‘The Holy Grail Of Forex Trading Strategies’ – Daily Chart Time frames

Let’s face it, 95% of you reading this are probably not consistently successful traders, in fact, you’ve probably blown out a trading account or three by now. You probably enter a trade and then sit at your computer watching the market tick away or reading economic news for the next two hours, unable to think about anything but what “could” happen to your trade. Maybe you can’t even sleep at night because you are so addicted to the 5 minute chart and to watching every pip of price movement that all you can think about is the market. If any of this sounds all too familiar to you, it’s obviously time for a change; it’s time to start concentrating your trading efforts on the daily chart time frame.

Let’s face it, 95% of you reading this are probably not consistently successful traders, in fact, you’ve probably blown out a trading account or three by now. You probably enter a trade and then sit at your computer watching the market tick away or reading economic news for the next two hours, unable to think about anything but what “could” happen to your trade. Maybe you can’t even sleep at night because you are so addicted to the 5 minute chart and to watching every pip of price movement that all you can think about is the market. If any of this sounds all too familiar to you, it’s obviously time for a change; it’s time to start concentrating your trading efforts on the daily chart time frame.

You know how that old cliché goes about ‘getting what you’ve always gotten from doing what you’ve always done‘…well now is the time to make the change…the one lesson that I learned early on in my trading career that helped me the most, was that the noise and false-signals of a 5 or 15 minute chart (lower time frames) were simply not worth spending my time on or risking my money on. I believe that daily chart trading can be your “Holy Grail” in the markets, here’s why…

Trading the 5 minute chart (and other lower time frames) decreases your chances of success and is widely considered gambling:

I am going to tell you guys something right now that you may not have thought about before…you only need 1 big winning trade a month to be a successful Forex trader. Yup, that’s correct, 1 big winning trade a month.

How is that possible you might ask? Well, I’ll bet if you go look at your trading account history right now you might just find the answer yourself. You see, most of you are losing money because you are trading too often, and you are trading too often because you are fixated on over-analyzing the market, Forex news variables, and lower time frame charts (I consider any chart under the 1 hour to be “lower time frame”).

Some of you probably even know that this over-involvement with the market is why you are losing money regularly or struggling to keep your head above water. Yet, even though you know it’s keeping you from achieving success in the markets, you cannot break your addiction to trading lower time frame charts and over-analyzing the markets. But, the cold hard truth of the matter is that you will likely never be a successful trader until you first break this addiction…

Now, here is why I firmly believe that trading lower time frame charts is a waste of time and money.

Trading a 5 minute chart stimulates the reward centers of your brain…it gives you instant gratification. Having patience and discipline to focus ONLY on the daily charts takes more effort from your more highly-evolved brain areas. So, what it really comes down to is that traders who are addicted to the lower time frames cannot break free from the instant stimulation they get when they enter a trade…even if it usually results in them losing money, because each time they enter the market, their brains are flooded with endorphins from the “thrill” of potentially making a lot of money really fast. So, the point here is that traders who are addicted to trading a 15 minute chart are actually addicted to the feeling they get from entering the market, and this means they are unable to use their more advanced planning and long-term brain areas effectively. It does not mean they are incapable of using them, it just means that they either don’t know they are addicted to trading lower time frames, or they don’t know how to stop it.

Trading a 5 minute chart stimulates the reward centers of your brain…it gives you instant gratification. Having patience and discipline to focus ONLY on the daily charts takes more effort from your more highly-evolved brain areas. So, what it really comes down to is that traders who are addicted to the lower time frames cannot break free from the instant stimulation they get when they enter a trade…even if it usually results in them losing money, because each time they enter the market, their brains are flooded with endorphins from the “thrill” of potentially making a lot of money really fast. So, the point here is that traders who are addicted to trading a 15 minute chart are actually addicted to the feeling they get from entering the market, and this means they are unable to use their more advanced planning and long-term brain areas effectively. It does not mean they are incapable of using them, it just means that they either don’t know they are addicted to trading lower time frames, or they don’t know how to stop it.

I have personally only met a few day-traders who make money consistently, and they almost all seem really frazzled and strung-out, like a junky who cannot stop thinking or talking about their drugs (the market). Sure, it’s possible to make money from sitting in front of your computer 8 hours a day staring at each tick, but why in the world would you want to? Let’s face it, watching the market tick away is not really that fun, NOR is it productive…at all.

Now, let’s get back to my main point that trading lower time frames is decreasing your chances of winning and destroying your trading account. To focus on daily chart trading you need patience and mental fortitude, this takes intelligence and forward-thinking, it takes checking your ego at the door, and it takes a realistic attitude. Anyone can go to a casino and get lucky a few times at the poker table, but why do you think it’s possible for some people to win at poker again and again and again, to the point where they make a living from it? It’s because they have taken a longer-term view and they realize that their success is not defined by any one hand of cards, just like your trading success is not defined by any one trade. So, if you want to turn your trading around, it’s time to swallow your need to “control” the market and for instant gratification, and begin taking a longer-term view of the markets by focusing on the daily chart time frame.

Nial, I don’t have enough money to trade the daily charts…

I get this email almost every day: “Nial, how can I trade the daily charts when I need to have wider stop losses and I don’t have a lot of money in my account, I can only afford to trade the 15 minute chart for now, then when I build up my account I will trade longer time frames”…

Many traders think this way, and it’s usually just because they don’t know enough about Forex trading position sizing or because they think by trading bigger position sizes on the lower time frame charts they are going to somehow make money faster.

So let me set this straight for you guys right now: Through position sizing, you can trade the daily charts just fine on a small trading account…you just have to trade a smaller position size. But, let’s face it, if you have a small trading account you should not be trading large position sizes anyways! You need to get rid of this attitude of “getting rich quick” and thinking that trading a 15 minute chart is somehow going to provide you with more opportunities to profit.

Here’s the deal…Yes, there are MORE trades on a 15 minute chart, however, there are also more false-signals and there is more random market noise, so you are just going to end up taking more losing trades and stressing yourself out more. This all contributes to a poor trading mindset and ultimately to you losing more and more money.

