Part 2: Forex Trading Terminology

Forex Trading Terminology

The Forex market comes with its very own set of terms and jargon. So, before you go any deeper into learning how to trade the Fx market, it’s important you understand some of the basic Forex terminology that you will encounter on your trading journey…

The Forex market comes with its very own set of terms and jargon. So, before you go any deeper into learning how to trade the Fx market, it’s important you understand some of the basic Forex terminology that you will encounter on your trading journey…

• Basic Forex terms:

Cross rate – The currency exchange rate between two currencies, both of which are not the official currencies of the country in which the exchange rate quote is given in. This phrase is also sometimes used to refer to currency quotes which do not involve the U.S. dollar, regardless of which country the quote is provided in.

For example, if an exchange rate between the British pound and the Japanese yen was quoted in an American newspaper, this would be considered a cross rate in this context, because neither the pound or the yen is the standard currency of the U.S. However, if the exchange rate between the pound and the U.S. dollar were quoted in that same newspaper, it would not be considered a cross rate because the quote involves the U.S. official currency.

Exchange Rate – The value of one currency expressed in terms of another. For example, if EUR/USD is 1.3200, 1 Euro is worth US$1.3200.

Pip – The smallest increment of price movement a currency can make. Also called point or points. For example, 1 pip for the EUR/USD = 0.0001 and 1 pip for the USD/JPY = 0.01.

Leverage – Leverage is the ability to gear your account into a position greater than your total account margin. For instance, if a trader has $1,000 of margin in his account and he opens a $100,000 position, he leverages his acc ount by 100 times, or 100:1. If he opens a $200,000 position with $1,000 of margin in his account, his leverage is 200 times, or 200:1. Increasing your leverage magnifies both gains and losses.

ount by 100 times, or 100:1. If he opens a $200,000 position with $1,000 of margin in his account, his leverage is 200 times, or 200:1. Increasing your leverage magnifies both gains and losses.

To calculate the leverage used, divide the total value of your open positions by the total margin balance in your account. For example, if you have $10,000 of margin in your account and you open one standard lot of USD/JPY (100,000 units of the base currency) for $100,000, your leverage ratio is 10:1 ($100,000 / $10,000). If you open one standard lot of EUR/USD for $150,000 (100,000 x EURUSD 1.5000) your leverage ratio is 15:1 ($150,000 / $10,000).

Margin – The deposit required to open or maintain a position. Margin can be either “free” or “used”. Used margin is that amount which is being used to maintain an open position, whereas free margin is the amount available to open new positions. With a $1,000 margin balance in your account and a 1% margin requirement to open a position, you can buy or sell a position worth up to a notional $100,000. This allows a trader to leverage his account by up to 100 times or a leverage ratio of 100:1.

If a trader’s account falls below the minimum amount required to maintain an open position, he will receive a “margin call” requiring him to either add more money into his or her account or to close the open position. Most brokers will automatically close a trade when the margin balance falls below the amount required to keep it open. The amount required to maintain an open position is dependent on the broker and could be 50% of the original margin required to open the trade.

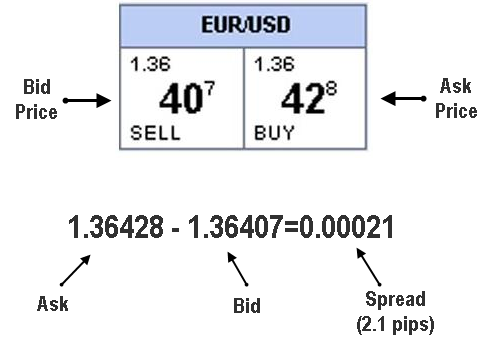

Spread – The difference between the sell quote and the buy quote or the bid and offer price. For example, if EUR/USD quotes read 1.3200/03, the spread is the difference between 1.3200 and 1.3203, or 3 pips. In order to break even on a trade, a position must move in the direction of the trade by an amount equal to the spread.

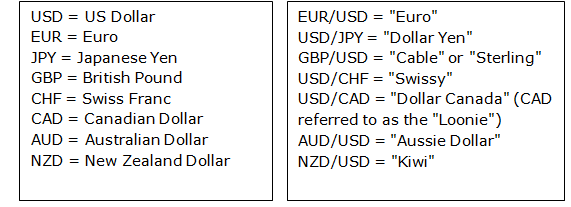

• The major Forex pairs and their nicknames:

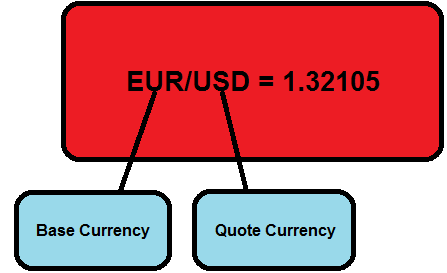

• Understanding Forex currency pair quotes:

You will need to understand how to properly read a currency pair quote before you start trading them. So, let’s get started with this:

The exchange rate of two currencies is quoted in a pair, such as the EURUSD or the USDJPY. The reason for this is because in any foreign exchange transaction you are simultaneously buying one currency and selling another. If you were to buy the EURUSD and the euro strengthened against the dollar, you would then be in a profitable trade. Here’s an example of a Forex quote for the euro vs. the U.S. dollar:

The first currency in the pair that is located to the left of the slash mark is called the base currency, and the second currency of the pair that’s located to the right of the slash market is called the counter or quote currency.

