How To Become A ‘Master’ Of Your Trading Strategy

In this week’s lesson, I am going to share with you a proven technique for becoming a “Master” of your Forex trading strategy. If you’re a regular reader of my blog then you know that I refer to “mastering” your trading strategy in many of my articles, and today’s lesson is going to get into the meat of exactly HOW to master your trading strategy and WHY it’s so important.

In this week’s lesson, I am going to share with you a proven technique for becoming a “Master” of your Forex trading strategy. If you’re a regular reader of my blog then you know that I refer to “mastering” your trading strategy in many of my articles, and today’s lesson is going to get into the meat of exactly HOW to master your trading strategy and WHY it’s so important.

Staying focused on one trading method long enough to really learn how to trade it effectively is something that many traders struggle with. Based on my personal experience from observing and helping thousands of traders, the traders who focus on learning one entry trigger or one setup at a time are typically the ones who succeed at trading. Since I am a price action trader and I teach price action trading, I teach my members to focus their attention on learning ONE price action setup at a time, until they feel they’ve “mastered” it, and then they can move on and add more setups to their arsenal.

Mastering one setup at a time helps create focus and clarity in a trader’s mind by removing clutter and minimizing decisions.

Why you need to become a “Master” of your trading strategy

I know that this might seem obvious, but you really need to “Master” your trading strategy before you try trading it on a live account. Why am I saying this if it seems so obvious you ask? It’s simple, from my interactions with traders every day, I know for a fact that far too many of them are diving into live-account trading without any real clue as to what their trading strategy is or how to trade it. Many traders “think” or “feel” like they know what their trading strategy is and how to trade it, but the truth is that most beginning and struggling traders have not truly “mastered” their trading strategy yet.

Ask yourself these two questions: Do I know my trading strategy inside and out? Am I at the point where I can flick through the charts in 5 or 10 minutes and instantly know if there’s a setup worth trading or not? If you can’t answer an honest “yes” to both of these questions then you aren’t ready to trade live and you have not mastered your trading strategy yet.

I talk about trading like a sniper in many of my articles. Whether it’s what crocodiles can teach you about trading or how to trade from a coffee shop in a minimalistic manner; the underlying point is basically the same; trading in a relaxed and scaled-back manner is best. But, HOW do you arrive at that point of trading in a relaxed and confident manner? You have to first become a master of your trading strategy, and then you will have the ability to quickly scan the markets and make a confident decision to trade or not to trade. If you aren’t doing that, then you are probably sitting there for hours mulling over your charts until you eventually convince yourself of a trade signal that later you realized was not really worth trading at all. If this sounds familiar then read on, I’m going to tell you how to fix it…

Creating FOCUS

Most traders struggle with focus, and it’s not surprising really. How can you easily focus when there are so many different trading methods, economic news events and other market variables bombarding you every day?

With all the different trading systems and strategies out there, how can you really know if what you’re doing is “right” or if it will work if you can’t focus on it enough? Well, the answer to that question is that you can’t. You can’t know if any strategy or system will work until you try it, and the key is that you have to try it over a large enough series of trades to see it play out.

MOST traders struggle with sticking to one trading method long enough to see it play out. Why? It’s because they try to tackle too much at one time; they try to trade with 10 different forex indicators or they try to trade 30 different markets at once with 5 different entry triggers. The truth is, the entry trigger is the easiest part of trading, and it’s also the part that traders over-complicate the most.

How do you create the focus that you need to really MASTER your trading strategy? It’s actually pretty simple; you break your trading strategy down into smaller pieces; you un-complicate it. This is actually the “key” to mastering anything in life, whether it’s reading a book, studying for a test or getting through your work day; if you break things down into smaller pieces, you will be able to focus more on each piece, rather than trying to do too much at one time. This, in turn, will help you achieve the larger end-goal faster and more effectively than if you try to do too much at once with no plan of action.

How to MASTER one price action setup at a time

Let’s get into the “meat” of the process of mastering one price action setup at a time. Before we begin, it is worth noting that when I say “one setup” I don’t mean “only” a pin bar or only some other price action bar…a price action strategy or “setup” consists not only of the bar but of the surrounding market conditions and events as well.

