Watching Charts Intraday Will Harm Your Trading Results

Trading is not the easiest profession in the world to succeed at, as you may well know by now. We need to do everything we can to put the odds of success as far in our favor as possible. However, most traders do the exact opposite; they turn the odds of success against them, most of the time unknowingly.

Trading is not the easiest profession in the world to succeed at, as you may well know by now. We need to do everything we can to put the odds of success as far in our favor as possible. However, most traders do the exact opposite; they turn the odds of success against them, most of the time unknowingly.

The single most significant and EASIEST way to tilt the scales of success in your favor, is by simply not watching intraday charts. Time and time again, I have seen traders fail because they are so hyper-focused on short time frames. There are many misconceptions about intraday charts that lead traders to believe watching them provides some type of advantage. In reality, especially to a beginning or amateur trader, watching intraday charts does nothing but impede their progress and decrease their chances of even surviving, let alone thriving in the market.

My Set and Forget Philosophy

If you read my blog regularly, you know I’m an advocate of end-of-day trading, which basically just means I analyze the market at the end of the trading day and place trades based on that end-of-day data. I then adopt a set and forget mentality, not touching trades for the most part, letting the market do its thing, because I know I can’t control what price does. This helps me to avoid most of the emotions that arise from watching intraday price movements. It’s important to note that I do monitor my trades and positions, but I certainly don’t sit around watching them ‘live on TV’ or for entertainment.

The mental advantages that you get when you adopt this set and forget trading philosophy are many and significant. I won’t get into all of them here, but to learn more about them check out my article on set and forget trading.

Don’t Torture Yourself Watching Your Trades

Ever entered a trade and watched it tick-by-tick for the next few days, agonizing over every 20-point swing for or against your position? If you go back to the chart and look at the situation retrospectively, you will see that the market moved from point X to Y, despite the intraday movement and chop. There is no reason to sit there watching all the intraday chop any time you have a trade on. All it will result in is a lot of mental anguish for you, which can lead you to make some pretty significant trading mistakes as we will talk about next…

Don’t be tempted to fiddle with your trades

Watching the intraday screens too much can certainly do a number on your trading mindset. We need to do everything we can to not induce the wrong mindset as we analyze and trade the market, because once we get into the wrong mindset it can be nearly impossible to break out of it.

As we sit at our charts, staring at them and watching price tick over, all kinds of things can happen in our minds. We make up reasons to move our entry orders from where we initially wanted to place them, we move stop losses or targets. We may enter a trade purely on emotion or exit a trade purely on emotion, all by watching the charts too much. However, it doesn’t end there, once you get into this mindset, it makes each subsequent trade more difficult because you are living in the hindsight loop. This is where you over-analyze and thus over-think about the market and your trades, causing you to lose sight of proper trading habits and second-guess every trade you take based on past trades that you missed out on, mainly from being in the wrong mindset and over-thinking.

End-of-Day vs Intraday

End-of-day trading is superior to intraday trading for many, many reasons. Perhaps the most important reason is that a daily chart time frame (end-of-day data) shows you a more important view of the market than any intraday chart does. As a result, any level, or price action signal you see on a daily chart is going to be much more accurate than any level or signal on a lower time frame, generally speaking.

As I discuss in my article on the best chart time frames to trade, the higher in time frame you go, the less market noise and random price movement there is. This of course makes it easier to complete your analysis each day, identify key chart levels, identify stop loss levels and plan out your risk management on any given trade.

When you look at LESS data each day, you have a much better chance of not falling victim to over-trading and trading addiction, something that can cause you to blow out your entire trading account much faster than you imagine.

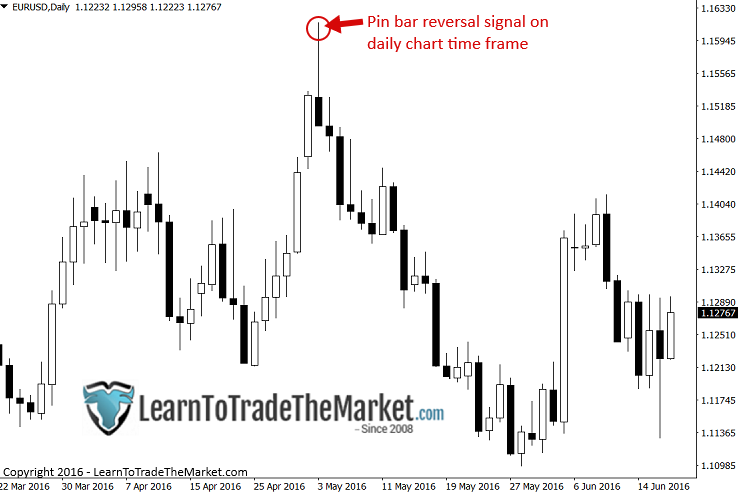

The below chart examples show the difference between analyzing daily charts and intraday charts. Each daily chart bar is a single bar that reflects 24-hours of data, the intraday chart is hundreds of smaller bars, ask yourself what is a cleaner and less stressful chart to look at to form a view of the market?

