6 Types Of Tailed Bar Candlestick Trading Strategies

Tailed bars are the most important bars on a price chart. Plain and simple. The reason they are so important is because they often give us a very strong clue as to what price might do next, more so than any other type of price bar.

Tailed bars are the most important bars on a price chart. Plain and simple. The reason they are so important is because they often give us a very strong clue as to what price might do next, more so than any other type of price bar.

Today’s lesson is a summary of my favorite tailed-bar candlestick patterns. These are the same patterns that I look for when I analyze the charts and that I trade regularly. You will learn what these patterns look like and how to identify them as well as what they mean. This will be a great introduction into different tailed bar candlestick strategies for beginners, but also, it’s an excellent refresher for those that already have a basic idea of how I trade and what I look for on the charts daily.

This lesson does rely on you knowing the basics of candlestick charts and candlesticks however, so if you aren’t too familiar with this topic then please checkout my candlestick chart tutorial for more information. I am not going to go into detail on specific entry and exits using the patterns discussed today because that is a whole topic unto itself, but I do expand on this in great detail in other articles and in my price action trading courses.

Now, let’s get started in learning about some of the best tailed bar candlestick trading patterns…

What are tailed bars?

A tailed bar is somewhat subjective in nature, but what I mean when I refer to “tailed bars” is a bar with a tail that is noticeably longer than the body or real body (area between the open and closing price).

The tails of price bars, sometimes called shadows or wicks, are important to decipher because of what they show and what they imply. They show rejection of a level or price area and either a small, medium or large reversal that happened quite quickly. This shows us that there was exhaustion at that area the tail formed, which has big implications. When we see an area price is becoming exhausted at, it means there is something happening that we need to take note of. That tail is showing us that either buyers really wanted to buy there, or sellers really wanted to sell, why doesn’t really matter, we only care about the what and the how.

A tail on a bar implies that price MIGHT move in the opposite direction, and soon. This is obviously a huge piece of data for a price action trader, and you can honestly base your entire trading approach around tailed bars if you want. Daily chart bars are, in my opinion, the most important bars and as a result, daily chart tailed bars are the most important bars of all. If you are unfamiliar with why daily charts are so important, please read my daily chart trading tutorial before moving on.

Even if we don’t have an extremely clear tailed price action signal like (my favorite) a pin bar pattern or perhaps a fakey pin bar combo signal, we can still gather a tremendous amount of information from simple tailed bars, which we will go over shortly.

In short, tailed price bars are your friend, perhaps your BEST FRIEND in the market, and I suggest you get as close to them as possible, you need to ‘fall in love’ with them and I suggest you make them the one thing you master to succeed at trading.

Examples of tailed bar candlestick patterns:

The Classic Pin Bar Candlestick Pattern

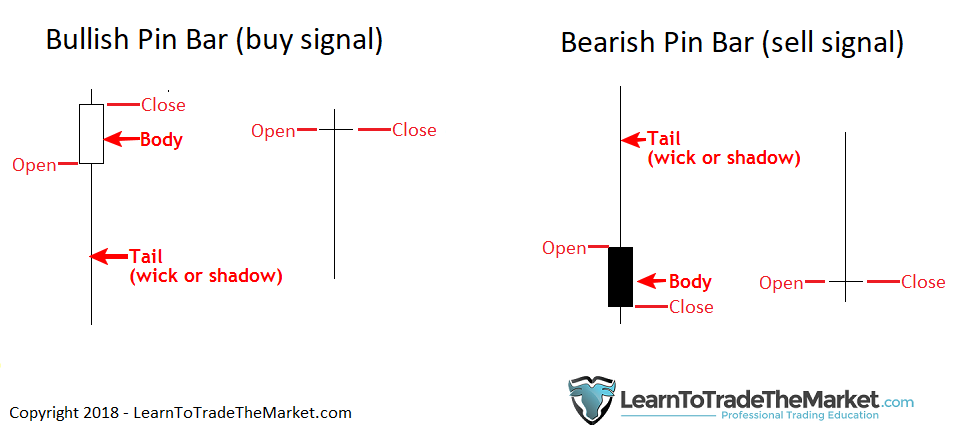

The pin bar candlestick pattern is a tailed bar that shows a sharp reversal in price across the time period of the chart. So, a daily chart pin bar is showing a sharp price reversal during that day period, whereas a 1-hour pin bar shows a reversal in price across a 1-hour period. The higher the time frame, the more ‘weight’ a signal carries, or the more important it is.

