Is Your Stop Loss Too Tight ?

What do pants and stop losses have in common? Very little, actually, but as Will Ferrell so hilariously demonstrates in this video on tight pants, they are not the prettiest thing in the world, in fact pants that are too tight can hurt you. Stop losses that are too tight can also hurt you, but in a much different way, financially…

What do pants and stop losses have in common? Very little, actually, but as Will Ferrell so hilariously demonstrates in this video on tight pants, they are not the prettiest thing in the world, in fact pants that are too tight can hurt you. Stop losses that are too tight can also hurt you, but in a much different way, financially…

I’m sure you know that where you place your stop loss is important. However, generally speaking, wider stop losses are going to lead to trading success much faster than tighter stop losses. In today’s lesson, we are going to discuss and see the importance of placing wider stop losses instead of tighter ones.

After more than 15 years of trading and having talked with over 20,000 members of my price action trading community, it’s clear to me that many traders can successfully call the direction of the market, however, they often get stopped out of their trades way too soon, sometimes right before the market reverses in the correct direction, sound familiar???

The reason this usually happens is because traders place their stop losses too tight or too close to the current market price. Thus…

When it comes to stop losses, size matters…

Before we really get into the ‘meat’ of today’s lesson, I just need to say that tight stop losses have their place in some forms of trading and some market scenarios. But, today I want to focus on daily chart trading and longer trade hold times of days to weeks (position trading), which is my main style of trading and what has made me the most money over the years.

I want to start by discussing the fact that markets move an average range each day and week, this is a fact that is reflected via the ATR or average true range indicator, which is something you can apply to your charts in the metatrader 4 platform. When focusing on the daily or weekly charts, we need to be aware of this ATR range, mainly so that we can make sure our stop loss is placed outside of it. It literally makes no sense to have a stop loss inside of this range because it means we risk being stopped out simply due to the normal day-to-day fluctuations in price volatility.

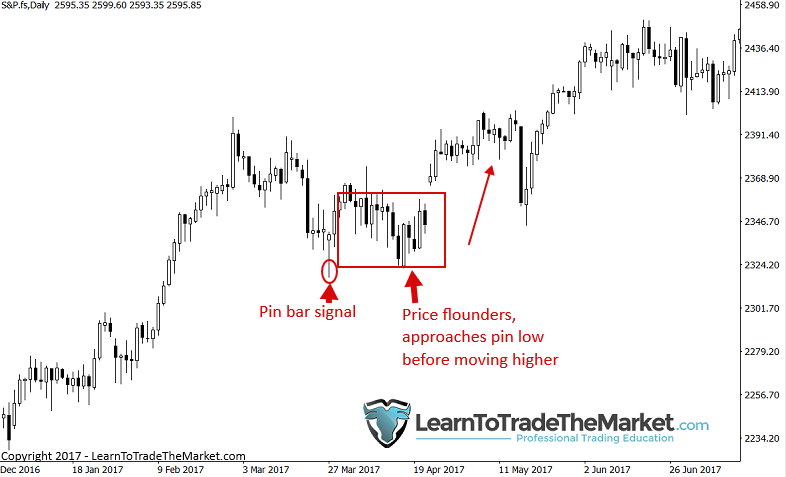

In the chart example below, we can see that:

- The ATR is taking into account multiple days of price action, the last 14 in this example. including multiple days that were well over 100 pips. So, the ATR at the time of our entry gives us a good baseline number of pips to make sure our stop loss is greater than. In this case, the ATR was about 100 pips at the time of the pin bar buy entry in point 2.

- The pin bar signal at point 2 on the chart below had a range of just 75 pips – but a big mistake many traders make is just setting their stop loss at 75 pips – or the distance from the pin bar entry (near the high likely) to the low. Since we know the ATR is 100, we want to have a stop loss that is greater than 100, ideally somewhere between 100 – 150 pips, the wider the better.

- You can see at point 3 how this would have worked out – a wider than normal stop loss would have kept you in this trade for a profit, despite price violating the pin bar low briefly. THIS is the difference between winners and losers in the Forex market.

The daily chart produces powerful signals, but as I say often, trades take time to play out. So, if trades usually take time to play out in our favor, then if our stop is too tight we risk it being hit before the signal starts to pay off. Have you ever seen the market chop around for days or weeks or even move down towards the stop level and then quickly snap back the other way? It happens a lot as you probably know, and you want to avoid being stopped out prematurely when this happens….

