5 Reasons You Should Learn To Read Price Action

One of the most frustratingly difficult concepts to get across to beginning traders is that you truly do not need to make the process of technical analysis messy or confusing, at all.

One of the most frustratingly difficult concepts to get across to beginning traders is that you truly do not need to make the process of technical analysis messy or confusing, at all.

Honestly, this piece of the trading “puzzle” should be the simplest and easiest, but for many traders, it’s the complete opposite…

They start off with dozens of indicators on their charts, 20 different websites open on their computer, literally trying to analyze hundreds of different variables at the same time. They do all of this to try and find a trading edge; something that will provide them with a “clue” of what might happen next in the market.

Guess what? This trading edge is sitting there right in front of them, hidden beneath the mountain of unnecessary distractions on their charts. That edge is, of course, price action analysis.

So don’t waste your time thinking there is some “Holy Grail” trading system based on indicators or software that will turn your computer into an ATM, because (sadly) there isn’t. I can tell you from 18+ years of live trading experience, the only thing you need to effectively analyze a price chart is your eyes, a computer, and the raw price action data the market supplies you for FREE, oh and maybe a lot of caffeine.

However, if you’re still not convinced that price action is truly the only thing you need to analyze the markets, then maybe one of these points will help to “knock” some sense into you:

1. Clean vs. Messy

As I clearly illustrated in my price action tutorial, one of the main reasons to learn how to read price action is so that you can declutter your charts and trade in a simple, “naked” manner, devoid of confusing and messy indicators.

The trading world is already filled with a myriad of conflicting and confusing advice, methods and approaches, so one of the biggest steps you can very easily take that will put you will ahead of other traders, is simply to remove all the “garbage” from your charts. Put simply, you do not need to trade with indicators, at all.

I recommend EVERY beginning trader start by learning to clearly map the charts and learn to listen to the market by simply learning to interpret and trade the price action. When it comes to technical analysis, simplifying the analysis portion is key, yet most traders do the complete opposite; they over-complicate it.

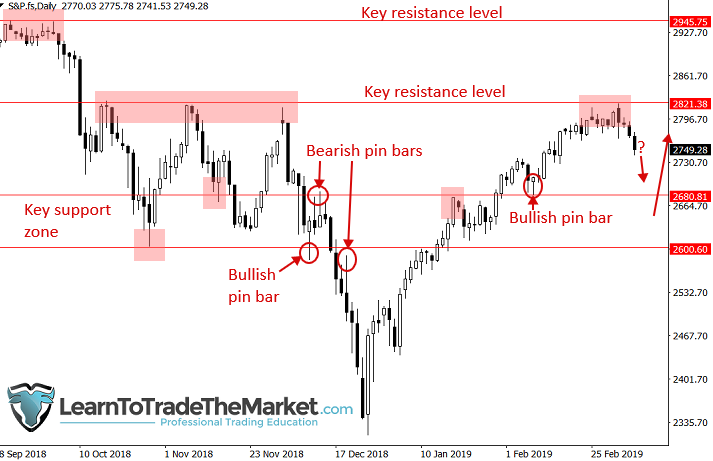

Take a look at the example chart below, look at all the things we can see just from analyzing a BARE indicator-free price chart:

- Periods of trending price action vs. Range-bound movement are very obvious

- Draw in the key horizontal chart levels

- Draw in any obvious price action signals

We can use the price action data described above to formulate an anticipatory trading plan, that effectively gives us a “window into the future” so that we can plan our next move. Which, as you can see in far right of the above chart, might involve waiting for a pullback to the support zone to look for a price action buy signal.

2. No News is Good News

One thing that I feel very strongly about and that is also a huge benefit of learning to read price action, is that by doing so you can ignore the news and all other unnecessary trading variables. You see, the price action reflects all the news as well as all other variables influencing it.

