What Is Price Action Trading ?

1- The definition Of Price Action trading

2- Trading with “Messy” Vs “Clean” Charts

3- How to identify trending and consolidating markets using price action

4- How to trade with Price Action trading strategies

5- How to use chart confluence and Price Action signals

The Definition of Price Action Trading

Price Action Trading (P.A.T.) is the discipline of making all of your trading decisions from a stripped down or “naked” price chart. This means no lagging indicators outside of maybe a couple moving averages to help identify dynamic support and resistance areas and trend. All financial markets generate data about the movement of the price of a market over varying periods of time; this data is displayed on price charts. Price charts reflect the beliefs and actions of all participants (human or computer) trading a market during a specified period of time and these beliefs are portrayed on a market’s price chart in the form of “price action” (P.A.).

Whilst economic data and other global news events are the catalysts for price movement in a market, we don’t need to analyze them to trade the market successfully. The reason is pretty simple; all economic data and world news that causes price movement within a market is ultimately reflected via P.A. on a market’s price chart.

Since a market’s P.A. reflects all variables affecting that market for any given period of time, using lagging price indictors like stochastics, MACD, RSI, and others is just a flat waste of time. Price movement provides all the signals you will ever need to develop a profitable and high-probability trading system. These signals collectively are called price action trading strategies and they provide a way to make sense of a market’s price movement and help predict its future movement with a high enough degree of accuracy to give you a high-probability trading strategy.

“Clean” Charts vs. “Messy” Indicator-laden Charts

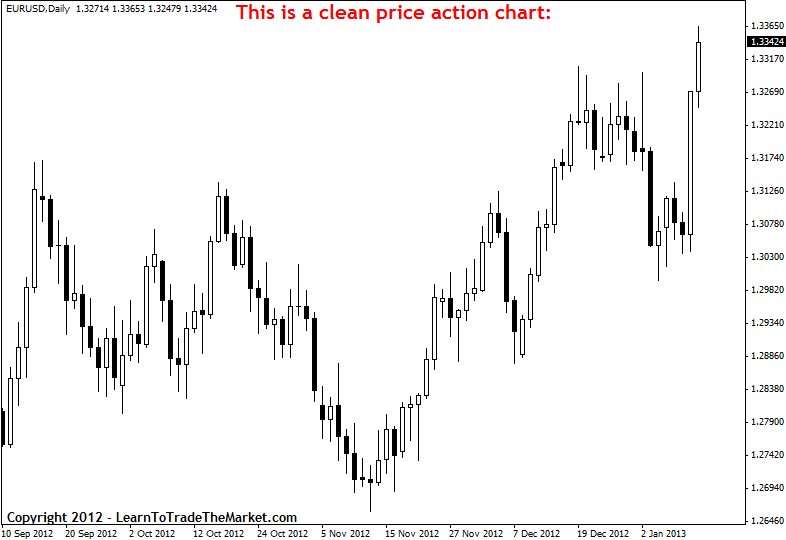

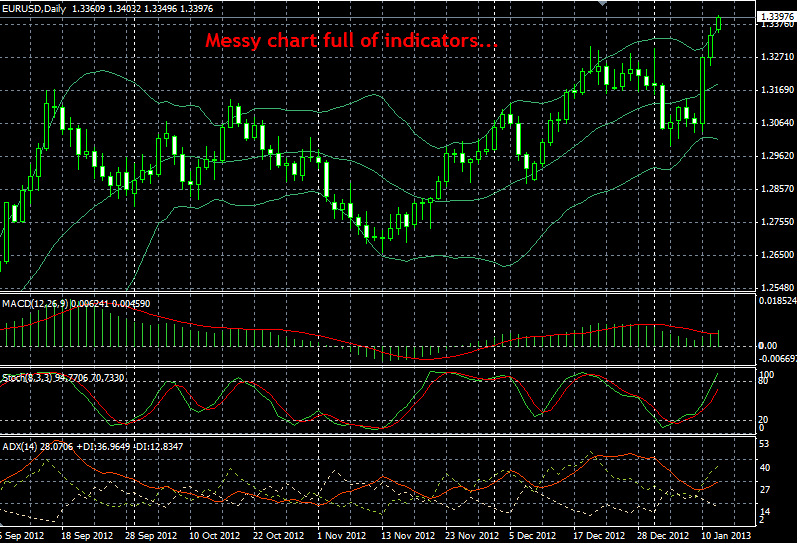

Next, to demonstrate the stark contrast between a pure P.A. chart and one with some of the most popular trading indicators on it, I have shown two charts in the examples below. The chart on the top has no indicators on it, there’s nothing but the raw P.A. of the market on that chart. The bottom chart has MACD, Stochastics, ADX and Bollinger Bands on it; four of the most widely used indicators AKA “secondary” analysis tools as they are sometimes called:

The image example below shows a clean price action chart, with no mess, and no indicators, just pure price bars:

The image example below shows a messy price action chart, with lots of clutter, indicators and mess:

It’s worth pointing out how in the indicator-laden chart you actually have to give up some room on the chart to have the indicators at the bottom, this forces you to make the P.A. part of the chart smaller, and it also draws your attention away from the natural P.A. and onto the indicators. So, not only do you have less screen area to view the P.A., but your focus is not totally on the price action of the market like it should be.

If you really look at both of those charts and think about which one is easier to analyze and trade from, the answer should be pretty clear. All of the indicators on the chart below, and indeed almost all indicators, are derived from the underlying P.A.. In other words, all traders do when they add indicators to their charts is produce more variables for themselves; they aren’t gaining any insight or predictive clues that aren’t already provided by the market’s raw price action.

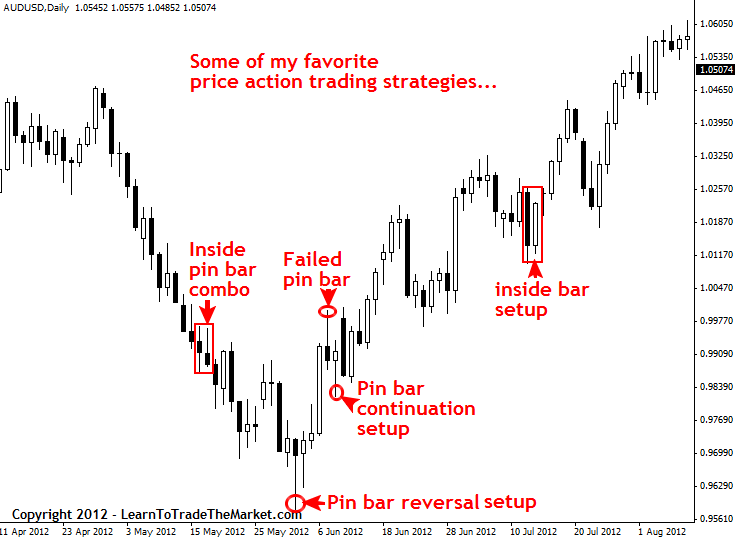

Examples of some of my favorite price action trading strategies:

Next, let’s take a look at some of the price action trading strategies that I teach. Note that I’ve included a “failed” trade setup because not every trade will be a winner; we aren’t here to show you “perfect” past trading results…we are here to teach you in an honest and realistic manner.

In the image example below, we are looking some of my favorite P.A. trading strategies:

Determine a market’s trend using price action

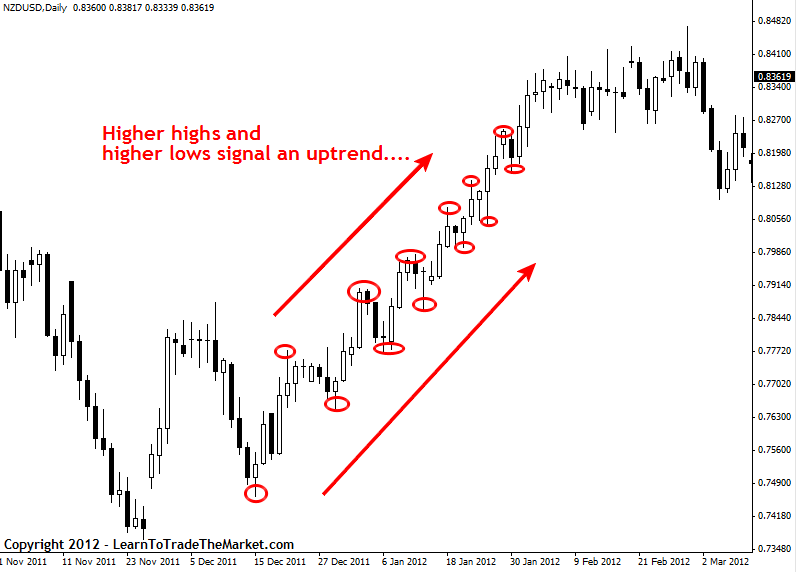

One of the most important aspects of learning to trade with P.A. is to first learn how to identify a trending market versus a consolidating market. Trading with the trend is highest-probability way to trade and it’s something you HAVE TO learn how to do if you want to stand a chance at making serious money as a trader.

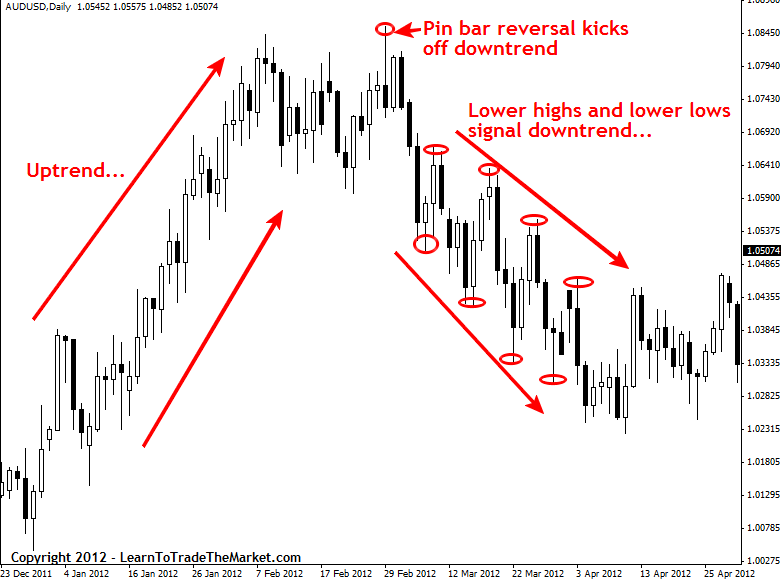

The charts below shows how to use price dynamics to determine a markets trend. We consider a market to be in an uptrend if it is making Higher Highs and Higher Lows (HH, HL) and a downtrend is Lower Highs and Lower Lows (LH, LL).

In the image example below, we can see how higher highs and higher lows signal an up-trend in a market:

In the image example below, we can see how lower highs and lower lows signal a down-trend in a market:

Determine Trending VS. Consolidating markets using price action

As we discussed earlier, P.A.or “price action trading analysis” is the analysis of the price movement of a market over time. From our analysis of price movement we can determine a market’s underlying directional bias or “trend”, or if the market has no trend it is said to be “consolidating”…we can easily determine whether a market is trending or consolidating from simply analyzing its P.A.. We saw how to determine a market’s trend above, to determine if a market is consolidating we just look for an absence of the HH, HL or LH, LL patterns. In the chart below note how the “consolidating price action” is bouncing between a horizontal support and resistance level and is not making HH, HL or LH, LL but is instead going sideways…

The image example below shows a market moving from a consolidation phase to a trending phase:

How to Trade with Price Action Trading Strategies

So how exactly do we trade with price action? It really boils down to learning to trade P.A. setups or patterns from confluent levels in the market. Now, if that sounds new or confusing to you right now, sit tight and I will clarify it soon. First we need to cover a couple more things:

Due to the repetitive nature of market participants and the way they react to global economic variables, the P.A. of a market tends to repeat itself in various patterns. These patterns are also called price action trading strategies, and there are many different price action strategies traded many different ways. These reoccurring price patterns or price action setups reflect changes or continuation in market sentiment. In layman’s terms, that just means by learning to spot price action patterns you can get “clues” as to where the price of a market will go next.

The first thing you should to begin P.A. trading is to take off all the “crap” on your charts. Get rid of the indicators, expert advisors; take off EVERYTHING but the raw price bars of the chart. I prefer to use candlestick charts because I feel they convey the price data of the market more dynamically and “forcefully”, if you are still using classic bar charts and want more info on candlesticks then checkout this candlestick trading tutorial.

