How to Filter Good & Bad Price Action Entry Signals

What do you get if you put two traders side by side for four weeks with the exact same training and trading plan? Most likely, you will get dramatically different results. Trading is a highly individualistic profession, and no two traders think exactly alike or possess the same level of natural trading skill, intelligence, talent or intuition. When you’re a student of the markets trying to develop your ability to find top-quality trading signals on the charts, even after years of study, it can still be mentally challenging and stressful.

What do you get if you put two traders side by side for four weeks with the exact same training and trading plan? Most likely, you will get dramatically different results. Trading is a highly individualistic profession, and no two traders think exactly alike or possess the same level of natural trading skill, intelligence, talent or intuition. When you’re a student of the markets trying to develop your ability to find top-quality trading signals on the charts, even after years of study, it can still be mentally challenging and stressful.

There is obviously a plethora of variables and influences that affect a trader’s decision making process when analyzing a chart, finding a trading signal and then executing a trade. Today I am going to talk about the main challenge in this process; filtering bad signals from good signals.

It’s probably safe to say that you struggle with your trading decisions sometimes, you struggle to pull the trigger due to a lack of confidence, or you struggle because you aren’t sure if this is a ‘good signal’ or a ‘bad signal’. Knowing what to look for and what the best signals look like is one of the main steps to increasing your chart-reading skills and confidence in your trading ability.

In this lesson, we will discuss a simple trading signal combined with various ‘filters’ that a trader may look for to enter trades. Keep in mind, the signal itself could be substituted with other strategies or signals of your choosing. The purpose of this article is to provide you with a guide to ‘filter’ your trading signals and build your confidence.

Tips for filtering trade signals

The following tips for filtering trades can be applied to any trade signal or entry trigger, but we are mainly using daily chart pin bar strategies in the examples below, as well as one 4 hour chart example. It should be noted before proceeding that these are not “rigid” rules but more like general filters that you should apply with discretion:

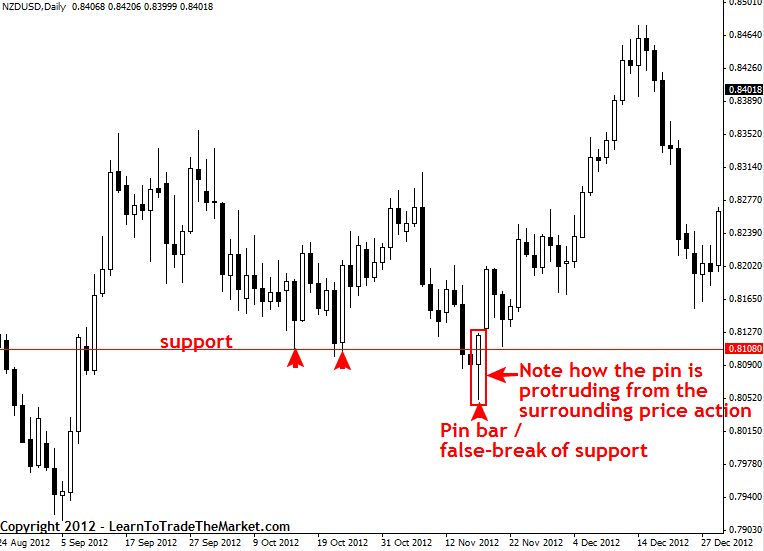

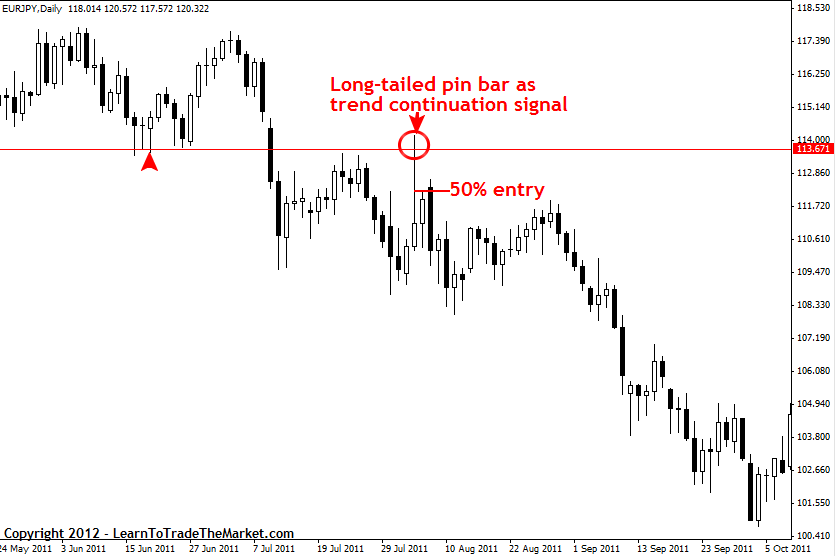

1. Look for a signal with a protruding tail that creates a false-break of a level

When we see a reversal / rejection signal like a pin bar with the tail or “rejection part” of the signal clearly protruding from a key level in the market, it’s a typically a very high-probability signal. When a pin bar signal has a tail that protrudes through a level, it also means that it created a false break trading strategy, and a false-break of a level adds a lot more weight to any signal. A false-break of a key level is a very important event, it shows that the market could not sustain itself below or above an important level and that a move in the opposite direction is highly probable. We can see an example of a pin bar signal that protruded through a key support in the NZDUSD, creating a false-break of that level:

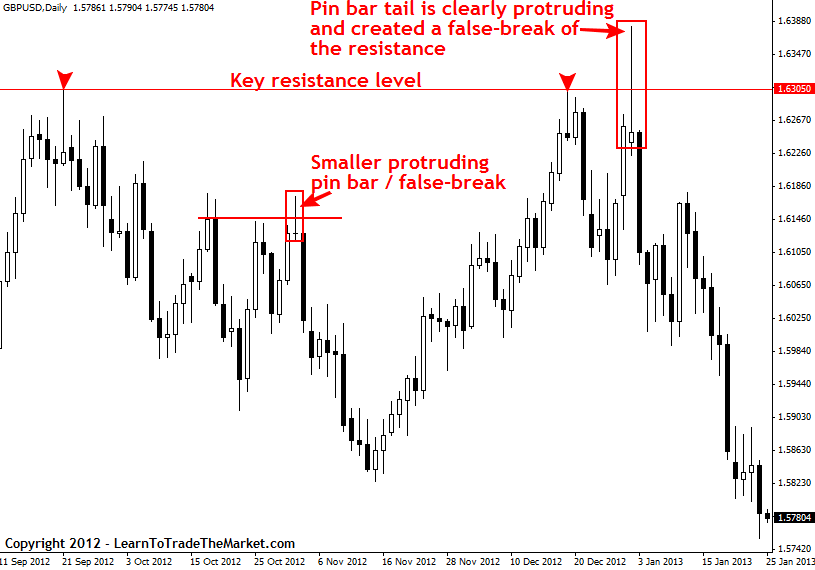

In the GBPUSD chart below, we can see two more examples of pin bar signals that had clear and obvious protrusions through a level and that also created false-breaks of the levels. Both of these signals lead to substantial moves lower, in fact, price is still moving lower as of this writing from the long-tailed pin bar that created a false-break through 1.6300 resistance on January 2nd:

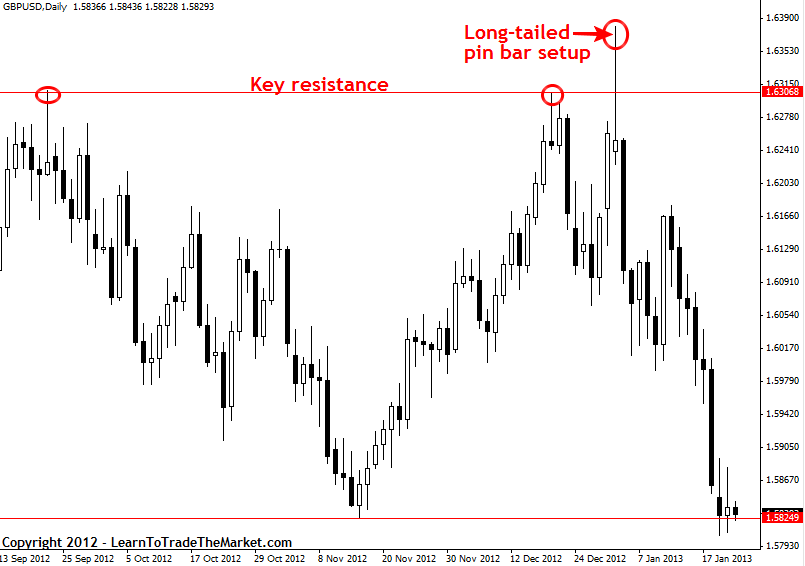

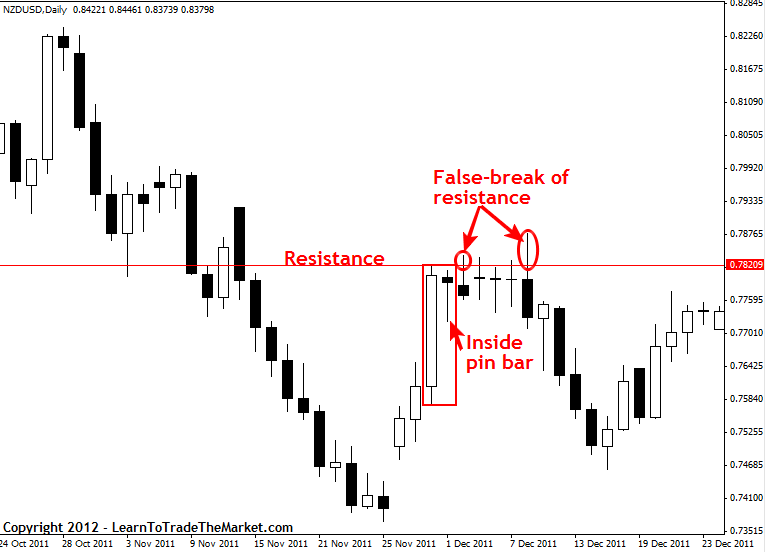

2. A long-tailed pin bar is a high-probability pin bar

The tail on a pin bar is very important, it shows rejection of price. It’s safe to say, generally speaking, the longer the tail on a pin bar the more “forceful” the rejection of price. This essentially means that a longer-tailed pin bar is more significant than a shorter-tailed pin, and that longer tail helps to “spring” prices in the opposite direction. It doesn’t mean that ‘every’ long-tailed pin bar works out perfectly, but certainly many of them do and it’s a high-probability setup that should be a staple of any price action trader’s trading plan. Note also that in the GBPUSD example below, the long-tailed pin bars tail was clearly protruding and created a false-break of a key resistance, as we discussed in the previous tip:

In the example below, we can see a long-tailed pin bar that occurred within the context of a downtrend in the EURJPY. When you see a move against a trend and then a long-tailed pin bar forms, it’s a good clue that the retracement is terminating and the trend will resume from the long-tailed pin bar. The key here is movement; when price is moving then the pin bars or other signals are going to be much more effective than they will be in stagnate or consolidating market. Note the 50% retrace entry of the pin bar, this is an entry technique we teach on our courses and it works good on long-tailed pins, giving you a much better risk reward potential due to the tighter stop loss distance.

