The Simplest Forex Trading Strategy in the World

If someone asked me to describe my trading strategy in as few words as possible, it would be this; horizontal levels and price action. Indeed, trading price action setups from horizontal levels is the “core” component of my trading theory and strategy, and if you were to take away only one thing from my website it would be that you can learn to trade the market effectively by simply drawing the core levels on your charts and waiting for obvious price action signals to form around them.

If someone asked me to describe my trading strategy in as few words as possible, it would be this; horizontal levels and price action. Indeed, trading price action setups from horizontal levels is the “core” component of my trading theory and strategy, and if you were to take away only one thing from my website it would be that you can learn to trade the market effectively by simply drawing the core levels on your charts and waiting for obvious price action signals to form around them.

After you finish reading this lesson, leave a comment, like it on facebook, tweet it on twitter and share it with others. :)

Why are horizontal levels so important?

If you want to learn to trade a “naked” price chart, you’ll need to learn about two things at minimum; price action and horizontal levels. Everything in the market starts with a horizontal line; this is the back-bone of my trading approach as well as the trading approach of many other great traders. Indeed, traders like George Soros, Warren Buffet, Jesse Livermore and others, all pay (paid) close attention to the key levels in the market, because they know that these levels are significant and can thus have a strong impact on the direction of price.

Horizontal levels help with timing and they provide “value areas” that can help you define your risk by giving you a price level to place your stop loss beyond. I have been a disciplined trader of levels combined with price action for years; probably about 80% of my trades involve an obvious “core” horizontal level combined with a price action signal. Horizontal levels provide us with a confluent area to trade from, but they are not the only factor of confluence that I look for; the more factors of confluence you have lining up with a price action signal the better. However, I do consider horizontal levels to be the “core” piece of confluence in my trading strategy and I want to show you guys some examples of how I use horizontal lines and price action to trade the markets. Ready? Let’s go…

Examples of trading with horizontal lines and price action signals:

I teach a plethora of price action trading confirmation signals in my course that I combine with levels and the trend, here’s a few examples of how I trade price action signals with obvious horizontal levels in the market.

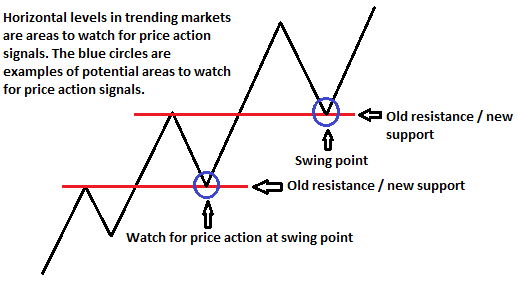

• Trading horizontal lines in trending markets with price action from “swing points”

My favorite way to trade with horizontal lines is to trade them in trending markets from swing points. As markets trend, they create horizontal levels as they ebb and flow, these levels are what I call “swing points”, and we can find very high-probability trade setups by watching for price action forming from these swing points in the market.

Look at the illustration below, note how the market is trending higher and as it makes new highs it also creates resistance when it falls away from these highs, then as it pulls back the previous high / resistance actually turns into support (swing point). Thus, old resistance becomes new support in an uptrend, and in a down trend old support becomes new resistance, also known as swing points.

The way that we take advantage of these horizontal level swing points, is to watch for price action strategies forming near them as the market pulls back. Look at the blue circles in the illustration above, these are the swing points at which you want to watch for obvious price action signals forming, then you are trading from a confluent point of “value” within a trending market.

