Why Swing Trading Gives You The Best Chance to Succeed

If trading seems frustrating and difficult to you, don’t worry, you are not alone. Many traders, if not most, begin their trading careers with lofty goals and a full tank of hope, but those things can fade very quickly if you aren’t approaching the market from the right ‘angle’.

If trading seems frustrating and difficult to you, don’t worry, you are not alone. Many traders, if not most, begin their trading careers with lofty goals and a full tank of hope, but those things can fade very quickly if you aren’t approaching the market from the right ‘angle’.

At Learn To Trade The Market, we take the view that whether or not a retail trader (like you or I) achieves consistent success in the market depends heavily on which method the trader uses. That is to say, we believe if you are trading with the wrong methodology, there is no way you will ever make money, even if you’re doing everything else right.

Trading success is the end result of getting the “3 M’s” right; Method, Mindset and Money Management. You cannot succeed with only two of the three; you must have all three down pat.

In this lesson, I want to focus on the first M; the Method that will give you the best chance to succeed at trading. You need to understand which method is the best, why it is the best and how you can master it, so let’s get started…

Swing Trading: The retail trader’s only real chance

I won’t lie to you; as a retail Forex trader, or a retail trader of any market really, there are multiple ‘forces’ working against you, which you may or not have been aware of until now. To be honest with you, you are a one-man (or woman) team when you’re a trader, and unless you have access to extremely large sums of money / the ability to withstand large drawdowns, you are not going to last very long if you don’t employ the proper trading method.

The big players in the market, like banks, hedge funds, etc. know where smaller retail traders place their orders and what they typically ‘do’ in the market (buy breakouts, day-trade, etc.). They know all the small-timer strategies and believe it or not, they enjoy taking your money every day in the market. You can’t survive without a stop loss, but they can, or at least they can for much longer than you or I and this is why day trading is dangerous; because traders put very small / tight stop losses on their positions they often get stopped out by normal daily price fluctuations in the market.

I’m not going to say that your broker ‘wants you to lose’, but I think saying they want you to day-trade is a fair assessment. Why do they want you to day-trade you ask? Well, for one you will generate a lot of fees in the form of spread payments or commissions, and two, you will lose a lot of trades for the reason I discussed in the previous paragraph. In short, day-trading is a fool’s game that sucks people in by appealing to their greedy / impatient desire to make ‘fast money’.

On the opposite end of the trading scale, we have position trading or investing, this is basically long-term buy and hold strategies that whilst they may pay off when you are ready to retire, they are not suitable for anyone looking to make a living as a trader, like you and I.

That brings us to what I call the trading ‘sweet spot’; swing trading. If you don’t already know, here’s what swing trading is: Swing Trading is a method of technical analysis to help you spot strong directional moves in the market that last on average, two to six days. Swing trading allows individual traders like us to exploit the strong short-term moves created by large institutional traders who cannot move in and out of the market as quickly.

What is a ‘swing point’ in the market?

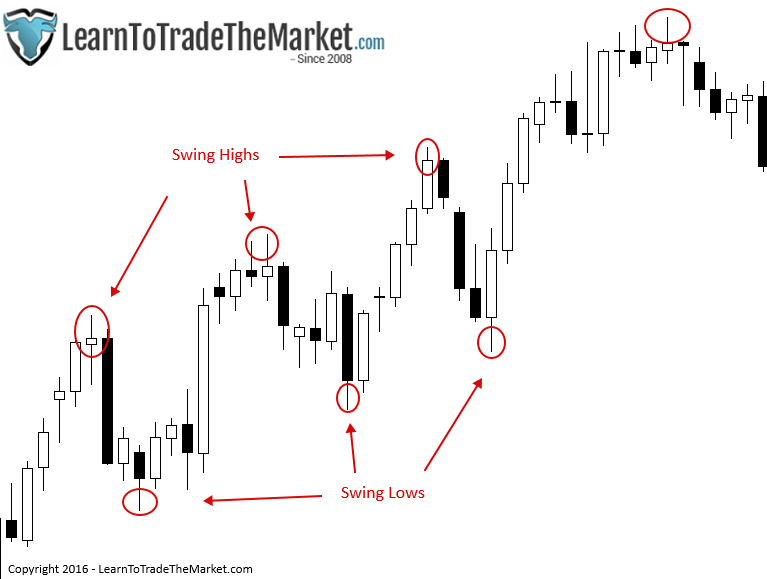

To put this in a little simpler terms, I’m assuming you have looked at a basic price chart before. If you have, you probably noticed that markets don’t move in straight lines for very long. Instead, price will ‘swing’ from high to low points in the market. Especially in a trending market, these chart swing points are critical points on a price chart where we can anticipate a price action signal to form at, and that often provide high-probability entries just before a trend is getting ready to resume.

