TIME: The Single Most Overlooked Component Of Trading

Time: The single most overlooked component of trading. Yet, it is time that is arguably the most important factor in determining whether a trade ends up a win or a loss. A trade that you close out after two hours for a loss may have ended up a huge winner if you held it for two weeks. As humans, WE are certainly the weakest link when it comes to trading, because most of us have very little patience, self-discipline and self-control, especially when it comes to holding our trades.

Time: The single most overlooked component of trading. Yet, it is time that is arguably the most important factor in determining whether a trade ends up a win or a loss. A trade that you close out after two hours for a loss may have ended up a huge winner if you held it for two weeks. As humans, WE are certainly the weakest link when it comes to trading, because most of us have very little patience, self-discipline and self-control, especially when it comes to holding our trades.

Nearly all of the best trades I’ve personally taken or that I’ve seen our members take, took a lot longer to play out than any of us originally expected or perhaps wanted. However, the fact of the matter is that what we want and expect to happen is typically not what the market has in store.

The bedrock of trading success consists of holding trades for longer than you want in most cases; letting them play out without your interference and just accepting that the market and price take TIME to do their thing. Look at a chart in hindsight and you will see this for yourself. Go ahead and actually look, count the days, weeks or months that some of the most obvious trade signals took to play out.

The entire logic of holding trades longer than you think you should stems from my belief that traders should use the daily chart time frames and wider stop losses to avoid being stopped out prematurely from short-term market noise. Today’s lesson will show you why you need to start holding your trades longer if you want to obtain long-term trading success…

How to Massively Improve Your Trading Results This Year

The New Year is upon us and as one of your New Year’s trading resolutions, I’m sure you want to improve your trading results. While you might be thinking that is easier said than done, here is the single most important thing you can do to improve your trading this year: Hold your trades for longer and meddle / look at them less.

In this lesson, we are going to look at several daily chart trade setups to show how thinking about time and not just price, can vastly improve your trading results. You must start viewing time just as important as you view the price of the trade you are in. For example, just because your trade is currently negative (but hasn’t hit your stop loss) does not mean it will end up as a loss, because of TIME. Time is your friend in the market, yet most traders make it into an enemy.

When trading the daily chart time frame, I would say the average period you should expect to hold a trade is about 1-3 weeks. I am willing to bet most of you reading this rarely hold your trades that long. Now, that is not meant to be offensive, it is meant to be an eye-opener and a helpful piece of wisdom. Let’s take a look at a few examples on the charts…

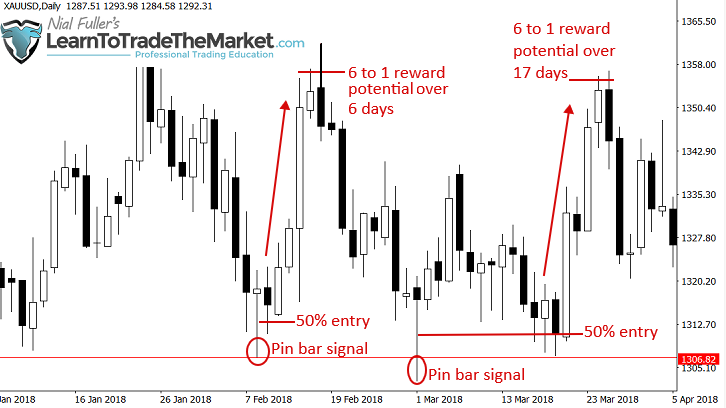

In the daily Gold chart below, we can see a couple of very nice pin bar signals that formed at a key support level. You will notice that the first pin bar saw price move higher fairly fast, but even that one took about 6 full days to play out if you wanted to make a substantial profit. The next pin bar a couple weeks later, took even longer to play out; notice this one took about 17 days to really net you a nice profit. Would you have been able to wait that long for the 50% tweak entry and then for price to move higher? It all boils down to having a plan and sticking to it.

