The 30-Minute Trading Routine For Busy People

You’re busy, I’m busy, everyone’s busy, right? I’ve got good news and bad news. The good news is, it doesn’t matter if you’re busy because you can learn how to trade and trade properly no matter what your schedule is. The bad news is, you aren’t going to get rich quick, but if you’ve followed me for any length of time you already knew that.

You’re busy, I’m busy, everyone’s busy, right? I’ve got good news and bad news. The good news is, it doesn’t matter if you’re busy because you can learn how to trade and trade properly no matter what your schedule is. The bad news is, you aren’t going to get rich quick, but if you’ve followed me for any length of time you already knew that.

Wait, there’s more good news…

In today’s lesson, I am going to show you the 30-minute trading routine that I’ve developed for myself that saves me tons of time and mental stress, and ultimately improves my lifestyle. Once I religiously started following this routine and adopted the mentality of placing my trades, walking away and letting the market just ‘do its thing’, my trading results improved dramatically.

The 30-minute trading routine:

The two main components to my 30-minute a day trading routine are…

#1. New York Close End-Of-Day Chart Analysis

End-of-day chart analysis basically just means you are doing your daily analysis after the market has closed. Now, the tricky part here is that different chart providers will show different close times on their daily bars, which is just silly. The New York close at 5pm New York time, is the REAL close of the Forex market, it’s the end of the trading day. If you don’t have the proper 5-day New York close charts, you need to get them by clicking on the previous hyperlinked text.

The point here is, we want to make our trading decisions on the daily chart time frame and we are only looking at daily bars that have closed out. So, it really doesn’t matter where you live in the world, just make sure you’re only looking at the previously closed out daily bars; if the current daily bar is still open, don’t give it much weight yet.

We are spending just 30 minutes or less, per day, analyzing the markets and making our trading decisions. This is the basic cornerstone principle, if you will, of my entire trading approach.

#2. Setting and Forgetting

The next part of the 30-minute trading routine is my set and forget trade management approach. This approach serves a couple purposes. The first and most important one is that it largely eliminates the potential for human error (you making mistakes) by being overly-involved with your trades once they’re live. Over-involvement or ‘meddling’ in your trades after they’re live, is the SINGLE BIGGEST REASON traders lose money. You simply must accept that you must LET THE MARKET DO THE ‘WORK’, by taking yourself mostly out of the equation after you push that buy or sell button.

Setting and forgetting is about walking away and trying to purposely avoid letting yourself get addicted to watching the charts. This is the second biggest purpose of my set and forget approach; it frees up your time. You can set your trade up and simply walk away and go play golf or some other sport or hobby, do whatever it is that you do. You need to learn to let go and let the market take you out of your trades rather than constantly trying to exit trades manually because you have a need to be in control. Trust me, the ONLY thing you can 100% control in the market is YOU.

Exceptions to the ‘rules’:

The concept of set and forget is not a perfect science and I do often exit trades before they reach my pre-planned target, or I may move a target further out if the market conditions look right, such as another subsequent signal or breakout and trending market that is looking like runaway trend type.

However, and I would STRESS THIS: I NEVER MOVE STOP LOSSES. But, IF there is a LARGE signal in the opposite direction of the trade I’m in, I may exit the trade prior to my stop being hit, but these instances are rare.

The biggest benefits of the 30-minute trading routine…

- Trading in this low frequency, reduced-involvement approach really is the best way to trade and it really is a “win-win” scenario. The very act of trading less and focusing on daily charts, increases your chances of making money over the long-term and it gives you the time off and the ability to spend 30 minutes or less a day on trading. Win-Win.

- The mental state of mind that you will get from focus on end-of-day charts and trading with reduced involvement is the state of mind you need to trade properly. The proper trading mindset is not easy to come by and most traders induce the completely wrong trading mindset by trading too much and focusing on intraday charts too much. The 30-minute trading routine allows you to cultivate a winning trading mindset.

- Your busy, we are all busy, you can’t spend 5 hours a day staring at your charts, and you shouldn’t! Not only will the 30-minute trading routine allow you to fit trading into your schedule, whatever that may be, but once you start building up your trading account you will really start reaping the rewards. You will realize that you can make money without ‘working’. You set the trade up and you leave, come back and check on it tomorrow. The trade either works or it doesn’t. Barring a huge signal against your position, as mentioned earlier, you just leave it be.

- By trading end-of-day and waiting for those obvious daily chart trades, you’re naturally going to get better trades than someone day trading. Less trades also means fewer transaction costs, and believe it or not, transaction costs (fees, commissions, spreads) can and do eat away at a trading account faster than most people think. Overall, this 30 minute a day approach is just the best way to trade, trust me, I’ve been at this about 16 years and I’ve done and seen it all. If you let it, this will work.

