What Are The Best Chart Time Frames To Trade ?

As price action traders, we primarily study charts and price bars, and the price bars in each time frame show us the ‘emotion’ of price for that specific period of time. Whether it’s a 1 hour, 4 hour or daily chart, each price bar on the chart shows the ‘emotion’ and sentiment for the period of time it reflects. For example, on a 1 hour chart we will be able to see the emotion and feeling of the market over the last hour by looking at the last price bar on that chart. That said, a 1 hour chart or a 4 hour chart is going to show us a lot more data, emotion and insight into the market than a 5 minute chart will, would you agree? Would you also agree that the daily chart will show us even more emotion than a 1 hour chart or 4 hour chart?

As price action traders, we primarily study charts and price bars, and the price bars in each time frame show us the ‘emotion’ of price for that specific period of time. Whether it’s a 1 hour, 4 hour or daily chart, each price bar on the chart shows the ‘emotion’ and sentiment for the period of time it reflects. For example, on a 1 hour chart we will be able to see the emotion and feeling of the market over the last hour by looking at the last price bar on that chart. That said, a 1 hour chart or a 4 hour chart is going to show us a lot more data, emotion and insight into the market than a 5 minute chart will, would you agree? Would you also agree that the daily chart will show us even more emotion than a 1 hour chart or 4 hour chart?

Today, I’m not just going to tell you what time frame to trade, but I’m going to explain to you why time frames influence the signal you’re trading, stop placement on a trade and the chances of winning and losing a trade. The implications of these points are profound, yet they are often over-looked or ignored by day-traders and scalpers. I am going to show you some evidence of why you need to take this stuff seriously and turn off your low time frame charts once and for all.

The connection between time and trustworthiness of a relationship

Think of the market like a personal relationship between two people; the longer you’ve known someone, the more you know whether or not you can trust them, right? If someone shows you they are a trustworthy person over time then you will probably trust them, however, if a person lies a lot you may actually trust them less as you get to know them…but the point is that until you’ve spent time getting to know a person, you really can’t make any judgments about them, one way or the other.

To give you a more specific example; when you meet someone for the first time, can you really get a good feel for their personality and character in just 5 minutes of talking to them? Or would it take a full day of conversation to get a more accurate feel for their personality and overall mood? The longer you’ve known someone, the better “feel” you have for who they really are.

It’s really very similar in trading; the more you study higher time frame charts like the 4 hour and daily, the better ‘feel’ you develop for the market because you are getting to know more about it and you can see the “bigger picture” a lot easier than you can on smaller time frames. The higher time frames carry more weight because they display more data and show more time than a smaller time frame does. If you are just studying 5 minute or 15 minute charts all the time, you are missing out on the bigger, more significant picture of the market. You’ve probably witnessed this with a long-time friend; you can almost figure out how they will react in any situation…whereas with a complete stranger whom you’ve known for only 5 or 10 minutes, this would almost be impossible; it’s obviously because you’ve had more time to study and learn about your friend.

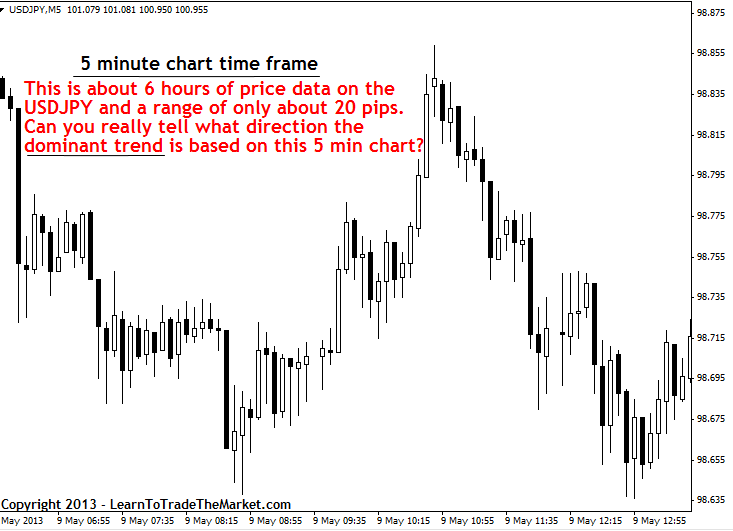

Let’s look at a chart example of how a 5 minute chart really does not tell you much about the “bigger picture” of a market. Below, we see the 5 minute USDJPY chart, and from this data we really cannot tell if the overall trend is up or down, as the market appears to just be ebbing and flowing very quickly and without much underlying or consistent sentiment:

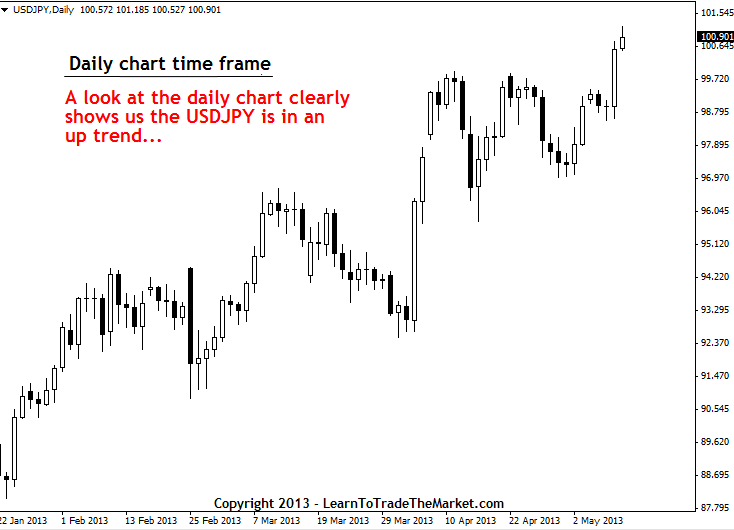

Next, let’s compare that 5 minute chart above to a daily chart time frame of the same market; USDJPY. From the chart below, even a 6 year old can tell that overall price is moving up; there’s an uptrend underway. Due to the simple fact that you are getting to know more about the market from looking at more data, you are learning some very very important things about it (that the trend is up!) that you cannot tell from just looking at the 5 minute chart.

Another example; if you are traveling and you stay in a town you’ve never been in before for one week, and it rained the whole week, would you tell everyone it “rains a lot in that town”? Or would you agree that you really need to stay in that town for longer and observe its longer-term weather patterns to make such a judgment? Most of us would agree that you need more than one week’s data to judge a town’s overall weather pattern…in other words, a week inside of a year is basically just noise. You can’t make an assumption about a town’s weather pattern unless you look over a longer period of time. Similarly, it’s nearly impossible to read a market’s underlying sentiment without analyzing higher time frame charts. Longer time periods = more data = more evidence / proof.

Why lower time frames are “noise”

Simply comparing a 5 minute chart to a 1 hour chart will show you how many more failed signals there are on lower time frames. The underlying reason as to why lower time frames (I consider anything under a 1 hour chart to be a “low time frame”) have more failed signals than their higher time frame counter parts, is because there will be a lot more meaningless price movement on a 5 minute chart than on a 1 hour. For example, if you were to just look at one price bar on a 1 hour chart, you would not see all the 5 minute incremental movements that made up that 1 hour period….you would instead see the collective picture of all those 5 minute movements.

You simply are not going to get a very strong directional movement out of a 5 minute or 15 minute chart signal, instead, you will get a lot of little meaningless movements. You’ll get a much stronger directional movement out of a 1 hour signal and even more out of a 4 hour signal and yet more out of a daily chart signal. You can expect more movement from a signal the higher up in time frame you go.