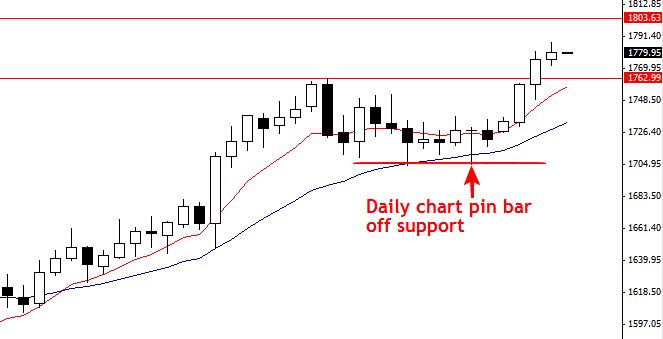

Look at this chart below of the daily spot Gold market. There was an obvious pin bar strategy from February 16th that we discussed first in the members’ forum as well as in the members’ commentary. This trade setup was clearly with the existing up trend, it was well defined, and formed near two areas of support….a ‘no-brainer’ for savvy price action traders like my members. The point is this…if you wait patiently and hit one big winner like this a month, you are doing very very well. My main trading philosophy is to trade Forex like a sniper, and this is a prime example of how that’s done:

Why you need to make the daily time frame your primary chart starting today…

• Daily charts provide more clarity

As I stated before, lower time frames are full of random market “noise” and false-signals, you will eliminate most of this noise by simply focusing on the daily charts. Focusing on the daily charts will also give you a clearer view of the overall market picture and will naturally improve your ability to read the market’s direction both near and long term.

• Daily charts help you develop a more effective and accurate market bias

Understanding the overall daily time frame bias of the market is very important for trading the daily charts and the 4hr or 1hr charts too. I do teach 4hr and 1hr time frame trading, but it’s crucial to master daily chart trading first so that you get a feeling of the underlying market sentiment. This goes along with developing your discretionary price action trading skill; you have to learn to “read” the market and get in touch with its ebbs and flows…it sounds a little cheesy maybe, but the market talks via price action, and if you “listen” closely enough to what it is saying you can understand where it is most likely to go next.

• Higher risk : reward

While the amount of money you risk per trade is a highly personal decision that depends on your individual financial situation, trading the daily charts can allow you to risk a bit more per trade than trading the lower time frames. Take note: I am NOT saying you should risk more per trade, I am saying that when you only TRADE 3 TIMES A MONTH (or thereabouts), you clearly can risk more money on one trade than if you are trading 30 times a month. So, this is an answer to the question “Nial, I can’t make as much money trading the daily charts as I can on the lower time frames”…yes you can because when you trade like a sniper you inherently enter far fewer trades each month than if you trade like a machine gunner, so this allows you to trade more lots per trade. However, keep in mind, this obviously only works if you can remain disciplined enough to not jump back into the market on revenge after you have a losing trade.

• Daily charts reduce the frequency with which you trade – slow and steady wins the race

One thing I firmly believe in is that Forex trading success is largely a result of the quality of the trades you take…not the quantity of trades you take. By simply reducing the frequency with which you trade, you will simultaneously improve your odds of succeeding over the long-term. You need to understand and accept the fact that 2 or 3 quality trades a month is going to put you much further ahead than 20 or 30 emotion-fueled impulse trades a month…no matter how good it makes you feel to take them. Remember, the tortoise won the fabled race because he was slow and consistent, instead of fast and full of emotion like the hare…

One thing I firmly believe in is that Forex trading success is largely a result of the quality of the trades you take…not the quantity of trades you take. By simply reducing the frequency with which you trade, you will simultaneously improve your odds of succeeding over the long-term. You need to understand and accept the fact that 2 or 3 quality trades a month is going to put you much further ahead than 20 or 30 emotion-fueled impulse trades a month…no matter how good it makes you feel to take them. Remember, the tortoise won the fabled race because he was slow and consistent, instead of fast and full of emotion like the hare…

Shift your thinking (Take this stuff seriously)

Trading success is a direct result of the way you think about the markets. So, if you view the markets as a game of chance that you just like to “play around with” and you think you will make money by getting lucky every now and then…your trading account will quickly shrink in size.

Professional traders view the market as an arena to spot high-probability setups, setups that virtually “jump” off the chart at them; they then trade these setups and risk only an amount of money that they are 100% comfortable with losing. They also view the markets as a reflection of their own ability to control their emotions and actions in an arena of constant temptation…most people cannot do this consistently, and that’s why many people are bad at trading. It takes consistent control of your emotions and actions in the market to produce consistent trading results.

To shift the way you think about trading, you need to start getting excited about patience and about NOT trading…understand that the way you are thinking now is the way most traders think about the market…and most traders lose money…so if you can learn to do what most traders don’t do and think opposite from them…it goes to reason that you will greatly improve your chances of making money…

Making the transition into ‘daily chart’ price action trading

Now that you understand why trading a 5 minute or other lower time frame chart is counter-productive to achieving long-term success in the markets, it’s time to make the transition to daily time frame trading. There is no sure-fire way to eliminate the temptation of the lower time frame charts, but if you re-read this article and some of my other Forex articles, you will reinforce the reasons why taking a slower and longer-term view on the market is the quickest way to making money as a trader.

Now that you understand why trading a 5 minute or other lower time frame chart is counter-productive to achieving long-term success in the markets, it’s time to make the transition to daily time frame trading. There is no sure-fire way to eliminate the temptation of the lower time frame charts, but if you re-read this article and some of my other Forex articles, you will reinforce the reasons why taking a slower and longer-term view on the market is the quickest way to making money as a trader.

The daily chart time frame is at the heart of how I trade and how I teach; my price action trading strategies and my overall trading philosophy revolve around taking a calm and stress-free approach to the markets. I know what I am looking for on the charts, if it shows up, I enter the trade, if not, I walk away from my computer.

