3 Trading Strategies I Would Take to A Desert Island

Everyone likes to have fun with hypothetical “Desert Island” questions. You know the ones where you’re sitting around with your friends asking each other what you would take with you or perhaps who you would take with you if you only had ONE choice and had to be banished to an uninhabited / desert island for the rest of your life?

Everyone likes to have fun with hypothetical “Desert Island” questions. You know the ones where you’re sitting around with your friends asking each other what you would take with you or perhaps who you would take with you if you only had ONE choice and had to be banished to an uninhabited / desert island for the rest of your life?

In today’s lesson, I wanted to have a bit of fun but also discuss with you what I would take with me if I could only pick ONE trading approach for the rest of my life. If I was going to a desert island (that had excellent internet connection lol) these are the trading tools that I would take with me…

Here’s how I would enter the market…

If I had to only look for ONE price action pattern to enter the market from, it would be a very obvious and powerful one, something that once you understand, is hard to miss…

What I would be looking for is a pin bar or tailed bar, ideally a long-tailed pin bar. These are patterns with an obviously long tail (or shadow), it doesn’t have to be a “pin bar” per say, although it’s better if it is, but a simple tailed bar located properly will work too.

Let’s look at some examples of what I am looking for on a day-to-day basis in the market regarding tailed bars and pin bar reversals:

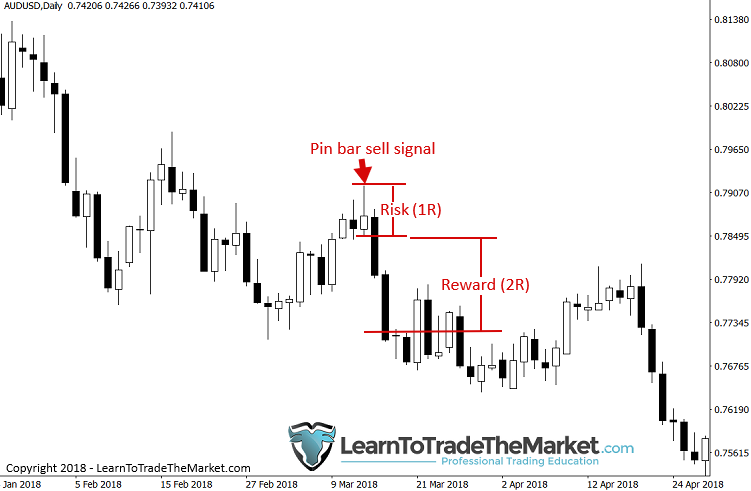

Here’s an example of a long-tailed pin bar (sell signal) within a down-trending market:

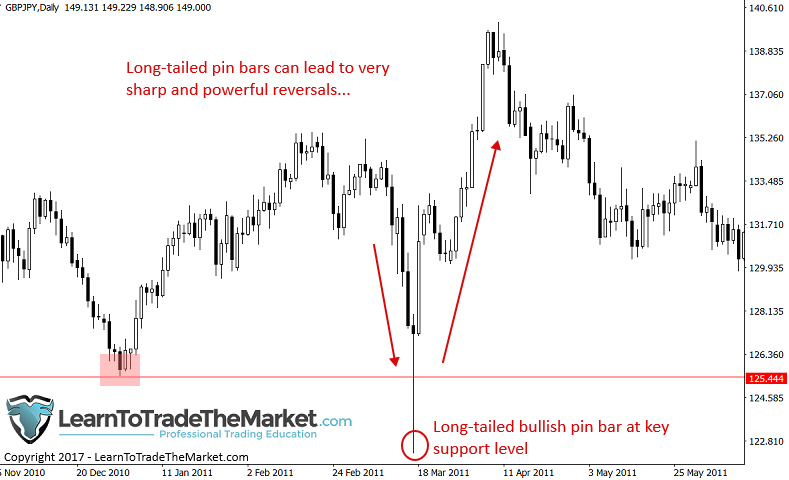

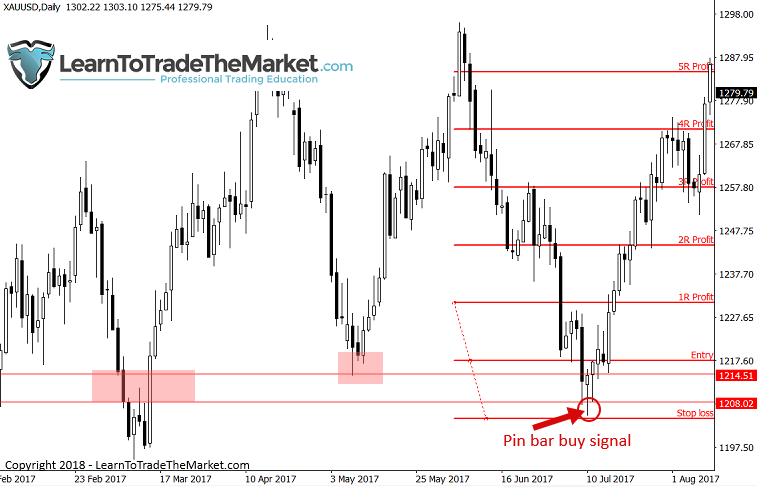

Here’s another example of a long-tailed pin bar. This time, it’s a bullish long-tailed pin bar (buy signal) that formed at a key support level in the market:

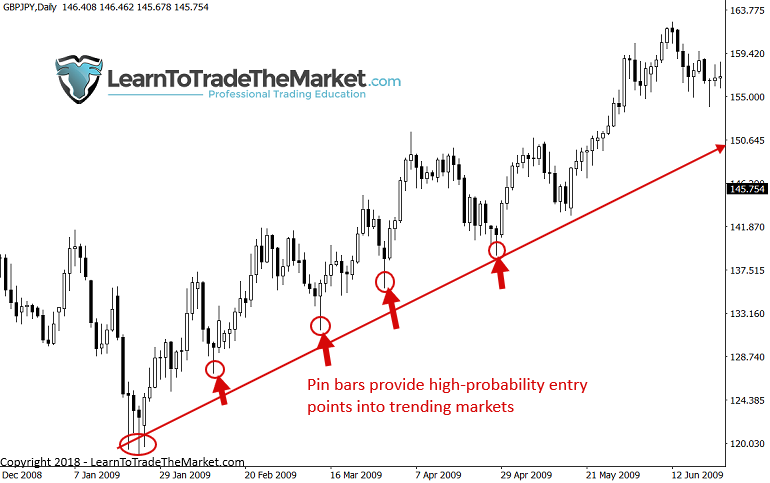

As we can see in the next example, pin bars often give us very easy to spot entries into powerful trends. In fact, a pin bar after a pull back within a trend is probably my favourite price action entry setup:

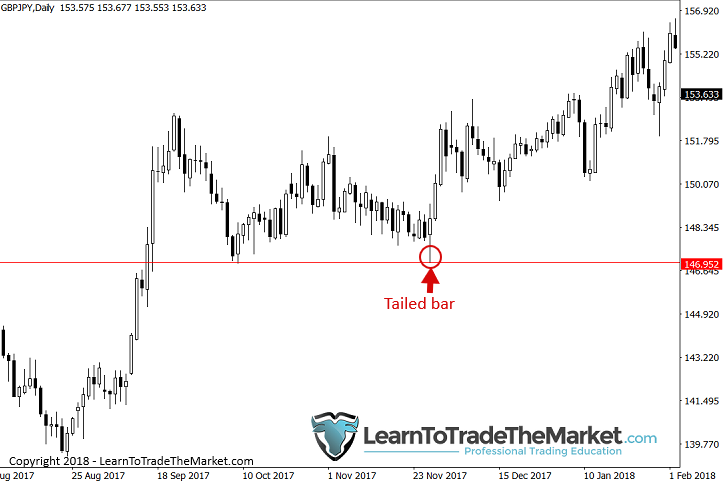

Next, let’s check out a tailed bar; a bar that is not quite a “pin bar” but still essentially portrays and implies the same thing. The main difference is the body (distance between open and close) of the bar is not quite as small as a pin bar’s in relation to the total length of the bar:

From the examples above, it should be apparent what I would be looking for if I could ONLY pick ONE entry signal to use for the rest of my life. It should also be apparent WHY I would choose pins / tailed bars; they convey a very important message about what is likely to happen next in the market, in a very clear and powerful way.

