Risk Reward and Money Management in Forex Trading

This could possibly be the most important Forex trading article you ever read. That might sound like a bold statement, but it’s really not too bold when you consider the fact that proper money management is the most important ingredient to successful Forex trading.

This could possibly be the most important Forex trading article you ever read. That might sound like a bold statement, but it’s really not too bold when you consider the fact that proper money management is the most important ingredient to successful Forex trading.

Money management in Forex trading is the term given to describe the various aspects of managing your risk and reward on every trade you make. If you don’t fully understand the implications of money management as well as how to actually implement money management techniques, you have a very slim chance of becoming a consistently profitable trader.

I am going to explain the most important aspects of money management in this article; risk / reward, position sizing, and fixed dollar risk vs. percentage risk. So, grab a cup of your favorite beverage and follow along as I help you understand some of the most critical concepts to a profitable Forex trading career…

Risk : Reward

Risk reward is the most important aspect to managing your money in the markets. However, many traders do not completely grasp how to fully take advantage of the power of risk reward. Every trader in the market wants to maximize their rewards and minimize their risks. This is the basic building block to becoming a consistently profitable trader. The proper knowledge and implementation of risk reward gives traders a practical framework to do this.

Many traders do not take full advantage of the power of risk reward because they don’t have the patience to consistently execute a large enough series of trades in order to realize what risk reward can actually do. Risk reward does not mean simply calculating the risk and reward on a trade, it means understanding that by achieving 2 to 3 times risk or more on all your winning trades, you should be able to make money over a series of trades even if you lose the majority of the time. When we combine the consistent execution of a risk / reward of 1:2 or larger with a high-probability trading edge like price action, we have the recipe for a very potent Forex trading strategy.

Let’s take a look at the 4hr chart of Gold to see how to calculate risk / reward on a pin bar setup. We can see in the chart below there was an obvious pin bar that formed from support in an up-trending market, so the price action signal was solid. Next, we calculate the risk; in this case our stop loss is placed just below the low of the pin bar, so we would then calculate how many lots we can trade given the stop loss distance. We are going to assume a hypothetical risk of $100 for this example. We can see this setup has so far grossed a reward of 3 times risk, which would be $300.

Now, with a reward of 3 times risk, how many trades can we lose out of a series of 25 and STILL make money? The answer is 18 trades or 72%. That’s right; you can lose 72% of your trades with a risk / reward of 1:3 or better and STILL make money…..over a series of trades.

Here is the math real quick:

18 losing trades at $100 risk = -$1800, 7 winning trades with a 3 R (risk) reward = $2100. So, after 25 trades you would have made $300, but you also would have had to endure 18 losing trades…and the trick is that you never know when the losers are coming. You might get 18 losers in a row before the 7 winners pop up, that is unlikely, but it IS possible.

So, risk / reward essentially all boils down to this main point; you have to have the fortitude to set and forget your trades over a large enough series of executions to realize the full power of risk / reward. Now, obviously if you are using a high-probability trading method like price action strategies, you aren’t likely to lose 72% of the time. So, just imagine what you can do if you properly and consistently implement risk reward with an effective trading strategy like price action.

Unfortunately, most traders are either too emotionally undisciplined to implement risk reward correctly, or they don’t know how to. Meddling in your trades by moving stops further from entry or not taking logical 2 or 3 R profits as they present themselves are two big mistakes traders make. They also tend to take profits of 1R or smaller, this only means you have to win a much higher percentage of your trades to make money over the long-run. Remember, trading is a marathon, not a sprint, and the WAY YOU WIN the marathon is through consistent implementation of risk reward combined with the mastery of a truly effective trading strategy.

Position Sizing

Position sizing is the term given to the process of adjusting the number of lots you trade to meet your pre-determined risk amount and stop loss distance. That is a bit of a loaded sentence for the newbie’s. So, let’s break it down piece by piece. This is how you calculate your position size on every trade you make:

1) First you need to decide how much money in dollars (or whatever your national currency is) you are COMFORTABLE WITH LOSING on the trade setup. This is not something you should take lightly. You need to genuinely be OK with losing on any ONE trade, because as we discussed in the previous section, you could indeed lose on ANY trade; you never know which trade will be a winner and which will be a loser.