3. Don’t “bet” on a breakout…wait for confirmation instead

Traders often get sucked into tempting looking breakout trades. Many breakouts result in false-breaks as we saw earlier. While there’s no “sure way” to know whether any given breakout will be a genuine one or a fake-out, it’s high-risk trading right into a key resistance or support; the closer a market is to a key level, the less chance it has of continuing. Don’t bet on a breakout before it happens, instead wait for a close above or below the level, because you can always enter later after the breakout on a retrace. Inside bars cause a lot of false-break scenarios like these, especially when a market is range-bound and not trending or if the inside bar setup is implying a counter-trend breakout like we see below:

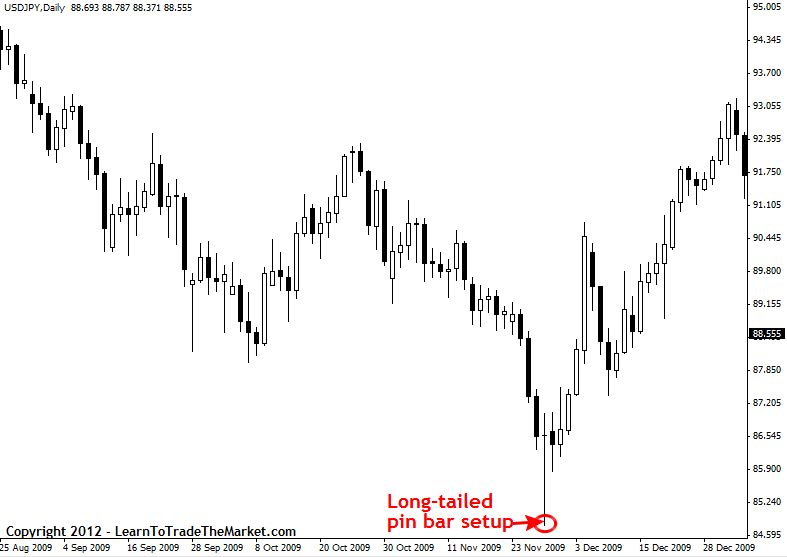

4. Long-tailed pin bars work very good as reversals after a sustained move

One aspect of long-tailed pin bars that can be used as a type of filter is that they tend to work very well after a sustained move in one direction; often marking important market turning points or even long-term trend changes. For example, in the USDJPY chart below, we can see that a long-tailed bullish pin bar occurred after a sustained downtrend, then the pin kicked off a large move higher…

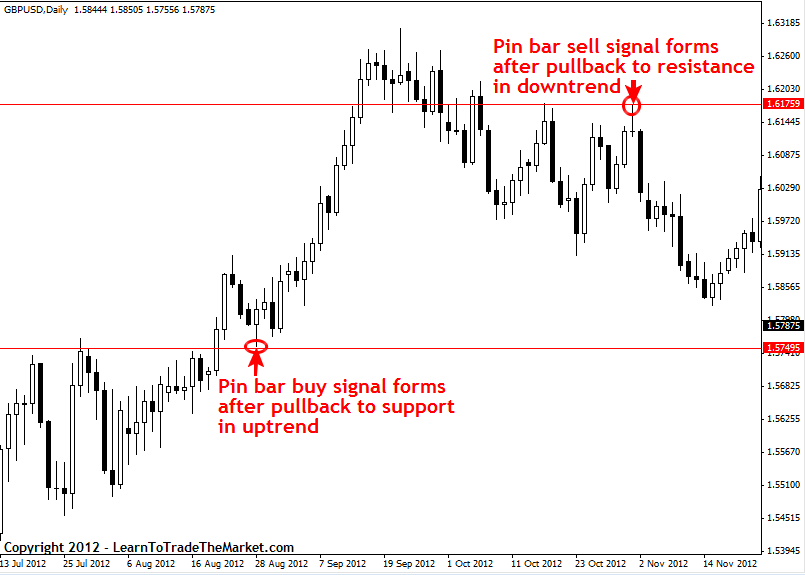

5. Look for continuation signals after a pullback to support or resistance in the trend

One of the “bread and butter” trading filters that I apply on a regular basis is to simply look for retracements or “pullbacks” to support or resistance within a trending market. For example, in the chart below we can see both an uptrend and a downtrend in the GBPUSD. Note how in the uptrend the retrace was pretty small…but the trend was clearly up and the pin bar had “confluence” with a key support level in the market…so it was a high-probability setup. In the downtrend portion, the retracement to resistance was a more significant pullback, and we had a key resistance level being rejected within the broader downtrend…this ended up being a very lucrative signal as well.

