How to Trade Long Tailed Pin Bar Signals on Daily Charts

I often get asked if I have a favorite price action chart pattern to trade, and the answer is yes, yes, I do. Today’s lesson is about that chart pattern, it’s what I call my ‘deserted island strategy’ because if I were stranded on a deserted island and could only pick one trading strategy or signal, it would be the one I am going to share with you today…

I often get asked if I have a favorite price action chart pattern to trade, and the answer is yes, yes, I do. Today’s lesson is about that chart pattern, it’s what I call my ‘deserted island strategy’ because if I were stranded on a deserted island and could only pick one trading strategy or signal, it would be the one I am going to share with you today…

Pin bars, in general, are my favorite overall price patterns to trade, mainly because they are simple, powerful and consistent. The pin bar has stood the test of time; go back and look at charts from 50 years ago, you will see pin bars worked then and they work now.

However, not all pin bars are created equal, perhaps you may think this is unfortunate, but if you learn to identify and trade them properly you will quickly change your mind. One type of pin bar in particular, the ‘long-tailed pin bar’, is probably the most important signal I have witnessed in my 15 + years of trading. Long-tailed pin bars are like the so called ‘black swan’; rare and beautiful and when you see one you stop and stare in awe, primarily because you know how important they are and how much money you can make from them, and if you don’t know, you will know after reading the rest of this lesson…

How does a long-tailed pin bar compare to a ‘normal’ pin bar…?

Pin bars come in all different sizes, but they can basically be categorized into two camps: ‘Normal’ pin bars and ‘Long-Tailed’ pin bars. However, if you do not know anything about pin bars, I suggest you stop for a minute and go over my pin bar trading tutorial to get familiar with them before continuing.

So, what does a long-tailed pin bar look like?

Here is an example:

In contrast, here is a chart showing what I would consider ‘normal’ sized pin bars…

Here are the most important characteristics and things to know about long-tailed pin bars:

- They have a tail or shadow that is OBVIOUSLY much longer than the nearby or surrounding price action.

- They tend to be very high probability signals.

- They occur much less frequently than other pin bars, but they often lead to major market moves.

- They can be difficult to enter due to wide stop loss requirement (will discuss this later) and you sometimes need to wait for a second chance entry to enter them.

- Long-tailed pin bars can set the theme for a major reversal in trend or a major continuation of trend (see examples to follow).

- They offer high-reward to risk, especially if the entry can be fine-tuned (more on this later).

One of the most important things to understand about long-tailed pin bars, is they are not JUST a signal you trade one time. Often, they are so powerful that they can re-shape the market’s ‘landscape’ for months or even years to come. After a long-tailed pin has formed and the market reacts in-line with the pin bar, we can then begin to ‘map the market’ based off that pin. I teach traders to read the market like a book, from left to right, to understand the ‘story’ the market is trying to tell you. When a long-tailed pin bar forms, it’s a very important part of the ‘story’ that will have implications for ‘chapters’ to come. For example, the market may come back and re-test the area where the pin bar formed, in which case, we would trade according to my event area theory.

You see, long-tailed pin bars are not just trade signals, they are that and a lot more. They help us understand the dynamics of a market and the psychology of the people trading it. A long-tailed pin bar typically shows a final exhaustion point in a market, or in the case of a trend continuation move, it’s a strong confirmation signal that a trend will continue. The long-tail on the pin bar shows that market participants became overwhelmingly bearish or bullish at that point, and that is a very important piece of information for a trader, as I’m sure you agree.

Where and how do you trade long-tailed pin bars?

Long-tailed pin bars with confluence

The best way to trade a long-tailed pin bar is the same as any other signal that I teach; with as much confluence as possible. When I talk about trading with confluence, I am talking about looking for trade signals that have come together with one or more pieces of evidence behind them. The main ones are T.L.S or trend, level, signal. So, ideally you want at least two of the three; trend and signal, or level and signal or even just trend and level (as in a blind entry). Note – there are more factors of confluence we can look for and I get into them more in-depth in my advanced trading course.

The chart example below shows us a good long-tailed pin bar with confluence of all three parts of T.L.S.

Counter-trend long-tailed pins with confluence

Often, because of the factors that lead to their formation, long-tailed pin bars will form counter to an existing trend or after a strong move up or down. With these pins, we want to look for protrusion through key levels, ideally within an obvious range. Or, we like to see the tail of the pin bar protruding through a level and making false-break of it. These things act as confluence for counter-trend long-tailed pin bars.

We may see a major reversal take place following a sustained move, this major reversal is often in the form of a long-tailed pin bar like in the example below. Think of it as the market ‘putting on the breaks’ after moving too far, too fast.

