How To Use 1 & 4 hour Chart Time-Frames to Confirm Daily Chart Signals

A common question beginning traders ask me is whether or not I use intraday or “lower time frame charts” and if so, how do I use them?

A common question beginning traders ask me is whether or not I use intraday or “lower time frame charts” and if so, how do I use them?

For the most part, the answer is yes, I do use intraday charts. However, (you knew there was going to be a however, right?) there is a time and place for everything, especially intraday charts. It’s important you understand when to use them and how to use them. This is something I go into much greater detail on in my advanced price action trading course, but for today’s lesson, I wanted to give you a brief overview of just how I incorporate intraday charts into my daily trading routine.

This tutorial will demonstrate several of the core ways I use intraday chart time frames to provide additional confirmation to daily chart signals as well as manage risk, manage position size and improve the risk reward of a trade.

My favorite intraday chart time frames to trade…

Typically, people who email me about the intraday time frames want to know if I ever trade solely off of these lower time frames. The answer is, yes, I sometimes do trade the 1-hour or 4-hour charts on their own without taking into account the daily or weekly time frame. However, 90% of the time I use the 1-hour and 4-hour charts to confirm the higher time frame signal, mainly the daily chart time frame.

In this way, the intraday charts work as an extra point of confluence to give weight to a trade and further confirm whether or not I want to enter it. The other big advantage of the intraday charts is that they can allow me to fine-tune my entry to achieve better risk management. More on these topics later.

- The most important thing to remember is that I never go lower than the 1-hour chart because from my experience, any time frame under the 1-hour is just noise. As you go lower in time frame, there are increasing amounts of meaningless price bars that you have to sift through and this makes the story of the market cloudier and cloudier, until you reach a 1-minute chart where you are basically just trying to make sense of gibberish.

- I only look at the 1-hour and 4-hour charts when I am looking at intraday time frames. The anchor chart that I base most of my trading decisions on is always the daily chart time frame.

- For those who like to look at weekly charts, the concepts in this lesson could be applied there as well. You would essentially use the daily charts to confirm weekly signals and add confluence to them, as well as fine-tune your risk management. It should be noted, I rarely trade off weekly charts alone, but for the die-hard weekly-chart traders, keep this in mind when reading the rest of this tutorial.

- Remember, it is NOT essential to trade the daily chart with confirmation from the intraday. It’s just something you might want to implement as you become more advanced and have mastered the basics of trading daily chart time frames.

- Remember, this is NOT day trading! The length of time we are holding these trades is still intended to be a full overnight position or multiple days / weeks. Remember, the initial trade trigger is still the higher time frame chart.

Using Intraday Charts for Second Chance Trade Entries

Everyone hates missing out on a perfectly good trade, myself included. Luckily, there are a number of different ways you can get a good second chance trade entry on a signal you initially missed.

One of those ways is by use of the 1-hour or 4-hour charts to look for a signal a few hours or even days later, to re-enter in the direction of the original daily chart signal that you missed.

In the example below, we see a clear-as-day pin bar buy signal from support in the S&P500, circled in the chart below. If you missed this one, you were definitely kicking yourself…

However, for savvy price action traders, they know a second-chance entry will often present itself on the intraday charts not long after the daily signal fires off. Notice, in the chart below, we see a fakey pin bar combo pattern formed shortly after the daily pin bar. Also, notice there was a larger 4-hour pin bar that formed the same day as the daily signal, adding more confluence to that daily signal.

Using Intraday Charts to Confirm Daily Signals

Sometimes, you may see a potential daily chart signal but you don’t feel convinced. It may not “look right” to you and you feel it needs some more confirmation as a result. This is normal, and it happens often.

You will sometimes then get a 1-hour or 4-hour chart showing a super-convincing signal after the daily one you weren’t sure about.

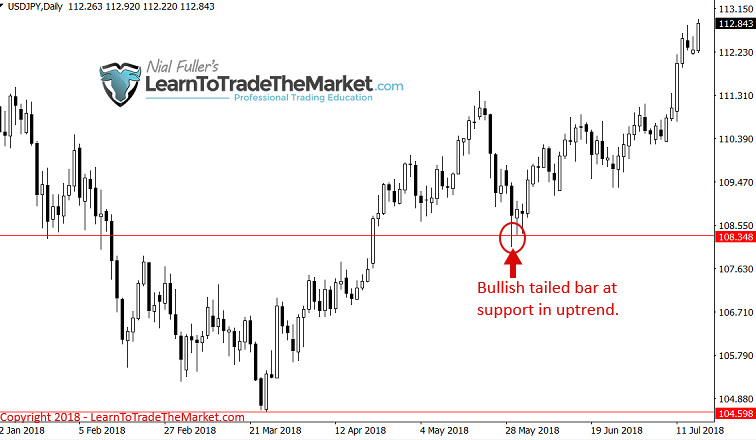

Notice, in the chart below, we had a bullish tailed bar at support in an up-trending market. But at the time that bar formed, you would probably be wondering if it was really worth taking or not, due to its bearish close and the preceding swing lower.

