Exactly How I Analyze Price On Clean Charts

There is much more to trading than just opening up your charts and looking for an entry signal. In fact, (don’t tell anyone this) a good price action trader knows how to set up and analyze his or her charts so well that they may not even need a price action “pattern” or “signal” for a trade entry. Indeed, the underlying market bias, which is defined by the structure of the market, i.e. trend, key horizontal levels, etc. can often provide us with enough clues to spot a potential entry. Hence, learning to identify and plot these pieces of the technical analysis “puzzle”, is very, very important.

There is much more to trading than just opening up your charts and looking for an entry signal. In fact, (don’t tell anyone this) a good price action trader knows how to set up and analyze his or her charts so well that they may not even need a price action “pattern” or “signal” for a trade entry. Indeed, the underlying market bias, which is defined by the structure of the market, i.e. trend, key horizontal levels, etc. can often provide us with enough clues to spot a potential entry. Hence, learning to identify and plot these pieces of the technical analysis “puzzle”, is very, very important.

In today’s lesson, I am basically going to walk you through how I do my daily and weekly chart analysis which you can see in my market commentaries. The primary pieces of this puzzle are: Clean black and white price charts, key levels, trends, price action, market bias and signals. As a result, these things are my main focus when doing my analysis and market commentaries, because learning how to properly map a market is vital to understanding how to properly trade with price action.

Why I Use “Clean” Charts & How to Set Them Up

Clean charts, or indicator-free charts, are the backbone of my technical analysis and price action approach. If you don’t yet know why I prefer clean, naked price charts, check out my article on why indicators will destroy your trading. Suffice it to say, I subscribe to a simple, less is more trading philosophy, and for some very, very good reasons, which I have written about often.

If you don’t yet use clean, indicator-free price charts, I have an excellent tutorial on how to set up your charts here that you definitely need to check out. You can also the download the metatrader trading platform we use here.

Here is a simple way to set up your charts properly:

First, you will right click on the chart and then select “properties” at the bottom of the pop up menu. Once you do that, you will see the following screen for chart options. First set the colors and other options how I have them in this image:

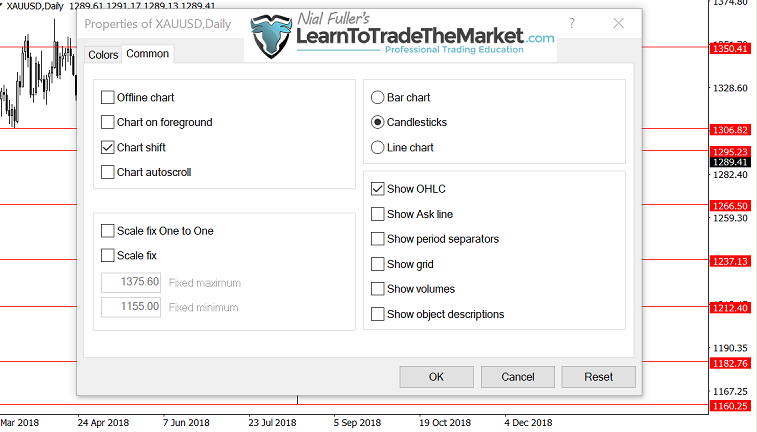

Next, you will select “common” and set the options as follows:

That’s a basic overview of how to quickly set your candlestick charts up exactly as mine are. Remember, there is a reason why I set them up this simply; because simple is better in trading and we are trying to eliminate variables that may confuse us or cause doubt, fear, etc.