Long-tailed pin bars with trend and confluence

Long-tailed pin bars are very good trend-continuation signals as well. We can look for them after a pull back within a trend, as well as at or near key swing points.

Look for signal as continuation, but be warned seeing a large pin at the top or bottom of a trend move can actually be a warning sign of imminent collapse and reverse, so be careful on these.

Long-tailed pin bars as breakout plays

A market that has been in a trading range for a sustained period will eventually breakout in an aggressive manner, typically. When we get a long-tailed pin bar after a market has been range-bound for a long period, it is often a sign that such an aggressive breakout is about to happen…

Long-tailed pin bars can create event areas

You may have read my article on how to trade event areas and if you have you will probably remember that I mentioned long-tailed pin bars are one of the primary ways event areas are formed. Therefore, when a long-tailed pin bar forms, we want to make sure we watch that area closely as the market pulls back to it, even weeks or months later, because that long-tailed pin bar area is a powerful event area to look for second chance entries at…

How to enter long-tailed pin bars

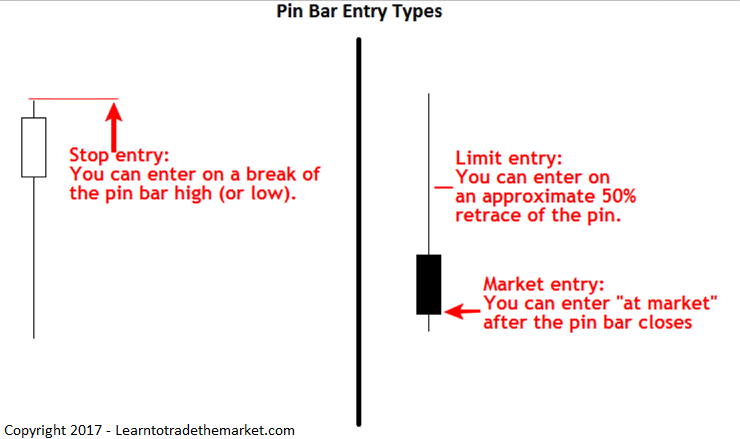

There is essentially three different ways you can enter a long-tailed pin bar signal:

- “At market entry” – This means you place a “market” order which gets filled immediately after you place it, at the best “market price”. A bullish pin would get a “buy market” order and a bearish pin a “sell market” order.

- “On stop entry” – This means you place a stop entry at the level you want to enter the market. The market needs to move up into your buy stop or down into your sell stop to trigger it. It’s important to note that a sell stop order must be under the current market price, including the spread, and a buy stop order must be above the current market price, including the spread. If you need more help on these “jargon” words checkout my free forex trading course for more. On a bullish pin bar formation, we will typically buy on a break of the high of the pin bar and on a bearish pin bar formation, we will typically sell on a break of the low of the pin bar. To read about pin bar stop loss placement, checkout my advanced price action trading course.

- “Limit entry” – This entry must be placed above the current market price for a sell and below the current market price for a buy. The basic idea is that some pin bars will retrace to around 50% of the tail, so we can look to enter there with a limit order. This provides a tight stop loss with our stop loss just above or below the pin bar high or low and a large potential risk reward on the trade as a result. This entry is great for long-tailed pin bars that retrace because it greatly improves your risk reward, I have a whole article dedicated to this entry technique and I call it the trade entry trick.

Tips on trading long-tailed pin bars

- You shouldn’t have to think too hard about a long-tailed pin bar. If you see one, recognize the opportunity and plan out how you will enter it. Don’t over-think it! A long-tailed pin bar is one that you don’t want to miss!

- Keep an eye on key chart levels as that is where long-tailed pins will often form.

- Long-tailed pin bars with tails that are clearly protruding out from the surrounding bars / price action, are usually the best ones. When you see a tail sticking out into ‘nothing’, it’s time to act.

- Watch for long-tailed pin bars that create false breaks of key levels, these are especially powerful and can often lead to trend changes.

- Be careful with large pin bars that form near the top of a move in an uptrend or the bottom of a move in a downtrend (so bullish pin near top of up-move in uptrend, for example) as these can actually be signals that the market direction may move the opposite way from what the pin bar implies.

- If the market doesn’t respect the long-tailed pin bar and it violates the high or low of the pin’s tail, that is a signal to take note of. I have a member’s article on what failed pin bars mean, check it out.

- Confluence is King with any trade signal, long-tailed pins included. When you see a signal coming together with a level and a trend, it’s time to set up a trade and make some money!

Whilst having knowledge of high-probability trade setups like long-tailed pins is very important, it is only one part of becoming a successful trader. The man or woman doing the analysis and pulling the trigger is JUST as important as the strategy or trading plan they are using.

