Why The Best Trading Plan Is Built Around Anticipation

Professional traders do not just react to the market, they anticipate it. If you want to move from the ranks of losing traders into the upper-echelon of the trading ‘elite’, you need to become an anticipatory trader instead of a reactive one.

Professional traders do not just react to the market, they anticipate it. If you want to move from the ranks of losing traders into the upper-echelon of the trading ‘elite’, you need to become an anticipatory trader instead of a reactive one.

Most traders open their trading platform and start looking through the charts thinking to themselves, “What can I trade today?”, this is very reactive and random, essentially, they are trading on a ‘whim’. Reactionary traders see the market go up and they say, “Oh it’s too high, let’s sell it now”, or they see a market go down and say, “it’s too low, let’s buy”. Another common mistake is when a trader sees a huge move take place in a day and then they get all excited and jump right into the market as a result – this is reactive trading, and it’s a loser’s game.

Winners will approach the market much differently; they plan things out, they have picked the areas they want to trade from and the direction they will trade, maybe days or weeks before they know an entry trigger is likely to form. They don’t react, they anticipate.

The brain of a winning trader vs. a losing trader

The brain chemistry of a drug addict is very similar to that of a losing trader who is addicted to trading, sadly. Both people are stuck in a cycle of constantly needing to get their fix of dopamine, a neurotransmitter in the brain that plays a key role in our reward system. In the case of a drug addict, that fix comes from their drug of choice, which obviously has severe long-term consequences on their brains and bodies, potentially even leading to early death. In the case of a trading addict, their fix comes from entering trades and being in the market as much as possible, which has severe long-term consequences to their bank account of course, but can also affect their mental health, relationships and even physical health if it goes on long-enough. You see, the trading addict is a reactionary trader, and if you believe you are currently more of a reactive trader than an anticipatory one, you are on your way to trading addiction.

In contrast, a calm, collected, professional trader, is one who can wait patiently for days or weeks if need be, for the right trade to come along. They are disciplined and methodical and as a result, they are not gambling in the market, they are trading it with skill and planning. A professional trader is not addicted to the market, he or she does not NEED to be in a trade all the time to get their fix of dopamine, because they are viewing and treating their trading as a business that is detached from their self and their emotions. To put it succinctly, a professional trader is an anticipatory trader rather than a reactionary one.

I would highly caution that if you are currently a reactionary trader you may well be addicted to trading or approaching a real addiction to the market. This is basically the same thing as a gambling addiction which is a real, documented psychological problem that people actual pay to get professional treatment for. If you believe you are on the path to trading addiction and (or) you are a reactionary trader, you need to keep reading because I am going TO SHOW YOU how to stop this self-destructive trading approach…

How to build a trading plan based on anticipation

Success is what happens when proper preparation meets opportunity. Read that again.

If you want to succeed at anything in life, trading included, you must be properly prepared so when opportunity comes ‘knocking’, you know the right thing to do. Every success story, whether in business, trading or any other field, is based on planning or anticipating, not solely on being reactionary.

Perhaps more so than in any other field, anticipating scenarios and events is critical in trading. There is a never-ending stream of variables bombarding you every time you open your charts or even think about the markets. Thus, if you do not have a proper framework in place you are going to end up as another one of the herd of reactionary traders, impulsively throwing money at every little up or down tick in the market.

“Give me six hours to chop down a tree and I will spend the first four sharpening the axe.”

― Abraham Lincoln

- Map the market in advance

The first step in learning to anticipate your trades, is mapping the market in advance. By this I mean, looking at the bigger picture, from a top-down approach to understand the story the charts are telling you, so that you can anticipate what is most likely to happen next. After all, if you don’t know where you’ve been, you can never know where you’re going.

I always start by mapping out the weekly chart first. To do this, I zoom out so that I can see about a couple years’ worth of price action, then I start drawing in the obvious key levels of support and resistance, as you can see below…

Next, I am going to look at long-term and near-term or short-term trends, to determine which direction I will trade in. In the case of the weekly GBPUUSD chart below, the long-term trend is clearly up or bullish, so now I have my long-term trend and key long-term levels drawn in, time to start looking at the daily chart.