The underlying point that you should take away from today’s lesson is that the more you push and “try” to make money in the markets by burning your eyeballs out staring at lower time frame charts, the more the money you so badly desire will elude you. Trading is an art, and like any art, it takes practice to become good at, but trading is a different beast because to excel at trading you need to take a largely “hands-off” approach, meaning you have to look at and study the markets a lot while actually “doing” relatively little (meaning not trading). Indeed, trading is the ultimate test of self-discipline and will power, and the more you develop these abilities, the more you will find that the profits you seek from the markets are not so elusive after all. If you enjoyed today’s lesson and want to learn more about developing a calm and stress-free approach to your Forex trading, check out my price action Forex trading course.

I keep wondering why I became so interested in trading as it seemed a random choice for me. Yes, the potential freedom is enticing, but I don’t get that excited by placing trades, more fearful if I’m honest…I over-think and often paralyse myself with doubt. So WHY would I choose to do it then?

Then I read this in your article…”

“To focus on daily chart trading you need patience and mental fortitude, this takes intelligence and forward-thinking, it takes checking your ego at the door, and it takes a realistic attitude.”

This makes so much sense to me. After flailing around switching and changing time frames and strategies etc., I came across your education and realised that the challenge for me was NOT so much about generating an income but much more about the developing the ability to change my behaviour.

To succeed in trading and live a balanced life I will need to develop the attributes you mentioned and that feels really worthwhile. Hopefully, the winning trades will be an additional incentive!

Thanks Nial for nailing this. So glad I came across your site.

I have really like what is described above and I am also sure to experience what I learn from the article. Thank you sir

This article spoke directly to me. I wondered if you had me in mind personally when writing.

Honestly, it’s bye bye to day trading. I am a forex newbie but my paid courses didn’t give me the kind of stuff I’m getting from your free articles.

I can’t wait to commence your paid training course.

Thanks Nial

You always nail your lessons and thoughts.

I have tried all the available TFs in MT4 from 1 min thru 1 week. Tried almost all indicators and PA. Traded all majors and some minors. Started with $ 1K . Went down to $500 and came back to $ 1.1K. These are all from Apr’20 to Mar’21. Didn’t get enough profit to buy a Lamborghini/golf shoe but didn’t lose my shirt. So, I plan to give D1 a long (12 months) try and stay with 1 pair. What price action strategy do you recommend (I thought of going for long when price is above 10 or 20 EMA or 50 EMA and exit when it is not)

Sir! I must confess that your strategies is a life sever, now I know the value of D1 trading, thanks for this.

I’m a member but your website is always such a great resource. I always find myself coming back to read and re read the material. Such a great help. Thanks Nial.

Nial Fuller I thank you for the article but I think as I said earlier for persons who have being in the game for long they will all agree and identify with this but for newbies it is very difficult so in your articles rearrange them into newbie.intermediate and veterans.Like this article it’s a good article for newbies who think that the markets is a print but it is a long marathon.

Thank you for the reminder the markets need patience.

One of the things to understand as a trader (new trader,beginner), aiming for success, who wants to stay long in the marker is understanding how position size works. Trading with daily chart is the most profitable strategy to me, as I have tested and it really worked out for me. This is what Nial highly recommended with emphasis. For example, I tried thing out recently by depositing $50 to my account, as a newbie, and I began to trade with 0.01 lot size, not minding how small this is, but lo and behold, my account keeps growing every day by at least $1,2 to 3 at times, and I am happy with this because I see this as a practice account. At times, I do trade with 0.03 lot size, at most. Things is really working for me. If I am risking $1, then I am aiming for $1.50 0r $2. If I am risking 50cent, then I am aiming for $1.

So, if one has $100 account, he or she must not trade with more than, at most, 0.05 lot size. This means you can only trade successfully with these lot sizes with $100 account: 0.01,0.02,0.03,0.04,0.05.(if you want succeed and stay long in the market).

Understanding position sizing matters in having success in forex market.

Thanks for that Clarifications and Confirmation. I did the same thing and I have to agree with you that Nial emphasizing that as beginners we should focus on the Daily Time Frame to Trade on. Definitely gonna keep doing this.

Guys Please as a fellow LTTTM Member, we should all listen to Nial. It works and it works 100%. Concentrate and Focus on the D1 Daily Time Frame.

It works

Simple to understand but important article!

Thank you, Nial!

Hello sir I would like to know which one of the two time frames is better to use.The weekly and daily time frames.I will glad to have your feedback

Good lesson! Thanks

Total rubbish!

Reducing the number of trades doesn’t make you successful! As if trading 3 times a month will give you a higher win rate than trading 30 a month is wrong. Average win rate for a success trader is 55% – 60% so after 3 trades you’d win 1.5 – 2 traded. The person trading 30 times would win over 15 trades… what you need to work on is your risk reward ratio which isn’t mentioned. Risking $1 to $2. The pros risk $1 to make $3 – $5 you trade less with those setups but it isn’t the volume of trading making the difference it’s the RRR

Trevor, it is incorrect to suggest that 10 trades on 30 min chart are the same as 10 trades on daily chart. The 30 min chart has far less weight behind it, a signal on 30 minute chart is closer to being market noise than a true signal from a higher time frame, which has far more weight behind it (24 hours of trade data). Quality over quantity is important. The less we trade the less spread and commission we give back to the broker or market as well, alot of people don’t ever consider this.

Hello Nial,

I’m Bert Pacheco of the Philippines.

I regretted the past months where I didn’t read your articles about learning to trade until I realized that your videos and website are worthy to be learned. I now developed a paradigm shift the I trade.

I previously listened and subscribed those free signals until I noticed it was all nonsense that my small account nearly wiped out.

Thank you very much for these articles. This is my “great awakening”

Please do not stop doing these things

#learndisciplineandpatiencefromyou

My appreciations,

Nilbert Pacheco

Cagayan de Oro City, Philippines

I tried this strategy this past week and I must say it’s very peaceful…. I don’t have to keep looking at my computer all day and getting frustrated…. thanks for this article….life saving stuff

Greetings from Brunei.