The chart below shows us what swing high points and swing low points look like. This market was trending higher, so as swing traders we would have looked for an entry near the swing lows…

Swing trading is the art and skill of reading a price chart to anticipate the next ‘swing’ in the market. I use price action trading strategies to find high-probability entries in the market at these swing points, you may see me refer to this as ‘buying weakness’ or ‘buying the dips’ in a rising market and ‘selling strength’ or ‘selling the rallies’ in a falling market. This terminology refers to the general approach that a swing trader uses; buying as a market falls down and hopefully buying the swing low point (or close to it) within an up-trending market, the opposite would be the case for a down trend of course.

Other reasons why you should become a swing trader

Now that we’ve discussed what swing trading is and the main reason why you need to learn it and make it your trading method, let’s discuss some of the other benefits of it.

Daily charts

As I’ve written about at length in other articles; when you trade the daily chart time frame as a swing trader does, you are reaping many benefits compared to those poor souls who still believe scalping a 5-minute chart is the key to success.

One of the reasons why swing trading is such a huge advantage to the retail trader, is that it allows you to skip all the market ‘noise’ of short time frames, like those under the 1-hour chart. Brokers and the big institutional traders WANT smaller retail traders to trade short time frames and day-trade / scalp, because they know they will get your money easily if you do.

Swing trading on higher time frames like the 4 hour and daily allows you to piggy back off the big moves created by the bigger players in the market, and it also allows you to place your stop loss outside of their reach, thus giving you greater ‘staying power’ so that you can stay in the market longer and increase your chances of getting aboard a big, profitable move.

Fit trading in around your schedule

Swing trading allows you to fit trading in around whatever busy schedule you may have, or if you don’t have a busy schedule it will allow you to make money trading and still enjoy your free time. There’s nothing more boring than having to sit in front of the charts all day, not to mention that it’s bad for your trading and your health.

Swing trading allows you to analyze the markets on your schedule, for short periods of time, because you are focusing on higher time frames as mentioned above. Also, because you are holding your trades for a day or more in most cases, you can enter a trade on a Tuesday let’s say, then go to sleep and wake up a day later and check on your trade. You do not need to sit there all night worrying about your trades, nor should you. An almost ‘magical’ thing happens when you stop paying so much attention to your trades; you start to see better trading results.

People over-complicate their trading by simply being too involved. Swing trading is the best method because it’s complementary to how you should behave in the market because it rewards you for being less involved and taking less trades over time, which is exactly what you need to do if you want to have any chance at success. The take home message here is, swing trading will help you avoid over-trading, and over-trading is the biggest reason why people lose their money trading.

Conclusion

Don’t be fooled by the marketing and gimmick trading systems out there. If you’ve been around the trading block a few times already you probably know what I’m talking about here. There are a lot of promises and guarantees out there in the trading world, but the question you should be asking is not about guarantees but about the method itself. Is the method actually going to teach me to understand a price chart and how to catch big moves in the market? Is it actually going to teach me how to trade properly? These are the types of questions you should ask yourself about any trading system or education you are considering, because these are ones that matter. Do not fall prey to big claims of fast money and fully-automated trading robots; remember, if it sounds too good to be true, it probably is.

In my price action forex trading course I teach my students the same swing trading techniques I have used to trade with for the past decade… methods which have stood the test of time across a range of different markets and conditions.

Strongly agree! About two years now I have been struggling to change my 9-5 to day trading, even testing half day off and half day trading – but no way – I now understand trading can`t be your bread and butter and just simply it`s also some type of investing and where are chances are bigger during swing trading, rather wasting a time on the screen for whole day waiting for the setup which you are not even sure if it ever exists better just spending that time for some useful thing.

Strong article!

Just a simple article and straight to the point.

It is an excellant Presentation to follow If we wish to succeed. There is nothing to learn more than Swing trading to achieve our trading goals in Forex Market.After reading your article

I was astonished at the results after following your Swing Trade set ups. I thank you for the

excellant presentation. I am following weekly chart and making entry points with Daily chart

with your Swing Points Set Forget Mode.within Five days astonishing results. I am blaming

myself for the foolish searches I made till now and got negative results.Your article gave me

path breaking success and I am marching forward with good results.