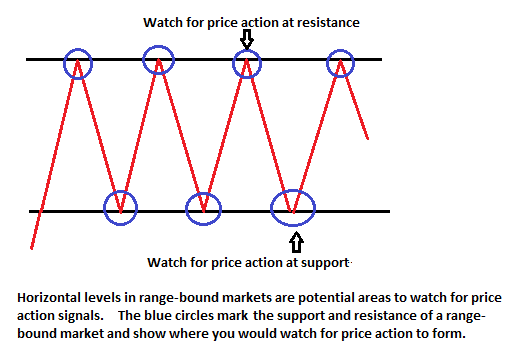

• Trading horizontal lines in range-bound markets with price action

Another excellent way to trade horizontal lines in the market is to simply watch for price action setups forming near the boundaries of a range-bound market. Unfortunately, markets do not always trend like we want them to, instead, they often swing between support and resistance in a trading range. Fortunately, trading with simple price action setups allows us to trade in any market condition, so we can still find high-probability trade setups even in range-bound market conditions.

In the illustration below we can see an example of what a range-bound market might look like. When price is obviously bouncing back and forth between a horizontal support and resistance level, we can wait for price to hit one of the boundaries of the range and then watch for price action signals forming there. This provides us with a very high-probability entry scenario and a very simple trading strategy. It also gives us obvious levels to define our risk and reward. Risk is defined just beyond the trading range high or low from the boundary you are entering near, and reward is defined near the opposite end of the trading range.

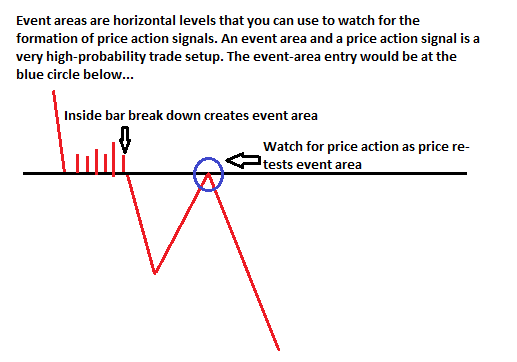

• Trading “event area” horizontal lines with price action

Event areas are horizontal lines that can be very high-probability areas to watch for price action setups forming near. Essentially, when a major price event occurs in a market, like an inside bar breakout or a pin bar reversal, price creates an “event area” at this horizontal level. You will notice that these event areas are significant most of the time because price will often stall or reverse as it re-tests them.

In the illustration below we can see an example of the creation of an event area as well as how it could subsequently be traded. Essentially, any price action signal can create an event area if it sets off a substantial move from the event area / horizontal level. In the example below we can see an inside bar breakdown occurred and then price came back and re-tested this event-area / horizontal level. As price re-tests the event area we would watch closely for price action signals, as the formation of a price action signal at an event area is a very high-probability event.

However, event areas also provide us with the ability to enter without confirmation from price action. This is a more advanced strategy that I teach in my price action trading course, but it is possible to enter “blindly” at the event area as price comes back to re-test it, that is to say without confirmation from price action.

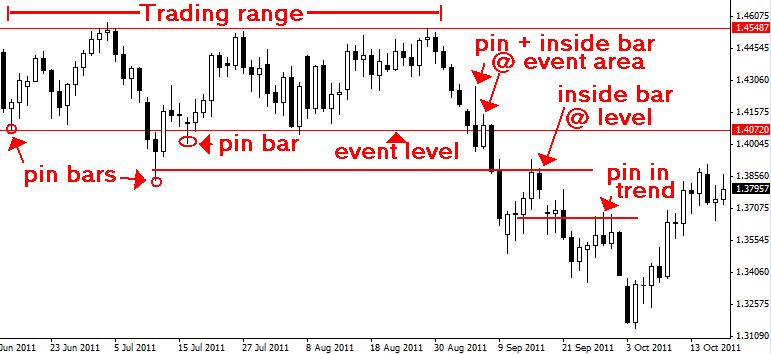

• Real-life examples of trading price action at horizontal levels

Finally, I wanted to show you guys a real chart of the EURUSD and analyze its recent price action and horizontal levels to show how you could have used simple horizontal levels with price action to trade the market.

1) Note the trading range that the EURUSD was in for about 3 months earlier this year. Price was bouncing back and forth between resistance near 1.4550 and support near 1.4100 – 1.4000. We didn’t get a lot of signals in this range, but there were at least three good pin bars that formed off the support of the range that traders could have made some very good money on.