I must say this is one of the best articles (among many other great one) that had completely transform the way and direction of my FX journey.

I sincerely want to thank you for your generosity in sharing all these great advice & tips to us. Be blessed and stay blessed.

This lession was awsome

Love it, now to practice it.

Good trade strategy indeed. It is working

Sir Nial, youre advice here is incredible, slowly but surely, i think i will join the course, this is right for me as aslow learner, thanks

Nial gives sage advice. My preacher has always taught that solid thinking, not emotions, should rule ones life.

I will defenetly put this into prectise from now on.

Good advice”

Good one.

Great.

Great article! Thanks Nial…

NICE ARTICLE

Hi Nial.

Is this the reason why 95%of traders lose money trading the lower time frames?

I used to trade the lower time frames heavily made money too but I was stressed and found myself thinking about charts all day. I found higher time frames by accident and never looked back. I still lose traded but not as much and I feel so much better.

Great article nial. A must read for all beginner traders.

I have not yet began trading but am studying my different options for executions. This seems so true because back in my poker days when I used to play a bunch of hands for small wins id end up playing a bad one that lost all my wins and my payroll. Where as when i was patient for my good hand id win the amount of all those small pots together and more without all the little and big losses to follow. So i definitely notice a big connection between these two games and the philosophy of patient play versus quick and impulsive ones.

Hi Nail,

I guess I am seeing this late… I am a victim of emotional trading but the love of forex won’t keep me away…. you said in your article, trading 15m and below is highly risky and considered as gambling… however, 30m, 1hr, 4hr… were not mentioned. Can one trade successfully and consistently using 30m, 1hr & 4hr trades? Because I am currently learn and the immediate switch from 1m to 1d charts looks very difficult from my point of view… Thank you,

Nial, I love this article particularly, and I have read many. I first started trading a little more than a month ago, and following your advice, I quickly started to realize great, consistent profits trading the daily charts. However, I am a naturally curious person, and having encountered some interesting trading strategies for lower timeframes, I decided to try my “luck”.

After research, study, and practice, I would reap great profits in 15 minutes or an hour on the 15m or 5m charts. Then, I would have an equally bad or twice as bad losing streak the next day. And I couldn’t make consistent profits. Reviewing my demo account, I noticed that my most profitable times were with your strategies on the daily chart, so I decided to revisit your website and see what you had to say on the subject.

Low and behold, I was suckered into impulsive gambling by the allure of quick profits without realizing it. I went in with the best of intentions, lead by curiosity and greed.

My true aim is self-control and iron-clad willpower, so I will be returning to the daily charts, implementing the strategies as you have described them. I’m sure you have lots of emails and feedback like my own, so mine may have little significance to you amidst all the “noise”, but I wanted to reinforce what an amazing job you are doing in sharing your knowledge with people like myself. Resources like yours enable people to climb out of soul-sucking wage labor.

Thank you.

So true

my two take home points today.

1. ‘I am going to tell you guys something right now that you may not have thought about before…you only need 1 big winning trade a month to be a successful Forex trader. Yup, that’s correct, 1 big winning trade a month’

2. I know what I am looking for on the charts, if it shows up, I enter the trade, if not, I walk away from my computer.

Hi,

You wrote, ” I know what I am looking for on the charts, if it shows up, I enter the trade, if not, I walk away from my computer”

I am curious. So, can you clarify what it is that you look for on the charts?

Thanks.

Ben A

Thanks Nial. U are so on point. Av blown my account severally bcos i didnt know which time frame to really trade. Always boxing up everything but now as am preparing to hit the fx market again and very sure to blow after trainings like this. Thanks Nial.

Thanks for the lesson. The seductive shorter time frames are a real trap. Really appreciate the importance of changing my midset and using the daily charts as a baseline. Thanks once again

Marvelous Nial!! You are an Angel for we traders.. May all your wishes come true!

Hi Nial,

I am trying to comprehend what exactly you meant here and will appreciate you could help me with this matter by answering the below questions:

I understand you trade on daily charts, but Does Nial Often Checks The Market On Four Hours Intervals on H4, Or Rather Solely Deals With Daily Charts For The Purpose Of Entries and Exits?

Monitoring 10 instruments 6 times a day on four-hour charts translates into 60 times analysis on one single trading day that could be really drowning, whereas dealing with daily charts downscale it to 10 analysis a day, if I am correctly getting what you have been trying to say.

Thank you in advance for your response

I perform analysis on daily charts at the end of the New York session and I check live trades a couple of times per day. (in the morning and in the evening)

Hello, I’ve been trading for about 4 years and it finally took me that long to realize that the lower time frames are the problem. Everything Nial mentioned in this article is true. Really good advice, but you have to wean yourself off the lower time frames first. I would never trade anything, but daily chart trades.

Thanks so much Nial,your article very helpful for a newbie Trader like me.B-)

Nial nial nial ,Thank you very much, You have been such a great inspiration for me,as I am started to trade for 6 months , keep the good work , one day I will come and see you . God bless you

I just started getting in to trading and coming across this is making me doubt my strategy. Is it possible to still be successful on a smaller time scale? I have been trading on a 4 hour, 1 hour, and 15 min scale depending on if I am looking for a trend or entry, then set my stops accordingly. I don’t sit glued staring at charts for hours on end, I check back a few times to see if I have a confirmed entry signal and that’s it.

Jesse, I am not a fan of short time-frames, I much prefer the higher time-frames eg: 4 hour and daily charts.

This is probably one of the best articles I have read about fx trading. Nial you are spot on here man. I have found no success with the 5 min b.s set up and you are right I am chasing nothing but emotion with the lower time frames. I will admit this fault and change it today. I can tell by your comments that this article stuck a cord with a lot of us traders. Much success to everyone on this board that seemed to absorb this information so well. Nial my man. Keep doing what you are doing, DAILY!!

Hi why there different day chart for different trading platform also different chart for different timezone. Even though forex market opens same time all over the world. Trading platform opens a dayily candle midnight base on their respective countrys timezone. I am quite confused the signal i can see from Uk might be different from the signal a trade sees from Us or far east. Please can you explain.

