6 Unknown Winning Habits of Successful Traders

It is a fact that successful traders think and act very differently from unsuccessful traders. In today’s lesson on the unknown and rarely discussed habits of successful traders, we are going to discuss some of the most important differences between winning and losing traders. We will look at how they think, how they act and what they do on a daily basis. This lesson aims to provide both beginner and advanced traders some much-needed insight into the mindset and activities of a professional trader, allowing you to start mimicking these habits and ultimately improving your trading results.

It is a fact that successful traders think and act very differently from unsuccessful traders. In today’s lesson on the unknown and rarely discussed habits of successful traders, we are going to discuss some of the most important differences between winning and losing traders. We will look at how they think, how they act and what they do on a daily basis. This lesson aims to provide both beginner and advanced traders some much-needed insight into the mindset and activities of a professional trader, allowing you to start mimicking these habits and ultimately improving your trading results.

You’ve heard it before I’m sure, but I’m going to say it again because it’s so true: If you keep doing what you’ve always done you will keep getting what you’ve always got. So, the question becomes, where are you now with your trading? Are you successful, or not? If you are not happy with your trading performance, then it’s time to do something different! Hopefully, the following unknown and rarely discussed habits of successful traders will enlighten you and get you on the path to profitable trading…

We Think Like Hedge Funds, Regardless of Our Account Size

I probably trade a much larger position size than most of you reading this right now, and I am not bragging at all. I am telling you that because I have been where you are at and after being there and moving to where I am now, I can tell you that account size simply doesn’t matter for the most part. It doesn’t matter in the sense that if you can’t trade successfully on a $1,000 account you won’t trade successfully on a $10,000 or $100,000 account either. Account size means nothing if you cannot trade properly.

However, account size can indeed magnify your gains and a larger account can change your life faster than a small one because profits (or losses) are obviously greater the bigger positions you can trade. But, before you can trade a big account profitably you have to trade a small account profitably, and it really is better you start on a small account first anyways. The point is, successful traders are always thinking like a hedge fund, they are in the mindset all the time. Don’t become consumed with making money fast, instead, become consumed with trading properly and winning and you’ll make money far faster.

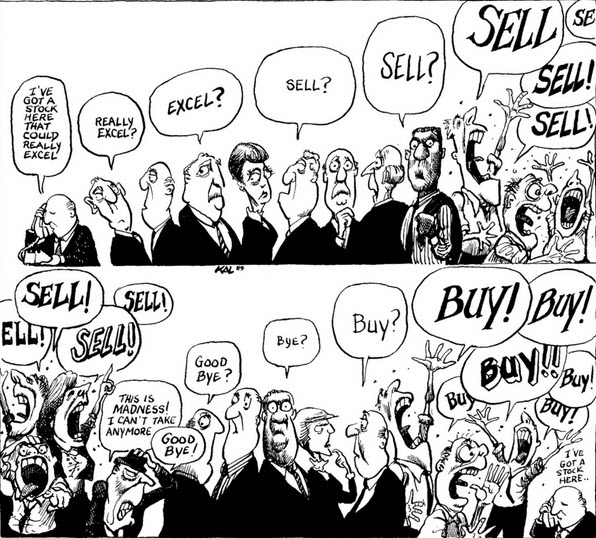

We Exploit Herd Behavior

The ‘herd’ is a common term used in the trading world when we refer to the masses of beginning / amateur traders who tend to lose money. The goal of any trader is to move from one of the herd to one that typically does opposite of the herd or perhaps I should say a ‘shepherd’, one who leads the herd. The main point to understand is that the herd usually end up losing money, you don’t want to be part of the them.

The ‘herd’ is a common term used in the trading world when we refer to the masses of beginning / amateur traders who tend to lose money. The goal of any trader is to move from one of the herd to one that typically does opposite of the herd or perhaps I should say a ‘shepherd’, one who leads the herd. The main point to understand is that the herd usually end up losing money, you don’t want to be part of the them.

For this reason, I have written articles on how to be a contrarian trader, because I prefer to trade contrary to the herd in most cases. Contrarian can actually come in two forms in the market….

