Trading Price Action With or Without Confirmation: You Decide

As a price action trader, we basically have two ways to trade; with or without a ‘confirmation’ signal. Now, I put the word ‘confirmation’ in single quotes because it has come to my attention that there has recently been some overly-literal interpretation of my usage of the phrase “price action confirmation signal” by certain individuals.

As a price action trader, we basically have two ways to trade; with or without a ‘confirmation’ signal. Now, I put the word ‘confirmation’ in single quotes because it has come to my attention that there has recently been some overly-literal interpretation of my usage of the phrase “price action confirmation signal” by certain individuals.

To clarify, when I say “confirmation signal”, that does NOT mean that it’s ‘confirmed’ that price will 100% for sure move in the direction the signal implicates. As I have stated many times in numerous articles, trading is a game of probabilities, not certainties. Thus, if you’ve studied my site for a while you would know that a price action ‘confirmation’ signal is simply an extra factor of confluence that supports a trade idea.

I do not suggest or say that “every trade” needs a price action confirmation signal either. In fact, I have a whole lesson on what I call “blind entries”, something else that has apparently and unfortunately been misinterpreted and misrepresented on other trading sites in recent times. A ‘blind entry’ does not mean you are just entering blindly with no consideration for market context or condition. In fact, in my article on trading event areas, it’s clear that a blind entry should typically only be taken from a key chart level of support or resistance, and ideally in-line with the dominant daily chart trend.

So, in today’s lesson, we are going to cover the two main ways a price action trader has to trade; with a confirmation signal or without one…

How do I decide to trade with or without a price action confirmation signal?

It’s important to understand that each trade and each chart situation is unique. There will never be two trading situations that are exactly the same in the market. Therefore, how a trader enters is at their discretion and is based on their perception of the chart at the time.

So, whether or not you enter on a price action signal or without one is going to be determined on a case by case basis. You might choose to wait for a signal at a key chart level in-line with the trend, or you might just enter ‘blindly’ at a key level. It’s ultimately up to you.

You may choose to wait for the ‘perfect storm’ of confluence by having as many supporting factors line up in your favour as possible, or you might just decide there’s a very well-defined pin bar signal with a long tail and that is enough for you to enter on. As long as you are entering on one strong component (ideally two or more) of the T.L.S. ‘system’ (Trend, Level or Signal), and it makes logical sense to you, it’s fine.

There are many variables in play and there’s no systematic way to look at trading. Anyone who tries selling you on a mechanical trading system has not yet developed their sense of trading gut feel and is still searching for that non-existent ‘Holy Grail’ of trading. Indeed, if you read the bio’s behind any of the traders in my Market Wizards article, you will soon discover that they all use gut feel to some degree in their own trading, doing so is the mark of a skilled and seasoned trader.

Trading with price action confirmation signals

Trading with a price action signal simply means you wait for an obvious price action signal or setup to form in the market, ideally from a key chart level of support or resistance or within a trending market. Let’s take a look at some examples of this…

