Perform This Trading Experiment & Learn A Life-Changing Lesson

The Trading Experiment:

The Trading Experiment:

Today’s lesson is going to fast-track your trading success if you actually follow-through with the interesting trading experiment I have designed for you.

This is a potentially life-changing experiment that will very quickly (in under one month) teach you many valuable trading lessons which will open areas of your mind that you may have not yet activated.

What you are going to do is trade every price action signal that you see for an entire month. The rules and conditions of the experiment will follow, but essentially you are going to take any pin bar, fakey setup or inside bar pattern that you see on the daily or 4-hour chart of the major markets we normally discuss in the members commentary each day. We encourage you to perform chart analysis and spot your own trades, as well as follow along with the analysis in the daily members trade ideas newsletter inside the members area.

The goal of this experiment is 3-fold:

1. To remove your fear of entering trades, get you pulling the trigger more often and trusting your judgement, to avoid living in a hindsight circle constantly (regretting not taking trades you knew you should have), to simply get you into the habit of executing trades rather than just spectating and hesitating.

2. To reveal the randomness of achieving a risk reward goal and reveal the truly random distribution of winners and losers.

3. To deter you from over-trading in the future, by the end of this experience you will understand that trading every signal and taking every trade will diminish your returns by churning your account of spread/commission and losing trades we could have avoided through filtering. To turn you from a machine gunner into a one shot one kill ‘sniper’

Rules and conditions of experiment:

The rules and conditions of this experiment are quite simple. However, you must follow them exactly for the intended lessons to have their effect and prove their point to you. The rules and conditions are as follows:

- Trade 1 micro lot or smaller or demo trade, but actually execute the trade on a broker platform for record keeping and exercising the habit of placing trades.

- Watch the 10 or so markets we follow in the daily members newsletter, and trade as many signals as you see fit, including pin bars , inside bars, fakeys, on 4 hour to daily charts (exclude any time frame under 4 hour).

- Apply a 2 to 1 risk reward with a minimum stop of 0.5% of the market price and minimum target of 1% of the market price (approx 50 pips stop and 100 pip target on Forex). For gold, and indices and commodities, adjust this accordingly.

- All trades are set and forget setups, meaning, you are either stopped out or achieve your target, no fiddling with the trade once it’s live.

- The goal is to determine overall R R (risk reward), we measure a loss as 1R (1 times risk) and profit as 2R (2 times risk), to learn more about why we measure results in R and not percentages, read our lesson on risk reward here.

Performing the experiment:

Here are two example trades so you can get accustomed to how you will actually carry-out this experiment.

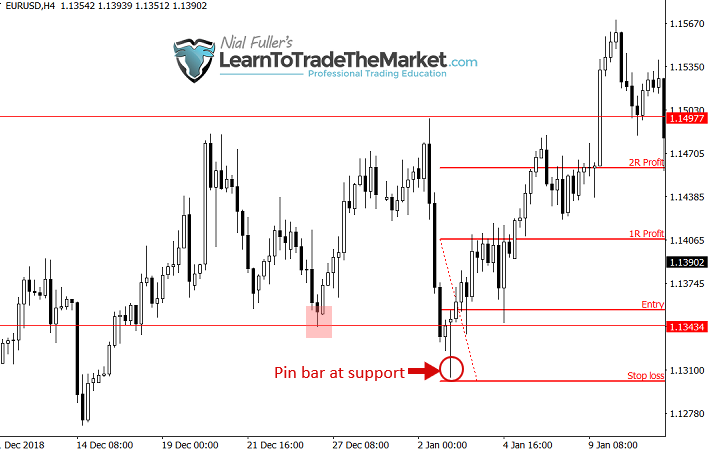

1. In the first example, we can see a 4-hour chart EURUSD pin bar signal that formed at a support level in the context of the recent trading range we have seen on this chart (see daily view too).

Once you spot a clear and obvious price action signal like the one below, you will simply set the stop loss (in this case below the pin low) and the entry (pin high) and the target (2 times risk), then you let the trade go.

You should also record the trade details in a spreadsheet / trading journal to track your trades and stay accountable, note that the risk reward is the most important piece of “evidence” for each trade.

