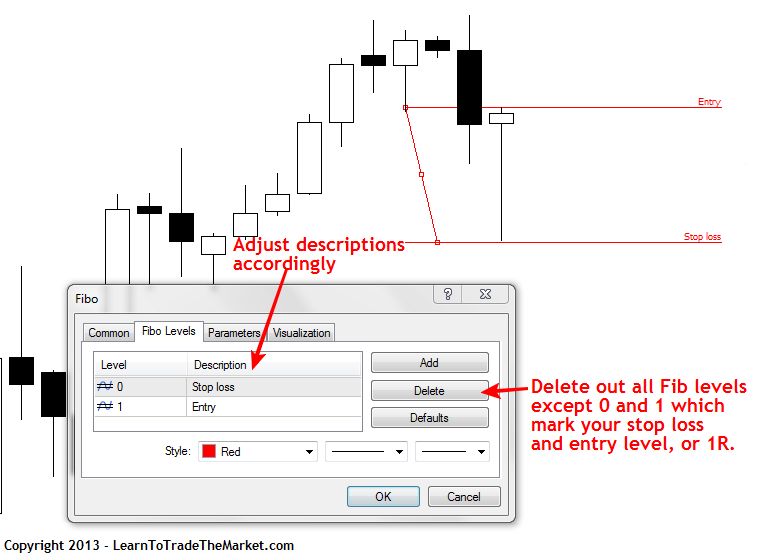

Step 3: Step 3 is where you will actually begin to adjust the Fibo settings according to the particular trade setup you are considering, in order to find the risk reward levels for the trade. For example’s sake, we are going to use a pin bar signal with a stop loss just below the pin bar’s low and a buy entry just above the pin bar’s high. Our 1R distance will be calculated from the entry level to the stop loss level…

By clicking on “Levels” in the Fibo properties box, under “Fibo Levels” tab, we can easily delete or add levels to the Fibo tool. In this case, we want to delete out all the levels except the 1 or 100 level which should mark your entry level and the 0 level which marks your stop loss level. You have now begun transforming the MetaTrader Fibonacci tool into the ‘risk reward tool’ and you’ve marked your 1R risk amount on the trade setup. In Step 4, you will use this 1R distance to locate potential reward levels.

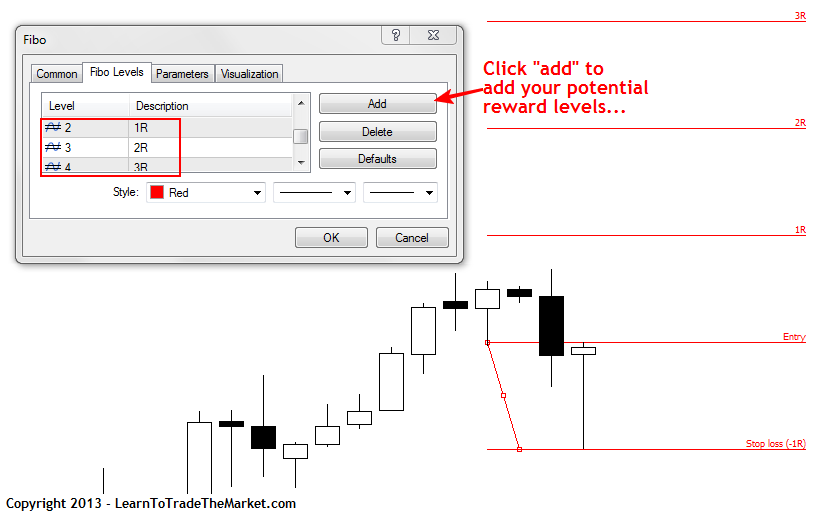

Step 4: This is where the ‘rubber meets the road’ with the risk / reward tool. You can now easily add your 1R, 2R, 3R etc. reward levels by simply adding levels in the “Fibo Levels” via the “add” button. You’ll notice in this example, when we add a “2” it gives us our 1R profit level, this is because the 1 level was already used for entry if you remember. When we added the “3” level it gives us our 2R profit level and etc…you can add as many R multiples as you need.

