The Power of The Pull Back Trading Strategy

Trading is easy, but people make it hard. I know this because, just like you are probably doing, I used to make trading very hard on myself. When I first started trading about 15 years ago, it felt like I was constantly on the wrong side of the market. As soon as I entered a position, it was as if someone was inside my computer, waiting to push price in the other direction. I literally felt like someone was ‘trading against me’ and trying to take my money.

Trading is easy, but people make it hard. I know this because, just like you are probably doing, I used to make trading very hard on myself. When I first started trading about 15 years ago, it felt like I was constantly on the wrong side of the market. As soon as I entered a position, it was as if someone was inside my computer, waiting to push price in the other direction. I literally felt like someone was ‘trading against me’ and trying to take my money.

Does this sound familiar to you??

If so, it’s probably because you are not aware of the power of pull backs or how to trade them properly. You are probably entering at the wrong time; just when the markets are ready to move against you. You are doing this because you are entering when it ‘feels’ good, instead of when it makes objective, logical sense to do so.

Today’s lesson will show you why market pull backs or retracements are SO powerful and why you need to start focusing on them ASAP….

The theory behind trading pull backs…

Everyone has heard the old cliché, “The trend is your friend until it ends”, but what exactly does “trading with the trend” entail? It can seem vague to the inexperienced or beginning trader. What we need are SPECIFICS, not vague clichés that accomplish nothing (unrelated side note; this is also what we need from politicians).

OK…so 90% of my trades are with the underlying bias of the market, in other words, I rarely try to pick tops and bottoms. However, that doesn’t mean I don’t trade against the current direction of the market. For example, I may see a long-term uptrend in Crude Oil and then wait for the market to start falling before I come in and buy the market, but I am doing that because I believe in the underlying trend. This is very different to top and bottom picking and it’s what professionals call “trading from value or trading pull backs or trading retracements” (all mean the same thing).

Waiting for a pull back and trading from that pull back is a much higher probability play than entering at the extended part of a move. Pull backs can help lower entry point risk as we are usually trading at a key market area (value area) that has previously shown support /resistance (depending on the direction you are trading of course). As we know, key levels are often major containment points and the tide can shift at these inflection points very quickly and lead to large moves in the opposite direction (in our trade’s favor).

To put it more succinctly, the reason why trading pull backs is so profitable, is because markets ebb and flow, and a pull back helps you to refine your entry point so that you are entering at or close to the turning point between the ebb and flow (again, this is not top or bottom picking because we are not trying to predict a trend change). You won’t always get it exactly right, but if you stick with the underlying trend or trade from a key chart level, you can usually get close.

Let’s look at a chart to understand this better…

In the chart below, we have a clear downtrend in place. By the time the circled areas occurred, it was obvious a downtrend was underway, if you don’t understand why, then read this article on trend trading. So, at the point of the red circled areas, experienced traders were certainly looking for pull backs within the trend, to join the trend from a high-probability point. Whereas, losing traders were thinking the ‘trend was extended’ and thinking it would end after every downward swing. As you can see, if you tried to buy near any of those low points, the market only moved up a small distance before the trend resumed, and the MUCH bigger pay-off came if you had looked to be a seller on the retracements higher, or a seller on strength.

Also, many traders only feel comfortable entering when the market is currently moving in the direction they like. So, many traders lost money because they sold right near those bottom points, when the market looked weak, but was actually getting ready to retrace higher. This is partially why trading gives many people trouble; because you typically must do the opposite of what you feel like you want to do, to make money. I can assure you that selling when this chart was retracing higher, wasn’t easy to do, because it felt like the ‘bottom was in’, but we should trust the underlying trend, we must have faith it will resume…

Retracements: The cornerstone of a market technician

Identify trend then look for pull backs…

The primary way to trade pull backs is to look for trends and then look for pullbacks within the trend. What you are doing here is first identifying the overall momentum of a chart; which direction is the chart generally moving, from left to right? This will be your path of least resistance, or the path the market is most likely to continue moving down in the near future.

We need to remember however, that markets do not move in straight lines. So, if you have identified an uptrend for example, it doesn’t mean the market may not move down for a day or two or three or even a week or two, within that overall uptrend. The thing traders forget about is the element of time. A downward pull back of 3 or 5 days, can seem significant to the average trader who really wants to make money, but in the context of a multi-month or multi-year uptrend, those few days are just a blip, a blip that can cause you to lose a lot of money if you aren’t careful.