I like simple black and white charts the best, as you can see below. In metatrader4 you simply right click on the chart and adjust the “properties” of the chart to get it looking like mine below. If you want more info on how to setup your MT4 trading platform checkout this metatrader 4 tutorial.

After you’ve removed all the indicators and other unnecessary variables from your charts, you can begin drawing in the key chart levels and looking for price action setups to trade from.

The image example below shows examples of some of the trading strategies I teach in my price action trading course. Note the key support / resistance levels have been drawn in:

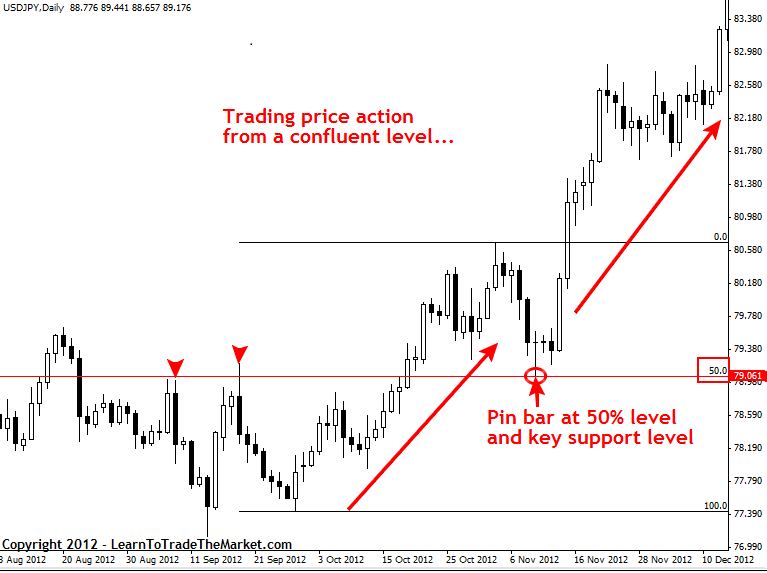

How to trade price action from confluent points in the market:

The next major step in trading P.A. is to draw in the key chart levels and look for confluent levels to trade from. In the chart below we can see that a very obvious and confluent pin bar setup formed in the USDJPY that kicked off a huge uptrend higher. Note that the pin bar trade setup showed rejection of a key horizontal support level as well as the 50% retrace of the last major move, thus the pin bar had “confluence” with the surrounding market structure…

In the image example below, we can see a pin bar setup that formed at a confluent point in the market:

All economic variables create price movement which can be easily seen on a market’s price chart. Whether an economic variable is filtered down through a human trader or a computer trader, the movement that it creates in the market will be easily visible on a price chart. Therefore, instead of trying to analyze a million economic variables each day (this is impossible obviously, although many traders try), you can simply learn to trade price action, because this style of trading allows you to easily analyze and make use of all market variables by simply reading and trading from the P.A. trail they leave behind in a market.

Closing thoughts on Price Action Trading…

I hope today’s introduction to Price Action Trading has been a helpful and enlightening lesson for you. No matter what strategy or system you end up trading with, having a solid understanding of P.A. will only make you a better trader. If you’re like me, and you love simplicity and minimalism, you’ll want to become a “pure” P.A trader and remove all unnecessary variables from your charts. If you’re interested in learning how I trade with simple price action strategies, checkout my Price Action Trading Course for more info.

Good trading, Nial Fuller

Related Price Action Lessons:

- Price Action Signals Introduction

- Price Action Strategies Introduction

- Professional Price Action Strategies – Introduction

- What Is Price Action Analysis ?

- Price Action – The Footprint Of Money

- How to Filter Good & Bad Price Action Trading Signals

Thanks for your help god bless your journey

Hi, Please let me know does your course applicable to only FX trading or stocks trading too.

All markets, not just FX.

Only knew technical analysis only but Price action just made things more clear with less noise on the chart.

Your work sir is highly appreciated

Hi, I want to be a successful trader .

Precise and well simplified start – up for a beginner like me, appreciated

Please teach become a perfect treder please help me sir

Nice explanation with charts.

Woo I love all the explanation in this sight

Your teaching great simple straight forward and easy to understand I love it.