Less variables to analyze means you can avoid the “analysis paralysis” that hurts so many traders by causing them to try and take in too much and “make sense of it”. When trading with price action we really only need to worry about the 3 main components: Trend, Levels and Price Action Signals.

As I wrote in other lessons in which I discussed why I don’t trade the news, most of the time when trading news is released, the actual move from it has already happened. This has to do with the “buy the rumor sell the fact” effect that happens in the markets as traders and especially the bigger players anticipate what will happen when XYZ event is released or takes place. The point is, often, what would seem like the logical price direction as a result of a certain news event, is not the direction it moves in, but sometimes it is. So, to try and gain some “edge” by “predicting” a market move based on the news, is truly futile, especially when the price action already likely tipped you off to the next market move, before the news or ahead of it.

3. Price Action is The Language of Money

Price action gives us the best insight into the psychology of those trading the market. In fact, the price movement we see on a chart is really all just human psychology playing out via the markets. What one trader thinks is a good place to buy is what another thinks is a good place to sell, etc. and when more people think buying is the right move, price goes up, or down if more think selling is the right move. Despite whatever variables went into those decisions, the end result is the same: price movement reflected via price bars on a chart. So, cut out the “middle man”, so to speak” (the variables other than price action) and learn to read the “language” of money that is right there staring you in the face on the charts.

So, if price encompasses all beliefs and views of all market participants and any particular moment of time, then reading the price bars on the charts allows us to read what the market participants are saying or trying to say. Let’s look at an example:

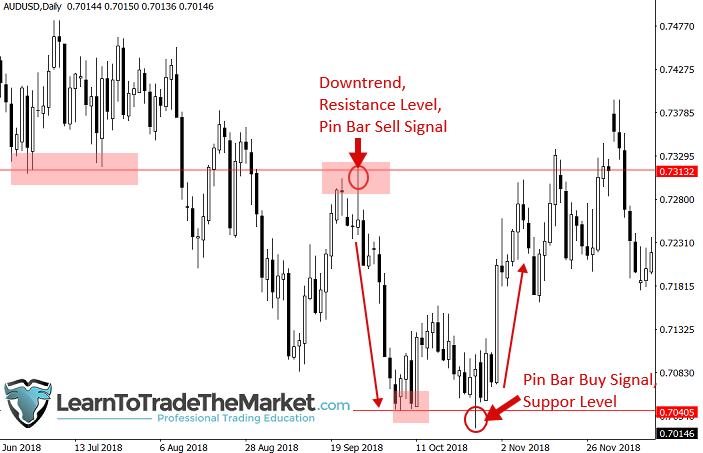

In the chart below, we can see with a bullish pin bar, bears initially pushed price lower but buyers saw that as an opportunity and bought into that down move more aggressively, resulting in a long lower tail or wick, and a bullish pin bar that indicates price may move higher soon. The bearish pin bar shows us the opposite; that sellers won out and price is now looking “heavier” or bearish…

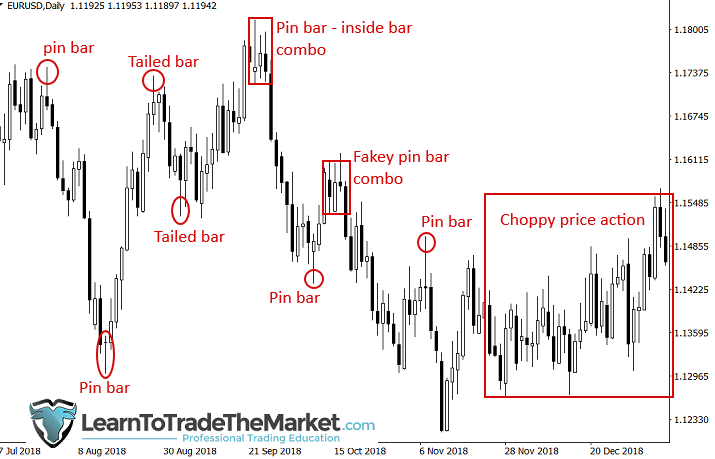

4. Price Action Lets Us Identify Clear Trading Signals and Repeating Patterns

If you know how to read the raw price action on the charts you also have a complete trading strategy that provides us with a defined set of entry and risk management rules whilst providing us with a high-probability edge.

