12 Killer Trading Lessons I Posted in 2018

2019 is now officially well underway and hopefully you are making the best of it and sticking to all those 2019 New Year’s trading resolutions you made January 1st. Before we get too much further into the new year, I want to make sure you didn’t miss any of our best posts from 2018.

2019 is now officially well underway and hopefully you are making the best of it and sticking to all those 2019 New Year’s trading resolutions you made January 1st. Before we get too much further into the new year, I want to make sure you didn’t miss any of our best posts from 2018.

Last year was an amazing year for me both professionally and personally and each year as I write about all the trading topics swirling around in my head, the process helps me improve and grow as a trader, and I want to share that knowledge with you as much as possible.

So, to get you up to speed on the highlights of 2018 here at Learn To Trade The Market, let me proudly present a list of 12 killer posts from last year that you may have missed:

1. To Make Big Money Trading, Don’t Think About The Money

The first post in our list was an article I wrote to try and convey to traders that becoming overly-focused on the “money” and “reward / profit” part of trading, is truly the underlying reason why most people fail to make money.

The first post in our list was an article I wrote to try and convey to traders that becoming overly-focused on the “money” and “reward / profit” part of trading, is truly the underlying reason why most people fail to make money.

What you need to do is become overly-focused on the actual process, the details of trading and learn to LOVE that part of it. If you get to the point where you truly enjoy being disciplined and patient as well as tracking your performance and sticking to a trading plan, money and profits will start to become more and more attracted to you…

Read Article Here – https://www.learntotradethemarket.com/forex-articles/to-make-big-money-trading

2. Three Trading Strategies I Would Take To a Desert Island

This lesson was meant to show you what trading strategies I would pick if I could only pick a few. Truthfully, all you really need is a small handful of trading strategies to enter the market at a high-probability point. This article served two purposes: to explain some of my favorite price action trading strategies but also to discuss the fact that a trading strategy involves more than just a “signal bar”. Things like money management and trading time-frames are just as important as the entry signal and are also pieces of your overall “trading strategy”:

This lesson was meant to show you what trading strategies I would pick if I could only pick a few. Truthfully, all you really need is a small handful of trading strategies to enter the market at a high-probability point. This article served two purposes: to explain some of my favorite price action trading strategies but also to discuss the fact that a trading strategy involves more than just a “signal bar”. Things like money management and trading time-frames are just as important as the entry signal and are also pieces of your overall “trading strategy”:

Read Article Here – https://www.learntotradethemarket.com/forex-trading-strategies/desert-island-trading-strategies

3. Beware of The Trading Pandora’s Box

This post was written to warn traders about the “snowball effect” of trading mistakes or the Pandora’s box, so to speak, that gets put into motion very easily in the trading world.

This post was written to warn traders about the “snowball effect” of trading mistakes or the Pandora’s box, so to speak, that gets put into motion very easily in the trading world.

Once a trader starts trading too frequently or risking too much, or makes any number of other mistakes, it typically sets off a “chain-reaction” of trading errors that quickly erases any progress they’ve made and can just as quickly blow-out their trading account. I give you tips and “tricks” in this lesson to avoid this huge trading pitfall:

Read Article Here – https://www.learntotradethemarket.com/forex-articles/beware-of-the-trading-pandoras-box

4. What If You Only Took 4 Trades a Month?

In this lesson, I discuss and SHOW YOU with examples the POWER of a low-frequency trading approach.

In this lesson, I discuss and SHOW YOU with examples the POWER of a low-frequency trading approach.

Far and away, the biggest reasons most retail traders lose their money in the markets, is trading too much. I show you in this lesson how taking just 4 trades a month can achieve, a very, very nice return even if you’re losing 50% of the trades, so that’s just 2 winning trades a month! Right now, I am willing to bet most of you are trading waaaaaay more than 4 times a month and you’re probably not profitable either. So, leave all that stress and overthinking at the curbside and follow the strategy in this article to fast-track your trading success:

Read Article Here – https://www.learntotradethemarket.com/forex-trading-strategies/what-if-4-trades-a-month

5. What I Wish I Knew About Trading 18 Years Ago

This lesson is an in-depth look at some of the most important lessons I have learned since I began trading the markets about 18 years ago. If you read this post carefully, you will absorb years of trading insight that cost me a lot of time and money to learn.

This lesson is an in-depth look at some of the most important lessons I have learned since I began trading the markets about 18 years ago. If you read this post carefully, you will absorb years of trading insight that cost me a lot of time and money to learn.