Let’s look at an example of this…

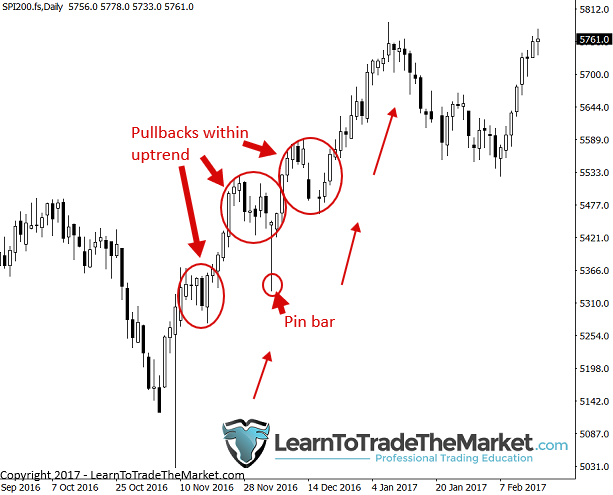

Notice in the chart below, a clear uptrend was in place. Note the minor pull backs to the downside within the trend; these are high-probability opportunities to enter the trend. The best entry and the most obvious, was the bullish pin bar notated on the chart; a prime example of trading a price action signal on a pull back or “buying weakness in an uptrend” …

Identify most recent swing move and trade early retracement

Now, there are many times when the market trend is not super clear or obvious, and during such times we can still use pull backs or retracements to our advantage. Notice in the chart below, there was an existing uptrend, this was obvious, but then price began to pull back, to swing lower, within that uptrend. Over the course of a few weeks, it became evident this was a protracted pull back that could keep moving lower, yet it was not quite clear whether the overall uptrend was over just yet. In this case, we can look for upside retraces to get short or to sell. Especially, after the first retrace higher got turned lower again, we would then be looking to sell on subsequent retraces…

Trading pull backs to support / resistance levels or moving averages

We also want to focus our attention on key chart levels of support or resistance as well as moving averages, for pull backs. You can easily identify support and resistance levels and watch for price to pull back to them and then either enter blindly or wait for a price action confirmation signal to enter and ‘fade’ the recent market direction into the level. By that I mean, if the market was falling into a level, you buy at the level, and if it was rising into the level, you sell at it, or fade it. Moving averages are usually better in obvious trends; you can watch for smaller retracements to the moving averages (exponential moving average or ema) and then look to join the trend from that ema, ideally on a price action signal, but it’s not always necessary, especially in very strong trends.

50% retraces even on intraday charts.

Pull backs provide us entry opportunities on daily as well as intraday charts. One way to look for pull backs is to watch for 50% retracements of moves. These don’t always have to be major moves, as we can see in the chart below. Sometimes, there won’t be an obvious key level to watch for pull backs to, or there won’t be a moving average, so you can also use the Fibonacci retracement tool to look for approximate 50% retracements of moves, look to get in near that 50% level. Ideally, the market will be trending and you can watch for these 50% retracements within the trending structure, and then re-join the overall trend direction from the 50% level. We can see an example of this on the 4-hour chart below:

Pull backs to key levels can result in big risk reward potential

Trading pull backs can also assist in creating high risk to reward plays, especially if we are entering from a long-term key level and using the 4 hour or 1 hour chart to pin-point an entry. It’s not uncommon to pick up trades that exceed a risk reward of 5 to 1 and sometimes far more.

In the chart below, we can see an example of trading a pull back to a key support level. We had a nice pin bar buy signal to confirm our entry and notice the huge potential risk reward here. Pullbacks to key / long-term levels often result in huge moves the other direction as price bounces or repels from the level, creating huge potential pay offs / risk rewards:

Order types used to enter on pull backs…

Generally speaking, one can use market entry orders or limit entry orders to enter the market after a pull back. As discussed above, a pullback provides us with a high-probability spot to enter a market, as a blind entry at a predetermined level with a pending limit order or on ‘confirmation’ with confluence which usually means a price action signal, which would be entered on a market order typically.

When waiting for a pull back and TLS or confluence, we usually can use market orders when the conditions are met.

When entering on a blind entry at an event area or similar key level, we can set a limit ‘pending’ entry order at or very near to the level.

What to do in a ‘runaway trend’ that doesn’t really pull back….

Please note, that just as great trades can be entered on pull backs, the ‘golden rule’ still prevails; that markets move in extended trends and remain in over-extended moves for longer than you think. It’s those who have the guts to commit to trading in the direction of what looks like an ‘over-extended trend’ when everybody else is running scared, that make the money. I would ideally want to be trading pull backs and entering on retracements during these large moves, but they don’t always come…

Sometimes we have to jump on-board the train and sometimes we must be prepared to miss the trade if we don’t get a pull back. Markets often run further than we expect, trends last longer than we imagine…

In these market conditions, we would ideally trade in-line with these moves but ideally enter a trade after a pull back, but if we only applied this concept, we will miss some trades as there won’t always be a pull back. So, if markets don’t pull back and we miss a trade if we don’t get on board, we will kick ourselves 50% of the time. A solution is to read the daily chart time frame on a day-to-day basis and watch for any price action signals which may provide entry opportunities. Even in the absence of a pull back in prices, there are often clues that the market is likely to continue and breakout with the trend (such as inside bar pattern trend breakout). As I have said, price action is like reading a book from left to right; you have to know what happened on the previous page for the current page to make sense…this is a skill mastered with education / training, time and experience.

