An Introduction To Trading Inside Bar Signals

Today’s lesson is an introduction to the inside bar signal and how to trade it. It’s really one of my favorite patterns to trade, especially on the daily chart time frame. Why, you ask?

It’s simple. The inside bar pattern shows a pause or indecision in the market, and depending on the surrounding price context it formed within, this provides us with an extremely valuable clue about what a market is about to do next.

The inside bar is yet another “tool” in your price action toolbox that will add to your trading strategy which when mastered will help improve your chances of long-term trading success.

Let’s get started with some introductory concepts and theory on inside bars…

What is An Inside Bar?

An inside bar pattern is a multi-bar pattern that consists of a “mother bar” which is the first bar in the pattern, followed by the inside bar. An inside bar pattern can sometimes have multiple inside bars within the same mother bar.

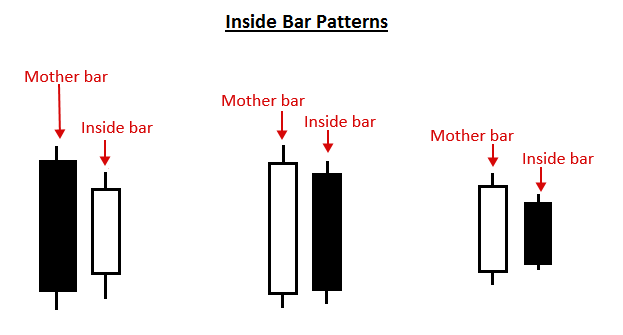

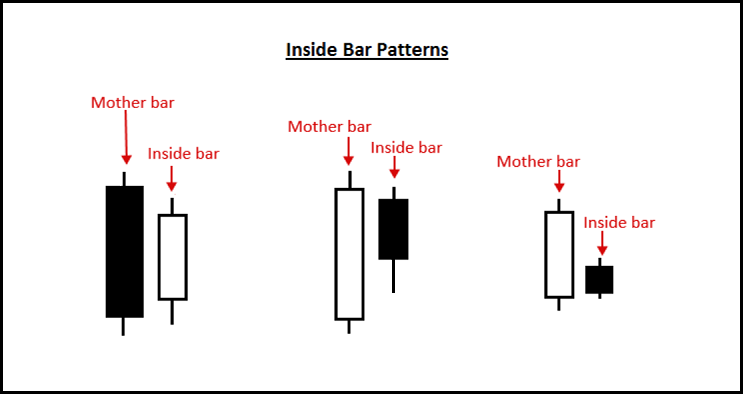

Here is what standard inside bars look like:

As you can see by the image below, inside bars can form exactly in the middle of the mother bar or close to either the high or low, there is not an EXACT way they have to look, just as long as they are contained within high to low distance of the mother bar