For a more detailed tutorial on tailed bars, see my tailed bar trading tutorial

For a more detailed tutorial on pin bars, see my pin bar trading tutorial

Money management

It’s always amusing to me that most beginning traders seem almost entirely concerned with their trade entries when in fact the more important part of trading is money management. Money is made or lost depending upon how well you manage your trades and your money, not so much on how well you enter the market (although entries do play an important role).

No trade entry strategy or trading method would be complete without a money management plan. The most important aspects of money management for a trader, are position sizing and risk reward. These are the money management components I would be worried about for my “desert island” approach.

When I talk about position sizing, I am referring to the number of lots (in Forex) or the trade volume / number of contracts / shares (stocks) etc. We are talking about the SIZE of the position you are trading. Why is this so important? Well, because it determines how much money you have at risk; the larger position, the more money you are risking. The other reason it’s so important is because properly adjusting your position size to maintain your overall 1R risk per trade, is vital to long-term trading success.

To read more about position sizing, check out my lesson on position sizing.

Risk reward is the other critical money management component. This refers to finding a trade’s risk vs. its potential reward, which you typically want at 1 to 2 or more (Reward at 2 times risk). It’s important to consider the potential risk / reward of any trade before you enter it, because whether a good risk / reward is attainable may impact your decision to take the trade or not.

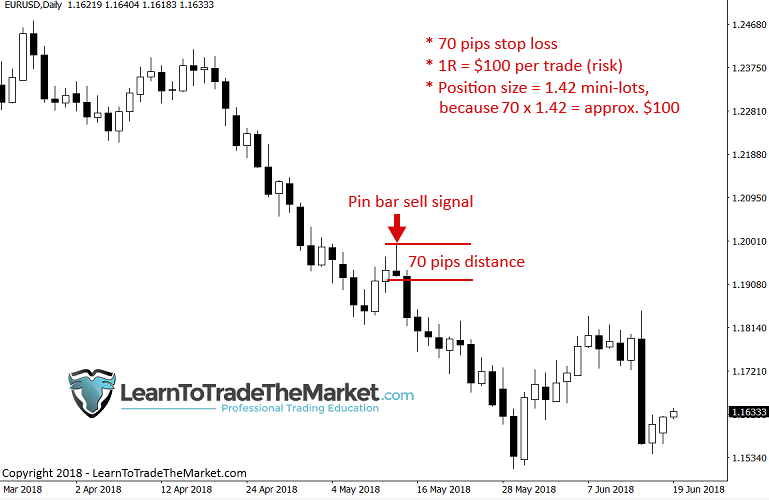

Notice in the example below, the risk is 1R, where R = the dollar amount you have at risk on the trade. In this case, the risk is the distance from the entry (pin bar low) to the stop loss (near pin high) and the reward is set at 2R or 2 times risk. It’s important to try and get reward of at least double your risk so that you take advantage of winners when they come along and so they are big enough to offset your losers and still give you a profit.

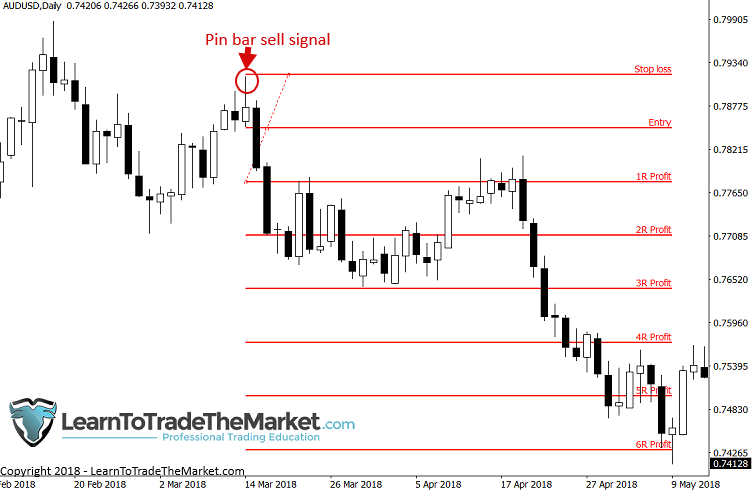

In the example below, we can see what it looks like to plot out the potential risk reward of a pin bar trade. Notice I have customized the MetaTrader 4 Fibonacci tool to show risk vs. reward of any trade setup. I have detailed how to do this in an article on the risk reward tool, so check that out to learn more. Notice, this pin bar signal set off a potential 5R winner…