We are setting the RR at a strict 2 to 1 and so whilst the stop loss placement can be somewhat discretionary (see article link for where you should place it) the profit target must always be two times the stop distance.

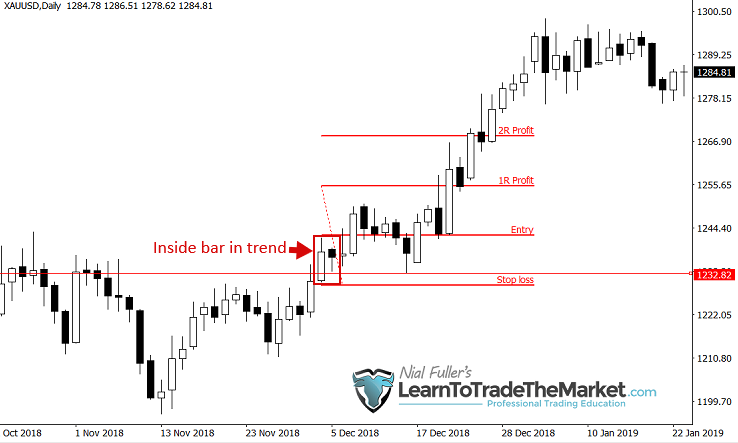

2. In the next example, we are looking at an inside bar signal that formed in a recent uptrend in Gold. This is a very simple trade to spot and set up, and to set and forget.

The stop loss is typically under the mother bar low and so the target is 2 times that of the stop loss distance. We can see in this case the target got hit for a win, as did the first example. However, not every trade will be a winner of course, and remember, one of the points of this experiment is to show you that you can’t take EVERY trade because some are not worth taking, you have to learn to filter the good from the bad.

Hopefully, after taking every signal you see for a month you will realize that the trades like these two above, that had confluence are the ones you want to take most of the time.

Other considerations…

Make sure that the price action signals you are taking are ones that I teach, you don’t want to be just trading anything you think is a pattern. You need to start trading an actual edge, that is the beginning. Blindly entering “every pin bar” or “every fakey setup” with no other supporting evidence, can indeed produce some amazingly profitable trades as you will discover, BUT overall, it’s not enough to achieve long-term consistent success. You will need to refine and filter that edge so that you are only taking the absolute highest probability occurrences of these setups (something I discuss in other lessons and teach in my pro trading course).

Traders should not approach the markets with pessimistic energy and try to “avoid” losing trades, because that is impossible. Every trader will have losses and make a bad call from time to time, no matter how good a chart reading technician they are. Traders should instead approach the markets with an optimistic energy and focus on finding winning trades that yield a substantial reward compared to their risk. This experiment is designed to get you pulling the trigger on trades and to avoid freezing up like a deer in headlights constantly (pessimistic energy). It is designed to teach you that your edge is going to produce winners and losers in a random fashion over xyz period of time, and that by being a little more selective with what trades you take in the future, you can improve your results substantially and place each trade with total confidence (optimistic energy).

When your done completing the experiment, there are going to be a tonne of trades you look back on and learn something from. You will want to study the ones that worked out really well and study the ones that didn’t work out well and find some common denominators that will then act as filters for your trades in the future. As you grow and learn as a trader, through your own experience, screen time, and through ongoing study, you will learn more about how to find the best price action trading opportunities in the market, and your eventual goal is to end up trading like a ‘crocodile’ , waiting in ambush for your ideal prey (your next high probability trade).

From here I would ask you to do 2 things right now.

1.Post your commitment to perform this experiment in the comments section below.

AND then

2. Come back and reply to your own comment below AFTER you complete the experiment with answers to the following:

- What did you achieve in overall profitability or losses ? example: 30 losses 20 wins and a total R return loss of -20 R ?

- What trading habits will you continue and what habits will you stop in the future ?

- Do you think you will be more selective and filter trades more carefully ?

- Any other lessons you want to share with others here ?

I hope you enjoyed today’s experiment-lesson, I truly believe if you follow it you will learn many lessons that most traders spend years learning through much trial and error.

Please Leave A Comment Below With Your Thoughts On This Lesson…

If You Have Any Questions, Please Contact Me Here.