4 Variations of Standard Inside Bars

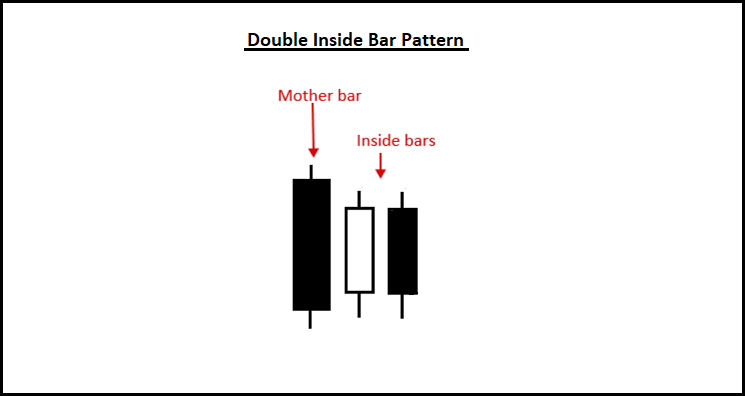

1. Double (multi) inside bar

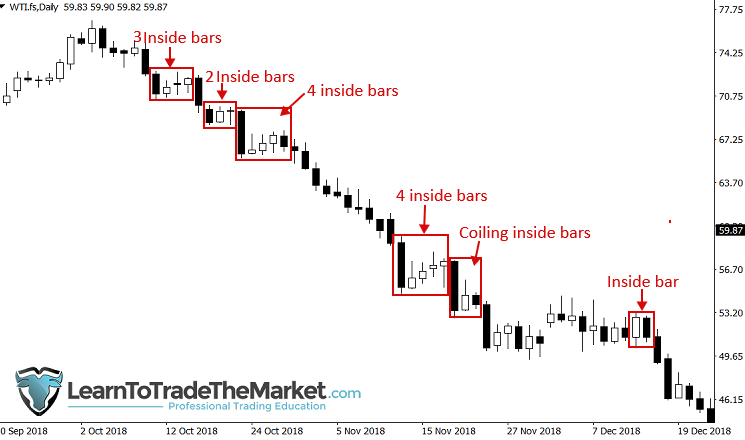

The “double inside bar” consists of two inside bars within the structure of the mother bar. They are pretty common and often times you will even see 3, 4 or sometimes (rarer) even more inside bars within the same mother bar structure. These patterns signify a prolonged period of indecision in the market and they can come before very powerful breakout moves…

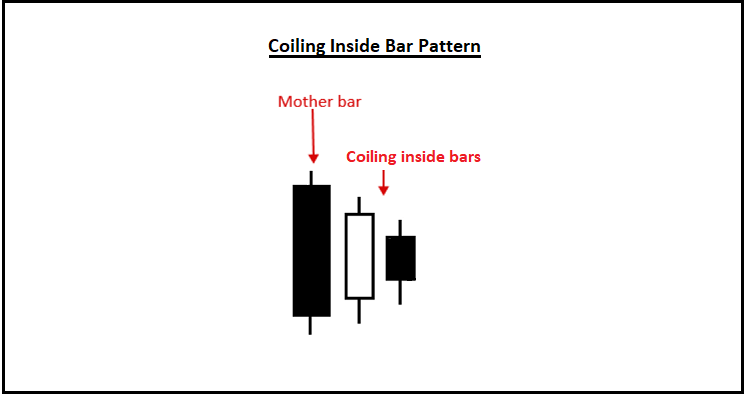

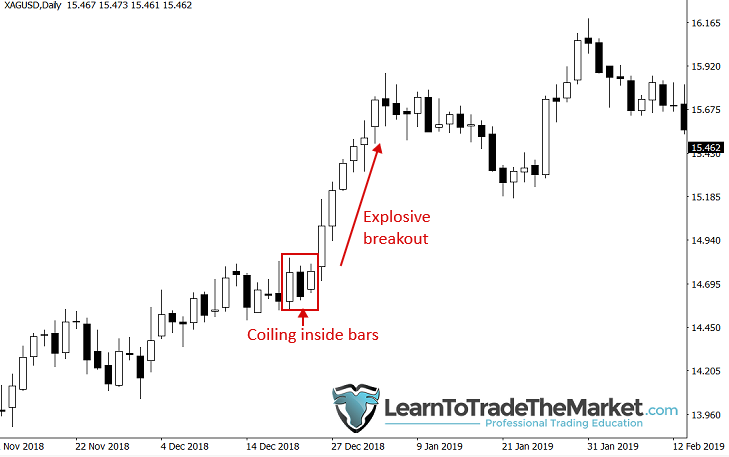

2. Coiling Inside Bars

Coiling inside bar patterns occur when 2 or more inside bars are “coiling” up tighter and tighter like a spring, within one another. Pay special attention when you see these because they mean the market is contracting and just like a spring wound up tighter and tighter, eventually it’s going to “release” and explode into a powerful move (in many cases).

