Why Trading ‘End-of-Day’ Strategies Will Improve Your Results

What is ‘End-of-Day’ Trading, what will it do for you and how exactly do you trade ‘End-of-Day’ strategies? Continue reading to find out…

What is ‘End-of-Day’ Trading, what will it do for you and how exactly do you trade ‘End-of-Day’ strategies? Continue reading to find out…

When I talk about ‘End-of-Day’ trading strategies, what I am basically talking about is trading based on the daily chart time frame. We are focusing on daily chart candles that are closed out, not candles that are still open. The actual daily close of the Forex market occurs at 5pm New York time, however, not all brokers provide charts that show the 5pm New York close. To make sure you are seeing the true daily close of the market, you need a broker that offers 5 daily bars per week that close at 5pm New York time. Here’s a link to get the right charting platform – New York close charts.

What will trading end-of-day do for you? Well, if you actually do it, it will improve your trading results and greatly simplify the entire trading process. It does this through several channels; it reduces the amount of time and number of variables needed for trading which helps to naturally form the correct trading mindset because you aren’t watching charts all day (most traders’ downfall). Watching charts too long is what causes you to over-think and over-analyze and ultimately over-trade (and lose money). End-of-day trading also naturally helps you with money management and trade management through the set and forget trading approach that goes along with it. It helps to eliminate much of the second-guessing, confusion and emotion that plague most traders.

Essentially, end-of-day trading gives traders a framework, that if properly utilized, allows them to avoid most of the trading mistakes that people make simply due to how we are wired. We are pre-wired, if you will, to seek pleasure and avoid pain, it’s in our DNA. This has served humans well for many, many centuries. However, in the modern world this type of wiring can cause many problems, especially with trading. For example: we naturally want to trade often because it makes us FEEL safe and ‘in control’ and it gives us an injection of endorphins when we hit the buy or sell button because we are full of the hope that we will hit a winner. Then, when that trade turns against us as it sometimes does, what do we naturally want to do? Avoid pain. So, we close the trade out for a small loss, only to then see it move back in our favor and go on to be a would-have-been winner, how frustrating! This is just one example of how we are wired to self-destruct in the market, there are many more.

So, what does end-of-day trading do for you? Multiple things, but perhaps the most beneficial is that it gives you a framework to help you circumnavigate your own tendencies and ‘faulty’ trading wiring. Read on to learn more…

Who’s really in control? (you or the market)

The only thing you can control in trading is yourself. If you over-trade and trade like a machine-gunner rather than trade like a sniper, you are not controlling yourself and you will end up being controlled by the market. The market can affect your emotions in very negative ways that cause you to give your money to it very quickly. The only way to counteract this is by controlling yourself.

The reason many people are attracted to day trading is because they feel more in control of the market by looking at smaller time frames and jumping in and out of positions frequently. Unfortunately for them, they have not figured out that they have the same amount of control as the swing trader who may hold positions for a week or more and only looks at the market for twenty minutes a day or even less. Neither trader has any control over the market, but day-trading and scalping gives traders the illusion of more control. The only thing we really have control over in trading, is ourselves.

What is a good approach to make sure you are controlling yourself and not being controlled by the market? End-of-Day trading!

Here’s how it’s done…

How to trade End-of-Day…

The best way for me to ‘explain’ how to trade end-of-day strategies is to simply show you. The proof is in the pudding, so to speak, so let’s take a look at some of my favorite price action signals and how you can trade them in an end-of-day manner.

OK, first off, we are going to check out how you can trade end-of-day with my inside bar price action pattern. In the chart image below, notice we had an existing up trend before the inside bar(s) pattern formed, and we typically like to trade inside bars with the daily chart trend, so we were looking good. Also, of course, notice we are on the DAILY CHART time frame and the inside bar pattern was closed out before our entry, so we were trading end of day.

Now, here is where the REAL POWER OF END-OF-DAY TRADING comes in…

In the above inside bar example, you will notice that the trade worked out nicely. This doesn’t always happen of course, because winners and losers are randomly distributed for any trading strategy, but in this case, it was a winner. The most important thing to notice is that you literally had to do nothing but place your entry order, stop loss and profit target and the market took care of the rest. You could have literally gone on a 7-day, 6-night Caribbean cruise, not looked at your trade and come back to a 5R winner by employing set and forget and trading this chart end-of-day.

You have eliminated the most difficult element of trading; trade management. You’ve taken your human emotion out of the equation by trading end-of-day and setting everything up in advance and just letting the trade run. The results speak for themselves!