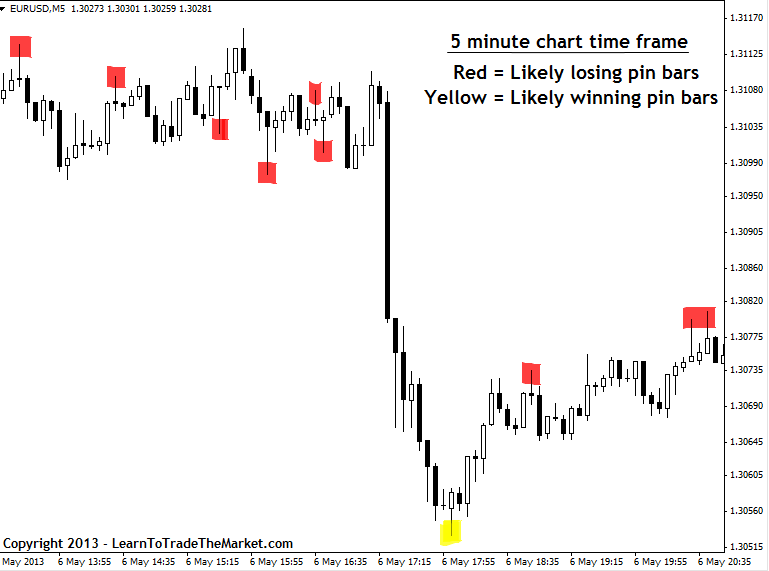

In the chart below, we are looking at some recent price action on the 5 minute EURUSD chart. You can see that there were a lot more pin bar signals that probably would have been losing trades than there were winning trades. This demonstrates clearly the fact that whilst there are more signals on lower time frames…more signals does not equal more money, in fact it usually means more losing trades and lost money.

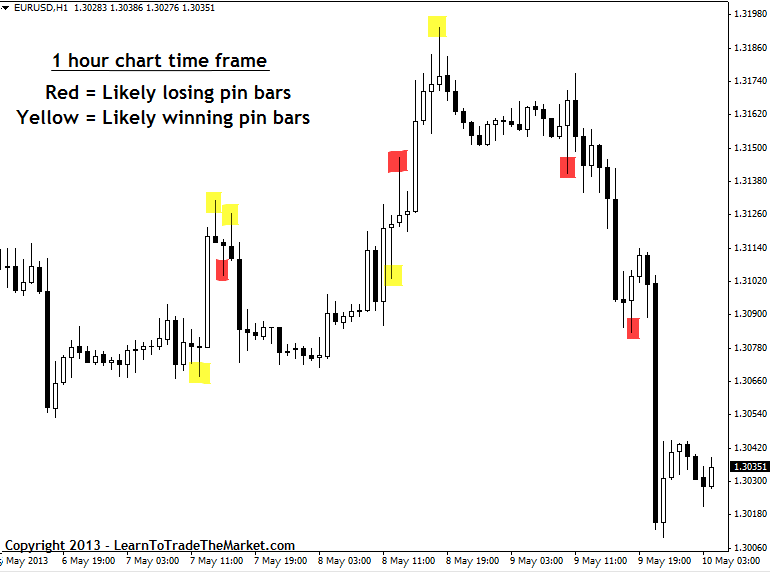

Next, let’s look at the price action that occurred on the 1 hour EURUSD chart around the same time as the 5 minute image above. The first thing you should immediately notice is that there were a lot less losing trades and a lot more winning trades. It’s because there were less false-signals on the 1 hour chart since the 1 hour chart filters out a lot of that “noise” on the 5 minute chart.

Market noise and daily ranges

Markets move in statistical average ranges each day; meaning there’s a certain average range that the market is probably going to move within on any given day. These average ranges will change over time as markets become more or less volatile, but you need to be aware how they affect your trades. The thing about these average ranges that many day traders and scalpers are seemingly unaware of, is that if you’re trading a small time frame and you place a stop loss on that small time frame, the chances that you will get stopped out simply because your stop is within the average statistical range of the higher time frame, are quite high.

If you’re trading a higher time frame, your stop loss is likely to be outside of the average daily range of the market so you are unlikely to get stopped out from the random intra-day market noise that occurs each day. Now, that’s not to say I want you guys to place wider stops, I’m telling you to be aware that stop loss placement is a big factor in your success or failure as a trader and you need to be aware how time frames affect stop loss placement. It’s pretty obvious that if your stop loss is close to the current market price, as it is on lower-time frame trades, it’s more likely to get hit than if you’re trading the higher time frames.

Small time frames demand a lot of attention.

Would you like to check the market every 5 minutes or every 4 hours? The higher the time frame, the less you have to check the markets. If you are like most people, you probably have a full-time job or full-time school, or maybe even both; most people simply don’t have the time to sit at their computers all day trying to trade a 5 minute chart. It’s also a lot more stressful, so it really just makes no sense to try and ‘force’ money out of the market by scalping or day-trading.

