How To Draw Support and Resistance Levels Like A Professional

In my daily Forex commentary each day, I draw in the key levels of support and resistance that I feel are the most significant in the current market environment. It’s something that I’ve done for so long it really only takes me a few minutes to do now, it really is a very logical and simple task for me and it can be for you too.

In my daily Forex commentary each day, I draw in the key levels of support and resistance that I feel are the most significant in the current market environment. It’s something that I’ve done for so long it really only takes me a few minutes to do now, it really is a very logical and simple task for me and it can be for you too.

Many traders make the process of drawing support and resistance levels a lot more difficult than it needs to be. After you have a general idea of how I draw my support and resistance levels, you should have no problem using that knowledge as a guideline to draw the levels yourself. We get tons of emails each week from traders asking how to properly draw support and resistance levels on their charts. Also, we get emails with chart attachments from traders who are clearly drawing far too many levels on the charts, thus complicating the process of price action trading and confusing themselves as well.

Today’s lesson is going to be a tutorial of how I draw my levels in the market. Basically, I’m going to take you guys on a ride through my brain (scary I know) as I decide where to draw support and resistance levels on some real-time daily charts. You can use this lesson as a reference until you feel comfortable enough drawing the levels on your own. Also, it will help you to make your own commentary each day of your favorite markets; writing down your analysis rather than keeping it all in your head is a good way to stay on track and make sure you have a clear plan for the week and day ahead. To get started, let’s clear up a few common myths about drawing support and resistance levels…

Common myths about drawing support and resistance levels:

Myth 1: You should draw every level you can find on your charts – Many traders fall into this trap, they end up taking an hour to draw on every little level they can find. What they end up with is a really messy chart that basically does more harm than good. You need to learn to draw only the significant levels on your charts, then you’ll have a useful framework to work from.

Myth 2: Your S/R (support and resistance) levels should always be drawn across the exact highs or lows of price bars – This is perhaps the biggest myth that traders have about drawing levels on their charts. Often times, support and resistance are more “zones” than exact “levels”, sometimes you will have a key level that is indeed an exact level, but more often than not we are going to be drawing our support and resistance lines midway through bar tails or even through the body of a bar sometimes. Point being, you don’t always have to draw the level exactly through the high or low of the bar. Note: if you are totally new and confused by some of the lingo here, please take some time to go over this candlestick tutorial before moving on.

Myth 3: You should go back really far in time with your levels – Unless you are a long-term buy-and-hold investor right now, you don’t need to go back more than about 8 months when drawing your levels. If you look at our free forex commentary you can see we really only focus on the last 3 to 6 months when drawing in the daily levels, and that goes for my own personal trading too. I am not sitting there trying to draw in levels from the last 5 years like some traders…you are wasting your time if you’re doing this.

OK! Now that we’ve cleared up those common myths about drawing S/R levels on your charts, let’s move on to some “meat”:

How I draw support and resistance levels on my charts:

Below are examples of how I would draw the relevant support and resistance levels on some of the major Forex pairs, Gold, Crude Oil and Dow Futures as they stand at the time of this writing. Above each chart is a brief explanation of why I drew the levels where I did.

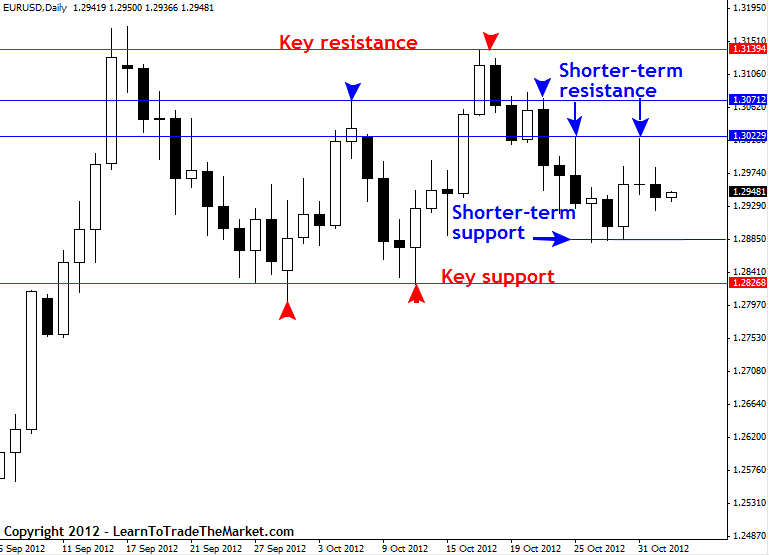

Example 1: EURUSD DAILY CHART

Here we are looking at the current euro / dollar daily chart. You’ll note the red lines highlight the longer-term or “key” levels and the blue lines highlight the shorter-term or “near-term” levels. This is how all the examples will be in this lesson and hopefully it will make it easier for you to differentiate between what I often refer to as “key” levels from shorter-term levels that aren’t quite as significant.