For example, when you get a clear pin bar signal at a key chart level and ideally within a trend, you have the “Big 3” factors of confluence lined up for you: Trend, Level, Signal or T.L.S. This provides you with not just an entry but also a risk management strategy “built in”; you will base your stop loss placement at least partially on the signal bar as well as surrounding levels and your position size and profit target is set from that.

To get a better idea of how the T.L.S strategy works so easily and effectively, take a look at the chart below:

A simple set of parameters: Trend, Level, and Signal can provide us with some very high-probability repeating price action setups:

Through self-study of charts, it becomes apparent that price action signals and other price action patterns tend to repeat themselves over and over, across time. Once we learn to identify these signals in real-time and start to develop trader’s gut feel and intuition, and start trusting ourselves, these signals and patterns will begin to “pop out” at you more and more. It will be almost as if the market is “talking” directly to you…

5. A Minimalist Approach is Often Best

Minimalism is a way of life for some people, and it’s something I am very attracted to and try to model in my own life in many ways. Having less, means you have less to worry about, less problems, less to think about. Most people end up buying stuff they don’t need and that they end up realizing they don’t even want. The results are in: “Stuff” doesn’t make you happy. Time, freedom, spending time with loved ones, not having to worry about money constantly; these things make you happy.

What does this have to do with trading? Everything.

I wrote an article on a minimalist guide to trading which you should definitely read. The basic idea of it is that doing less; thinking less, analyzing less and TRADING LESS is what ends up as the catalyst for trading success. You truly need to minimize your interactions with the market, from how many trades you enter to how often you check on them once they’re live, to how many times you open your charts. Less is More and it’s the way you make money faster, trust me.

Conclusion

In my early days of learning how to trade, I honestly felt like I was lost, perhaps some of you feel the same way right now. There is just so much information out there and much of it I would call “misinformation”, that a beginning trader really has to be able to filter the “good from the bad” quite well to know what is worth spending their time on and what isn’t.

After studying just about every indicator and trading system under the sun, and realizing they didn’t work as advertised, I finally came back to plain and simple price action trading. I quickly realized that this is what made the most sense and that I didn’t need all that other “crap” on my charts, which was just obstructing the REAL view of the market; the price action.

I have been trading with price action for well over 15 years now and it has proven itself time and time again. It’s simple yet highly effective and it eliminates the need to look at other variables, because everything truly is reflected via the price movement, you just have to know how to read it.

The trading tutorials I have produced for my students since 2008 are the exact type of real world education resources I wish I had access to when I started my trading journey all those years ago. If you apply yourself and stick with the core philosophies of reading price action, bar by bar, and keeping your overall trading methodology simple, then your chances of making it in the world of professional trading are increased substantially.

This blog and the hundreds upon hundreds of trading lessons I have authored, as well as my Professional Price Action Trading Course are here to help you dramatically fast-track your knowledge and help you achieve trading success sooner.

Cheers to your future trading success, Nial.

Please Leave A Comment Below With Your Thoughts On This Lesson…

If You Have Any Questions, Please Contact Me Here.

Hey Nail, Thank you for this wonderful article, i also don’t like messy chart and unnecessary news, but when i see around myself a lots of indicators on chart and lots of news about stock market i use to think i am much behind, but thanks to you , your article gave me clearity . I love clean chart and i must keep learning in same direction.

it’s great Nail … I read your article very hard and now I feel like I’ve changed a lot, thank you very much, good health and happiness ..

Very helpful article. Thanks fuller. Please write a new post about it.some Itime I found daily market is up trend but h4 trend is down but why.i dont know it please explain this matter.

