Inside Bar Forex Trading Strategy

Inside Bar Forex Trading Entry

Inside bars are one of my favorite price action setups to trade with; they are a high-probability trading strategy that provides traders with a good risk reward ratio since they typically require smaller stop losses than other setups. I like to trade inside bars on the daily chart time frame and ideally in strong trending markets, as I have found over the years that inside bars are best in trending markets as breakout plays in the direction of the trend. However, they can indeed also be used as reversal signals from key chart levels, we will discuss both in this tutorial. Let’s discuss some facts about inside bars first and then I will go over some examples of how I like to trade them.

Inside bars are one of my favorite price action setups to trade with; they are a high-probability trading strategy that provides traders with a good risk reward ratio since they typically require smaller stop losses than other setups. I like to trade inside bars on the daily chart time frame and ideally in strong trending markets, as I have found over the years that inside bars are best in trending markets as breakout plays in the direction of the trend. However, they can indeed also be used as reversal signals from key chart levels, we will discuss both in this tutorial. Let’s discuss some facts about inside bars first and then I will go over some examples of how I like to trade them.

What is an inside bar?

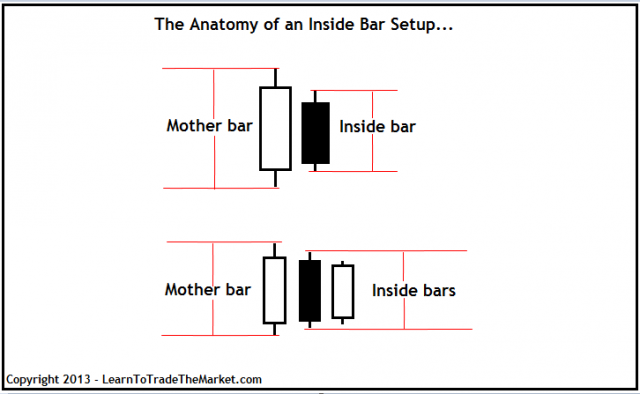

An inside bar is a bar (or a series of bars) that is completely contained within the range of the preceding bar, also known as the “mother bar”. The inside bar should have a higher low and lower high than the mother bar (some traders use a more lenient definition of inside bars to include equal bars). On a smaller time frame such as a 1 hour chart, a daily chart inside bar will sometimes look like a triangle pattern.

Important note: Since the inside bar setup is by its very nature a potential breakout signal, I ONLY enter an inside bar on a breakout of the mother bar high or low. If I am looking to buy, I will place a buy on stop entry just above the mother bar high, and if I am looking to sell I will place a sell on stop entry just below the mother bar low.

There are different variations, but the way I determine an inside bar setup is if the inside bar is contained within the range of the mother bar from high to low. That is to say, I use the mother bar high and low to define the range that the inside bar can be contained within, others might use only the real body of the mother candle as the determining range, but I do not teach or trade it that way.

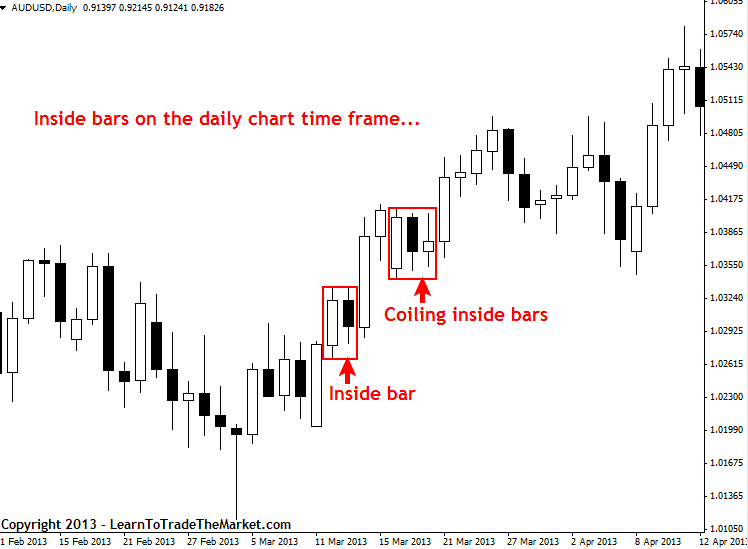

In the example image below, we can see the anatomy of an inside bar setup. Note that the inside bar is fully contained within the range of the high and low of the mother bar. You can have multiple inside bars within the range of one mother bar. If you see a pattern of consecutive inside bars that are “coiling” and all within the previous bar’s range, this can signal that a powerful breakout might be coming, more on this later.

