The Art of Trading Forex – Part 1

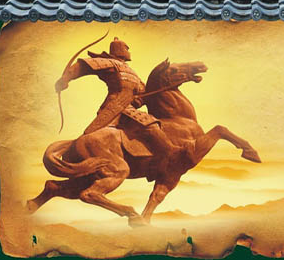

In war, you cannot control the enemy nor know exactly what they will do. In trading, you cannot control the market nor know for sure what it will do. In both war and trading the only variables you can truly control are your own mind and your own actions. The better you control your mind and actions while trading, the better you will do. In war, one side will naturally be less prepared and trained than the other side, and this is usually the side that loses. Just as a military can tilt the scales of success in their favor by out-preparing their opponents, you can put the odds of trading success in your favor by being as prepared as possible before you go to “war” trading the markets.

In war, you cannot control the enemy nor know exactly what they will do. In trading, you cannot control the market nor know for sure what it will do. In both war and trading the only variables you can truly control are your own mind and your own actions. The better you control your mind and actions while trading, the better you will do. In war, one side will naturally be less prepared and trained than the other side, and this is usually the side that loses. Just as a military can tilt the scales of success in their favor by out-preparing their opponents, you can put the odds of trading success in your favor by being as prepared as possible before you go to “war” trading the markets.

Now the general who wins a battle makes many calculations in his temple ere the battle is fought. The general who loses a battle makes but few calculations beforehand. Thus do many calculations lead to victory and few calculations to defeat: how much more no calculation at all! It is by attention to this point that I can foresee who is likely to win or lose. – Sun Tzu’s Art of War

The above quote is from the famous Chinese book The Art of War by Sun Tzu, it is one of the oldest and most successful books on military strategy ever written, dating back to the second century B.C. This book on military strategy has many similarities to the world of trading. War and trading both deal with constantly changing variables that cannot be predicted with 100% accuracy. Thus, in both war and trading the best way to put the odds of success in your favor is by being as prepared as you possible can BEFORE you enter the battle, or before you enter the markets.

Trading truly is an art

To be a successful Forex trader means that you have developed the internal ability to control both your mind and actions. It also means you have polished your chart reading skills and market analysis skills to the point of having supreme confidence in your ability to “read” the market. Reading the market is not a technically difficult thing to do, however, there is certain element of discretion and “gut” trading feel that sets the top traders apart from the masses. For some traders, fully developing this discretionary trading sense comes sooner than it does for others.

Trading cannot be approached in a mechanical fashion because the markets are dynamic and changing all the time. The only way to effectively navigate such an environment is to follow a method or a guide that gives you some sort of framework to work off of. The obvious choice here is price action, because it is the price action of the market that displays the underlying sentiment of all participants. So, by becoming a successful Forex trader you are also becoming a successful “artist” of the market by learning to read the ebb and flow of price.

Prepare your mind for the “war” of Forex trading

![MP9004388051 e1376026365712 » Learn To Trade The Market MP900438805[1]](https://www.learntotradethemarket.com/wp-content/uploads/MP9004388051-e1376026365712.jpg) Preparing your mind for the battle of trading is essential for success. The battle consists of you vs. your own emotional urges and impulses, so essentially you are battling yourself… not other traders like many people seem to think. You need to enter the markets with a clean mind, free from confusing trading systems or over-analysis of news and fundamental data, and be consciously aware of the reality of trading.

Preparing your mind for the battle of trading is essential for success. The battle consists of you vs. your own emotional urges and impulses, so essentially you are battling yourself… not other traders like many people seem to think. You need to enter the markets with a clean mind, free from confusing trading systems or over-analysis of news and fundamental data, and be consciously aware of the reality of trading.

You can prepare you mind by accepting the true nature of trading and the reality of what is possible given your individual financial situation. If you have a $1,000 trading account, you aren’t going to earn enough to live on and quit your job, it’s just that simple. You need to focus on the mechanics of proper trading and proper forex money management first, and then the money will come. Most beginning traders do the opposite; they focus on the money first and proper trading and risk control techniques later only after losing more money than they care to admit.