Daily time frames and low-frequency

A trading strategy wouldn’t be complete without something to hold it altogether, the X-factor, so to speak. For me, that is trading daily chart time frames in a low frequency trading approach.

This type of trading essentially means that we are focused on the daily charts and we are not looking to trade often, instead, we are looking for high-quality setups (which tend to be somewhat rare). What this does is increases our potential win-rate per trade and thus gives us a better chance of making money over the long-run. It also allows us to more easily keep our emotions in check and largely eliminates the potential to over-trade, which is typically the number one thing that kills traders’ accounts.

In the example below, notice the pin bar entry signals that formed at a key support level, what I want you to really notice is that this was the daily chart (as are all the other charts in this lesson and most of my lessons). If I was stranded on a desert island, I could enter this trade long and let it set for 1-2 weeks and spend that time…trying to build shelter and gather food…and come back to a huge profit. Perhaps a bit too hypothetical of an example (what would you do with money stranded on an island? Pay pirates to save you maybe?!), but the point is still valid – End-of-Day trading allows you to reduce your time commitment and helps to subdue / tame your emotional responses to the market so that you have a better chance at long-term trading success, it is a win-win!

If I was stranded on a desert island and could only use one trading approach, it would be:

- Pin bars / tailed bars

- Money management

- Daily charts / end-of-day approach

It really is as simple as the three-point plan I outlined above, so stop over-complicating it.

To learn more about daily chart trading and end-of-day trading, check out these tutorials:

How to trade ‘end of day’ trading strategies

Daily chart time frame trading tutorial

Conclusion

While today’s lesson dealt in a hypothetical situation of being forced to pick one trading strategy to take to a desert island for the rest of your life, the wisdom and strategies discussed are not hypothetical at all.

The strategies I discussed above are how I trade 90% of the time in my day-to-day trading. The concepts are transferable across all types of markets, from Forex to futures, stocks and anywhere in between. They are most applicable to the 1-hour time frame and above, but as discussed, I greatly prefer the daily chart time frame to all others. So, no matter where you end up, on an island or a trading desk, remember that the concepts discussed here and that are expanded upon in my advanced price action trading course, have stood the test of time and will serve you well in not just surviving… but in thriving in all trading environments.

What did you think of this lesson? Please share your feedback in the comments below!

This is a very nice, entertaining, simple, fluent, and educational article. It’s very important for us to continue sharing this kind of content. Thank you.

I love this strategy, so straightforward, with a simple decision on where to place the stop loss.

Great article i have ever read. Thsnk you nial.

Its was so amazing 🤩

One blog for key support levels 😁

I’m Very excited for this article because it has trained my eyes to see the market differently

Great

You are simply the best tutor I have ever listen to, your strategy make trading just as simple as ABC… Am 100% impressed in your teachings. I would sincerely love to register for your advance courses though still trying to gather the fee for it. Thank you sir for your effort to educate us especially newbies like myself

Straight forward and concise stuff. Great work sir.

Great!!!!

It is exactly such strategies I was looking for.

Thank you so much.

Great trading strategy I have ever come across, thank you so much.

Thanks for that risk reward concept coz am a victim of that but now am free

Thanks for the knowledge sir, important knowledge like this are not easily found.

This is an amazing lesson because it’s insightful may God continue to bless you

Based on my experience, if you do everything as you described, the profit target rule will determine the final outcome, profit or loss long term. So if you were also to pick 1 specific profit target always, what that would be? My stats over the past 20 years give best results for a profit target = 2.5 R. What is your feeling on this? Do you have a specific rule for determining profit targets or you treat it as executive decision on a trade by trade basis? Thanks

What a wonderful mentor,u made forex to be so easy,I really appreciate sir

This article was well put together and gave me a better insight on trading.

