What If You Only Took 4 Trades a Month?

How many trades did you take last month? 4? 40? 400? The answer will tell me a lot about you and how you’re doing in the market. There’s an extremely high correlation between trade frequency or number of trades taken per month and one’s trading equity curve.

How many trades did you take last month? 4? 40? 400? The answer will tell me a lot about you and how you’re doing in the market. There’s an extremely high correlation between trade frequency or number of trades taken per month and one’s trading equity curve.

In other words…

Show me a steadily increasing equity curve and there is almost certainly a low-frequency trading approach behind it. Show me a steadily declining equity curve and there is probably a much higher-frequency of trading taking place behind it.

Today’s lesson, whilst using hypothetical examples, is very, very real in its theory and the concepts taught. I am going to show you my trading style and take you through a mock example 3-month trading routine that looks very similar to my personal trading routine on a month-to-month bias. I am going to show you how I trade, how I think, how often I trade, planning risk / reward and more. So, let’s get this party started…

The 4-trade per month trading routine…

My entire trading philosophy as well as my life’s philosophy is that less is usually more, simple is better, I consider myself a minimalist especially regarding trading. There are some very good reasons why I do this. I have discovered over time and through much experience that the more you push and try to ‘force’ money out of the market, they less you will make.

What this means, is that I prefer to take a low-frequency trading approach because the reality is that it’s what works. Traders who trade a lot or who day-trade tend to rack up the costs in spreads / commissions as well as in losing trades. Not to mention, there is a very real mental cost that comes with trading a lot, it’s incredibly mentally stressful and draining, which has a physical cost on you as well as relationship costs on your friends and family.

You need to understand that:

- You do NOT need to trade a lot to make a lot of money.

- You do NOT need to win a super high percentage of your trades to make a lot of money.

Once you understand the two above points, it will begin to change how you think about trading. Consider that with a strike-rate of just 50% you can put your trading account WELL into the black (profitable). How is this done, you ask? With risk-reward; by making sure your risk-reward is averaging about 2 to 1 (reward 2 times risk). The power of risk reward is often poorly understood and under-utilized by most traders, as a result, they lose money. When you are not taking advantage of risk-reward, you must win a very high percentage of your trades to be profitable, and that is a very hard thing to do.

Now, let’s look at a mock / hypothetical set of 3 months of my trading routine. These aren’t actual trades I took, but the charts you see ARE good examples of high-probability price action signals that I teach in my courses and that you can and should learn how to trade. Some of the trades in the spreadsheets (the losers) are totally made up and just there for example’s sake.

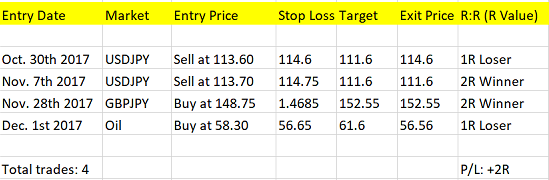

Here are the results of Month 1:

You will notice in the spreadsheet below that 4 trades were taken in approximately one month of time. Notice that there were 2 losing trades and 2 winners, but the winners were both 2R, meaning 2 times risk, so a 2 to 1 risk reward. The result was a positive 2R profit. So, if you were risking say $500 per trade, you would have made $1000 in profit for this month, not bad for only entering 4 trades which would require VERY little time investment on your part.