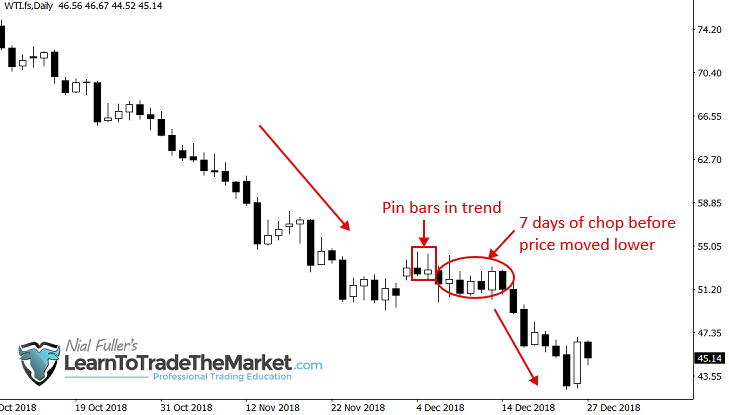

Let us take a look at another chart now. This time it’s WTI – Crude Oil on the daily chart time frame of course. This trade setup formed within a very strong downtrend. We got two bearish pin bars that, whilst small in size, had the weight of a huge trend behind them, so the signals were fine to take. However, you will notice after entering short the market decided to consolidate and move sideways for a full 7 days before finally falling lower again and netting you a profit. It’s sad to say but most traders would have gotten all chopped up and confused in that 7 days, turning would should have been a big winner likely into multiple losing trades.

Use Wider Stop Losses and Stop Meddling with Your Trades

You have a tool on your side to assist you in giving trades the time that they require to turn into big winners. That tool is stop loss placement and more specifically, considering the use of wider stop losses than what you may be used to. Giving a trade even another 50 pips or so can significantly improve the chances of that trade flipping from a loser to a winner. The reason is that many trades are taken (or should be taken) at levels of support or resistance, perhaps after a pullback within the trend, however, we cannot predict exactly how far a market will retrace. So, giving that trade some more “padding” or room near that pullback area can many times avoid a stop out.

When you do increase stop loss distance you naturally increase the time you will need to hold that trade as you are placing the stop outside of the daily and weekly average ranges of price movement (or at least this is the goal). For example, the EURUSD moves, on average, 150 – 200 pips a week so if your target is 400 or 600 pips wide, you have to WAIT and there is no way around this.

However, remember, wider stops will KEEP US IN THE GAME LONGER AND IMPROVE OUR CHANCES OF SUCCESS OVER A SERIES OF TRADES. And that is the goal, is it not?

Here’s an example: The daily Crude Oil chart below shows us two very nice back-to-back daily bullish pin bars that formed. Price then creeped sideways for a few days before just barely violating the low of those pins and then sling-shotting higher. What a cruel fact it is that most traders who entered long off these pins got stopped out for a loss at the low of the bars right before price surged higher. The solution? Increase your stop distance and that loss becomes a win. Don’t be greedy by choosing the tighter stop just so you can increase your position size. Remember, bulls and bears make money but pigs get SLAUGHTERED by the market. Are you a bull, bear or pig?

Here’s another prime example of how wider stops as well as having the patience to give a trade time to play out can yield a monster profit…

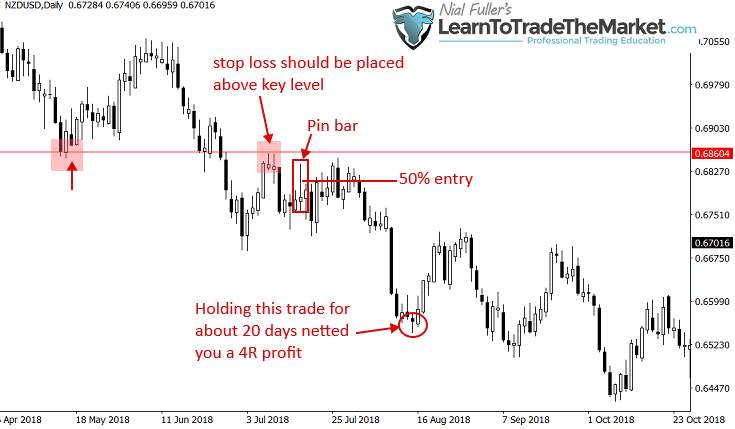

We are looking at the daily NZDUSD chart this time and we can see a very clear and obvious bearish pin bar sell signal formed near a resistance level. Now, what’s most important here is the key resistance level just overhead. You need to place your stop loss just beyond that level, NOT the pin bar high. It literally is the difference between a loss and win. Notice if you entered the trade on a 50% tweak entry price creeped a little higher after that and just violated the pin high (but stayed under the resistance level) before selling off. Notice you had to wait for 20 days to make a nice profit, but if you just set and forget this trade you are literally doing NOTHING while making money! Don’t make it harder than it needs to be!

