My Favorite Markets To Trade and Why

I get a lot people asking me what markets I trade. The short answer is that I follow a handful of highly-liquid, major markets that provide me with the best price action trading opportunities.

I get a lot people asking me what markets I trade. The short answer is that I follow a handful of highly-liquid, major markets that provide me with the best price action trading opportunities.

A big problem that inhibits many traders’ success is that they are focusing on too many markets in addition to all the other trading variables they are overly-focused on. From news events to indicators to having 50 different charts open on your trading platform, there’s a never-ending supply of data and variables that a trader can get caught up in trying to digest everyday. It really is enough to drive you mad if you allow it to. So what’s the solution to avoiding this data-driven madness?

The solution is to scale-back the amount of data you’re trying to make sense of each day as you analyze the markets. Putting the odds in your favor is not done by trying to keep track of 30 or 50 different markets and frantically scouring them all for signals each day. It is done by become a market specialist; a trader who has an intimate relationship with small handful of his or her favorite markets…

Note, if you are new to Forex trading it will help if you first go through my article that outlines what the major forex currency pairs are compared to the minors and exotics.

Why I only trade a handful of markets

Just because you can do something doesn’t mean you should. You can go try and wrestle a Saltwater crocodile, but that doesn’t mean you should. You can eat McDonald’s every day, but obviously that doesn’t mean you should. You get my point here I’m sure…

In trading it’s really no different; just because you can trade all the markets offered by your broker doesn’t mean you should. Despite this seemingly obvious fact, many traders confuse and frustrate themselves everyday by trying to track and trade too many markets.

Most traders have access to hundreds of markets from around the world. I also have access to hundreds of markets, yet I wake up each day with a very small number of charts open on my trading platform. Most of the time, I am focused on 4 to 6 major currency pairs, a couple of stock indexes and a few commodities (more on these later). What I am certainly NOT doing is scrolling through 50 different markets and over-loading my brain with unnecessary bull$%@! that is just going to result in me taking a low-probability trade that I don’t need or want to take.

Becoming a specialist in your chosen markets

Specialization is a key component to success in the market, as well as just about everything else in life (think doctors, lawyers, entrepreneurs who start companies, these are all specialists because they know a lot about one very specific field, this allows them to command high compensation as a result).

You are not going to become a successful trader if you don’t learn to specialize in and master one trading strategy. It’s also going to be nearly impossible for you to find consistent trading success if you don’t become a specialist in a small handful of your favorite markets. You don’t need to follow 100 markets, just the ones you specialize in and are most comfortable with, you need to develop an intimate relationship with these markets.

I want you to develop a very close feel for the behavior of a small group of major markets, because doing so is going to improve your trading in more ways than you might think:

Developing an intimate relationship with a handful of markets, will improve your trading by:

- Keeping you keep your mind clean and clear, and ‘forcing’ discipline. If you’ve only got XYZ on your market watch list then you’re naturally going to be more focused and this will assist you in becoming a specialist in these markets as well as eliminate a lot of unnecessary / distracting variables from your trading platform and trading mindset.

- Helping you avoid double-risk. You don’t want to double-up if you see the same signal on correlated markets (a very common mistake many newbies make). Often times, even experienced traders will make the mistake of entering multiple trades at the same time because they see good signals on many markets / pairs. Focusing on a small handful of markets will help you remove the risk of getting tempted into being in too many positions at the same time, even if you think you can control the temptation.

- Having less markets reduces the chance that you’ll be in the market too much. Limiting your choices reduces the risk of over-trading, and over-trading is probably the number one reason most traders fail to make money over the long-run.

- Reducing your urge to trade. The less pairs you look at, the less likely you will be to feel an ‘urge’ to enter a trade. Traders tend to enter trades far too often just because they want to be in the market, not because there’s a high quality price action signal present. Focusing on a small handful of major markets will help you concentrate more on quality of trades, instead of quantity, as I teach in my course and members area.

So, what are the markets I trade?