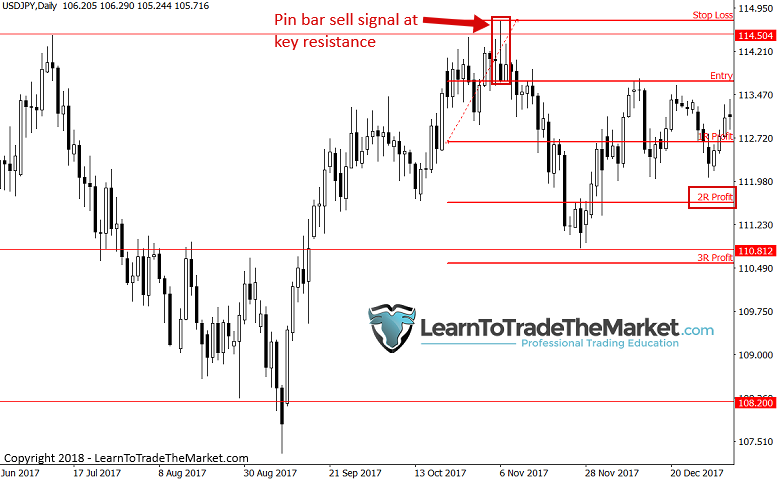

The first winner in the above spreadsheet was a nice pin bar sell signal at a key resistance level, as seen below. This trade went on to make 2R. Notice however, it took 2 to 3 weeks to play out from entry to exit. You must have patience to trade this way, that’s why I always say patience is what makes you money in trading. Most traders were jumping in and out of the market during these 2 to 3 weeks, losing money and chewing up their accounts with spread fees, losing sleep and generally just getting frustrated and angry. Not you! You’re trading the 4-trade per month method!

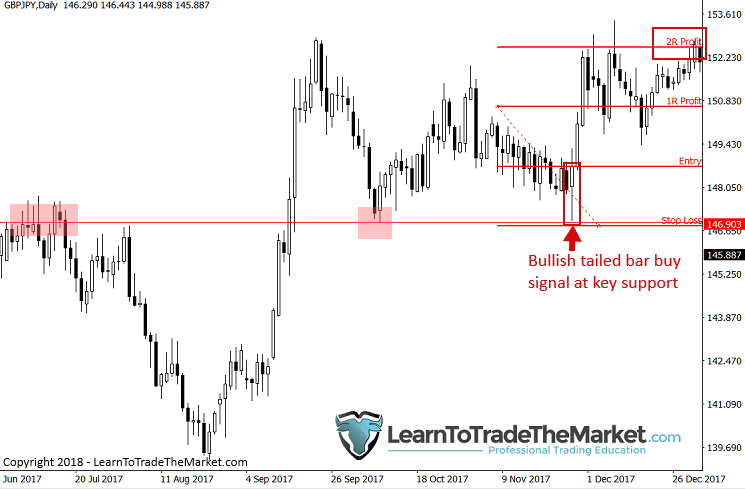

The second winner was also a nice 2R profit. Starting from a bullish tailed reversal bar that formed after a pull back to support, as seen in the chart below.

Keep in mind, this is hypothetical. A skilled price action trader could easily win more than 50% of their trades some months. I am trying to show you that even with a low strike-rate (even below 50%) with proper risk-reward, you can still make good money. Traders get into trouble by entering stupid trades and thus taking stupid losses that were unnecessary, risking too much and then losing too much and just generally deviating from their trading plans.

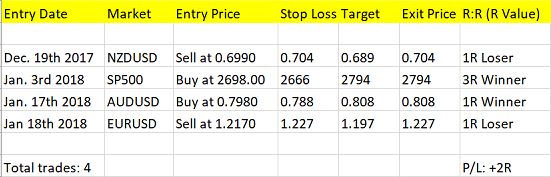

Here are the results of Month 2:

You will notice in the spreadsheet below that 4 trades were taken in approximately one month of time. Notice that there were 2 losing trades and 2 winners, but the winners 3R and 1R, meaning 3 times risk and 1times risk. The result was a positive 2R profit. So, if you were risking say $500 per trade, you would have made $1000 in profit for this month, not bad for only entering 4 trades which would require VERY little time investment on your part.