- We are not afraid to buy new highs or sell new lows

Ironically, whilst great traders are contrarian thinkers (doing the opposite to the crowd), sometimes actually going with the herd and following huge moves in the market can be the contrarian thing to do, because everybody else is looking to bet against the move.

How often do markets trend much further than you think they will? Very often, a market will get into a strong trend and unsuccessful traders will continue to bet against that trend simply because they come up with all kinds of reasons why it ‘can’t keep going’.

“The market can stay irrational longer than you can stay solvent.” – John Maynard Keynes

- Take the other side of the herd

The obvious and most common contrarian trade is to take the other side of the crowded trade (market moving into a key level), we fade that move (fade, meaning sell into strength or buy into weakness). We know that most people get the market moves wrong, so we jump on the opposite side, either blindly at a key level or with a price action signal to confirm an entry.

We Don’t day trade

Successful traders are rarely day traders. There are many reasons why I ‘hate’ day trading, but the biggest one is simply that it’s much harder to make money consistently as a day trader than it is as a swing trader or position trader.

Most successful traders are what are known as swing or position traders, which basically means we hold positions for multiple days or even weeks, riding swings in the market and trying to profit on them. This is in stark contrast to a day trader who ducks in and out of the market multiple times on a day, trying to take tiny gains from each trade.

We focus on the daily chart time frame as position traders because we know it’s the most important and lucrative time frame to trade. I personally spend most of my chart time on the daily chart, second is the weekly and third is the 4 hour, occasionally, I look at the 1 hour but never do I below that.

In the chart below, notice on the left we have a 15-minute chart vs. a daily chart on the right. This is the same market, the EURUSD. You are looking at almost 5 months of price data on the daily chart (each bar is a day) vs. the 15-minute chart which is showing you a few days. That alone should tell you which chart is more significant and powerful. If you don’t understand why, please check out this article on the power of the daily chart:

A low-frequency trading approach is what you need to adopt if you want to become a successful trader. Remember what I said in the introduction? Well, what do most traders do? They trade a lot. Most traders lose money as you know, so you want to trade less frequently if you want to be profitable. One often over-looked reason that many traders lose money due to trading a lot, is because they get eaten up by the spread. Constantly entering and exiting trades adds up to big transaction costs (called the Forex spread) and for most traders this just throws more dirt on the grave they are digging for themselves by over-trading (it’s a huge unseen trading cost over time).

All the above points on why professional traders don’t day trade lead me to my next sub-point: clutter vs. clarity. You see, having a cluttered trading approach where you are trading all the time and using many different methods (especially trading with indicators) results in mental clutter. Chart clutter and trading method clutter result in mental clutter which leads to confusion and second-guessing, this all leads to losing trades and losing money. Successful traders stick with the strategy they have used and have confidence in, they typically only have a handful of ‘tools’ they use in their toolbox. I always suggest traders master one trade setup at a time so that they learn which ones they like best and then stick with those.

After all, you don’t want to end up like this guy, right? :)

We Hardly Trade at All

One thing that separates successful traders from losing traders, is that successful traders do not trade a lot, in fact, we hardly trade at all. The ‘big boys’ trade like snipers, not machine gunners because we know that is how you preserve trading capital long enough to take advantage of big market moves.

Beginning traders often do not understand the fact that being flat (not in) the market is a position. Remember; no position is often the best position. You need to have discipline and patience to excel at trading and this is built through waiting and only taking high-quality setups and learning to ENJOY passing on low-quality trades or when there is no trading edge present.

The great Warren Buffet teaches this exact same approach. If you’ve never heard of his “Punch-card” concept, here is what he says about it:

“”I could improve your ultimate financial welfare by giving you a ticket with only twenty slots in it so that you had twenty punches – representing all the investments that you got to make in a lifetime. And once you’d punched through the card, you couldn’t make any more investments at all. Under those rules, you’d really think carefully about what you did, and you’d be forced to load up on what you’d really thought about. So, you’d do so much better.” – Warren Buffet

Notice that he says, “you’d be forced to load up on what you’d really thought about”. This is a very important part of my personal approach. I don’t take many trades at all, but when I do, I believe in them because they meet me pre-defined criteria or I’ve researched them and I’m confident in them, so I ‘load up’ and I go in big. Keep in mind, you cannot trade this way if you’re trading very often, but you also do not need to trade a lot; one big winner a month or every three months even, can make you enough profit if you know what you’re doing.

