The Psychological Advantages of Set and Forget Trading Regimes

Set and forget trading is a phrase that I coined several years back in an article I wrote on the topic. It’s a trading approach that works if you follow it, to put it simply. For this reason, I write about it often, and those of you who have been following me for some time no doubt understand the main benefits of the set and forget trading approach.

Set and forget trading is a phrase that I coined several years back in an article I wrote on the topic. It’s a trading approach that works if you follow it, to put it simply. For this reason, I write about it often, and those of you who have been following me for some time no doubt understand the main benefits of the set and forget trading approach.

However, in today’s lesson, I want to focus on the psychological aspects and benefits of the set and forget approach and why it will help your trading performance, based on my personal experiences.

We get many members who email us regularly with success stories after they have adopted the set and forget approach. Hopefully, more of you will start trialing this concept because there is nothing that makes me happier than hearing my students’ success stories.

As you may already know from some of my other articles on this topic, set and forget trading works partially because of the way it helps you to systemize the entry, stop and target of your trades. By allowing the edge to play out uninterrupted, without you fiddling with it for arbitrary reasons, your long-term trading performance will improve simply as a ‘side-effect’.

However, there are also some very important mental benefits of set and forget trading which I don’t often discuss.

In this lesson, I want to focus on the psychological benefits of set and forget trading to help more of you make the mental transition to this style of trading. By committing to the trade completely before you even place it, it means you’re identifying the trade, placing the orders and walking away with very little monitoring. It also means being at peace and avoiding the emotional ups and downs that come with watching your trades as they are live. It means walking away and letting the market ‘do the work’ whilst you go do something more productive or fun. It means removing yourself from the temptations of chart-watching and getting influenced by chart whipsaws from news releases, short-term volatility and so on. In short, it means setting and forgetting!

By understanding the mental advantages of set and forget trading, perhaps you will gain a deeper understanding of its power and begin trading this way sooner.

Mental advantages…

1. Significantly Reduce Stress & Emotional Ups & Downs

Trading can be as stressful or as stress-free as you want it to be, it all depends on what you do. If you sit there staring at the charts all night when you should be asleep, you are doing to drive-up your body’s stress response and your cortisol (stress hormone) levels will sky-rocket both from the lack of sleep and from over-thinking about your trades.

Now, as if the stress wasn’t bad enough, it’s going to get worse. You’re also going to hurt your trading performance by doing what I described above, this will work to further increase your stress levels. Eventually, you will be tired, angry, frustrated, on the verge of tears and left with an empty trading account.

By employing my set and forget trading approach, you can eliminate all this stress, worry and losing! Show me a set and forget trader and I will show you a stress-free trader who is on the path to trading success. There have been studies done on investors / traders and their trading performance in relation to their trading frequency, and they always show that less-involved traders do better over the long-run. Similarly, even though trading is a male-dominated arena, when women do step into it they tend to do much better on average than men. Why? Simple; they do not over-trade as much and they do not risk too much like many men do. The reason has to do with men having higher testosterone levels (a hormone that makes men take more risks and feel over-confident, things that can hurt you in trading). I have an article in which I discuss this female vs. male trading phenomena more in-depth, check it out: What is The Weakest Link in Your Trading? Suffice it to say, us men are not always right, and we can and should learn from women sometimes and trading seems to be one area where we can benefit from their seemingly innate ability to set and forget their trades.

2. Help Cure Your Obsessive Chart-Watching

Have you ever heard of positive reinforcement? It’s when you get a reward from doing the right thing, this will then reinforce whatever the ‘right thing’ was that you did so that hopefully you keep doing it. It works on kids and it can work on adults too, especially in trading.

When you watch charts all the time, you are probably going to lose money, so the chart-watching is a negative behavior. The tricky part here is that the act of chart-watching can feel very good while you’re doing it (dopamine – the chemical in your brain that gives you the rush you get from the ‘hope’ of making money), so you are essentially getting a mental reward from committing a negative behavior and you are reinforcing a negative behavior by continuing to do this. Therefore, traders get stuck in an addictive cycle of watching charts, making the same mistakes over and over and losing money.

But, YOU CAN STOP THIS and YOU CAN REVERSE IT! By utilizing set and forget trading you can literally begin to reinforce positive behavior rather than negative. This will work like a positive feedback loop in which the improved performance you see from behaving properly in the markets works to make you want to continue that positive behavior. It’s no different than someone who sticks to a regime of exercise over a period of months; soon enough the endorphins and improved strength and energy-levels begin to reinforce the behavior of working out consistently. Yes, in the beginning it may seem like a ‘boring’ chore you don’t want to do and it may even hurt a little, but rest assured, that pain is good for you.

