My 4 Secrets For Making The Perfect Trade Entry

As you probably already know, trade entries are very important in determining whether you succeed or fail as a trader. One good trade entry can make or break your month in the market. Yet, traders tend to take trade entries for granted by assuming they are the ‘easy part of trading’ and putting little thought into getting the best trade entries possible.

As you probably already know, trade entries are very important in determining whether you succeed or fail as a trader. One good trade entry can make or break your month in the market. Yet, traders tend to take trade entries for granted by assuming they are the ‘easy part of trading’ and putting little thought into getting the best trade entries possible.

A better trade entry can significantly improve the risk reward potential of a trade as well as get you a better stop loss placement which can decrease your chances of getting stopped out of a big move in the market.

What are some things you can do to improve your trade entries? Today’s lesson will outline 4 tips for making better trade entries that can help you improve your trading results if you practice them consistently.

Using limit orders to get better prices

A limit order is a pending order that you place above or below the current market price, depending on which direction you’re trading. If you’re trading long, you place a limit buy entry below the current market price, then, IF price rotates down into your limit buy order, you will get filled long. If you’re trading short, you place a limit sell entry above the current market price, then, IF price moves higher into your limit sell order.

Limit orders give you the power to get into a trade at a price of your choosing. The only ‘catch’ is, you may not get filled at all on the trade, but if you do get filled you know you got a good entry price and a better stop loss placement than if you had just entered at market or on a stop entry.

One good example of using limit orders to get a better entry price is discussed in my article on ‘the trade entry trick’. The trade entry ‘trick’ is essentially entering a price action signal on an approximate 50% retrace, i.e. entering on a limit order as price retraces to the 50% level of a pin bar for example. This gets you a better entry because it significantly improves the risk reward profile of a trade by allowing you to place a tighter (smaller distance) stop loss, making it more likely that you’ll make 2R or more on a trade.

The other big advantage to getting a better entry via a limit order 50% retrace (trade entry trick) is that it gives you more flexibility in your stop loss placement. You can either take the trade with a tighter stop loss as we discussed above, or you can use a normal distance stop loss (in the example of a pin bar, a normal stop loss distance would be the full length of the pin bar from high to low). As I discussed in my trade entry trick article linked to in the previous paragraph, using a normal stop loss distance with a limit entry order on a pin bar for example, allows you more ‘breathing room’ in the trade.

Remember; limit orders allow you to ‘let the market come to you’ by only entering if the market retraces to a price of your choosing. You have to be prepared to miss the trade, but as we discussed above, the advantages of a better risk reward profile on the trade and increased flexibility in stop loss placement are nothing to sneeze at.

Set up trades at the end of each day

Analyzing the markets and setting up trades at the New York close, is a very easy and effective way to improve you trade entries. Doing so, removes the noise and mental confusion that comes with trying to trade from intraday charts. Monitoring your trades just once or twice a day also helps you avoid the temptation of fiddling with your trades unnecessarily as well as the psychological ups and downs that come with day trading.

The daily chart time frame carries more ‘weight’ (relevancy) than its lower time frame counter-parts. So, just the very act of focusing on daily charts is going to significantly improve your trade entries. Think of the daily chart as a sort of natural ‘filter’ for bad trade entries, since it filters out the noise and irrelevancy of the lower time frame price movement and as a result, the signals on the daily chart are more reliable.

Note: When I say “lower time frames”, I am mainly referring to those intra-day time frames under the 1 hour chart.

Wait for confluence using the T.L.S principle

90% of the trades I take use the ‘TLS’ model. T.LS. stands for Trend, Level, Signal, in other words; Find the TREND / market bias, find the key LEVELS, and look for a trade SIGNAL, when you have all three of these or even two of these points in alignment, you have the ‘perfect storm’ in terms of a trading opportunity.

