What Is A Fakey Pattern and How Do You Trade It?

One of my favourite price action trading patterns is the fakey pattern. There are many reasons why I like this pattern but perhaps the most important is the meaning behind it and its ability to be a reliable indicator of potential near-term (and sometimes long-term) market direction.

One of my favourite price action trading patterns is the fakey pattern. There are many reasons why I like this pattern but perhaps the most important is the meaning behind it and its ability to be a reliable indicator of potential near-term (and sometimes long-term) market direction.

What is a fakey price action pattern?

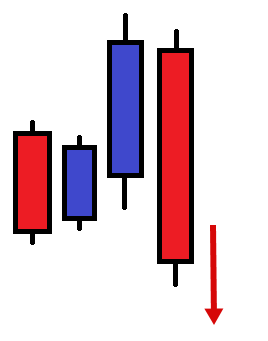

A fakey pattern in the market means that a false-breakout of an inside bar pattern has occurred. In other words, a fakey is when price initially breaks one way from an inside bar pattern but then price snaps back the other direction, creating a false break of the inside bar structure.

Now, as I mentioned previously, the meaning behind a fakey is what really attracts my attention when I see one on the charts. Essentially, a fakey means that the bigger market players (banks, hedge funds, big money traders) have either, 1) Purposely ran the stops (stop losses) on small retail traders, sucking them out of their positions and creating a ‘vacuum’ for price to reverse back in the opposite direction, or 2) Reacted to some big market event that has caused price to snap back the opposite direction from an initial breakout.

Either way, the fakey setup is a very strong signal that price may continue to move in the direction opposite the false-break. So, if for example, an inside bar setup false-breaks to the upside, forming a ‘bearish’ fakey pattern, the implication is that price may continue moving lower, opposite to the direction of the initial breakout.

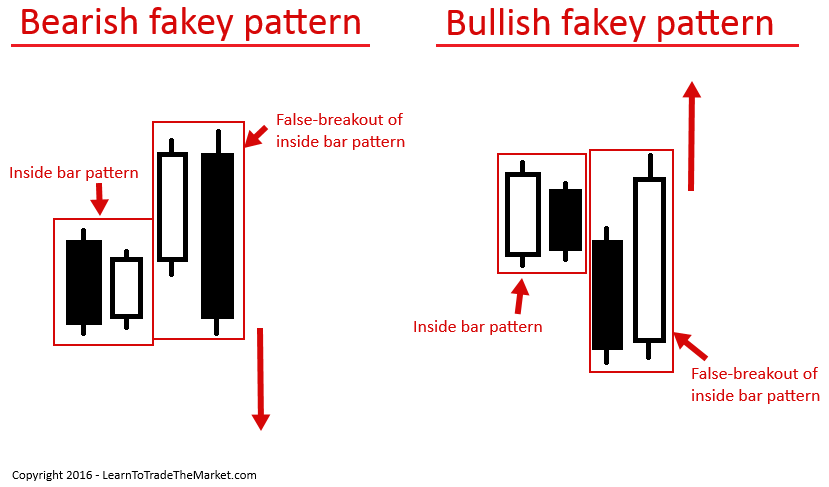

To clarify all of this let’s look at some examples:

In the example below, we see a ‘classic’ bearish and bullish fakey signal. Note that first there is an inside bar, followed by a false-breakout of that inside bar pattern which results in the fakey pattern forming:

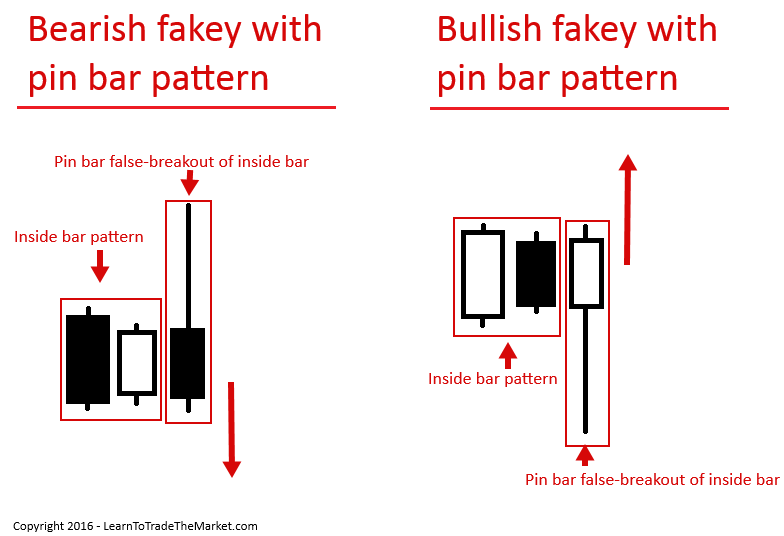

Note: Not every fakey signal will look exactly like the ones above, there are variations of the fakey pattern, which I cover more extensively in my price action trading course. You will for example, see fakey’s with a pin bar pattern as the false-break structure. In the case of a pin bar, the false-break would only be one bar, as opposed to the two-bar false-break structure I’ve shown in the diagram above. You may also come across fakey’s with three-bar false breaks, although these are rarer and I consider them less ideal than a fakey with a pin bar or a two-bar fakey false break structure.