What does an inside bar mean?

The inside bar forex trading strategy is a ‘flashing light’, a major signal to the trader that reversal or continuation is about to occur.

An inside bar indicates a time of indecision or consolidation. Inside bars typically occur as a market consolidates after making a large directional move, they can also occur at turning points in a market and at key decision points like major support/resistance levels.

They often provide a low-risk place to enter a trade or a logical exit point. In the image you will see next, we see an example of inside bars that formed as a continuation signals and then one that formed as a turning point signal. While they can be used in both scenarios, inside bars as continuation signals are more reliable and easier for beginning traders to learn. Turning-point, or inside bar reversal signals, are best to leave alone until you have some solid experience under your belt as a forex price action trader.

How to trade the inside bar setup

There are basically two ways to trade an inside bar setup: As a continuation signal or as a reversal signal.

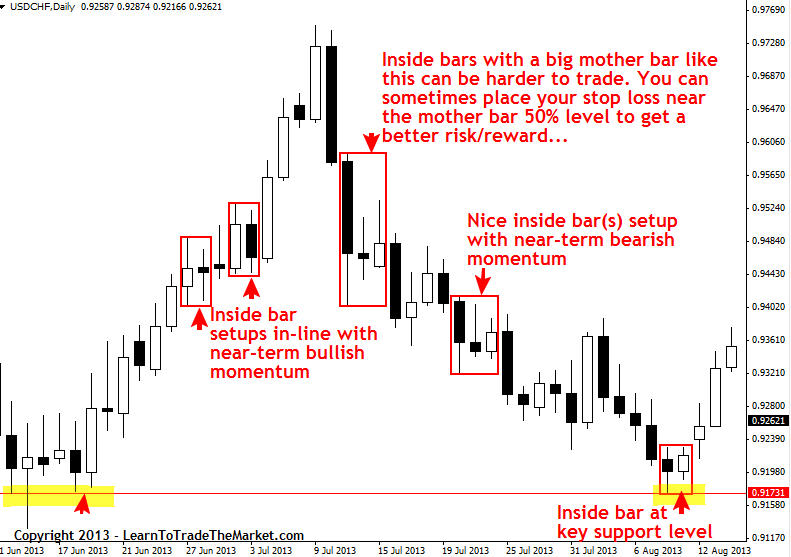

The chart image below has a variety of inside bars for us to pick apart…

First, you will see that we have inside bars that acted as continuation signals, that is they resulted in a continuation of the previous momentum before their formation. These continuation inside bars often result in nice breakouts in-line with the current trend and near-term momentum.

We can also see a good example of an inside bar that acted as a reversal or turning point signal. Note on the far right side of the chart an inside bar formed at a key support level, the market then broke back the other direction and made a nice move higher from the inside bar / stalling pattern that formed at a previous level of key support.

Important note: There are basically two different stop loss placements for inside bar setups, and you will have to use some discretion in determining the best one for each inside bar you trade.

The “classic” and most commonly used stop loss placement will be just above or below the mother bar high or low, depending on if you are trading long or short of course. I typically go with 1 pip above or below the mother bar high or low…no need to try and figure out the “best” distance above or below the mother bar…the trade either works or it doesn’t, a few pips won’t make that big a difference over the long-run.

The next stop placement is typically used on inside bars with larger mother bars. Although a larger mother bar on an inside bar setup is not really what I like to see, you can sometimes trade inside bars with larger mother bars, and if you do, you will probably want to place your stop loss near the mother bar 50% level, that is the ‘halfway point’ between the high and low of the mother bar, as that is really the only way to get a decent risk reward ratio on these types of inside bar setups.

I prefer smaller and “tighter” inside bars that don’t have really large mother bars…this shows more ‘compression’ and thus a stronger potential breakout from that compression. If you are a beginner or struggling trader, I suggest you avoid inside bars with big mother bars for now, see the previous example chart above for an example of an inside bar with a big mother bar.