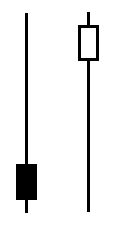

The pin bar typically has a much longer tail than the body, the body is the distance between the open and close. The tail on a pin bar should be at least 2/3 the length of the total bar, ideally 3/4. Sometimes, there is little or no body, as in the second pin bars depicted below. Here are examples of a couple of different looking pin bars that both have the same meaning; a reversal in price has occurred, represented by the long tail. The implication is that price may move the other direction, opposite the tail…

- Here’s a real-world example of the classic pin bar candlestick pattern:

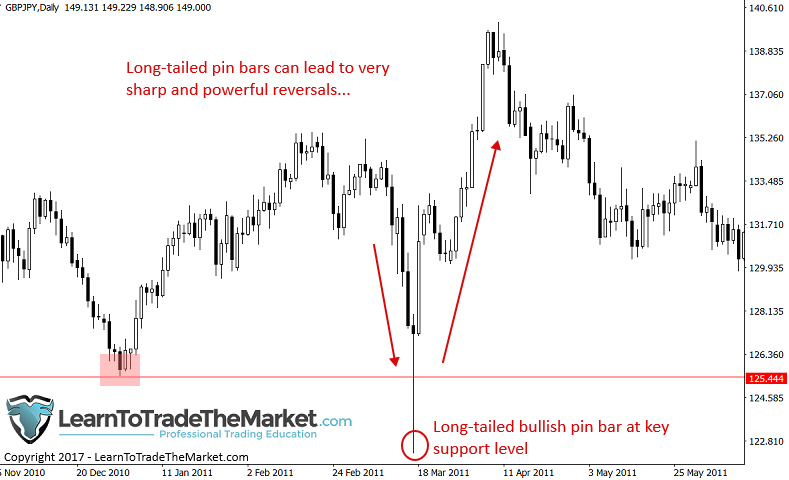

The Long-tailed Pin Bar Candlestick Pattern

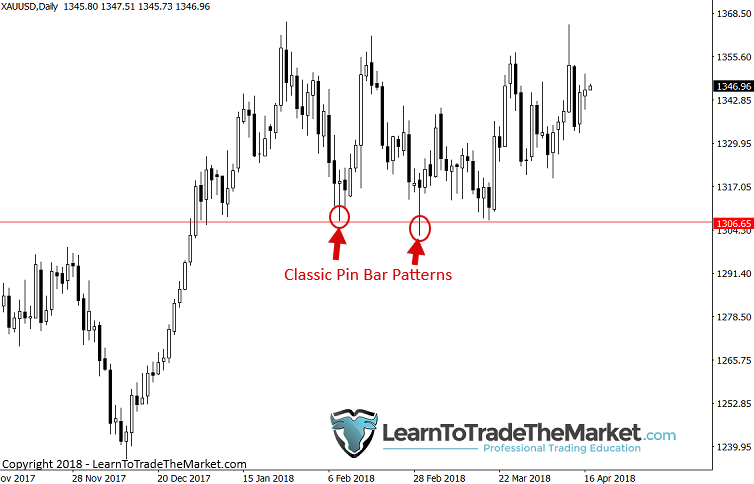

A long-tailed pin bar pattern is exactly what its name implies; a pin with an unusually long tail on it. These are perhaps the most important bars in all of trading, and they are rare as well. When you see a long-tailed pin bar, stop and take notice because it’s a huge clue that price is going to swing in the other direction. Long-tailed pins often mark major directional changes in the market and even major trend changes.