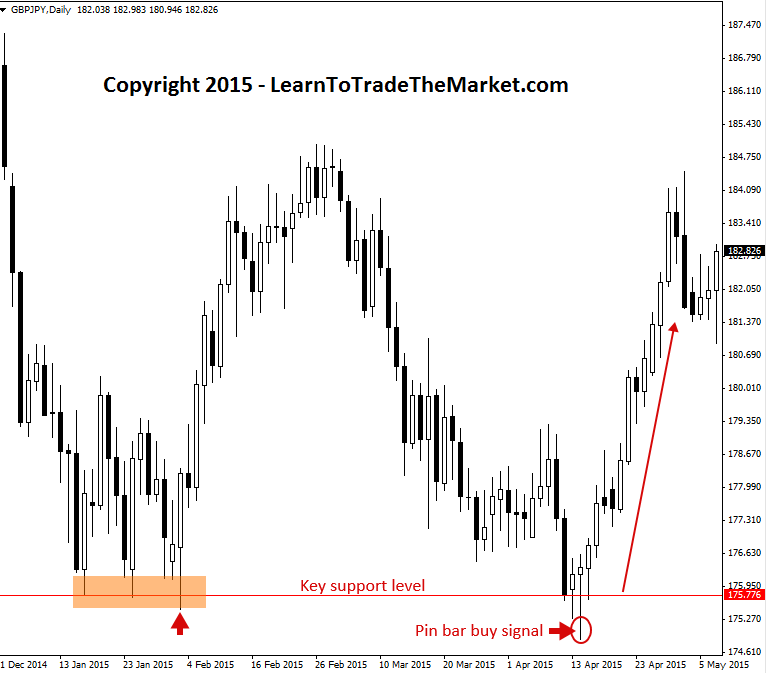

In the chart below, we see an example of waiting for a price action confirmation buy signal at a key chart level of support. Especially for a trade like this that would be considered against the previous downtrend leading up to it, I like to see a confirmation signal before entering. We can see a nice up move followed this pin bar buy signal in the GBPJPY at key support near 175.75…

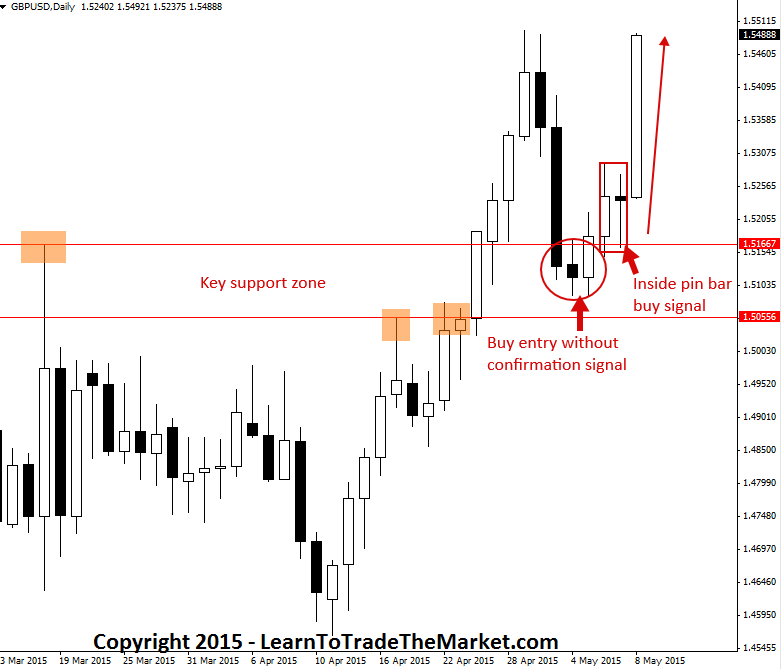

In the next chart, we are looking at the GBPUSD where we have a recent example of entering both with a price action confirmation signal and without. We can see the support zone in the chart below, between about 1.5165 – 1.5055 area, this support area was a logical place to look to be a buyer following the previous strong breakout above it. Thus, when price came back down and re-tested it, we could have either entered ‘blindly’ within that support zone with a stop loss below it, or we could have waited for a price action buy signal.

Note that both options would have worked here but the ‘blind entry’ would have gotten you in at a better price with a larger potential risk reward. Blind entries can do this, but it’s at the sacrifice of that extra piece of confluence that a confirmation signal provides, thus it’s a bit more aggressive of an entry…

Trading without a price action confirmation signal

Sometimes you will have a nice price action signal like in the examples above, sometimes you won’t. There’s no reason to not enter a trade for long periods of time just because you don’t have a price action signal. We can enter a trade without a confirmation signal in a number of different ways, and this can still be considered ‘sniper trading’ since we are waiting to enter from levels or from value points within trends, despite what you may have read elsewhere.

