Part 8: What Is A Forex Trading Strategy?

What Is A Forex Trading Strategy?

There are many different Forex trading strategies. However, there are some basics of reading a price chart that you need to know before you can move on to learning any one strategy in-depth. Let’s cover the basic building blocks of trading the Forex market from a technical analysis approach:

• Support and Resistance levels – How to identify and plot them

Support levels are created as a market turns higher. So, if a market is moving lower for example and it then changes direction and begins moving higher, it either has created a level of support or bounced off a previously existing level of support.

Resistance levels are created as a market turns lower. So, if a market is moving higher for example, and it then changed direction and beings moving lower, it either has created a level of resistance or bounced off a previously existing level of resistance:

Identifying and plotting support and resistance levels is by no means an exact science. Instead, it requires the use of the discerning human eye and a little bit of brain power…don’t be worried though, it’s really not that difficult to become proficient and confident in drawing support and resistance levels on your charts.

In the chart below, we can see the daily GBPUSD chart, with all the relevant support and resistance levels drawn in:

Now, one important point that I want you to know about support and resistance levels is that they are not concrete. Many traders seem to think support and resistance levels are concrete and that they should never trade a setup if there is a support or resistance level close by, this can result in them getting analysis paralysis and never entering a trade. While it is true that you need to take into consideration the key support and resistance levels in the market, you also need to look at the overall market condition. You see, in trending markets, support and resistance levels will often be broken by the trend momentum; so don’t be afraid of support and resistance levels, as they will often break. Instead, watch these levels for trading signals. You see, when a Forex trading signal like a price action setup forms at a key support or resistance level, it is a very high-probability even to take notice of.

• Trend trading

Trending markets offer us the best opportunity to profit, since the market is clearly moving in one general direction; we can use this information to our advantage by looking to enter the market in the direction of the trend.

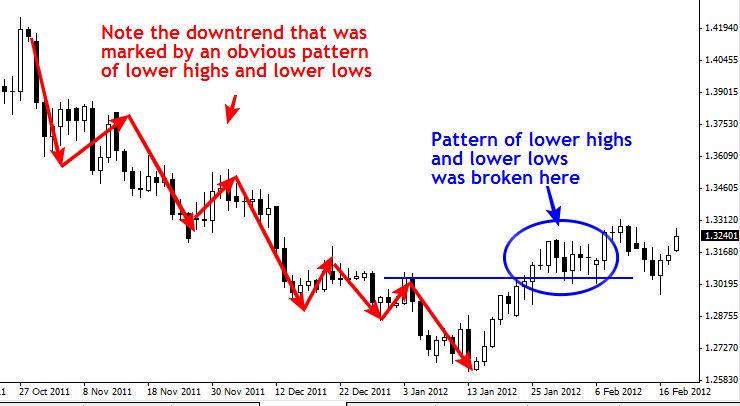

An uptrend is marked by a series of higher highs and higher lows, and a downtrend is marked by a series of lower highs and lower lows. Note that trends do end, as we can see in the daily EURUSD chart below, the downtrend has come to an end recently after the pattern of lower highs and lower lows was broken…

I like to trade with the near-term daily trend by looking for high-probability price action strategies forming within the structure of the market trend. What I mean by this is essentially looking for price action setups forming near support as a market rotates lower in an uptrend and near resistance as a market rotates higher in a downtrend. Markets ebb and flow, and if you can learn to take advantage of trending markets, you will have a very good shot at becoming a profitable Forex trader:

• Counter-trend trading

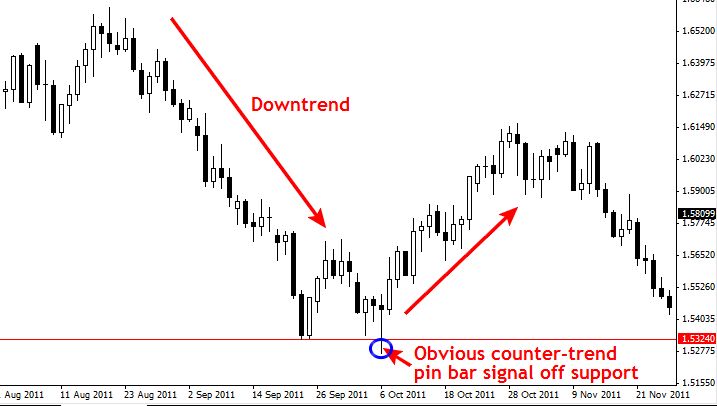

Since trends do end, we can also take advantage of this information. However, counter-trend trading is inherently riskier and more difficult than trading with the trend, so it should only be attempted after you have fully mastered trading with the trend. Some of the things to look for in a good counter-trend signal is a price action pattern or setup forming at a very obvious and ‘key’ support or resistance level on the daily chart, see here:

• Range-bound market trading

When a market is in a trading range it means that it is consolidating between a level of support and resistance. We can use the fact that a market is bouncing between support and resistance to our advantage. As the market approaches the support or resistance boundary of the trading range, we have a high-probability entry level, since risk is clearly defined just above or below the resistance or support of the range. When trading price action in trading ranges, you can watch for obvious price action setups forming near the boundaries of the range, see here:

• Forex candlestick charts and patterns

We discussed Forex charts in Part 7, but as they are very important to the way that I trade and teach price action, I wanted to give them a little more time. I have previously written an excellent tutorial on Forex candlestick charts that you can check out here: Forex candlestick charts

It’s important to understand that candlestick patterns have certain terminology all to their self that you should become familiar with before you attempt to master a trading strategy like price action.

I have an excellent free tutorial on candlesticks that you can read here: Forex Japanese Candlestick Patterns

Here’s a cool video on trading with Forex candlesticks: Forex candlestick reversal bar trading strategy

• The myth of automated Forex trading systems

While we are talking about different ways of trading the Forex market, I want to touch on what I feel is a widely believed “myth” regarding automated robot and indicator-based trading systems…

You are probably going to come across many Forex website selling Forex software that they claim will fully mechanize the process of trading, so that all you have to do is click your mouse when the software tells you to and then rake in the profits. You need to constantly keep in mind the old saying “If it sounds too good to be true it probably is…” when you are learning to trade Forex. Like I said before, you are probably going to come across a lot of these robot websites if you have not already. You are best served by ignoring them all together.

You will probably see track records that they claim are “indisputable” evidence of the robots performance in the markets…what they don’t tell you is that this track record is simply a display of a “perfect” set of data that the software was back-tested on. The point is that trading software cannot work over the long-term because the market is constantly changing and as such, it takes the discerning discretion of the human brain to effectively trade the markets over the long-term. I am not saying that computer software has no place in trading, but it cannot be the only thing you rely on, and it certainly should not be used in attempt to fully-automate the trading process. The ability to read the raw price action of a market and grow and evolve with the ever-changing conditions of the market is how I personally trade and how I teach my students to trade.

Jump To Next Chapter – Part 9: Common Forex trading mistakes and traps

Jump Back To Start – Forex Trading Beginners University

Syllabus Of All Chapters

Part 1: Introduction – What Is Forex Trading ?

Part 2: Forex Trading Terminology

Part 3: Long or Short ? Order Types And Calculating Profits & Losses

Part 4: What is Professional Forex Trading?

Part 5: What is Fundamental Analysis?

Part 6: What is Price Action Trading Analysis?

Part 7: Introduction to Forex Charting

Part 8: What Is A Forex Trading Strategy?

Part 9: Common Forex trading mistakes and traps

Part 10: What is Technical Analysis

Part 11: How to Make a Forex Trading Plan

Part 12: The Psychology of Forex Trading

Part 13: Professional Price Action Forex Trading Strategies

Other Trading Tutorials:

How To Correctly Set Up MetaTrader Forex Charts

How To Place Different Trade Entry Types Using MetaTrader Platform

How To Set Up Price Alerts In MetaTrader 4 & 5

Beginners Introduction To Japanese Candlestick Charts

Why Serious Traders Need ‘New York Close’ Forex Charts

Please Share This With Other Traders, Click The Like & Share Buttons Below.

Please Leave A Comment Below With Your Thoughts On This Lesson…

If You Have Any Questions, Please Contact Me Here.

I like the way Mr nailfuller breaks it down on how to trade the forex market with a naked price action . If you open your price charts and try to trade the market without indicators. the chat looks very simple and easy to read and trade. I am looking forward to take your professional fx trading courses. Keep on educating, informing and stay blessed.

This is really good I would like to be receiving email on this course whenever you discuss on any topic thanks

I have read the forex trading beginners write-up. It is great information. I appreciate your thorough explanation. Let me organise myself, I will be back. Thank you.

kindly allow me register my vote of thanks and or gratitude to His Excellency Nial Fuller, i call him EXCELLENCY because of his SIMPLE approach to Forex Matters,i was a non-starter in this game but after reading his well articulated articles i am confident and have the audacity to say..YES I CAN trade Forex. God bless you Nial Fuller..i love you.

Pleasure.