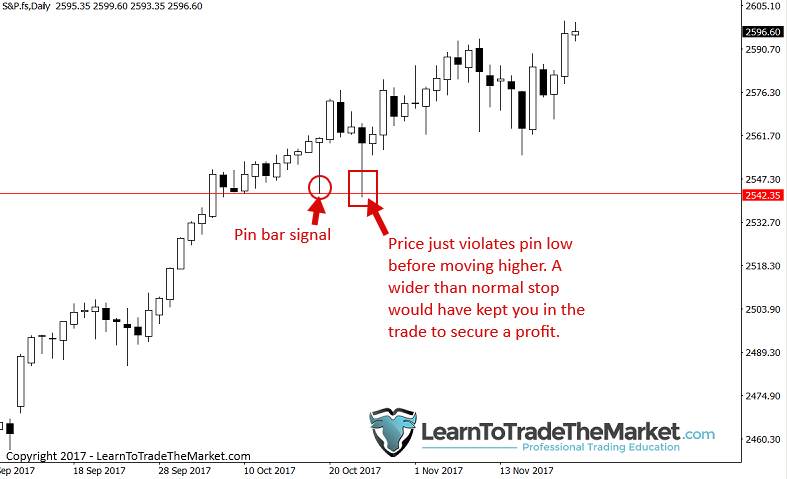

Moving on, it’s important we set our stop loss beyond areas or levels on the chart that the professionals, like banks and larger players, may try to squeeze us out of. This will usually show itself by a sharp move below the highs / lows of the tails of candles or key swing levels. For example, often you will see price just barely violate the tail of a clean pin bar signal before reversing back in the direction of the pin bar trade. In the example below we can see this, note the pin bar and then the move lower a few days later, which would have stopped out many traders for a loss just before moving higher again. For this reason, it’s good practice to put your stops outside of the ATR (as mentioned above) and a safe distance beyond a pin bar’s tail, not simply one pip above or below.

Traders often place stop losses at arbitrary places on the chart just for the sake of having a stop in, with no real rhyme or reason to where they placed it. This is bad. A stop loss should ALWAYS be based on logic and strategy, i.e., an area or level on the chart that nullified the trade signal, such as, above or below the signal highs or lows or beyond a key chart level such as horizontal resistance, a swing point or even a moving average.

With a wider stop loss, you will not only stay in good trades and not get stopped out before they move in your favor, but you will also give the market a chance to give you a real exit signal rather than being taken out of the trade at an arbitrary point.

By doing this, we achieve 2 things: One, the market has room to move and Two, the market has plenty of space to produce an opposing signal or pattern that can lead us to exit the trade with a smaller loss or even a profit.

In the chart example below, I have put the ATR on. It shows that at the time of the pin bar entry buy signal, the ATR was near 100 pips. As I said earlier, you want your stop outside of the ATR, so in this case it would be a stop greater than 100 pips, which would have kept you in this trade even after price violated the pin bar low. It went on to become a winner and even produced a counter-trend pin bar that you could have used as an obvious exit point.

MYTH: One MYTH about larger stop losses that I need to be sure and dispel before I end today’s lesson, is the myth that says wider stops mean larger losses. Many beginning traders think this and it’s simply because they don’t understand position sizing. You will need to adjust position sizing of trades as you adjust your stop loss, in this way you keep your dollar risk constant.

Conclusion

I hope that from today’s lesson you can clearly see the importance of wider stop losses over tight ones. It may sound cliché, but stop losses truly do make or break a trader. A trader who puts more time into his or her stop loss placement than their trade entries is likely to be a much more profitable trader than those who just briefly consider stop loss placement. A good rule of thumb regarding risk management and stop loss placement is: When in doubt (whether it’s about a trade entry or where to place a stop or position size) elect for LESS contracts and WIDER STOP.

Perhaps the most beneficial aspect of wider stops is that they give your trades time to play out, as most traders are usually right with the market direction but wrong on stop losses. Meaning, the more space you give a trade (wider stops) the more time you are giving the market to potentially play out in your favor. There’s nothing worse than being right about the market but wrong on your stop loss placement, resulting in a loss that should have been a win!

Any trader out there who has been around the block for any significant period will tell you that trade entry and trade management go together to form a successful long-term trading approach. The ‘wheels’ will fall off the wagon if you neglect one or the other. Stop loss placement doesn’t need to be stressful, if anything, it should reduce your stress because if you do it correctly you can go about your daily business without worrying about every up and down tick of the market.

My courses focus on not only finding trade entries but much more, including placing stops and target levels to manage risk / reward effectively and how to bring it all together into a comprehensive trading plan. My approach to trading is to simplify, but not just for the sake of simplicity, it’s primarily because simple is better regarding all aspects of trading and it’s what leads to profitable trading. From trade entries to stop loss placement, risk management and psychology, the simple, minimalistic approach is what works.