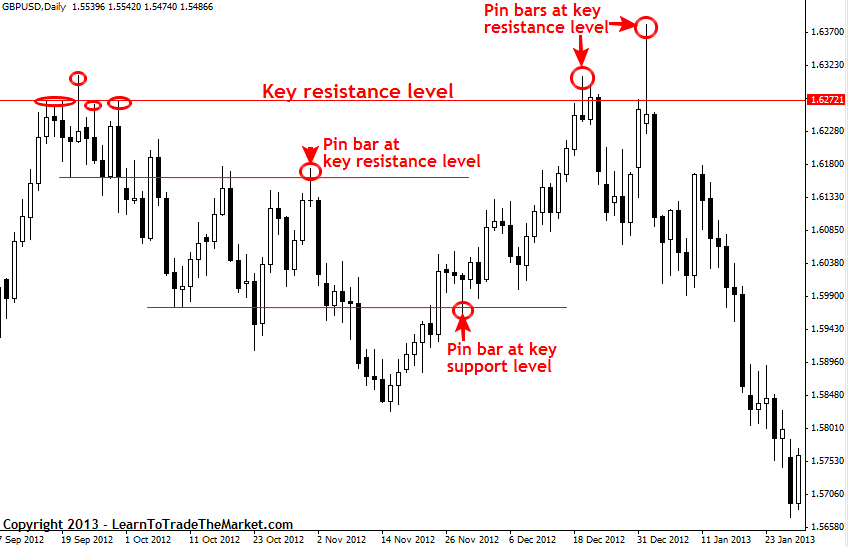

For example, in the charts below, we are going to look at mastering the daily chart pin bar setup from key chart levels of horizontal support and resistance. Thus, you don’t trade unless there’s an obvious daily chart pin bar setup formed at or rejecting a key level of horizontal support or resistance. Let’s look at some examples now:

In the example chart below, we can see 4 different examples of trades that would fit our criteria of trading only daily chart pin bars from key levels of support or resistance. These would be the ONLY types of setups you would be looking for until you feel you mastered them:

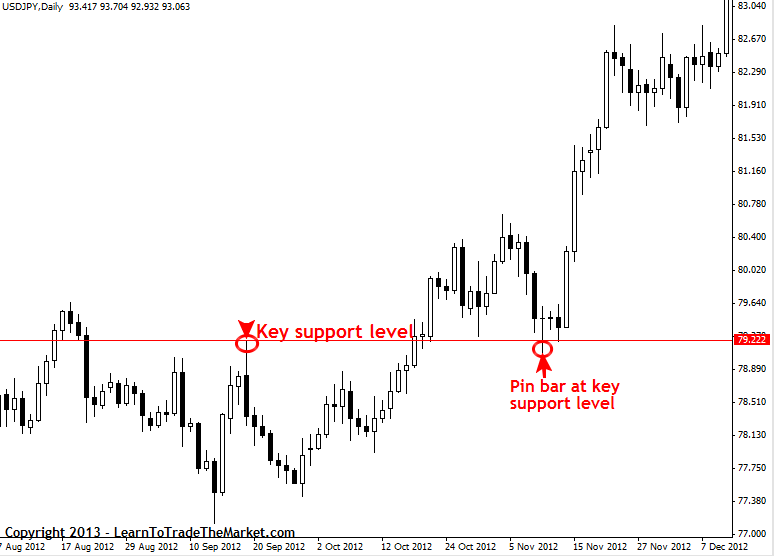

In the example chart below, we can see a good example of a pin bar on the daily chart of the USDJPY that formed rejecting a key horizontal support level through 79.20. It’s worth noting that this pin bar actually kicked off the huge up trend in the USDJPY that is still underway:

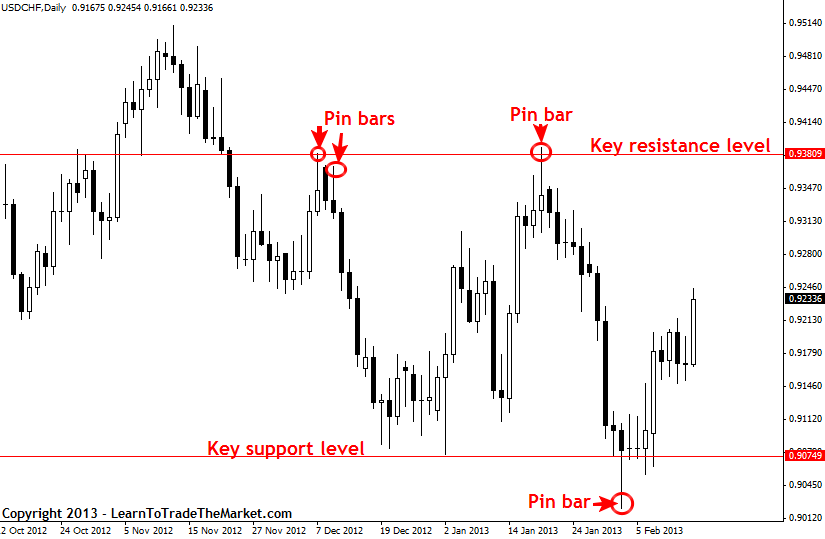

In the example chart below, we are looking at more examples of daily chart pin bars that formed at or near key levels of horizontal support or resistance:

One important thing to take note of with trading a strategy that involves finding key levels like this; you have to wait until a key level actually forms…don’t guess. I wrote an article about how to draw support and resistance that will help you to distinguish key levels from less significant / minor market levels. This is why in the USDCHF example (the last one above); I didn’t mark that first pin bar from support that formed on January 2nd as an example of our trade setup that we are mastering. At the time that pin formed that level was not really established yet, so it wasn’t a “key level” and thus it didn’t meet the criteria of the “one setup” that we are focusing on.