Now, we have the daily chart view; notice some of the same key levels are visible from the weekly chart above, and I have also labeled a pin bar buy signal as well as a short-term support level that we had been discussing recently in our weekly GBPUSD commentaries. We had been discussing that after price re-connected above 1.3340 we were looking to buy on a pull back near that level. If you had been anticipating this pull back you could have placed a buy limit entry order at 1.3340 to enter blindly IF price pulled back, which in this case it did…

Let’s look at another recent example of mapping the market and then anticipating a trade entry, in this example we are looking at the recent daily EURUSD chart that we discussed in our November 20th weekly market commentary:

Notice that we had mapped the key levels and we were anticipating a retrace back to support near 1.1660 area, so that we could get long as price had recently re-connected back above that level which switched our bias back to bullish, as mentioned in the commentary.

After a few weeks of price action, we can see that the market has pulled back and as of this past Friday (December 8th) formed a small bullish pin bar in-line with our existing view and at the support zone we have been anticipating to buy from in our recent discussions. Now, there’s no guarantee price will move higher from here, but there’s a strong chance we will see a move higher whilst it’s above 1.1660 and we now have a potential entry signal…

In summary: we have mapped the weekly and daily charts and determined the immediate direction we are looking to trade in for the upcoming week; which is up. We have levels we are anticipating trades at and we now can focus our attention on one direction and certain levels or areas on the chart.

- Determine which entry triggers to look for

I always like to include a few good examples of ‘ideal’ entry triggers in my trading plan, so that I never forget exactly what I’m looking for. Then, when I see a very similar entry trigger at a ‘hot area’ on the chart that I’ve previously mapped (see above), I have nothing to think about anymore, I just need to execute the trade. Thus, I am NOT REACTING, I am ACTING ON MY PLAN or using my anticipation.

My favorite entry triggers are, of course, price action signals. If you are new to my site, check out the following lessons to learn more about three of my favorite signals:

- Focus on levels or areas you want to trade from

Now that we have our markets mapped and we know the signals we are looking for, we can begin to focus-in on levels or areas / zones we would like to see these signals form at. I do get into this much more in-depth in my advanced price action trading course, but I will touch on this briefly here.

Remember, context is king, as with most things in life, but especially in trading. If you get a pin bar signal for example, at the wrong place on a chart or going against a strong trend, even if it looks ‘perfect’, it may be nothing more than market ‘chatter’ or random movement. For a price action signal to bear any significance, it must occur within the proper context on the chart, or at the proper place, this is called trading with confluence.

Of course, this is why you map the market in advance; to determine key levels and direction of trading. Then, you already have your bias and the areas you’re watching, so you know the context, you just need a signal to form that agrees with it. This is where the waiting comes in, and it’s probably the hardest part of trading and the most common part that people screw up. Can you sit on your hands for a week? Two weeks? Three? Most people can’t, and most people LOSE MONEY in the markets primarily because they can’t. Unfortunately, I cannot teach you to be disciplined and patient, all I can do is stress to you the importance of it, YOU must do this part yourself, and quite frankly, if you cannot do it you will never succeed at trading.

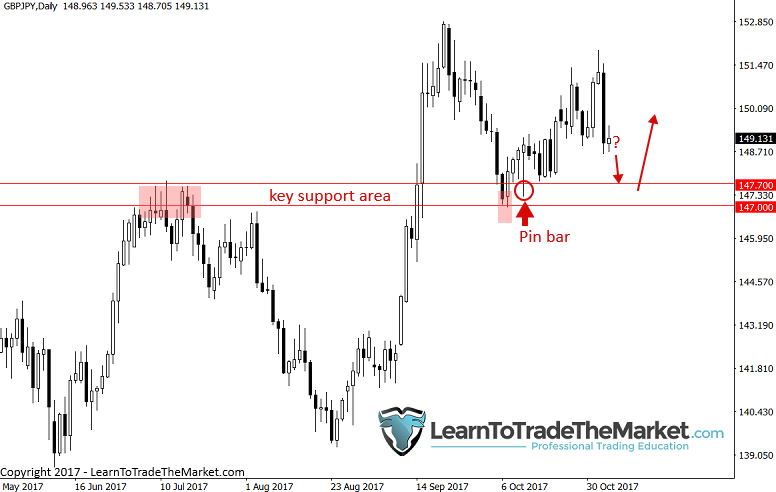

In the GBPJPY example below, we see a solid level at 147.00 – 147.70 area, indeed this was a level we discussed in our November 6th commentary. Notice we already had a pin bar buy signal there that paid off, a signal we discussed in our members daily trade setups newsletter the day it formed. Then, as price bounced higher and began pulling back, we were anticipating that we may get a re-test of that support at 147.00 – 147.70 area for another potential buying opportunity…