In this example, you can see this market is clearly in a trading range right now between about 1.3140-70 resistance and 1.2830 support. Those are what I would call the “key levels” on this current daily EURUSD chart. Within the range, we have some shorter-term levels that are still significant albeit less so than the key levels just discussed. Of special note are the two shorter-term resistance levels marked on the chart below. You will see that the one near 1.3070 is hitting a bar high from October 5th, but also it’s going through the bodies and middle of the tails of the bars from October 17th – 23rd. This brings up a good point…a support or resistance level can be significant even if it isn’t exactly touching bar highs and lows. This is also seen at the key resistance of the range, note how the line through 1.3140 is not touching the exact highs on September 14th and 17th at 1.3171…this brings up the point that sometimes support or resistance is more of a “zone” than a strict / exact level. In this case the resistance of the current range is really a small zone of resistance from 1.3140 to about 1.3171 (more on support / resistance “zones” soon).

Also of note, there was an inside bar on October 18th, and after the market broke down from that inside bar it tried to rotate back up to about where it broke down at, and this breakdown level acted as resistance and held the market off from advancing further, and then as we can see the market has since fallen away from that level. These are some of the more subtle things you need to learn about when drawing in your levels…especially shorter-term levels; that inside bar breakdown point held as a resistance, and often inside bar breakout points will act as support or resistance, even if it’s just for the short-term.

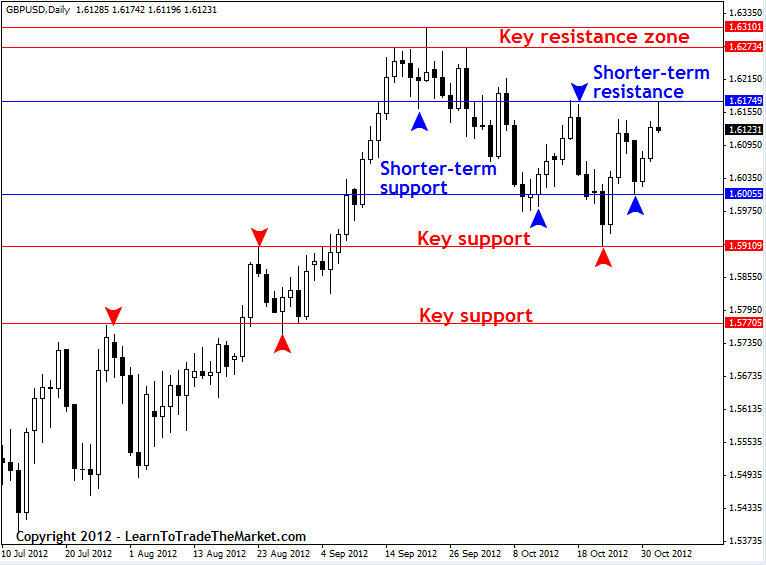

Example 2: GBPUSD DAILY CHART

Here’s a good exercise for you to work on: When marking support and resistance levels on your charts, mark the longer-term “key” levels first and then draw the shorter-term levels. This will work to give you a framework for the current market conditions and gives your analysis some routine as well.

One of the things I often write about is support or resistance “zones”, as often a support or resistance is not really an exact level but more of a zone. In the example below, we can see a very good example of a resistance zone that occurs between about 1.6270 and 1.6310.

“Key” support or resistance levels are generally levels that price rejected forcefully and that gave rise to a significant move up or down, or they can be levels that have contained or supported price many times. Whereas, shorter-term levels give rise to smaller movements and tend to break easier. We can see good examples of both in the GBPUSD daily chart below:

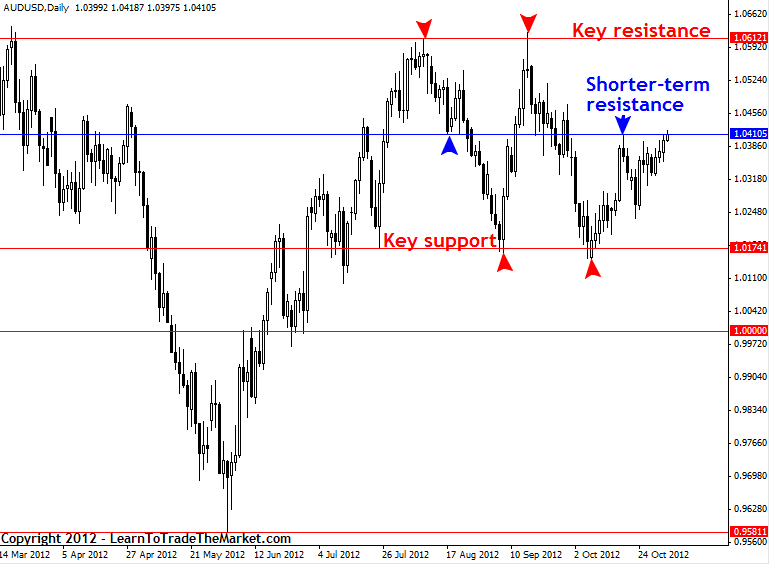

Example 3: AUDUSD DAILY CHART

In this example we are looking at the AUDUSD daily chart and we can see currently the market is in a large trading range between about 1.0612 and 1.0175. We classify 1.0612 as “key resistance” since it has caused significant turning points in the market and held on the last two tests. Similarly, 1.0175 is “key support” because it has led to significant turning points in the market and held on about the last 4 tests. The shorter-term level through 1.0410 is clearly significant, but again it’s not “quite” as significant as the two levels just mentioned. As you can see, some of drawing in your levels and deciding which is more important than the other can be left up to your own interpretation, but at the same time you should have a logical line of reasoning such as “this level has held price more times”, or “that level created a larger move”, etc.

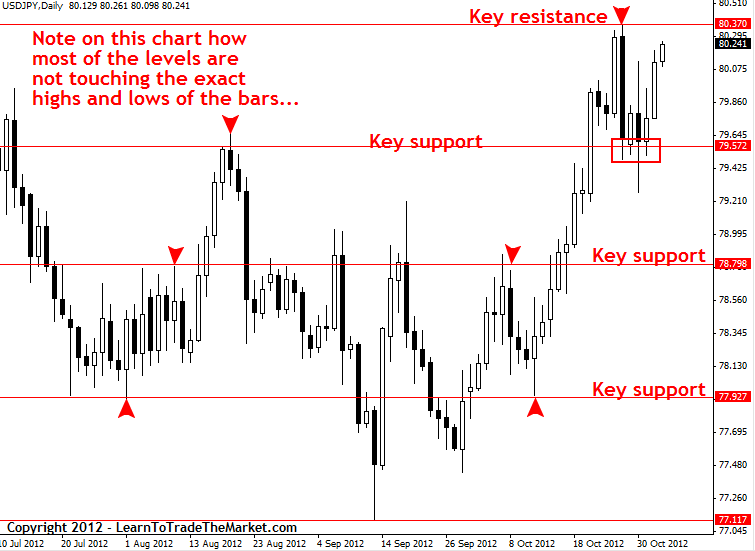

Example 4: USDJPY DAILY CHART

In the USDJPY example below, we are looking at all “key levels” because I did not see any that I considered to be short-term levels. The reason being, every level I’ve drawn in has created a significant turning point. The USDJPY most recently has been breaking higher, and if the resistance near 80.37 gives way we will likely see another leg higher.

Of special note in this chart are the bar tails or wicks. Note how some of the levels are not drawn exactly at the bar highs or lows but rather through the middle portion of the tail. This is important, and it’s one of the myths I mentioned at the start of this lesson; you don’t always have to draw your S/R levels exactly at a bar high or low. In fact, it’s more important to have a lot of tails touching a level than it is to have a level exactly at two or three bar highs or lows. An example of this is the level at 78.79 in the chart below; note how I drew it through as many bar tails (or wicks) that I could, rather than moving it further up and just hitting the exact highs of a couple bars. Drawing your levels in this manner gives you a better reference point to look for signals from since you are getting closer to the mean or average turning point price in the market, so it’s basically a higher-probability level than a level that’s further out but exactly at a bar high or low. That’s not to say you will never draw S/R levels at exact highs or lows, because you will, a lot, but it just means you don’t always have to draw them that way and won’t always want to.