To make this exercise of mastering one setup at a time work, you really have to obey the rules that you’ve outlined for the particular setup you are trying to master. In this case, our main “rules” would be this:

1) Identify the obvious / key chart levels on the daily chart

2) Look for obvious pin bar reversal setups that have formed at or near those levels. Meaning, pin bars that are showing rejection of the level and (or) are creating a false-break of them.

Now, keep in mind that even with such a simple set of rules, with price action there is always discretion involved….you have to decide if a pin bar is “obvious” and if a level is “key”…but these things are easy to get better at through training, time and practice. I’ve already linked you guys to some good articles on these topics within this lesson, so you should understand what I’m talking about here.

In closing…

Professional traders do not sit in front of their charts wondering what to do. They know what to do already; they are just waiting for the right combinations of events to come together to give them a reason to trade. Knowing what these are events are, exactly what they look like and how to trade them is something you can easily accomplish by following the template laid out in today’s lesson. You first decide on what your entry trigger is, in our case it was the daily chart pin bar, and then you decide how to trade it. There are many different combinations of price action setups and factors of confluence that you can learn to master. Eventually, all of these setups that you’ve mastered will begin to “paint a picture” of the market for you and you will begin to have clarity and confidence whenever you look at a market’s price action.

If you don’t think and act like a pro trader then you will never become one, so start becoming a “master” price action trader by learning one particular setup at a time. Get it down on demo first, then try trading it live, and if you find after a couple months that you are making consistent money with it, then you can consider adding another setup. Your aim should be to have a handful of setups that you have an “intimate” knowledge of; that you are a “master” of. At that point, trading simply becomes a game of waiting patiently for the price action setups that you have mastered to show themselves in the market. It really can be as simple as that.

If you want to learn more about the price action setups that I have personally mastered, checkout my price action trading course.

I lack words of appreciation to you sir that was a very great article KEEP IT NAIL FULLER.

I am not clear about the meaning of the word “inside” and “outside” in this sentence.

“Do I know my trading strategy inside and outside?”

Does “inside” mean completely, practically, deeply, and “outside” means a bit, a bit, or a little – does it mean something else?

Thanks Neil!

Your article is great and came at the very right time when I’m undergoing a 2months training of learning forex trading.

Please, what is the procedure to have ur system install on my laptop (INDICATOR).

I need it to help me learn more using a demo account to trade

Kindly reply

Nial your articles are great, i have read many of them i am now seeing the forest not only the tree, You mentioned in one article that patients is the key, very true, like a crocodile waiting patiently to attack, like a sniper,this is what we need in forex, true, its what new traders dont have , keep up your great and educating rich articles.

Thank you for keeping me abreast of your wonderful trading recipes, breaking the encasing wall build across my wit zone, opening up my tunnel vision. But I think the exact mechanics for me to keep sailing is recoil from a cluck of impatience while keeping your amazing techniques under a constructive ardent observatory structure which you have floated up in your previous article.

this is valueable info for both begginers and experienced traders.

thanks nial

Very helpful. Thanks very much.

Love one

Very clear set of rules //goals to follow making the whole process less confusing. Great article.

Thank you so much Meister nial and a very happy new year 2016 to you.

Best Regard from Germany.

Thank you so much nial and a very happy new year 2016 to you.

Nice training. Secret unfolded.

thanks you verry much.

Nial, this article of yours is a valuable contribution towards making our heads clear about how to trade in forex market. Thanks a lot.

Focus brings to light every aspect of your trading. Success in forex trading is possible with or without an indicator. It is about you. When you focus on one thing, everything that is not right about the manner with which you handle it will gradually show up.

Focus is power. It helps you to filter out the unnecessary so that you can diagnose what exactly the problem is.

When you bring in all elements of successful trading like mm, rr, discipline into a forex setup, you will succeed in the long run.

Without focus, you cannot spot a statistical edge.

Thank you so much.

“break your trading strategy into smaller pieces” this is a very important lesson. Thank you

i am happy i know you thanks

Thank you so much Nial ! I will to work hard by your advice.