We Use Wider Stops

Since I trade the daily charts most of the time, I run my stops according to daily chart price action setups and to the dynamics of the daily chart price action. The daily chart has wider daily ranges of price action (naturally) so we need to have wider stop losses than we would on an intraday chart so that we leave room for the market to move and not stop us out prematurely.

As we can see below, traders can use the average true range (atr) as well as nearby levels to help place their stop losses at safe levels on the charts (wider than what you’re probably used to) so they don’t get stopped out prematurely. Successful traders use wide stops because they know the natural daily price fluctuations can stop them out before their positions get a chance to take off in their favor.

In the chart below, notice that price moved slightly beyond the low of the pin bar signal in the chart, before rocketing up in favor of the trade. A professional trader knows that price will sometimes just violate the low or high of a signal before moving in their favor, this is one reason they choose to use wider stops than an amateur who would likely put the stop exactly at the pin bar low (which would have resulted in a loss). Wider is better in regards to stops!

We know what we are trading ahead of time

The best traders anticipate the market, they do not just react to it. I wrote about this extensively in a recent article on how to build a trading plan around anticipation, but I will discuss it briefly again here…

Successful traders trade like a predator, sitting on the sidelines and waiting to pounce on their prey like a tiger. Our trading plan pre-defines the conditions we are looking for, and as we map out the market in advance we see if it meets those conditions or not. This gives us something to stay accountable to so that we are not just trading on a whim everyday we open our charts. All we need to do is wait for the market to ‘walk into our trap’, so to speak.

We measure ourselves on R not % Returns

Successful traders focus on trading, not on the money. By doing this, we essentially make trading into a game or competition, and it’s us against the world. You have to play it right to win, and if you make a mistake, the consequences are very real. Thus, we measure ourselves based on R, not on pips or percentages. By R, I am talking about risk / reward where R = risk and success is measured in multiples of it. So, a 2R winner means we risked R and doubled our risk to make 2R. To learn more about this concept, check out this article: Measure profits in R, not pips or percentages

Conclusion

I’m not going to pretend that the above points are all you need to become a successful trader, but I will say that unless you take note of these core ideas and implement them into your trading, your chances of success are greatly reduced. With sixteen years of experience trading and markets and nine years teaching people how to trade, I see it as my duty to instill into you the ideas, processes and belief systems that I have had success with and that I know others have had success with (including some of the members of our trading community) since I launched this blog back in 2008.

Becoming a successful trader isn’t necessarily difficult but one thing is crystal clear, if you don’t think and act like the winning traders whom you’re competing against, you will get chewed up and spit out faster than you think. It’s time to stop being naive and start thinking differently if you want to have a real shot at making money as a trader. Ask yourself one question; if you do whatever everybody else is doing and think how everybody else is thinking, what will you get? You will only end up like them, and as traders, we need to be thinking and acting differently from the ‘herd’ (who lose) to gain an edge and become successful. I hope the tips and insights in today’s article help give you a better understanding of some of the ways professional traders think and act so that you can start acting more like the ‘shepherd’ and less like one of the ‘herd’.

Now I Would Really Love To Hear What You Thought Of This Lesson ? Please Leave Your Comments & Feedback Below …

If You Have Any Questions, Please Email Me Here.

I found your articles on trading by chance and continue to read material like this one. You have helped me focus on my trading approach especially honing in on trading strategies meaning limiting them and not drifting from one to another. Keep writing and sharing your insights because your “footprint” is helpful and easy to follow.

Thanks for your help fuller,

No word can explain your great work

I have benefited from Nial more than any one can imagine. My trading has improved immensely. Thank you very much.