Let’s look at another example…

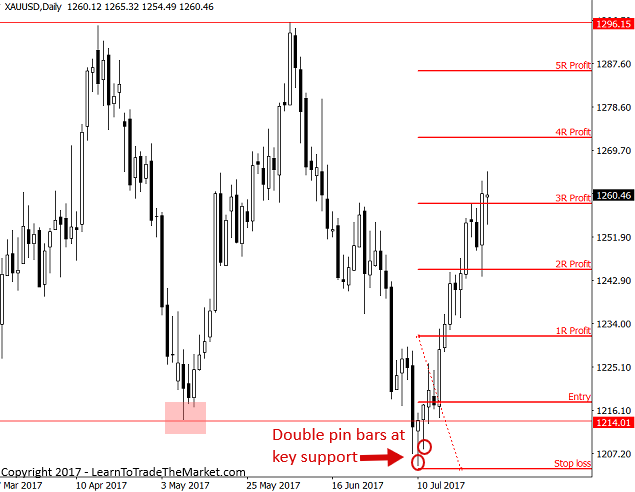

Now we are going to check out an example of trading the pin bar trading strategy in an end-of-day manner…

In the chart example below, we had a solid and defined trading range in the Gold market when we got a daily chart pin bar buy signal at the bottom of the range (key support level). Actually, we got back-to-back pin bar buy signals at this key support level, so we had plenty of confirmation and confluence for a nice end-of-day trade entry. Coincidentally, we did discuss this exact pin bar setup in our daily members market commentary the day it formed as a potential buying opportunity.

As of this writing, a solid 3R profit was possible from this trade setup, without any involvement needed on your part. You could have entered this trade and let it sit, come back 11 days later and you had a 3R profit in the bank. Now, how easy is it to ignore the market for a week or two while your trades play out? Perhaps not as easy it sounds, but if you want to trade end-of-day, you must believe in the power of patience, in other words, you have to fight your own desire to over-analyze, over-think and over-trade, and you will come out WELL ahead of 90% of most traders.

Before we move on to our next example, here is a little-added benefit of daily chart or end-of-day trading that whilst obvious, needs pointing out…

Many traders prefer to trade off these daily chart signals because it is a less stressful way to trade since you don’t have to ‘wade through’ hours of less-significant price action. Think about it, would you rather sit at your charts trying to find a ‘needle in a haystack’ on the 5-minute charts or sit back and analyze the daily chart time frame and only focus on obvious end-of-day setups?

Don’t be fooled into thinking there are more ‘opportunities’ by looking at the short time frames, it’s just not true. There ARE more price bars, sure, but are they really opportunities? Or are they just noise? Remember, the higher in time frame you go the more significant each bar or candlestick becomes, and the daily chart time frame is truly the sweet-spot for a trader.

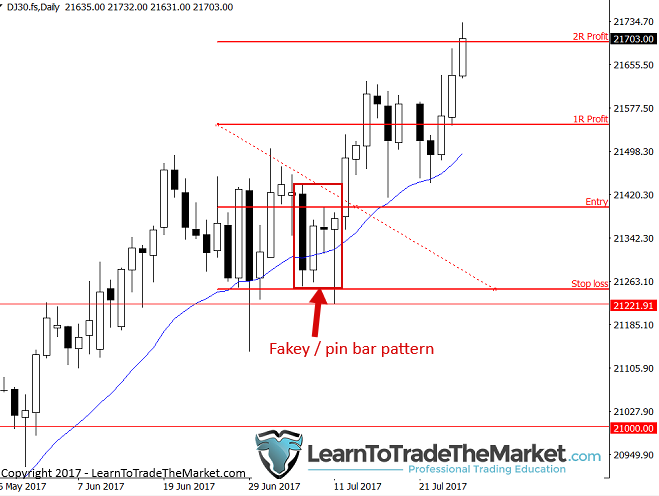

Let’s look at an example of trading end-of-day with the fakey pattern…

In the chart image below, we see a fine example of a fakey pin bar combo pattern which formed in-line with the underlying daily chart uptrend in the Dow Jones Index.

Had you entered this fakey near the breakout of the inside bar or pin bar high and stop loss below the mother bar low, you would currently be up a nice 2R reward. The ‘catch’, if you want to call it that, is that you had to sit on your hands for about 10 trading days before you realized that reward.

Most traders were over-trading and blowing out their accounts during those 10 days. Do you want to be the trader who is patiently waiting for high-probability trades to play out, like the ones above, or do you want to be the trader who is trading intra-day during those 10 days? I can guarantee you the trader who entered one trade and waited patiently for it to play out was FAR better off than the guy who day-traded that whole time.

Conclusion

You now understand why end-of-day trading strategies can significantly improve your results in the market, and you also have a basic understanding of how to trade end-of-day. I don’t want to sound like this is easy, but it is far easier to trade end-of-day than the way most traders trade. Most traders trade way too much, they meddle too much with their trades and they expend too much mental energy on their trading. This leads to losses, losses and more losses.