2) Next, as the trading range formed and the pin bars developed along support, we got an event area forming around 1.4100 – 1.4000. As price began to move lower from the top of the trading range before it broke out, it formed a long-tailed pin bar and then an inside bar right at this event area. Thus, a break of the pin bar low meant a break of the event area and we can see a significant move followed.

3) Next, we can see an inside bar and a pin bar setup that formed as the market trended lower. These setups both formed at horizontal levels and we can see they resulted in large moves to the downside that provided good risk reward ratios for savvy price action traders

In closing, trading horizontal levels with price action signals is the primary technique that I use to analyze and trade the market. It is essentially the “foundation” of my trading strategy and I believe it truly is the “simplest trading strategy in the world”, as well as the most effective. It is obvious that horizontal levels are very important in the market, and by combining them with my price action strategies you have a very effective and simple trading strategy. If you want to learn more about how I use horizontal lines and price action, as well as my other trading strategies, check out my price action trading course here.

The best thing in your your trading way is the simplicity in every thing that can be applying in many way inside the market also outside it. Great ” Nial ” it’s very useful work.

Dear Sir,. Am very much interested to know more about the horizontal line trading so thank you for the knowledge i have got but i need more and also how to use with moving Average. What if candle stick do not touch the horizontal line but come close it, can one still take the trade at that point

I read the article about two years ago. I then did not understand the concept behind it. Now I again read it and realize this is the golden rule of forex trading. Thank you Neil.

Wow! What a big a moment I have here! I am beginning to enjoy trading more i can imagine. Future is here please. This is simple strategy that has great potential of making forex traders profitable. This is killing!

Thanks Nial for this great job.

Hej Nial,

Excellent and honest explanation. But we need more to write about the horizontal levels( greediness).

very good artical sir,thank you

gud stuff for newbies like me

thanks for the lesson,i think it will improve my trading. thanks for sharing your experience

your strategy to bring fundamental change in the perception of me, thank you!

Enjoyed your article thoroughly!!! Just had my ah ha moment just before reading this article. I came to some of the exact same conclusions. Good to see that you are in agreement. I finally understand your simple price action strategy using the 4 hour and daily charts.

Thanks for the lesson but i need a video or article on how to setup a trade in 4H and Daily chart, Really like your KISS strategy

You make it easy to understand, support ,resistance and price action. Great stuff. Appreciate your efforts.

Thanks

Taseen

Best blog that i ever read.

Thanks Nial !!!

thanks so much dude for your blog seriously it make significant changes of my trade .. god bless u

clear, concise, legible and meaningful, keep them coming Nial.

I believe in all you said. Price action is a confirmation of trends. As they say, the trend is your friend eventaully.

“Everything should be made as simple as possible, but not simpler.”-Einstein. “Simpler explanations are, other things being equal, generally better than more complex ones” Occam’s Razor. This simple trading strategy also works in smaller timeframes and other instruments as well. Simple yet great stuff. Thanks!

WOW! This article is mind blowing.Or all your effort Nial i wanna say a big THANKS.

This a great tutorials, awesome~!!!!

Someone in this forum said thanks for the free advice. Yes, it is free, but God knows how potent this methodology is. I don’t know if Soros or Livermore drew lines on their charts, but if not for Nial, i will still be plugging away Macd’s and what nots……..

Huge thanks, Guru. Thank you so much.

Sanjay Ram

Basic stuff, love the KISS Principle – aim for it everytime. Thanks Nial. K :)

Nial, thankyou for todays lesson. Awesome!

Great article! You make the whole issue look so simple and easy…!! Thanks. Tasos

It’s the simplicity and power of your methods that makes it so easy to understand. You’re like ZEN MASTER of trading :)

Well and good, you inspire me too understand the formations of price action all that much more.Home work on the various set ups, will dig into the comprehension of the inside bar and pin bar signals. Thank-you for providing such pertinent material. Feel fortunate to have found this site after some five diligent months of forex study. Repeatedly I see that the more confident traders rely staunchly on price action, your emphasis of this yet again echoes the necessity to understand this element especially coupled with support and resistance.