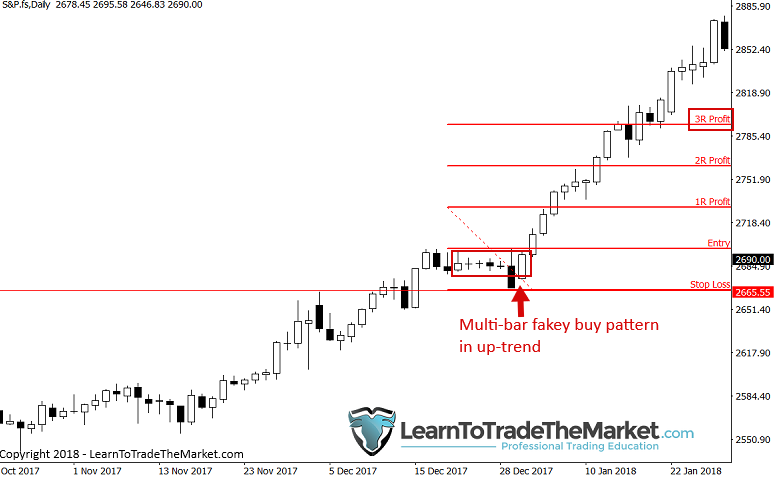

The first winning trade of this month period was an interesting fakey pattern that formed on the daily chart of the S&P500 within the recent runaway trend this market was in just before all the recent volatility set in. you will notice we netted a 3R winner here and could have netted a 4 or 5R winner. Getting one big winner like this a month, if you’re trading a very minimal amount of trades like I do, can literally pay for MONTHS of losing trades and put you into the black. Are you starting to see why I love this style of trading so much? You could be out doing anything during this trade’s lifespan; you don’t have to sit in front of your screen worrying, you just set and forget your trades…

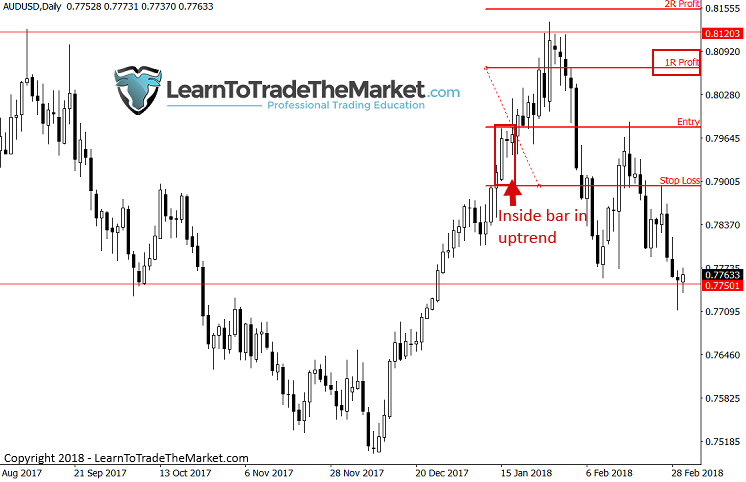

The next winning trade in this month period was an inside bar breakout play. Notice, this was only a 1R profit with the reason being, there was a key resistance level coming into play before 2R would have been hit, so logic would dictate we exit ahead of the key level rather than hoping and praying price breaks through it. It’s OK to take 1R profits sometimes if it makes sense, just don’t make it a regular occurrence or else you will have to win a much higher percentage of trades to make money.

Here are the results of Month 3:

You will notice in the spreadsheet below that 4 trades were taken in approximately one month of time. Notice that there were 2 losing trades and 2 winners, but the winners were both 2R meaning 2 times risk, for a total of 4R profit. The result was a positive 2R profit after you subtract out the two 2 1R losers. So, if you were risking say $500 per trade, you would have made $1000 in profit for this month, not bad for only entering 4 trades which would require VERY little time investment on your part.

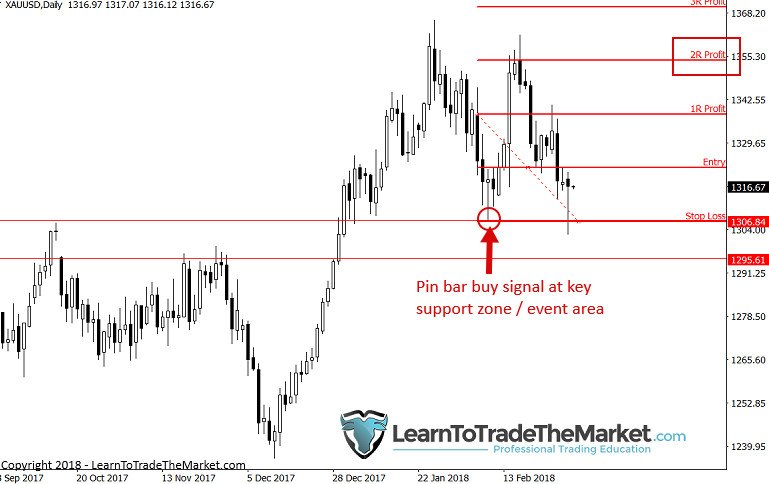

The first winner in this group was an obvious pin bar buy signal on Gold which formed at an event area that we discussed extensively in our daily trade setups newsletter as a buy zone before that pin formed. This was a quick turn around on this trade, netting a 2R winner only 4 days after entry.