Thank God I found you, right when I was giving up hope on Forex trading.

Thanks Nial!

Ashok.

Nial,its wonderfull lesson and you are cool man.

Thank you so much Nial.

Hi Nial

Thank you for sharing yet another very informative article with us. I truly appreciate all your time and effort which you put into these articles.

Niall, you mention adding other ‘setups’ to the ‘price action’. Which ones do you use?

I have been trading demo with only daily pin bar setup at key levels for 2 and a half months and have had a very impressive profit. Thank Nial.

The Article worth more than millions i appreciate u

Illustrations are very clear. Thanks

Thanks for great info, am still at the beginning stage, so very helpful.

U are great GOD bless u

NIAL! Many Thanks, “GOD bless you and your family,” for the great service’ you are rendering selflessly.

with REGARDS, AMIN MALIK

Simple & easy to understand…

This is an excellent article Nial and it really all makes perfect sense and thank you very much for your huge efforts:)

This is pure gold dust thanks for truly giving us the true knowledge in forex trading really appreciate your teachings

thanks again

Just Awesome…keeping me back in focus….tq

Thanks FX Guru,this is a good training to be followed.I appreciate it.

Hi Nials, good presentation, straight forward, simple lesson ,kiss method, great stuff. W

Thanks Nial. It’s good to read todays article knowing I still have questions tinkering away in the back of mind regarding price action support and resistance. Always great to be continually inspired by your words of wisdom.

Nice lesson as always

Thank you Nial!! Is exactly what I’m doing since I bought your course!

Perfect!

Hi Nial, Your article always mind opening, as always, thanks for your invaluable sharing. Have a nice weekend!

As always, nice and clear from “FX Yoda” professor. Do not overtrade, do not over leverage, do not average the loss, do not move stop losses and stick to one good strategy that you feel comfortable. And I hope to do not repeat all these mistakes again :)

Greetings.

thnx for the article Nial,

I have started waiting for friday afternoon eagerly for ur articles{educational tools}

I am more interested in friday than a weekend these days, coz i guess i cannot get such a good education even after spending hours and hours on net to get a good and true information abt Forex.

Thank you Nial

I am completely exhausted in the vein attempts in using indicators and robots I am driving myself crazy even as

I write this comment. I am coming home Nial I am coming home to price action and starting with one set up and mastering it.

it-is-a-simple-thing

Thanks Nial,

Needed to here this.

Have a fun weekend

Nial is a great coach always. He will answer your questions very promptly and never fail you.He is the best !!!

A first rate lesson Niall. I know it works as I have been using this one particular setup for some time. Keep up the good work!

I must admit that ever since i started learning from you,I’ve been blessed even more.i now look at Forex trading in a totally different perspective.Its a blessing to know you and may God bless you abundantly for your generosity.

What I can say.You are fantastic. you are a person that will see poor gays will win. there is no one who can share his experience with others like you. May God bless you and your family.

Thanks Nial

It is realy make my day…trading….

Cheers

Great article Nial…one just needs the patience to see these great setups bring great returns…thanks, really enjoy reading your work.

Universal lesson

Thanks Nial, another great lesson for me!

Another great one…Perfect timing…. for me…

Great lesson Nial. Thanks….

every of your lessons re a pack of resource and insights always rich enough to turn every serious trader into profitability. it has been a priviledge to my career as a trader. thanks for all you do and may God bless you always..

Thanks for that Nial will keep comming back to that.

wow, really powerfull trading note. thanks 1000X

Wow! Another great lesson. Pure Gold. Thank you Nail.

Nial, as usual, amazing.

That lesson could totally change the game!

Thank you!

True, I have discovered these aspects the “hard way”. I also discovered that it is best to stick to one time frame. One daily(D1) trade lost can wipe out all the profits made over a number of 15min trades. These lessons are important.

I love the lesson. Thank you.

This article is very important for anybody wants to be successful in the forex Market. If you fail to implement this strategy you will have yourself to blame.

i wounder how you find time sending this numerous article … more greece to ur elbow

as always

Really powerful lesson as usual Nial

I was delighted to see the USD CHF daily chart in the series of examples, as I traded the exact set ups you highlighted!

thank you so much for your consistent selfless postings

a great weekend to you, your family and all of your followers, best

Paul

I like this : “a price action strategy or “setup” consists not only of the bar but of the surrounding market conditions and events as well.”

Thanks Nial. Always on point.

Thank you for this…. That is all true, I am working now to improve this strategy and I am doing it on demo account. Thank you one more time

Wonderful lesson

thank you nial.

DEAR ‘Prof, I AM HAPPY I KNOW YOU AS IT CONCERNS TRADING IN FOREX. THANK YOU SO VERY MUCH.