Long-tailed pin bars typically have a smaller real body than a classic pin bar. Their tails are always significantly longer than any nearby bars and as such, they are impossible to miss. They are sometimes good candidates for entering on a 50% retrace per my trade entry trick strategy. Here are a couple of examples of ideal looking long-tailed pin bars. For those of you who are new: Bullish means it’s a potential buy signal and bearish means a potential sell signal…

- Here’s a real-world example of a long-tailed pin bar candlestick pattern:

- Another example of a classic long-tailed pin bar candlestick pattern:

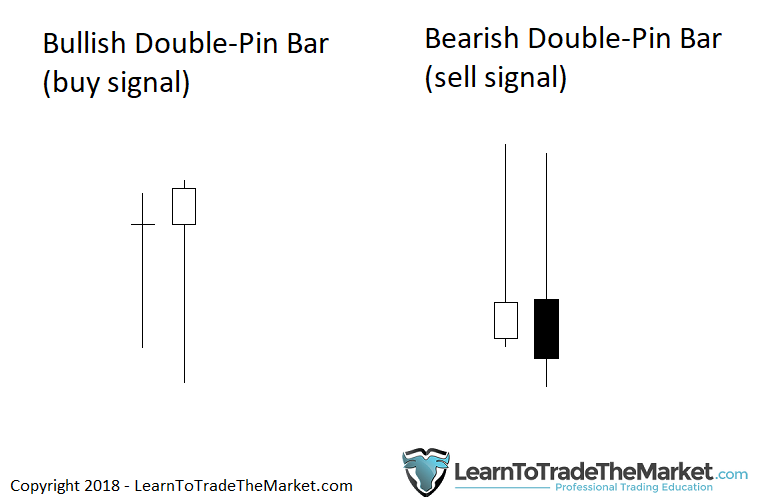

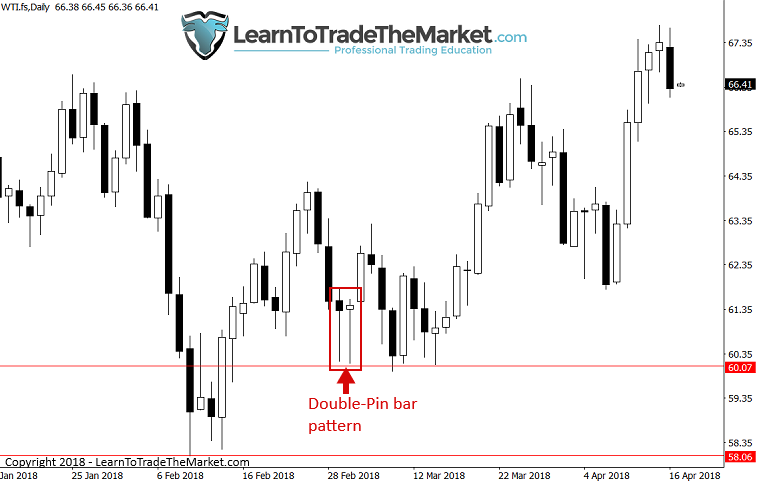

Double Pin Bar Candlestick Pattern

It’s not uncommon to see consecutive pin bars form in a market, often at key chart support and resistance levels as the market is ‘testing’ these areas to see which party is going to win between the bulls and bears (buyers and sellers). You will more commonly see double pin bars or two pin bars back-to-back, but I have even seen three in a row before, but that is rare. Double-pins are something to take very strong notice of because formed within the proper market context and with confluence, they can be an obvious warning signal that price is about to surge the other direction. Here is what they look like…

- Here’s a real-world example of a double pin bar candlestick pattern:

Note: You may notice price just barely violated the lows of the double-pin bar pattern pictured. This happens sometimes and it’s why you need to thoroughly understand proper stop loss placement on your trades before you start trading live. The proper stop loss, a wide-enough one, would have kept you from getting stopped out before the trade went on to be a huge winner…

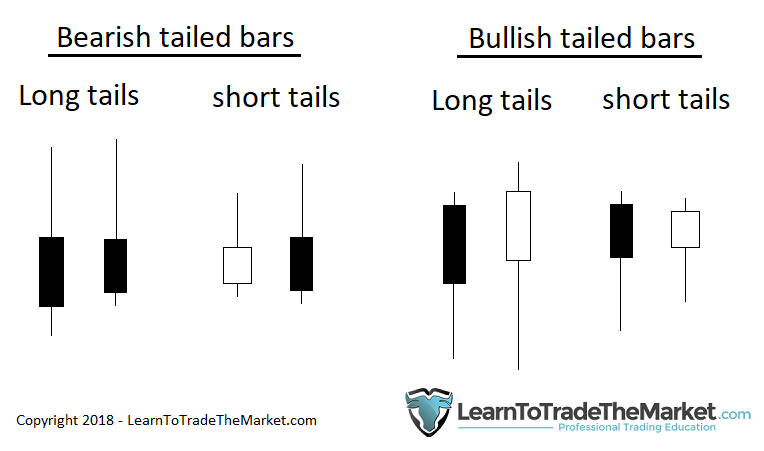

Small tailed bars and Long tailed bars (not pin bars)

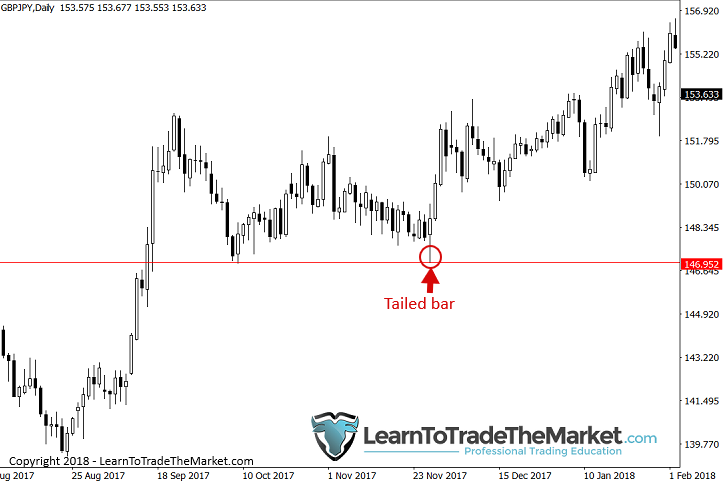

The following diagram shows what I simply refer to as “tailed bars”. These are bars with significant tails but that are not perfect enough to be considered a “pin bar signal”. As I said in the opening; tails are often significant, so we need to look at any tailed bar as potentially having an impact on near-term market direction, even if they aren’t perfect pin bar signals. I have dedicated an entire new chapter in my course to this tailed bar “phenomenon”.

- The chart below shows a fairly ‘classic’ tailed bar. This was a bullish tailed bar that formed at a support level within an overall up-trending market; we can see it lead to a strong push higher. Note, it was not a bullish pin bar because the lower tail wasn’t quite long enough in relation to the body and its upper tail was a bit too long. But, still, the lower tail was long enough to classify it has a “bullish tailed bar” …

- In the next image, you can see the differences between a long and small tailed bar as well as classic pin bar patterns…

Other tailed bar candlestick patterns

There are other tailed bar patterns that I get into more in-depth in my course, but for now, let’s look at some of the more common ones briefly.