Akmal, we discuss this in our article about using ‘new york close forex charts’ here – https://www.learntotradethemarket.com/meta-trader-demo-account-sign-up-new-york-close-charts

Thanks bruh, really helpful

This makes a lot of sense. Almost every trader I know trades the M15. And every trader I know loses money. The lower time frames are just chaos and noise. The D1 is crystal clear (or pretty damn close!)

Yes, there are fewer trades and you’re holding them for a lot longer (my record is holding a trade for 40 days) but the ROI is much higher and with pyramiding, it’s insane. I trade five pairs and typically only have one 2% trade a month in each but the return is usually 8-10% in each pair. Huge.

If you can’t seem to make money as a trader, try trading D1 before throwing in the towel. You’ll be pleasantly surprised. And if you find it too boring that’s OK. Still trade D1 and go find something else to do for your kicks!

Thanks for sharing your experience!

Dear Nial

Regards!

M.A Hameed from Dubai and newbie in forex trading wondering how to learn fundamental skill to become a professional trader. Indeed your great and down to earth research and knowledge is empowering me to learn step by step. Your articles are incredible resources for us to go through the career path. Wish you best of luck!

Good article and its a must to read and apply for new traders.Thanks

Hi Nial,

It is a great article about the inside of forex trading and why lower time frame won’t help to become consistent winner. I had the same experience when I was using the lower time frame. CHANGE to daily time frame is a must to get high probability trades. Thanks a lot Nial for your art of writing of all your articles. They are very informative & easy to understand. Keep up your good work. GOD BLESS YOU Nial.

This is the truth you explain in this artical. Thanks Nail

great advice nial

Very sound and logical article. I sometimes wonder are there any 5min chart winners at all! It’s true that daily chart is more efficient than 5 mins but overall, market itself is not and that’s how winners cashout from losers.

In relation to the article, the only time I ever made huge profit was buying and adding on to my long term position in silver from $37 to $49 more than 1000 pips and why it happened? Cuz one day I was tired of gambling and decided to long silver cuz it was a hot topic and the daily chart was bullish. I had no bs tight stops and bought very little amount. I added and added more while trailing the stop till one day my P/L was so attractive I took a screen shot of it :-)

Very frank, but the 1st sentence hit home with my experience. That’s why I like Nial’s approach in teaching. Being blunt is probably the quickest way to learn. To many it may seem like a slap in the face; but to many it’s very well needed.

Great comment Nial, the best Id never read on forums… since I began to trade with 1d, (I trade with 12 hrs as well) all was changed. I think some people will be able to trade properly just reading your post, and no time later like me! I will keep and recommend this site to newbies.

Just please, the pic :(

I know everybody says “The Holy..” but its really Holy :P

cheers

Thanks Nial,you are the great like always Thank you

greatest write up about price action i ever read. thanks Nial

Excellent and Helpful article. thanks for sharing!

all the books Ive read and the videos I have watched has never sound this easy, I wished I knew of your knowledge when I was blowing money or should I say giving away money.

You are so cool! I do not suppose I have read something like this before.

So great to discover another person with a few original thoughts on this

topic. Really.. thank you for starting this up. This site is one thing that is required on the web, someone with

a little originality!

Excellent article thnks!

Great article, thankx for sharing.

Very eye opening Nial. You are one of a kind. You are a straight shooter no bs no gimmicks. It is your true desire to help other succeed and not just sell a product that sets you apart. I have learned much from you free lessons videos and commentaries. I thank you Nial, and this is why I will be purchasing your trading course

great article Nial

Hi Nial,

Thank you so much for generously sharing your valuable knowledge. May God Bless you.

I am a experienced and consistently profitable trader with over 5 years experience. Your article is 100% correct. I’ve seen “gurus” charge very steep fees to disclose such information.

You are truly a rare gem who speak the the truth.

Very nice article nial

fantastic article… playing around with 5 min and lower time frames chart is totally like wiping your account instant. I lost 5k in just a matter of 2 months.. so I am now really looking for long term horizon.. and yeah DAILY CHART is the holy grail.. people are still searching for the holy grail, but they don’ t know holy grail is just in their pc’s in the form of daily chart.

Your articles are refreshing; Does taking trades off a larger time chart(daily chart) work for other markets like Futures and options charts.

Nial,you’re so incredible.i’m a victim of lower timeframe,i was even trading this same lower timeframe while reading your article.i will keep reading this article to change my weak knowledge about trading (trading the lower timeframe).i enjoyed every bit i read here so i just have to leave a comment and say A BIG THANKS TO YOU Nial.Cheers

You have just described my trading over the last 6 months. Can I make the switch (that I know I need to do)to the daily chart? The hard work starts now. Thanks Nial for your honest words

I have read 3 articles in a row and still love to read but have to sleep as per your training we need to maintain our decipline levels. Thanks much!!

BR

Rahim Aziz

Thank you Nial, I was not wrong in monitoring trend trading thru daily time frame.

Very good article Nial, i am feeling the same nowadays as well, thanks a lot for your sharing and hope i can be a trader like you in the near future…..fingers crossed ;-)

Thx Nail. Thx for the lesson. I totally agree on what u say.

Sometimes all it takes is to have what we konw is the right approach in our minds alraedy put in front of us like this, to actually take action.

Very good read!

Nice Lesson.

it gives me such motivation and knowledge of your each and every article and chart,inspired me to do well in every trade. thank u very much.

Great teaching Nial!!

Indeed the state that we are in, is vital in our trading result.

Thanks Nial this has giving me a somewhat better direction

Thank You for this valuable information!!!!!

WE really really like your stuff

Thanks Nail, I enjoy your blog.

Thank you very much Nial…

I agree with everything here. Thanks for that Nail. I want to know if you have a section where we can make question and you can answer this question. Exist this? Thanks again. William.

Thank you very much. I may undertstand it.

Nial,your teachings are just practical truths.

Keep it up.