You are significantly shortening your learning curve by reading posts like this one that combine years of trading trial and error into one educational lesson:

Read Article Here – https://www.learntotradethemarket.com/forex-articles/what-i-wish-i-knew-about-trading-18-years-ago

6. Price Action Analysis Reveals The Footprint of Money

In one of my most detailed posts about the power of price action, I get into exactly how price action is like a story on the charts that you can learn to read if you get the proper training and put in the screen time. You will learn to understand which price bars matter and which ones probably don’t as well as how to interpret their meaning if you get a proper price action trading education, the basics of which are discussed in this lesson…

Read Article Here – https://www.learntotradethemarket.com/forex-trading-strategies/price-action-technical-analysis-footprint-money

7. Here’s What Happens if You Practice Once Trading Strategy 10,000 Times

Bruce Lee said, “I fear not the man who has practiced 10,000 kicks once, but I fear the man who has practiced one kick, 10,000 times.”

Bruce Lee said, “I fear not the man who has practiced 10,000 kicks once, but I fear the man who has practiced one kick, 10,000 times.”

For a trader, what this means is that you are more “lethal” in the markets if you focus on fewer things and just get really, really good at them. To contrast, what most traders do is try to learn “everything” they read or hear about, trading indicators, gurus, forums, etc. they end up getting “lost in the sauce” of trading information, so to speak. This article explains just how stupid that is and why you should focus on one strategy at a time…

Read Article Here – https://www.learntotradethemarket.com/forex-articles/what-will-happen-practice-one-trading-strategy-10000-times

8. 6 Types of Tailed Bar Candlestick Trading Strategies

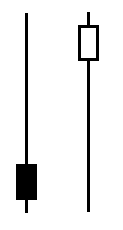

The tails on candlestick bars, also sometimes called “shadows” or “wicks” are very, very important. So much so, that I devoted an entire lesson to them, which you can read in the link below. However, not “every” tailed bar is equal to the others, so you need to learn the differences and how to trade them, that’s what this lesson is about:

The tails on candlestick bars, also sometimes called “shadows” or “wicks” are very, very important. So much so, that I devoted an entire lesson to them, which you can read in the link below. However, not “every” tailed bar is equal to the others, so you need to learn the differences and how to trade them, that’s what this lesson is about:

Read Article Here – https://www.learntotradethemarket.com/forex-trading-strategies/types-tailed-bar-candlestick-trading-strategies

9. How to Develop a Winning Trader’s Mindset

A large portion of my professional trading course is dedicated to topics of trader psychology, mindset and self-control, because developing a winning trading mindset is truly one of most important components of successful trading, and many would make the case that it is THEE most important. Read this lesson to learn how to develop a winning trader’s mindset:

A large portion of my professional trading course is dedicated to topics of trader psychology, mindset and self-control, because developing a winning trading mindset is truly one of most important components of successful trading, and many would make the case that it is THEE most important. Read this lesson to learn how to develop a winning trader’s mindset:

Read Article Here – https://www.learntotradethemarket.com/forex-articles/how-to-develop-a-winning-traders-mindset

10. How to Use 1 & 4 Hour Chart Time Frames to Confirm Daily Chart Signals

If you’ve been following my blog for any length of time, you know I am a proponent of the daily chart time frame and that I’ve written multiple articles on this topic. However, I also use the 1 hour and 4 hour time frames, as discussed in my trading course, and I give you a glimpse into exactly how I use them in this lesson on the matter:

If you’ve been following my blog for any length of time, you know I am a proponent of the daily chart time frame and that I’ve written multiple articles on this topic. However, I also use the 1 hour and 4 hour time frames, as discussed in my trading course, and I give you a glimpse into exactly how I use them in this lesson on the matter:

Read Article Here – https://www.learntotradethemarket.com/forex-trading-strategies/how-to-use-1-4-hour-charts-to-confirm-daily-chart-signals

11. How to Trade Like a Hedge Fund Manager

Some of you may not like this or may even not agree with it, but in all my years of business and financial market speculation, I have yet to find this to be untrue: To succeed you have to “fake it until you make it”. It sounds cliche, yes, but it’s damn true, and here’s why: In order to become a success in ANY FIELD, you have to first believe you can do it and then you have to start following that belief religiously so that you devise a PLAN OF ATTACK and follow that plan one day at a time. A belief or a dream such as “becoming a profitable trader” is nothing if you don’t break it down into actionable steps, this is what success is made of and it all starts with “acting as if” and believing with 100% certainty you are going to achieve it, in fact, you must behave as if you already have achieved it….

Some of you may not like this or may even not agree with it, but in all my years of business and financial market speculation, I have yet to find this to be untrue: To succeed you have to “fake it until you make it”. It sounds cliche, yes, but it’s damn true, and here’s why: In order to become a success in ANY FIELD, you have to first believe you can do it and then you have to start following that belief religiously so that you devise a PLAN OF ATTACK and follow that plan one day at a time. A belief or a dream such as “becoming a profitable trader” is nothing if you don’t break it down into actionable steps, this is what success is made of and it all starts with “acting as if” and believing with 100% certainty you are going to achieve it, in fact, you must behave as if you already have achieved it….