Would you like to check the market every 5 minutes or every 4 hours? The higher the time frame, the less you have to check the markets. If you are like most people, you probably have a full-time job or full-time school, or maybe even both; most people simply don’t have the time to sit at their computers all day trying to trade a 5 minute chart. It’s also a lot more stressful, so it really just makes no sense to try and ‘force’ money out of the market by scalping or day-trading.

I am a huge proponent of ‘letting the trades come to me’. Meaning, I check the markets two or three times a day and look for obvious signals, primarily on the daily and 4 hour charts, and if nothing meets my criteria for a trade setup, I don’t trade…I go do something else instead. I don’t sit there ruminating over the market all day wishing and hoping for a trade like many beginning and struggling traders do. I really do not care if I am in the market or not on any given day, and this is the attitude and trading mindset that you need if you want to trade completely devoid of emotional attachment to the market. My point is simply this; focusing on higher time frames is much better for busy professionals as well as for people who don’t want to have the stress of being glued to their charts all day. It also allows you to employ my crocodile trading method which is a cornerstone of my overall trading theory and strategy.

Small time frames elicit over-trading

“Over-trading”, also known as trading when no obvious signal is present, or taking “stupid” trades, or “gambling”, is something I have discussed quite a bit in other articles, so I won’t get into it too much today. However, I will say that trading low time frames like the 5 minute and 15 minute charts, etc. is one of the biggest reasons why traders trade too frequently. The longer you park your ‘bottom’ in your computer chair watching the 5 minute chart tick up and down, the greater the chance you will rationalize a reason to be in the market.

If you sit there staring at a 5 minute chart all day, the odds of you actually not entering a trade are extremely low. As humans, we struggle with self-control and self-discipline, especially when we put ourselves directly in the realm of temptation, like when trading low time frames. However, one area that we are lucky in as humans, is that we can plan ahead and avoid temptation altogether if we put our minds to it. Just as not buying junk food at the supermarket is the easiest way to avoid eating it…not immersing yourself in low time frame charts is the best way to avoid the temptation to constantly be in the market.

Learn, change, grow…

I obviously cannot speak for everyone in the trading world, but the traders who contact me on a regular basis about struggling in the market and blowing out their accounts, are typically the ones who trade the lower time frames…that has to say something right? From these experiences that I’ve had with other traders over the years, it’s pretty safe to say that ‘social evidence’ suggests that a main cause of failure in the market is trading low time frame charts. However, don’t take my word for it, last year we had over 15,000 emails hit our inbox, and I can comfortably say that the majority of the struggling traders I’ve helped were trying to trade small time frames.

I obviously cannot speak for everyone in the trading world, but the traders who contact me on a regular basis about struggling in the market and blowing out their accounts, are typically the ones who trade the lower time frames…that has to say something right? From these experiences that I’ve had with other traders over the years, it’s pretty safe to say that ‘social evidence’ suggests that a main cause of failure in the market is trading low time frame charts. However, don’t take my word for it, last year we had over 15,000 emails hit our inbox, and I can comfortably say that the majority of the struggling traders I’ve helped were trying to trade small time frames.

Thus, YOU should do something different…don’t be like the masses of failing traders who are constantly searching for trades on the low time frame charts. Have patience, trade only the higher time frames (1hr, 4hr, daily time frames are my favorites) and see if your trading doesn’t just slowly but steadily improve.

If you want to learn more about higher time frame trading and how it can improve your trading results by filtering out meaningless market ‘noise’ and allowing you to see the ‘bigger picture’ of the market, checkout my Price action trading course.

Thanks Nial for such an informative lesson.

My eyes are getting open after blowing up 3 accounts od $100 each. I shall be in your course this year. Thank you for the good works you are doing.

More great advice on precision trading

Very informative indeed! Glad to be part of the family.

Now I will have more time to focus on other activities!

Very great Sir and thankyou.

Wish I had read this before,invaluable information.

The best explaination for time frame trading ever! I have tried low time frame and i totally agree.

You explain it the best!

Thank you so much for your insight!!! I have been searching far and wide for a some answers on a few questions i had and I literally found it here. Others did not break it down as simple as you did. I guess it is true when they say keep trading simple. Thank you!

,thank you for your insight. I tade the daily charts and that is much more rewarding . I use parabolic sar as stoploss. is there a better way? for SL ? Thank you for your reply!