Setting and forgetting your trades is truly the key to eliminating almost every negative trading behavior that traders have. You need to implement this sooner than later.

A man smarter than me once said; “Suffer the pain of discipline or suffer the pain of regret”. That means, pay your dues, be disciplined now and it will pay off later, or you can continue to act lazy and undisciplined and you will suffer the pain of regret later.

3. Sleep at Night – Know What You Stand to Lose or Make

Sleep is critical to all physical and mental process in the human body. There are thousands of studies on this. I can tell you for a 100% iron-clad fact that IF you are losing sleep from watching charts and worrying about losing too much or not winning enough, you are hurting your trading performance and you are starting down the road to reinforcing negative trading habits as we discussed in point 2.

When you are using set and forget trading, your stop loss and profit targets are pre-defined, so you know what you stand to lose and what you stand to win on any given trade. I can tell you from experience, this makes it a lot easier to get and stay asleep at night so don’t under-estimate this benefit!

This brings up another point: When you know what you stand to lose or win on a trade it goes a long way towards eliminating greedy behavior. Greed is a huge reason traders fail. It causes them to hold trades too long whether the trade is moving in their favor or against them. How many times have you been in a big winning trade and you didn’t take the profit because you had no profit target or because you moved your profit target from its initial setting? This is greed. Being greedy inevitably causes traders to end up with no money.

Bulls make money, bears make money, Pigs? Pigs get slaughtered! That is one of the oldest Wall Street sayings and it rings louder than perhaps any other, still to this day.

When you set a profit target and stick to it, you aren’t being greedy, so over-time you should end up making money. When you set a stop loss and stick to it, you can pre-define your risk to a dollar amount you’re mentally OK with (potentially) losing. When you adjust your risk properly and you know what you can lose, you should have no problem setting your trade and walking away.

Disclaimer: There is never a 100% certain outcome for any trade and losses can sometimes exceed stop losses due to slippage.

4. Exercise the Mental Muscles of Routine & Discipline

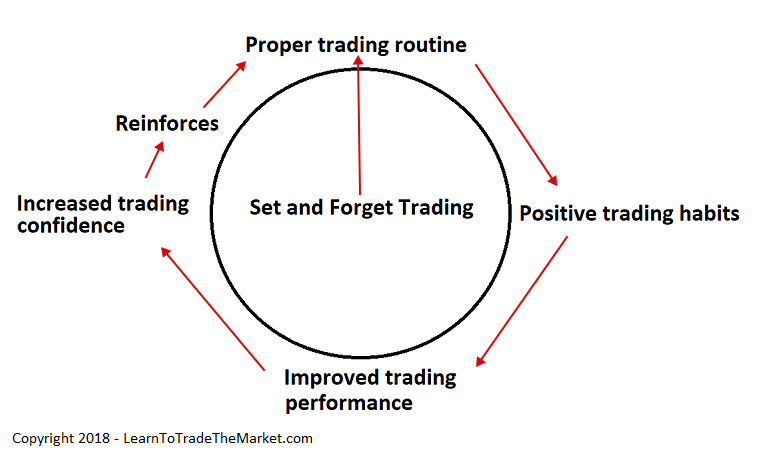

When you make the commitment to start set and forget trading, you are kicking off a process that is self-reinforcing and will continue to strengthen the longer you use it. The power of routine and discipline, of repeating an effective system or process and staying accountable to THAT, will help you accelerate your development of the proper trading habits.

Once you have the proper trading habits in place you will see improved trading performance which gives rise to a huge surge of trading confidence in both yourself and what you’re doing. This reinforces the routine you started with and it all stems from committing to the set and forget trading approach.

Here is what this looks like in a diagram. Notice that set and forget is in the center, because it really all starts with that idea – once you commit you will quickly figure out the proper trading routine from the help of my articles and trading courses, then it really starts to almost ‘take care of itself’ as long as you stay disciplined and stick to the set and forget plan.

The set and forget ‘wheel’ of trading success:

5. Confidence Through Achieving Better Trading Results

Confidence in business, trading or even in your personal life is something that truly is so important that it has no dollar value; it is invaluable. Confidence breeds more confidence and it works to reinforce those positive trading habits we discussed earlier. By trading properly not only are you reinforcing positive trading habits but you’re breeding confidence in yourself and your ability to stick to a plan, this confidence helps you stick to what was working. It’s all a positive feedback loop as I said before.

