How To Place Stop Losses Like a Pro Trader

Stop loss placement is perhaps not the most glamorous of trading topics to discuss, but it is a critically important one. If you do not know how to properly place your stop losses you will be in for a very, very rough ride as you trade the markets. Essentially, for a trader, everything hinges on proper stop loss placement and risk management. If you understand these two aspects of trading and how to approach them properly, making consistent money in the market will become much, much easier for you.

Stop loss placement is perhaps not the most glamorous of trading topics to discuss, but it is a critically important one. If you do not know how to properly place your stop losses you will be in for a very, very rough ride as you trade the markets. Essentially, for a trader, everything hinges on proper stop loss placement and risk management. If you understand these two aspects of trading and how to approach them properly, making consistent money in the market will become much, much easier for you.

Note: This lesson is based on higher time frame charts and the concepts are not applicable to very low time frames which is a different world of trading and not something I do or recommend so I can’t comment on it.

The theory behind placing stop losses like a pro trader

The first thing to understand and drill into your head about stop loss placement is that you should NEVER place a stop loss based on some random amount of pips. I know a lot of traders do this because I get emails from traders telling me they use “20 pip stops” or “50 pip stops”, etc. etc. This is NOT proper stop loss placement and it is definitely NOT how professional traders place their stop losses…

A stop loss should typically be based on a level in the market. Price should have to breach a level to ‘prove’ your trade wrong. You want to see price invalidate your view by giving you fact-based evidence you are wrong, that evidence comes in the form of the most logical nearby level of support or resistance being breached.

You need to take into account the context of the market you are trading and determine what level price would have to break through before your original view doesn’t make technical sense anymore. Let’s take a look at two examples to make this clearer…

The first example below shows a random pip amount stop loss placement, the second example shows a stop loss placed within the context of the market and nearby levels. Make note of the end results of both trades…

Notice in the chart below the trader placed his stop loss at an arbitrary 50 pip distance from entry. Traders typically do this because they don’t understand how to place stops properly and also because they want to trade a bigger position size. This is wrong. You need a logic / chart-based reason to place a stop loss, not just a random pip distance or a pip distance that will allow you to trade the size you want. Notice this trader would have been stopped out for a loss just before the market shot higher, without them on board…

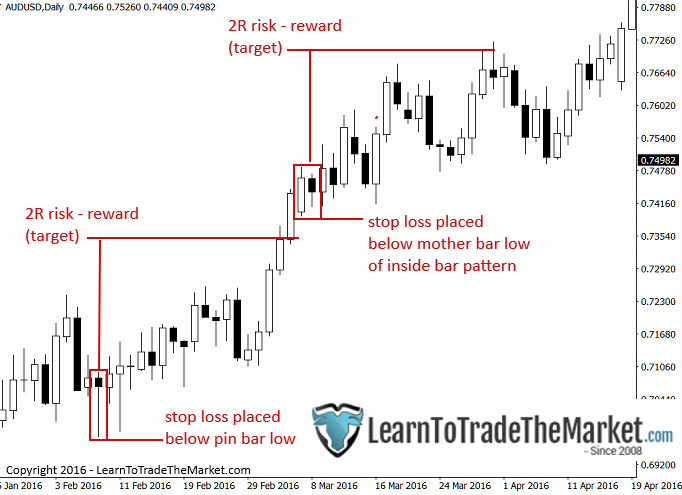

In the next chart, we can see how this trade worked out for the trader who knew how to place stops properly / like a pro and who wasn’t placing his stop arbitrarily or based on greed (to trade a bigger size). Notice the stop loss was placed beyond the key support level and beyond the pin bar low, giving the trade good space to work out but also being placed at a point that would logically invalidate the trade if price moved beyond it….

Let’s briefly go over typical stop loss placement on two price action setups I teach; the pin bar signal and the inside bar signal. You will notice, I used a risk reward ratio of 2 to 1 on each trade, this is my ‘default’ risk reward. In other words, I always start any trade by seeing if a 2 to 1 (or more) risk reward is realistically possible given the market structure and context the pattern formed within. For expanded examples, check out my lesson on how to place stops and targets like a pro.

Note: Be aware of the average volatility over the last 7 to 10 days of the market you’re trading. You want your stop at least half of ATR (average true range) if not more or you will get stopped out due to noise.

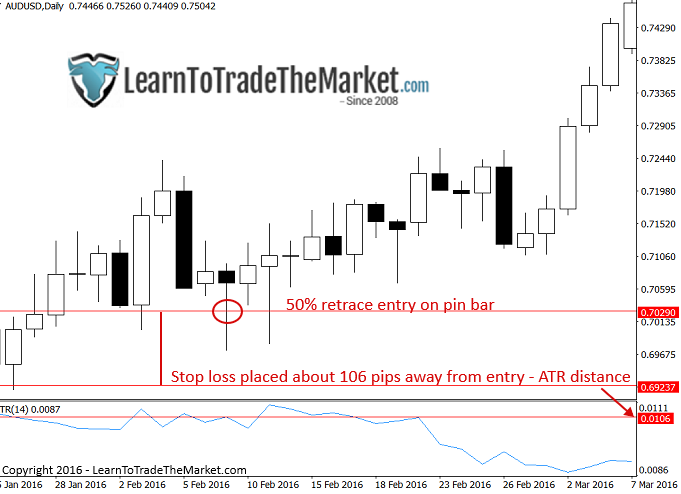

The Average True Range is a tool we can use to see average market volatility over XYZ days. It is a good tool to utilize for stop loss placement when no nearby key levels are present. To learn how to apply and use the ATR tool more in-depth, check out my article on the average true range.