NIAL FULLER you are throughly the King of price action trading. I subscribe to your signal but i was not getting the methodology behinde the signal till now. I have gone back to study the lesson carefully.

thank you

I real want to improve my profit

Here are my results:

Started in june-21, finished in january-22.

Initial account balance: USD 300.00.

Trades taken: 32 (4/month average)

Wins: 15

Losses: 15

Breakeven: 2

Number of BUY orders: 18

Number of SELL orders: 14

Risk: USD 50.00 per trade

Average reward/risk: 2.28

Cumulative reward/risk: 19.2

Max. drawdown: USD 200.00

Average days holding a position: 7.37

Most traded setups: bullish pin bar > bearish pin bar > inside bar

Setup hit ratio:

Inside bar: 66.67%

Bullish pin bar: 46.15%

Bearish pin bar: 45.45%

Final account balance: USD 1,260.00.

420% returns over the span of 8 months.

I’m up for this experiment.

Experiment started 13/10/2020-31/3/2021

Was trading EUR/USD only using Inside Bar strategy.Using the H4 Time frame.

Money Management: I was risking $4-5 to make $10.

I made 76 trades 29wins. 47loses.

The experiment was done on $140 account

Wins 29X10=290

Loses 47X5=235

Profit =$55

Return on investment =39.2% in 6 months

Now looking m to play with Big money using the same mindset,same money management,same strategy .

Thanx Nial.

Thuli. BW

Well done! Money management is the Key.

I learnt more with your lesson then a book.

I am going to try this experiment this day 18th June, 2020

I am in this experiment from 15 June I’m coming back after a month

Dear Nial, thanks for all your support. I have been some problems with my entries, (inside bar) because I am not sure if I have to go in the break moment or I have to wait until price back and testing. For example if I have a 4 H inside bar set up…I have to wait until the last candle close even if that candle close so far from high or low of my mother candle? that problem is bigger in terms of pip if we talk in daily time frame.

Sorry for my english,

Eduardo Zuñiga

I’m ready,going to be very exciting

Already in the Mt4 lab to begin the experiment. Will return in April,2020 to provide updates. Thanks very much Nail

Ready for the experiment!

hi, must this be only on all pin or fakey setups, or must you check support and resistance areas aswell?

I am in. Starting today.

Hi Nial

Sounds good . Have sort of been doing it with ur style. Results good. Now will start end April and c how it goes. Currently working on trading plan and strategies so will make time soon.

I’m in.

Hi,

I want to share my results. Keeping PA strategy (using H4 and D chrats) I was trading for a three weeks of february (last one had problem with computer). There were 6 losses, 3 profits (one – 2.5R, one – 1.5R, one – 1R) and 3 zero trades (zero got, when, having 1R profit, price reversed to entry).

So, I will continue to trade in such manner for a while, because, noticed, it was good to see my mistakes more often, release fear opening trades and getting losses (profits wasnt frightening :), deeper analyse markets changes.

Good day !

Hi Nial

Only traded the last 3 weeks of Feb due some family matters and results were ….

8 total trades. 6 winners, all at 2:1, and 2 losses.

I actually found it very difficult to take just any signal, hence only eight trades, I intend to try again this month (March) and just take each signal that I see.

Another thing that I found difficult was to not touch the trade at all once it was triggered, (to actually set and forget). Usually when a trade is more than half way to its profit target I would at least move the stop to break even. The temptation to intervene was highlighted with one particular trade which hovered up and down above the entry for more than two weeks. I had to just glance at the charts and then turn them off so I wouldn’t fiddle with that or any other trade that was live and I think that this also played a part in only taking a handful of trades.

That trade did actually jump up to the 2:1 profit target right at the end of the month, so patience is the key.

I finished the 30 day experiment.

20 trades of which 9 winners and 11 losers. My overall profit was 7R and a R:R = 1:1.6

A few losing trades were countertrend.

I entered each trades just on the signal, although I found it hard not to look at other confluence factors!

I believe when I would have looked at confluence factors, my R:R would have increased to 1:2 at least and I would have taken less trades. Allthough I am pretty happy with this result.