Patience and Discipline – Do You Have Them?

Of course, the “glue” that makes all of this “waiting” and “doing nothing” possible is patience and discipline, two things that many people struggle with in our age of “I want it now” mentality. It is only when a trader chooses to stick to his plan and stay the course in the face of temptation, that a well-executed trade can yield monster returns.

In my experience, even the best most obvious trades that come off in your direction right away, still take about a week, sometimes more, to really turn into big wins. Case in point, this setup from the AUDUSD daily chart earlier this year. The trend was overall down and price had swung back up to a key resistance area and formed a very obvious bearish pin bar sell signal. Price moved lower the very next day but many traders probably settled for a small profit after just that one day instead of holding it for 6 days and waiting for price to hit that next support area, netting a much larger profit…

Conclusion

What I want you to take away from this lesson is that you need to start thinking about TIME as a critical component to trading success, not just as an afterthought. Every time you enter a trade you need to be prepared to give it the space and time it needs to potentially turn into a winner, or else you will be enduring many unnecessary losses.

Don’t be in a rush to make money because this is simply greed and as you know, greedy people end up losing in the market. You need to not get too attached to your trades and trading, and the main way you do this is by controlling your risk and not over-leveraging your trading account, but also, by not being in a rush and over-trading.

The traders who make money and end up in the infamous “10% of traders who are successful” are the ones who are brave enough to hold trades and who have the patience to not get shaken out by every little fluctuation in the market. You don’t want to be reactionary like an animal in the wild, you want to be skilled and patient, like an intelligent human being who is using their frontal lobe to control their impulses.

If you want to learn more about how I trade with simple price action patterns like the ones in today’s lesson as well as how I manage my emotions and money in the market, check out my freshly updated price action trading course for more in-depth education and training.

Please Leave A Comment Below With Your Thoughts On This Lesson…

If You Have Any Questions, Please Contact Me Here.

thanks for sharing great knowledge of forex trading strategies in business.

Brilliant explanation Nial

You open up my eyes I have lost severely because of overlooking time.

Hello Nail this is one of the best article in your articles but you have to group your articles in groups I believe this needs to an article for newbies who think that you must open a position and close it on that day so my to all traders who believe trading is marathon not a sprint from your article this is the best way to which is not a skill found in new comers .It is a psychological muscle needed once again thank you Nail Fuller.

Ooooh yes…..this is great stuff we all need to understand. I can not thank yu enough Nial. Ever since i stumbled upon yuor teaching my trading has change….and largely my thinking of the market dynamics. Keep em coming,we real need em. Love from TANZANIA,WELCOME.

Thank you so much Nial for the article. Been learning a lot. If am holding trades for long, what about my account balance.

If your trade direction was right your account balance will increase. Remember the wise saying: If the man is right his world will be right.

Thanks Nial

Kind Regards

Colin

Thanks very much Nial for your expert advice. I have recently made the very mistakes you have mentioned in this article that is settled for a loss when I should have held on longer for the win.What I am struggling with is the question of how wide the stops should actually be, of course as you have mentioned factors which dictate are the amount of capital and lot sizes but is there a magical pip number to use as a benchmark for the stop placement? Thank you

Thanks for the lesson Nial .. ! It’s so easy to start doing stupid things when you ‘urgently’ wanting to make money. But your lessons always remind me to stay grounded and focused on my trading edge. Thank-you!

thanks a lot

I mostly agree, but I have one thing to mention (I do not know the correct English phrase, but it is a proverb in Germany): rockets that do not rise explode on earth. I mean: when a trade needs to much time to play out, you better check the fundamentals, currency strength, seasonals and so on, and if the odds are no longer on your side, it is maybe better to close instead of waiting for the explosion when hitting stoploss.