The example below shows how to use the ATR for stop loss placement and how it can keep you in a trade despite initial choppy conditions after the pattern…

Important stop loss placement tips

It’s important to consider reward or target potential before taking any trade. You base the potential target of a trade on the stop loss distance. If the stop has to be too wide in order for the trade to have enough space to potentially work out, and the risk reward potential doesn’t stack up, then it’s usually not the best idea to take the trade.

Risk reward and position sizing are intimately related to stop loss placement obviously, and crucial topics in their own right. But, we are focusing here in this lesson just on stops, be aware that stops are paramount and take precedence over targets, in a way, stops are a qualifier for the target and overall risk reward and will effectively help you filter trades you should take and should not.

It is important to note that stops should always remain constant and can’t be widened, however targets can be widened, stops should only ever be tightened and moved into break even and trailed, make sure that’s concrete in your trading plan.

Stops are crucial to managing risk because once we find the stop loss placement we can then determine our position size on the trade and then we know ahead of time the cost and risks of the trade. As part of our trading business plan, stops are a cost of doing business as a trader, they are also there to force us to get out if we are wrong on a trade, despite our emotional bias towards staying in a trade, which in the end can cost us dearly if we were to hang onto a loser until we blew out our account balance.

Conclusion

A properly placed stop loss is truly the starting point of a successful trade. It allows us to proceed with calculating reward targets on trades and position size, effectively allowing us to execute our predetermined trading edge with a clear mental state and discipline. Traders who do not focus on stop loss placement first or put a lot of importance on doing it right, are doomed to fail and blow out their accounts.

I hope today’s lesson has given you a little ‘snapshot’ into how I approach stop loss placement. My trading course and members’ area will further educate you on how I place stop losses and how I incorporate stop loss placement into my overall trading strategy. To learn more, click here.

Thanks so much for your educative article that’s have been improving my Trading career so much, please I want to ask how can I set the stop loss using the ATR multiple according to a percentage of account balance I’m to risk ? And also in cases When I can no longer reduce my position size ?

Thanks for that Nial

Will always be grateful with your lectures, thanks Nial.

The whole Truth and nothing but the Truth. Thanks Nial ~

Realy helpful Nial thanks

Thank you for this article.

Thank you for a nice article.

I am new to the business, l will need good guidance to make profitable trades, l indeed find your article helpful, this is my first time of coming across it. Thanks, it’s quite a good job.

I would like to learn more about Forex. Can you please induct me more

Very insightful, didn’t treat the stop loss with that much respect until I read this article! Great work Nial! Looking forward to becoming a full time member of your community

hello niall, regarding your statement “A stop loss should typically be based on a level in the market. Price should have to breach a level to ‘prove’ your trade wrong”, even if it means 10 pips or less for the stoploss. for eg theres a bullish engulfing candle after a test in a support level at 5 min chart, ideally i would put my stop few pips below the wick of that support.

please clarify. thank you

He trades higher time frame, so this write up might not suit your trading time frame

Thanks Mr Fuller for this very good article on stop placement. It really helps !

Its a great pleasure to learn as a begginer in the market and i wish to learn more so that oneday i can make a better profit.

i agree with nail words

Good article thank you

Thank you for sharing Nial. Outstanding! article. Keep up the great work that you are doing. Thank you!

I would like to convey my gratitude with powerful learning lesson i receive from you. Thank you.

Thanks a great deal.

I remember this cable pin above, and was in for a ride, £2.75 a point only to be hit the following day before take off. It’s not that I didn’t know what I was doing, but sometimes the market do crazy things. Nice Article

This lesson is worth its salt. Thanks NIAL.

This is great post and I have experience it. I have lost many trade any time i trade with tight stop loss. I think that proper placement of stop loss is the first thing to learnt for successful trading.

Great article Niall – thank you. Stop losses for me are now mandatory (they weren’t before!). Since I started using stops I find I don’t have to continually top up my account anymore.

Good article thank you

Excellent post about proper SL placing. Nial proves his experiance in every lesson.

I have witnessed this quite a number of occasions, not knowing how to put a stop loss properly is simply not knowing how to trade. Thanks Nial.

Great article

A timely article. I almost blew my account by placing wrong stop loss, being too greedy…when i was down to my last 100 dollars, i had my Aha moment on the stop loss and 2 to 1 ratio. Now i am back to my profitable days and peaceful sleep.