Apply The 3 M’s Of Trading To Improve Your Results

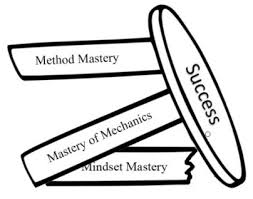

The 3 M’s of trading: Mind, Money and Method, maybe you have heard of them, maybe not. Either way, in today’s lesson you are going to learn what they mean and why successful trading requires them.

The 3 M’s of trading: Mind, Money and Method, maybe you have heard of them, maybe not. Either way, in today’s lesson you are going to learn what they mean and why successful trading requires them.

Note: The 3 M’s was not my idea, rather it came from a book called Come into My Trading Room by Alexander Elder. However, I want to show you how I use the 3 M’s and how it applies to my personal trading approach.

All three of the M’s are equally important, and you can think of them as the three pillars of trading and the backbone of your trading business plan. Without one of them, your trading foundation will not hold, and you will not succeed. You need all three of them working together to make money as trader…

Mind

The Mind part of the 3 M’s essentially means developing psychological ‘rules’ that will keep you calm amidst the noise and constant temptation of the markets. Everything begins (or ends) with your trading mindset.

You cannot make money over a period of consecutive months if you are not in the proper trading mindset. There are many things that go into achieving the proper trading mindset and I have written about this topic extensively. However, if there is one over-arching theme that you need to understand in regard to your trading mindset, it is self-control.

Most of trading can be boiled down to your ability or inability to control yourself in the face of the near constant temptation to trade, because most of the time, doing so means you will inflict harm on yourself.

As a trader, speculating in the markets, an endeavor that is obviously very risky, it is up to you to control yourself, and this ability starts with the mental understanding of what you are doing, what is possible and what you are risking.

My suggestion is that you think more about the fact that it’s very easy to lose money trading, rather than the fact that you MIGHT hit a big winner on any given trade. It’s about understanding and accepting risk and then behaving in-line with this acceptance. Which means basically that you shouldn’t be trading a lot because high-probability trading opportunities are not nearly as common as many traders think they are (or trade as if they are).

Money

The Money part of the 3 M’s refers to money management, of course. This encompasses both risk and reward; how do you manage risk and how do you manage your profits / rewards?

Getting your money management down is heavily dependent on having the proper trading mindset, as well as having a firm understanding of what money management actually means. Here is what it means in a nutshell:

- You always think about risk before reward.

- You know what your per trade risk amount is and you never exceed that amount. This should be a dollar mount that you are mentally and financially able to safely lose on any given trade.

- You understand how to place stop losses properly and how to manage your position sizes.

- You have a clear understanding of how to place profit targets and an overall strategy for exiting trades.

- You understand how to calculate the risk reward on a trade and this also means you know sometimes a trade won’t be worth taking if the risk reward doesn’t make sense.

Money management can be thought of as the ‘glue’ the 3 M’s, because it really holds everything together. If you do not have properly money management, your mindset is going to quickly get out of whack. Also, your method will become irrelevant almost, if you do not manage your money correctly. So, if you want to make everything much, much easier on yourself, focus on managing your money, especially your risk, the most. Understand that capital preservation is really the key to money management. Capital preservation means managing your trading capital so that you are not using too much of it on any one trade and that you are not using it too frequently. Essentially, you want to only use your trading capital when a very obvious / high-probability trade comes along, because then you have more capital to use on better trades. Don’t blow your trading capital by over-trading.

Method

The Method part of the 3 M’s is how you trade the market. What is your approach or method to analyzing prices and making decisions about when to trade and when not to? You must have an effective trading method, but what is an “effective trading method” and how do you know if yours is or not?

The simplest way to judge whether or not your trading method is effective, is to demo trade it for a couple of months and see what kind of results you are getting. One caveat here however; make sure you are ACTUALLY following the method as it was taught to you and not over-trading (trading when no signal is present).

Now, there are many different trading strategies and methods out there. Ultimately, you have to find one that is A) effective and that B) you personally enjoy and that works well with your personality and schedule.

Personally, I am a huge proponent (duh) of price action trading. My trading method is price action and it is the only method I trade and teach to my students. If you have been following my blog for any length of time, you should know a little bit about how I trade with price action, if you don’t, click here. I have written many articles on why I prefer price action over any other method, but in case you missed them, are a few for you to check out:

Beginners Guide To Price Action Trading

Learning Price Action Is The Key To Trading Success

Why Price Action Trading Will Improve Your Trading

4 Facts About Price Action Trading You Need To Know

The ultimate resource on how I trade price action is my advanced price action trading course. Within in my trading course, you will not only learn about my Method, but you will also learn how I manage the Mind and Money aspects that are so very important to a trader as well. You will learn how to build your own trading plan with the building blocks being the 3 M’s, to get started, click here.

Don’t hesitate to email me with any questions or concerns you may have, and remember to leave a comment below.

Something holds me in the market. Your articles always intall confidence and deep understanding to hang in.

The hunt involves a lot of waiting. Takes a while to really grasp that concept. Thanks for the ongoing insight into staying positive and trading on plan.

Hi, Dear Nial, Your every article push one-step forward of my journey to forex market. Your articles are like a energy- drink for loser to redrill oneself and re-enter in the forex ring. Thanks

I was last weekend at a forex seminar in Lagos ,Nigeria and one of the distinguished speakers praised you very well particularly your concept of the ‘sniper and the crocodile’ and I didn’t hesitate to openly declare how deeply I adore you This article is another masterstroke Please keep it up

God Bless you real good for your concern for my progress

Thanks Nial,

3 M’s really helpful in avoid overtrading, Improve trading and thereby trading account will be safed.

Hmmm,good article as usual. With d 3ms,the trader is almost in control, especially when it comes to d mind.u can take control of your mind in respect to this and i think if this is strictly adhered to,confidence and consistent winning is certain.

Thanks my man

Thanks Nial. Always on point.

thank you

I love your articles because you stress about Mind, above all, in a way many others can’t do. Thanks.

thanks Nial, I enjoy reading your atticles

Thank You Nial for your precious efforts.