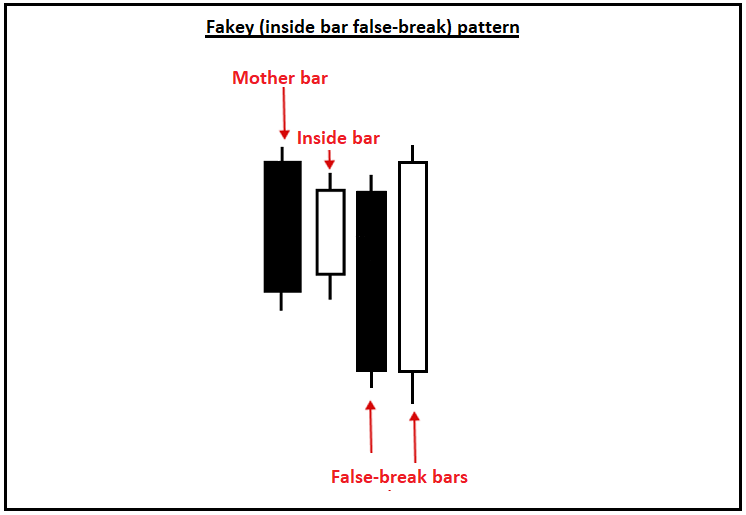

3. Fakey Pattern (inside bar false-break)

The fakey trading pattern is very important in regards to inside bars because there is an inside bar pattern within a fakey. As you can see below, a fakey is actually a false break out from an inside bar pattern. It’s literally where price initially breaks one way from an inside bar pattern, but then quickly reverses, sucking everyone out who was wrong and then charging back the other direction. Obviously, these are giving us VERY intelligent clues as to the next potential direction in price.

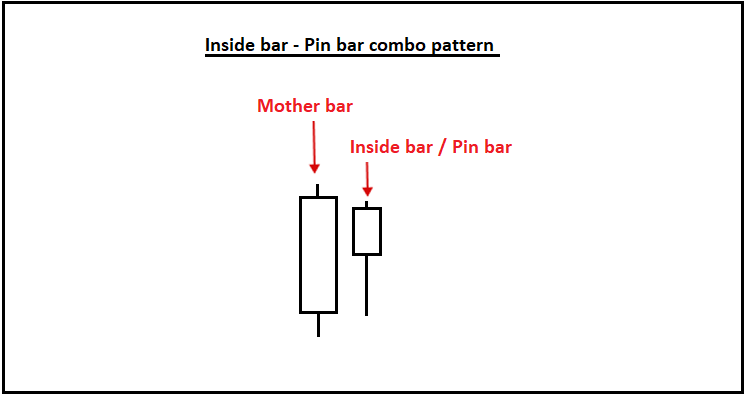

4. Inside Bar Pin Bar Combo Pattern

As we all know, pin bars are one of the best price patterns you can trade and when it’s when you get a pin bar that is also an inside bar, that you have an inside bar pin bar combo pattern.

When you combine a pin bar into an inside bar, you are getting both a “wind-up” that is going to be released and a pin bar with a tail / shadow that indicates the next potential direction of the market. Hence, an inside bar is not just a pause in the market, it’s a pause with an extra piece of confluence behind it, and as a result, a more powerful price action signal.

Trading Inside Bar Patterns

There are essentially two main ways we can look to trade inside bars, as with most other patterns; as a continuation signal or as a reversal pattern.

Now, I prefer to trade them as continuation signals in trending markets on the daily chart, because that’s the easiest way to trade them quite frankly. However, inside bars CAN indeed be very powerful at major support and resistance levels as reversals. Let’s look at some examples:

Trading Inside Bars as Continuation Moves

The “classic” way to trade an inside bar pattern, and the way that I love trading them the most, is within a trending market, as a continuation move.

An inside bar is much easier to take in a trending market because the odds are already in your favor for trading with the trend. The inside bar will many times lead to a breakout or continuation in-line with the existing trend direction. They can provide a good structure to try to pyramid your trade into a huge win.

Tip: Avoid trading inside bars at major levels until the level has cleared, because many times such inside bars will create a false break at the major level.

Trading Inside Bars as “Stall Patterns” / Reversals

Sometimes, you can trade an inside bar as a reversal / stall pattern where price “stalls” out at a level and that leads to a reversal back the other direction.

In the chart below, we can see an example of a good inside bar reversal signal. Notice that the inside bar formed at a key chart level, indicating the market was hesitating and “unsure” if it wanted to move any higher. We can see a strong downside move occurred as price broke down past the inside bar’s mother bar low..