Most of all this experiment has given me an enormous boost in the way I trade and keep to my strategy with discipline. This experiment is truely a turningpoint in my short trading career.

Thanks Nial.

Hi Nial,

As promised I am back to post my results after carrying out this experiment for the month of February 2019.

What did you achieve in overall profitability or losses ?

A total of 22 Trades of which 13 trades were winners and 9 were losers whilst maintaining a RR of 1:2, total R return is +17, which I am surprised of. That’s a win rate of 59% which I find extremely good, maybe its a beginners luck for me as I am new and only into my 4th month of trading. Id also like to add on I risked 3% off my account per trade and as a result of 17R this means I gained just over 50% of my account size in February alone. I still cannot believe it and I am thinking this maybe beginners luck. I understand after this winning month I have to keep myself grounded with reality and not get carried away with euphoria.

What trading habits will you continue and what habits will you stop in the future ?

I continued to manage my risk on all trades.

I’d probably stop looking at my live trades once I am in a trade. I am working on this and trying to look at the charts less and less as there is no point really to check the charts once your in a trade. Just let it play out, as you have already done the analysis before entering.

Do you think you will be more selective and filter trades more carefully ?

I think so, I found that if you find a trade on AUDUSD, there is potential the same trade will be on other AUD pairs like AUDJPY AUDNZD etc. So always check the charts for the best looking trade with the most confluence and only take that one instead of taking all trades.

Any other lessons you want to share with others here ?

I’d like to share that trading is a journey. Although I am a newbie I have only been trading for 4 months now, I find that the best way to learn is from your mistakes. Also its impossible to learn everything in a month, trading experience is something one gains through charts and practice, I am learning new things every week. So have the knowledge and discipline to keep trading long enough that you can actually learn the ropes. In order to do that you must protect your capital as the longer you have your capital the longer you can trade the more you can learn.

I performed this experiment from jan 30 until today. I opened my trading platform 1 or 2 times a day only for looking at 4h price signals and for entering trade orders (20-30 mins each session).

Total 48 trades entered with a RR 1:2

18 with profit

26 with loss

1 break even

3 still open – currently all in profit

On the closed trades: Total profit of 0,5 R (half the sum of the risk amount from one single trade).

If I close remaining open trades now: Total profit of 3,8 R.

(Reason for not all trades not reaching either 1R loss or 2R profit was because reversal price signals caused a reversal of positions in a number of occasions)

These were trades entered into on price signals only – without considering additional confluence factors (trend/resistance levels).

In my opinion an interesting result.

Hi Nial,

As promised I am back to post my results after carrying out this experiment for the month of February 2019.

What did you achieve in overall profitability or losses ?

A total of 23 Trades of which 13 trades were winners and 10 were losers whilst maintaining a RR of 1:2, total R return is +16, which I am surprised of. That’s a win rate of 56% which I find extremely good, maybe its a beginners luck for me as I am new and only into my 4th month of trading. Id also like to add on I risked 3% off my account per trade and as a result of 17R this means I gained 48% of my account size in February alone. I still cannot believe it and I am thinking this maybe beginners luck. I understand after this winning month I have to keep myself grounded with reality and not get carried away with euphoria.

What trading habits will you continue and what habits will you stop in the future ?

I continued to manage my risk on all trades.

I’d probably stop looking at my live trades once I am in a trade. I am working on this and trying to look at the charts less and less as there is no point really to check the charts once your in a trade. Just let it play out, as you have already done the analysis before entering.

Do you think you will be more selective and filter trades more carefully ?

I think so, I found that if you find a trade on AUDUSD, there is potential the same trade will be on other AUD pairs like AUDJPY AUDNZD etc. So always check the charts for the best looking trade with the most confluence and only take that one instead of taking all trades.

Any other lessons you want to share with others here ?

I’d like to share that trading is a journey. Although I am a newbie I have only been trading for 4 months now, I find that the best way to learn is from your mistakes. Also its impossible to learn everything in a month, trading experience is something one gains through charts and practice, I am learning new things every week. So have the knowledge and discipline to keep trading long enough that you can actually learn the ropes. In order to do that you must protect your capital as the longer you have your capital the longer you can trade the more you can learn.

I will start this Sunday (Feb 17, 2019).