Thanks Niall for a very important article for me. I’ve been looking for this article for a long time. No, it’s probably right to say-I worked hard on my thoughts to find this article. This article has given me answers to many questions. Thank you teacher.

Too good n thanks. i start this trade after 10 to 15 days.

Sir fuller

This article have opened my eyes,as I am trading on a demo I made several mistakes because of focusing in money not trading.This article make me to move from the ‘herd’ right now

Thank you very much keep it up the good work you are doing.

From

Anastasia

Nial I do not see the difference between losing 1R or 1% it is the same.

Hey Nial,

Very excellent blog. Likes it. You always post wonderful ideas and thoughts , which a trader should know. Also very helpful for beginners. Keep posting.

Thank you :)

Many thx for your excllent article. I agree with all of them

You are the best teacher I have ever known. Thanks a lot this information is so powerful indeed.

Blessing

Nial is the greatest teacher of all time!

Thanks Nial. A very informative article and following this advice given, can save us a lot trading capital and heartache, along with the benefit of fast forwarding our trading skills.

Many thanks!

Im very doubtful about the theory of the risk reward idea. On a daily basis, I think that you can look at the largest range in the last month say, either up or down, and tentatively double that as the likely largest excursion expected in the current cycle of trend. That can represent your stoploss. Then you look at the number of days likely in the present cycle, from the past behavior. You can then get an idea of the average daily range at present, and you can work out how large the swing of the remaining cycle is likely to be. If then this is significantly larger than double the largest daily range recently, then you have a good chance of a winning trade. This of course depends on the trading pair involved and your own past expertise. You can of course alter the multiplier of largest excursion for stoploss according to the behaviour of the trading pair involved..

Thank you for your articles,I am now sure that I am on the right part to make it in forex trading, this is because I not seen or heard somebody said what say about trading before. I have known about FX trading for quite a long time but many people around me are intraday traders and this always bore me and gives me a lot of pain and sleepless night but I believe that it is possible to not always trade that way.And also I have not got the best method I that I want until I am able to understand your method which is also good for me, and I know that it is not hard but it is the simplest if one is not in a hast to make money.Thanks a lot .

Thanks Nial, I am improving my trading skill Evert time,because of your articles.may God bless you.

Whether as a reminder or fresh lesson, I discover that any time I don’t follow thses rules, the losses are colossal. The market doesn’t know anybody’s face. Thanks. Your teaching on Price Action is a great help Sir.

Thanks Nial and team

important lesson

Hi Nial, great article, I am impressed with your knowledge and wisdom. Very thoughtful and well written. Incredibly useful. Thank you.

Another master piece from Nial,I’ll make sure i read it a few more time to have it ingrained in my memory so i can use it when trading.

Thanks Nial, I have have basically been on the same spot! Using stop loss but also putting my take profit far off. i take some small profit and also get stopped on some trades. I am eager to improve with the advice in your articles. thanks again

Nice boss…..

This article has made my YEAR. With a new resolve to trade better, before this piece,

I have a great confidence in myself now as a trader. I had most of this points in my

‘action bill’ before this article came.

Thank you Nial.

Thanks. Great Article. If the ATR is 100 pips like in the example, how much more do you add to the ATR number for your stop loss? Do you add 20 pips or 50 pips for example?

Erica, why dont’ you simply test forward 3 or 4 variants (like 1.1 x ATR, 1.5 ATR etc) on a demo account and after 50 trades or so you can check for yourself what ATR level suits best your trading style?

Thank you very much Nial for the SEVEN golden winning habits! :)

Thank you Nail, it means a lot.

Hi Nial, thank you for another great article. One question though: how do you reconcile “loading up” / “going in deep” when a quality trading setup is present with never risking more than an amount you could afford to lose “twenty times in a row” as mentioned in one of your previous articles? Many thanks for your insights.

Thanks Nial.

As a beginner in trading-land with a small account size, I am too much focussed on ‘earning/making’ money. And in the process loosing more then winning. It’s an eagerness I have to calm down. It’s getting better. And articles like this inspire me to do better and less.