The same chart pattern in different time frames can be comparable.

I must say that your posts always hit the nail in the head Nial. It is through your blog that I came to realize that short term time frames were not for me. I find them to be quite stressful and I agree fully with your analogy of a relationship when comparing the market on short vs longer time frames.

Am so happy to read this article, it have change my trading Arsenal. I have been looking every were for this kind of material. thanks to you master of FOREX.you are the best i have ever seen.

Small time frames waste of time, never liked them but i do at times find myself looking at them. Moving averages yeah i find them useless on lower time frames as well but on 4hr and daily chart for long term trades they so far have worked. Price action has taught me to look for support and resistance before entering a trade and while am busy with your strategy i am also very interested in news trading.

Best article I have read yet on time frames and reading it is going to save me a lot of headaches and lost money. Many thanks for a “point blank” article that hits the message home ! After reading many articles about time frames and watching many videos about that subject your article was the one that just made sense and took away all the frustration and confusion over the issue of time frames and I can put it to rest !

Wow I’m glad I researched about time frames when I still had time, God Bless Brother….

“…….like many beginning and struggling traders” .That describes what I’ve been.Not anymore now that am receiving this information.You are a man sent from God to me.Blessings sir!!

Duncan from Uganda.

I am in the market for over 20 years. Being in full time job, I was not able to trade in low time frames, but tempted to try the same. I did try for some months and found the same to be frustrating and often wrong decisions out of greed or being smart.

Meanwhile came across your articles and found them of eminent value, simple to pursue and being out of noise of the market. Results are really gratifying with lot of mental peace. I have preserved all articles and keeps on reading the same. It keeps me on track.

Truly a great service and valuable guidance to investors/traders at large.

Wish you all the very best.

D K SINGHAL

hello .thanks a lot for the info its very informative and less stresfull and more profitable i must say .i have been wanting to understand these time frames.so how do i put my sell or buy

Thanks Nial, I am a struggling trader, I think this artical will be very useful for me. thanks a lot

Very helpful article that you’ve shared..

I have tired so search many strategy or blog to improve my trading skill..

Maybe i will not search for trading strategy anymore that make me more confuse…

Thanks for your knowledge, article with a lot of experience and truth!

Keep doing you outstanding work and sharing…

Thank u verymuch NIAL…

Best regards from Padang/Indonesia

This is an absolute brilliant article! The reason why I say this is that I experienced just over the last 2 days the difference in trading 5 minute vs 4 Hour charts. I am going to force myself NEVER again to look at anything lower than the H1 timeframe, even the H1 seems a bit risky to me.

Thanks Nial!

Regards

Arend

Pin Bar in Day and 4 Hour chart would give more wins than any lower time frame.

Great advice. many thanks.

thank you my dear friend for your excellent articles

although you are a young man but your trading experience

is just like a big old trader like larry williams and warren buffet.

as warren buffet confirmed what you say he said: “short term markets

are like prison”

thanks again

reinforce my timeframe of choices

Thanks man for the info (info is power)thumbs up

I’ve been with all lower time frames available on MT4, there was some wins, but the losers were bigger. Until I decided to switch to daily charts after I read one of Nial’s article about the daily chart being as close to a holy grail. And i’ve been making money since. I would suggest you guys try to organized all of Nial’s free articles, especially those that talk about price action. If you would observed the daily chart, you’ll be amazed how these price action patterns like pinbars, inside bars, fakey, just keeps on repeating themselves. pair that with a solid money management plan, and you’re all set.

Hi Mate, Im testing the weekly set-ups, I check my trades every day or every second day. my stop is tight according to price action levels. Looking @ the weekly really gives you precise market behavior.

Im in no rush to make money, the market will be there the next day.

Great info Nial !!

HELLO NIAL, YOUR POSTS HAVE ALWAYS BEEN UPGRADES TO ANY SERIOUS MINDED TRADER. IN FACT, I’M BEGINING TO SEE WHY I WAS INCONSISTENT IN MY TRADING SUCCESS. BUT BY GOD’S GRACE, YOUR COACHING AND TIPS HAVE REALLY CHANGED MY MINDSET FOR GOOD. THANKS A LOT AND PLEASE LET’S CONTINUE TO GROW TOGETHER. MAY GOD HELP US ALL!