2) Find the most logical place to put your stop loss. If you are trading a pin bar setup this will usually be just above / below the high / low of the tail of the pin bar. Similarly, the other setups I teach generally have “ideal” places to put your stop loss. The basic idea is to place your stop loss at a level that will nullify the setup if it gets hit, or on the other side of an obvious support or resistance area; this is logical stop placement. What you should NEVER DO, is place your stop too close to your entry at an arbitrary position just because you want to trade a higher lot size, this is GREED, and it will come back to bite you much harder than you can possibly imagine.

3) Next, you need to enter the number of lots or mini-lots that will give you the $ risk you want with the stop loss distance you have decided is the most logical. One mini-lot is typically about $1 per pip, so if your pre-defined risk amount is $100 and your stop loss distance 50 pips, you will trade 2 mini-lots; $2 per pip x 50 pip stop loss = $100 risked.

The three steps above describe how to properly use position sizing. The biggest point to remember is that you NEVER adjust your stop loss to meet your desired position size; instead you ALWAYS adjust your position size to meet your pre-defined risk and logical stop loss placement. This is VERY IMPORTANT, read it again.

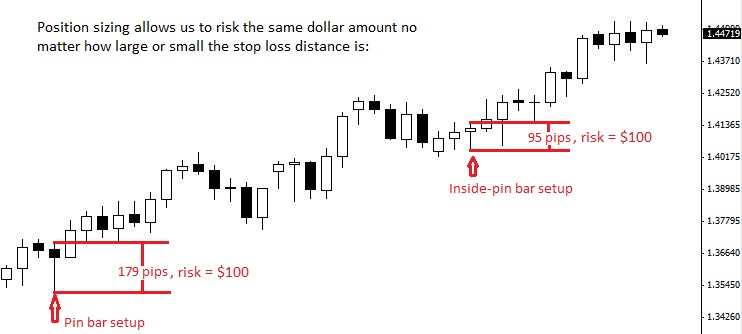

The next important aspect of position sizing that you need to understand, is that it allows you to trade the same $ amount of risk on any trade. For example, just because you have to have a wider stop on a trade doesn’t mean you need to risk more money on it, and just because you can have a smaller stop on a trade does not mean you will risk less money it. You adjust your position size to meet your pre-determined risk amount, no matter how big or small your stop loss is. Many beginning traders get confused by this and think they are risking more with a bigger stop or less with a smaller stop; this is not necessarily the case.

Let’s take a look at the current daily chart of the EURUSD below. We can see two different price action trading setups; a pin bar setup and an inside-pin bar setup. These setups required different stop loss distances, but as we can see in the chart below we still would risk the exact same amount on both trades, thanks to position sizing:

The fixed dollar risk model VS The percent risk model

Fixed dollar risk model = A trader predetermines how much money they are comfortable with potentially losing per trade and risks that same amount on every trade until they decide to change their risk.

Fixed percent risk model = A trader picks a percentage of their account to risk per trade (usually 2 or 3%) and sticks with that risk percentage.

In a previous article that I wrote about money management titled “Forex Trading Money Management – An Eye Opening Article”, I argued that using a fixed dollar amount of risk is superior to the percent of account risk model. The primary argument I make about this topic is that although the % R method will grow an account relatively quickly when a trader hits a series of winners, it actually slows account growth after a trader hits a series of losers, and makes it very difficult to bring the account back up to where it previously stood. This is because with the % R risk model you trade fewer lots as your account value decreases, while this can be good to limit losses, it also essentially puts you in a rut that is very hard to get out of. What is needed is mastery of one’s trading strategy combined with a fixed dollar risk you are comfortable with losing on any given trade, and when you combine these factors with consistent execution of risk / reward, you have an excellent chance at making money over a series of trades.

The % R model essentially induces a trader to ‘lose slowly’ because what tends to happen is that traders begin to think “Since my position size is decreasing on every trade it’s OK if I trade more often”…and whilst they may not specifically think that sentence…it is often what happens. I personally believe the % R model makes traders lazy…it makes them take setups that they otherwise wouldn’t…because they are now risking less money per trade they don’t value that money as much…it’s human nature.

Also, the %R model really serves no real world purpose in professional trading as the account size is arbitrary; meaning the account size does not reflect the true risk profile of each person, nor does it represent their entire net worth. The account size is actually a ‘margin account’ and you only need to deposit enough in an account to cover the margin on positions…so you could have the rest of your trading money in a savings account or in a mutual fund or even precious metals…many professional traders do not keep all of their potential risk capital in their trading account.