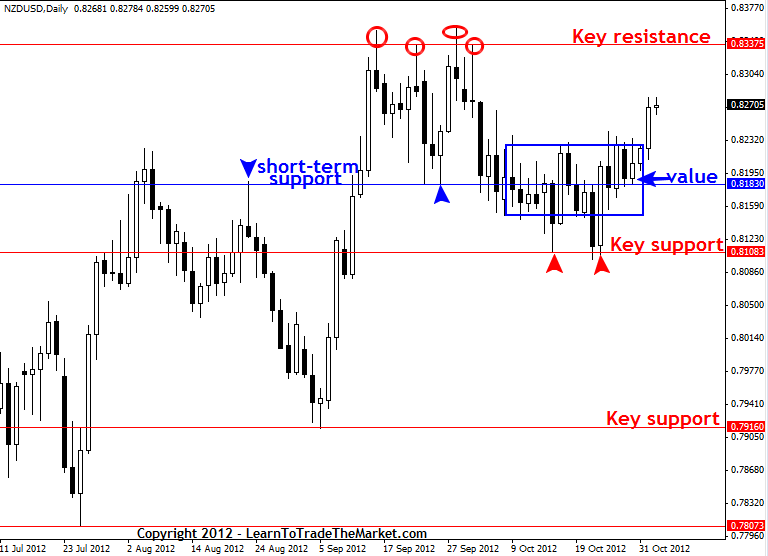

Example 5: NZDUSD DAILY CHART

In the NZDUSD chart below we want to take note of what I refer to as a “value area”. Now, what I mean by “value area” is basically just an area where it’s obvious that price “likes” to be. This is essentially just another word for consolidation, since an area of consolidation on a chart is essentially where a market has found “fair value”. These value areas typically act as support or resistance zones, and this means when price retraces back to them you can watch for price action trading strategies forming at them. You will also sometimes have existing support or resistance levels that basically run right through the center of a value area, showing about the middle of the value area, and we can see this clearly by the blue line in the chart below. In this specific NZDUSD example that blue value line would be a good support to watch for buy signals if price rotates lower soon.

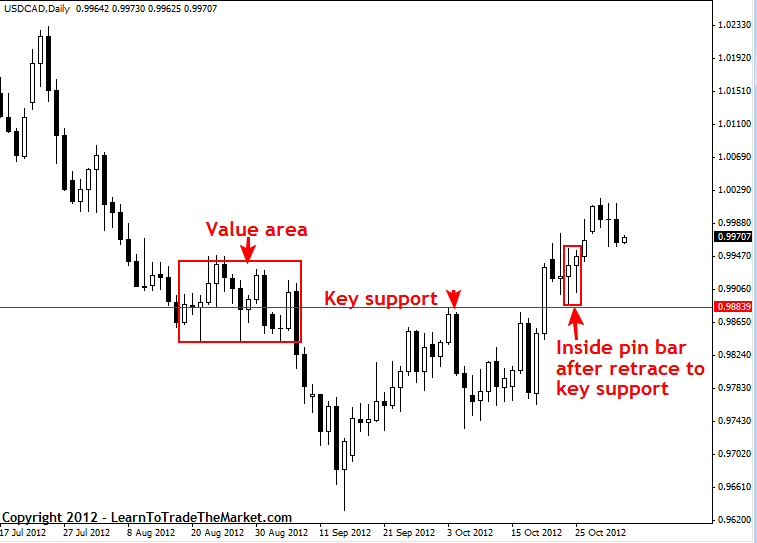

Example 6: USDCAD DAILY CHART

The USDCAD daily chart below shows us a good example of the “value” concept that I discussed in the last example. Note how price formed that area of consolidation or “value” marked on the chart below, and then later price retraced back up to it and found resistance exactly at the center of the value near 0.9883 on October 3rd. Then, after price finally broke back above that value level it formed a price action setup after it retraced back down to it, as we can see an inside pin bar combo setup formed showing rejection of that same level.

So, here’s a very simple strategy for you; wait for a key level to break, then wait for price to retrace back to it and look for a price action setup entry trigger to form near the breakout level in the direction of the initial breakout.