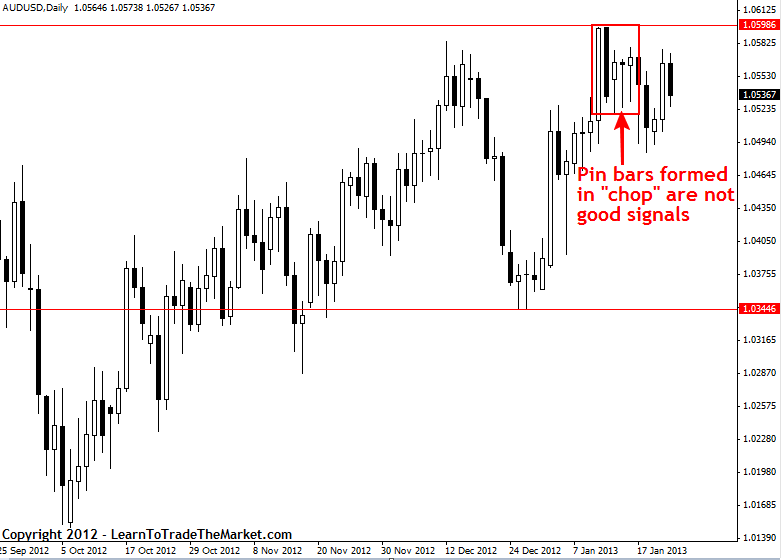

6. Don’t trade signals in tight “chop”

Trading signals that form in the middle of thick consolidation, also known as “chop”, is usually a bad idea. For example, if you see consecutive bars of consolidation for a period of time, and then a pin bar signal forms inside that chop…the signal become less valid. ALWAYS wait for momentum and a confirmed break of the choppy congestion area to validate your signal…a “confirmed” break would be a close outside of the chop. Below, we see an example of some recent pin bars that failed on the AUDUSD, note how there was no protrusion from the surrounding price action and that they formed in the middle of “chop”:

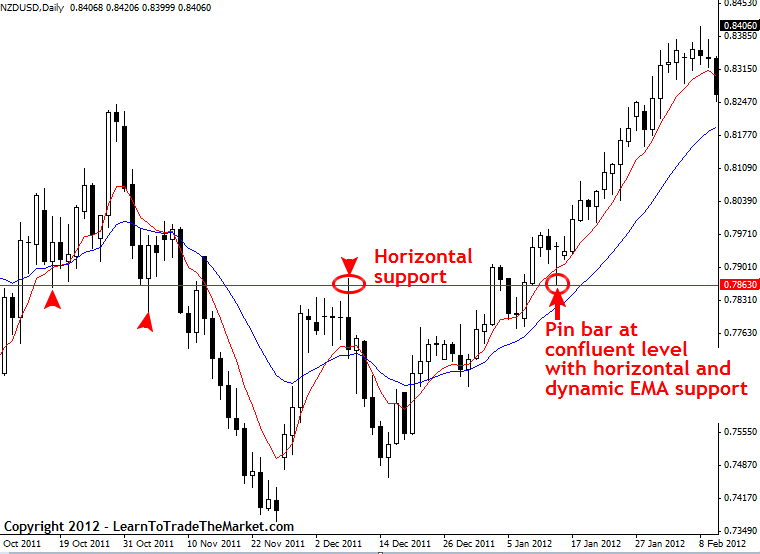

7. Look for “confluence”

A “confluent level” is simply a level that has at least two supporting factors behind it. Those factors might be an obvious support or resistance level with a dynamic EMA level, or a 50% retrace and a key support and resistance level; the more the merrier. Simply put…confluence adds weight to ANY trade signal. Looking for a signal that forms at a confluent point in the market is one of the best filters for separating a ‘good’ signal from a ‘bad’ signal. Note: whilst sometimes you can trade a daily chart signal that didn’t occur at an obviously confluent level, you want to avoid trading 4 hour signals or 1 hour signals that don’t have any confluence with other supporting factors (see point 8 for an example of this)

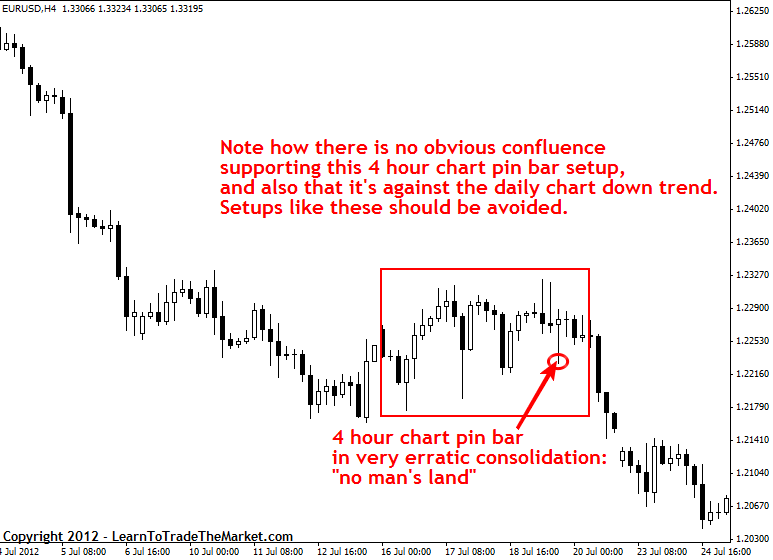

8. Avoid signals that form in “no man’s land”

One of the best “filters” is actually the lack of any supporting factors or confluence. If you see a trade setup that is essentially just “floating” in “no man’s land” without anything to give “weight” to it, it’s probably a good setup to pass on. This is even more accurate for intra-day signals. A 4 hour or 1 hour signal without any type of confluence behind it is usually not a high-probability setup worth trading. See the example below:

You shouldn’t have to “think” too hard about whether or not a setup is valid

The point of using filters like the ones we discussed above is that you should never “guess” about a trade setup or try to convince yourself a setup is valid. The best signals will “jump” out at you and are so obvious that you don’t even enter into that mindset of guessing and trying to convince yourself a signal is worth taking. Remember, the market will always be there, so leave any sense of urgency at the door…if you’re not “sure” that your signal is there waiting for you to trade it, then walk away, there will be another signal tomorrow or the next day.