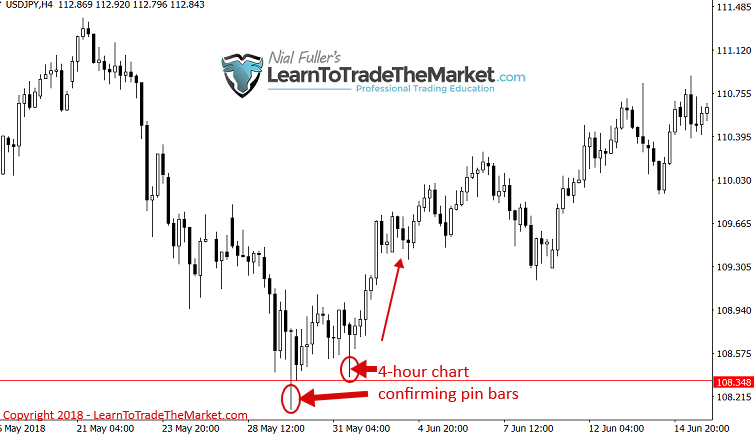

Intraday chart to the rescue. Notice the two convincing 4-hour pin bars that formed around the time of the above daily chart bullish tailed bar. You could have used these 4-hour pins to further confirm your feeling about the daily chart signal you weren’t sure about.

Sometimes, you will see a daily chart signal forms but does not have any real obvious confluence with a strong trend or key chart level. In these cases, you can rely on a clean intraday signal to be the confluence that you need to either enter the trade or pass on it.

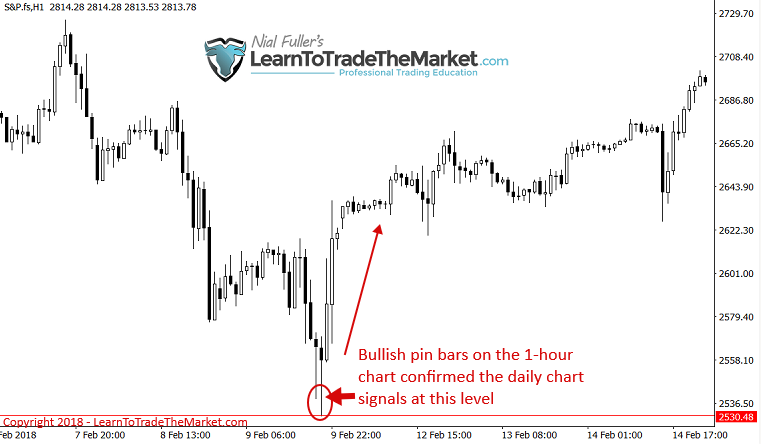

Notice in the daily S&P500 chart below, there was an intense sell off in early 2018. It would have been very tough for most traders to buy right after such a strong sell-off. There was a lot of bearish momentum and pressure overhead and this would have cast doubt on the daily chart pin bar signals seen below.

The 1-hour chart would have helped us in this situation. As seen below, back-to-back 1-hour chart pin bars formed at the time of the above daily signals, indicating further confluence and giving us further confirmation, it was safe to enter long. Also, entering on these 1-hour pin bars allowed a much tighter stop loss and thus better risk / reward profile as will be discussed in the next section.

Using Intraday Charts to Tweak Your Risk Reward and Position Size

As we know, the daily chart requires us to use wider stops most of the time (unless we use the 50% tweak entry as exception), so in most cases, when we use the 1 or 4-hour intraday chart, we can implement a tighter stop loss and adjust position size accordingly. This allows us to substantially improve our risk reward because the stop loss distance is reduced and the position size can be increased as a result, but the profit target remains the same.

This is not going to be the case on every trade on intraday charts, sometimes the risk management ends up being very similar to what it would have been on the daily chart on its own. But there are many instances where it works out to where you can double or triple the potential reward on a trade by utilizing intraday signals.