Great as ever…thank you))

Very good stuff, Nial. I cannot thank you enough for sharing your vast knowledge and experience. I only wish I had found your site before paying thousands to attend a local trading school to learn nearly the exact same things.

Great…Thank you ))))

Great info as usual. Would like to hear from

you in answer to the question about using Fibonacci

in addition to the S/R levels, etc.

Nial,

Nice! Nice! Nice article.! Had my all-time (.02) daily best mini trade yesterday and profited $63 overnight? When your trading for “peanuts” this was “big potatoes” for me. Love you, your site and set-ups! Thanks again! Larry

Best strategy EVER. Best strategy EXPOSED! Simple but POWERFUL. I wonder wht ur price action course would be like? Mind blowing i guess. I will definitely enroll. God bless you!

DIS IS MIND BLOWING. TNX. CAN I ASK IF KEYLEVELS ARE ALSO PIVOT POINTS? I HAVE AN AUTO PIVOT LINE SFTWR DAT DRAWS ON MY CHAT PIVOT. PLS COMMENT…

Hi Nial,

This is an invaluable article. Thanks

Rikus

Good to know that simple things DO Work.

Yes, your fine article has greatly reinforced the concept of Horizontle levels and their importance in Trading.

I do presume that it would work equally well on 8 and 4 hour charts.

Thanks

u hv suceded in reducin tradin to 1+1 Nial…n u hv sucede in creatin a success in me.Thanx Nial n God bless

great stuff. refreshing approach. good to see someone thinking for themselves and also not spruiking expensive programs.

Thanks, Nial, for a GREAT article. For me, this is your BEST article ever! Thanks again.

Thanks for sharing.

Thanks nial really good information, patience is my big problem.

Wow you got a good following , and you have me aswell good job. Don’t stop what you are doing.

thanks nial this is one of the greatest lesson i have received from you,i thank God that i met you,lesson from you have change my trade drastically……God bless you.

Thank you, Nial for this best free lesson – excellent and full of wisdom in it. I am very much impressed with your simple style of teaching. From today, I’ll pay close attention to PA and S/R levels in my trading – and am sure (and hope) that it will bring me success that has eluded me so far. Indeed when I have a cash sum in my account = 2 x your course fees, I’ll enrol to be your student! No doubt about it.

Thanks Nial. I was watching a review on the eurusd the other day and noted how many horizontal lines she used. Thanks for sharing this lesson which has enriched and added value to my trading.

Thank you so much Nial for these weekly articles, I look forward to receiving them as they are always so informative and inspirational, with no BS, just honest, raw knowledge. Thank you so much and please keep them coming!

Great Article Nial and thanks for the illustrations with charts.

Hi Nial

A realy good refresher lesson for me, it realy is about keeping it simple.

Many thanks

Steve

NAIL! Thank you for sharing your valuable experience.

It is really simple and most effective strategy.I enjoyed

reading your each and every LESSON…. and learnt a lot.

REGARDS, AMIN MALIK

Hi Nial

Great stuff I shall practice this stratigy.

very very helpful and very clear. this is amazing how u have made trading really really easy. u sure have got a big heart kz i dont know many people who go this far to help out novice traders such as myself. thank you so much and God bless u.

Bro! I really don’t know how to thank you, but God will surely bless you for giving us the simple thing that most forex product vendors use to squeeze out our little hard-earned income. Kudos!!!!!

Hi Nial,

Hope you are well. Thank you very much for another fantastic and superb lesson where in which you have shared your priceless insight.

Thank you for all your help

Thanks and Regards

Gurpal

Really good

Hi Coach,

Thanks for spending the effort to put up an enriching article like this. Once again, I have learnt something new and it has reinforced the concept on resistance support together with price action.

Please continue to provide us with great article like this to help us to do better in this trading business.