How I Analyze Clean Price Charts

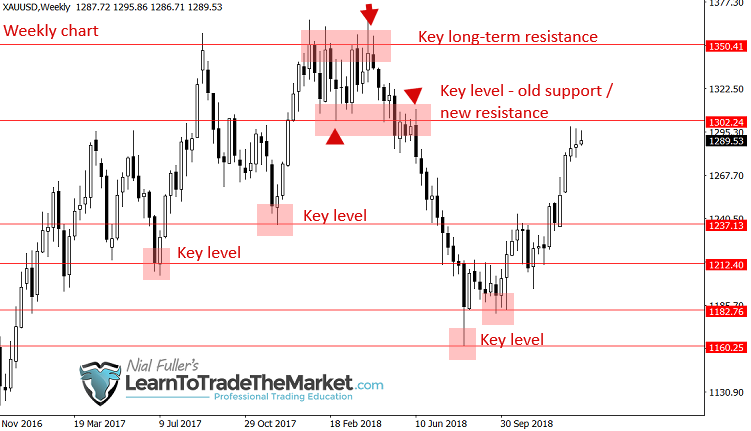

When writing my weekly members market commentary, the first thing I do is zoom out on the weekly chart, because I want to get that bird’s eye top-down view, this gives me a good idea of what has happened and how that may influence what currently is happening.

In the chart below, notice I’ve zoomed out to the weekly view of the current Gold charts. I have marked the most obvious key levels of support and resistance. Note, often these levels will “flip” from support to resistance or vice versa, as price moves up or down:

In the chart image below, notice I’ve zoomed out so I am looking about the last year’s worth of data on the daily charts. This gives me plenty of time to see how the previous year’s levels and trends, as well as price action, as led us to the current point. You will see what I’ve drawn in below on the chart, these are the levels I view as the most relevant as well as the areas of consolidation and trending price action, these are the first things I am looking for when I do my price action analysis…

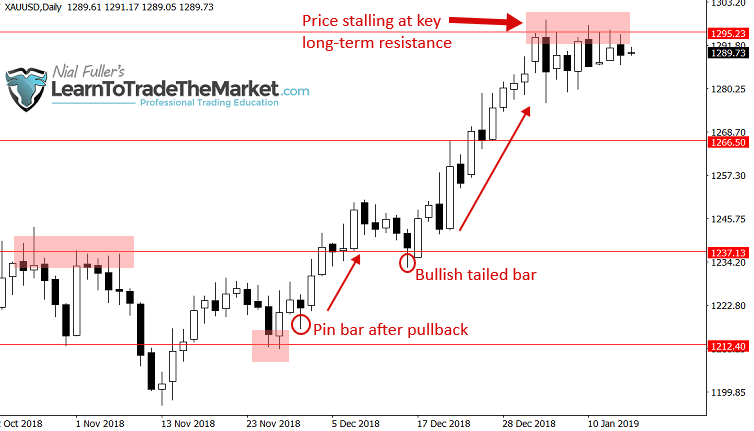

In the next chart, we have zoomed in a bit more, but you’ll notice the same levels are there. We are going to dissect things a bit more here.

First, notice the bullish tailed bar on the far left of the chart, this was clearly an important turning point from down to up, so we will draw a horizontal level at the low of that bar; this level would once again be relevant if price fell back down to it. Then, notice price entered into a period of sideways consolidation for almost two months, before breaking up and out of it. However, after the breakout, price chopped slowly higher and then formed a bearish pin bar at 1237.00 area; a resistance level we had previously marked on the chart. Now, whilst this would be considered a “counter-trend” pin bar, which usually i don’t like, since it was at an important level we already had on the chart, and there was a clear target below at the previous breakout level of 1212.00 area, savvy price action traders could have considered a short-term trade targeting a move into that level. Note: 1212.00 or really 1215.00 – 1205.00 area was a very strong zone of support due to the previous breakout and I would have been looking to get long on a pull back to that area after the upside breakout.

In the next chart, we are looking at how when a market swings, it leaves behind a level, and we then watch those levels for pull backs to trade in-line with the existing momentum.

Notice the areas marked “watch for pullbacks”, we would have been watching for price to pull back to these levels after it broke above them, to get long and trade in-line with the bullish momentum that was clearly developing. Ideally, we would get a price action signal at these levels after price pulls back to it, but this is not always necessary, as I’ve written about, sometimes all you need is a level and a trend for an entry, see my T.L.S. article for more…

Finally, we have zoomed in to the most recent price action of the daily Gold chart.