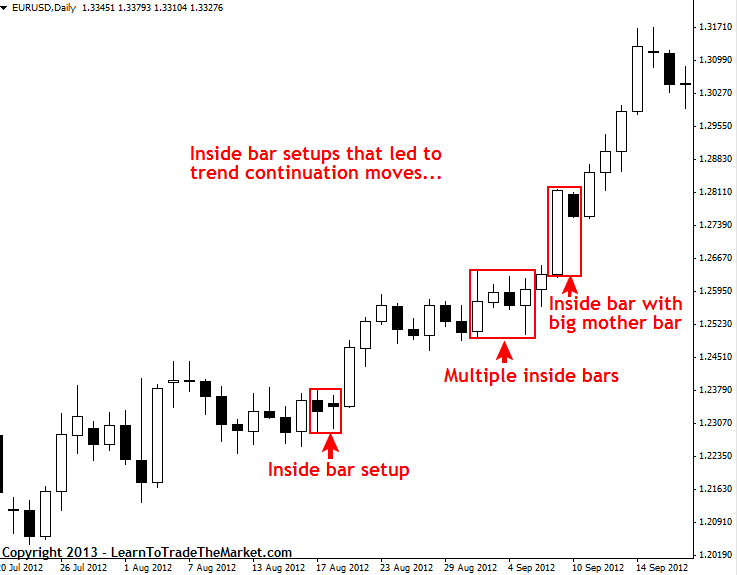

Inside bars as continuation signals

The most logical time to use an inside bar is when a strong trend is in progress or the market has clearly been moving in one direction and then decides to pause for a short time.

Inside bars can be used when trading a trend on the 4 hour charts or the daily charts, but I personally prefer to trade inside bars on the daily charts and I recommend all beginning traders stick to the daily charts and until they have fully mastered and found consistent success with the inside bar setup on that time frame. I also recommend sticking to inside bars that are in-line with the daily chart trend as continuation signals until you have fully mastered trading them that way.

In the chart example below, we can see a few examples of inside bar setups on the daily EURUSD chart that worked out quite nicely. They were in-line with the near-term dominant daily chart trend and resulted in nice breakout continuation plays…

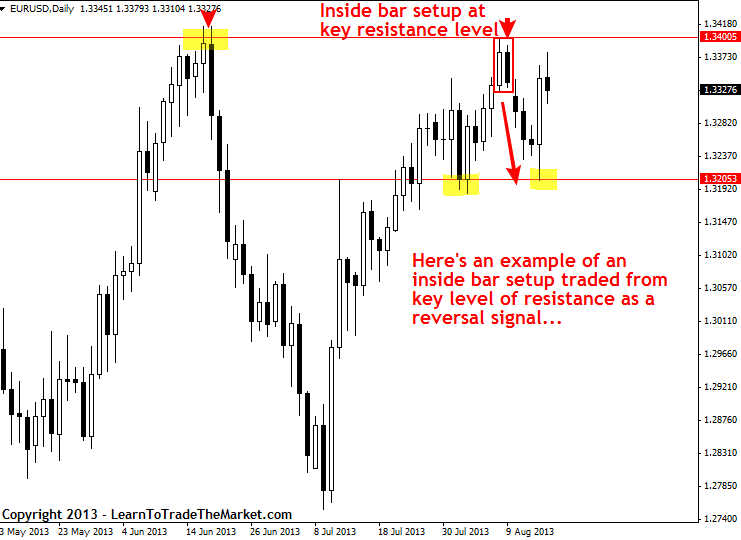

Inside bars as reversal signals

You can sometimes trade inside bars as reversal signals from key chart levels. Please note that this should ONLY be tried after you have successfully mastered trading inside bars in-line with the daily chart trend as continuation / breakout plays, as we discussed above.

In the chart below, we can see an example of a good inside bar reversal signal. Of critical importance here, is that the inside bar formed at a key chart level, indicating the market was hesitating and “unsure” if it wanted to move any higher. We can see a decent downside move occurred as price broke down past the inside bar’s mother bar low..