Let’s look at some examples of trades that had T.L.S. confluence…

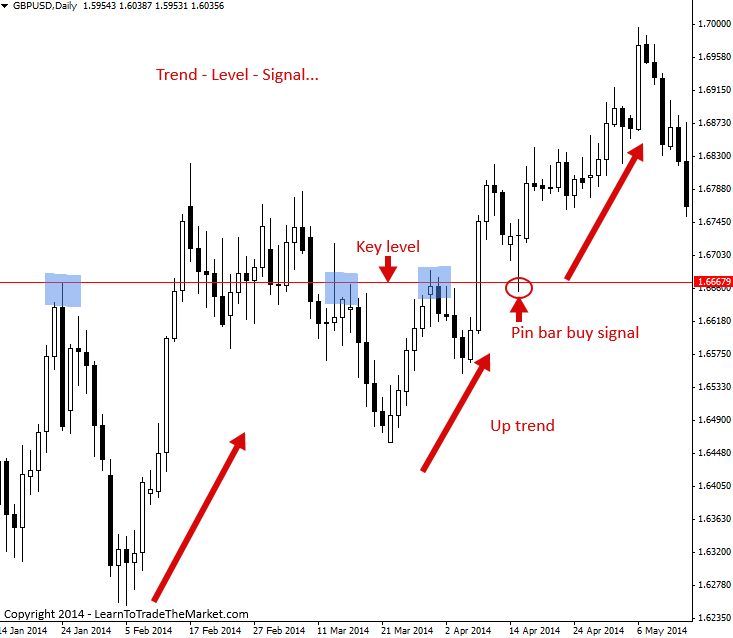

The chart example below shows us a clear T.L.S scenario to enter the market from. Note the market bias / TREND was clearly bullish, we had a clear key LEVEL through 1.6660 area and then a clear pin bar buy SIGNAL formed in alignment with the trend and the level.

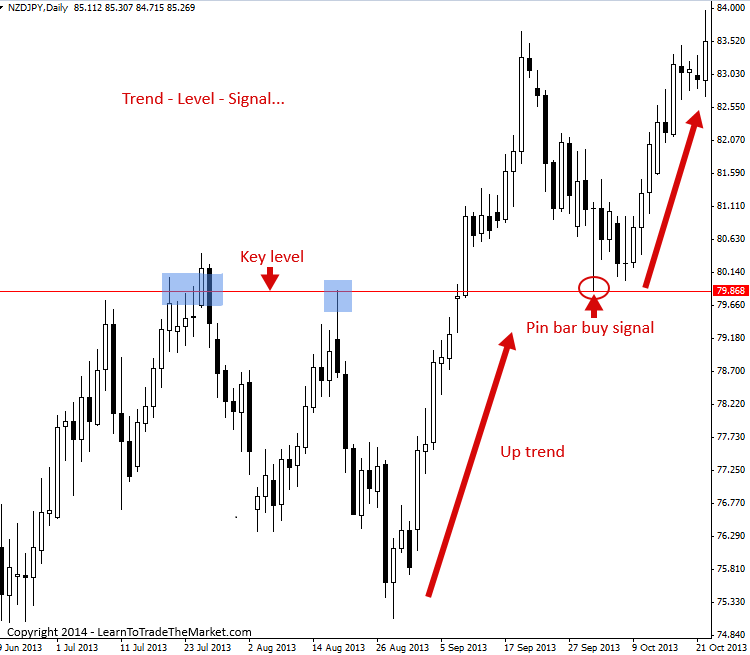

The chart example below shows another clear example of using T.L.S. confluence to enter the market. Again, we had an up TREND / bullish market bias, a clear key LEVEL and then a clear pin bar buy SIGNAL formed in-line with the uptrend and the level. Thus, we had a highly-confluent price action entry signal.