Please note that trading inside bars as reversal patterns should ONLY be tried after you have successfully mastered trading them in-line with the daily chart trend as continuation / breakout plays, as we discussed above.

Special Inside Bar Trading Tips

Here are some of my tips and tricks when trading inside bars. These are things that I learned over the years that will improve your chances of success when trading this pattern:

- Tighter inside bar patterns and coiling inside bar patterns often lead to explosive large break out moves. This is because of the “stored energy” that took place as the market “coiled”, that energy typically gets released in the form of a strong breakout move…

- Patterns containing smaller inside bar patterns allow tighter stop losses and great risk reward, these are the ideal candidates.

- Be wary of patterns with both very large mother bars and large inside bars, these can often be difficult to trade due to lots of false signals and they make it more difficult to manage risk.

- My favorite 2 patterns are – Fakey signals and – Inside bar pin bar combos.

- We must learn to filter inside bars because the one bad thing about them is that a lot of them form across all time frames. However, with proper training and experience on the charts, you will learn to differentiate.

Conclusion

This was a basic introduction to the inside bar signal and how I trade it, I cover this pattern and much more in my advanced price action trading courses. Upon joining, some of what you will learn is:

- More inside bar variations and how to trade them.

- More example charts.

- Members trading discussion forum, including inside bar discussion

- Daily members on-going daily and weekly market commentary where we discuss potential inside bar trade setups as they form.

- Members trading videos and articles library that includes more in-depth inside bar trading training.

- Email coaching & Support line.

- On-going updates for free

I hope you found today’s lesson helpful and inspiring. Inside bars are truly one of the most interesting and powerful price action signals so I hope you enjoyed learning about them and that you’ll continue to do so.

Please Leave A Comment Below With Your Thoughts On This Lesson…

If You Have Any Questions, Please Contact Me Here.

In fact, your explanations on inside bars left my jaw sagged, dropped, bulged. This is a flash-light for me as well as oar to sail across ocean of intricacies on trading chart. With these tools I think I am satisfied. Thank you boss.

Thank you Neil for sharing your knowledge. well-done and Peace upon you.

Very very helpful for me. I have no words to express my ward regards to you Mr Nail and Co. I will try to do best use of it and let you know my outcomes in coming days. Thanks once again.

Thanks nial for this important strategy .it has given me the courage to trade as a price action trader since am a bigginer in forex who is searching for a method to trade with. Thanks

Thanks for delivering such great teaching.am surely learning sir!

Thank you for sharing this information, I appreciate and i wish to join your students one day.

excellent

Impactful

Thank you so much for sharing

Thank you for sharing best information about.

Thank you for sharing best information

I always find your lessons very helpful.

thanks a lot

thank you so much for the lesson i learned it for the first time i understood very much i love price action trading

because no one has ever taught me such things, it’s very detailed and specific

I know this site through a forum, I’m very impressed with what I read on here, thanks you

I like the fact that ur strategy is easy to master

Thank you Neil for sharing your knowledge. Peace upon you .

Nial,you are great.I will say you are the master of price action. Please help me to understand this price action very well. I love it and will eventually want to become a life member. Thanks

You have opened my eyes more and more about this pattern…. Thanks very much and God bless ????

Good knowledge, thanks

Thank you very much this article was great I think your articles are making trading price action signals easy

Your course so refreshing. Thanks

Great work, thanks ????

Is there a outside bar partern ?

These inside bars really do help in the markets. When they work out the risk to reward is brilliant. One of my favourite candlesticks patterns. Of course, we must use confluence and support and resistance to our advantage. I also trade them mainly with the trend.

Thanks Nial. Is the mother bar inside bar pattern the same as the harami?

Yes, similar.

I really love your inside bar trading..it makes easy to understand the market..thank you

Hi Nial,

In this lesson you stated “We must learn to filter inside bars because the one bad thing about them is that a lot of them form across all time frames. However, with proper training and experience on the charts, you will learn to differentiate.” Can you please explain the filtering and what you mean by these forming across different time frames? Or, maybe just point me in the right direction to read up on this information.

Many thanks Nial, I really appreciate your sharing of your knowledge and insights with us.

