Part 4 – Become a Professional Trader: Putting It All Together

Putting It All Together

In Part 3 of this mini-series we discussed how to “take off the training wheels” of demo-trading and progress on to trading with a real-money account. If you missed Part 3 click here.

In Part 3 of this mini-series we discussed how to “take off the training wheels” of demo-trading and progress on to trading with a real-money account. If you missed Part 3 click here.

Here’s a quick review of the main points we covered last week:

Step 7: How to handle the emotions of trading with real money

Step 8: Successful Forex trading money management

We are going to wrap up this 4-part blog mini-series in today’s lesson by discussing how to “put it all together”. I am going to walk you guys through an example of how a professional trader operates in the market by taking you through a trade step by step. Hopefully, in today’s lesson you will understand how all the steps in this series work together to provide you with an effective trading approach. Now, let’s check out how a pro price action trader would progress through a trade:

Step 9: Finding a price action signal

If you’ve completed all the previous steps in this mini-series, you will be ready to take the next step which is to actually look for a price action signal to trade on your real-money account. This is where your Forex trading plan comes in; it will give you a checklist to guide you through the process of finding a valid price action signal. It is not a concrete rule-set, but rather a guide or an outline that you follow to make sure any potential setup that you find meets certain criteria. Here’s an example:

• What time frame am I looking at? The daily chart time frame is best.

• What market am I trading? Is it a major Forex pair or a more volatile exotic pair?

• What condition is the market in? Trending, consolidating?

• Where are the obvious key support / resistance levels in the market? Have I drawn them in?

• What are the 8 and 21 daily EMAs doing? Where is price in relation to them?

• Is there an obvious price action signal on the chart?

• If there is an obvious signal, does it have confluence?

• What confluence does it have? Trend, static support / resistance, dynamic support / resistance, 50% retrace level? Event area? The more the better…

• Is the signal showing rejection of a key market level?

• Is the signal showing a false-break of a key market level?

These are just some of the things you would want to look for as you analyze the market and try to find a high-probability price action setup; it’s not a ‘complete’ trading plan or checklist. A professional Forex trader will have gone through the process of making sure any potential trade setup meets his or her checklist so many times that it turns into a habit and gets ingrained into their mind. Trading success is all about developing and maintaining the proper trading habits.

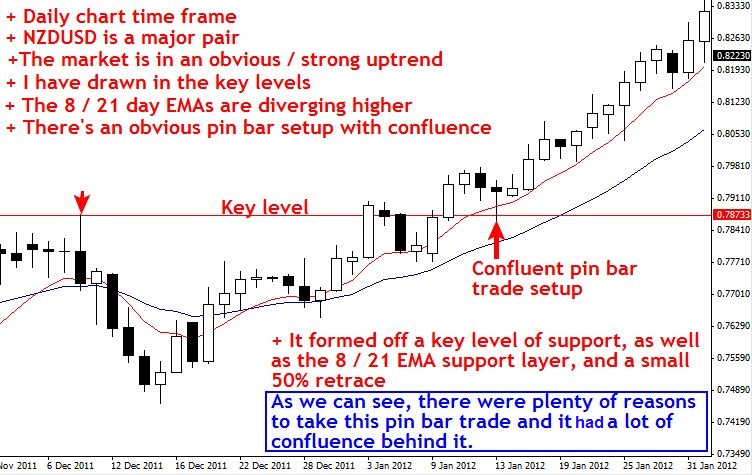

Here’s an example chart of the Kiwi/Yen pair, we can see this was a pin bar trading strategy that formed at a key level in the market and with the dominant daily trend. This was a very obvious price action setup that any professional trader trading this market would have caught. Note that it provided a very nice profit as the trend took off after the pin bar broke out to the upside:

Step 10: Calculating the risk to reward ratio of the trade

After a professional Forex trader finds a valid signal to trade, the next thing they will do is concentrate on the risk. That’s right; the RISK is the first thing a pro trader concentrates on…not the reward, like most amateurs.

Depending on the particular setup you are trading and were the nearby key support or resistance levels are, a pro trader will place their stop loss at the most logical place that gives the trade room to breathe. Logical stop placement is a crucial difference between winning and losing Forex traders. Winning traders will take the time to focus on finding the “safest” place to put their stop, while beginners usually place too tight of a stop just because they want to trade a bigger position size…or they place no stop at all, which is just insane.