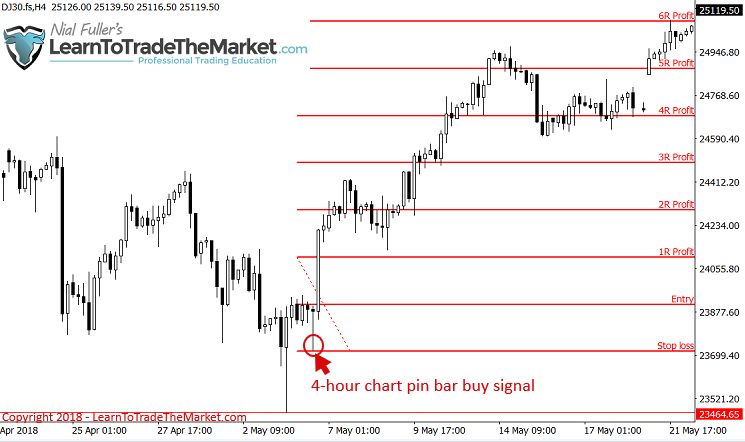

In the Dow Jones daily chart example below, we can see a clear pin bar signal formed and if you had entered near the pin high with the classic stop placement of the pin low, you’d likely get a 2R reward, POSSIBLY 2.5 or 3R at the most.

The 4-hour Dow Jones chart around this same time, fired off a 4-hour pin bar shortly after the daily pin above, providing us the potential to essential trade that pin bar instead, this reduces the stop loss by about half and allows us to double the position size, upping the reward to 6R max instead of 3R. Maximizing winning trades is essentially how you build a small account into a big one and how you make big money in the markets.

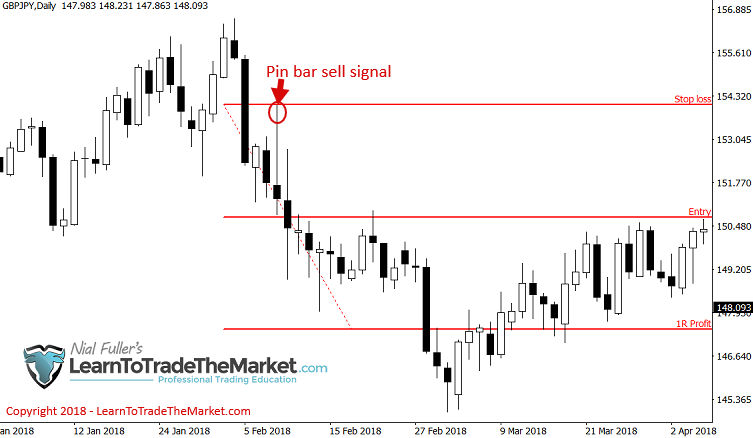

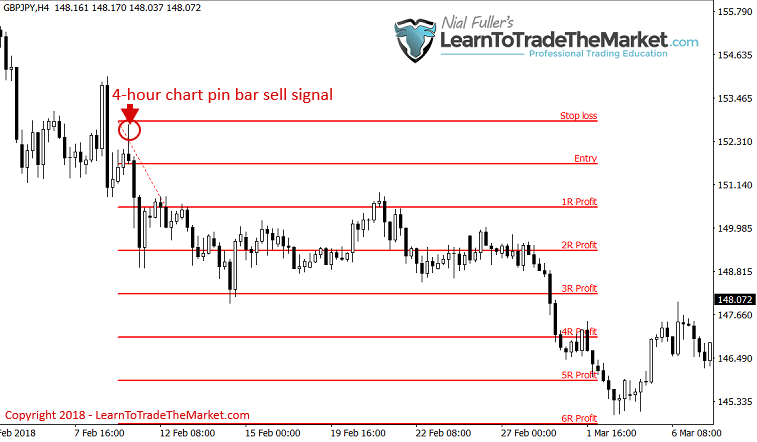

A similar situation in the example below. A nice GBPJPY bearish daily pin bar formed, albeit a pretty wide one. Your stop loss would have been over 300 pips from pin high to low on this one, greatly limiting the potential Risk Reward:

The 4-hour chart fired off a much smaller pin bar after the above daily pin. This allowed us to turn a 1R winner into a 5R or more potential.

Conclusion

The intraday tweaks and ‘tricks’ that I showed you in today’s lesson are just some of the ways I utilize the 1-hour and 4-hour charts with my three core price action trading strategies in my trading plan.

Price action trading does not simply consist of just looking for a few candle patterns on a chart and then placing a trade, not even close. There is a lot more involved. The process of actually finding and filtering trades, managing risk / reward and then executing the trade and managing it both technically and mentally, is something you can’t learn overnight. There is a technical analysis side and a mental side to every trade, and both parts have to be learned and practiced over and over before you truly gain the ability to make consistent money in the market.