Conclusion

Trading pull backs not only provides you with very high-probability entry points into trends and from levels with huge potential risk rewards, it also helps with the psychology of trading. You can consider this yet another advantage of pull backs and another reason they are so powerful; trading pull backs will teach you great habits.

A trader truly focused on trading pull backs must learn discipline and patience, because trading pull backs means you aren’t just entering wherever and whenever you want. It means you are held accountable to a set of planned scenarios that you have defined in your trading plan and that you wait and watch for in the market.

I personally employ the idea of set and forget and this has forced self-discipline and routine into my trading approach by only trading at pre-determined levels and scenarios. It helps me avoid the urge of jumping into the market on market orders and over-trading, and it develops the patient, sniper trading mindset that is the foundation on which my entire trading strategy is built. Today’s lesson is a just small preview of what you will learn in my price action trading course and members’ area. I hope you have learned something new that you can apply to your trading.

PLEASE LEAVE A COMMENT BELOW – I WOULD LIKE TO HEAR YOUR FEEDBACK :)

QUESTIONS ? – CONTACT ME HERE

Thanx and very important for me

A very powerful article to learn it really changes my way of looking at antry points thank very much

the other reason why i love pull back is it give me very risk reward ration once the position is open it will finish and end with blue.

great Nial

Hello Nail easy than done especially in a live account but thank very much for the golden words.

Hello once again, it’s like you really see my heart, what’s going on in it. I felt like my broker was hunting for my money,even in midnight. I felt uncomfortable within me all because of what was going on with my account. Your articles have now changed the way I trade tremendously that when I open up my chart, after I have drawn in my key levels, I already see the direction of the market clearly without effort. Your articles are indispensable,most especially for newbies. Thanks again.

Thank you for sharing this erticle and the idea is really useful for me to change my trading concepts.

Solid write up, thank you for your time and effort.

Christopher Wic

i love this mentor, he style is bruce lee

Thank you for this article!

Really nice…

This is so helpful and informative… totally feels like a fresh breath of air; learnt where I was going wrong… I appreciate this so much. Thank You.

Great👍

The most thorough lesson about pullbacks ever read. Thanks and congratulations

Thanks You for this!!

Pure gold!

I have enjoyed reading this lesson and will re-read it a couple of more times. Very well written.

Great read! Definite bookmark!

Thanks, thats really works

Thank You for the lesson

He will stay awsome until one time he is wrong and all of you will stab him in the back and brutality appears. The hardest thing is how to tell the magnitude of a correction. 10%>, 10-20% more than 25%.

Please help me to understand that how I will be sure that whether the trend will continue or pull back. if the major resistance level bounce then we think that it will go down,what is the sign that will tell me that the trend will continue or pull back

Great in depth write up on low risk entries using price retracements. Thanks Nial

Another new lesson to me as a beginner.thanks a lot.

Greate Strategy

I missed a pull back on the sgdjpy pair..I’ll wait for another one to get in. Thanks Nial

Doff off my head Nial, you are a true legend

This power of pull back trading strategy is realy very interesting but, i believe in every market, following strategy is the best.

please sent me a notification when you will post every article, because your analysis is awesome sir

please sent me a notification when you will post every article

awesome sir

Thank you very much

You are indeed Authority when it comes to Price Action. This is the website i spend much of my time. Thank you Nial

hi,

thanks for sharing…………that´s just a start off

Be well

Regards

I like such 50% fibo retracement, prices moving like using spring energy.

When making a blind entry at an event area, where do you put your stop? Sometimes price will breach the event area and stop you out only for price to go back and make the move in your direction.

Sir dis pull back means a lot to me as trader nd i will definitely implement it with patience nd discipline nd thanks very much sir

Hello Nial, some ideas of pull back trading strategy i met at your different articles, now i read full strategy in your new, great article!

Thank you again and again for your hard work!

Regards

Superb..thnx Nial

thanks a lot for opening our eyes.u

Thank you so much, Nial. An extremely helpful piece of advice, as always. Very much appreciated…

Wonderful. Thanks Nial

Hi Nial keep up the good work

Beat by beat I`m getting there. Thanks Nial, powerful and nutricious site to spend time on.

Waiting for pull back like a sniper waiting for his victim.

Excellent Nial, thank you.

Hi Nial.

Another excellent article explanation and teaching, thank you!