Important note: Once you get the risk / reward tool setup you can easily use it on any other setup as it should stay saved how you have it, unless you revert it back to default Fibo settings. In other words, you can just adjust the risk / reward tool to each new setup after you initially set the tool up…just click on the little diagonal arm to stretch the tool and line up the 1 level with your entry and the 0 level with your stop loss for each setup.

Now that you know how to adjust the Fibo properties to make a risk / reward tool, you can begin using it on trades you’re considering. It will probably take a few practices of going in and adjusting the Fib levels to reflect the RR levels of your trade setup, but it really isn’t hard to do and it will become an integral part of your trading routine before you know it.

Let’s look at an example of the risk / reward tool “in action” to see exactly how it can help us find the most logically attainable profit targets on a trade setup as well as act as a filter for whether or not to take a trade…

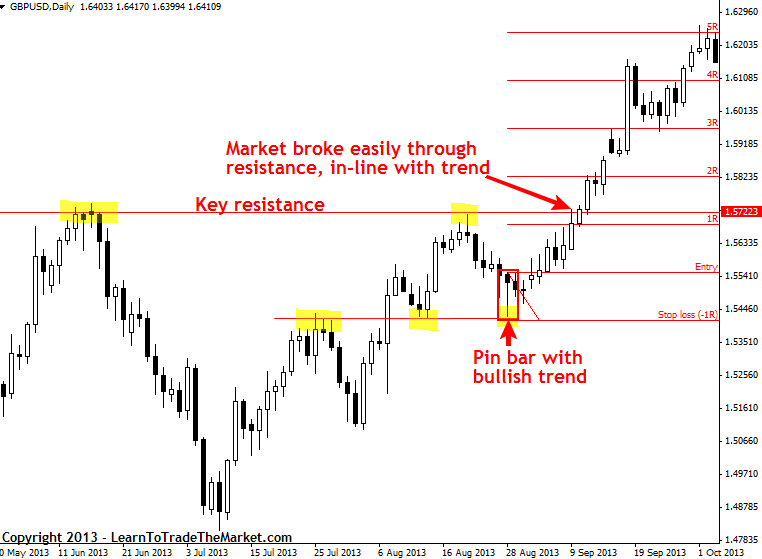

In the example below, we are looking at the risk / reward tool on a GBPUSD pin bar setup. Note that the setup was in-line with the underlying daily chart uptrend. Also, note there was a key resistance level coming in up near 1.5717 area that was coming in just above the 1R profit level. Given that the setup was with a strong daily uptrend, I don’t think that resistance was enough to not take this trade. In a situation like this, you would just want to gauge the price action as price approaches the resistance level and be ready to adjust your stop loss up to breakeven or close the trade if you see an obvious reversal signal against your trade. In this case, nothing happened except for the trend continuing and we can see a solid 4 or 5R reward was attainable here:

When you find a price action setup you are thinking about trading, you’ll want to play around with different stop loss distances and see how they affect the reward areas on the chart. See if a trade makes sense to take by overlaying the RR tool and measuring the stop distance, and if the risk reward levels are in bad places on the chart (for example on the far side of a nearby key level), we might think twice about the trade. In this way, the risk / reward tool can act as a filter for good and bad trades.

The power of risk / reward

Understanding risk / reward and what it means in the broader context of money management is critical to your long-term success as a trader. Not only do you need to understand the importance of risk / reward, you also need to begin thinking about potential trade setups in terms of risk / reward. It is critical to understand that most traders who are successful over the long-term are not winning more than about 50% of their trades, but it doesn’t matter as long as they are harnessing the power of risk / reward. Consider that if you get a 1:3 risk / reward per trade and you win just 30% of the time, you can still be a successful trader over a series of trades. The key here is to understand that it takes a “series” of trades for risk / reward to show off its true power…you cannot get bogged down into worrying about any one losing or winning trade if you want to be a successful trader over the long-term.