After reading today’s lesson, I hope you have a better understanding of how to use the intraday charts properly, unlike most traders. Don’t make the mistake of using the intraday charts to micro-manage your position and over-trade. This is wrong and will cause you to lose money.

Instead, utilize the tips and tricks learned in this lesson and the others I teach in my trading course, to use the intraday charts to your advantage. Trading is about making the most out of a good signal, and this is what I use the intraday charts for, not to over-trade or meddle in my trades like most traders do. I hope you too can now use the intraday charts to your advantage by implementing the theory and concepts in this tutorial to ultimately improve the odds of any given trade working out in your favor and maximize its profit.

What did you think of this lesson? Please leave your comments & feedback below!

wow, wow, wow.. thank you sir…you are incredible! I’m newbie and I think this is what I wanted to hear/read…. God bless you sir !!!!

This is absolutely good. I have been trying to piece together the intraday charts for a while and how they can help my trading. Now to take this info and learn it. Many Thanks!

Thank you for your share Nial, you are still the best.

Thanks you a lot sir it’s really helpful I personally appreciate ????????

hey sir this lesson was very informative an to someone like me who love using these time frame its help alot hope i could get in touched with thank you

Thanks ???? what a good job

Hi Mr. Fuller,

My question may sound a little naive but I want to know how do a sell or buy stop order on a pin bar for the next trade when the pin bar has not yet developed? Is it the previous day sell or buy pin bar signal you meant? My question is based on the following excerpt from one of your articles:

If you are trading an inside bar setup for example, you do not need to sit there waiting for the market to break past the mother bar high or low to enter. Instead, you can simply place a buy stop or sell stop just above the high or low of the inside bar and then go do something else.

Secondly, is your advanced course already posted in the membership area or members have to pay for it?

In meta trader you can set buy stop or sell stop orders to enter break out trades when you are away from your computer.

The new course is included for all members.

This is absolute GOLD!

This article is priceless for me.

Thank you Coach.

Thank you, Mr. Fuller! This is very convincing!

I would like to know more about the 50% tweak entry. Which article should I read to understand this entry method?

Thanks Nial, God bless you

thank you man God bless people like you.you are an angel?

Excellent lesson, informatively. Thanks

I can’t trade good. because i have too much information in my head.

You will get there eventually. Keep God first

I have been getting more knowledge after reading this lesson. Thank very much Mr Nial

its such an insightful lesson. Thank you

This tutorial is one in a million….God bless u real good

Thanks for clearing up the 1 and 4 hour chart time frame, now I know how to use it, thanks a lot!

thank you sir.

The best and clearest article I’ve ever read. Thank you for the lesson.

Mr. Nial! article is very informative, I am very glad that has found your blog, the sea of important information, thank you

Nial

I sometimes get confused seeing you show black tail bars as BUY signals. do they indicate buy in an uptrend if it has a long tail at the low end of a bearish price bar

Regards

So simple and yet so profound. Thanks Fuller

As always Nial comes in with sane thinking…

Hi Nial.

This lesson is the apex of my study.

I have been scalping on a demo account the last one month, have blown it and now stranded.

I hear you indeed.

Awesome

this is just an awesome strategy to reduce your risk and maximize your reward. Thanks alot Nial for this awesome article

nial this is the most accurate of your forex analysis that youve ever published. Its true that whenever trading, though one is using the daily chart candle signals, as entry should and must be done in the lower chart frames, one can never enter based on the signal of the daily chart alone as ive noticed but also on all the lower chart frames, specifically the hourly and 15 charts combined.

I am a newbie and the way you break it down is awesome. Keep up the good work Nial.

Thank you sir for your another very good lesion.

Thank you Nial for the charts and explanation. Seeing examples is a great way to learn. Mil gracias

Superb ideas to share with. Its wonderful. Mind blowing ideas. Thank you Mr. Nial.

Thanks for this idea …

Can you include in your article on “When is the right time to close an floating order?

What are the risk if I have to wait for the market to changes?

This lesson is so useful. Thank you my Mentor.

Another helpful article but wouldn’t there be an added advantage by using an 8 or 12 hour candle which would more closely reflect the markets closing in London or New York?.If so can MT4 produce 8 or 12 candles?

No it can’t. I don’t think there is an advantage either.

Thanks Nail

Great trading tip to increase the R:R ratio. This is priceless information for me.