Catherine

Hello Nial

Thanx a lot for the fabulous education.Really you open our eyes and give us the best secrets to success. Today i am zero, but tomorrow i will be hero because of these lessons. Big ups.

U captured pullbacks from the simplest view. its great and it make complete logical sence for me..easiest way of refining my entry point…..this is the only way am able to see the power of the naked price action(pullback)…great stuff, i learned!!!

Nial,

Great article with a lot of good “reminders”. Personally I will come back to it

on a regular basis in order to improve my trading!!

Thanks!!!

Hello nial. I have been following your comment and suggestion for quite a long time. I just cannot deny the fact that you out there to help a lot of struggling traders. each time I adopt price action to trade, I always ended up with loses despite the fact that am in love with price action and I have read a lot of your article and strategies. I have discovered that my major constraint were my poor money management and my lack of discipline which I have decided to work on in order to be a better trader like you.

The pullback strategy will also go a long way to improve trading , thank you so much

Hi Nial,

The problem with pullbacks is whether It is a pullback or a turning trend. That’s why I rather wait until the trends continues after the retracement before I enter the market. As a trendfollower I buy high and sell low. To determine the main trend I use SMA 200.

Kind regards,

Henk

Fantastic explanation… I love this article

Excellent advice Nial, thanks for sharing

Good topic

point taken

thanks nial

Hi, Dear Nial,

excellent as always , and well-explained pull back and retracement delimma. Thanks and best of luck.

Nial good morning. Great article. On the SPI200 the second example you gave us. How would you enter and set stoplosses for that trade. Thank you.

A pullback just happened on several markets (after NFP data)… will the trend be resuming or reversing? Is the dollar overbought? Will see :)

Alin,

As I discussed in the lesson, we have to identify the dominant trend and then watch for retracements within that trend. Look for price action signals as the market retraces. Often, the best time to enter in the overall trend direction, is when it feels like maybe you shouldn’t; these retracements can often seem like tops or bottoms, and many traders trade them as such, and then get burned as the dominant trend resumes.

Nial

what a wonderful article it is . I highly regard your skills as forex trader. This topic is usually not discussed so wonderfully by many so called gurus. Even many dont want to touch the subject at all. thanks for sharing

this lesson is very useful for me

After taking your advice of starting with the weekly charts and drawing the major levels there first, realizing the longer trend, then scaling down to the daily and then as low as required, everything is better for me. The market is not as much after me personally as it used to be, occasionally it even smiles at me (still rather rarely though- but a bit more often)

Now the retracements and pullbacks will be the next landmarks to look for.

And even lately I find myself turning away more than I did and not trading when not seeing any wave motion or tempting setups.

I also set more generous margins on my stop losses than I used to do and I like to monitor the trades and move the stop losses if if the trades are good. I do not have enough confidence to set and forget, also you may miss out something that happens quickly like in the oil.

I still am tempted to trade on the 5 minutes when I see a couple or three sizable agressiv consecutive bars forming-guess I can´t help my compulsive gambling instinct. Often I make a small profit by chasing the price with the stop the losses until the trade is bust.

But your teachings are what I am striving to follow because they work.

And trading keeps on getting more luring and addicting every day. Although the real profits are yet to show the losses are getting slower.

I know I have a lot to learn and want to learn so keep on posting your advises Nial.

I used to do the 5 min chart. Give it time. You will see daily chart and higher time frames give you less stress and allow for more time to make decisions.

Fantastic information, just what i needed – much appreciated Nail

Great article keeping us calm and teaching us to take time over our trade selection

Thank you so much, I will try and master what you have taught. Nearly every trade I take makes some money but then retraces and stops me out.

Great article. This is precisely how I trade except I use divergence in the direction of the trade to determine entry points.

thanks a lot nial

Good artical all newbies take notice. ..

It has taken me 12 months to get this simple fact in my chart blind head (Truisum ) can’t see the wood for the trees

Yes definetly, I have learned something new about pullbacks. thank sir, I will have a look at it again.

Very informative

Thanks Nial. As a beginner there is quite a bit of terminology that is over my head but definitely the article is shaping a ‘sniper’ mindset towards trading and it seems its less complicated than I first thought.

Hi Abigail,

If there were any terms you didn’t understand, feel free to shoot me an email via the contact page and I will help you out.

– Nial

writing from experience, i agree with you.

Thanks Neal for the excellent article, I’m from Russia and I use google translator, but even my little knowledge of English is enough to understand what you want to tell us, very intelligibly and understandably, subscribed to these updates ! :)

Thanks Nial, great article. I have certainly found patience is the key!

Another educational truth about trading. These are truths you are sharing with the whole world. Thanks Nial

Excellent Nial, thank you.

hi Nial

very nice article.many thanks to your effortS.

Mehdi