In the example below, we see a bullish and bearish fakey pattern with a pin bar reversal as the false-break of the inside bar pattern:

How to trade a fakey signal

A fakey signal can be traded in just about any market condition except in a choppy market, which we don’t want to trade no matter what. But, a fakey can be used in a trending market or in a range bound market or even against a trend if it’s at a key support or resistance level.

The fakey provides us with a high-probability entry point as well as an obvious stop loss placement, let’s look at some examples to clarify…

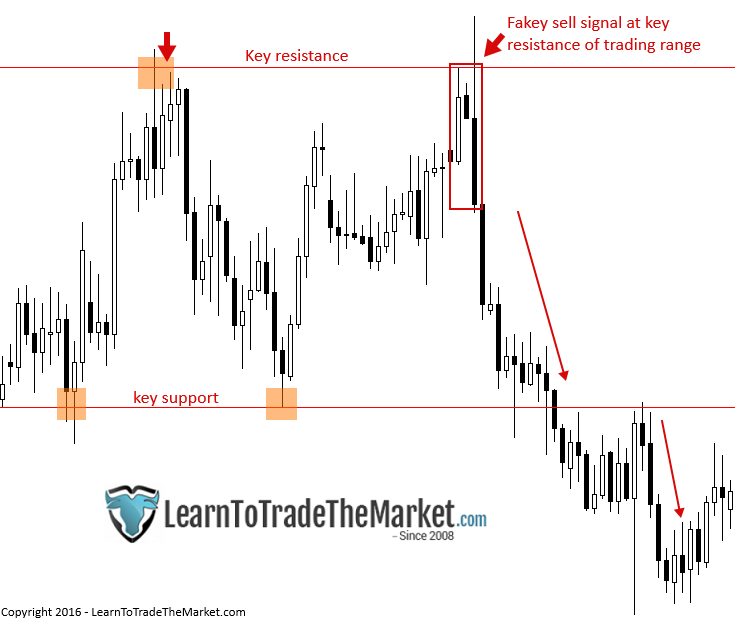

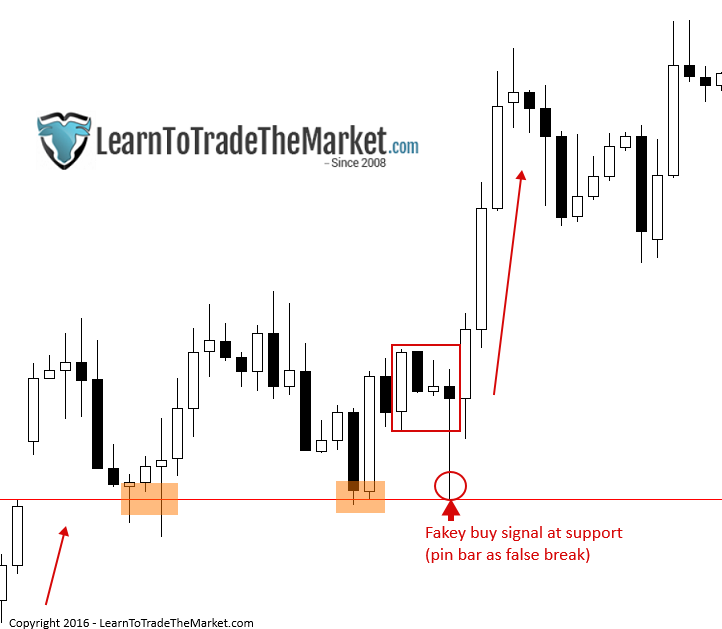

In the chart example below, we can see that the market was clearly trending higher before a period of consolidation / range-bound movement and then a fakey buy signal formed at the trading range support. Your stop loss would most logically be placed just below the lowest point of the two-bar false-break. This fakey formed at what I would call a confluent chart level because we had multiple supporting factors for the trade; in this case the support level and the uptrend:

Let’s look at another example of a fakey signal, but this time it’s one that formed at the upper boundary / key resistance of a trading range. Note, the false-break on this fakey was not quite a ‘pin bar’ because the real body of the candle was not small enough relative to the tail, but it was a bearish tailed reversal bar, which is one of the price patterns I teach in my trading course. Notice how price not only reversed to the downside after this fakey, but it actually kicked off a new downtrend…

Caveats to the fakey:

A fakey won’t always look ‘perfect’, there is some discretion involved, but developing a good gut feel in trading is what separates the pros from the amateur traders.