Read Article Here – https://www.learntotradethemarket.com/forex-articles/how-trade-like-hedge-fund-manager

12. The Top 10 Lessons I’ve Learned in 18 Years of Trading

This post is exactly what it says in the title: A list of the 10 most important lessons I have learned over my 18 years in the markets. As I stated earlier, you have what is probably the best possible educational tool right here in front of your face; the insight that I share with you. Whether you take my course to learn more or simply read all my free lessons, my goal is to teach traders what I have learned, so that I can hopefully help them avoid losing as much time and money as I did:

This post is exactly what it says in the title: A list of the 10 most important lessons I have learned over my 18 years in the markets. As I stated earlier, you have what is probably the best possible educational tool right here in front of your face; the insight that I share with you. Whether you take my course to learn more or simply read all my free lessons, my goal is to teach traders what I have learned, so that I can hopefully help them avoid losing as much time and money as I did:

Read Article Here – https://www.learntotradethemarket.com/forex-articles/top-10-lessons-ive-learned-in-18-years-of-trading

Tell me what trading topic you want me to write about in 2019 ? Post your suggestion in the comments below…

I really enjoyed compiling this list of some of the best trading posts I wrote in 2018. However, there is one thing that I would really like to know that will help me continue to come up with helpful content for you guys in this year. In the comments below, tell me what was your favorite post from my blog in 2018 ? OR, what is a topic you would like me to write a lesson about this year?

Have a Great Rest of 2019 and Good Trading! – Nial

thanks for given the information relates trading .

Useful Post

Hi Nial,

please write a lesson about your last actual trades you took and post few live trading videos as well.

Thanks

Hello, thank you very much for the information

hi Mr NIAL

if i had to choose your best articles i really wouldn’t be able to because there are all very good, always on time and on point that sometimes i would ask myself if you read my mind. You make me feel like i am your only student and i pray that God blesses you with a healthy long life. Your heart is pure, you give so much each day and i am always thankful of the day i read about you when i was doing a research to find the best mentor.

Pls, write about price action strategy

I would like to read and understand more about the physiological side of trading, all emotions, fears… (Pandora Box), come from physiological changes in body and brain.

can you really control yourself?

Please sir, write more on pull backs, retracements, break outs and trend continuation signals

Hi Nigel I followed your strategy of holding during a price swing against my position on gold just recently and held onto gold while it lingered below my stop for a week…what concerned me was the swap rate it was significant and worrying… finally price went my way and hit my TP for a tidy profit Is there a way of working out swap rates? I notice that US500 attracts a low swap rate keen for your thoughts on this

Hey Nial

Thanks so much. You are a special gift to mankind from God.

I have lost money through broker manipulation due to requoting, Markups, swap, slippage, SL hunting and constant prevention from reaching targets. I will wish you advise us on good choice of brokers and give some possible recommendations of some brokers.

Thanks

Hello Nial,

I am interested in understanding the relationship of 8/21EMA ( which I lean on too heavily) and past pivot points, namely previous month’s highs and lows… I am seeing a relationship that exists… So , how much emphasis do you give to the EMAs?

Thank you,

4 trades a month is really cool i filtered my trades from B quality setup to A quality setup and only took A quality setup.

Thank you Mr Nial For useful ideas.

I feel it is good if you make a lesson which summarizes the most important aspects to consider when one makes a trade. The lot size in comparison to trading account size, how many trades of which lot sizes to be trade at a time, at what times we can identify a situation of overtrading in relation to a trade account size

Furthe more if you kindly advise on optimum R/R ratio for beginners, how that ratio could be made bigger, suppose any currency pair reaches the highest point in the week chart time frame and a pin bar appears indicating downward move. In such a situation also should there be expected reward as the chart indicates that it starts falling to the lowest level of 3000 pips.

You valuable guidance showing examples are highly appreciated.

Thank you sir.

Thanks Nial for reminding me these are very useful articles

Hi Nial!

You are doing a good job.

Thanks!

Hi first of all much thanks for all the knowledge shared, and the question Is about your advice over Forex TICK VOLUME

Thanks Nial for all the great articles you posted. I would like you to write an article about how to stay focused, motivated, with the proper mindset, and keep following your plan no matter what, even if you are not achieving the results you want or even you are getting bored.

Thanks for your articles and your sharing acknowledgments. Please write article about supply and demand levels and relation with support and resistant levels. and about that how do you use it in your strategy .

Thank you for all the posts in the year 2018. They were very helpful. Personally it boosted my confidence in trading and it increased my knowledge of some best trade practises.