Wow, what a nice sdiscipline to engage to such a learning process, will try to trade less.

Nial you are a rare Gem in the forex market community, May God continue to bless you.More Green pips to your trading.

i also have a game plan that looking like this and doing well with it before read this article.thanks

So simple yet so effective in the short space of time that I have visited this website a lot of my questions have been answered…

I look forward to becoming a member so I can learn how to be a successful trader

Nial,

You r not just considered an Authority in Price Action…boy,you sure do preach with Authority on Price Action..let him who is wise listen n learn..glad l took the right steps towards you…you r a breath of Fresh Air in the complex world of FX trading…Cheers!!

Greetings, do you factor in any particular time of day? Meaning, do you look at the markets for morning and/or night trading, or have a preference for either? Thanks in advance :) EC

Great stuff Nial

Totally agree with your excellent article

A couple of small points I would like to add please

It is possible to be a very profitable trader on the lower time frames…BUT…one must exercise the same sort of PATIENCE required for the Daily time frames (Don’t over trade)

And ..the lower time frames MUST suit your personal makeup(Type of person you are)

It is fair to say the larger time frames will not suit everyone, just as the shorter time frames will not suit many, many traders personal makeup….So to sum up what a great article and learning to trade the time frame(s) that suit Your personal makeup with PATIENCE is critical…

Thanks again Nial

Cheers Kevin(Zach)Harper

Awesome insight into myself … and my flaws. Thanks!!!

Hi Nial

One of your best articles, well done! It’s also one of the best pieces of advice currently on the internet in relation to trading.

The daily time-frame is all that is needed for people to trade “for a living”. We just start at different starting points but the key is to accept your start position and begin to head towards the finishing line.

There have been countless cases of retail (and professional) traders getting caught up in their emotions (greed in this case) and consequently blowing their accounts.

In my humble opinion, position sizing stands alongside a traders strategy in terms of importance to being a successful trader. So few people touch upon this subject but all successful traders know the following when entering a trade:

1. How much they are risking on this trade

2. How much they are looking to make on this trade

The above is only possible through position sizing on each and every trade. The novice trader will often trade 1 mini-lot per trade or there abouts but this does not make the above two statements true and hence the account does not grow according to expectations.

Thanks again for your article and as you can see, you’ve touched a raw nerve for me as I firmly believe in the points you have raised and I don’t think the importance of the points are emphasised enough.

°\(^▿^)/°

This is a great article and i think if some of the so called fx guru read this they will be submissive to enough to learn more

Great, thx Nial, as ever…

Thanks for the reminder and motivation to stay patient.

I’ve been trying many short timeframe strategies. They’re all gone wrong. But with daily charts, I get much better results. Stick on Daily!

Hi Nial,

Informative and useful article with some hidden truth. Want to learn more from you.

Thanks

Hi Nial,

I’m a believer that one does need experience before one will master something (there’s the rule of a thumb of 10000 hours to become a master). It takes some time to really come to the point to realize and to be at ease with your greedy mind to accept the truth that reducing trading frequency does improve your performance. Only enter the 95% trades and then go away…I hope that the people will sometime really see the truth of what your constantly saying.

Hi Nial

As always what a wonderful article. The same thing happened to me as what Chris pointed out in his mail. My “Guru” also told me trade 5min chart and I have experienced the consequences. The really bad thing about is that you are so addicted to it and struggling to come out of it. I think this will be a good lesson for traders like me.

Thank you for your excellent teaching.

Nial: Many thanks again for a g r e a t article. It should

be read by all fx traders, new or old, and followed.

Thanks!!!!!!!

Nial,

A great article and a must read for all traders who think the money is in the lower time frames. Invariably most traders start out with the wrong mindset and it is those who are persistant with their education realise after time that 5-15 minute charts are the playground of gamblers and 4hour-daily charts are for traders. I started with the 5 minute chart several years ago and blew my account several times before I realised that patience, discipline and the ‘less is more’ approach in terms of frequency of trading is where the success lies. I trade twice a month on average. Happy Trading!!!!!

Thanks sir nial..this’s one of my best articles ave read…patience,discipline.on the daily chart is the key…

Thank you so much Nial,

brilliant article, as always!!!

It would seem logical if a person is going trade a daily chart, it would be helpful to look at a longer term chart say for example the weekly chart to know where one is at in the bigger picture, a 4 hour chart if one is going to trade a 1 hour chart to determine whether we are at resistance/supply or support/demand. For example, if we are looking at a daily chart to trade and we see that the weekly chart is near a support level in the long term chart, we might have to find that level on daily chart to see if their is enough room to trade it for profits.

A great stuff. Thanks Nial

Another great lesson,thanks Nial, you are an excellent Mentor.

Simply Outstanding!!!

Greetings from the CZECH REPUBLIC.

As usually a brilliant article. Anti scalping definition nicely sharpened there. I also appriciate the english writting stile of yours, the nice hidden humor you drop “between the lines” is always matching the case and hitting the point in the end, showing no mercy towards the run down scalpers. Thanks a lot for it and I am already looking forward for another catchy article like this. Price action setups forever.

Sound Advice Nial’s, I wish that I would have taken your lessons two years ago when I first started. I agree that the daily time frames will keep me out of losing more trades than I should. I understand and will make good use of this lesson. Thanx Nial’s

“To shift the way you think about trading, you need to start getting excited about patience and about NOT trading…understand that the way you are thinking now is the way most traders think about the market…and most traders lose money…so if you can learn to do what most traders don’t do and think opposite from them…it goes to reason that you will greatly improve your chances of making money…”

If everyone gets this one statement from Nial, you understand what he is trying to teach…EXCELLENT NIAL!!!

HI NIAL Thank you so much. Your recommended”DAILY”timeframe

is a sure ANTI-DOTE to unwanted losses.You are so honest in

sharing your valuable knowledge.It speaks of your Nobility.