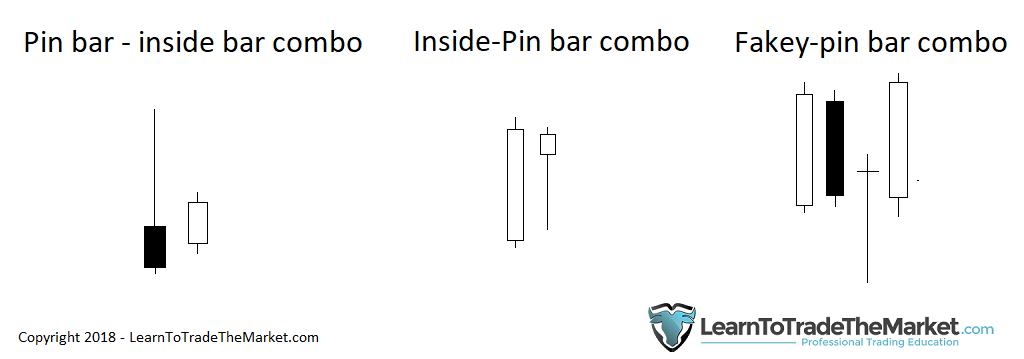

Below, you will see a pin bar inside bar combo pattern, this is where an inside bar pattern forms after a pin bar and within the pin’s structure. Next, you will see an inside-pin bar pattern, now don’t get confused, this is not the same as the previous combo pattern, this is where you have a pin bar that is ALSO an inside bar, so it’s an inside bar pattern where the inside bar is a pin, essentially it’s treated just like an inside bar pattern with a little added ‘weight’ since you have that pin bar as an extra piece of confluence. Lastly, we have a fakey pin bar combo setup where the fakey or false-break part of the fakey pattern is also a pin bar.

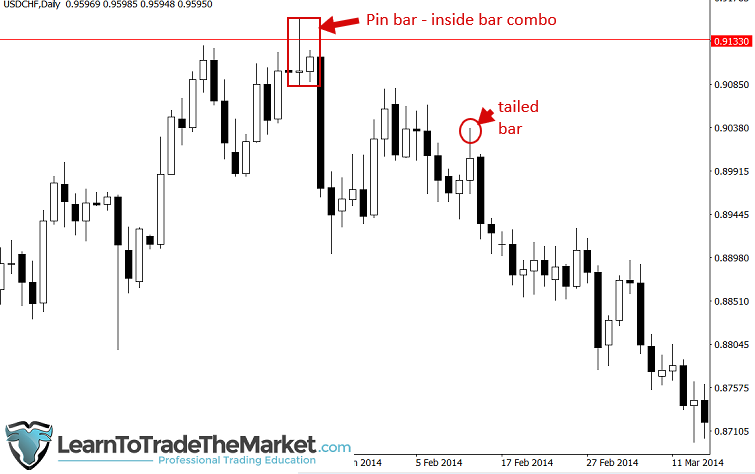

- Below, we can see a real-world example of a bearish pin bar inside bar combo pattern. This led to a large decline as the pattern implied. Also, notice the bearish tailed bar that followed, another nice sell signal in that downtrend…

- Here’s a real-world example of an inside-pin bar combo candlestick pattern:

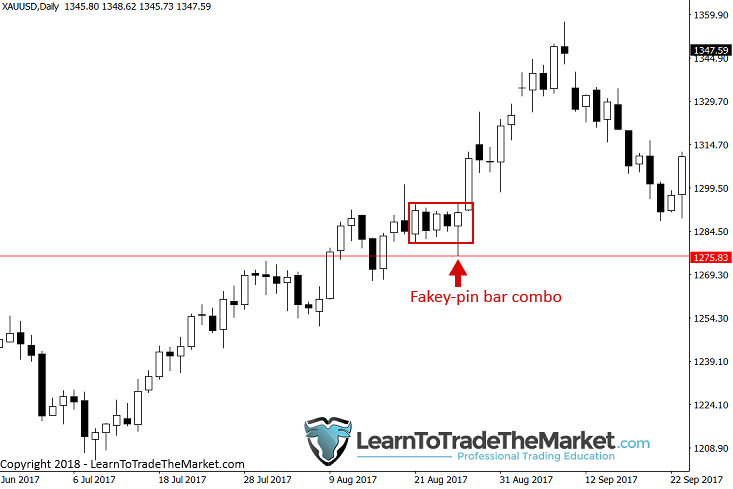

- Here’s a real-world example of a fakey-pin bar combo candlestick pattern:

Conclusion

I hope you have enjoyed this tutorial on tailed bar candlestick patterns and what they mean. It was a brief introduction to these patterns, but you should have learned enough to start identifying them on the charts and practicing them on your demo account.

I get into these patterns and a lot more in much greater detail in my comprehensive price action trading mastery course. We go in-depth on how to enter trades using these patterns, identifying the proper chart context in which to enter them and ‘confirm’ our entry, as well as understanding how to filter the signals in different market conditions. Effectively, I teach you to read the charts from left to right, much like you read a book, which is a key element in profitable trading.

What did you think of this lesson? Please share it with us in the comments below!

Thank you so much I have learnt a lot and I will continue learning from you may God bless you

good to learn

I have studied your professional approach, and it is quite good

Simple, powerful and effective!

It’s such a eye opening message thanks alot

your knowledge was helpful

Thanks for sharing what you know about the market, God bless you sire.

writing far away from Bangladesh..I am a regular fan of your writing.

Should i take profit if the target reach during the day or should i wait till end of the day? (during the day, when target reach, chart still posting bullish candle)

Awesome, good job

Great indeed your doing. Thanks so much for the exposition.

I so much enjoyed the course… I would keep reading it over and over again.

Thank you for your great work Nial! You make us traders see what’s really important. Excellent article!

great articles .. thanks

You are great, man. I am greatly cool with your site.though am a newbies trader,but i have gain more knowledge from your articles. thanks a lot

Please contract me….love u so much.boss……

It’s such a beutiful experience to trade with pin bars.

Thank you so very much Nial, especially for sharing with us your trading ideas. Second last month I earned 10% and last month 11% of my deposit. I’ve been following your guidance and hope for more :D Thank you one more time!

Great article, thank you Nial.

Thanks Nial, I have been so confused as regards this issue different pin bars I always come across on the market chart, but now the confusion is totally gone. You are great, man. I am greatly cool with your site. The design is so simple and easy to navigate.

Thanks coach, I appreciate.

Thanks for such a standard lesson. I the Case of the double pin bar candlestick pattern why should a price action trader wait for a second pin bar before entering the market when the first pin bar and other market conditions favour entry into the market

Great article! But I couldn’t print or save the pdf file, something is wrong.

Hi….

Nail

I enjoy reading your trading article and learn from you. I always read your trading articles. I can understand clearly for me that you explain and articles.

I thank deeply you…

Hi Nial,

I enjoy reading your articles about Forex Trading.

But I don’t trade fforex but only stocks. My question, can I use these texts for trading stocks too. I see many principles which are the same?

Thanks a lot Nail for the clear explanations.

Yes

I have very much enjoyed reading about pin bars in this chapter. i have truly learnt A GREAT DEAL.

Thank you so much.

Nial, thank you so much for sharing your knowledge. Can you also apply the tailed bar analysis in doing scalp trading?

So informed since I met u,thanx for such an information.i believe I will trade the market soon.

Thank you very much for such a valuable guidance in very short and in simple understanding way. Really appreciate your work.

It is an excellent lesson on pin bar . No doubt it is an holy grain. Keeping give lessons.

Thanks

This is wonderfully an eye-opener, thank you Nail remain fulfilled

commentdata

thanks for sharing yor skill with us may the good God bless you in every aspect

Thanks Nial

Im totally different since I started reading your articles. You are very inspiring!

Neil thanks man for sharing your nolegy with us,personaly i appreciate

Great article. Very educational.

classic trading signals:article appreciated greatly,Thanks.