Thank You So Much !!

Hello good time

I read this article, it was great because you did not use the indicator. I would like him to teach me about this. Thank you very much.

Sincerely

Mohammad Reza

Thanks so for your style of teaching you are too good.

Dear sir,

The way you have explained much information in short with ???????? chart easy to understand for begginer also.

Great job, Thanks a lot sir!!

You helped us, God will help you.

You are most Welcome! Glad you are enjoying the commentary.

Thanks for the insight and God bless you.

Hey broo how you?? Sorry broo also me I beginer forex trender I want to master price action so i need support for you my broo or advise to master this strategy

Excellent presenteatio

Thank you sir for this wonderful knowledge.

You are the best.

I confirm all you said to be true

nail u are 1 of my best top 3 Forex mentor, u are obviously great keep it up, GOD bless. pls i want u to discus the strategy, best time to use in trading crude oil, gold and silver thanks.

Thanks Sir!

Hi,

So, this is my first time browsing your site and I can see you have some useful info on the site; however, what I noticed is that almost all of your teachings are based off of a ‘daily’ chart! Now, unless somewhere on your site or in your courses you mention to people that trading off of a daily chart requires a rather large trading account, none of this analysis would really mean much or be useful to someone with a small account (which is almost everyone looking for a new trading course) who is trading on a 1, 2 or 5 min chart.

Taking your signal bars on a 5 minute chart would cause many many stop outs before one would work out, simply because of the noise. Unless you have other signals bars to enter on smaller timeframes of course.

Just my opinion and based on my own studies and trading of price action on all timeframes over the past 10 or so years. Robust price action trading should work on all timeframes, not just the higher timeframes in my opinion.

Cheers

You are incorrect on 2 points. It is incorrect to assume price action works the same on all timeframes. The lower the timeframe the less effective the signal is because of noise. If a signal takes a day to form it has more weight behind it, if a signal takes 5 minutes to form is has much less weight behind it. Does a pebble have the same impact on a pool of water as a boulder ? Think about that for a moment.

It is incorrect to assume that daily charts mean you need a larger size trading account, you can solve this problem by reducing position size per trade (less contracts or fractional lots).

Agree totally Nial

This was so helpful for me as a beginner.Looking forward to put it into action and learn more.

Wow,thank you so much Sir Nail this was so eye opening and informative.

Sir many many thanks. God bless you.

Mentor Nial, thanks so much for your concern and introduction to price action strategy, am now off to go now Mr Nial, thanks so much

Neil, Thanks for a great read. I have few questions

1) On what time frame do you draw support and resistance? Do you keep changing it as per time frame or keep it constant?

2) If I get a pin bar at 1 hour chart, Can’t i trade it without getting confluence from longer time frame of charts?

It’s 2020 so far no better PA explanation than this one..your writing is concise and no BS.

Keep up good work..

Thanks

To be sincere, as a trader, price action gives me an edge over the market every time. And no other trading strategies I have ever seen comparable to the price action strategy. Therefore, any trader who really wants to make it big in this business has to learn this price action strategy wholeheartedly. I love it so much. Though the learning curve is long, but the end result is highly, incomparably and indisputably profitable.

Thanks Nial for this great work here!

You have helped me to deepen my understanding of the price action strategy.Thank you so much. God bless you abundantly.

Thank you sir you have change the way I have been trading

wow!!! what a wonderful information, very understandable and comprehensive… more knowledge to your wisdom.

Thank you for sharing such a piece of wonderful information with us. Great job!

woow your lesson was fantastic. i wish to get more . i graduated from the university 3 months ago and want to divert my profession to fx trading. thanks so much sir.

thank you so much sir for this wonderful explanation. i am really happy for this information because its now that i became aware that i was lost by other traders.

thank you so much, i wish you can go deeper if possible

Hey Nial. I’ve been a price action trader for almost a year now, and what you wrote is completely relatable. I do this. If I may ask though, what are the benefits of being your group member? With all this info at our disposal and all. Is there any more stuff to learn?

Thank you Nial, the lesson was so interesting and have started to use those stratergies, will give youfeedback.

Thanks for sharing price action it helped me be a profitable trade

i think u will be a great teacher

lesson was very comprehensive,thanks alot

Great lesson

You have explain price action in a very simple way, well- done

So great !!!