I’ve refreshed all 3 PA signals from the course. I’m starting with my own weekend analisys procedure (trend. lvl, PA signals). Luckily I have Nial’s commentary to verify my work :)

See you in a month. Good luck everybody.

I am INN. Will update in due course of time. Thanks for nice article

you area Great teacher

I join the expériment.

I’ll be back soon

I started the experiment on February 1st. For the first week there are already shifts to the best in trade. Thank you for the interesting lectures and articles Nial.

I commit to perform this experiment.

I will join the experiment! Trading SIMSCI – will test out for the period from 11 Feb 2019 – 12 March 2019.

Im also in, Will be interesting for me to be disciplined and patient with my trading, as I have been scalping lately and this is the total opposite. Looking forward to the journey and the end result.

a great experience Nial, i`ll commit myself according to this teaching

Hi Nial,

I will try.

Des.

Will try too

Am in too.

Ken

I commit to this experiment. I also thank Nial fuller for this initiative.

I’m on it.show time!

Ill give it a try????

Des

I’m in.

I join the experiment!

I’m in

Will be back soon with the results

I’m going to try it in February when I’ll get the correct trading charts and platform, I’ve tried to get it but without any success.

I accept every commitment you have extended, I shall for for all the signals on the 4 hours to Daily platform, and entry points just as your have instructed. Thanks for the training you have saved a soul.

I shall report me experience.

Thanks

I’m in

I join the experiment too!

Nice one……….I will stay committed to what I have read now this month, and see how it goes

this is great experiment. am in

I’m in

One thing is inside-bar and pin-bar. It can be traded in many different ways, and Nial does not show them all in this article. Nial want us to buy at support and short at resistance. But what about riding a trend? There is a lot of money there too….;)

Frank, I teach riding / following trends more than any other method, not just buying/selling at levels.

I’m in.

Im In….

I’m in

I’m in for the experiment.

Definitely going to try it in February Thanks Nial

In but struggling …..just don’t seem to get the right signals at the right time/ location but doing my best

This is interesting. I will try my hands on it. Getting back to you by end of February

I am in as well

I have committed to the experiment, trading CL…Trading on the 60M and 4H…thus far in a week, 3 trades and 3 losses…

IN..

I’ll do it, start in Feb.

Not pulling the trigger and the market shooting me on the head

Hi Nial,

It’s a very good idea. I’m a beginner, but I will take your challenge

Have a nice time,

Jolanta

100% committed to start exp. 31st Jan

I will join to the challenge – start date 30th January

Dear Niall and Colleagues,

After a month of the trading exercise on a demo account, I opened 24 positions of which 11 was closed with profit. However, I made many mistakes, so my end of the month profit is 4R.

My bad habits are:

1. Closed position before reaching 2R target.

2. To frequent checking to the charts- the result reason of point 1.

3. Freezing up like a deer in headlights in the view of good set up.

4. Too many open positions and overlooked the good ones.

Remedy:

I have to be more selective while choosing the set up’s and less often look at the charts.

Thank you for the article that convinced me to take part in the competition

Oskar

I will commit for the month of Feb

Hi Nial,

I am a victim of not pulling the trigger so many times. I always wait, then wait, and wait a little more, and then ………..Oh too late.

This is a great exercise and i will definitely be doing this through Feb and will post my results at the end of the month.

Steve

You need to read ‘Trading in the Zone, Mark Douglas or audio free on youtube. You will thank me later!

Thanks Nial for this guidance through the experiment .

I will go into the experiment from next Monday to end of February .

yes Nial, I promise to do the lesson by following all the rules!

I’m in for the experiment.

Hi Nial,

I have done this exact experiment and the results were exactly like you say. Turned my trading around. Funny thing, though. You can, as you, say, trade every signal. Then, suddenly, a great set will appear and you think, ‘if only I had waited for that one!”

So filtering is key. For me, I guess I just got into this habit of not trusting that I’d recognize “the one”, when it appeared. But, since the experiment, I’ve learned to trust myself and my set-ups. Watching, waiting, and having a plan makes for a better trader.

Thanks for the great article!

I’m in!