The fixed $ risk model makes sense for professional traders who want to derive a real income from their trading; it’s how I trade and it’s how many others I know trade. Pro traders actually withdrawal their profits from their trading account each month, their account then goes back to its “baseline” level.

Example of Fixed $ Risk Vs. % Risk

Let’s take a look at a hypothetical example of 25 trades. We are comparing the fixed $ risk model to a 2% account risk model. Note: We have chosen the 2% risk because it’s a very popular percent risk amount amongst newbie traders and on many other Forex education sites. The fixed $ risk was set at $100 per trade in this example just to show how a trader who is confident in his or her trading skills and trades like a sniper would be able to build his or her account faster than someone settling on a 2% per trade risk. In reality, the fixed $ risk will vary between traders and it’s up to the trader to determine what they are truly OK with losing per trade. For me, if I was trading a small $2,000 account, I would personally be comfortable risking about $100 per trade, so this is what our example below reflects.

It’s quite obvious upon analyzing this series of random trades that the fixed $ model is superior. Sure you will draw your account down a bit quicker when you hit a series of losers with the fixed $ model, but the flip side is that you also build your account much quicker when you hit a series of winners (and recover from draw downs a lot faster). The key is that if you’re really trading like a sniper and you’ve mastered your trading strategy…you’re unlikely to have a lot of losing trades in a row, so the fixed $ risk model will be more beneficial to you.

In the example image below, we are looking at the fixed $ risk model versus the % risk model:

Now this example is a bit extreme, if you are trading with price action trading strategies and have truly mastered them, you shouldn’t be losing 68% of the time; your winning percentage is likely to average close to 50%. You can imagine how much better the results would be with a 50% winning percentage. If you won 50% of the time over 25 trades while risking $100 on a $2,000 account, you would have $4,500. If you won 50% of the time over 25 trades while risking 2% of $2,000, you would have only about $3,300.

Many professional traders use the fixed dollar risk method because they know that they have mastered their forex trading strategy, they don’t over-trade, and they don’t over-leverage, so they can safely risk a set amount they are comfortable with losing on any trade.

People who trade the %R model are more likely to over-trade and think that because their dollar risk per trade is decreasing with each loser it’s OK to trade more trades (and thus they lose more trades because they are taking lower-probability trades)…and then over time this over-trading puts them much further behind a fixed $ trader who is probably more cautious and sniper- like.

Conclusion

To succeed at trading the Forex markets, you need to not only thoroughly understand risk reward, position sizing, and risk amount per trade, you also need to consistently execute each of these aspects of money management in combination with a highly effective yet simple to understand trading strategy like price action. To learn more about price action trading and the money management principles discussed in this article, check out my Forex trading course.

Awesome. I read this all day and I don’t get tired.

Sincerely speaking, my trading improved INSTANTLY.Just a week after buying Mr.Nial’s course.And I applied all the trading guideline as per this course,my account became profitable .

I am relaxed,no more tension and fear …like when used sit all day in front of my screen scalping 5min Tframe.

I now trade on Daily and 4H .Where I patiently wait for my setups to emerge organically.

I lack proper words to express my joy and gratitude to Mr. Nial.

Thank you and God bless you!

This post is critical in succeeding in FX trading. The importance of position sizing risk/reward and fixed $ amount to potentially loose and sticking with it. Instead of opting for the insidious % fixed model that sounds more like throwing good money after bad money.

I REALY used to ignore MM but not after reading this…….thanks Nial for all your efforts to help other traders succeed. Be blessed.

Important lesson! Thanks

I am new to trading. This is a great ARTICLE and i will for sure follow your advice. I am also bussy reading all other articles.

GREAT STUFF.

thumbs up!!!!

When I started with trading a year ago MM was my worst favorite topic. Thanks Neil, you made it simple to understand. Keep it up!

Greeting Nial.

Great article!

I am thinking of leverage as well you did not mention in your article above. However is it reasonable to say that it is better to take highest leverage of the trade I am allowed?

Thank you.

Bin

Nial

I don’t know where you came from nor where you are going. But you are scary!!!! What you know is scary.

I’m an accountant by profession but with this article, I think you cracked the code!

Every trader must study this article.

God bless you even more, with wisdom.