Hello Nial,

I am from the Czech Republic and have searched on the internet for 50% retracement setup and discovered your site. Even though I went through the training of some good teachers, I see that studying your articles will move me another piece on my journey to be a trader. Thank you very much.

So far I want to study them and get them under my skin.

Then I’ll call and sign up for your live course.

Everything good in the new year.

Karel

Thank you so much for this special knowledge you provide, I suggest if possible to convert to pdf so that can be easy for someone to read when they are offline

Thank you Nial I found this P.A useful sir

I,without any hesitation would like to comment that your articles are so simple ,informative and educative that even a novice like me can easily understand .I feel myself to be a lucky guy to meet a great teacher like you .Thank you very much .

thanks sir I went through it seems interesting, I’ll practice price section and see the results

I am a beginner. And I find your articles interesting. They are full of insights. Thanks a lot.

Probably the best lesson I have ever learned in forex ; I’ll practice and see the result

This Article helped a lot in helping grasp the concept. I’m using the support & resistance strategy to trade but one thing always gets me losing when the market is consolidated: how do I select my entry and re-entry points?

It is a nice technical analysis.

Good evening I find your lesson vey usefully I am looking forward to build a career out of trading so i will need all the help I can get

I took the week off from work to learn more and today my last day of the week cane across this article. I’m so thankful as it is all confirmation that I am on the right track. Also if I hadn’t traded the whole week before it might not have made so much sense. Thanks a million for this great informative and accurate information! GREAT JOB!

Thank you so much Nial.

Amazing!!!

nice one

Congratulations.Between all market Gurus I like your writtings and v. simple explanations by charts.I am trading since 1992

Awesome Stuff

Wao!! your are Great Sir its Precisely understandable we are together

your MAXIMILLIAN SASAGU

Loving this already. So insightful.

youre really excellent at this. too bad the membership is too high

Invaluable reference and knowledge this is truly tailor made.

Big thanks

a very good info tQ sir

Good info….

Ok. …..

Nice

THANK YOU SIR

Lucid,brevity and stark thanks Nial.

This is clear and very well simplified for us beginners . Thanks

Big Thanks!

thank you sir

thanks i understand it now

Fantastic!

Great stuff thanks

nice

Amazing…

thanks

i want your student in forex analisis

very useful

pretty useful

Thank you

thank u so much…

Great article

wow youre great .

Great article Nial. Straightforward yet detailed enough to offer a solid grasp of PA trading.

thank u sir

Nial price action article is superb….! very informative..

Thanks

Nial,Thanks for the free information on p/a I found it makes sense and is easy to understand so far gday davej

Dear Sir Nial,

You done the best job for us to learn price action trading strategy easily. Hope every one can learn this price action trading easily if they read carefully this article.

This is great, am glad for the job Mr Fuller is doing here. Thanks.

good work

all respect

Hi Nial,

I find your blog site very valuable and interesting. Theres a lot to learn here. Now I come to know why I fail in my trading. Thanks for the free information Nial. Its a good place to start learning to trade profitably. I will consider learning more from you and eventually be part of your community. :-)

Many thanks Nial.

Mike G.

Dear Nial Fuller,

. your teaching is the fuel to my Motor to keep moving and profit in my forex trading .

Thank you for the time you use for all of them.

Olalekan

Thanks for the clearer picture Nail! I have studied all available indicators in the trading scope and they confused me even more and have decided to go for price-action trade through my own conciense. Your affirmation in this strategy give me more confidence. I would like to learn more from you.

Thanks Sir, this article totally change my view towards market now I feel much more confident with simple pure price chart. Eager to learn more from you…

this is the final piece to my forex puzzle. Sir Nial Fuller you are indeed an expert in forex strategy. thanks

nail u are 1 of my best top 3 Forex mentor, u are obviously great keep it up, GOD bless. pls i want u to discus the strategy, best time to use in trading crude oil, gold and silver thanks.

Thanks for the lesson..eager to learn more and glad I found you

tks

Thanks, for the lessons.

Its really clear and comprehensive.

thank you so much for these notes…they have really helped me understand price action

Sir Nial this is such a great introduction. This proved to be helpful in concept building thanks…!