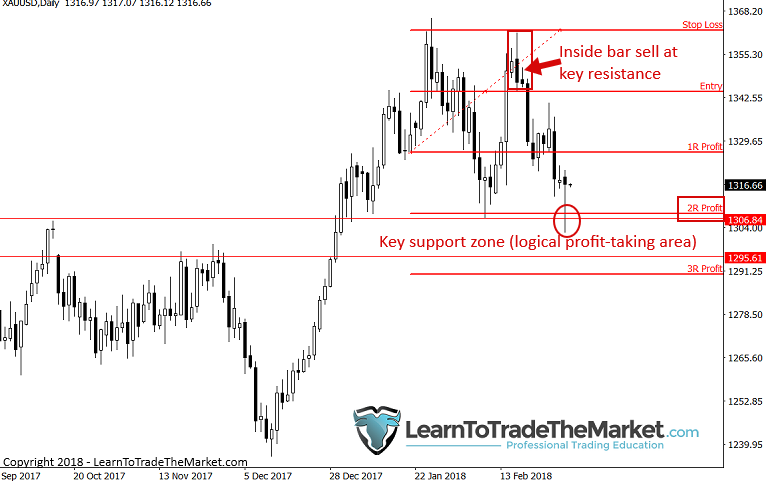

The second winner in this group was a bit of a cheeky one; an inside bar sell signal at a key resistance level. Normally, I like inside bars as trend-continuation breakout plays, but in certain situations they can be used counter-trend, something I explain much more in-depth in my price action trading course. Notice that we had a nice 2R profit off this setup that ended in a bullish pin bar from support as of last Friday which may well lead to a buying opportunity (See our daily members commentary for updates on this).

Key points to bring it all together:

- Minimalistic approach to trading (and life) is what I love and what works for me in the markets, it will work for you if you let it.

- All trades were taken on the daily chart time frame. This is how I trade 90% of the time and it’s how you should. Stop wasting your time and money on short time frames, this is a big reason you’re losing.

- If you don’t stick to your anticipatory trading plan, none of this will work. You can’t be trigger-happy. You must trade like a sniper, not a machine gunner! It does take time, training and patience to get good at this, like anything.

- You must BELIEVE in your trading edge and that it will play out over time. You must trade like a baller, not a scared trader desperate to make money.

The end results of taking just 4 trades per month over 3 different one-month periods:

Conclusion

I want you to promise yourself you will try this starting tomorrow: You will COMMIT to taking JUST 4 trades per month. Try it. Leave me a comment below with your promise to commit to this experiment, then after a month, contact me here and let me know your results. I firmly believe that if you follow-through with this, you’re not only going to see your trading results improve, you’re also going to be awakened to an entirely different trading mindset, something that I hope will completely change the direction of your trading career.

Now, just imagine if you combine the simple trading approach I outlined here today with the ability to find high-probability price action entry signals, place strategic stop losses, profit targets, manage your money properly and stay cool, calm and collected (like I teach my students). Once you learn how to bring all this together you should be unstoppable, far less stressed, hopefully more profitable, and most of all, living a happier, healthier lifestyle.

What did you think of this lesson? Please share it with us in the comments below!

Wonderful, now I can trade better with your strategies.

People make me thought that you need to stay on the

computer all day long but inside me I knew that it ought not to be but as God would have it I came across your write up and I thought that it was tough but now it is simple as A B C. God bless you.

Nial,

Thank you for all your blog posts. The have truly resonated with me and changed my approach to trading. I am now focusing on trading less, focusing on the best setups, and have completely given up scalping and day trading. I can’t thank you enough for your insight!

Nial I’m seriously learning a lot from you buddy thank you so much for the content and definitely your strategy makes a lot of sense I’m definitely going to try it believe that. Thanks again

I will do my best

Thankyou very much Nail Fuller through this method trading a lot of stress and panic is reduced which encourages clear mindset when trading.

will definitely follow this. starting coming week .

Here in what force! Thanks

started trading November 2018, but started reading your articles April 2019 which has added more value to me than all the expensive course and signals i have subscribed to in the past. this has been impactful. i promise to stick to this rules in the next three month and return to this platform with my testimony by 20th of July 2019. Thanks for your dedicated time and services.

Hi

As always excellent. I am a subscribed to the course. This is fundamentally the correct approach though somewhat difficult to put into practice.