As traders, we need to develop our subconscious gut trading feel on an ongoing basis, learn from the charts and keep notes and simply keep in touch with the day-to-day developments in the markets. This helps us develop a good intuition and gut feel which go hand in hand with a good trading strategy.

Conclusion

After fifteen years in the markets and about eight years of teaching traders, it’s obvious to me that most traders simply don’t know an obvious trade setup when it’s staring them in the face. With long-tailed pin bars, this problem is largely eliminated, because they are so large. For this reason, I recommend you make long-tailed pin bars the foundation of your price action trading plan.

So many traders miss great trades and so many traders tend to get stung by trading everything that they “think” might be a signal. This is like a madman with a gun walking around shooting anything that moves. Trading and money are weapons, so to speak, and just like a gun, you do need to be careful with it. You need to be patient and what for the best trades…then “pick your targets” and execute the trade with absolute precision and confidence.

My trading course covers all types of pin bars as well as my other price action setups. Combined with the daily members trade setups newsletter, you have a lot of resources to help you spot worth-while pin bar trades. Essentially, these resources allow you to look over my shoulder as I analyze the market, and this is the quickest way for you to learn how to trade profitably.

PLEASE LEAVE A COMMENT BELOW & GIVE ME YOUR FEEDBACK…

Any questions or want to talk ? Contact me here.

Awesome Article Boss ..

Thanks

Thanks again for your teaching us.

Thanks NIAL for your generous info in as far as pin bars are concerned.

Atleast now I have a sigh of relief and a life-line.

Good job Nial. I trade futures and I am going to try to apply more of your pin bar strategies and using the daily charts rather than the intraday for day trading.

Good way of teaching.Thanks alot.

Hello Nial I am new to your page and what I have seen so far out ways any thing i have ever seen .

When I started using this method my trading has improved a lot . In the past I seemed to used too many indicators and made my charts look like a train smash.

As I have been here for a short time reading your articles Have really started to enjoy my trading a lot more and have gone back to simple charts and this has made trading easier and clearer to spot more trade opportunities. Thanks again for you web page, Andrew.

another one…..this is great

This article is one of the MUST READ. It is very interesting. Thanks for this post.

Thank for your lessons… I am a big fan of Kangaroo Tails strategy… It is ideal to trade in connection with support and resistance lines…

Amazing lesson, thank you.

Thanks for you nail fuller nice lecture

Long life sir Bangladeshi Mosharaf Hossain

Long live Mr. Nail , xanks for awesome article,wel explained man yr my best teacher atleast am catching up, hoping very soon l wil resume blness an l will need more of yr help to get a truth worthy broker. Long live nail

Explained in a real way to understand. Thanks Nial

Tnx.

Well explained and just at the right time. Thank you Nial.

Keep it up. Nice lecture and clear….. Nail

Love you, man. Keep doing what you do.

Notes taken. :)

Appreciate your articles very much.

Thank you Nial

Owsom lesson. First time I heard about long tailed pin bar trading.Thank for new lessons. Wish u all the best mr Nial.!

Thanks Nial, great article. Would this apply to the 4hr chart as well?

Thank you. Very helpful information.

Thanks for clarity of explanation and examples Nial

Dear Nial,

Your tailed pin bar is very smart.

Please write a paper about Trading Entry Point with Last Wholesale Price (LWP).

Best Regards,

Mohammad Haghshenas

Trade it don’t be a deer in headlights. No one the entry.

Darren

Thank you Nial for explaining Pin Bar in detail. However, it is not easy to detect a Long Tailed Pin Bar(bearish/bullish) with good experience, you mentioned in your article here. Is there a rigid rule on Long Tailed Pin Bar to take entry correctly?

Hello again Nial This is a very well written and illustrative lesson. This sentence should be memorized: “Think of it as the market ‘putting on the breaks’ after moving too far, too fast.” It says it all really. You can literally hear the screech. I also personally like also to look for the double bottoms that form everywhere that you have pointed out. More often than not there is an oppositive move after those form. Also the halfway retrace after the sum of a large movement. And the Ebb and Flow of Markets. And the patience and perseverance being the most difficult part. I feel that all those little things are adding up to in my trading personality. Even though I know have miles to go before I sleep. Best regards

Thank you for such technical explanation of forex trading signal pattern named long tailed pinbar. I think it is also interesting to zoom in such signal pattern as entry strategy.

Hi Nial,

great article.

Some questions:

– is this setup tradable/reliable also in the stock market?

– how often does a signal like this happen?

– I guess it can be reliable also on weekly/monthly charts

Regards

Thanks for the lesson Nial. I am member but don’t mind reading the stuff again and again.