Thanks Niel…..thanks alot

Thanks Nial. Great article revealing the nuances

An excellent article, which helped me understand price action trading much better than before.

Thanks for sharing. Appreciate it.

I like the concept of using the intra day charts to give extra weight to a proposed trade. Still using the daily charts as the ‘anchor’ for filtering trades. Great lesson. Thank you

Dear Mr. Nial,

Detailed and well_informative , good article for weekend. Thank you .

In fact, this is a wonderful article that can enhance trading results. God bless you a lot.

Nice information. Thanks

Thank you

This is great piece and its straight forward and very eazy to understand…..keep it up sir. Salute!!

nial grasias por tan intructiva lecsion no tiene precio estas lecsiones que erecivido thank you once again

Dear Nial,

Many thanks for this educative and straightforward tutorial.

E X C E L L E NT Article !

Great lesson Nial, I am guilty of cutting my profits short and this has been a great lesson, Thank You.

Great lesson Nial

This is a great insight on money management in forex trading.I have just been blessed by this article.A million thanks to

Nial.

Great article as always, thanks a million.

Learned more from this article than six months of listening to other so called guru’s.

thank You and I will be joining your group today.

thank you sir. i will go and test it out

Nial thanks for this eyeing opening secret on how to use lower time frame with higher time to confirm signal, thank you once again

Nial you have just open my eye on how to combine lower time frame with higher time frame, thanks God bless you

Fantastic ! I’m often told to look for trends on daily but place your trade on H4 or H1. You have made it easier to understand.

Thanks a lot. great teacher. I’m new in trading but I have learnt a lot in your articles

Thank you for this lesson, it is super helpful

Regards

Helen

Brilliant article with recent market. Thanks Nial.

Top lesson from top trader.Thank you,Sir!

as always , you are straight to the point , i have been using the daily charts for quiet sometime now but i did not know how to use the lower time-frame for entries . my profit target is usually 2R max 3R . so does this mean that i if i use the lower time-frame for entries my risk reward ratio increases ? your articles have been very helpful , in fact your articles alone are a trading course and i have improved a lot . one of my favourite articles is A SIMPLE PLAN TO DRAMATICALLY IMPROVE YOUR TRADING RESULTS and TRADE LIKE NIAL , and indeed my trading results have improved , i am currently saving money to purchase your trading course .

thanks you NIAL FULLER you are a great mentor .

Thank u so much Nail. U are good teacher and I hope send me useful article more and more.

Very educative and informing, helps a lot in improving my daily trading strategy. God bless you

This article comes just after I recently noticed the 1hour chart gives more tailed bars with good reward ratio’s which can offer three to four trades per week. Is this something you can recommend?

Again great article as always.

very informative.just beginning to love to the game.

u r a great teacher sir.. I love your teaching..

This is the last piece I have been missing,am your disciple and read your article every week,you have made me a good trader and I know with you am on my way to been a professional Fx trader.This article is an eye opener because I have been in a dilemma over the usefulness of 1h and 4h chats if I trade daily.Thanks Niel

Exacto!

My sincere thanks and salutation to you Sir. Nial. Thank you for all these amazing tips and great guidelines. God bless you.

Wow this is very informative , thanks Nial

Wow!!!

This is really good … my dear Maestro.

Thank you.

Nial, thank you for another excellent articles.

Hi Mr Fuller,

Thanks for the the very important clatification of this part of trading

SUPER

Best Regards

Rossen Dimitrov

Hello Nial

I have purchased your price action course and found it to be excellent in the way you explain straight to the point along with your transparency in trading I have in recent times purchased other courses and found them to be rubbish and a waste of money they all seemed to hold back on their little trade secrets

I’m still trading on a demo account (not confident as yet) I’m still getting my head around how to trade off the 1&4 hour charts and with your examples above they have helped I would like to know when do you start to look on the lower timeframes that is the close of the daily candle or during the daily session. (hope that makes sense)

Regards

Paul

excellent

super noted boss, jah bless ya. the skill of forex trading is in ya blood jst lyk i feel is in me too. see ya at the top

As always, a timely, concise yet robust feature. I have been looking at this specific time frames recently as a way of finding more trades and will have to read and read again this piece until every line on it is translated into my trading charts moving forward. I will surely get back to you with my testimonies. Thank you

This is a brilliant strategy thanks Nial. I do miss a number of daily trades

Nial, thanks for this very good lecture. May God Bless you and your family.

Have you written anything on how to use a trail stop or can you please write an article on how you use a trail stop. Thank you once again!!