Nial,

very good, for informations.

‘m really learning a lot from you.

is tempting to go for shorter times but we have to resist!

congratulations from Brazil!

Also all traders trading 5m charts know or even look at 1h and 1d frame simultaneously, using them as an important filter. That USD/JPY move last Thursday gave me 2 signals only on 1h chart – one at 99.40 second at 100. While 5m chart gave me at least 10 opportunities to go with the flow and to pyramide. I agree though that this time frame requires self control and self discipline 10 times greater than when trading 1d charts, so if you speak to newbies it’s right to start with HTF. (Moderator Note – Comment length edited)

Agreed, thumb up !!

thank u nial!

Great article Nial thanks.

To other commenters though, what does god have to do with trading?

Hi Nial,

Thanks for your sharing…

I very agreed about time frame to trade..

But I still cannot set good stop loss for 4h and daily..

May you give good suggestion for me??? thanks lot..God bless

Cheers nial thanks to your trading strategies im really improving.

As usual, another great article. There is always a lot of wisdom in your post. Some practical tips that will help a trader. Have always gained something from coming here. God bless.

nice indeed i love that…very educative

Great stuff here Nial, thank you very much. I like to have my trading platform split into four charts, for each pair. The lower two charts display the weekly & monthly time-frame, with their respective closest swing high and swing lows clearly marked, as potential future Support / Resistance levels, where I will focus my attention to the price action that occurs on my top two charts (4 hour and daily time-frame) when price moves to one of my SR levels on the highest time-frames.I review all of my pairs on a weekly basis and ‘glance’ at them just once a day. Its obvious from a ‘glance’ whether price has reached a level of potential interest (on the weekly & monthly time-frame charts) and if so, it doesn’t take many seconds to check the two lower time-frames for a trade ‘signal’ to have been printed. Thanks for your encouragement that aligns with my personal style of wanting to trade, however I also believe that some traders make excellent livings on the lower (1 minute and less!) time-frames too, its just not for me. (Moderator Note – Comment length edited)

Another great article with a lot of experience and truth!

Thank you Nial for sharing your knowledge.

Keep doing you outstanding work.

Best regards from Hamburg/Germany

Something splendid article as usual.May God bless you and your whole family.

ON THE 5 MINUTE CHART OF THE EUR/USD the red squares that you have marked are indeed and would be indeed losing buys. The reason is 2 fold. 1. there is little profit. 2. a person would be buying right into long term resistance or supply side. a person would need to sell short at the far right candle. that selling short there would be a heck of a profit…that large long black ugly candles represent institutional selling off..all the way down to support or the demand side. I agree its extreme important to know what the bigger picture is no matter what time frame a person is looking at. If your trading the daily, it is a good idea to take a look at the weekly to know where you are in the big picture before you pull the trigger and if there is a enough room on the daily for example with respect to the weekly, to make a profit or not.

Higher time frames do take out the noise and give you a good directional bias. Candlesticks give the trader an idea what the market is doing….but sometimes you have to wait for confirmation of this which could take 4 – 24 hours. To get around this going to the lower time frames have the advantage once you have an idea of the direction of the trend the period to trade that with better entries and better risk to reward ratio.

On a 4 hour plus chart 60 – 100 pips is the norm where on a 15 – 60 min chart 20 – 30 pips is about right……so with money management on a 1 : 1 on the lower time frame the volume can be twice that of the bigger trade and the same made at the end of the day with the same amount of trades but in a shorter time period……one last thought, what I am getting to grips with is trading at the right time of day as well which will reduce your time in front of your PC and hopefully produce winning trades more consistently …my thoughts on a very good article Cheers Euan

Thanks Nials, higher time frames are the only way to go , relax, chill-out , enjoy. great article by the way.

cheers W

Nial gave a very good analogy of why higher time frame is more trustworthy.

Thanks Nial!

Thanks Nial, I will focus on Daily timeframes only because easy to see a trending market & sketch the key level.

Enlightening.

Thanks Prof.