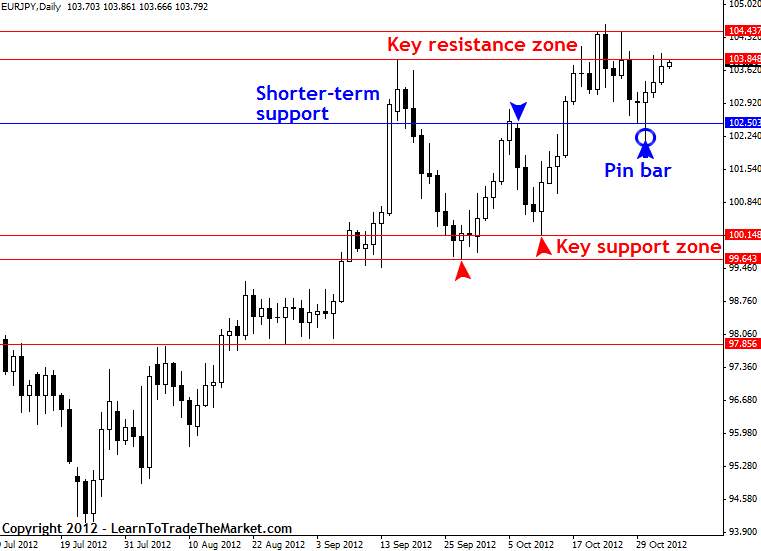

Example 7: EURJPY DAILY CHART

We can see in the EURJPY chart below that it’s been in an uptrend since about the end of July. This uptrend has had some pretty large counter-trend retraces, which of course we need to mark with levels. We can see in the chart below the support levels and zones left behind by the different points in the market were the retrace ended and the uptrend resumed. Also, in a trending market like this, we can watch the previous swing points for price action signals as the market retraces back to them. For example, in an uptrend we can look for price action entries at the previous resistance / swing points in the market which turn into support after price breaks up past them. We can see a clear example of this in the chart below with the recent pin bar trading strategy that formed at the shorter-term support through 102.50 area, note that this level was previous resistance.

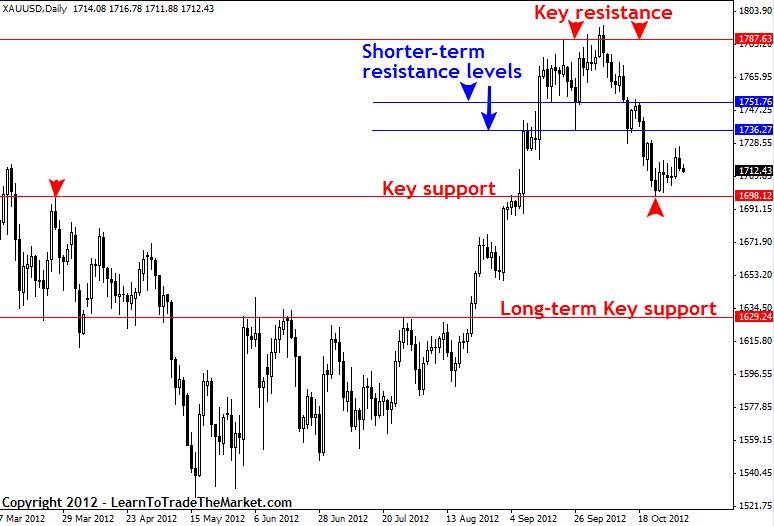

Example 8: XAUUSD DAILY CHART

In the Gold chart below, you can see I’ve gone back about 8 months in drawing in my long-term levels. This is about the farthest back I typically go when drawing in my levels on the daily charts. Again, longer-term “key levels” are those levels that clearly caused a significant change of direction in price and / or held strong on multiple tests across time. Shorter-term levels are those that caused less significant price direction changes and may be “newer” levels. You don’t have to get carried away drawing in too many of the shorter-term levels though, just use common sense and decide which are the most obvious and draw those in. If you put too many support and resistance levels on your charts you’ll end up with a messy chart that just confuses you and might even cause you not to trade because you think there are too many levels for the market to have to move through.

This brings me to a very important point you should remember: In an up-trending market, resistance levels will often break, and in a down-trending market support levels will often break. I say that because I get a lot of emails from traders telling me they can’t get a proper 1:2 or more risk reward ratio because there are too many support or resistance levels in the way. Well, you have to look at the market context that your trade setup has formed in and use some common sense and discretion…not every little level you find is significant.

Example 9: DJ30 DAILY CHART

In the Dow Jones futures chart below, we can see the current picture of key levels that are relevant for this market. Of special note, we can see how consistently these key levels hold as price retraces back to them. Knowing that price often bounces or repels from key levels is a very valuable piece of information. Indeed, a big portion of my trading theory revolves around waiting patiently for an obvious price action setup to form at a key chart level as the market retraces back to it. If you observe this chart for a few minutes, you’ll begin to see how accurate these levels are in rejecting, it really is uncanny.