Started taking a couple on the 4 hour and realized it’s going to be too many trades so quickly decided to only take trades on the daily chart. I’ll come back at the end of February with an update!

Looking forward to everyone’s results!

If it’s a valid trade setup then what does it matter. Your intention is to have more winners than loses so if you can find more trade via the 4H then why not take them?

Very good idea and very good experiment, I will try)))

Great idea Neil!!!

I will start on the 1st Feb

ok nial….this sounds great…i am committed to this experiment.

Great idea Im in

Hi,

Exactly what I needed! Thanks!!

Jan

nice exercise, and it is a very good commitment and helpful for being discipline when opening any trade.

Why not, I’m giving it a shot.

Great article… I will try as soon as possible

Will do on Weekly charts initially because of time constraint. Regards

r

This is a great idea, I will also join this trial and ask the more longer term members to join in as well

Would give it a try

I’m in. Start date tbd within next couple days, no later than Feb. 1.

Gordon

Great idea. I am in starting today.

Dear Nail,

This is nice concept. This will help to us, because now I am learning your PA FX trading

Please provide these type of exercise to continual improve trading in PA.

Sounds all good – Count me in

annton

I will perform this experiment.

Yah, This is one the best experiments I’ve ever knew. Brilliant idea !!!

Thanks Nail very strong lesson iam in for the challenge .

100% I’m in. Will start this on 1st Feb and get back to you by the end of the month with the results. Thank you Nial.

Best Regards

Dararith

Let’s go..project Feb!!

Definitely taking this experiment on ????

I will commit myself from the 1st of February to try this out. The outcomes should be interesting

This is a tough challenge, but I’m up for it. I’ll be commenting here with my results over the next month and in the member’s forum with my setups.

l commit to carry out this experiment

I’m in.

I am on it.

Hi Nial.

Thank you for a fantastic article. everyday my trading skill is improving because of you.

May God bless you and your whole family.

I will try.From 1st of February to the End.

I will give it a go.

Sounds good.

Thanks again Niall im in and commited

Lets do this

I commit to the experiment, for at least two weaks starting today.

Excellent idea, It’s a great way to learn by doing, we often rush out of the expectation of winning and end up frustrated. Will do it, never tried this before.

Am in

After 20 trades i won 9 trades and loosed 11 trades …i the Risk ward after 11 losses is 1:1.6 after 11 losses

The trading habits i will continue .confident i will have to increase my level of confident

The trading habit i will stop in the future ?is increasing my lot size because of some winners

i think i will trade lest now

LESSON TO SHARE .

the lessons i want to share with others here ,for a trader to make money in the financial market

he/her must be defensive and aggressive figure out when to be aggressive and when to be defensive

Kelechi,

I could not but add a little to your comments. It is great to know that you had the above amazing results at your trial of Nial’s challenge. I hope you will be ready to dig deeper to find out while this particular candles act the way they do (seeing beyond the candles),it will really help you a lot, As you continue to trade, the type of trader you are will begin to come at you, either a conservative or an aggressive trader. As a senior once told me , ‘the market will find you out’, For now kudos

This is perfect for the start of next month, thanks Nial great timing and motivation! I commit to this challenge :)

i have picked alot from this more so trading like a crocodile. thanks so much sir

Hi Niall, I am prepared to give this experiment a good shot. I know my biggest problem is entering the wrong trades and not being able to recognise when a trade is going to produce a result or when it is going to be a dud.

Hopefully this experiment will show me the error of my ways.

I look forward to your continued tutelage.

Thank u Nial for this exercise.Im in and will give feedback end of February

I commit to carrying out this experiment starting from today (Jan 28) and will post results at the end of February.

Thanks for your ongoing support and mentoring Nial.

Great Experiment! I am going to do this!

I am agree with you, short & sweety explanation

Thanks Nial

ok

I join the experiment.

This experiment changed my way of trading.

For the last 9 months I’ve given up on what I think I know and just traded the signal. Admittedly I require three signals to enter but I have tried to take each one and allocate risk through position size.

I’ts paid off most weeks are profitable and I have more then tripled my account. The most disappointing thing I have learnt is that the trades I didn’t like were the best winners.

The trades I thought were a shoe in were the worst.

Hey Nial.