Thank you for keeping me on track

Wow Nial, i can’t thank you enough, your articles are so helpful and easy to understand. I like your writing style it has less “noise” and goes straight to the point. Since i subscribed and read your articles i managed to improve my trades immediately.

much appreciated man, keep it up!

i am grateful many thanks ,for all you are sending to me for free be bless

great advice,thanks!!!!!!!!!!!!!!

Wonderful and excellent examples to explain the significance of longer time frames in forex trading.

But I wonder about day trading as their living for longer daily time frames. He would hardly get a trade in whole day [8-10 hrs] by observing / waiting for pin-bar in daily charts.

Oh how I agree with this Nial I hope every aspiring trader takes note and takes thes points onboard, if I had this article years ago it would have saved me tons of money……..

Thank you for a really good convincing analogy for sticking to the bigtimes! Your explaination of the failed pinbars shows why is very instructive.

Please keep up the good work!

Thanks

Paddy

With a method such as price action, what you write makes sense. On the other hand though, smaller time frame charts offer greater price development, rarely seen on daily charts or higher (maybe once in 3 months). If you can read what price is telling you (which always needs to be done with context of a higher time frame IMO), then you can only trade those pairs that more probably will give you a big move, and you can also time the market tightly to give you a nice risk-reward. While your stop is within the daily range, if you read the chart correctly and time the breakout properly, your stop will most likely not get hit. Trading in this manner prevents over trading because there will only be 1-2 pairs that meet your criteria per day (or 0 sometimes), nor does it necessarily demand a lot of attention, depending on your trading plan. You could for example have a trading plan that calls to let the trade go for the day, and not actively manage it within the day. Often a strong breakout takes place quickly and you can move your stop to breakeven and the day is done (for example that happened to me yesterday on a long on GBPJPY).

Learn how the “smart money” trades–the market makes large moves when the big players take positions. They have to buy/sell in increments–they don’t buy/sell thousands of lots at a single time. They also want to minimize public participation in the big move. Understanding this and how it plays out on the chart, allows you to discern with some accuracy on what position they are taking, and when the breakout could commence.

I have not read the above write up yet but before i do, i want to tell everyone here that daily time frame is the stress-free holy grail. I just moved up by 10%+ on my account balance from the GU inside bar that formed on monday and thursday’s bullish engulfing bar on USDCAD (all from daily TF). Eh! lower time frames suck and drain our money, men.

Let me now go and refresh my learning fron the above article, i am quiet sure it will be hot.

Lest i forget,…….. thanks Nial.

Great articles as usual

For beginners, focus only one daily chart !

Some people use the right indicators, some people use multiple time frames, and they become very good at it. What people call noise is when people don’t overlay indicators on the charts and don’t care about mastering the complexity of why price move here and there.

HIGHER TIME FRAMES, they are like the immunization to us and they help (protect) us from over-trading and keeps us calm and stressfree, I agree to ur explanation Nial

Always thank u

Thank you Nial, very good article. It cleared some questions about time frames.

Hi mate, thanks for this. Because i learnt off you first i only look at daily and 4 hr charts i Would love to know more about what you get out of 1 hour charts, Gye :)

I almost totally agree with this article but any successful daytrader knows that taking decisions based on 1 candlestick on 5 min chart is a noob error. Also, when you daytrade you also need to pay attention on higher timeframes as well, for instance, if a bullish 4 hourly candlestick is forming during market hours and moving averages on 5 min chart and pointing up, then it is time to go long and stand market noise. Day trading is difficult because of the market noise. Also, daytrade requires being glued to the computer during hours so if you left your day job for better life, day trading is not definetely for that.

Thank you very much Sir for your inputs in our trading.I for one need to change from my 30min time frame to an hour.I have observed that in 30min time frame I can hardly spot the market trend.

thx nial!great article.

As a Forex beginner,this article comes particularly for me as if I personally requested for it. I have been struggling to understand the best time frames and I find this very enlightening.

Best of regards.

Thanks once again Nail! Great explanation and analogy! :)

Cheers!

Nial, your articles are always encouraging and enlightening. I am working on my discipline and patience to follow the price action in the longer time frames. I will be reporting back on my progress. Thanks for the guidance

This is one of the best articles on Time Frames. Thanks Nial.

Thanks Nial, I will focus on 4H and Daily charts!

Great article…thank you Nial!!!

This is more helpfull than me try to understand about time frame. That is great Nial..