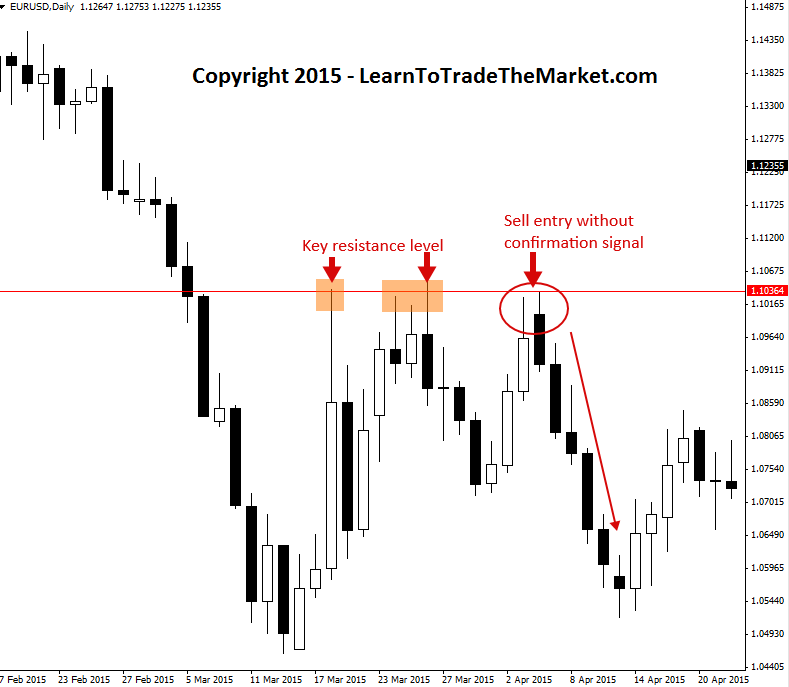

In the chart below, we see an example of entering a trade without a price action confirmation signal. As price retraced back up to the key resistance in the EURUSD near 1.1035, we could have been looking to sell anywhere from about 1.1000 to 1.1035. This trade had confluence but without a signal, so whilst it didn’t have a price action signal, it has the weight of the downtrend and a key resistance level behind it…

In the next example, we see an entry without a confirmation signal on the 4 hour chart of the EURUSD. Note that sometimes you will not be able to find a good entry on the daily chart in a strong-trending market. Thus, it’s OK to drop down to the 4 hour and 1 hour and look for pullbacks within a trend, to enter at an intraday level. In this case, we had a nice little 4 hour chart level and multiple tests of that level before the trend resumed by the market falling lower. This is another example of having confluence without a confirmation signal; in this case it was the overall daily chart trend and an intraday resistance level that was the confluence, we could have then entered short at or close to the level in anticipation of the downtrend resuming…

Conclusion

I hope that from this lesson you can see there is more than one way to trade price action. You do not always need a ‘confirmation’ signal, and often times you won’t see one for a while, so it’s best to learn how to trade both with and without them.

Despite what you may have read on other trading sites, there is always going to be some gut feel and individual discretion required with trading, and the most successful traders in the world know this and they embrace and rely on it. Each trade has to be taken on a case-by-case basis and it’s up to you to decide when and how to pull the trigger on a trade. When you take my price action trading course, you are going to learn in-depth how I trade both with price action signals and without them, and this is the foundation upon which you will develop your own gut feel and discretionary trading sense. Once you’ve begun to develop this, you will feel in-tune and almost ‘connected’ to the charts, and when you combine this ability with self-discipline and strong money management skills, you have what it takes to succeed as a trader.

Now I understand that price action signal is only a technical bridge to exercise our gut feel to be able to listen to market sounds. Finally market moves on its own will with signal or without that we need to feel..feel..and feel. So thank you Nial.

Nice article Nial. Like all of them.

Thanks Nial, always learning from you ????

Hi….maybe you can try using the word ‘trigger’ instead of confirmation at places to avoid misleading interpretation by others……trigger is not a confirmation but merely adds to probability of movement of price in one direction!