Hey Nial,

Commenting back here after exactly 1 month.

Prior to that I usee to take 3 to 5 trades a day resulting in 60 to 100 trades a month. I am very excited to tell you I have reduced my trading frequency down to 6 trades over the last 1 month. Thats 60 trades down to 6, and I couldn’t be any happier to say that this has been as a result of reading through your articles. Each and every one of your articles has a powerful message if one truly tries to understand it.

Mate, I couldn’t thank you enough.

Low frequency trading is so much better in every aspect and ideal for the long term. This method is stress-less, ideal for full time worker and gives the best chance to succeed.

Thanks again

AJ

Hi Nial,

I am one of your students. Your website is a wealth of knowledge and your a blessing to 1000’s of traders out there trying to be a CONSISTENTLY SUCCESSFUL TRADER. I have read most of your articles and re-read a-lot of them as well, it all seems to make more sense every-time i read it the second time.

Yes, its extremely hard to maintain discipline over the longer term, however I pledge to take 4 trades per month starting from today.

I will keep you posted.

AJ

One of the best artices

Awesome, I am just starting trading and this is a deinate edge. I will be leaning from you. Thanks Nial

I trade forex around 8 years. I never see that you kind to teach open to all people, thank you.

Tommorrow itself I start this method. Thanks Nial.

Hi Neil, I promise u to take only 4trades a month.

Hi Sheetal good

I am presently taking 2 trades a week .

how is your trading going on ?

I lost a lot of money due to over trading. This post came at the right time. Now I can work on trading only quality price action signals.

Nice article and i think its one of the valuable articles i have ever read in Forex. thank you so much and absolutely will adopt this trading style. will be back after one month however the result will be.

Thanks master

Im going to give this a try Nial, Fantastic article thanks.

2018 and I still came back to read this. Been following since 2011 Nial and since then, have never had a losing year. FACT!

so confident of my trading ability Now and it’s all thanks to the your free contents.

Thanks Phronesis, great to hear about your progress and results.

As from tomorrow 22-05-2018, I am going to take 4 trades months.

I made a great discovery with your teachings after losing money trading against the trend thank you sir and God bless you I am very greatful

Thanks Nial, best tutor

Very nice.. I’d start.

sir i promise to do only 4 trades per month

Well, my trading history says that I have winners when Stop Loss is about 300-500 pips and losers when it is about 50-80 pips. That means, that trades taken on Daily or H4 chart are more successful. So I am starting today and I expect that after 3 months my trading mindset will be quite different and it finally changes the way I trade.

Starting today… 4 trades a month..

When I first read this article I was part way throught Nails training. It did not make sense then but it does now that I understand the errors in the risk 1% of account balance mantra. I am not there but I can see myself getting down tothis volume of trading.

I am grateful to you sir. thank you for giving so much to the trading community of humanity.

Ok i will try this from April 2018 and let you know by the end of April 2018.

Nice article!

Starting today 4 trades in a month

Thank for the Educational advice Nial. I commit to the 4 trades a month experiment, and can’t wait to bear the fruits of this lovely article.

God Bless

And Happy Profits.

from today i will set only 4 trades in a month to see how it goes. very educative post. R/R is the best way to go about trading

I have a lot to learn.

hi nial thanks for the knowledge i now trade pin bars alone and i can tell you for2018-03-14T06:36:38 a fact that nice pin bars are a bit hard form maybe twice or thrice a month and trading them has proved to be fulfilling i made a profit of 50% last month

A good approach. I am trying to follow this. I only trade Dailys since several years and it has been succesful for me and better than shorter timeframes. Also only trading liquid markets with smaller movements but gives higher sucessrate using candlestick signals in my opinion.

Thanks Nial, Ive been a member since 2011 and I can only bow deeply for your teaching method.//Joe

Nial fuller you are best among best.

Excellent lesson NIal. Thank you. Q: How does one set up the fib for R1,R2, etc?

Thank you sir, this is going to be helpful

Thanks for a good article. I absolutely believe in this. I started getting interested in forex in October 2017. I searched for websites and was intrigued by yours. I took the chance (was skeptical) and subscribed to your course. Went through your material in less than a week. When I finished, I thought, this looks too simple- is it really?. You suggested in your course articles to try the demo platform and use it for some time. I traded on the demo platform (free for use for a month- trading with fake money) and found that it worked.