Don’t get caught up in fretting over what “could have been”

If you pass on a trade and it goes on to work out in your favor, learn from it, and increase your knowledge form it, but don’t beat yourself up or fall into the trap of believing your missing all these ‘great signals’… remember even some of the worst signals can end up working out, and if you start teaching yourself with ‘hindsight’ and telling yourself “oh i should have traded that and next time I will”… you’re really going to confuse the hell out of your subconscious and it will end up destroying your trading career. So whilst you should learn from each potential missed trade, you should not become emotional or “worried” that you are “losing money” because you’re passing up some good setups.

Learning to pass on trades is part of being a trader, and as you get your own filters down like the ones we discussed above, you will start to develop a more refined sense of which signals are worth trading and which aren’t, over time you’ll get better at this. The most important thing is to remain sickeningly patient on the sidelines…let a lot of trades pass and don’t get attached to hindsight trade setups that

“might” have worked out for you.

The “big boys” know how to filter their trades

If you’ve fallen prey to thinking that the “big boys” are trading a hundred times a day and day trading until their eyes bleed, you’re mistaken. Many of the guys with big money wait on the sidelines patiently and “pounce” only when the best signals, levels and trends are present on their charts. You need to learn to think like the big boys, act “as if” you’re a “player”; be intelligent and stop using the market for entertainment and start treating this as a real business.

The best and most logical explanation for why you should trade less is because there are inherently less good signals for any strategy or system; think about it…the reason a signal is high-probability is because it doesn’t happen extremely often, if it did then it wouldn’t be a high-probability event would it? If you force yourself to trade all the time you’re going to be taking a large quantity of useless and second-rate signals, this is simply a waste of your time and money.

Creating a filter checklist for you trades

A good exercise for any trader is to create their own checklist of different filters that they use to scan the markets for potential signals. You can just create a quick checklist with one to three sentences describing what the filter is and then an example image of the filter under it.

Here’s an example filter checklist that I’ve created from the examples above (in yours you would place an example image below or next to each sentence like the ones above but maybe a little smaller):

1. Look for a signal with a protruding tail that creates a false-break of a level. Watch for obvious protrusions and false-breaks of key levels in the market. This filter can be applied to trending markets or to counter-trend trades. Wherever you have a key support or resistance level, keep an eye out for false-breaks / protrusions of that level.

2. A long-tailed pin bar is a high-probability pin bar. Long-tailed pin bars work very well in trending markets and as counter-trend signals, as we saw in the examples above. A long-tailed pin bar is always something to keep an eye out for when analyzing the markets.

3. Don’t “bet” on a breakout…wait for confirmation instead. A good filter to use for tempting looking breakout trades is to wait for the breakout and close above or below the level. Then, the breakout is “confirmed” and you can start looking for a signal in the direction of the break. This will help you avoid many false-breaks, especially in range-bound markets.

4. Look for continuation signals after a pullback to support or resistance in the trend. Trend continuation signals are a ‘bread and butter’ strategy that you need to watch for.Watch for trends and then retracements within those trends, then keep an eye out for signals forming from “value” areas that indicate the trend might resume.

5. Don’t trade signals in tight “chop”. Be cautious trading pin bars or other signals that form in thick and choppy consolidation. If you see two or three pin bars in a row as in our example above and the market is not coming off in the direction implied by the pins, it’s an indication that it’s probably not going to come off. We need to see momentum and a clear breakout from consolidation before entering from a signal formed in “chop”.

6. Look for “confluence”. Watch for obvious “hot points” in the market, or areas where two or three or more levels are intersecting…these are very high-probability levels to trade from.

7. Avoid signals that form in “no man’s land”. This one is sort of the opposite of the confluence point. If you see a signal that just looks like it formed without any type of confluence and looks like it’s just placed wrong, you should probably avoid it. This filter is especially important to use on the 4 hour and 1 hour charts.

Whilst having things like checklists and an overall trading plan are very important, they are only one part of finding the best trading signals. The man or woman doing the analysis and pulling the trigger is JUST as important as the strategy or trading plan they are using.

As traders, we need to develop our subconscious “gut” trading feel on an ongoing basis, learning from the charts and keeping notes and simply immersing ourselves in day-to-day market analysis and observation (note I didn’t say immerse ourselves in ‘trading’). This helps us develop a good intuition and gut feel which go hand in hand with a good trading strategy.

Conclusion

After twelve years in the markets and five years of teaching traders, it’s obvious to me that the number one problem for most traders is knowing how to filter a good trade from a bad trade. So many traders miss great trades and so many traders tend to get stung by trading everything that they “think” might be a signal. This is like a madman with a gun walking around shooting anything that moves. Trading and money is a weapon, and just like a gun, you do need to be careful with it. You need to be patient and filter your trades…then “pick your targets” and execute the trade with absolute precision and confidence.

If you are interested in developing your ability to filter good trade signals from bad trade signals and increase your overall confidence level in pulling the trigger on quality trades…you should check out my trader’s education courses and daily trade setups newsletter where I expand on these concepts in greater detail.

Thank you very much for your lessons that I found very helpful to me I m now a better trader

SO grt of u dear.really an eye opener.

This is by far the best article I have read on trading. I have been studying your material (paid member) for awhile and I must say my results have greatly improved since. But this article should be “Bookmarked” and revisited often by every trader!