From this chart, we can see a couple of potential entry signals that formed after pullbacks to 1212.00 area and 1237; again, we had already marked these levels on our charts and were waiting to “attack” should price rotate back into them. Currently, as of this writing, price is hovering just under the key resistance area up near 1305 – 1295 area.

Conclusion

I always think of analyzing a market from the “top, down”. This means, you want to start with the longest time frame, zoomed out, and then you gradually shorten the time frame and zoom closer in. You do this to get a “bird’s eye” view of the market so that what is happening recently makes more sense within the longer-term context. Think of performing your weekly and daily market analysis like reading a book; in order for you to understand what’s happening on page 100, you have to have read and comprehend pages 1-99. It’s really no different in trading; you have to build a narrative in your head from the market you are analyzing, and you do this by looking back in time, plotting levels, analyzing the price action and then keeping up with the market each day at the close, adjusting levels or adding news ones as necessary.

Once you start doing this regularly, it will start to become your price action trading routine and eventually it will turn into a habit. Soon, you will thoroughly enjoy it because let’s face it, keeping up with the markets is fun (if you’re a trading nerd like me anyways). So, enjoy it, but also realize that what you’re doing is getting in-tune with the market and its price action, and this truly is a requirement if you want to have any chance at learning to trading professionally.

Please Leave A Comment Below With Your Thoughts On This Lesson…

If You Have Any Questions, Please Contact Me Here.

Dear Nial

Thanks for sending me important trading documents.

I am enjoying reading and try to remember them as well

It is very informative. I hope I may be a good trader one day.

I think I need a mentor which will help me to learn to trade.

Thanks

This is one of the bests i had ever read about how to trade the market correctly .

thanks nial

you’re a genius, nial. You’ve changed my whole perspective, and you keep changing it. I’ve learned a lot from you in a short time. thank you so much.

Since i start top down analysis my trading account is breathing very well …. Thanks so much sir.

Glad you are having a good time trading the markets.

Do you think its a good thing to trade price action with just the volume indicator on its own?

This lesson was very very informative and has changed the way i trade

Thank you Mr Fuller for your time you spend putting this information together for us to read and learn from

Thank you Mr Nial for your, reply but I dont mean FIB.50% retracement but when you see a pin bar form after a pull back,how do you know if you could enter using the low or high of the pin bar, or 50% of the same pin bar. Thanks.

Once again, boss, you broke the bone of the forex market, not ordinary bone, but the back bone; you nailed it on the head by showing me how to ride the market like a horse to the haven of success. I know you for this, man. The areas on chart that always get me so confused have been broken into pieces by your very simple market analysis.

As a result of your article, I am improving so rapidly in my trade career.

Thanks

your teachings are so simple as ABC with clear illustrations making things easily understandable. im learning and definately after your lesson i will be a better trader. love you Nial

NIAL THANKS MAN

I’m beginning to think if you are the one who invented forex ????. The way you teach & explain things makes forex so simple. I Iove you Niall. Thanks for this wonderful piece.

Thanks for this market analysis.

This is understandable enough.

Hello Nial

It’s so amazing ,it’s so true and looks easy to follow your advise .

It’s the only one way to growing as trader : keep it simple as it is !

Thank you , useful article again !

Xx

Adriana

great work like ever,truly enjoyable,i like it,it reminds me of strong pin bar,wick support and wick resistance,thanks a lot,i ll also like to download the platform you sent.

i started trading since 10 march 2012, i have lost money and time without base knowledge. i have subscribed your course since June 2018. after 3 months i have started earning money without any time waste and problem. THANKS A LOT OF DEAR GURU.

Thanks, really like the article. Especially to ‘read the market like a book’ as the top down approach is so revealing for correct analysis.

Excellent article. Puts many of your other important articles in perspective.

Regards

Wow, what an eye opener. Thanks very much Nial.

Amazing article and analysis Mr. Nial. It also amazes me to see how the Price Action remembers those support and resistance lines almost every time it retraces.

I’m indebted to you.