So I started trading (first day Jan 30, 2018) with real money. Since then, following Nial’s advice ( as member subscription) you get his weekly newsletter and also daily newsletter; and gut feeling, I have made 6 trades since and have taken profit (2R) in 4 of them and taken loss (1R loss) in 2 of them. Which means I Have made 4x2R = 8R – 2 x 1R = 6 R net profit. Unbelievable and that too for a newbie.

e.g. the last trade was on AUSUSD pair, entered at 0.774 last Friday (March 1) (because a nice pin bar had formed at support/resistance). Placed stop loss (1R) at 0.769 and took profit (2R) (March 9) when it reached 0.785. This thing works!

Thanks Nial for the good work you are doing.

P.S. This is my honest few words and I receive no commission from Nial for promoting this.

Nitin, thanks for sharing your story with us, good to see you’re making progress with your trading and getting the results your working so hard for.

are you still making good??

Great adivice. Let’s start today :)

Simply Great Sir! Thank you so much for your kind advice.

This is what I`ll be doing Nial.

Great article, I have tried it in the past in my real account with a small risk and the results were very much close to your examples. I ended up with around 7R

Thank you Nial. This is a challenge I will take on as it is my biggest problem with trading. Will see how it goes.Great insights!

Thank you Nial for this great article. For sure I will try and let you know. Thanks for all the articles you have done they are very helpfull to me. God bless you!

Thank you Nial. It makes so much sense. I will cimmit and see what happens.

I am in.

Thanks for this article, Nail. I promise to commit to 4 trade per month experiment.

This is exactly what I needed Nial… Thanks a lot… I’ll contact you at the end of one month.

MUST.

Great article Nial, so different from the other trading Gurus, your trading style makes sense.

As of now, I am doing about 10-14 trades a month, but after reading this, I SHALL COMMIT to making only 4 trades a MONTH and watching closely everyday on the charts! I will get back here again! Thanks Nial!

Very nice educative article. Keep it up.

Hi Nial, honestly I must commend ur effort in trying to make us a successful traders as u are, at no cost. But I have question as regard to how u handle the effect of news on the forex market, as I ve never heard u make mention of fundamental analysis on forex trading.

Thks, I hope u make a respond to this.

https://www.learntotradethemarket.com/blog/never-trade-news-fundamentals

https://www.learntotradethemarket.com/forex-articles/truth-about-forex-fundamentals-and-trading-the-news

Great article Nial, I will commit to 4 trades per month and let you know the results.

The Tomorrow we talked about Yesterday is Today.

actually nial we are on the same page….i do four to six trades a month and the results are the best to say…i actually have zero loss because after my first exit is hittted i modify my stop to entry so to elimaniate any losses as ed ponsi would say…

Thanks Nial, very informative. When I return from my visit to Asia I would love to try your suggestion and I will certainly let you know how I get on. Thanks again. Walter.

Hi Niall,

Great article, so obviously logical and yet so difficult to do. More patience and more discipline required.

I notice that the entry for the trades with pinbars appear to be either at market or buy/sell Stops. Is that correct? Is that so as to trade with momentum?

Will be giving this a go absolutely nothing to loose and everything to gain. Cheers Nial

on point as usual..less trading does bring about more profit!

Thanks Nial, I promise to commit to this experiment!!!

Thanks Nial…i am going to try this 4 trades a month… Thank you so much …your articles really help a whole lot!!

I’m going to give this a month

Great article!

Brilliant. As always. Thanks for another terrific article.

I would have to see a genuine Account Record for verification of the trades illustrated above. For example, the Sop Loss placed for the Oil Buy trade is above the Entry Price. In addition there are is some very obscure positioning of Stops for other trades too (eg. AUDUSD Buy on Jan 17th- what exactly is the rationale for the Stop placed at 0.7880? After all its the Stop/Entry difference which determines the PLR.).

Sounds like a plan, less is always more. As i have said before and Nial and other great traders will confirm it is always about PATIENCE & DISCIPLINE. So 4 trades a month it is then and we should all stick to the plan. Excellent Nial thanks

I never miss any of your article, but have you written any article on how to face a trade competition? If not, would you kindly put some light on this topic. I am sure its a burning question of many traders..

State10, promise to commit to 4 trade a month from today 6/03/18.

simple but really well done….