Thank you once again.

kindest REGARDS. AMIN

Excellent article. Higher time frames foster discipline, patience and have a more healthy effect on us mentally. I also

come from a poker playing background and to be successful you really do have to understand that its about the long term results. Anyone that goes for a quick fix, fast profits, instant gratification ultimately ends in pain. Forex along with poker offers all the pitfalls, highs and lows that any adrenaline junkie could ask for. You can make it hard or easy for yourself and trading the higher time frames is the easy route. Be kind to yourself and slow down and enjoy your wonderful life!

Such good advice. I figured this out on my own after a year and a half of trading. Daily charts are the way to go but I still trade on the 4 hour charts too. Anyone can be successful trading price action strategy on the higher time frames. It is quite simple, trading forex is not as complex as most “gurus” want you to believe.

I want to be a better trader and am looking forward to trying longer time frames. Thanks for the great advice!!

true stuff.I wish i read this year ago and listened to it rather thinking my plan would work.yeah i made thousands in one day greed and lack of knowledge soon lost a lot more than i gained wasting money hitting highs and lows.

Nial it’s an honor to have you as my Mentor. All the time i review your articles better trader i become. The best thing about your articles and your course it’s that, with all this good information you give me, it alouds me to do my own plan, with my own ideas, on my own time.

Thanks a lot Nial

another gem…:-) thank you!

Hi Nail

Every day I am learning something. May God bless you and your family. the harvest is as ones sow. your harvest will be wealth, health and life long respect.

I am in the way to be successful trader.

regard

A F

Nial… It’s a incredible lesson. I opened my account last month. Nearly 60% of my money lost because of what you say above. After that I focus higher time frame. And earn some moolah. It’s true what you said, but I am late….. (Sigh.. If you publish this one month before… I can make some sense.)

Very Good.

Thanks, Nial…

Coming from a die-hard day trader who trades from the 5 minute and 15 minute charts, I am convinced that you are indeed correct. I have been struggling to stay ahead as a day-trader for the past 8 months. I have 2 accounts – one was opened last September and the other this past December. The September account has an account balance of 3,100 (opened at 2,500), but the Equity in the account is only 1,100. That’s because I had to hedge alot of my trades to avoid losses I feel I did not deserve to lose. The same thing is happening to the December account which has a balance of 2,850 (opened at 2,500) and the equity is at 1,850 because of hedge positions. I work so hard at this on a daily basis, getting up at 2:00 or 3:00 in the morning and trading until noon and sometimes later. I feel like I am knocking myself out burning myself out trying to become successful at this business. The reason I put hedge trades on is because I am getting tired of blowing out accounts and accepting losses I don’t deserve to lose. Maybe it is time for a change to the Daily charts. Hopefully it will solve the problems I have been having, and get me back on the road to success. I love this stuff, and I have put alot of hard-earned money and time into it. I don’t want to give up on it, especially when it fits in to my personality so well.

Awesome article, another Great insight and definitely soooooo much truth in what you say, I thank you Nial for really opening my eyes in this forex business.

The course is fantastic, it will help me to fix my shortcomings in forex trading.

thanks over the pieces of information revealed

Lots of wisdom here. I have been trading for 6 years — sure wish I had started trading Daily charts

Nial is absolutely right. The daily and 4H time frame completely changed the game for me. This article is a winner

Cheers mate!

Fantastic, you will help many of the would be fx traders. Thanks and keep up the good deed…..

This is the first thing that I learned from Nial a long time ago, and it has paid and paid and paid ever since.

Great article Nial, I have been consistently profitable for 6 months now thanks to your methods!

I Wouldn’t say I’m part of a 95% but I love reading articles like these to just bring myself back to reality and also home in on some psychology skills Nial has to offer. I think today’s article has re-inforced trading like a sniper! Instead of looking and trying to force opportunity in the market. Patience and Discipline is the KEY!! Thanks

Trading in daily charts with quality setups only, is the fastest way to earn from the forex market.So true this statement is.Thanks for your all insight Nial.

Yep…………….someone said above “lower time frames suck”

Yep…………….suck the $ right out of your account.

Some else above mentioned a Mantra. How about “Less is More”

I really liked this article especially in the last paragraph, i.e., “you have to look at and study the markets a lot while actually “doing” relatively little (meaning not trading). Indeed, trading is the ultimate test of self-discipline and will power,”

Hi Nial,

This is a great insight to trading, great lesson.

Thanks Nial. Great article as always. Really. I’m a member since a long while and still appreciate all your articles. Especially this one. You made my day. =) Thanks

Another point against trading lower time frames that is not mentioned is that in any forex trade you have to cross the spread (usually around one or two pips depending on the pair) so the market maker/broker get their cut.

If you are trading a longer time frame you might have 100 pip stop with a 300 pip profit target so crossing the spread doesn’t cost that much on a trade by trade basis. But if you have small stop of five pips with a 15 pip profit target that a spread of 1.5 pips represents 10% of your profits.

Hey Nial,

thank you very much for this article. Very enjoy that and agree in 100% – daily chart is the holy grail.

All the best and have a fantastic weekend. :-)))))))))))))

Josef from the CZECH REPUBLIC

Hello Nial

I started dancing with the lower time frames on a demo account and walked away with aching feet and my head spinning wondering what moves did I make. I now dance exclusively with the daily and on some occasions the 4hour charts and the steps which are given through your instructions allow me to sail acrose the floor.

I sincerely appreciate your lesson

so very much.

Your Student

Hello Nial

I started dancing with the lower time frames on a demo account and walked away with acheing feet and my head spinning wondering what moves did I make. I now dance exclussively with the daily and on some occassion the 4hour charts and the steps which are given through your instructions allow me to sail acrose the floor.

I sincerely appreciate your lesson

so very much.

Your Student

Controlling your emotions in an “arena of constant temptation”… great description of the markets.

Another top article Nial, cheers.

Tony

Nial your articules always inspire me to be the successful trader I’ve always dreamed of becoming.

I’m coming onboard with you shorting

Gary (from Canada eh.)

Thank’s Nial…

It’s time to change my trading style…:)

As a trader, I never traded any time frames lower than the 4hr chart. As a matter of fact, I discontinued using the 4hr chart and only focus on the daily about 2 months! Big improvement!