Wayne

Hi Nial,

You’re a great mentor whom I love and respect very much. After I have managed enough money/fund, I’ll certainly do your courses and become life time member .Wishing all the good .

Ferdous

Nial. Can this be applied to heiken_Ashi ?

Excellent introductory lesson. Expecting more.

Excellent! Thank you. I have noticed alot of similar mkt reactions with Spinning Tops, Dojis in a trend….with the next candle showing a good probability of follow through. Perhaps there are similar emotional behaviors present.

NIAL !!! Thanks for high lighting one of the useful strategy in such an honest and simple way.

Kindest Regards, AMIN MALIK

Thank you so much for sharing your great ideas for us to benefit from.

Thanks Nial what a lovely article

Hi Nial and thank you for sharing this amazing stuff and knowledge. Just a question here: Could we use an indicator to identify inside bar or just rely on our eyes ?

To identify the inside bars you could, but not to trade them, as filtering must be applied.

Hi Nial

Another great one Mate! Keep them coming!

Swell!

Geoff

Very helpful boss, this is nice .

Sir, I have read out your article. It’s amazing !! I will try to apply in my trades . Thank you sir.

Hi Nial,

I’ve been following for years, and have to agree with Koos De Klerk, the most important part especially when trading daily timeframe is the patience. waiting for the signal to turn out day by day.

You’re talking about inside bar, which is great. I would like to know what’s your view on Outside Bar/Engulfing. I’ve spotted this pattern in the daily trading from time to time. and would like to know your opinion on this pattern.

Appreciate your response.

Regards,

norraine

I don’t trade outside bar engulfing.

Dear Noorain

Outside bar/engulfing can be used when it is combined with Fakey.

Mother bar then inside bar then out side bar. It’s a strong Fakey.

Thanks

B/R

Jaman

Thank you Nial for the intro to another piece of “ammo” which I will study and add to my price action trading knapsack.

Excellent expose. Very good , clear and useful . Thanks

Nial, this is very useful. In fact this played out today in the EurJpy pair. If i had known what you thought now, i wouldn’t have missed the move.

Thanks so much for sharing.

Thanks for more enlightening on this subject. It’s very clear.

thanks nail , really great article.

Thanks Coach. Very informative

Very useful information, thank you so much for sharing such information.

Hello Nial Fuller , I read a lot of useful paper on your website. Tkank you a lot about that. I wanna to learn more about the way to read Volume Indicator and the combination of Volume with Price Action. Hope you read about that soon.tks

very informative lesson

very helpful article. pleas Nial help us to use inside bar on entry strategy, how to put a stop-loss on inside bar, can we trade inside bar at all higher time frame (4h, a day, a week) ? or which time frame to consider? fakey setup is formed from the inside bar so how we can sure that this inside bar can not form fakey setup?

What a great info for this strategy… Thanks for this great article for us newby in currency world.

Much more here in Philippines.. not a lot of people knows how this market move.

Again thank you so much NF

Great topic as always Nial and team. Thank you very much.

Great lesson Nial, thanks for the way yu have been naturing me thru your blogs.

Thank you for this good lesson.

Dear Sir,

Really very informative and helpful topic. Main admirable thing is in your forex topics is, that you always try to explain the context in very simple and easy ways. Low educated person also can understand easily.

Thanks Nial Fuller!

Hi Nial

Since I came upon your “Price Action” trading system I came to the conclusion that it is what I was looking for. I hate a cluttered screen as it is very confusing. With a clean screen you can “see” where the currency pair is heading. Once you have your favourite “bars” that you follow, patience just need to kick in (difficult at times).

I find that the 4h time frame sort of “speak to me”. Now I just need to find another time frame to zoom into for the entry & exits, (1h as an example)

I am still in the demo trading mode. I think it is my personality that need a precise confirmation to enter a trade. (Star sign – Virgo) :-)

Have a great day Nial

Mr Nial

It is working I have seen it, and I`m using it since then I seen a different in my trading

Thanks Nial

Thank you Nial for the most useful info. Do you have any articles one can read on indices at all please? Thanks. Lungile.