Understanding risk / reward and what it means in the broader context of money management is critical to your long-term success as a trader. Not only do you need to understand the importance of risk / reward, you also need to begin thinking about potential trade setups in terms of risk / reward. It is critical to understand that most traders who are successful over the long-term are not winning more than about 50% of their trades, but it doesn’t matter as long as they are harnessing the power of risk / reward. Consider that if you get a 1:3 risk / reward per trade and you win just 30% of the time, you can still be a successful trader over a series of trades. The key here is to understand that it takes a “series” of trades for risk / reward to show off its true power…you cannot get bogged down into worrying about any one losing or winning trade if you want to be a successful trader over the long-term.

Every time you encounter a potential trade setup, you should immediately begin thinking about the risk / reward potential on the trade (this is how you think about trades “in terms” of RR). Get out your RR tool that I showed you how to make here today and start comparing potential reward levels against a few different potential stop loss placements. Make sure you do not place your stop loss arbitrarily however, just to “make the trade work”, if you haven’t already, please read my article on how to place stop losses.

Having the knowledge and ability to view each potential trade setup from a risk / reward standpoint is critical in achieving lasting trading success. The first step, is mastering an effective trading method like the price action method I teach in my courses and members’ area. Once you have both mastery of an effective trading method and a thorough understanding of how to use risk / reward, you will have an excellent chance of attaining long-term success in the market.

Note, if you don’t yet have the MetaTrader trading platform that we use, you can download it here for free.

If you type in the characters, “%$” (percentage symbol and dollar sign without quotation marks) in each description box for each level, it will display the price for that level. I learned this in another article and it works.

Thanks to Nial & you. It’s work.

Thank you sir.

Your teachings has transformed me from a mediocre to a consistently profitable trader.

Today after reading one of your blog post,this caught my attention.So real ,precise and handy to be ignored!

Again I am pretty grateful for good work you do.

“The key here is to understand that it takes a “series” of trades for risk / reward to show off its true power…you cannot get bogged down into worrying about any one losing or winning trade if you want to be a successful trader over the long-term.”~Nia Fuller

I use fib expansion for the targets.

Thank you very much for the Risk / Reward tool. No more guess work in setting TPs.

super

Gracias Nial, thank you very much.

Thanks Nial!!!!!!!

I have been away from you for some time.

This has changed my mind and I will be back on board

Thanks Nial, This tool very very perfect and simple…..

Perfect, thanks Nial!

Thank you Nail – this is really a pretty nice & simple tool really helpfull

Thanks nial,

Great tool..

Thank you Nial, great tool.

I applied it to my Fibonacci Expansion tool instead, since I use the Fibonacci Retracement tool

often.

Nial thanks man.You mean so much to me.Great tool.Just saved a lot of trading stress

The same can be done with the Fibonacci Channel tool in MT4 thus freeing up the retracement tool.

Just a few days ago I was thing how to place a stop loss and was there some method in doing so. All I hear is that you have to have a stop loss with every trade you place. This is the first time I have seen a Good method in setting up and calculating a stop loss. I thank you very much to bringing me closer to being a successful Trader

Nial i do not have words to say, i can only wish you God’s Blessings!!!! You changed my trading for the better!!

THANK YOU NIAL i’M SO HAPPY TO READ THIS ARTICLE ABOUT THE RISK/REWARD SETUP AND I ‘M SO HAPPY YOU SHOWED US HOW TO DO IT .I TOOK 15 MINUTES TO FIND OUT HOW THE FINOBACCI WORKS ON MY CHART BUT I’LL USE IT ON EVERY TRADE I DO AS IT HELPS ME TO UNDERSTAND BETTER ABOUT MONEY MANAGEMENT .

THANK YOU NIAL YOU ARE THE BEST .

HAVE A NICE DAY, ADRIANA

I am curious why Metatrader does not have in-built any tools, which would help in Money Management. But thanks to smart people like Nial, we can use such tools like Fibonacci Retracement. Very clever!