Hi Mr Fuller,

Your conception is the only truth

I CAN NOT FIND WORDS TO EXPRESS MY ADMIRATION

THANKS

BEST REGARDS

very usefull remarks . obviously trading this style you earn peace in mind more free time. after all as in real life sometimes less is more! ty nial for your valuable observations.

i only take 2 trades a month and they are based on the daily chart mostly….

Hi Nial

I guess part of my problem was that I was a failed stock trader and I did so want to be a successful currency trader, but no matter how many times I read through your course, no matter how much effort I put in, I could not crack it.

Finally your lesson about how you do your homework each weekend, understanding what had happened and what you expected to happen, changed it all for me. This together with patience and a very low volume of day (time frame) trades, has paid off. Its funny, I really enjoy doing my homework on the weekend. Also, finally I feel relaxed about trading. You can’t be clear if you are sweating over every pip!

Thanks again, Nial.

Regards

Ron

There is nothing that beats the weekend analysis, especially with a full-time job and family things to do. The weekend analysis affords me to spend 30 – 45 minutes on charts during the week.

thank you sir.

this is really great.

i have a question though, how do you deal with news? i mean, if you have long position eur/usd and anticipating big news ? do you close the trade or just let it take care of itself?

Honestly Nial you are the real deal. I will surprise you one of these days to show you how much I appreciate your lessons and invaluable FREEEEE mentoring.

Very inspirational Nial and thank you for your outstanding guidance. Will let you know in a month time the outcome , assuming of course, there will be good trades to take.

Mr Nial…. You are the market wizzard…..Thanks for your mentorship.

Nial You are the real deal. Thanks again

Already trading less than i have done before and have seen a change in my account from negative to positive. Thanks to your mentoring. I have already recovered my tution fees. Will have to continue practising whan I have learnt from your course. Thanks again Nial.

Hello Nial You article is just amazing and truthful. Its in concomitance with my new baby LIVE trading account finally after 4 years following you, reading and practicing on demo accounts. Finally I finished to pay all my debts and I still have my part time job that give me time studying , trading and enjoy life. I have learnt lots of things over the years from you and I dont have words to say THANK YOU for sharing your experience and knowledge. Thank you Nial ! And now back to work have a good day

aswesome aswesome…as always !!!

Well done sir. How do I get the training

Thanks Nial very enlightening. Going to try this.

Thanks a lot Nial

Fantastic article, as always. Thank you so much Nial

Good insight there. My doubt are cleared . Thanks a lot.

Thanks Nial.

OK I’ll commence this as from today.

makes sense, and this could be the winning edge I am always looking for.

Thank you Nial. I will do as you recommend. I commit Today, Monday March 5th, 2018 at 7.40pm USA, MST, that for the next one month I will take only four [4] trades a month.

I promise myself that I will try this starting tomorrow: I COMMIT to taking JUST 4 trades per month.

I will Try it. And I am hereby leaving you a comment now, right here, my promise to commit to this experiment. I will keep a trading journal and after a month, on Saturday April 07, 2018, God willing,

I will contact you again here and let you know my results.

Hello Nial

I promise to take 4high probability trades this month with risk reward management and will send you my results.

Not committing to the experiment but I’m a firm believer in your minimalistic approach, it’s because of your guidance that I’m a profitable trader after almost 4years. Took me some time + losses to completely understand what you’re actually trying to convey thank you for that, keep it up mentor!

I have promised myself to commit to this experiment, no matter what.

You are a beautiful soul that is making so many lives happier and healthier.

God bless you!!

Hi Nial,

I love the approach, and will commit to this experiment of 4 trades per month.

very good analysis

I promise to commit to just 4 trades per month.

I appreciate this article Nial. Being a newbie trader I seem to make a lot of trades, will do this for my own benefit.

I am a novis in fx.what i need are: 1 basic 2 .professionl fx training. Then you lunch me into actual fx training God bless my good teacher Nial and his team.

Hi Nial, quite an eye-opening article, thanks – I hereby promise to commit to the Trade-Just-4-Trades-per-Month experiment. Will keep you posted!

Thank you very much for your fantastic article. Hereby I commit to the experiment.

Make lot of sence. Has come to same conclution

I have seen great results using this approach.

Great one again!!!

You are simply the best AUTHORITY on PRICE ACTION!!!!