Professional Forex traders calculate their risk reward ratio in terms of dollars at risk. So, if you have 100 dollars at risk, 1R (1 times risk) for you is $100, 2R is $200, and so on. Most pro traders are not very concerned with percentages or pips, because at the end of the year all that matters is how much money you lost relative to how much money you won. That’s why I measure my risk and reward in dollars, not percentages or pips.

In the chart below, we see the same NZDUSD pin bar trade, but this time we are calculating the potential risk reward on the trade. This trade actually ended up moving about 5R higher, meaning it would have returned 5 times what you risked if you had your stop loss just below the low of the pin and you entered at the high; a very good risk reward ratio indeed.

Step 11: Managing the trade after it’s live

Managing trades after they are live is perhaps the part of trading that gives traders the most trouble. The reason why traders have difficulty managing their trades is primarily because they over-complicate the process. I am a strong believer in “set and forget Forex trading”, and indeed this is a core part of my overall trading philosophy. Meddling in your trades after they are live and second-guessing your trade setups are things amateur traders do. Professional traders only take trades they are 100% OK in risking their hard-earned money on, thus they don’t second-guess themselves usually, and they rarely meddle in their trades. If you have a Forex trading plan and actually follow it, there should be no reason to mess around with your trades a lot after they are live. I personally have found that just letting the market run its course is usually the most lucrative forex trade management technique out there.

In the NZDUSD pin bar trade below, we can see this market easily presented us with more than a 2 times risk reward. I personally almost always take a reward of two times my risk, as more often than not, the market is ready to retrace substantially after pushing in one direction long enough to net me 2 times my risk. However, in strong trending markets like in our example trade below, there is usually a good probability you can get a reward of more than 2 times your risk. Indeed, in the example below this NZDUSD trade provided a 5 times risk reward.

I get a lot of emails about exits and how to manage them. The simple truth is that I almost always set and forget my trades; it’s a rare occasion that I meddle in my trade by closing it out before it hits my stop or by moving my profit target further away. I like to either take the loss or take the profit. Over a longer period of time, this trade management technique will work out in your favor, because you are not acting emotionally. Most traders who meddle in their trades are trying to “control” the market or force their will upon it.

You are far better off just entering your high-probability price action setup and letting the market “do its thing”. You will get better at this and at taking profits from your Forex trades, but it’s not something that will magically happen overnight. It takes a solid understanding of price action and market dynamics as well as putting in the screen time to develop your discretionary price action trading skills. All of this adds up to obtaining a keen “sense” of how to read and trade the raw price action in the market, and this is an art and a skill which will reward you many times over.

Step 12: Controlling yourself after a trade

Finally, we come to the last step of this mini-series on becoming a professional trader, and it is perhaps the most important one:

I know that most of you have had some good trades and made some money in the markets. But, what did you do after your trade? The honest answer to that question is truly what defines a professional trader. Your mindset right after a trade is at its most fragile, because you are likely either feeling a bit euphoric over your winnings or angry and frustrated over your losses. Granted, you should not experience these emotions too intensely if you’ve manage your risk properly, but you will likely still feel them to some degree no matter what, after all, you are risking your hard-earned money.

Whether you win or lose on a trade, you are at the greatest risk to make an emotional trading decision immediately after a trade closes. While there is no miracle-formula for making sure you avoid these emotional trading errors, if you understand and accept the following points you will be far less likely to make them:

• If you have just lost on a trade, remember that jumping in the market again to try and “make back” what you lost is an emotional reason for trading, not a logical one. Do not enter another trade right away unless there is a valid price action trade setup that meets the criteria in your trading plan.

• If you have just won on a trade, remember that you are not some “perfect” trader who can do no wrong in the markets. Beginning traders tend to get over-confident after a winner or a string of winners, this can cause them to veer of course and “run and gun” rather than trading Forex like a sniper.

• Remember, your trading success is not defined by your last trade; rather it is defined by the result of a large series of your trades. To become emotional and react defensively to any one trade is to say that you think your success as a trader hinges on one trade, and it simply does not. You have to learn to take your losses as just a part of doing business in the Forex market.

• In regards to taking losses, it will be a lot easier to swallow the inevitable losses if you are only risking an amount per trade that you are truly OK with losing. When you start trading with money that you need for other life expenses, or risking too much per trade, you put yourself at a very great risk for wanting to enter a “revenge” trade after you lose.

• Perhaps the best way to control yourself after any one trade is to simply take some time away from trading. Rarely are you going to exit a trade and then get another high-probability opportunity immediately after that. It usually pays to separate yourself from your charts for at least 24 hours after you exit a trade, whether it was a winner or loser. This will give your emotions time to die down and cool off before you begin analyzing the charts gain.