Thanks for the feedback! Glad you are enjoying the article.

This is indeed a great eye opener.

Thanks Sir

Thanks Niall

A great article that needs to be reread due to the golden information it contains.

Excellent lesson. Thanks

How i wish i had come across this piece of knowledge earlier on in my trading life. ..Target selection is going to be my thing.

Thanks Nial.

This article is very interesting thank you for you explanation I like the part you said there are inherity less good signal for any strategy or system because many peoples who sell system or strategy they try to make you believe that their system a perfect thanks for open my eyes

Great tips.

Recommend for any trader, novice or experienced.

Novice to learn the trade and experienced to review some of the important trading tips.

This blog is great.

Suitable for the Nobel Prize.

Wow.. This is superb

THANKS FOR THE ARTICLE AND THANKS FOR UR TIME,EFFORT AND INFORMATION THAT I DID NOT KNOW THANKS AM ON A NEW LEVEL

Filtering Good/Bad signals, it’s really useful in improving trading. Well done Nial.

AWESOME bro informative

Every time I’m not sure, I read this again.

Interestingly educative and simplified for the average mind to grasp/comprehend.

It is extremely rare to get such treasure trove of information for free in this present Capitalist society.

All i can say about Nial is that his contribution to our success in this business and humanity in general will forever be engraved in our consciousness.

Thank u Nial.

ur greattttttttt man i have no words for you nail sir you are not human sun you are god,s sun

Thanks to the article writer!

I like the part “If you force yourself to trade all the time you’re going to be taking a large quantity of useless and second-rate signals, this is simply a waste of your time and money”

That currently is my problem, the need of trading all the time even its choppy and I always convince myself oh there u go its a signal and trade on the spot. It costed me a lot of money.

But this article helped me to manage myself. Thanks again.

This article was awesome and a great organizational approach to filtering your trades. That’s why you’re the best out there mate! v

wesome and a great organizational approach to filtering your trades. That’s why you’re the best out there mate!

Thank you Nail. One of your best articles!

It’s just in time and hit right on target! Thanks a lot for your hard work. The old hit ‘Simply the best’ – is it about you? Thank you once more!

An antidepressant article, thanks Nial

Very rich and educating article

hello nial

i have a great time to read this article, its so inspiring tips that every trader might have forgotten in their trading strategy. this is a piece of puzzle that fits perfectly in my trading plan. thanks nial.

best regards

Thank you Nial,

Very clear and easy to understand.

Sir Nial,

You are simply the best.

Everybody who come across and read this masterpiece article could be successful and rich in trading.

thank you

mr nail great article

Dear Nial Fuller, you are really awesome. your description is so simple % clear but attractive. by read your article i find that before i was in dark hole. now a days i can see there are some light there. thanks again.

very good article

Hello, Nial.

Great article Nial, I’m really enjoying being part of this trading site. With each of your article, I am a successful professional trader.

Thank you very much.

Hello, Nial.

Great article Nial, I’m really enjoying being part of this trading site. It helps me very much. With each of your article, I’m a successful professional trader.

Thank you so much for your mentoring. Cheers…

You just addressed a sensitive spot ive been getting confused about recently. I cant wait to join. Catch you up soonest in your trading community.

Once again, thanks for your selfless service to humanity.

Nial many thanks for this excellent article. Excellent checklist.

All the best in new year 2014

Good article, this remembers me a poker game. You do not play with every hand, same in forex- not trade every setup. Waiting and patience is probably the most important skills and you know to shoot when you so it even a kid can :)

Always great to be riminded of the fundamentals. Wonderful explanation Nial. Thanks so much! -Mimi

Very Brilliant and eye opening article

simply put, this is a master piece.

Good job

Very well explained. I’m beginning in forex and persons like you help me very much.

Thank you

Gil from Brazil

one of the best lesson for “BUYING SELLING SIGNALS”…….By nial…………..thanks nial you have amazing skill ti find and filter of trade

Thanks nial this is very useful and helpful for me.

Thank you one millions!

thanks a lot for this explanation. this is what I have been looking for. right now am putting it into practice.

Excellent research work and very useful publication.Every trader reading this article should thank you.

Very great article,I read your article so many times and every time I find something new … I like it … thanks allot sir

I have been reading all your articles on price action trading . The info you put out is very goodnnb.Hope to join your community soon

Thanks for this gem of wisdom!

Grate work thank u for your time & effort.

very good thanks alot

i have just started to enjoy my trade for over almost six years im into tradinig.thanks to you .

Thanks nial for being so selfless in giving out this wealth of info.. I must say that in today’s market conditions, PA is the key.. my trades are better bcos of u.. THANKS A TRILLION

Well done amigo!

I read every article you make and i have the feeling of understanding the markets much more! I’m glad i found you and i thank you for all the knowledge! From the very beggining i read everithing and then practicing for a while, and i can tell that my demo account is not loosing anymore. It’s building up! Slowly but confident! Thank you!

Hi Nial

Almost certainly the best article on the subject I have ever read , and I have read many.I am determined to reduce my trades as a result.

Thankyou nial

best wishes to you and yours ,

Hi Nial,

Great lesson with lots of good practical strategies to follow.

Thank you

Yet another addition to my treasure of trading knowledge…You are just GREAT Nial….

Thanks Nial

A very good lesson yet again….my trading skills is never the same since i started following your lessons.

Thank you nial

the article was wanderful and very lighting

Yet another great high quality lesson on Pin bars, I really find these articles invaluable. They are giving me real practical help in trading only the best signals.