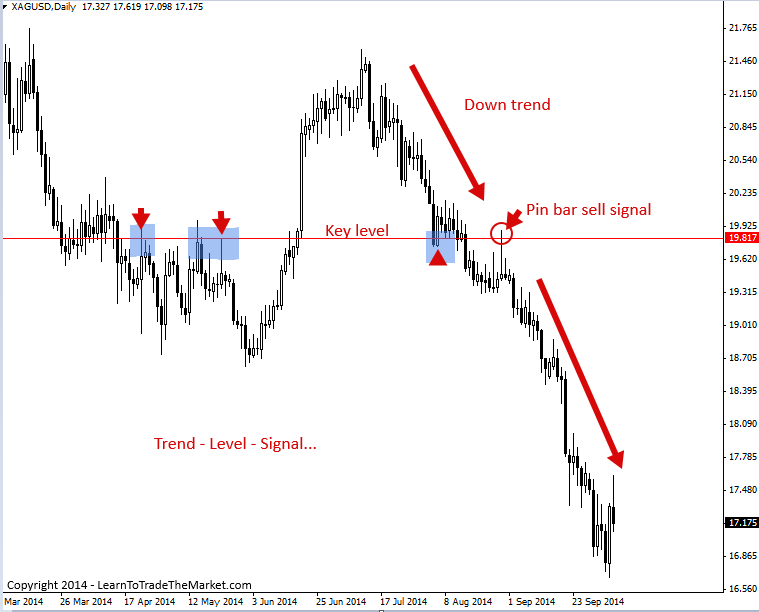

The last chart example we are looking at shows a clear example of using the T.L.S. principle in a down trending market. Note the clear down TREND that was in place prior to the formation of the signal, as well as the clear key LEVEL. Then once we got a clear pin bar sell SIGNAL at the intersection of the trend and the level, we had an obvious and high-probability trade entry on our hands…

Have a simple trading checklist and use it religiously

It’s not just about finding a trade and placing it, it’s about actually finding the right trades and then having confidence to pull the trigger. A simple checklist / plan will assist you in filtering good signals from bad signals, and will also hold you accountable.

A simple checklist might consist of several images / drawings showing your ideal trade setup and chart conditions with some basic wording such as “Locate signal (insert signal type), find nearest key level, find trend, if chart conditions are confluent / in alignment then consider trade. If correct money management parameters can be applied, i.e. if your risk reward makes sense on the trade, set up orders and place trade. It’s a personal and customizable plan designed for you and your personality.

Of course, if you have not yet mastered a trading method, you will not be able to get good entries into the market. Thus, the first step is taking some time to get proper training on an effective trading strategy such as the price action trading strategies I teach in my course and members area.

Thanks very much .. this article is of a great importance to my trading knowledge..I m now a better trader..

Hi Nial,

I have gone through all your publications on TRADING and found it is very much useful for any TRADER.

After going through all chapters, i hoping that i will definitely be a GOOD TRADER.

Thank you very much for publishing your all our experiences.

With Regards,

P V R

Thank you for the great article especially trend, level, and signal.

Nial, good job.

Your strategy and skill of teaching is out of this world. Keep it up and thanks l can see clearly now. Kudos.

Everything here is quite as it always is. Trend following strategy gives high probability to trade placement. This is what I have learnt here, and it’s working for me. Even now, I trade with set and forget strategy; I now always have sound sleep while i place a trade.

thanks my mentor. i appreciate your efforts in making us better traders.

Bless you Nail Fuller this article has done good for me than bad…. I really like your simplicity way of explaining forex

This is a great tutorial. Thanks Nail.

Thank you very much! I’m a new trader, help me please!

Many Many thanks Nial Guruji.

You explain it in such a fashion that the reader easily understands it — sign of a true Brahmin.

Regards

girish

Had a light bulb moment with this article Nial. Thank you so much. Can’t wait to start the course.

hi Nial. Thanks for helping us to become better traders. this has improved my trade aready

Excellent article. since I have been an avid student of yours as well as the market, all I have chosen to trade are pullbacks. That being said I have forced myself not to trade every day,but only to wait for pull backs like an old seasoned hunter waiting for the right moment set-up and moment to pull the trigger

Fabulous article Nial… i luv your simplistic style, easy to understand and follow… i will print this article to have on hand for easy referral … thanks again cheers Jenny

Trading made simple. I now see why I have been losing money all this while.

Thank you for the good job done.

Nial ,great professor , great trader, great sharer….. thanks

Dear Nial

Your TLS method is simple and easy to understand.

I find another name for your method “Ctrl S”

Yes, it is keyboard shortcut to save our work. LOL.

Indeed, “Ctrl S” stand for Confluence of Trend, Range, Level and Signal. Other way we can say confluence the signal with level in trend or range.

I find great importance of price level from your several articles.

Some important price levels are as follows

– old tops or old bottoms level

– 50% level of prior move/wave

– mean or value level (EMA)

Old top or old bottom play important rule in case of trending or ranging both market environment.