Where to go from here…

Now that you’ve finished this mini-series on becoming a professional trader, you should have learned a lot and have a deeper understanding of what pro trading is all about. I am not implying that you will be a professional trader just because you read this blog series. You need to understand that becoming a pro trader is the result of months and likely years of disciplined trading and making small steps toward your ultimate goal of professional Forex trading.

Now that you’ve finished this mini-series on becoming a professional trader, you should have learned a lot and have a deeper understanding of what pro trading is all about. I am not implying that you will be a professional trader just because you read this blog series. You need to understand that becoming a pro trader is the result of months and likely years of disciplined trading and making small steps toward your ultimate goal of professional Forex trading.

The first thing you should aim to do now is to follow all the insight in this series and aim for making small yet consistent gains each month on your trading account. If you are making money each month while managing your risk effectively on every trade and trading like a sniper…YOU ARE A SUCCESSFUL TRADER. You don’t need to be a professional / full-time trader right out of the gate to be a winner. Rather, this should be a longer-term goal that will sort of just “happen” if you trade consistently and remain disciplined over a long enough period of time.

Every trader is different, and so every trader will take a different amount of time to become successful. But, I promise you that if you learn and master a high-probability trading strategy like price action, and combine that mastery with a realistic attitude and a disciplined trading approach, you will be well on your way to becoming a profitable trader. To learn more about the professional Forex trading concepts discussed in this mini-series and my personal approach to trading the markets, check out my price action Forex trading course and members’ community. If you have any questions or feedback you can contact me here.

I’m amazed by Nial ability to demonstrate how a trader turn from mediocre to professional. I felt like there is honest guy need to give help to advanced trader live. no word can emphasis exactly what i attend to say.

Thank Nail for writing many good articles.

Tanx nial, just awesome.

Thanks a lot. It’s very useful and interesting.

Thank you for these mini series parts – it is really , really helpful to be a professional trader.

Thanx Niel. This was really helpful. Great job

Many thanks Nial. Excellent advice.

Thank you so much Nail. That are very worth for me.

Great detailed information shared in this blog. I can see myself as a sucess with this program.

Very detailed and clear information here, thats what I need to understand this as a newbie.

wonderful job Nial, many thanks.

Great lessons Nial. Always find your lessons very interesting and useful.

Please keep up the great work!

Aziz

REALLY GOOD

Thank you so much Nial…..

thanks nial, you’re my trully master

Good article for success.

Thanks for your great forward paying generosity. Well done and keep it up and you will see it coming in too!

Nial,

Thanks I’m finding the need for daily reinforcement of your trading method – You are indeed providing me with knowledge and discipline. I like the way that you present your method in a meaningful and consistent manner. It is because of this course that I realized I had slipped up in my process of identifying a great trade. Thank you for your unselfish attitude of helping others – jerry

Another great one! Thanks Nial!

nice

Love your work.

Hi Nial, thanks for the series much appreciated. Great course!

Many thanks Nial.. again. All the best to you.

Thanks Nial for these fantastic series. They are great value. These series alone are worth thousands of dollars I’m sure – at least to those who will use the lessons effectively.

You are truly a star and to all those who have not bought Nial’s course, this is great testimony to the quality of the course and I recommend it to anyone.

I’m certainly not a pro yet, but a beginner who can almost say successful trader – just need a few more trading months under my belt to be able to say so:) I’m trying to implement all the things you are teaching and they work.:)

Thanks heaps Nial and your team at LTTTM.

Taffy.

thanks this will help me pls more GOD BLESS YOU

Hi Nial

What a comprehensive series you have put together. I will read and re-read all the information again as your advice is straight talking and common sense… I have been trading a demo account for a short while with some success but am thinking of going live at some stage in the future..Your advice is excellent..

Thanks mate will be in touch shortly..

Nial

Exclusive, Mini series “How To Become a Professional Forex Trader”.I like these mini series more.

Thanks more.

Awesome.Each time I read Nial’s article,my Forex IQ increases.

I LOVE THAT ,PLS KEEP POSTING

well,it is interesting and i enjoy it so much.but if i may ask how long have you been using it?can it work on other time frame?

Nial,

Excellent article. When is the trade placed? Is it after the closing on the candlestick following the pin bar, or before the candlestick after the pin bar closes ?