The most helpful posts (for me) were the ones on trading the 4-hour chart and the pin bar strategy.

HI, NIAL

VERY GOOD ALL 12 LESSONS

THANKS A LOT

MANOHAR

thanks fo all Nial… I would like understand better and for this I would like that you deep the topic of position size of stop loss and risk\reward..

Hi,Nial

I am a new member in price action trading. i really enjoyed all your articles and benefited a lot.

One of my challenges is how to Draw support and resistant line in a right way ! and how far back should i look ?

Am happy to announce that:AM NOW A PROFESSIONAL FOREX TRADER THAT MAKES CONSISTENT PROFIT FROM THE MARKET.Thank you so much NIAL for all you’ve been doing,is doing and will continue to do for any one that truly and humbly want to learn to trade the financial market.

I learnt this in a hard way though,but i am happy to be where i am today.I no longer worry about the money i have lost as a trader,because my brain you’ve configured A MONEY MAKING MACHINE.Once again,THANK YOU.

But the little challenge am having now includes:

(1) PRACTICAL WAY OF CALCULATING (XAUUSD) STOP LOSS PROPERLY(that is how to set it so as to end at that specific amount I use as my per trade.If there are other similar markets,please include them in your preceding articles).

(2) PRACTICAL WAYS OF PYRAMIDING IN A TRENDING MARKET(note:I know and understood the topic when I studied it.But I don’t know how to go about it in that brokers platform which you referred me to,the provision for the VOLUME or POSITION SIZE while my trade is on does not adjust).Please help.

Nuil what a insightul post,Thank you for all those post they have been helpful.

Thank you Nial, very helpful articles! :-)

new to this trading experience. hoping to learn a lot.

Set and forget was a game changer for me :-)

Thank u coach.My favourite one was : To make money ,Dont think abt Money…

Would appreciate any insights you might share coz u writting from experience.Probably more on Mindset.

You such a genius, thank’s for all the posts they where all insightful.

However I have a hard time trying to read the ATR.

How do you get the actual value of the ATR?

Nial, I would like to see an article that teaching us more about living from trading. I mean, what do you do? What percentage of your net worth do you keep in the broker, and how much (%) do you keep in other investments? How to manage net worth, considering that it is not necessary to keep all our capital deposited in the broker’s account?

I also like when you tell us about low frequency of trading, and daily chart time frame. That kind of articles made real change in my entire carrer.

Thank you for all the lessons you brought to us in 2018, God bless you.

1. To Make Big Money Trading, Don’t Think About The Money..this was my favorite article and I would appreciate if you may write about how to trade correlated pairs

How to trade engulfing .

I can’t understand how to trade h4 market with price action.can I enter without signal.

hi nial.

thank you for your effort.

i would like to know more about

1-1&4 hours chart time frames trading

2-more about tailed bar trading

3- 8&21 and 50 moving average trading strategy.

mehdi

Excellent Sir ,you are the best

All your lessons what I read everything very super very strongly help, your website excellent, I advise all it. I will be on your courses soon! Thanks Mr. Nial! For your works!

Niall Fuller I don’t know how else to thank you for your generosity with your forex knowledge. I’ve really benefited and I am forever grateful to you.

All your 2018 articles were very educating, interesting, and enjoyable reading. However, my two best articles are number 6 and 7

https://www.learntotradethemarket.com/forex-trading-strategies/price-action-technical-analysis-footprint-money and https://www.learntotradethemarket.com/forex-articles/what-will-happen-practice-one-trading-strategy-10000-times

Please I would love you to teach us how the market makers manipulate the market and robb us the Retail traders our money.

Thank you so very much????????

very very good 12 lessons . I almost came to tears as it clarified me to the core. Was struggling bro!

The best is:

“3 trading strategies i would take to a desert island”

The best is:

“3 trading strategiest i would take to a desert island”

https://www.learntotradethemarket.com/forex-trading-strategies/desert-island-trading-strategies

Thank you Mr Nial, my favorite post of last year was “To make big money trading. Don’t think about the money.” They were all interesting and helpful posts last year.

I would love that you do an article on trade management. That is: scaling in, scaling out, trailing stop loss and when to and not to use a TP level.

Thank you.

By far my favorite trading input and much appreciated lessons from this reader. Thank you. My fave one among many was about difficulties in pulling the trigger on trades as it really hit home.

Thank sir Alot!

They are so helpfull ! hoping have more lesson from you!

Pls through some light hiw to hedge an option trade

how to write and follow a trading plan

A topic I wish you would share your knowledge, experience and insight on is:

How would you/ what would your strategy be starting with a small ($500-1000) trading-account, to grow your account steadily?

Thanks for all your blogs, they have been very helpful and inspiring.