In addition to trading the daily, try not focus on too many pairs!

Each pair has it owns ebbs and flow and we need to know the market by listening and reading it! If we have to do this many pairs, we’ll lose focus!

Thank you Nial for this article! A superb one!

This is a nice article and i think if some of the so called fx guru read this they will be submissive to enough to learn more

i really appreciate ypur articles, i have blown my account lyk 5 times but this year i decided to only focus on the daily chats and thanks to your advise my account keep on growing and growing nyc1

Good day Sir Since finding you I have figured out what you say is true. Trading is alot les stressful now, and guess what i make more money. I send every trader i meet to you. However only the ones with some brains embrace your style. The rest flounder even years later. Thank you for everthing

Nial, have just finished the first paragraph and I had to post and say… Right on! While you can, and some do be profitable from only looking at smaller time frames, it is extremely tough. I know my fair amount of successful small time frame traders and I can say that every one of them knows exactly where the daily’s are before they pull the trigger on a five minute!!!

Very nice post; now I’ll read it. (o:

Great article, especially the insights about the instant gratifications on 5min charts and its pitfalls, cheers, g

ps. it’s better to go to a casino once in a while for a thrill..

hey nial

I am so that person, or was, have been trying your methods out on demo acc. for a couple of months now, and slowly its getting there. Still have a bit of trouble reading the charts though, but am starting to get the whole “daily and 4hr time frame method”

Good lesson

Cheers

Daza

That last paragraph is pure gold.

Great article. Thanks Nial.

Thanks Nial,

Now,after reading this article and having a quick look at the charts and price actions of some previous weeks I

undestand that “daily trading”in FX market is the best appeoach for money making.

It is so true. I started to trade forex 1 & half year ago. But the newbie of myself tends to trade a lot in 1 hour chart and eventually led to loses. At this time, I came across Nial’s course and try to practice his teaching in demo account for more than half year with profit. And now I bring it to live account and the result is the same – profitable. Now I trade very less, sometime I didn’t trade at all for 2 weeks. But I trade when there is obvious price action. With the price action, displine and patience, that’s bring me profit. I really love Nial’s teaching and other trades should follow this if you not yet a profitable trader. Please continue your good job, Nial.

Hi Nial,

An excellent article. I had a number of highly profitable trades by following your advice and trading off the daily (and sometimes 4H) charts and looking for pin bars.

Cheers,

Zsolt

Hello Nial,

Priceless as usual.

Self discipline control over your emotions and trading with a clear strategy will always bring better results long term.

Less trades, less emotion equals better results.

Regards

Graham Pearce WA

Nial,

Another great article and lesson to all traders out there and myself, it took me about 2 years to figure out what you have put in this article and apply it in my trading.

Trading small time frames DOESN’T MAKE ANY SENSE AT ALL!

It will just destroy you and your trading account…

I trade off the daily charts only and I am happy if I enter 1 trade a month!

All the best and good trading,

Hi Nial

I think a daily mantra is appropriate here:

” I am a great trader, who only trades Daily charts”

Thanks for reminding me that lower time-frames suck!!!

Dear ‘Prof Forex’. You have hit the nail on the head once again. Thank you for this nugget. For the past one month and over I have maintained my trading account with a profit for the first time in two years. This is because I have followed you and your teachings up religiously. I feel a sense of pride now because I have not blown my account within a week. Instead I am trading with over 100% profit within a month. Dear ‘Prof’, the credit goes to you. Thank YOU.

I have enjoyed reading your article about trading daily time frames as against very short time frames. Why can’t most other trading coaches be so honest and generous with their knowledge. Nial, it was well written and should turn around many FX traders from losses into potential profit without the stress attached.

Richard

Your lessons are wonderful, I am trying to follow your advice on discipline and Have found that this is a major to success in fx trading

nice reading Nial and so true

Another good class today and i believe some is gaining. Kudos!

I respect all the Nials rules and I am amazed when I look in my trading journal.

The first year of trading and I am constantly positive. My best investment is price action trading course !

THANKS Nial!

Best regards!

Thanks for the info Nial, at the end of October 2011 i decided

that i would only day trade, if i had stuck with that thought

i would of increased my account by the end of December by

17K instead i lost 2K trying to trade the 5m set up.

all your article are very educative and always hitting the nail on the head with what l have read now my loosing time in forex is over thank nial

You have put it in a nutshell…..cleraly and effectively.

1. I really enjoyed reading it.

2. I enjoyed reflecting on my own trading pattern.

3. And realized why I have less stress lately tahn when I

used to trade lower time frames.

Day and 4 hrs are what I do now.

Thanks Nial

Good job

Many thanks

You are fantastic

jamal jber

So true that you can risk a lot more when you only take the most obvious signals on a daily timeframe. In fact, you will get rich quicker by trading the dailys mainly and spending the rest of your time on something you really like. In the end, trading is pretty boring. Find your edge, take the trade. You win, you’re happy. you lose, you’re happy.

I took that trade in gold by the way. That one was screaming at us: “please trade me :-) “

Good stuff from a savvy price action Authority.Daily chart always act as a filter for the polluted and biased noise of lower timeframes.I discovered that with daily charts, you only have one or two quality setup in a week.This eventually helps you to embrace quality over quantity.Forex trading, the greatest test of self discipline.

This is one of the best articles on trading that I have ever read.

Patience and mental fortitude is so important. Many thanks for sharing your strategies with us.

Hi Nial,

This is so so true, when i started fx trading, my “guru” told me to emulate his success using 5 min charts, that was the biggest mistake i had ever made…..over time even his account went into margin call…many traders under him gave up as a result and called Forex a scam…

Longer time frames enable one to have more time and still make the money they want if they know what they are doing …thanks Nial, integrity and honesty don’t come by that easily now a days..

Its really gift to Read Your Articles Nial.

Thanks.

Bravo!!!….thats all i can say….Bravo!!!

Good stuff Nial! As always thanks so very much for your incredible lessons!