Thank you very much! Mr Nial

Thank you again for your continued support.In my question some minutes ago I have failed to indicate that the pin bar reversal formed on the 4 hour time frame.please combine this to make the question very clear.

Thanks, I needed to read this again!

I absolutely loved this lesson, great and very informative. Thank you

Thanks Mr. Nial! Very informative lesson!

A very straightforward and concise article, the message is simple, keep it simple and follow your rules. Many thanks Niall

Excellent lesson..

Thank you.

Learned much from this lesson. I will put it to practice in my trades.

Excellent very positive

good lesson and easy to understand

Dear Nial,

I would like to know when entering on a pinbar signal should one wait for the next candle to close above/under the entry value or can one take it immediately if price moves above/under the entry value?

rgds,

deon

Thank you very for your insights, this was really a great read and I’m planning on following it????

Awesome as always.

A million thanks!

Nardo

This is amazing , a must have for every Forex trader !! thank you for sharing my friend.

awesome lesson, thank you

Thank you Mr Niall

The legend himself…!

A word is enough.

This article only makes sense to those who understand the language of the market and are able to read inbetween the lines. It was not until I got to that level that I discovered my own AHA moment in trading.

Thank you Mr Nial.

When You show like chart pattern then I can undersand but when I trade everytime falior the every trade. What can I do?

Great Mr Nial

I,m following you and I,m gaining a lot

hi Mentor

excellent as usual

many thanks my mentor.

Mehdi

Great idea, felt to be very much useful in real time situations.

Great lesson . I really enjoyed it. Hope more will come

Thanks for your today’s article. Really helps and will always wait the next one.

Hi Nial

I have been following you for a number of years and I have a great respect for both you and your trading strategy

That said I have seen the best Price Action setup with all of the confluence in place, but miss the trade because I have been waiting for a Pinbar

What could I do differently?

Thanks Nial for sharing your strategys

I like ur lessons I make more wins than losses cz I follow all ur articles they are eye opener.

Hi Nigel Excellent article , straightforward and concise , well done

Question, you never mention your trailing stop strategy ,do you use trailing stops ?

Personally I use the middle Bollinger band on the 4 hour chart to set my trailing stop level ,any thoughts ?

Regards Jon Kyle

Sir you are a good teacher …thank you

Well appreciated.

Eye opener… end of day trading, now I will save me lots of energy

It is powerful. The content is amazing. will use it in my trading.

Typical of the Maestro himself.

Excellent article , you always hit the nail on its head. Nice one

Thank you, Nial.

Such a great article. Thanks Nial !

This is typical of the Maestro himself.

Merci beaucoup.

your lesson are very good. thanks so much

Another home-run. Brilliantly written and full of great information, as to be expected from Nial. I have to admit, however, that the long-tail pin bar, made me think of being stranded with a tall, long-legged, beautiful woman . . . . .

Extremely clear and concise. Thank you!

I always enjoy all your books very short and easy to grab thanks for this tips Nial

Hello Nial,

I love your teaching generally. personally i would like to have you as my mentor, if possible.

Thank you.

Regards

Idogei

Hey Nial, I like it as to the point conclusion to be a simple but ultimate trading apparatus as you figure it out like on an desert island for the rest of life approach. Great Article ever.

Thanks a million.

Looks easy.

Patients!

Budget on one trade a month?

this is the best way to trade. price action, money management and daily time frame. that’s the holy grail right there.

Top notch advice as usual

Quite a simple, quick and straight-forward lesson. But it has to be mastered by reading across those references in the lesson.

Well done.

Excellent article it has put me back on track after trying various “Holy Grail ” strategies. There is no substitute for a solid staight forward trading plan. Thanks

THIS POST IS LIFE CHANGER NAIL. AM THINKING YOU WROTE THIS POST FOR ME…I JUST READ THIS RIGHT ON TIME.

I do like the keep it simple approach. I find the information quite useful, though discretionary to a certain degree.

Thank you very much for sharing.

Thanks nial i would use these trading approach for the rest of my life

Awesome content and reading material

Keep up the good work… lesson was fruitful