First, take a look at this daily EURUSD chart and the clear and obvious pin bar reversal signal that formed…

Next, look at the 5-minute chart of the exact same period of time as the pin bar on the daily chart above. First off, you can’t even see the pin bar signal that lead to a huge decline in price in the subsequent days. Also, there are literally hundreds of bars on this chart, tons of chop, which would quite literally ‘chop’ up your thinking and confuse you, causing you to possibly miss-out on the daily chart trade as a result of over-thinking and over-analyzing…

In the daily chart of the AUDUSD below, you can see a clear set of bullish pin bar buy signals that formed in-line with the previous bullish momentum. A clear buying opportunity for any end-of-day trader; no stress, no worries…

Next, look at the 4-hour chart time frame of the same period of time as the daily above. Now, the 4-hour chart can be traded successfully if you know how to trade the daily properly. But, the point here is to show that even a good time frame like the 4 hour, is not nearly as clear and easy to trade as the daily chart end-of-day data. I don’t know about you, but all I see is choppy sideways price movement on this chart…

Conclusion

This article has explained why watching intraday charts will harm your trading results, and harm your ability to make accurate decisions on a consistent basis. If you want to transition from screen-watching to end-of-day trading and a less stressful trading career and life, you need to start learning to trade end of day, and train yourself to adopt a set and forget mentality. My professional trading course, expands on these concepts in great detail and is the core foundation of my trading approach and beliefs. My personal aim in trading is to spend the least amount of time possible analyzing the market and watching the market so I can avoid the stress and emotions of trading and ultimately enjoy my life and the fruits that my profession offers.

I love all of your articles so much. I have been trading options for almost 3 years and have yet to make a profit but I have learned a great deal from my mistakes. Trading on the lower timeframe is a habit I am breaking and cutting losses quickly. I know how to read price action and still have a hard time breaking myself from the 5 min and 1 min chart. I had a light bulb moment when I realized if I just be patient and only watch the 4 hr chart and daily candles I would avoid a lot of stress! I make the most money and stay in my trades longer when I ignore the smaller timeframes. I’m beyond annoyed that I picked up the bad day trading habit but I’m dropping it the same way I dropped buying weekly contracts. It’s just not worth it. Thanks for the article!!!

fine lesson! all is accurate and clear, thanks Mr. Nial!

You couldn’t have said it better.

I wish I knew this when I started out.

Thanks Nial.

Me too. i think even brokers want all beginners to trade on small time frames only. Even my own broker suggested to me i should trade 30 mins and below timeframe as there is more signals and you can make more money! it makes me sick to think brokers do this.

thanks Nial for an honest article

I am always trading in small timeframe and lossing money every time. Now l read your article and develop day by day. Following your End-of-day trading formula with daily chart and improve my trading ability. What a great idea in forex market. I also follow your weekly trade setup(free) and properly read your various type of trading article 3/4 hours in a day to your website “LEARN TO TRADE THE MARKET.COM”. Its a great helpfull for myself and Thank you.

I want setup my trade in small timeframe that will be loss trade. Now l read your article and habit End-of-day trading with daily chart and take profit successful. I also fallow your weekly setup and comentory (free). It is very help full to trade entry for major pair in the weekly trade. Thank you for your great help to trade in forex market. I am learning with your various type of trading article. I study your article 3/4 hours in a day. I am very happy and hopefull to trade in forex market. I wish always reading your trading article.

Thanks,many years have known a daily chart is good for me but for some reason I could not follow through,your price action and pin bars are a plus and am looking forward to use this knowledge for my advantage.

Thanks Nail, for this masterpiece. I very much appreciate u

Good article, espevially for beginners. Definitely start with swing trading and if you’re comfortable you can always transition into day trading, if you understand two key points:

– intraday price action develops the daily candle

– multiple timeframe analysis

It is also worth noting that there is a correlation between the intraday trend and price action, and a daily reversal turning into a successful trade. This will help you avoid bear and bull traps, and is the reason I will personally never take a trade on the daily without at least looking at the 4h chart.

Thanks for the insightful lesson. Please,by end of day analysis, does it mean you place your trade towards the end of the day after making analysis in the evening? Thanks

It means when the daily bar closes (new york close), that chart analysis is performed.

One can never go wrong with your teachings, much appreciated. Thanks Nial

Grt article. Well presented. Tanks Nial

Thank you nial your video n forex technic helps me alot.

Thanks Nial

I have come to understand that the more randomness one can eliminate from a system,the greater understanding of what drives results,both good and bad,and the better the chance for delivering REPEATABLE SUCCESS.What better way to do this in forex trading than to focus on daily chart. Thanks Nial.

thanks niall…iv just started my live account after success with demo…ive been following all the tutorials and videos you post etc…and after my first week trading i have increased my account by 50 percent by waiting…for the set ups you teach,mainly pin bar reversals on the daily charts.i lost alot of profit by not letting a trade go to its tp,constantly watching,getting paranoid i would close the trade ,take the profit i had made ,only to find the next day if i had left it i would of hit tp….thanks again niall,you have made something that always looked difficult extremely simple and logical…

very valuable lessons posted by you time to time to keep me discplined in thought process and style of trading you teach . Thanks a lot Nial

Yes , indeed

Thanks for the insight as always!!!!!!!

It’s a good lesson. But does it mean that 4H counter Bullish candle won’t have any impact on End Of Day Bearish candle (Daily candle) ?

Cheers!

Yusuf, no this is not the case. The 4 hour chart can be traded in conjunction with the daily chart and visa versa.

Thanks Nail for this wonderful article, I have actually been a victim of trading the lower time frame chart while missing out on the actions on the Daily chart. Now its very clear why stoploss get hit on the lower time frame and price reverses only to continues on it’s earlier direction.

Much thanks for your timely advice. Through you I got to know about 5 days chart. All along I’ve been using the 6 days chart and never knew how it affected my trades. Now I’ve opened an account with your preferred forex broker which offers 5 days chart and your insights make great sense

This is new I guess…

I luv you Nial…

Thank you for sharing

Thanks for shear this kind of special article.