Great plan, matey. I’m up for it.

Thanks

Andy Moore

I’m in for February

Dear Maestro Nial,

I am definitely taking part in the experiment starting Feb 01, 2019 to Feb 28, 2019.

Thank you for this and keep up the great work.

Hello Nial,

I took trade 8 trades and got 5 wins and 3 losses. That is +10R and -3R … overall +7R (reward-to-risk ratio of 2:1). I only traded with confluence (trend, level & signal). There were signals that I refused to take because the three requirements (TLS) were not met. It was difficult to stick to these three requirements as some signals that did not meet the requirements paid of handsomely. But the rule is the rule … and must be followed. I deployed the set and forget approach.

Lesson – Have a plan with an analysis routine, and stick to plan judiciously.

Thanks sir awesome guide

I am in. This will be very interesting.

I’m in. Will track trades for the Month of February.

Great exercise Nial…

I’m excited…..

I am so excited to do this. I am in.

I must do this experience, cause I have big problem with take the good shoot because I feel fear.

i will fallow this to perform this experience also i sign for pro trading course and december 2018 and i still waiting for you response thank you nial

I will perform the experiment from this very week.

Thanks Nial.

I’m in, effective immediately. What fun to be free to just do it with no concern for the consequences except to learn from it and develop cell memory. Thanks

I am in…

Thank you Nial..

Lovely article..I am all in nial

I’ll let you Nial, and thank you!

Thank you Nial for presenting this experiment.

I will participate and commit myself starting the February 1.

I commit to the experiment.

I will commit to the trading experiment

will follow this strategy from this week.

I am 100% in on this experiment starting February 01,2019

Thanks Nial. I’m in. During the month I will need to “un-learn” alot of my strategies, info I’ve collected, various Moving Averages (which have totally confused me) and stick to your method. Nice and simple to follow. Thanks again.

Thank you nail I lean lot from you

ill start next week Monday,thanks Nial

I’m committed to do this experiment for the month of feb 2019.

Sign,

Norraine

Count me in, Nial :) That’s great, thanks. I’ll check the markets once after NY close, if a PA signal with confluence present, set and forget!

Excited to report in a month from tomorrow …

I will commit to the experiment starting February

I’m in, Nial. This experiment is worth thousands lessons. Thanks.

A great suggestion – will give it a go. Thanks.

GOOD MORNING NIAL.

first of all let me thank you my friend for the great lesson ,secondly ever since i knew you all my trades are based on the price action ,yes i do mistakes ,i loose trades ,and this part of the game ,BUT honestly my win to loss ratio completely changed ,and more over is my confidence in any trade i take is a lot more .

SO,thanks again and i’ll commit to it .

I’m in

I am not gonna try this I will do IT…

See you in mounth.

Thanks

Nial

Sounds like a plan. I’m in.

Hello Nial

Just to say I am in with the experiment ! This is a great idea to make us to understand how to change the mindset and strategies for long life trading.

Thank you ..

Ready to get started

Have a good day ,Adriana

Hello Nial,

Many thanks for the article. I commit to this experiment. Eagerly looking forward to see how it will turn out.

I appreciate your efforts at ensuring we succeed.

Regards

Phil

Yes sir I commit starting this upcoming wk. the 28th of Jan.

Excellent Nial.

Hi Nail

Thanks for the challenge, I will start on the 1st of Feb. This will be very easy for me, I ve been working on filtering my trades and achieving 2R or more. 4 hour chart I stopped using it, I’m using 1week and entering my trades on a daily chart. I’m now a master of “Set n forget” Thanks once again for another addition into my trading tool box.

Regards a

Collin

am in

I, Paweł Dubert commit to perform this experiment starting 28.01.2019

Committed to launch a separate small acc to really implement this experiment. Will start on 28th of January. Thanks for the idea.

Im committed

I’m in.

Thanks for this great idea. I will participate in this experiment and start on Monday 04.02.2019

Thank you Nial. I am in on this trading experiment starting February.

Thanks, Niall – I will follow this…

Excellent, thanks Nial, I’m in.

Another great lesson Nial!

I will commit to this experience, starting February 2019.