The difficult part of trading lies in conquering your inner demons, not in finding entries or in comprehending how to read a price chart. What I have laid out for you in today’s lesson and what I explain in much greater detail in my trading course, is exactly how I use end-of-day trading strategies to circumnavigate my own faulty human wiring (we all have it) as it applies to trading. By controlling myself and only focusing on that, I can truly take advantage of the incredible opportunities the market offers me, however frequently or infrequently that may be.

I WOULD LOVE TO HEAR YOUR COMMENTS & STORIES BELOW :)

QUESTIONS ? – CONTACT ME HERE

Hi Nial. I am from Namibia (Africa) and to tell you the truth I’ve blown accounts since 2020 to date. Am a self taught forex aspiring trader who has challenges in form of phones, or internet a laptop. I use public library computers to analyse and place trades only to come back some time later and find it either in crazy reds or hit SL. Its a painful experience but i thank God that i come across people like yourself who drop free valuable contents on internet. I add more value to some of us who are not able to afford courses at the same time you inspire. Even as i write this comment, am doing it from a library computer. I have fallen in-love with Forex, I’ve developed passion for this, over the years I’ve invested in acquiring understanding and knowledge and encountering you is a plus for me. I’m a high-school drop out not by choice though and when i discovered Forex back in 2017 i decided to invest my time in getting knowledge the skills. I’m an Orphan, grew up without a mother or father and ever since i came across Forex i knew this was my answer to change my story. Others had opportunities in form of completing school, further studies or funding of businesses, but as for me i knew this was my answer. Though my current social status show nothing like a Forex trader i thank God for the knowledge and little understanding which you add daily to my market knowledge. Thank you

This is a amazing and clear strategy that provides with profitable setup thank you sir

The hardest part of “End-of-Day” trade is the emergence of pattern is limited. Maybe once two months. The circle of “feedback-adjust-prove” takes too long time.

Nice article

Thank you NF for this wonderful piece. But my concern is about the opportunities in end of day trading. It seems insignificant unlike d intra day trading. Any help here? Thanks.

Mr. Nial! article is excellent, itself I study on this strategy, thank you

Excellent article Mr. Nial! very good strategy, thank you

Hi Nial, thank you for wonderful article on trading daily timeframe. You did mentioned that you do about 4 to 5 trades a month and unless you are trading standard lots trades, your gains will not be large. So, how does the average trader makes money trading daily timeframe?

I don’t think the lot size is relevant, the only relevant point is will the trade/strategy be profitable. Because, once you have mastered a solid strategy/edge in the market, then the profits take care of themselves over time. 5 trades in a month is more than enough to start building an account. A small account or a large account, small lot size or big lot size, does not decide your success in trading, your ability to trade does. Money will always find a good trader.

I tend to agree with you. If you have patiently waited for a good signal and entered the market at the right time you should not be worried about the lot size.

thank you so much sir

The Forex market pays very well for patience. Excellent article. Thank you Nial

Patience! Patience! Patience!

I cant wait to learn from your next article Nial. So educative indeed

U hve given me the key to my forex success . I like ur articles. Tank u

Daily charts help a lot. Thanks Nial.

https://www.learntotradethemarket.com/forex-trading-tools/risk-reward-tool-metatrader

Sounds great,Nial…Really perfect idea, didnt occur to me…

Great reading Nial. I liked the sound of end of day trading.

Love this strategy, I am surprised not to see an Engulfing candle entry?

Oh thank you Nial this has opened my eyes the more on the end of day tradin strategy. Meanwhile considering financial news during this periods when ones order has been triggered how should a trader act to that?thanks

THANKS

thanks

thanks nial fuller .i want to learn from you some things

Very Cool

Hello Nial, thanks so much for your articles, they are really helpful. I would like to ask if your 3 main strategies,(ie Inside bar; fakey and pinbar) work well on smaller time frames like H1 and H4? Again i would like to ask if there are any links which expalin your 3 strategies a bit deeper as i do not have money to join your community yet.I have USD100 in my MT5 account. Cheers!

thanks Niall wonderful as always. its true the hardest part of trading is to prevent yourself from trading WHEN THERE’S NO SETUP. It took me years discipline myself due to lack of knowledge in this. It hits me when I stopped trading, shift to Daily chart, and focus my trade on Tuesday – Thursday where its easier to make a profit (according to my own research). Thank again and looking forward for your next article. :-)

Carl Hammet

Great and very informative article. I must admit my serious drawback is my lack of confidence /cowardice. I tend to panic and close my trades early, only to realize that if I had the courage to hang on i would be doing much better.