Resistance become support or support become resistance is a vital rule of trending market environment.

However, please clarify me if I’m wrong.

I’m grateful to you for your priceless articles. Specifically for your thinking of simplicity attract me that improving my trading psychology.

Once again thanks for your kind works.

B/R

Jaman

Simply Brilliant thank you Nial.

This is a wonderful method that I will continue to use. It is working well for me now. Thanks for this great job.

Very Informative . Thanks for Guiding Small Traders. I will TRY this Method.

very good, i am learn price action, this article help me. thanks.

from Brazil.

Great article…

If you want to gain the pot,

never enter on the spot!

Thanks for your trick and tip to trade the market Mr Nial Fuller

Dear Mr.Nial Fuller,

Thank you so much for you, this really helped me to deepen my knowledge.

Regards.

Great lesson Nial

Thanks great lesson.Keep it coming.

Change my trading life style by nial. now i am very free and easy.

special thanks nial

Hello, Nial.

It’s a good lesson Nial, I’m really enjoying being part of this trading site. With each of your article, I’m a successful professional trader. It’s really giving me the boost and better understanding of forex trading…

Thank you very much.

Good one Mr Fuller I can feel the effect of TLS as I am reading the article my self .

i feel updated when ever i read your post/ article.!!!

Thanks so much.

Hello Nia l,

Thank you for your tremendous expertise in trading the markets.. I have literally learned everything from you! From the videos I first seen on YouTube.. You have been a blessing! Thanks again, and I hope to keep learning and profiting as I go! It’s been a long journey from when I was first introduce..

Regards,

Rod

very good artical,sir

Mr Nail

I feel successful whenever i read your articles.

You are appreciated.

Nial,

Great Job Mate!

Thanks for pointing out again how important entry points are in successful trades. In the beginning it did not seem that important to me. As you have pointed out the importance in the past, I finally got it and made many extra PIPs because of your lessons.

Thanks again!

Another very informative – common sense atricle Nial. Brilliant! Thanks you for taking the time to share this, it is appreciated.

Cheers

Phil

Wales

Good Sunday Nial

Thank you very much so such a good lessons, if all trades may apply such lessons to their minds, surely our trading may improves.

Thabo Ntshisi RSA

hi!! i’m italian , good lessonn Nial!! congratulation.

Its a good lesson and making trading simple ..Thanks Nial

The gist of this brilliant article is “Stick to T.L.S. principle and you will Trade Like Specialist”.

thanks you nial for your sharing, it was really improve my trade

HI NIAL,

THIS IS ANOTHER MASTER PIECE FROM YOU!THE FIRST ONE I READ WAS TRADING TREND,INFACT IT WAS THE TURNING POINT OF MY ENTIRE TRADING CARREER! I ALWAYS REMEMBER YOUR MOST VALUABLE FORMULA=THE BEST TRADES=TREND+CONFLUENT LEVEL+PRICE ACTION SIGNAL.NIAL YOU ARE A WONDERFUL GUY,WORDS CANT THANK YOU ENOUGH.FINALLY,I WILL LIKE TO SUBSCRIBE AS A MEMBER OF YOUR TRADING COMMUNITY,WHAT DO I DO?

very nice article. dont chase the market for entry .let the market comes at you. golden words.!!!!!!!!!!!! in cricketing terms dont chase the ball ,allow the ball to come at your comfortable zone to be hit. this is basic of cricketing stroke play.we have to apply crickets basics fully in our trading.Being a cricket player i am always apply my cricketing theory into my trading. YOUR ADVICE IS IMMACULATE ..WELL SAID.

Thanks.

great article thank you

Another excellent report Nial

God bless you thanks

Nial,

This is one of the best posts you have ever done. It is ongoing posts like this that more than justify getting your course and membership a few years back. Some times I even already know the basic principle but have let it go by the wayside because I lost sight of its value.

Thanks much

Gary

Always good stuff and no fluff!!!

Thanks j.c.

Thanks Nial

This is brief to the point. I have been struggling with – point of entry but with this , i am going to focus to improving my entries

very interesting, i will try to apply this

Dear Mr. Nial Fuller,

Thank you very much for your Educative Article !

Regards.