PLEASE LEAVE A COMMENT BELOW & GIVE ME YOUR FEEDBACK…

Any questions or want to talk ? Contact me here.

Hello mr. Fuller, and many thanks for sharing this topic.

How would you combine wider stop losses with a proper trailing stop strategy?

I guess ATR would be the key, once more…

In any case, thanks in advance for your professional reply.

B.r.

excellent lesson

Outstanding, Nial! I’ve been studying forex for about three years, and am about to go live. I’ve been tossed about as in a tornado when it comes to opinions about wide or tight stops, but this study convinced me! Wide, even 1.75 or 2.0 ATR, is the way to go!

STOPS AND HEIKEN-ASHI: For those who are wondering about where to place stops on Heikin-Ashi charts – and I’m new to them, so don’t take this as Gospel – but if I have it right, H-A bodies smooth out trends, but their wick tips are exactly at the same levels at, and therefore as ragged as, those of Japanese candles, and it’s the wicks that stop you out! So it seems to make sense to me to place your stops exactly where you’d place them if you were using Japanese candles – and, if I may say so again, I think Nial’s got a bead on where to place them. SOMEBODY PLEASE AFFIRM OR CORRECT WHAT I’M SAYING.

Thanks Nial,

Norm

Thanks Nial. This is one area in fx not very well covered by many authors ie use of ATR when setting SL

Very valuable info on this blog for beginners and experienced traders, keep up the great work.

Thanks Nial! ????

Fantastic. You have answered my question without my asking it. Thanks

Great article appreciate !

Very helpful Nial.

After reading this article I feel like I am having a benefit of your 15 years of experience ,,

thanks

Thanks Nial for the info.

Wider stops are important for the beginning trader to learn to use properly. It is important for people who may not understand how stops work though that incresing the stop does not mean risking more. If you increase your stop size, then you must lower the volume you’re trading. If you do this you’re increasing your odds of winning trades while also maintaining or lowering your risk. Win – Win!

A very valuable topic. Thank you Nial!

Great.Thanks alot

One of the best article i’ve seen so far. Wider stop loss with adjusted volume of trade. I’ve never executed that properly

yes and it would always be, i do analysis on daily & 4 hours. pick trade on 30mins or 1 hour. so i do not need high SL

Very helpful Coach, many thanks

Great article and lesson from the great mind of Nial F. Thanks so much.

Nice lesson very helpfull for newer just like me

This is one of the most important articles youve done i.m.o. As soon as I started using wider stops,the consistencey kicked in………

thanks Nial, is bollinger band same function as atr for stop loss positioning ?

no, they are not the same thing.

Thank you, Nial and team.

Thanks Nial what a wonderful title

Thank sir

this is amazing and soundly resourceful. i am one of the many traders who has suffered immensely from wrong stop loss placements, but now i know better and will do better. As always, thanks Niall for this resourse and empowerment.

Dear Nial,

This is indeed very useful article that can strengthen the STOP loss management. It supplements the initial stop loss technique (e.g placing at low/HIGH of Pin bar).

It will be great if you can have future articles talk about exit management. (can we use ATR?) In the recent trade, I found the instrument moves in my favour (e.g. Reach 1:2.x risk reward ratio) but reverse significantly (without reverse price action signal in the daily chart). I will send you some screenshot separately to discuss this in another email.

Again, many thx for your nice articles.

YK

Excellent article. A nice refresher on the proper use of a stop loss.

Another fantastic article Nial. May God bless you.

This is really enlightening to the placement of a SL, though it looks very scary. By using this strategy of placing a SL, I have to be very selective and disciplined with my trades…… and I think that is good too.

This is a wonderful article because stop loss placement is one of the major challenges of new traders. Keep it up.

Gracias Nial. Helpful write up and nicely written. I enjoy reading your articles; they are refresher training of important tips from your own course.

Thanks heaps for teaching the use of the ATR indicator. I shall use it and widen my stops. I think you are dead right.

Thank you , this is nice

I love the tight pant video link. thanks Nail

Nial, Thanks a million for this article. With the right position size one maybe assured of positive “Expectancy” outcomes in their forex trades using ATRs. Are there any “good” in the use of MACD (though you have emphasized non-use of such tools). Thanks, Eric

Very true! On many occasions I have been taken out, before moving in the right direction.

As I am building my account from very small numbers, I am very alert on positioning my SL at a logic level. But the downside with working with such a small account is, there is only little/limited space for positionsizing.

Thanks Nial.

I like the photo, :D

Thanks a million. This is an eye opener.