Neil, thank you very much for sharing your knowledge with us. I really appreciate your article.

Hi, Nial

You are doing a great job sir, keep it up on lightning our path

Much appreciated

Neil, you are very good in your writting. Thanks Neil. Keep it up! Chinedum Bright

Very useful technical article. Thanks.

Much appreciated sir

Really appreciate

Neil, writing far away from Bangladesh..I am a regular fan of your writing. I would kindly request to write some thing about the forex contests..How to participate in a contest, any extra rules and how to win? would appreciate that

This lesson is very powerful and today I truelly understand why you always say to us ‘do away with messy of indicators’ in our charts only learn price action strategies.

Thank you very much for this article,may God richly bless you .I am having a light now otherwise the tunnel was dark to me.

Hi Nial,

Very useful tips. Thank You

G’day Nial, I have come to realize and accept what you are teaching, I can sense the wisdom in it and from this day forward, will only trade the Daily Chart. You have described me and my trading to a ‘T’. I am somewhat impulsive and impatient by nature and have been working on correcting these traits which has, to be honest, been difficult but I am persistent, to the point that I spend much more time correcting these above mentioned traits than actually trading. It is paying off and I expect that, as I ease myself back into trading, with my newly developed demeanor, my trading will start paying off also! I have one of your courses, which I intend to reread and study and I read with relish, every article you send me. You are an excellent mentor and I greatly appreciate you and the knowledge you share.

Kind Regards,

Phil Edmunds.

Hi Neil Very useful article like others, many thanks

Thanks to you man for your care to us coz we are new to forex

Thanks

thank you

It was a great article Nial. One of the best. Thank for sharing that kind of knowledge with us. I hope to get into your course soon.

God bless you

Eneias Nascimento

Brazil

Thanks neil, great lesson to technical analysis

I have No Words For You .sir you are great and your lesson is a reward for every traders .bundle of thanks

I think your lessons are very good and clear , but they has to be more in order. to explain different bars separately with what we know about them and than compare to other bars. Isaac

My favourite article from Nial.

Great lesson Nial, I learn so much from you and you make you teaching plane and clear, so easy to understand. you truly have the gift of teaching, keep up the good work.

Really great descriptions!! Thank you!!

Thx Nial

Thanks Nial, this is very key and helpful in building my skills set. Great lesson.

nice bro

As usual simple and powerful. thnx.

What a simple but powerful article. I mean its invaluable if one can be patient enough to follow it religiously. Thannk yo Master Nial.

Good job Nial !!!

What a brilliant article. I was particularly inspired by the inside-pin bar combos. It can be easy to focus on just the pin and dismiss it, if it’s not protruding from price enough. I will be sure to look, look and look again in future! Many thanks, Nial.

Nial,

I just want to continue to say Thank You for your generosity in sharing your trading approach. The more I read your information the better I become in my Trading. Thank you!!!

John Mullins

USA

Thank you very much Nial. Your lessons are very informative and have helped me a great deal in making informed decisions when I am doing my trades.I am starting to see some profits and the great thing is that I now know why that is happening. It is not by sheer stroke of luck but knowing what you are doing and why you are doing it.

Keep up with good advises.

Thanks Sir.

Hi you are correct they the pin bars are very rare, GBPUSD, previous opportunity (valid) was 23 January this year.

We have another pin bar today, on 4H chart GBPUSD, will watch how this bearish pin bar plays out. Thanks for the lesson once again

Hi Thanks for your valuable info. but as ive told you before these information trading is ok after the trend has finished and its okey for issuing subject about trading in the books At the time of trading they are useless not only for scalpers but also for long trade traders.

I am sure you know better than me because can not get profit a lot yourself , otherwise you have been focusing for trading not making site and subject a lot

Hi

Thanks for the nice lecture

Best Regards Rossen Dimitrov

Exellant Nial

Excellent Niall, really like these candles and I am making them work for me… many thanks