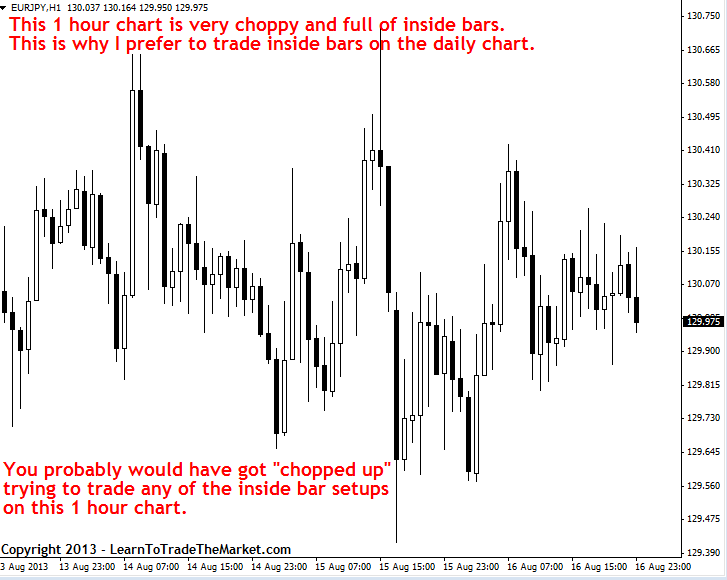

The best time frame for trading inside bars

I really only trade inside bars on the daily chart time frame. There’s good reason for this, and that reason is mainly because on time frames under the daily chart, inside bars simply grow too numerous to be worth trading. There can be long strings of inside bars on a 4 hour or 1 hour chart before a breakout for example, and trying to trade them will most likely cause you a lot of frustration due to all the false breaks that can occur on those chart time frames.

I get a lot of emails about inside bars, and many traders try in vain to trade them on lower time frame charts, and it really is just a huge waste of time. Once you gain experience, you MIGHT be able to trade inside bars on a 4 hour chart time frame, but that is the LOWEST time frame I would ever consider trading an inside bar on. The daily chart is the best for inside bars, and even the weekly chart can sometimes yield some very lucrative inside bar setups.

Inside bars can be used when trading a trend on the 240 minute charts or the daily forex charts, but I personally prefer to trade inside bars on the daily charts and I recommend all beginning traders should stick to the daily charts until they have fully mastered and found consistent success with the inside bar setup on that time frame.

In the chart example below, note how well the inside bars highlighted worked out. They won’t all work out obviously, but inside bars on the daily chart have a much higher probability of bringing you a profit than an inside bar on a lower time frame…

The chart example below shows a recent 1 hour chart of the EURJPY. If you look closely you will see A LOT of inside bars that failed, this is a prime example of why I avoid trading inside bars on the 1 hour chart and also why I LOVE to trade them on the daily chart time frame…

Finally, here is a video of a past live trade using the Inside Bar Strategy:

Thank you VERY MUCH for such a VALUABLE KNOWLEDGE and GOD BLESS YOU .

Thanks for this article. Will surely improve my trading.

Well appreciated.

Yeah this article is of a great importance to me as a learner thanks

Cheers!

Good bless you for this

Thank you Nial for this valuable material !

Hi Nial,many many thanks ???????? for your wonderful gift (powerful Pin Bar Strategy).

Got bless you.

Hi Nial,

Lets say is uptrend now. and Inside bar form. so we put our entry at the top of mother bar.

what if it go up and our entry triggered. and it pull back as fakey?

Anything can happen in the market. That’s the reason for stop loss.

Quite amazing!

Thank you Nial, for your wonderful gift !

Can you provide more explanation about inside bar and mother bar?

Lovely. God bless you Nail.

super article!

I have a question:

Must the mother bar have a big body or can a candle with long wicks and a tiny body be considered a mother as well?

Though i am a novice or a beginner in learning how to trade Forex, i could attest without fear that you are the Maestro and the best professor of all the people i have paid substantial money to teach me. You are just awesome since i am learning the skills and knowledge at a faster pace. And i now feel so confident that because of your teaching i gonna make it as a Forex Trader. I ,more than appreciate you Master Nial.

Thanks so much

YOU ARE THE KING OF CRISTAL CLEAR LOGICAL AN D CONVINCING EXPLANATION OF THE PFILOSOPHY OF TRADING TO READ YOUR LECTURES IS A GREAT LEASURE

BEST REGARDS

ROSSEN DIMITROV

Very nice article. Learned some important information on inside bars. Thank you.

hello Nial, I wanted to make an inquiry about the inside bar, as I have been able to test they have a high reliability in the time frame D1 W1 as well as in H4, recommend placing order buy or sell stop in the rupture of the bar mother? the mother bar should go in line with the trend? I mean if it’s a bullish inside that this is a big bullish bar and upside down, thanks

just stumbled on your post in my quest to understing why am loosing in Forex and find you post informative boss…. can i get some info on Fibonacci pls? thank for the good job well done

Thank you so much, Nial. Can’t wait to be a member soon.