HOW GOOD IS THAT,thanks mate

Mr Nial

I have never left a comment here before but this tool definitely got me blown over i have incorporated it into my trading arsenal and i know its a very great tool thanks a lot and may the Lord continue to give you the inspiration to continue helping us all aspiring traders out here.Thank you

Dear Guru, with due respect I want to highlight this. Instead of using Fibonacci Retracement tool, we can use Fibonacci Channel tool in Insert –> Channels –> Fibonnacci. In that we have to untick the Ray option. By this way, we can use Fibo. Retracement and Risk:Reward tool together.

Thank you.

Very good approach , Thanks

Hey Neil,

Amazingly smart tool boss! I’m going to change my MT4 settings now!

Thanks a lot!

Keep up the good work! :D

Thanks a billion for this simple yet power insight.

Thanks Nial . A wonderful tool

tanks a lot Nial. i ve backtested the tool and found it to be a great aid for Risk – Reward. you are really a gem .

Nial Brilliant saves me a lot of mind work and so simple.

Also if I add after R1 a space then %$ This gives the pair value as well. So I can see quickly my target value to take profit.

Namaste

Geoff

thats a great lesson

Nial, I love you simplicity vary clear and understood. Thanks.

Nial, you are a great coach simple and clear Thanks

Nial you remain the greatest coach, thanks.

Great info which will be put to use straight away. Thank you Nial

很好的想法啊,我怎么没有想到呢! 非常感谢,以后做交易策略就方便多了。

嗯,节约了很多时间。

This is very simple but it works fine. Thanks for that. I used and this works. My trades setup are now ordered; especially when it comes to stop loss.

Thank Niall. For those interested in a little extra for this R/R Tool…. if you add ‘- %$’ to the end of each description (so for example you might have ‘5R – %$’)…the price will then be displayed next to each level. I believe this is a huge help since you don’t have to work out the value of each level – it is shown on your chart.

Again Nial, THANK YOU Soooo MUCH for your article! With this tool, I will finally improve much more my risk/reward balance!

Nial, this article is brilliant!!! It made my backtesting so much easier!! Normally i use a handheld calculator to calculate. With this method, it saves me lots of time!!! I love Nial. You are the best

thank you very much, Nial!

It Is such a smart idea, Nial !

Hey Nial and members,

if you write ‘1R at %$’ instead of ‘1R’ you’ll get the price of that level as well. Helps to calculate the Pips… ;-)

Cheers, Kai.

Thanks a lot, Kai!!! It has become so much easier to use the Fibo tool with your advice!

That is a totally mind refreshing article Mr Fuller and I just read it once and I amazed thank you once again Mr Fuller

Hi Nial

It is a very good strategy I use this always and it is very helpful to recognize stop loss and take profit level.

Regards

GENIUS!!!! Super cool. Thanks for this tip and i must say great job you have been doing.

This is what succesful traders have been doing for years.

Bravo, it is very useful, thanks mate

Really usefull article I use fibo on daily basis and I never think about this. Thanks Nial

Nial,

Awesome, simple addition to MT4.

Nice work!!

Great idea!

Thanks for the heads up – really appreciated!

Hi Niall,

Many thanks for sharing your knowledge and helping others.this is a nice tool that fastly tell us that is it good to take a trade or no.i learned from you importance of risk reward and we must take a trade when there is a RR>=2 till nearest support or resistance.

thanks again

naser

Dear. Mr Fuller, would also be useful, since many of his suggestions were essential for me.You can also add price levels to retracements as modified by you, do so: ‘% $ ‘ at every level. greetings Antonio

thanks Nial. You`re always on point. This is a very useful tool.

If you use Fibs in your trading(as many of us do) then set up the R/R tool using the Fib Expansion tool. this will save you constantly having to change the values of your Fib Retracement tool.

Just made my R:R tool, Nial, and I start using it immediately. This is a great lesson and so, so useful.

Thank you and all the best.

Dorota

Hi, Niall,

that’s exactly how I set up the fib tool, to show r/r.

THANK YOU NIAL – this is really a pretty nice & simple tool to visualize the MAIN thing for us – what is my risk & what should i get back!