I know what you’re probably thinking right about now: “This is all great Nial but what markets are YOU actually trading and focusing on each day, that’s what I really want to know”. If you weren’t thinking that, my apologies, but either way here’s my answer…

I know what you’re probably thinking right about now: “This is all great Nial but what markets are YOU actually trading and focusing on each day, that’s what I really want to know”. If you weren’t thinking that, my apologies, but either way here’s my answer…

If you follow my members’ commentary it’s no secret that you’re only going to see me talk about a maximum of about 10 to 12 different markets over the period of any given month. Here are those markets:

EUR/USD, GBP/USD, AUD/USD, NZD/USD, USD/JPY, EUR/JPY, GBP/JPY, Gold / Silver, Oil, Dow index and S&P 500 index

Not only are these the markets that I discuss the most in my members’ commentary each day, they are also the ones I personally trade and analyze the most, in fact, I rarely even look at any other markets besides these 12. For an even more focused list, I probably spend more time on the EUR/USD, GBP/USD, AUD/USD, GBP/JPY, Gold, Oil and Dow than any of the others, these are my 7 favorite markets. How many markets are you trying to trade? In my opinion, if it’s any more than 12, it’s way too many. My suggestion is to start with my list of 12 markets here and pick your 5 to 7 favorites and stick with them; learn their behavior intimately and become a ‘specialist’ of them.

This article is written using images from the trading platform that we use, if you don’t yet have that platform you can download it here.

Market correlation and why I really dislike certain markets

I feel it’s necessary to quickly go over market correlations as well as explain why I don’t trade certain markets as I know some of you will have questions about these things. Here are my answers:

You might have 20 Forex pairs on your watch list right now and more than half of them are correlated (correlation means that certain markets tend to move in the same direction). I see no reason to follow more than 3 to 5 of the major / top liquid currency pairs, because once you start adding more, the correlations increase and that can increase the risk for doubling up risk as we mentioned above, or over-trading. As for stock indexes, the major indexes to some extent are correlated so that’s why I mainly stick to the Dow, S&P 500 and my local market.

Here are some of the markets I hate to trade and why: Of the major currency pairs, I really don’t ever look at or trade the USD/CHF or USD/CAD, primarily because from my experience they both tend to behave in a choppy and erratic fashion. The USD/CHF has a very strong inverse correlation with the EUR/USD, so there really is no point in looking at both of these markets, I prefer the EUR/USD.

I also hate to trade any of the exotic currency pairs, these would be currency pairs that include a currency from a developing / emerging economy in the pair. These markets are very erratic and have very wide spreads and low liquidity, all bad things for a trader.

It’s time to take action

Now that you know what my favorite markets are and why, you should reduce the number of markets you’re trading, it’s time to take action. I want you to de-clutter your quote board after you finish reading this lesson, and don’t worry if you think you don’t know how, I’m going to show you right now…

In your MetaTrader 4 trading platform:

1) Find and open the “market watch” window. Below is what the market watch window will look like after you complete these 8 steps:

2) You should see a screen appear with some or all of the markets offered.

3) Now, right click anywhere in the “market watch” window, you should see a menu appear with various options.

4) This is where you can pick and choose which currency pairs you follow. You may want to first select “show all” to open all markets and then you can scale them down from there. You will need to first select a currency pair if you want to hide it, then right click and select “hide”, it will now disappear from your market watch menu. (Note: if you have an open trade or chart you cannot hide the quote of the currency pair from the trade you are in, you need to close the chart first or wait till your trade is finished)

5) To reverse this just click “show all” and all the currency pairs will pop back up.

6) You can also just click on “symbols” and then go through and hide or show which ever currency pairs you want.

7) Once you get your watch list set, right click in the market watch window again and go to “sets” and save it. You can save multiple watch lists if you want.