Hi Nial,

Thanks for the article. I’m new to trading and would like to know few things,

– How much drawndown (or balance in account) before I reduce the $100?

– How much do we need to increase our balance before increasing the fixed $ risk?

Regards,

Victor Yong

Increasing the reward versus the risk sounds attractive, but I think the more important thing to notice is how much, on average, does price action move above your take profit level with equal risk to reward (1/1). If on most of your winning trades (1/1) the market moves 3x your risk then 3x risk would be appropriate. But increasing your reward vs risk to 3x on your trades, even though the majority of your trades would be nullified because of an activated stop loss wouldn’t be worth it. People shouldn’t forget that you can be very specific about the risk/reward and have a profile that is 1/1.25 or 1/1.33, 1/1.5, 1/1.75. It’s whatever profile matches the trading consistency you have developed through demo trading at equal risk vs reward. I wish I read this article 4 years ago.

@ Manuel, u are correct, just was about to post that. Anyhow Nial is a great guy…. I have learnt a lot from him…. i incorporate his method and fine tuned some to soothe me needs..anyhow Kudos to you…..

Hi Nial!

I have found today your website and i think it’s very interesting! I’m a trader, i started one year ago … I live in italy and i started to trade following the price action metods with witch i find so well .

But i’ve read this article about the money management and when you refer to chose between fixed risk or % risk i think your example is not fully correct . In fact if you think to use a % risk of 2%, your fixed risk should be of 40 $ and not 100$ . With 100 $ your risk is the 5% … In this way the final result will be different, showing that fixed risk is not better than the % risk, but similar … (at the end of the 25 trades the % risk is light better than the fixed risk …)

I hope to have been clear (sorry for my not perfect english ;) )

I continue to follow you

Thanks

Manuel

Having strugled for years with emotions… These pages have opened up the perspective of how simple and fearless forex trading can be.

Mr. Fuller! You have made my day with your simple aproach to the matter!

FIRST explanation on this topic that has made sense to me, and I love the comparison of fixed $ amount vs percentage! Very smart…

You have made the world understand that Forex is far from what many people think it is.God Bless you Nial.

GOD blees you Nail.

Hi Nial,

are you sure that e.g. having 30% of winning trades with R/R 1:3 is easier than having 60% of winning trades with R/R 1:1.

thanks for your lessons

Any

It’s not about being sure, it’s about being realistic.

Nial,

Great Lesson. Thanks a lot Nial.

Nial’s money management articles are the best part of his entire course. Nobody else teaches this.

thank you very much Nail, this artical is vital for me and I will implement these abilities on my trading.

another good one. one thing i was thinking when i started trading was i had to win all my trades. it got me no where, until i started to practice proper money management skills. thanks for refreshing my memory once again.

Thanks Nial, Very useful. Do you have an excel sheet that does the automatic calculation given in the capital, number pips to risk and it automatically calculates the position sizing for the fixed model and 2% model?

I do personally, and will be hard coding something like this into the members area soon.

Nial, you’re GOD!!

Thank you SO much!!

Amen!

Great lesson Nial!

helps me a lot to stay focused on the basics elements that are so critical in being and staying a profitable trader, it’s so easy to carried away if the key elements in your plan are not solidely established and respected! cheers!

Yep, great article as always but it’s a little bit scary to me risking $100 while I’m having $2,000 account;] IMHO for me, as a completely newbie a better way to ‘beat the market’ is to start with 2% option and then, when I get some confidence with my trading move over to fixed $100 strategy. Regards

Hi Nial,

Hope you are well. Another fantastic article. Thank you very much.

Thanks and Regards

Gurpal

thank”s.

Love examples Nial, a great lesson once again, keep examples coming. Thanks Nial.

Thanks Nial, this is beautifully explained and very useful.

U are just too precious with your articles.Thank u and keep it up.

Once again ,thank u.

Olusola

Nigeria

Thanks Nial

Thailand

As a member of LTTTM I can say that understanding and implementing the principles in this article are what has made me profitable as a trader – I am 3 months in profit in a row on my demo and in profit for my 4th month. If I make 5 months in a row I will go ‘live’. Manage your risk well, take your profit and everything else falls into place….Also, as a bonus, I can really fluff up my analysis and lose money safe in the knowledge that my rewards will outweigh my risk over the long term…

Thanks Nial – great article; definitely required reading for all newbie traders. Thanks for your willingness to share your knowledge.