Example of the 30-minute trading routine:

I typically start my day out by scanning through my favorite markets. I am looking mainly at the long-term trend and the near-term daily chart trend. I may look at the weekly first, then look at the daily chart. This gives me a good top-down view of a market and I can quickly and easily see the key chart levels as well as the current market condition, be it trending or consolidating.

If I spot a daily chart signal that I am interested in, I will quickly make note of it in my trading journal and then after my analysis is complete I will come back to it and decide if I want to trade it or not.

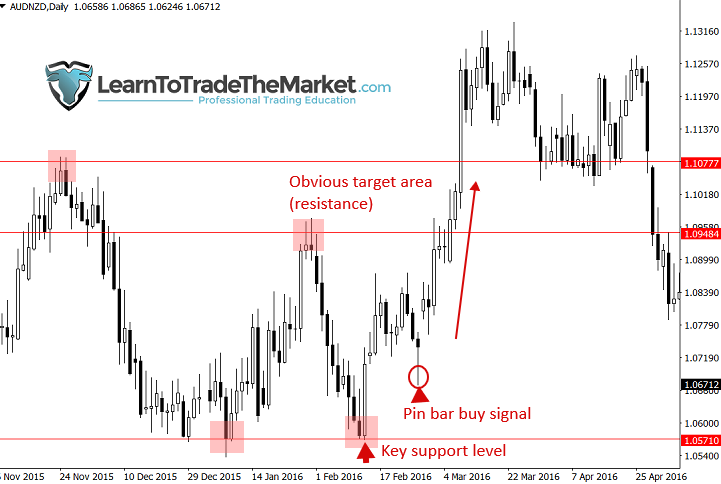

In the daily chart below, price had just bounced up from a very strong / key support level when it formed the bullish pin bar highlighted:

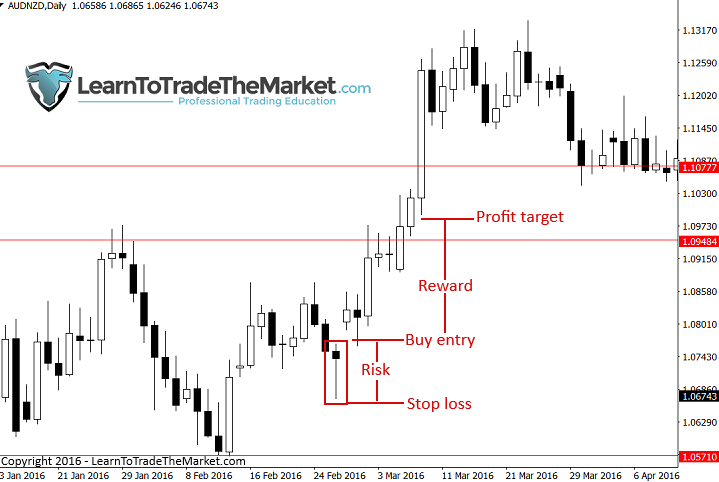

Next, I will come back to that signal and I will decide if I want to trade it or not. If I do, I simply determine my stop loss placement FIRST, then I will determine my profit target and set my position size. Now, if a 1:2 risk reward or more isn’t clearly possible, I will aim for 1:1 or 1:1.5, I never even consider anything less than 1:1 risk reward because the trading math simply doesn’t play out.

I typically will monitor a trade I am in every 12 hours or so after the next few days. I am NOT incessantly checking on it or watching at night when I should be sleeping. One big reason I don’t do that is because I don’t ever risk more money than I care to lose. Once you start jacking up your risk beyond what you’re comfortable with, you’re doomed to start staring at those charts all night and that will cause you to make all kinds of mistakes.

Let the trade run and let the market do the ‘work’ – YOU don’t have to do anything 90% of the time!

You may want to use your trading journal each day to record how you’re feeling, what you’re thinking and just to stay accountable to something. Over enough time, you will notice trends and patterns regarding your feelings and your trading outcomes. There is really no end to how helpful a trading journal can be, and I highly recommend all beginning or struggling experienced traders use one consistently.

Conclusion

The 30-minute trading routine can transform your trading career. Once you get into the grove of this minimalist trading approach, you will start to see it’s power and the routine will turn into a habit. The goal is to develop the proper trading habits, that is how you make money in this game. It’s no different then getting in good physical shape; you start with a routine, that may even be ‘boring’ to you in the beginning, but you keep pushing and keep trusting the routine and the reasoning behind it. Then, over time, you will start seeing results and this will reinforce what you’ve been doing and you will begin to ENJOY the routine. It’s at THIS POINT that habits are born, and lives are changed. Utilizing the concepts that I taught in this lesson and that I expand upon in further detail in my trading courses and in my members area, you will develop a trading routine that meshes with your life and your schedule. This low-frequency reduced-involvement approach will work if you give it time, I know because its what has worked for me and it’s what I live and breathe on a daily basis.