Many thanks

Thank you so much Nial. I been hit by the “chop” (AUDUSD)and a big question mark rise in my head. Now I have the answer already. Thanks again Nial…

Very,Very good lesson Nail THANK YOU VERY much. I learn alot from you.

Am on a voyage of discovery here. Really like this offering Nial.

Thanks Nail.

I’ve traded about 40 lots this month with some very nice profits and lot’s of losses. At the end I have 50 dollars profit :(. My profit factor (risk reward ratio) is 1.01 :(.

What I was thinking for weeks now was that I need to stop myself from entering the market ten times a day and thus improving my profit.

I guess that’s one of the greatest articles ever… a lot of people are looking for it on their trades and It includes me! Muito Obrigado Niall :D

Thank You Sir,

thats an brilliant article…Thank you so much…Cheers.

It all makes sense . There’s alot to digest and put into action

thanks nial…u always the great

What i take home from this is that,Creating a list of filters with examples is a powerful idea.It creates a visual image which,when looked at frequently works wonders on the subconscious mind.

This combined with consistent application of price action strategies,overtime result in good trading habits. Meaning this practice becomes second nature creating the “gut” feeling. Hence i will endeavour to make each trade count in exercising and sharpening my skills.

Thank you Nial

Yet another brilliant article. One of the best, actually, and very helpful.

thank!

Thanks Niall. You provide sobering realities of what the markets really are. Especially your emphasis on trading end of day. Do you also look at the shorter timeframes, especially th 60min, to see whether price bounced off and retested the key levelin confirmation of the false breakout. Same in the case of a breakout, do you check the 60 for a break and retest.

Nial, you must have started trading at 16 yrs.

Filtering a good trade signal is like finding a good match for one’s daughter. Whether the fiance is :

– looking good (shape of the pin bar)

– whether his family is good (area where it is formed)

– his wealth & business (confluence)

brilliant, LTTTM is the bomb, worth every penny.

Nice lesson nail.

Neil, I am sure you are very proud of your trading skills, but there is something you should be even more proud of and that is your mentoring skills.

One of your best lessons I have read!

Just what I needed to get me back on track.

Thanks,

If I had learnt only this one lesson during the last

three years,I’d never had lost any considerable amount

of money in FX Market.

This and the last article are just priceless guidance as far as I can see. I’m still relatively new to forex trading but these articles and your daily set-ups are helping me immensely.

Cheers Nial

excellent ,this will be the differential !!! thank you very much !!!

That checklist is now the first thing I look at before I open any

Trades.Brilliant instructions.

Thanks Nial

Sean

Never seen anything like this before thanks Nial for your effort. This is why I subscribed value for value.

Overall..probably one the best articles especially for New Members who have recently joined. Excellent summary of overall chart analysis.

you just add up another 30% to my trading trading confidence..

E X C E L L E N T !

Hi Nials, nice, everyone should join your FX course, simple as that.

Cheers W

Fabulous article and approach to trading, many thanks Nial.

This is one of the best articles. Cheers mate.

Hello Nial

“Until their eyes bleed”.

I like it. Well put!!!

this lesson alone, strictly followed, can make anyone a successful trader.

Hi Nial,

this is really a very nice information which provides us the knowledge to diffentiate the good, the better and the best trades.

I am little confused abt the example which u have given for the choppy price of AUD/USD coz after the pin bars were formed, the australian employment change news was released and market moved in an opposite side, so how can we understand abt this choppy price action? can we see this choppy price action

in trending and even non-trending markets?

Hi Niall, It is nice to have someone like you who can share your knowledge selflessly with us. Thanks for all the priceless information.It has definitely helped me with my trading. I am still a learner – on DEMO – at present!

thank !

your articlesare always fantastic. I am in the way of successful trader because of you. thank you nail.May God bless you and your family.

Great article

Thanks Nial…

Great stuff, I learn so much from each and evry article that you publish, but this one is an eye opener. Thank you for taking your time out for us..God bless.

You make it so easy coach. Hallmark of a genius!

Thanks.

really good stuff. trust the system and trade smart

Thanks a million times Professor Nial! Excellent stuff. Your articles and course material are priceless and have completely changed, in a positive way, the way I used to trade. I am now a much better trader than I have ever been. Once again I thank u very very much! Keep up the good work!

Thanks Nial. With your years of trading and teaching has absolutely with my 3.5 years of learning “price action” to firm belief, has brought both an understanding of trading “like the big boys” and “self belief”. Your course has taught me to keep my process super simple by removing all the unnecessary noise in the market with following a disciplined routine using “price action strategies “.

This is great info as usual! If you do not belong to the course these are the meat and potatoes. But the appetizers and the desert are the finer details you will hone in on once you join.

Such a high quality and well explained article, kudos Nial!

Nial is the MAN !!!!

thanks very much for all great lessons but i hope if your lessons in arabic language.

Nial this is a pragmatic lesson for even a beginner in forex trading. More gcrees to your elbow.

Excellent in-depth presentation of the pin-bar in different

market conditions. Thank you for imparting your extensive

knowledge and insights with regard to this particular form

of price-action in the markets. This is the first presentation of substance I’ve ever seen thus far on what

is typically refered to as a ‘hammer’ and a ‘hanging-man’

and simply cast-off as mere ‘reversal signals’ at tops

and bottoms. You have taken them to higher levels of meaning worthy of a whole course at Harvard.

Great Nial as ever!

Magnificent article!

Nial thanks.

Wonderful article, difficult topic but you explained very well.

Thanks for the contribution.