Thank you once again

I am un stock market since 6 years, I was a breakout or momentum trader and during the frequency of getting hit the stop is more while in swing if you trade with the main trend or in a range (if a stock is in a range) your stop gets hit very rarely. Even if I dont achieve my target still I dont have to loose much while swing trading. The only point I dont agree with author is holding period coz if the trend is strong and I am in the direction of the trend then hold at least 33 to 50% of position for 15 to 20% gain (in stocks).

Nial great article as always … let me just add that the reason people lose money on 5 minute time frame is because things happen way too fast for us to decide correctly … however if you run a computer program to place, monitor and close trades on set criteria 5 minute TF can be very profitable on daily bases. Such computer programs can be bought, however a lot of them are either scams or don’t work very well … I decided to dedicate my time to learning about Forex but also to learning how to design such programs because eventually I want to leave the computer behind and let it do it’s work, too much screen time is not living ;-)

Why would you want to have too much screen time with the noisy 5 min TF when you can do better on Daily chart TF? You said it yourself that too much screen time is not living; so I bet the only thing stopping you from switching to longer time frame (H4 at least) is GREED.

The sooner you eliminate that the better.

You’re simply wasting time on trading programs. Only way for you to make profits, is to master your trading strategy.

Thanks Nail

Hello:

I want to learn your trade video very much, but I don’t understand English, if only video with Chinese subtitles.

Thanks Sir

Thank you Nial once again for a very insight article especially in regards to beginning traders like myself.

Hi Nial

You are perfectly right. Months ago I had 68 trades in a month and

if I subtract the weekends, I had 68 trades in 22 days. The result… I lost

90% of these trades.

Following your instructions from the course I changed to swing trading

and the results were just Great !

Thank you for your sincerity and your knowledge

Alf Garcia

Excellent article. Thanks so much for your time and effort to write these snippits of valuable information.

Thank you for your article .

Hello Nial,

This lesson on swing trading is a great eye-opener which every trader who wants to make real profit needs to read. I thank you so much for such great lessons. God bless you.

Great timing on this article Nial.

Thanks much.

Thank you, Mr. Fuller for all your eye opening articles for making me a better trader. I really appreciate your mentorship. Again thank you sir.

Love it as usual. Thanks

Great, you are always on point. Out of the 3 M’s the most important is the mindset, the others you can learn but the mindset is your magnet, your focus, your discipline. which will attract success or failure. My 2 cents. Cheers

Sometimes I wonder what to call Nial-an experienced and wise trader?Sure.A trading psychologist?O yes.A philosopher?Really!It is difficult to say this or that article is Nial’s best.They are all beautifully written and well thought out.

Nonetheless,I am convinced that while swing trading under the higher time frame say 4H and above is perhaps one of the safest styles to trade,I know by experience that lower time frame even as low as 1 minute time frame with its rules and in the direction of the higher time frame above yields no less amazing result though more involving.

It is definitely as easy to blow up an account on 1min time frames as it is on daily charts.

This i would agree with. But i do find it hard to believe that anyone can produce the same results of a Master Traders like Soros, Jones, Lipschultz, etc, trading these lower time frames especially 1min. Trading at the best of times is equivalent to walking over a canyon with a narrow wooden bridge and a mile to bottom. Trading 1min frames is equivalent to walking over the same canyon on a piece of wire. So to hear people are producing the same results as the traders mentioned above or any professional for that matter, on those shorter time frames is a bit of a stretch for my imagination. Contradicting the article with over whelming evidence that trading trends and swings is the only logical method to produce consistent as a retail trader, seems to me to be a miss leading statement for fellow traders to read.

very helpful article.A real trader.

i love this

very informative

Deciding to choose your swing trading method of trading has liberated my trading habits and now I have the freedom to work and play while practicing the art of reading the markets from naked price charts.

GREAT ARTICLE MR. NIAL…..EDL

Really good read this was and informative. Thank you.

Very good article and straight to the point. Thanks Nial

Love this lesson Nial , i like your no BS approach.

Great article. I have traded the short term charts in the past and have felt and seen exactly what you are talking bout. I just purchased your program and I’m take a completely different approach to trading this time.

It interesting to follow yr method thx.

Excellent Nial. You are helping me to build my brain muscle every week :)

Very timely article. It was like u were watching everything I did wrong!

Nice article. Thanks Nial.