The closest real world example of this would be an ‘opposing price action signal’ suggesting the rocket is not going to take off :)

I haven’t heard this rocket proverb before but it is consistent with my own observation that small losses tend to become big losses (stop-loss is hit) and little profits tend to become big profits (target is hit). I trade mostly the 1 hour chart so the dynamics may be slightly different but there is no doubt that in general, setting and forgetting is the way to go – as long as the original entry was correct.

Thanks Thilo and many thanks Nial for sharing your experience and these invaluable principles.

thank you for this to understand the market better and its behaver frome sweden Spelling maby wrong ai alredy have live account now for two weeks and still not in Money but now ai am not so afraid any more let the market do wath it do cind regards frome a newbie frome sweden

The star never shone this bright, always on point. You the great!!!

Thanks sir since I started to read your post I have totally changed my mind

Quite a while I have taken time to read from you Nial. Simple as always. Yet profound. Thanks so much. God bless you.

Thanks Nial once again.great and valuable education right there.Getting better at it everyday.

Thanks Nial this is a nice lesson good advice to stick to..

Thank you for the insight. I learnt l was afraid to hold a trade for long

This post just put my mind at peace. I thought I am crazy for setting my stop losses to not less than 200 pips. Thanks Nial. Your lessons always prove to be invaluable.

I’m currently on a trade for about 8 days now and was about to give it up thanks to your article I’ll hold on

Thanks

Spot on again Nial.I don’t trade hourly,daily,weekly and monthly.Trust me I trade 5 min,15m,30min,1h and 4h but I know it benefit me to hold my trades overnight as long I don’t trade against the trend.

Thanks NIAL.I was much scared when I started trading but after reading your insightful articles I now feel confident and good to go again.i have heard much noise about forex trading and confused me but your simply perfectly expressed ideas and thoughts have reignited me.Looking forward to registering as a member before new year.You are changing many lifes by your generosity.Be blessed and a happy new year.

Very true

Besides the time I think a critical factor of holding or giving up a trade is the trade size. One needs to always trade conservatively…with small lot sizes

Hi Nial

As the Stones sang ‘time is on my siide’

Thanks

Cletus

Hello Nail,

This is is a very powerful lesson. It took time for me to understand the concepts of your lessons, I will give my trades TIME to play out. THANK YOU!!

I see SR here great way to use it.I compared it to what I trade.I know NFuller is a great SRTrader.

Thanks champ and your team.

Enjoy your festive season with your family.

Kind Regards

Thanks champ and your team.

Enjoy your festive season with your family.

Kind Regards

Thanks discussing for the important factor – Time. You carefully showed examples of how important it is to be patient and use ‘time’ for the market to play out and maximise our profit potential. Thank you again for sharing this most valid aspect to be successful.

Nice article. Highly insightful.

Time is the single most important factor in Trading and Investing.

Thanks Mr. Nial! For your lessons! Your articles are very strong! They to me helped to change thinking to the best. Thank you!

Thank you ????

Thanks Nial i appreciate the article it means a lot and and I’ll apply this lesson.

This is a monster lesson !! Thanks Nial ! This is what i need!!!

A very instructive and scintillating lesson for 2019. May your elbow be full of more Grace

This will be one of the most important lessons tha you have given to novicetraders.The lesson gives clear time periods showing practical situations.

Thanks Nial, I have heard many traders say “ cut your losses “ so if a trade is going against us how do we know when to close the trades, is is not better to take a smaller loss than a big one. And I notice you say that set your stop 50 pips above an entry point ! , what if the risk is greater than 1% which is my general limit on all trades, I presume one has to do smaller lots , but that cuts ones reward ??

Would like to hear your thoughts on this please

Happy new year ????

Peter Miller

Thank you so much for this article!

It confirms what I have been thinking and sometimes practising. Am excited to be on the right track.

How much wisdom in a man. big Nial, how much I have learned from your publications, from your course, you are a teacher.

Thanks Nial.

This is a struggle that I battle with regularly in my trading but with this insightful instruction I will prayerfully follow through come 2019 by God’s grace. Thank you Nial for your help as usual. God bless you.

What a great lesson Nial.I have traded with your system now for about two years i am making a small profit i am sure this lesson will make my trading much more successful.Thank you Nial you are truly a great coach.