For example, you don’t need to have only one inside bar in a fakey structure, sometimes you will see two or three inside bars or possibly more. In the example below we see a nice fakey pin bar combo pattern with two inside bars before the pin bar false-breakout, this is totally OK and is something you’ll probably see often in fakey setups:

The KEY defining characteristic of a good fakey signal is a CLEAR false break of the inside bar structure. If you have an OBVIOUS false breakout of an inside bar, then you may just have a good fakey on your hands, assuming it has some confluence and makes sense in the context of the market. If you have to wonder and guess / ask other traders if a certain pattern is a fakey, then the false-break is probably not obvious enough for you to risk your money on. The best fakey’s are dead obvious and won’t require a lot of ‘deciphering’ on your part.

Final word on the fakey pattern

The fakey pattern is an extremely powerful price action pattern if you know how to properly spot it and trade it. What a fakey reflects to us, is a reversal in market sentiment and a ‘fake out’, which obviously has some profound trading implications. A false breakout is a very big clue in the market, it shows us what the ‘big boys’ are thinking and doing and gives us an opportunity to take advantage of that.

Amateur and beginner traders often get caught up in buying breakouts. Indeed, there are entire trading strategies and systems built around trading breakouts. Breakouts are one of the oldest and most over-used trading approaches in existence, and for that reason, they are easily snuffed out and taken advantage of by the bigger market players, whilst smaller retail traders are usually the ones getting taken advantage of.

A fakey pattern is essentially the hard evidence of what I said in the above paragraph, and they give savvy price action traders the ability to truly trade like the ‘big boys’. I invite you to learn more about this topic and get my price action trading course, because that is where I coalesce all of my knowledge and experience on the fakey pattern and exactly how to trade it properly.

I thank u from the bottom of my heart Mr Fuller. You have brought a breakthrough in my trading career after a long time really. My the good Lord bless u more n more. You are the mentor I just needed, clearly. Thanks

All the way…. South Africa

Hello Nial, I don’t know what to say as regards your article here. To be sincere, you’re such an indisputable professional trader because you make everything appear so simple to me here. Your articles are indispensable. I found this particular strategy discussed here the greatest among other trading strategies I have ever come across. And it always appears on every chart’s pattern. I have tested it and found it appears on every charts pattern, every day. It’s a leading indicator, and this makes it better than any other indicators out there.

Thanks so much .God bless you indeed.

This clean an clear article completely solved my price action problem. Wow, I am very happy. Thanks Nial for this wonderful, straightforward, well-written article.

thanks about your explanation, this is very good article

thanks Mr. Nial! I think each trader has to have this installation in the arsenal, thanks for your works

Thanks Sir for very very technical and effective information. i’m really learning well by reading your articles and appreciate your efforts form the core of my heart. Fakey Pattern analysis has increased more productivity and profit in my trades. God bless you

Thank Boss

Thanks, I now trade more if fakey a friend of mine introduced it to me. Nice and powerful csp

Trade like the “Big Boys” i like that. Trade in line with the Market Makers

Thak you, may i ask ” is this fakey pattern also can apply to all timeframe? Tq

I just started using it on 4 hours chart and I am seeing good results

thanks nial.. u always clear things out.. really appreciate it.

Am telling you Nial, if u had not honestly pointed out some amazing realities in trading,perhaps Won’t be appealing to me anymore and might av given up.your articles always makes a lot of senses.GOD bless u.

Thank you Nial, I have lost thousands of dollars before I found your website. Now I know what I’m doing and when to trade. Even if your price action course was $5000, I’d still buy it. May our Father in Heaven bless you abundantly for not being selfish.

Nial, you are a Redeemer. You have simplified the seemingly difficult forex trading with your down to earth expositions. Thank you.

Thanks Mr Nail your explanation is always to the point and always gain something from your topic. Thanks.

Good stuff Nial, thanks

well? this is clear Nial.

i was wondering whats fakey, inside bar and pin bar…. but at least out of the three i get FAKEY and INSIDE very clear now….

hmmmmm…. Nial thou art one in a million…

you will be richer than you can imagine!

amen

Wonderful. Many thanks Nial

thanks for this write- ups. i have learned something new. what i love most is how clear you made it for us to understand . i would also like to say that since i read your article on trading like a sniper and mastering one particular setup at a time, my trading style has changed.

Thanks God bless

Nice explanation nial

I am still learning forex jargon but i think you make it simple and straight foward

Thanks a lot Guru,

Excellent explanation nial. Thanks

Kudos Baba

Good job thanks alot

Thanks Nial

Your ability to make things crystal clear is a gift…

Thanks ????

Thanks Nial!

Soon ro write My trading plan and You explain well.

Br

Stephen

Thanks Nial, much appreciate your contribution. My trading eye sight is improving with your wisdom.

Cheers,

Gr8 article as usual.

I think that over time our eyes get better at seeing these price action signals form.

Many thanks.

Thanks Nial, have thoroughly enjoyed this article as this is what I have enjoyed the most in price action. Thank you.

Hi Nial, From the last 5 years I am reading your writings. I have learned many things from this sites. I like to give you a special thanks. I think I have got a full idea about forex not only trading but also all aspects about trading. Thanks again

When I was functioning with your trading approach, my performance was better. But now… Coming back to my ROOT. Thanks Buddy.