One of the best trading articles I have read so far, thanks alot nial its opened me up to alot, indicators have been confusing.

Very informative article. Thanks

THANK YOU SO MUCH SIR

Thank you very much for creating this website. I’ve learned so much from you.

Thanks Nial. You are a great teacher!

To be factual, this is IT. You nail it from the top to toe. Price Action has no rival. Since I have come across your articles, my trading level has changed speedily. This is really working sir.

Thanks so much.

Thank you Nial. You are always the best.

It’s very awesome thanks for the lessons. I don’t know why I find it hard to make my trading uncomplicated. My goal is to be a professional trader but i have not been right in my analysis. I think u are all I need to achieve my goals.

Great great great … thank you Maestro Nial & Co.

As a beginner, am getting hopeful and more

anxious to move on. Thanks Nial.

thanks Nial

I really appreciate your tutorial and knowledge and how you explain to us. I think its me talking to me.

Whenever i feel like i am getting overconfidence or something like that, i read your tutorial and it make me realize that i need to learn more and its easy through you.

Lots of thanks.

Hi Nial,

The article is a fantastic and loaded one

Thanks for the inspiration it gives

Really inspiring !! Thank you sir .

Thanks again Nial, it’s like you read my trading mind !

Always addressing the thing that will help me the most !

Thanks I have learnt the nutrient of TLS strategy may God bless you

What can i say? Every time i came here, i come across with an excelent knowledge from you, Nial.

Thanks again for all lessons you have been brought to us around the world.

it’s always a pleasure reading your articles and strategies .

Nice one,Nial..Truly reflects how Trading really is like.Have a good one

Definitely this is one of the best article I had read ever. After a very long period jumping from indicator to indicator, beating my head against wall, I finally realized that PA is the key. My problem now is just how to start… Thank you

Thank you very much for the secret of trading its really helpful

Thanks Niall for sincere advice, looking forward to becoming your student thanks once more am grateful.

Great article again. Price action is truly the way to Go.

Whatever it is that inspires you to continue to nourish our trading knowledge with core trading philosophies like these, we ask the universe through our collective gratitude and through its wisdom to continue to nourish it in you for many a year to come.

Hi Nial,

You are really a life saver

So deep and understandable

Thanks a lot

Excellent article, thanks Nial

hi Nial, Love to read your articles. Always encouraging and very informative.

Thank you very much Nial. You are always helping hand for me. 100% I will be successful in the near future, because of you.May God bless you and your whole family.

Nice one again from my Forex Mentor. If I didn’t grab anything from this Tutorial, I can always remember the TLS abbreviations. It works all the time and I thank you Niall for this piece once more.

This sound’s & look’s like the training I need as I have had to deal with a lot of clutter & in the process lost or blown account’s of my hard earned money.

I will need to save up and eventually pay for the course & hopefully graduate as a better trader…

Hello Nial Fuller. i will like to use this opportunity to express my gratitude to you and your team for the good work you are doing using this medium. i have been getting value from your wealth of your knowledge and experience.

Again thank you for your sacrificing your resources in other to improve trading skill across board.

I like price actions mentioned above, thank you very much.

Thanks Noel, as one who have lost so much money in the market using indicators, I believe this will help me to start making success. Once again, thank you!

Thanks Nial, very good article..very helpful and motivational.

Excellent article defining the holy grail of Forex trading. Keep it sweet simple is the theme. Less is more is the philosophy. I fully agree with Nial.

Saman

Hi Nail

It is always a pleasure to read your Price Action, I have learn a lot

Thanks Mr

Mavis

thank you sir for your valuable article……

Thank you for this valuable article,Be blessed.

but at the time of the fakey or pin bar .

trading the hard right edge.

we dont know for sure if its really is a fakey pin bar or not.

thats the tricky bit about trading.

thanks nial.