Regards

Henry

Nial, Excellent, as usual! I have, after 3.5 years of FX [complicated] edu finally have the right [simple] place to roost :) While mastering the Price Action, might as well master MM while I am at it. I think real soon, I’ll be soaring with all the other eagles in here!! Thanks so much!!! God bless.

thank’s Nial…so useful for my supply and demand analysis

henry

Indonesia

JUST WHEN I THINK YOU’VE GIVEN US ALL THE WEAPONS WE NEED FOR SUCCESS…BAM! YOU PULL ANOTHER GREAT ONE OUT OF YOUR HAT. SWEET LESSON, NIAL.

Hai Nial,

Thanks for this articles. I will read it over n over again

to fully understand it.

Rikus

It is good to refresh our brain sometime with what we have learned in the past. The article look as if, I heard it for the first time. Thank Nial for reminding me of this important aspect.

Thanks Nial. Great stuff as I always enjoy your articles. Extremely practicle and priceless.

thanks nial

I’m just an aspiring trader and have been just reading for six months or so, this web site being definitely my best forex discovery :).

As for fix amount versus fixed percentage, in the long run (at least 100-200) fixed percentage is certainly superior (Kelly criterion). As can be seen the the table above both the growth AND the drawdown of the fixed percentage order size were smaller.

It would be interesting to see the two strategies side by side on two live accounts with ‘mirrored’ trades.

Hi Nial,

Question. Before we master a good strategy would it be OK to implement the risk % method to limit losses. I like the fixed dollar amount once I am consistently profitable :) Also, at what point should we increase the fixed dollar amount risked? I plan on starting with $3,000 and risking $30 every time, then if and when my account hits $4,000 increasing the risk to $40.

Thanks!

Yep. Simple. Yet, crucial. Without proper risk management methods in place, there is no need to place a trade.

It allows you to partake in trading in a business fashion – to confidently build a scalable business(especially when applying the percentage model).

Thanks Nial for helping me to personally improve my trading by understand consolidations which often involve pin bars/inside bars/and as you say ‘fakeys’.

Ike

Los Angeles

Very clever way to look at MM thank you, it has always

been my biggest problem.

Nial, you are using $100 as example for risk, when would

you rise the stake to say $200, would that be after a set

winning days, or doubling of your account, what criteria would you use?

Thanks Nial

I tend to withdraw profits .. but if you leave the money in the account, it’s up to you when you want to increase the fixed amount. I personally don’t compound my account forever, it’s not logical. Traders have to draw down money in order to realize the gains the have made. They risk giving it back to the market if they leave it all in the account.

Nial,

Excellent article…easy to understand what has been a complicated subject for me…until now.

Thanks much.

Cliff

Hastings, Minnesota

I remember that article about the fixed amount of dollars vs the fixed amount of risk per trade and it was an eye opener! I have been using that method and my account has grown much faster because of it when I hit a good number of winning trades in a row.

A great trading strategy that is mastered, along with the proper trading pyschology (Respect Greed and Fear but don’t let either consume you) and excellent money management are the real keys to success in trading.

Sadly though, 95% people will not take the time to discover this truth so in the meantime I along with other professional traders will be on the other side of the losing trades that the newbies continue to take until they realize there is no magic indicator or forex robot that exists.

Thanks so much for teaching me PA Nial! You have no idea how much you transformed my life forever! :-)

very nice and important subject.

Thanks Nail

Hi Nial:

Thanks for sharing, I always enjoy reading your informative articles. I tend to re-read them and constantly pick up more information or reinforce what I’ve already learned.

Great lesson as usually.

Thanks Nial

Ricardo

Your articles have become like tasty morsels to digest! I did get my favourite beverage and took it all in.

I’m a newbie and this is fantastic. Risk/Reward as presented above takes away the scary from forex. I read these disclaimers all over about forex being high risk and hear the horror stories of people wiping out their entire account in a short space of time.

It is clear to me now that with the correct risk/reward plan, position size and risk amount per trade coupled with the simple non-intimidating price action setups you teach, I can be on the good side of the statistics :)

I get the feeling also that even if I sometimes get my levels slightly wrong (while learning) and pick weak trade setups, the above in place will still keep me afloat.

Thanks, Nial.