What did you think of this lesson? Please share it with us in the comments below!

I have improved greatly by following your articles but the market does what it wants, so from my opinion have positions sizes that even in gapping the markets will leave your account safe.

Magnificent article!

Nial,

I have covered your Set and forget strategy and agree that it’s the best way to go. I just have one question. In the beginning you say I must focus on the yesterdays chart and forget to days. You do not say when and where I must start trading. Do I start at yesterdays end of day to trade or at todays end of day.

Please help cause am a bit confused.

Regards

Hi Niall,

For me the NY close occurs at 0000 and 0100 depending on whether it is daylight savings or not. I normally have to be up by 6-7 for school. How do you suggest I work around this?

what if after you enter a trade, next day its opens gap up/ gap down against your positon? you stop loss does not make sense in this case

Curious as to how you know there is a big move against your position that you might exit out of early if you are only looking at the charts once a day?

Hi.Thanks again for taking out the panic with your timely reminder. On demo till results stack up a positive equity curve with my adjusted strategy. No rush. Regards, K.

I think that your advice is reach though am new.Just registered in Nigeria.

your articles clear the obscured

Brilliant article. Thanks Coach.

Hy I want to starts the trending but I am trending before so I need to start fresh to trade my self trending can I help me about this trending

thank you great article sir..

Thank you Nial for the such a great insightful article. God belss you.

Respected Sir are very good teacher i have been learn many many things since last four years but still i did not investment in because of no chance to invest i mean less fund my desir to invest but i have no even 500 $ for invest i still learning and learning in different ways

Thanks for the article Nial. The 30 minute trading is what I have been doing since the beginning of this year after deciding on strictly trading the D1 timeframe. I guess one this that makes it easier is that I only trade 8 currency pairs as I am still new to forex trading i.e. < 1 year. Unfortunately I can only look at the charts once a day and that is 4 hrs after NY close (04:00 am South Africa). Applying the 'set and forget' mentality, I've removed the MT4 app on my cellphone so that I don't interfere with my trades during the day – improved my profitability as I easily hit TP on my winning trades.

Hi Nial, i am a brazilian guy who enjoy your articles. i’ve been reading your posts and changing my way to trading.

So, i’m here, reading and learning more about price action.

Great article, by the way. I take more than 30 minutes for analyses the charts, but i’ve been trying decrease that time.

God bless you

Hi Tess here.New to forex trading. I am in Pennsylvania uses Eastern time. So if the new york time closes at 5pm eastern time does that mean we can start trading after 5pm? or wait until morning to see where the market is going? Any comment on this will be appreciated. Thanks

Thank you Nial, for empasing this low – frequency trading style.I must recommend using split-money management, to come out of risk as quickly as possible.How I do it Nial:

1.calculating my risk amount in dollars,e.g $200

2.splitting my overall risk amount into half, e.g $200÷2=$100

3.opening two trades at same entry,same stop loss

4.Trade1= 1:1 Trade2= 1:3 or 1:4 depending on my next key levels

reasons behind this system:

1.to be out of risk quickly as possible

2.your overall risked amount of $200is safe, once 1:1 triggered/reached.

3.be able to open another trade,while the Trade2= 1:3 or 1:4 running without risk

4.be able to open 10 trades , once their1:1 have reached

5.be able to sleep well at night knowing exactly risked free trades.

Thanks Nial, please elaborate in this,your input and your professional understanding will make magic!

thank you Nial Fuller, has shared his knowledge and experience “The 30-minute trading routine”. It is very helpful and will change the trading style is exhausting. For example intraday and scalping. Once again, thank you so much.

Is it the same if you wait until before the market opens on the following morning as looking at the market at the close of the previous day. I am much more awake in the mornings.

Good lesson Sir

Thank You so much.I was following you and I changed the trading routine as you tought.I am having my aha moments

Nial i am a newby at trading FX but will try your approach.Thanking u.

Thank you very much

I’m sure it’s the best way to trade, but to achieve it.

I keep on trying it but I end up baby sitting my trades! but I will keep on trying until I achieve it.

Thanks again

H

Thank you Nial

Thanks Nial. Another great article.

you are right but some people live on the other side of the world and NY Close is somewhere in the night for them and not everybody wants to get up midle in the night

Clear & Straight forward