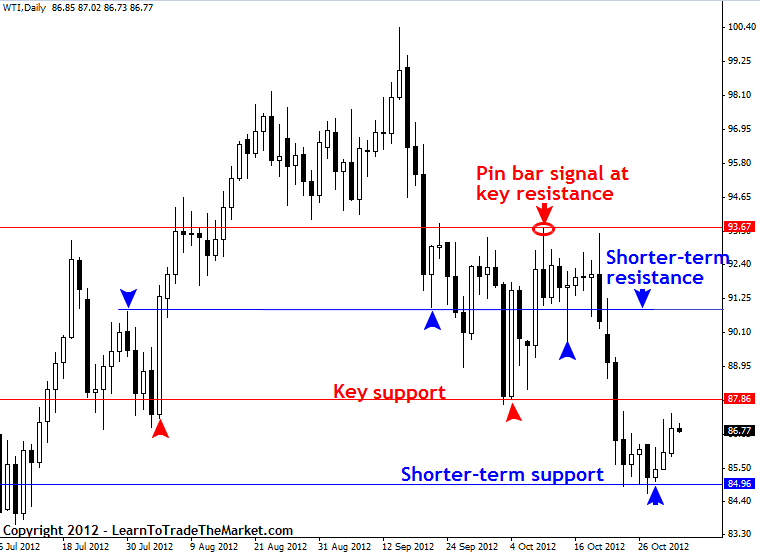

Example 10: WTI DAILY CHART

In the example below, we are looking at the current Crude Oil chart. This chart shows us a very important lesson. Note the pin bar marked on the chart below, it was an obvious pin bar that showed forceful rejection of a key resistance level, and then the market chopped around about 6 days before finally moving lower. The most obvious stop loss placement on that pin bar would have been just above its high which was also the key resistance through $93.65 area. If you enter an obvious price action setup like that and you’ve placed your stop loss at a logical spot in-line with the existing market structure, there’s no reason to panic if the market moves against you and almost stops you out. This exact scenario was very likely in this Crude oil pin bar setup, and I know some traders who panicked when price moved against them. Had they just stayed in the market, their initial stops just above the key resistance would not have been hit and they would have made a killing. Lesson: trust your stops if you’ve placed them beyond a key support or resistance level or in another logical place.

Conclusion:

I hope you now have a better idea of how I draw support and resistance levels on my charts and why I draw them where I do. I suggest you try drawing the relevant levels on your charts now according to what you’ve learned in today’s lesson. Also, follow my daily Forex commentary for a good daily example of how I draw the levels on a major market each day.

Determining where to draw your support and resistance levels is really not as difficult as many traders make it out to be. When in doubt, slow down and take a step back, ask yourself if a level your about to put on your chart makes sense and why. If it makes logical sense you should be able to easily explain why to someone who has no trading experience. For example, you might say “This level is important because it clearly caused price to make a significant change of direction recently”. If you just take a logical approach to drawing in your support and resistance levels you will save yourself a lot of time and frustration in the end. Don’t be one of those traders with so many lines on their charts you can’t figure out what’s happening. If you would like more help with drawing support and resistance levels and how to use them in combination with price action strategies, checkout my Forex price action trading course for more in-depth instruction.

many thanks chief ,

you make the complicated details very handy

Thank You Very Much Nial. Love The Breakdown And Explanation

Cheers! Glad you enjoyed the article.

This has improved my trading knowledge.

Sir… Very useful article. ..I use to read your articles since last 5Years..

Really …love ..your …information.

Thanks you so much nial.. So valuable information to change entire forex trading patterns. God bless you.

I have never understood support and resistance better. Thank you fuller.

Thank you so much, i am getting it gradually

Thanks so much Nial, I’ve learned so much today and a majority of my questions have been answered. You know what you’re doing, Kudos

Thank you very helpful.

Support and Resistance are most significant aspect of trading.

Excellent piece of information.Thanks Nial….

Another great article from Nial. Spot on. Thanks for a very helpful lesson.

Nial Fuller,

I must say thta your fore knowledge in forex, has help me to know when to begin, where to start the drawing and the required time frame.

keep the good work sir

I can’t believe even now that how this can be done so simple it was a pin point explanation ?? it ?✅

Perfectly explained Hial!

Been a member for a long time, just now getting serious about a potential career change. Learned a lot from this section today.

Thanks Nial!

Yes Nial, that helped!

Thank you

THANKS NIAL. YOU’RE THE BEST

Thank you very much Nial, you helped to find itself me in trading.