Thanks very much Nial. This is very informative and eye opener.

Very informative, thank you so much

knowledge :)

Thanks for another great article and thanks for those useful links which you always include with your lessons.

This cleared my confusion on price action analysis wheather it done zooming to nearly 6,3 months or one or more year. That confusion made on me by reading your own members article and other articles.

However, This article itself cleared out everything. Thanks mr. Nial. God bless you!

Thanks Nial excellent article

insightful and encouraging Nial as usual :)

Thank you Nial. An excellent and informative article that everyone should read!

I’m short of words. Thanks a million, Mail. I can feel it, it’s in my fingertips!!!

Hello Nial,

This write up is very instructive, informative and educating. Thanks a lot Sir.

Thanks for the article Nial.

Perhaps I should write a book on all the things I have done wrong when Trading.

The number one point would be a very messy chart. ( I have even written reminders to pick up the grandchildren on mine)

this was excellent – thanks

Thank you for once again sharing your knowledge, this a very powerfull tool to analyze charts that we as traders ignore. Thank you Nial.

Dear Nial,

You are the light that shows us the way.

Thank you for the great enlightenment.

More grease to your elbow.

thank you Nial. I am still struggling trader, but I am 100% sure I will succeed in the near future , because of you. May God bless you and your family

Helpful , Thank you

Good Morning Nial

Thanks for this important basic lesson which will help us to follow your pattern and methods of analyzing the market.

May God bless you with your family and your team.

Kind Regards

Yet another absolutely fantastic article. Thank you Nial.

Nice and precise analysis.Many thanks

Nial,

It is always great to here how the person is thinking when they display chats and why they have chosen levels they have- you have opened up another level of learning for me. Thank you

Off to practice!

Simple, but difficult :-)

Very nice!

Great. Thank you NIAL

Great article, very educational and shows the power of Price Action, Thank you Niall

It is a very handy article to mention, am closely following each directives given in. However, it happens that either in short time frame “say 30 minutes” there is consolidation and getting to high time frame (4 hours also) I hardly see the consolidation. How then can I figure out the price action for consolidation from the lower time on the higher time frame?

Sir Nial,

as always, brilliant approach.

all the way from Phils.

BR,

Paul

Great article Nial. Thank you.

Hi, Nial

Thanks for beautiful and useful article..

Manoha Nadkar

One of your best articles Nial!

I totally agree. That kind of articles are the best, but i also like those with psychology of trading ones.

Thaks, Nial, you are top! God bless you.

Best lesson ever.

Thanks a lot……

Thank you Nail great lesson if there no planing everthing will be ruin at the end.

MY FRIEND NIAL.

READING YOUR LESSON IS AN AMAZING GUIDELINE FOR ME ,EVER SINCE I KNEW YOU I STOPPED USING A LOT OF INDICATORS ,AND BECAME SO ABLE TO ANALYZE ANY CHARTS AND IF I AM IN DOUBT I ALWAYS STAY OUT .SO THANKS MY MASTER .

Great. Thank you

Oh! What a lovely day to have read this….. Thanks boss.

Insightful as always.

Great write up,keep up the good work of impacting lives positively.

Thanks,

Nial

Good piece n insightful as well… Thumbs up

Thanks Nail, you have no idea how your articles are improving our trading skills.

Thank you

THANK YOU FOR THE MATERIAL PROVIDED.IT IS DEEPLY APPRECIATED.

Educative!

Very informative Nial. Thank you.

There is much more to trading than just opening up your charts and looking for an entry signal. In fact, (don’t tell anyone this) a good price action trader knows how to set up and analyze his or her charts so well that they may not even need a price action “pattern” or “signal” for a trade entry. Indeed, the underlying market bias, which is defined by the structure of the market, i.e. trend, key horizontal levels, etc. can often provide us with enough clues to spot a potential entry. Hence, learning to identify and plot these pieces of the technical analysis “puzzle”, is very, very important.”

THIS MAKE MY DAY….

Thanks boss!!

Awesome article, quite helpful. Thank you Nial