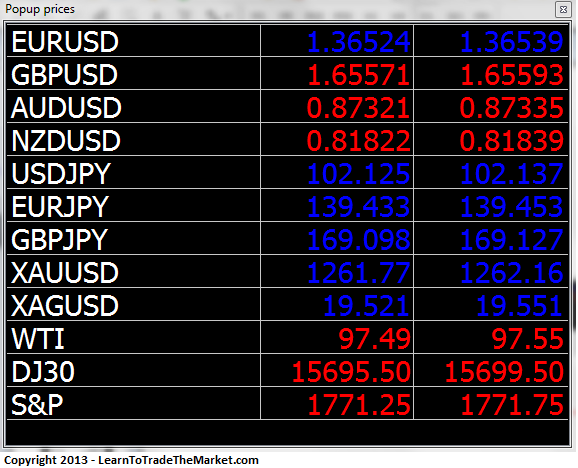

8) Hit F10 and a pop-up price menu of your currently opened watch list will appear. This is a handy little short cut that you can use to check the prices of all the instruments on your watch list very quickly so that you don’t have to have the watch list window open all the time. Here’s what it looks like:

Now you know my favorite markets and why I prefer to specialize in them. If you want to learn how I trade these markets successfully using simple yet effective price action strategies, check out my price action trading course.

Very valuable article. Thanks Nial

I should have known that long time ago! thanks man!

Whenever I read your write-up, it’s always very academic and practical. Respect.

Great nail

What’s the best time to trade Europe/usd in the morning in your guys opinion

Wow…..that’s sounds good. You are the best Neil and thanks for sharing such a wonderful trading strategies.

anyone focus on WTI.fs ?

any comment if i would like to focus on that ? any advice to look out to ?

Sincerely.

HS GOH

Hi Niall. Just wondering why you have excluded EURGBP and USDCAD?

If I didn’t include them it’s because they are not one of my favorite markets to trade.

No words to explain how much good u are. Tks

You are the best. Thanks Nial

hi Nial, yes i could get ur clear idea about market where i should trade . this lesson is very useful and nice. thanks after one month again i will contact u after putting ur lesson in my trade.

Very interesting Nial. Thanks.

You are right as always, Nial! My experience tells that diversification is the greatest enemy of trader. The only way to survive in the market ocean is to master professionally one-two maximum three volatile instruments. It is more than enough for success. Thank you Nial for your articles!

Ludmila

Hello Nial. Thanks for this article. I also noticed that USDCHF pair has its chart rather erratic as movements of the price are secondary after that of EURUSD. I am not going to trade USDCHF anymore.

Thank you so much Nial for excellent advice.

How I so wish you had written this article 18 months or so ago.

Why? I have been a “Jack of far too many pairs and Master of NONE” which I now know is not very smart.

I now believe like you do that in general & not only in trading, it is much smarter and ultimately “profitable” to know a little about everything and EVERYTHING about ONE thing!

Thanks for sharing your expertise and for your encouraging words to be a “specialist” which is what I strive to be with today’s article tweaking my trading habits to declutter any unnecessary pairs like the usdchf correlating with the eurusd.

Thank you so much.That was an eye opener at the correct time Nial because most of my trades with USDCHF have gone bad even though I had a good set up.Thanx.Will stick to your list

thanx great nail for teaching me change my thinking on forex trading. its now fun

Thanks for the article, Sir..

Great insight. Some members in the LTTTM community can prosper off of this article.

go for most liquid currency pair and small spread. mostly major currency.

Thank you dear nial

Shoot, Nial, with 12 markets you’re more ambitious than I am – I rarely look at anything beyond Eur/usd, Gbp/Usd, and Aud/usd. Occasionally I’ll glance at the JPY pairs, but it’s usually more to confirm something I’m thinking about doing in one of those 3 major pairs. I do, of course, keep an eye on Gold/silver and the stock market indexes, but I don’t actively trade them.

P.S. I concur on Usd/Chf – often frustrated trying to trade that market, don’t even try any more.

Thank you Nial for sharing what you trade, I too will shorten my list.

Excellent, I use this in trading companies, you get to know what they are going to do next.

Terry

Very nice article

good article

Hi Nial

Good article got a question though

What about crosses, i mean especially aud?

I do trade AUDUSD, but most of the time I don’t trade exotics or lower volume crosses. I stick to the highly liquid actively traded pairs, index’s and commodities.

Wonderful article. Thanks Very Much !

So dear Nial (my great teacher),

Thank you very much for another useful article which contains many valuable points along side the main title.

Thanks a million.

Regards

Mehdi

special article to become a liquid markets specialist. great

Till now I was not aware of the “Sets” in Market Watch Window.

Thank you for yet another excellent article.

thanks dear nial that you share your experiences …