If you buy the EUR/USD (or any other currency pair), the exchange rate tells you how much you need to pay in terms of the quote currency to buy one unit of the base currency. In other words, in the example above, you have to pay 1.32105 U.S. dollars to buy 1 euro.

If you sell the EUR/USD (or any other currency pair), the exchange rate tells you how much of the quote currency you receive for selling one unit of the base currency. In other words, in the example above, you will receive 1.32105 U.S. dollars if you sell 1 euro.

An easy way to think about it is like this: the BASE currency is the BASIS for the trade. So, if you buy the EURUSD you are buying euro’s (base currency) and selling dollars (quote currency), if you sell the EURUSD you are selling euro’s (base currency) and buying dollars (quote currency). So, whether you buy or sell a currency pair, it is always based upon the first currency in the pair; the base currency.

The basic point of Forex trading is to buy a currency pair if you think its base currency will appreciate (increase in value) relative to the quote currency. If you think the base currency will depreciate (lose value) relative to the quote currency you would sell the pair.

• Bid and Ask price

Bid Price – The bid is the price at which the market (or your broker) will buy a specific currency pair from you. Thus, at the bid price, a trader can sell the base currency to their broker.

Bid Price – The bid is the price at which the market (or your broker) will buy a specific currency pair from you. Thus, at the bid price, a trader can sell the base currency to their broker.

Ask Price – The ask price is the price at which the market (or your broker) will sell a specific currency pair to you. Thus, at the ask price you can buy the base currency from your broker.

Bid/Ask Spread – The spread of a currency pair varies between brokers and it is the difference between the bid and ask the price.

Jump To Next Chapter – Part 3: Long or Short ? Order Types And Calculating Profits & Losses

Jump Back To Start – Forex Trading Beginners University

Syllabus Of All Chapters

Part 1: Introduction – What Is Forex Trading ?

Part 2: Forex Trading Terminology

Part 3: Long or Short ? Order Types And Calculating Profits & Losses

Part 4: What is Professional Forex Trading?

Part 5: What is Fundamental Analysis?

Part 6: What is Price Action Trading Analysis?

Part 7: Introduction to Forex Charting

Part 8: What Is A Forex Trading Strategy?

Part 9: Common Forex trading mistakes and traps

Part 10: What is Technical Analysis

Part 11: How to Make a Forex Trading Plan

Part 12: The Psychology of Forex Trading

Part 13: Professional Price Action Forex Trading Strategies

Other Trading Tutorials:

How To Correctly Set Up MetaTrader Forex Charts

How To Place Different Trade Entry Types Using MetaTrader Platform

How To Set Up Price Alerts In MetaTrader 4 & 5

Beginners Introduction To Japanese Candlestick Charts

Why Serious Traders Need ‘New York Close’ Forex Charts

Please Share This With Other Traders, Click The Like & Share Buttons Below.

Please Leave A Comment Below With Your Thoughts On This Lesson…

If You Have Any Questions, Please Contact Me Here.

sir,pls help me to teach me forex trading,I am poor I need your help

I enjoy reading and studying the offline course,as a begginer i feel like i am hooked to this currency trading bug.I you could also do videos that would be great.Thank you for the course.I like reading so for me it’s a great course.

Information is key. You are indeed helping the world become a better place by this awesome information which will help a lot of people become self employed and empowered and become a blessing to the world. More grace, more favour and more money in your account sir. I appreciate

Hello there.

This is very informative piece of read. Am a beginner in the Forex training and would like to advance to the level of being a pro. Kindly share more on the email I have sent you.

Kind regards.

Daniel.

I have started in February 2019 unfortunately I have blown my account only because I have noticed that I was not equipped enough to start trading.

Thank you for this important information, well done Nial.

Marvelous, these keeps me craving for more info. Salute

Interested in leaning forex trading

That was simplified I really enjoyed it Sir and will love you to teach me more. Thank so much

You are just GREAT, I love you, I thank you for your magnanimity for the vast info out there …

Thanks for providing details about Forex Trading Terminology – Their are one more web Advisorymandi they are also provide such kind of news and updates.

Good

Slippage?

I enjoyed the simplicity in the style of how you presented the information to the audience much like myself. This Terminology part has helped me a lot, i used to google term by term even the not so important ones. After reading this part i managed to make more sense of the information i was trying to crasp at the time. Thank you for sharing the informattion.

Your website is very informative all the info i need is here , I should have read this long before..I wasted a lot of time and money..I will save money and will subscribe soon ty…you are not a crocodile..

I want to learn, been reading some of your materials.

Hello, I am very much a beginner in the world of finance and would like to know how I can start trading with forex. I do understand that you can start with as little as £250,but how. My goal is to learn how to trade with forex to build something for my future along with my day job. Please help.

Thanks

Linda kaye

Wish to learn

good easy to digest stuff .Thanks

This is good

The course is really nice, i enjoyed reading it. I have interest on starting forex business, i am not too strong on it so i decided to take some course online. On the basic side, your course has lead me into some strong understanding. Thanks for every thing….

I AM INTERESTED AND WANT TO TRAIN ONE DAY

Thats a good job sir i would really like to learn from you too