Confidence is spawned by the momentum of winning trades or at the very least, having better trading experiences and having more control over the capital in your account; the strategic planning that set and forget allows, that results in improved results. It’s not going to happen all at once, but over time, when you master this style of trading, you will start to feel more in control because you’re controlling the things you can and not trying to control the things you can’t (the market’s movement is uncontrollable).

Being more confident will spawn more motivation to continue mastering the act of finding the trade and placing the trade. It’s just like the earlier example I gave of exercise; when you get over the initial ‘pain’ of it or the initial ‘I don’t want to do this feeling’ and you start seeing positive results, it’s going to inject you with a whole boat-load of motivation and confidence that will work to fuel your on-going progress and quest for being the best. This will give you the willpower and discipline you need to make it as a trader.

Conclusion

I focus on the set and forget approach and 95% of the time I will resign to the fact I’m about to lose XYZ or make XYZ on a trade; this works to eliminate the potential of making emotional mistakes. The expectancy of my trading method combined with the set and forget money management approach has helped me, as well as many of my students improve their trading. It’s not an exact science, and of course there will be times trades are adjusted and there are times that no amount of mechanical money management can override the natural human emotion of trading, but we are not after perfection, we are after training and exercising the mind to be able to let go of the need to control the outcomes and control the market, after all the market is going to do what it’s going to do with or without us watching it or trading it. All we can do is control ourselves and our own behaviors in the market and that is what set and forget trading is all about.

What did you think of this lesson? Please share it with us in the comments below!

This is something i want re enforced in my psyche. (set it and forget). I traded real money and demo but make a ton more on the demo than on the real account. On the real account, i monitored each trade meticulously and in most cases closed trades due to market volatility and loose money quite often. While on the demo i set it and forget it ( though not deliberately). Sometimes its at the end of the day i remembered my demo, when i checked, wha-la! Lots of money.

Thanks for the lesson, i know its tough to set ( real money ) and forget it but i will give it my best shot.

Kebo

Very useful article. Thanks

I have begun to train the thinking I have opened and I have forgotten, even from phone I have deleted the application, thanks for article Mr. Nial!

Great article, I am also moving to higher time frames as they seem to have more consistency in price action. However, it takes smaller lot sizes for now as my account is small.

Takes patience. Nial, your method seems to have a calming effect.

Thanks for continuing your lessons to all of us.

excellent article. I am trying this on the daily and weekly timeframes.

THANKS ONCEMORE. HIGHLY REWARDING. LEARNT EFFECT OF GREED, TO BE PATIENT, DEDICATED AND DISCIPLINED. ABOVE ALL, NO BABY SITTING OF TRADES

Thank you Nial for sharing. I have read this one few years ago and I use it as one of my strategy .I never trade without SL but sometimes I am not sure where to put TP. So is good to read again and be more disciplined :) All the best Adriana

Thanks!

Definetly set and forget strategy really works.As I am still learning through your articles I have seen this.

Mr fuller you are the best to free our souls from stress,thank you very much.

May God bless you.

Thanks man, great article, great lecture. Am learning from a true trader and mentor.

Very nice article, Nial.

I have been trying to stick on the plan of only see the market and my trades once a day, after New York’s closing. And i do it only for 2, or 3 hours at tops. Then, i go to sleep.

Seriously, your texts have been helping me to do it, thanks a lot.

God bless you

Obrigado!

Muito boa a sua abordagem!

Very nice and effective article.

Nial you are my hero. I am 100% certain that I will suceed in trading , because of you.

Wow! what a timely and accurate article. I have just embarked (trade # 2) on a 20 trade series using my strategy combined with a set and forget a approach. Further, using the Kaizen approach, I am now checking my positions once every 4 hours when I am awake. I have finally accepted the fact that the market will do what the market wants to do with or without me checking constantly. Thanks Nial’s this just what I needed to reinforce my trade series and mindset.

True that.

My results improved a lot after trying this method i.e. more winning trades started hitting TPs. I even went further and deleted the trading apps on my cellphone to avoid checking the charts while at work and my productivity also improved as there is no distraction anymore.

Thanks Super

Best Regards

Rossen Dimitrov

Wonderful. I am working on this. It is getting better, I am in a long term trade now that I am not watching. Just waiting to see how it pans out – I think it will take all week to get where I think it might go.

Great article, thanks!