The best traders do not care if they win or lose on any given trade, because they are aware that trading is about proper execution of their trading edge and proper risk management, and they know that losing some trades is just part of the game. Another reason successful traders do not care if they win or lose on any given trade is because they don’t put unnecessary pressure on themselves to make a certain amount of money. Trading is profession where you never know for sure how much you will earn each month, so you have to learn to master your trading strategy and follow it to the T, whatever gains you make on top of that should be seen as success.

When you enter the market with unrealistic expectations about how much money you can make given the amount you have to trade with, you set yourself up for failure right out of the gate, obviously this is not the best way to get started. Also, when you put pressure on yourself to make money on every single trade you are setting yourself up for failure. You need to approach the markets from a realistic attitude about what’s possible with the money you have available and given the fact that you MUST manage risk effectively on every trade, if you can achieve and maintain this attitude, you will develop an effective trading mindset.

Being mentally prepared for trading on an on-going basis

What happens when you fall off the track and your emotions get the better of you in the markets? You know when you spin out of control and lose a bunch of stupid trades in a row? I’m willing to bet this has happened to you but only after it’s all said and done do you realize the mistakes you’ve made.

The way around committing these huge emotional trading errors is to make sure you are mentally prepared not just as you start trading, but every time you trade. You need a Forex trading plan to condense all of your trading strategies and money management ideas into one concise and practical format. This will give you a framework to base your trading off of and will hopefully act as a guide to keep your mind on the right track. You need to include your trading strategies, your money management plans, and any important insights for staying motivated to remain disciplined.

The next thing you need to employ to help you remain mentally prepared on an on-going basis is a Forex trading journal. Keeping a track record of your trading is of paramount importance to your on-going success and to maintaining the proper mindset as you trade the markets. You need to see via hard evidence how your trading is progressing (or not progressing), this will give you some much needed insight into what you are doing wrong or right, and then hopefully you can learn from these insights and become a better trader.

In the final part of this article series we are going to talk a lot more about trading journals and trading plans, for now you can learn more here: forex trading plans and forex trading journals

Part 1 Conclusion:

The art of trading is something that takes time and effort to become proficient at. There’s no “magic bullet” to making money in the markets like so many scam artists and marketers in the Forex world would like you to believe. You have to learn to trade effectively from a real trading methodology like price action, and you have to combine this with the proper trading mindset and the proper tools to help you maintain positive trading habits. You can read Part 2 Of the “Art of Trading Forex” Here

Thanks alot for this article.

Am over whelmed to reach out to this platform because i have been watching à lot of youtube videos and reading some different kind of trading forex books but this one fit my needs.

Thanks a lots Mr Nial

Hei, Nial!

Thanks a lot. I am getting better in trading after reading yr great articles. May God bless u always!

Rikus

thanks Dude,I love the write up, keep up with the good work!

Nial, Your legacy IS being written. Your extravagantly generous spirit and your simple, easy-to-comprehend explanations of a market that requires a prudent and foxy play to capture are a thing of beauty and art. The strategies to approach forex trading certainly require the elements as outlined in “The Art Of War”. Thank you for all you are giving to your trading(warring) community.

Nial Fuller NEVER disappoints. I look forward to his posts each week. He never promises you the moon, but he sure points you in the right direction.

Thanks Nial for improving my trading.

Hi Nial and thanks for the awesome article. Your insight is so much appreciated. Thank You.

love all your articles…Keep them coming.. your the reason for my success for in forex.. Thanks again.

Hi Nial,

I bought this book by Sun Tzu earlier. There are couple of usefull thoughts for trading. I especially appreciate tactical part of book:

The good fighters of old first put themselves beyond the possibility of defeat, and then waited for an opportunity of defeating the enemy.

To secure ourselves against defeat lies in our own hands, but the opportunity of defeating the

enemy is provided by the enemy himself.

Thus the good fighter is able to secure himself against defeat, but cannot make certain of defeating

the enemy.

Hence the saying: One may know how to conquer without being able to do it.

Nial,

If I could trade like you write I would be wealthy. Thanks again for the article and your sharing. Larry

Am so motivated by your writeup! Thanks for preparing many for this profession which needs discilpine,playing by the rules for there are no short cuts to success, thanks and God Bless!