Thank you Nial my trading skills have improved because you this days, i analyses almost like you. there is a huge from my account since i read you article. even if still panic

God Bless you, thank you.

great post!! patience is the key

I love how frequently you post new lessons, Nial. It is enormously comforting, as well as being the oxygen feeding the flames of positive thinking; giving rise to overall success in the markets. Thank you, thank you and thank you.

Nial, you are one of the most serious and trustworthy traders out-there, giving so much useful information to wannabe traders for free; this clearly states you are very profitable as a trader. Please stick around, people like you are a blessing for forex newbies.

Clear & very enlighted articles. Thank you. Btw may I ask 1 question, in your Pinbar example with the Daily Charts you just using only EMA 21 By Close, where is the EMA 8 by Close ?

Hi Thanks Nial for good article just question when candle is closed in and of the day then look to enter setup I meen late evening in Europe.

Great masterpiece as always from the Guru down under! Pure piece of mind. Pure genius!!

Thanks, Nail for the good write up. Trading using the daily chart really help eliminate the risk of over trading and busting your account.

Hey Nial,

Thanks for next portion of sound knowledge.

Dont’t you think that this approach requires to have a larger amount of money to be risked for 1R if we want have significant profits?

Or alternatively requires to follow many more markets/currency pairs?

Thank you Nail for this article.

Great article Nial and I agree wholeheartedly this is the only way to trade, takes the stress out of trading and gives the results as you have shown above.

N.F i can’t thank you enough. To be frank everyday I read your articles I gain something out of them such as confidence, patience and many other thing. End of trading together with TSL works. This year I opened real account and I understand market trading because of you Fuller.

Thank you so much and God Bless You.

Thank you, Nial…Learning much from your article…

Nial thank for your sharing. Could you provide more method trade when down trend?

Thx

Thanks Nial for a great article.

It is the truth without dispute.

This makes everything clear to me now how to “Trade End Of Day Strategy”. This is what I miss to do in my trading. Hopefully this coming month, my trade will improve much better and my capital will start to grow. Thank you Mr. Nial Fuller for your very clear sample of each strategy. God Bless!

Great article thanks Nial

Hi Nial, your article is so interesting, may I have your advice- my timezone is GMT+2, how can I trade end of the day strategy cause 5pm New York time for me is 12pm in South Africa

great piece N F, South Africa 12am at New York 5pm

When I was first introduced to the world of trading nearly 6 months ago, my heartbeat, nerves, emotions, breathing and adrenaline showed the same pattern and speed up and down as the lower time-frame candlestick charts. I did not understand how people could sit infront of there screen watching this for a whole day. I had come almost come to the conclusion that trading was not going to be my thing and then I came across your website and articles. I felt such relieve to read that there is another way to learn to trade. I have been a fan ever since and never been more chill while trading. From the bottom of my heart, I thank you for all your knowlege you share and provide to us. I am no master yet, but I have no doubt I will manage in the long run and I am enjoying the process.

Thank you very much Nial.

Awesome article Nial! I have been trading some of those trades above i.e. gold and pound based on the daily but got out too quickly because I saw “warning signs” on the 4 hour. Thanks to the above article I will stick to just what the daily says.

Thanks, Nial :-)

Thanks Nial for those insights

The greatest challenge I face in my trading Carrie is the demons in me, the way I can overcome is by applying the end of day trading strategy. Thanks so much

Thanks Nial for this great article. You’ve completely changed my trading perspective. My trades has improved dramatically.

Big fan of you from Iran

Hi Niall. Great article as always. I tried to be a trader daytrader but after 4 years I realized that I do not have a chance to do it. I started trading some time ago like my friend who sent me your Niall site. And since I started trading from h4 to d1 interval. My trading is finally starting to look better. The only thing I do not agree with is ignoring the macro economic calendar data. I learned to read this data and which are really important. Thanks to that I manage to take the profits in time before giving the market what he worked for me.

How did you achieve this? Do you mind sharing with us?

Thank you

hi Nial,i got few question about how you trade,do trade only during US market open or only end of day of the week.thanks alot

Still learning big from you man

Since I started to read your articles my trading skills improved a lot, trading daily charts avoid many things like over trading, noise in the market etc. Using Trend, Level and Signal in daily charts make me win 3 trades in the row and it allow me naturally to trade like sniper , it works. Because i work as a teacher i just place my trade and go to work ,that is set and forget after identify trading edge . THANK YOU NIAL FULLER FOR BEEN THERE FOR ME…… South Africa

Thank you, Nial, for another one amazing article.

Thanking you Nial.

Tq sir for the great art of trading…

This is true most traders trade to much and end up making loses and most of the time I give up to early only to realize that if II made a big sellstop may be for week the trade was going in my favour. I like how you analys this strategy

Thanking you Nial Fuller

Slow but sure I am learning a great deal from you.

May God bless you.