Hey Nial,

Thank you for writing such helpful article. It is the best. I have a question to you? As a Price Action Guru, What is your view regarding Trend Line? How does it work as Support and resistance. Should we use trend line? I know yours is the best.

Best Regards

Golam Moktadir

Rarely looked at trend lines during my entire career. Trend lines look great ‘after the fact’ (hindsight), however in real live trading they are quite haphazard and not a consistent enough tool for me to incorporate them into my day to day trading activities.

I got it Nial great! Will start drawing them on my charts. Thanks

Hi, nial its very helpful for everybody and also for me.

Great article man. Keep up the good work

Thank you Nial, now I already have an idea on how to identify the key resistance and support levels in a candlestick chart.

Thanks You For The Great Lesson Sir..Its Was Helpful and Excelent.>>>.

SNR really useful and very accurate on timeframe H4 and above . use Pending order buy stop or sell stop and Trade like a sniper .trade on major pairs + 3 only.

Hey Nial, this is the part that I am having a hard time to understand. Do I draw key support and resistance levels from the pinbars? How can I recognize better where should I draw these critical lines? Thanks

Hi Nial,

Do you think using bar chart to draw support and resistance is a good idea?

More good stuff from you.

If you only trade on a raw price action chart, then these lines are essential

Yeah, that keeps us objective and unemotional.

Fantastic article full of gems of wisdom. I now have 10 theories on entry points and stop loss points to test on other charts and in my demo trading, having scrutinised these charts in this article in detail.

Many thanks for a great piece of education..

Great lesson Nial Thank you.

The Penny has almost dropped but I think there is no substitute for practice and more practice.

From now on, I am going to do my lines When New York closes then compare with yours. What do you think of that idea?

Hi Nial, very good lesson on S & R Lines, but as a newbie I have not grasped it yet. As someone has mentioned most of your S/R lines are on the Daily charts but would that change on the 4Hour charts or do we start again on them.

Regards Chrisaw

I appreciate your shared knowledge and experience in forex. Most of your articles are very very useful and helpful. Pls may i ask if you do send trade set and signals to your members on daily basis?

We have a daily market commentary which talks about potential price action setups, key levels, market bias and other relevant information.

Nial i have got to say this is the best , in detail instruction on drawing S/R i have ever read. Thank you so much very helpful.

this is a good and self-confident approach to drawing support and resistance level…….infact i really love this, keep it up Mister Niall Fuller.

Thank you for this wonderful article. I have been struggling for a long time with “how” and “where” to draw S&R lines. This simplifies my understanding and will really help. Thank you.

Thanks again for the great article, Nial. Don’t you ever use diagonal trend lines? These tend to work as support and resistance too.

Wonderfully beautifully described

wow… great lesson …..you are superb …thank you .

Wonderful. How a simple and comprehensive way of guidance. Well done. Thanks Nial

Hi Nial I support your ideas.

DAN

Hi Nial

Thanks for the tutorial. It has helped me get an explanation for the short term R/S levels. They have been confusing me so much.

I learned a lot.

Nial, do you set these S/R everyday? or how long you

use since you set?

Nial, what do you think about clearing charts and drawing new w/r lines once in a while to get a fresh look on the market?

Hi Nial… this S/R article is great..really useful..

May i also ask if you draw trendlines for your trade set-ups? or do you rely on S/R 99% of the time…

Thanks Nial…

Such an important article for all of us.

Thanks, Nial.

Great article Nial, many thanks

nice and clear explanation. very helpful tutorial.

you are a great instructor, Nail.Thanks

Hi

I had the same problem. I hope it will be easier now :)

Thanks sir. your lesson is very intresting

I enjoyed your lesson sir. Thanks

Support and resistance is easy and tricky at the same time.

Thanks Nial,

it makes alot more sense now. I have question though. If I draw these levels on the daily chart, should I comfortably trade off them on the H4 chart or do I have to draw a fresh set of levels for the H4 chart.

From my experience, after drawing on the daily chart, on the H4 chart, some levels would match while some would be missed.

What is the way around this?

DJ30 Uncanny alright !! Check Friday/s close.Resistance to Support,again.Wow.Great stuf again,Niall

Sam

Very simple and plain chart as sweet as a candy……..

Good day Nial.

Are you saying that s/r levels are purely visual and not from any specific price points to the left affecting price behavior in these zones? Something is missing for me…Thanks

Wow!!! Nial….this is one your better articles….just amazing…thanks

Excellent commentary. Straight forward & to the point.

Thank you for the info I read every word you type , hopefully I can make this work.

Thank you I now have a better understanding.