Very informative and helpful course!

How use inside bar bull market

Good job

Good job!

This is making my forex journey much more exciting. This lesson is so enriching and rewarding. Thanks

Nial gave me a very good lessen I never have before

thanks a lot very clear explanation.

You are a great inspiration sir.Iam learning alot, Sir.

very informative – loved it

It’s very nice and instructive

Really it is amazing.

Thanks for sharing such a wonderful strategy.

Love to learn many more strategy from you.

Thanks a lot!!!!

Nyc post, greatful

thanks Nail this is great stuff as i have gone through almost all your articles

thank u

You are Awesome Nial

You are a great inspiration sir.Iam learning alot and I know my trading ability cannot remain the same after learning from you.Blessings!!

nail fuller I sincerely appreciate your gesture toward make other traders to be successful. thanks God bless you

I usually spend time reading your lessons before trading on my own as it instills confidence in my moves. It helps cement your lessons in my mind. The AHHA moments come more frequently now and my trading becomes or seems to become more attuned to the market. Thanks again Nial for your professionalism and attention.

You are simply awesome

I really learnt a great deal from your insight

Hopeful to join your membership community in earnest

Please keep up the good work

My pleasure my regards!

I am Timothy in Abeokuta.Nigeria

Just look at the (second) inside bar 50% retracement of the breakout candlestick!

Thanks, coach!

For long have always seen u talk about the inside bar & today-3/7/2013 have seen & understood its implication when verified on the D1 platform

Thanks a lot Nial-God bless u & keep it up

regard

your great treding analysis.

Hi, Can I use this pattern on H1?

Thanks

Thanks for this Nial.

This is really Very Good post – Learned how to put stop loss and set the target — Thanks a lot !!

I have usually not commented on posts but i cant stop myself to say that it is very clear and informative article.thanks

you are a great guy..you are indeed a guru nial…keep it up.

Thank you, clear and great course lessons. I really admire and appreciate your work :)

you are the best nial

Nial…your work is full of insights and informative as usual…i doff my hat…cheers

Thanks Nial, your article has been helpful. Will try them on Demo.

God Bless you Mr Nail for your analysis

three years of studying everything I could get my hands on about forex and trading live and this is the first time I have ever heard of a mother bar. Thanks Nial.

hi nial, you are making my head swell. have i been wasting my time elsewhere. thanks a million and i mean it

So, if I read this correcly; after an inside bar, the trade can go one of two ways – either with the prevailing trend or against it? Am I being thick – but what is the point of knowing that? How do I choose which way to place the trade?!? What am I missing? Thanks.

very good explanation and lesson, tq Nial!

thanks for this wonderful piece of info.

ur da best…

great informatoins, all i can say is thank you

Your clear and graphic illustration sure the teacher in you.It was good for newbies I like. Thanks for making me know more about fx.

I will adopt your system. Thank you for your wealth of knowledge.

Nial,

Thanks for your contribution I am finding your material very useful indeed and it is helping my trading. I have one question about the Inside Bar strategy: How do you determine whether the inside bar set up is legitimate or if a Fakey set up is forming. Do you have to take the inside bar regardless and risk taking the hit and just reverse your position if you get stopped out?

Your input would be very much appreciated.

Many Thanks and good trading

Steve

thanks Nial for this article…the explanation is very satisfying…i think inside bar strategy is the best..i have made profits on it all the time i have used it.

thank you

Great stuff. Very informative and educative as well.

hello boss. you are a great ace .keep going and we are following ciao

I have been looking at inside bars at locations that you have mentioned; support, resistance, and trend continuations and fine them to be rather strong and fascinating little creatures.

Thank you Mr. Fuller

Very Informative and helpful! Thanks a million for every single artice and video you have in here Nial. I feel fortunate to have bumped in to your website.

You may be the best price action trainor in bussiness. Simple clean effective.

hmm I am becoming perfect, i mean it…these are what traders need

Nice explanation. Most traders neglect to learn the basics before trading. So simple and effective.

Hi Nial it is indeed a great stuff for your inside bar strategy.I had close my position with 60pips of profit using your strategy on USDYEN trade on 11 Dec 2009.Thank!

Amaizing stuff Nial. Thanx for sharing.

As usual great stuff

Peace,

DR