Thanks Nial, you are really good figurate writer. It would be great to use next strong pin bar setup to walk up us thruogh trade example from start to the end. We could choose one FX pair and observe it day by day and decide to “jump into trade” or “stay sideways”.

Greetings.

Good and very important stuff Nial. Thanks for this one.

Hi Nial,

It is indeed very informative article. Thank you sending it. I have question, as you wrote 50% retraces as entry, is that mean wait until the pin bar to close and enter at the fifty percent level of second candle? If enter trade in the 50% of pin bar? We dont see the how market and big guys drive the next candle be! How could make our perfect sense to put the trade? Some people might think this is silly topic im increasing here, but im confuse! Please make it clear thanking you!

Awan

EXCELLENT ARTICLE! To patiently wait for the A++ grade signals and to not force oneself to trade B or C grade signals is what differentiate a pro trader and an amateur trader. KUDOS!

Thanks Nial.I appreciate your honesty and abundance of knowledge on the way forex is traded.Thanks a million

Nial When I started using your price action signal my earnings increased to 40 percent..thanks you very much..bow down..God Bles

As usual – words of wisdom. Thanks Nial.

wowwww nial… really good one

Wow! what a great lesson, very insightful indeed

thanks a lot

Thanks for the priceless information. I’m currently saving to buy your price action course

Hay Nial,

Just want to thank you for the great lesson

Your ace my friend, cant tell you how much I appreciate your input.

ED

Hi Nial,

Moving forward I will look at each “Candle” as a prospective Customer-or a client.To build further business relations:

(1) I will wait for this client to show its crendtials, and only when it has shown a “Long Tail” , that it invites any further attention-if any serious business be considered at all.

(2) If “yes” than I will do the “Background -Check” from my side to ascertain whether there is any “Confluence”- akin to a favorable reference check,

(3) I will still await “background check” in terms of confirmation from the next candle.

This will hopefully lead me to take a decision “TO enter into Business” in the present scenario for a trade profit!

Thanks Nial,

You are indeed helpful, i think I’ve got one problem in my trading solved.

I wish you all the best.

Nial, that’s good Article.thank you For Your Lesson.

Thanks Nial

Valuable lesson indeed.

Hi Nial,this article is really a good way to plan trades.you’ve really helped by your articles and your quick answer to questions.thanks so much Nial

Thanks Nial

Very good article

Prefectly trade guidence .

Cheers

Wonderful input Nial! Keep on writing these very useful and fun-to-read material.

very good lesson, thanks.

Thank you so much for your mentoring. Cheers

Thanks Nial . Its very informative for newbies like me .

Thanks Nial

Very useful information for me,

Real talk.

Nial I can’t begin to tell you how much I look forward to your posts.

The information resonates with me fully.

Thanks for helping me become a better trader.

Thank you for another concise and insightful article.You have completely changed the way I look at and trade the forex. I now have a high degree of success and trade with confidence.I want you to know that there are many of us out here that really appreciate your help and clarity.

This is indeed the University of FX Trading. Clear illustration, precise description and accurate presentation. No clustering the charts with this indicator or that indicator. The lesson is a great gem and archive. It is indeed the ‘Prof’s Best among other bests.

Thank you Dear Prof Nial for your excellent works every day and week.

Hi Nial,

Fantastic lesson it comes at a time that is perfect for me.The fog clears daily after reading your articles.

Many thanks

Greg

Hi Nial,

Thanks for this article again, it helps a lot(again)

Thanks Nial Thats five star information

Great lesson, thanks Nial :)

Its great to have some food for thought at the end of the week

— Friday night is my time to revise and learn, I look forward to these articles, thank you.

thanks Nial

lots of very good information here,

I’ll take a print of it, and give it a good read over

All best wishes

Peter

Clear helpful trading guidance as always from you Nial

Phenomenal !

Thank-you so much and have a great weekend, best

Paul

Nial, I always treasure your emails and

go through them time and again, I can not

thank you enough. God bless

Thanks Nial,

Great education lesson

You are indeed a blessing,am really learning a lot.often times I fall a prey of all you have thought in this lesson. thanks.

Fantastic Nial,i was caught in the false breakout on gbpusd and reading your articles is refreshing and make me stop being so overconfident and careless after a few wins,thank you!

Thanks Nial- Excellent, Excellent, Excellent

Thanks Nial,

It is an issue trying to find out if the PA is worth risking your money at but this will help me a lot.

I also think it can be difficult when there are several PA’s at the same time as recently in the Yen-pairs.

For me, I thought that the Dollar was the strongest so I took a long in that pair.

Anyway, thank you for sharing, it helps me very much.

Tomson

These points were very useful because they showed what the story is with ample diagrams- the latter are immensely helpful when they are taken from real time charts and the red ink gives a good idea- and less confusion with unknowns- such as point 6 :”Chop”, and point 3: “Don’t bet on a break out- wait till it happens, Kathy Lien is not nearly so descriptive.

The best piece of trading information that i have read is here Nial,its like you are talking to me alone when you write these articles…so real and points well driven home.

Thank you Nial

very nice and informative article well done

Nial

thanks

tino

AWESOME lesson

This lesson is a great treasure for any investor,analyst and trader trying to be a professional.Thank you Nial

simple concise analysis explained on charts,nice work.

Thanks Nial that would have to be one of the best lessons I have read in a while. Now things are a lot more clear to me now. Thanks once again Nial

Regards Colin

Nial:

This article was awesome and a great organizational approach to filtering your trades. That’s why you’re the best out there mate!