Thanks Nial…

Nial,

Thanks for your sound advice, I KNOW price action is the best indicator, and I KNOW I should be trading the Dailey time frame, but with my small account (under $1000.00), I feel more comfortabe with the 4-hour. Is it practable to trade the daily time frame with such a small acccount?

Thanks, and Cheers,

Ric

Hi Nial,

Your articles being a tonic for me, and refresh my memory each time when i read it…

Cheers Mate…!!

Thank you Master for the valuable article !!

Thanks for the sharing, Nial.

Great article. keep up the good work

Amazing, clear, clever. Thanks one more time to share with us this value information.

I having been looking for an effective method to trade the market for more than a year now,with no success. During this time i new indicators is a recipe for failure,after reading your articles and watching your videos i have no doubt your teaching will transform my mind and my trading into a success. Look for my membership this week.

THANKS Nail,

Hi, nial you are greate,may GOOD bless you for your good work.

Very good advice.

Thanks again for helping me get closer to reaching my goals.

Thanks Nial!

Hi Nial,

Hope you are well. Thank you very much for another superb lesson and for sharing your fantastic insight.

Thank you for all your help

Thanks and Regards

Gurpal

Thanks NIal

This is the most important and best article to date.

Todays’ lesson is to date my favourite. I love Art of War and can relate to the way you apply it in trading. Many thanks Nial.

can i call forex the second game of chess,100% mentally alert thanks a lot for this write up,thanks one more time, to me fx is a cool business.

A very informative article. And I have been through what Neil describes. Be prepared. Know what you are doing. These are very wise words indeed.

That was good motivation I needed that

Nice article Nial – Thanks

Well said…

Your articles are always insightful and timely.I always hear traders say that stoploss orders are a most for every trade but i have had a series of losing trades recently,not because i analyze the market wrongly,but the market moves counter to my analysis just enough to touch my stoploss before moving in the anticipated direction.How do i avoid that?By increasing the stoploss?my stoploss is on the average,30 to 40 pips.

Nice Written!

Thanks Nial, very insightful and food for thought…

Your lessons have really helped and improved my trading strategies. Thank you again and keep up the great work.

Thanks Nial. Again something I’m sure we all needed to hear as a refresher and reminder to what we should continue to incorporate along our path to trading success.

Thank you Nial, it’s always good to read this… Especially before the NFP numbers.

Nial – What A Great Artical.

Success, really… is a mind set. You could be the best chart reader in the world, but if you have not got the will to develop and maintain a successful mindset then you will be bunched with the thousands of average traders out there.

Like I always say – “Be Mindful. Variable by Variable. Edge by Edge”.

I Look forward to part 2!

I concur with Graham, Nial has made the off road adventure of forex trading smoother,

Thanks again,

Filopastry

My Dear ‘Prof” Nial, you have once more given us an ingredient of immeasurable value. If only we(I) heard this TRUTHS earlier I would have gained and not lost much. My true happiness now is that I know you.. Thank you because of of all the efforts you are making to give these wonderful angelic messages.

Remain our blesssing.

Hi Nial, Great…simple and very true explanation…keep it up, please!!!

Regards from

Hamburg, Germany

GlobalTrader

(,”)

You practice what you preach & prove that there is no short cuts to hard work.My hats off for your persurance, patience&politness to Spread the Art of Forex trading.Hope God willing i would like to join your course at the earliest.

Srinivas.

Another invaluable reminder of who and what we are.

It is not nonchalance but really a confidence in what we are doing and the ability to use negative outcomes as further training experience.

I would like to say it’s not the money but the satisfaction of being proved correct.

But being human – I like the ca-ching sound.

And let’s face it – if we were billionaires – we wouldn’t be doing this!

It is a bumpy ride made easier with a great coach and excellent forum input.

Thanks to everyone.

You are a man with an amazing talent Nial Fuller, this article is a work of ‘art’ itself. I am avid fan of your teachings and strategies, soon I will join your trading group and courses, looking forward to working with you to improve my trading. Thank you for your hard work and dedication

Pat