It took a few more weeks to play out, but price did pull-back to that support and dipped JUST under 147.00 before rocketing higher again. Hopefully, ‘light bulbs’ are going on in your head and you are starting to see the POWER of being a patient and anticipatory trader!

- Risk management

Of course, risk management is something every trader must spend a lot of time on, and it has everything to do with anticipation. However, in this case, we are anticipating that we may lose money on any given trade, EVEN IF we anticipate properly as described above.

I have written many articles about the psychology of why you need to accept that you COULD lose on any given trade. If you haven’t read any of them, check out this lesson on the key to lasting trading success.

In addition to knowing why you must manage risk properly on every trade, you must also understand HOW to do it. This basically comes down to stop loss placement (which is an art and skill unto itself) as well as position sizing. I strongly suggest you click on the last two hyperlinks to learn more about these topics.

In closing

I hope now you have a good idea of why you need to become an anticipatory trader rather than a reactionary one, and how to do it. The more time and energy you put into learning to read the price action on the charts and the ‘story’ the market is telling, the better anticipatory trader you will become. I have spent nearly two decades perfecting my trading approach and if I could summarize it in one brief lesson, it would probably be the one you just read. However, I delve into these topics in much more detail in my trading course and members area.

Everything in my course leads up to the section on trading plans, in which I share with you my trading plan template and show you exactly how I plan out my trading approach. I am preparing you to become an anticipatory trader with a plan of action, because that is how I trade, and I know it’s what works. You will become the ‘sniper’, not the ‘machine gunner’ and you will learn how to wait patiently until the time is just right to ‘attack’ the market.

LEAVE A COMMENT BELOW & TELL ME WHAT YOU THINK …

Any questions or feedback? Contact me here.

Good lesson. Thanks

My Very old and. Professional teacher nial I got lot of success…thanks

Anticipate and dont be participate.

Wow, what an insight to trading. You the best nial I am learning so much from you honestly this article totally changed the way I look at my charts

Excellent article!

Thanks for all !

im learning a lot about that !

Nayel Hi, is undoubtedly one of the best and concise articles you wrote, well done, I learned a lot from you over the years and wish you had many more years of successful trading and learning new traders along the way. from benny tzarfaty

Great article. You got a new fan

Thanks sir.

Hello Nial, this article is among the best you have prepared so far, continues to clarify with advice the best way to prepare for a good merchant. Greetings and have a happy holiday and that the coming year is the best year of trade possible Justo Salazar Coello

i realy enjoy when read your article, thx a lot for the most important tips

:)

thanks MR NIALyou are the best teacher and lecture..if not you .whos i m.in trader.thank very kind

Thank you ,Mr Nial,I really happy and got too much knowledge .

Thank you Nial. This is great.

Hi There.

I find I was trying to trade every signal. After reading Why best trading plan must be built around anticipation.

I selected my confluence areas (levels) and have high lighted the areas at these levels where I anticipate the price will trade to.

Two reasons

1. it will improve my ability to anticipate price action movement.

2. forces me to wait for price action to reach the correct areas to trade

Great lesson. To anticipate is everything on the higher timeframes. No stress of the lower time frames, I’ll never go back to them again. Thanks Nial

Great wrap up of all your important trading lessons. Thank you Nial.

Unparallel. Promising and hopeful. Thanks without limit.

Another great Lesson as always from the guru himself. Thank you very much.

Thanks,

very educative & insightful.

Great insight Sir, coz i realized the hard way how confusing it can be when you enter the battle (market) the following trading week without adequate preparation.

Excellent Niall, your entire trading philosophy beautifully encapsulated.