You mentioned: “When trading the daily chart time frame, I would say the average period you should expect to hold a trade is about 1-3 weeks.”

The normal duration of a cycle from top to bottom for different time frames are:

– Daily: 1 month

– 4 hour: 1 week

– 1 hour: 1 to 2 days

So you are almost right saying to hold a trade for 1-3 weeks on a daily time frame. However if you are trading a different time frame the timing should be adjusted to that time frame as shown above.

Please comment on that.

Regards

You mentioned “A trade that you close out after two hours for a loss may shave ended up a huge winner if you held it for two weeks. However in 2 weeks the swings could be very large, with lange negative positions and this concept would only be valid if you had a large account.

With smaller accounts the substantial negative positions might lead to margin call.

I would like to hear your comments on that.

Awesome Nial,

LIVE THE DREAM.

Take Care

time always tell the truth …………..

I remember about 3 and a half years ago or so you suggested I use the daily chart for trading. I understood why you said that but I just couldn’t get my head around all the potential lower time frame trades I could have been missing.

Now fast forward past all the additional study, and loss of accounts trading live funds rather than in a dummy platform, and I’ve finally got to the point where my trading is dictated by the daily chart and I can confidently enter using a lower time frame and then Hold The Trade for the remainder of the week or several weeks without concern.

So in short your early advice was golden and every post of yours I read makes so much pounds and pence ????????

Thanks again

Thanks a lot Nial for your helpful insight

Morning Nial from the UK.

The 5% entry is new for me since I subscribed to your training which was a long time ago.

I so agree about leaving trades in longer really does work and stop losses positioned out of danger is for me obvious.

I have not traded for the past 12 months for personal reasons. But come the new year 2019 I’ll rekindle the fire and start again.

I prefer 240 and daily charts and try very hard to get the timing right, give or take a few pips. Watching the 240 charts for entry on the daily has worked well for me.

I have had some success in the past, making several 70K and the highest 250k, but lost the big one due to panic and the broker showing me my P&L which I hide. Still lessons kick, and now will start again.

Will first look at Monthly for direction and go from there.

All the best for 2019

I was in the WTI Short and I have entered the trade exactly at the beginning of the 7 days ranging period. I’ve to admit that it is hard to hold on a trade Like this especially if the Broker are charging a overnight fee. But I’ve read one of ur article saying that a trade will take more time than u expected to play out. So, I’m keep on holding the until now.

Hey Nial you are crazy psychologist of trading world! :) Except of technical side you always touch mental sphere. Am grateful for it

You should not forget to include swap fees in your calculation. Depending on the broker, these fees could eat up your wins over the time…

Nial this is abosulutely true, I have on a few occasions jumped out of trades and after wards I thought I shouldn’t. This is my new resolution to hold trades much longer until they play out, this a great lesson for patience even in daily life !!!

Thanks Nial

hi Nail, you are a great teacher. thanks a lot.

Thank you Nail,for lesson I like the way you said don’t rush and greedy,I want to learn more.

Excellently put..may be il resolve to hold my trades long now and try and not meddle with them anymore…

Thanks for the eye opener.

This is awesome, you really hit the main points, thanks for a timely reminder.

Ha! I was just reflecting on this subject in my trading journal last week for the year ahead. Thanks for the reinforcement happy new year

Thanks for your infotmative lessons. I always learn a lot to improve my trading skills. Wish you happy new year.

Regards

Chabana

Hello Nial,

In fact am very grateful for your lessons.how would I be able to know when to enter a trade?how to identify the pin par.thank you Nial.

Hello Nial,

In fact am very grateful for your lessons,am learng.thank you.

Time is our friend, I am sure about it. Impulsiveness is not, and usually we are very impulsive when considering money.

Just this question: if you trade daily charts and a trade takes for example 2 weeks to reach your target profit, how much money is paid on trading costs (rollover)? I know it depends on the pair you trade, but could you give us an example of a real trade that last few weeks and how much you paid to your broker.

Thanks a lot. Great article.

Thanks Nial :)

Thank you Nial,

Always “on cue” with your informative lessons and wisdom.

I am looking forward to commencing trading again next year.

Best regards,

William

Thank you Nial.I am improving my trading skill every day, because of you. May God bless you and your family.