Cheers,

Roger

Hi Nial,

You have expanded it for me. I found this horizontal out by self discovery. It was making money for me, but indisciplined emotion made me not to continue using it to mastery. Thank you for getting me out of my slumber as my mentor.

Fantastic lesson. Keep it simple ! Thanks. Nail!! All the best for you!!

Thanks mr nial for another wonderful insight,the combination of this methods with patience and discipline will guarantee success.

Thanx Nial

That would have to be one of your best lessons so far. You make it sound so simple.I will pay more close attention to S/R from now on

Thanks again Colin

After 18 months of trying to find a strategy that works for me, I’ve found it, yours. Thanks a million (pips). John

You’re absolutely spot on.There is nothing like simple.

Cheers

Ash

thanks Nail, i am newbie and new fan of you, thanks again

Hi Niel

I was thrilled, not many understand. that those gold falls from the mouth or actually from the pen

Alois

Nial Sir,

I am a stock day trader using all your price action set ups and getting success day by day.

I have some query for you about support and resistance levels and i.e. …….

Can one use previous session’s closing level,current session’s opening level and current session’s average traded price level(ATP),as core levels for current session’s intra day trading ?

Awaiting your response anxiously.

Thanks

Price action coupled with daily charts, using horizontal lines, it doesn’t get much simpler for applying a set & forget strategy. It’s all that I use. Having a pro back me up is the icing on the cake.

I’m really impressed at the amount of updated content you provide Nial. It’s hard to keep up with. It’s all there but.

There’s certainly nothing set & forget about the way you conduct your business.

Cheers

Hi Nial,

clear explanation and concentrated wisdom. I think, especially last few months is very hard for everyone trade intraday because of confuse and very volatile movements of the market and is necessary to use daily charts. Your articles are my most favorite. Please continue.Thanks.

I must agree with Bel – patience and discipline – … loosing bad trading habits from last year when I didn’t know Price Action is really big challenge.

Hi Nial

Great stuff as always. Sometimes being reminded of the basics and making sure I adhering to them is more important and valuable a trading lesson than learning about more sophisticated pattern recognition.

Plain vanilla support / resistance (horizontal levels) and ‘obvious’ price action. You just can’t beat it. (unless you add “R” to your rules!)

all the best & keep up the excellent work

Paul

Thanks for your support Nial. You’re the best trading coach out there.

Hey

I have been using price action, support & resistance since monday. i have made 909 pips, when i only make a single trade a day. Thanks to your articles

Excellent lesson Nial, really insightful and simple. But beneath the simplicity we really need to develop our skill at spotting event areas combined with price action confirmations. Many thanks and all the best for you Nial, and please keep enlighten us.

Hi Nial

Great article!

I wonder if you ever use Fibonacci retracement levels as further weight and confirmation for these horizontal levels?

I’ve heard big players = big moves(i.e. banks etc) use them a lot!

Great job Nial!

Your explanation is always clear and simple. Whenever I open my laptop I check for any RSS updates of your website for some knowledge:)

Thanks for another Great Artical Nial! I really enjoy your teachings!

You always mange to keep me on track.

Thanks Nial

Thanks Nail. Good insight.

Thats great!

Hi Nial,

Thanks again for sharing your wisdom, experience & knowledge. Your daily commentaries & constant trading lessons are invaluable.

This is a great article, it is how I am trading & it really does work. The hardest part is being patient & disciplined !!

Don’t give up on us, please keep providing us with information :)

Bel.

Thanks Nial

Another methode of trade.

Cheers

is there a way to determine what the average daily range is for a given currency pair and therefore to understand which price points it bounces off of on a regular basis?

Good Refresher on Horizontal Levels. Thanks!

Hi Nial, I’ve been a member for over six months and I’m a huge fan of the way you explain it…

This article is really insightful, and I really appreciate your genuine passion in sharing your strategies that actually work and more members should share how its working for them too… I look forward to seeing many more!!