Souto

I am a new student and have 2 problems/ questions … is there Absolute definitions for Pin Bar , Support/ resistance. For many years / courses I have problems being able to do what someone else would do or see. I usually see far too many of a set up/ signal that meets requirements but due to some other variable isn’t acceptable. I will try some more of the course before the experiment as I am just frustrated for now.

I will follow the experiment.

Thanks Nial!

I will try this for a month starting London opening tomorrow night and look forward to the results no matter what. I have been a machine gunner as my name is Kelly “Machine Gun Kelly” but although i have many more wins than losses…my avg. wins to losses is too low. Goal is to become a sniper, results back in a month thanks Nial!

I commit to apply this experiment from this week and will give a feedback by the end of February. I thank u for this lesson and appreciate the challenge.

I commit to apply this experiment from this week and will give a feedback by the end of February. I thank you for this lesson and appreciate the challenge.

Thank you Nial

Great lesson again. I am starting this on Monday and will post my results in a month. Been really excited with trading at last since taking your course. Everything just seems a lot more clearer the more simple we keep things.

Many thanks

Totally agree. Trading is like practising a musical instrument. You don’t learn by reading a book about “how to play piano”. You sit in front of the piano and start playing. Trading is the same. With practise, you will adquire expertise and be a professional.

I have already done this experiments to create my own system. I used pinbars on H4 and EMA10, EMA20 to filter them. Now I trade on D1 only.

Great post. Trading require practising, that’s all.

Hello Nial

That’s interesting for me, I’ll try this way for a month.

I want to participate to this experimen, because I believe will make me better by prooving (once again) things I already know or believe I know

method stick and carrot works 100%, however stick is short term method, carrot works stronger and longer, as when you teach someone something well, this someone will remember that and do it all the time – your constant support is a carrot – thank you for your impressive work

GP

Hello Nial,

Once again thank you for sharing you knowledge with this powerfull lesson which I will commit to. Remember when ever I have a question I will ask excuse me but thats how I learn. Sure think boss & GOD BLESS

I will commit to the experiment, obviously with the trend !

Thanks for all you post to help us to be successful and confident traders

Hi Nial,

thanks for the article. I will commit to this experiment. Let’s see what will turn out after a month. I am already quite anxious.

I understood: during the experiment do not filter too much. The lesson learned shall come at the end.

Eugen

Thank you boss….I am in..

I will follow

I’m in.

Thank you so much for yet amazing lesson. You are simply the best forex mentor. I am definitely In and will start the experiment from Monday 28 January to end of February 2019. I will follow the set and forget rules which so far I find difficult doing. Thank you once again and God Bless.

Good Evening Nial & Team

I am making a commitment and will provided feedback next week.

Enjoy your weekend with your family

Kind Regards

Short and very clear explained, I will perform this experiment

Will try this to smooth my trading . sometimes fund it hard to pull that trigger, over analysis

Excellent Nial. Will / already doing this since I started trading.

You are great man, i got this website link on social media 10 15 days ago but your writing skills and thoughts are awesome. I am learning so many from you.

Thanks Guru

Faithfully going to follow the instructions

Thanks you very much

Thanks Nial for this guidance through the experiment .

I will go into the experiment from next Monday to end of February .

From now onwards I will no longer fiddling with the trade once its life because I can see that I should have been profited more. On the profit target really you opened my eye I could not know how to measure it. Actually the article as whole is an eye opener to me. Thank you

Excellent lesson! Today I will begin to use your council, on day charts with selection of 20 transactions, Thanks Mr. Nial

Yes. I shall try

Hi Niall,

This sounds like the kind of challenge that I need right now. I can be a hesitant trader and see setbips but not take action. I’m really looking forward to completing this task.

I will commit to logging the trades I take and why and leave my results after the month.

Thanks

This is a similar method to what the military would use to train you to be a sniper. Extremely good lesson. You can do a bar replay, but real-time will always provide your mind with a better result.

Well done Sir, you are the only person I send people to price action trading.

I’m in! This should be fun. Thanks coach!

Hi Nial,

Thanks for yet another valuable article.

I will commit to the trading experiment starting in February 2019. Will post my results at the end of the month.

AJ

I commit to perform this experiment.