Pratice time.

sir,

i enjoy your lessons on s/r

“You don’t need to go back more than about 8 months when drawing your levels.”

This was a very important clue for me. I have been really struggling on this. Thank you Nial! The most useful technical advice for me for a long time.

Clean and effective.as ever…great Nial

You’re simply the best, Nial!

Thanks, Nial, lots to learn here.

Wow !!! It’s really great Nial and to me it’s very usefull

and very worthed. Thank you for this great lesson Nial ! ! ! !

Thanks Nial for sharing your wisdom and experience , it is always helps us. Ps .. The Usd / Jpy did breakthrough the 80.37 resistance level friday ,so a retest of that level and a good price action setup would be a good place to enter long ?

Phil

nice,thanks!

filopastry…..when Nial said its a Myth that you need to go back several months to determine your S/R levels…he means that generally speaking its a waste of time and that in doing so you would be drawing to many lines on your chart and further confusing yourself.

S/R is better than any all indicators put together. Thank you professor.

Thanks Nial, As a newbie, This helps a lot. Thanks

Thanks Nial just awesome!!!

Thanks Nial. This article provided a lot of “support” in my trading. Now I’m finding very little “resistance” in following my trading plan.

I have actually just started to take more notice of the Weekly charts and drawing key levels through them. I’m surprised you don’t mention this Nial.

Since i started doing this about a month ago..my Trading has improved greatly..as i don’t need as many lines on the Daily chart.

I also look at Monthly Charts and draw ‘obvious’ key levels there also!

this was a invaluable article for me as I was not greatly clued up on S/R lines but as usual you make it look easy Nial.

many thanks Nial

Grant

thanks Nial…

Dear Nial,

Thank you for the email and all the work you have done. However, I am not sure that I still draw the support and resistance lines correctly. Also, do you send ” Signals” to traders? Or you know a reliable source who would do so?

I appreciate your advice,

Best regards,

Mahnaz

It’s very DOOD!

SnR are really important to trade. able to plot exact will definitely help improve trade tremendously. TQ

My question is that what time frame and how many month data one should be focusing on when draw this levels

Learned a lot on support / resistance levels ! Thanks.

Dear Nail,

Drawing S/R is very vital , am grateful.

Thanks you nial

Great article……….

Hi Nial,

Great practical article.

I found this sentence confusing.

Myth 3: You should go back really far in time with your levels??

Thanks again for your support

Hi Nial!

This is a great article for the newbies! I draw my S/R lines the same way but it took me a few years of experimenting to do it. I’ve moved on further and combine them with triangles (my way!) My three trades this week were all winners and my a/c grew another 3.2%! Further I am working f/t and trade off dailies. It takes me about 30 minutes each day to check the charts etc. ! So it can be done!

Nials,

Many thanks again for a brilliant article, just nails it.

Best regards

rayh

Thanks Nial for a good tutorial.

Very helpful indeed!

I am glad to say that the levels you marked matched the ones I had on my charts almost exactly which proves a few things

– there are no levels but more like zones

– each person marks them differently without being necessary wrong, and finally,

– your lessons/teaching/articles/ideas work and provide real, useful information.

Thank you very much for taking the time to develop this website!

Excelent ! Just what we need to know

Edward

yes this is very helpful for me .thanks.

Exceptional. Many thanks.

Hail Nail

Thankx my Breo, that is exactly what I needed since I trade the price action I used to struggle a lot with S/R someone even told me to use a line-chart……….but what U’ve explained here makes a lot sense,

Big-up Brroe

Hi Nial,

Yet again, you nailed it. Beautifully put, and patiently explained, enjoyed it. thank you.

One comment though, Do you agree that the more times a line(S/R) is Touched (respected) the stronger, and the more time is broken it’s weaker!

I personally don’t take too much notice of lines broken more than Twice

(that is to cater for Head and Shoulder pattern!) So the chart do not get too cluttered.

Thanks.

thanks Nial.a very good tutorial on S/R zones,very helpful.

Hi,

do you use the same levels for intraday trading (h1 and h4 charts) or do you draw anothers levels?

Thank You very much, this is really good and useful.

Very simple and practicable. Thanks Nial

THX)))

Very Thanks Nial!,,, This is the best article you wrote!!

Thanks

Very very much informative text.

Surely much appreciated and my respect to Nial.

cheers

Morning

This is helpful for me ,kindly as still on a learning program kindly take me through as to when and how must i enter a trade?

Regards

Thanks Nial…very helpful and great tutorial.