You are correct that no 2 trades are like, which is exactly why thesebtrading robots are a complete waste time because they take the trader completely out of the picture. I definitely agree that learning to read price action on live charts gives the once novice trader a big edge.

great article, you show us a new way of trading

Initially after reading the pin bar strategies from Nial I felt that ok ok kind , because many times pin bars will fail. From this article its clear that Nial has a very strong knowledge on the market on how to trade and how to be flexible.

Thank you Nial Sir..

Trading is a game of PROBABILITIES but not CERTAINTIES.

Well Said.

thanks!

Hi Nial

Congratulations on your recent award.

Hi Nail,

I thought first we have to master one strageis about Trading Price Action With signal. After that we research about trading price action without signal. I thought trading price action without signal is more difficult than trading price action with signal because Without signal was less confluent than with signal.

How do you think about my thought Nail?

Hoan,

first, focus on trading with a signal, this is always preferred. When you master trading with confirmation, you can explore the other ideas in this article.

was just about to quit trading until i read an article about you winning a million dollar competition i had studied candlestick patterns and i ignored them and used the system instead but ever since i started following you videos on you tube i have learned a lot ,about candles sticks and support i think you have opened my eyes and i am becoming a good trader day by day.

Congrats on your recent award.

hi Nial congratulations on your great achievement – you make it look easy – Yo must feel fantastic. I admire you. I hope I can learn a lot from you.

Hi Nial

I just want to congratulate with you for your recent success and great achievement you did! That ‘s confirming I’m learning from the right person ..I’m so proud of you !

Thank you for sharing your experience and knowledge with us .

Wish you the best .

Adriana

Congratulations Mr Fuller on your achievement, you deserve all the great things :) Thanks for the article, its educational as always.

Hi Nial, Congratulations on your recent success and thank you for this article. I am still a struggling beginer at Price Action Trading so such articles bring me a step closer to understanding………..this one seems to be particularly beneficial. Best wishes from Ireland.

Hmm Today I have clear about this. From now my focus in both . thanks

This is a very meaningful post, also it is very encouraging to hear about your win. Its possible for a person to be a good trader and have extensive knowledge ect, but this doesn’t automatically mean the person can make good money. So, thankyou for sharing your success, it just happens to be that you are also a good guy, well done

I look forward to reading your articles all the time. You’re right, there are so called teachers who teaches the “do not trade without confirmation signal” doctrine. After reading this, you gave clarified both sides of the issue…thanks.

thank you very much for this very important and ensightful post.

How many successful trades did I miss bcz no signal.If I didn’t read this valuable article I will miss thousands of those kind of trades in future.. thank you very much sir..

Another great lesson. Thank you very much.

Congratulations Nial and good lessons.

Cheers

Thank you. This is very insightful

congrats! you are good at what you do.you are my mentor

Nial,

Congrats on your major win with such a huge percentage on your side. Obviously, that was no fluke. Your willingness to help other traders adds to your blessings. You are a great trader.

Thank you Nial.

Congrats on winning the aforementioned competition.

Fantastic course!

Regards

Thanks Nial. You’re the best.Keep it up.

Congratulations Nial,

Your simplicity is simply the best!

Cheers Alan

Congratulations on your achievement.

You really deserve that.

Indeed it is not a surprise for us. You are the best trader.

Good on you mate!

Alf

A million congrats on this well-deserved achievement!

I want to focus more on my gut feel and discretion. This rely to the trader it self, not just the strategy.

The more i like about this article is that sometimes the daily chart with so much movement doesn´t give us any oportunity, its better to see the 4h chart to in trading scenario.

Nial,

This is a very educational article with clear explanation. Thank you, I got my answer.

Hi Nial,

This makes a lot of sense and open more opportunities to trade PA.

Thank you.

The most awaiting article ! Thanks a lot.

Thanks Nial, good article, as always is very educational .

Very good post.

“Gut feel” is absolutely underestimated.

When I asked my friend to explain “why he entered” , and the answer “can’t really explain in detail”.

Then I knew he got it, and proved to this day.

Keep up the good work:)

I have long waited for this article! Thank you.

Great article just opened another window at let some more light in thanks

Enlightening, thanks