Thanks Again Nial

Hi Nial

Many thanks for the excellent mini series, which really does bring it all together

Just one question regarding the example NZD trade if I may.

Whilst I understand how you calculated the risk of the trade before committing to a live order, how did you calculate the target return?

Did you just set the ‘take profit’ at twice the risk (I doubt it) or,

did you look further back in history (either on the daily chart or the weekly or monthly chart of the pair) to see what level had acted as S/R immediately above the entry level?

The latter makes more sense to me, as you are then using a very realistic and previously defined level for price to move to (likely reward) in support of your decision if the set up should ‘work’.

ie you know your risk (from the ‘set up’ or ‘trigger candle’) and reward (from a previously defined market level) thus you are calculating the set ups “R” BEFORE taking the decision to place a live order to open in the market.

Only with the benefit of hindsight can it be said that the reward was five times the risk for the set up (you may have changed your trade management once the trade had opened so that you trailed your stop and thus achieved closer to the 5R indicated.) But you could also have taken a 2R trade and re-entered the market on the trigger candle 5 days after the one highlighted (for 2R), the one 2 after that (for -1R)and the one directly after that(for R2). Three winners (+2 X 3 = +6 and one looser -1) = net +5, which is still a R5 outcome, although admittedly not as perfect as the R5 you hit in one go!

Nial,

Once again your articles are so educational. Thanks for you heart that you truly want to help people learn to be Professional Traders.

Toby

💎💎💎💎💎💎💎💎💎

🔥🔥🔥🔥🔥🔥🔥🔥

like it so much these master piece series. It is brilliant and Wonderful stuff for those who want consistently success from Forex. I have definately leant a lot from these seriesT.

Great Job!!! Thanks Nial :)

Dear Nial,

I agree almost your ideas. Your lessons is always helpful for me. But frankly to say, very hard to practice and keep on line because every people has lack of discipline enough.The final part of lesson is a extraordinary experience. At present, after 5 days lucky trading with money management, I am getting 43% profit above 850 $ account but I am not sure how is the final result if I go ahead.

One more thank Nial , hoping you can share more

Great article Nial – once again, explained extremely well. Thanks very much!

Thanks for the 4 part series Nial. I learned a lot and especially enjoyed this one. Stepping away after a successful or unsuccessful trade is something I do not do well and need to learn from your wisdom. Thanks again!

Same old talk .. We get that .. How about get in to details .. How to spot PA. and what is the best time to get it and staff like that ..

But I like your stile it’s very simple witch is good ..

Thanks Nial this as realy all brought it all together now.I have saved all these lessons. & will go over them a few more times. As for my trading plan I think I might have to tweak it some more as you have some very good pointers in this lesson. Thanks once again

Very informative and explained very well in detail without a bunch of waves and indicator crap…good job Nial

What a golden advice from the professor of Forex trading.

Thank you dear Nial for this article.

We shall always follow you.

Thanx Nial i found this article very helpful and educative on how to handle the market

i enjoy this series my prayer is that God will continue to give u wisdom pls explain 50percent retracement and support dynamics

Hi nial thanks a lot

Hi Nial,

this was a brilliant mini-series and the longer I´m a trader and following your course and your strategies and reading your articles over and over, I´m becoming more confident because I realise that what you teach really works!

Keep up the great work and I´m looking forward to your next articles! Have a great day!

sonja

Nial, thank you for your tremendous generosity in putting your years of experience freely on the iNet for anyone to profit from. I am not actively trading yet because I have not spent enough hours educating myself, even though I have had your full course since December 2011. Education comes first, as you said many times. However, I have compared your course with various others and will say that I am still sticking to your philosophy of clean charts and price action trading. Wonderful to have you as a mentor!

Great Nial, it takes a long time to sink in! I’m still on Demo..kicking around at the bottom..but NOT in Negative Territory..yet!

Nice information as always.

Thanks Nial!

very good

Excellent lessons!

Thanks Nial!

Hi Nial

Great strategy planning; inspiration and motivation.

This is a great article indeed.However there is a great difference between what you know and what you actually do while in front of a computer trading.

In any case,who the trader really is determines whether he will succeed or fail in the long run.Success is who you are!

Hi Nial,

Wonderful stuff I have definately leant alot from these series

Thank you so much. These series are a master piece!!

Hi Nial,

Wonderful stuff I have definately leant alot from these series

Thank you so much..

Thanks for the mini series, it was brilliant and explained alot, far to much information for free but i’m not complaining.

keep p the posts

Just beautiful. Thanks Nial.

Thanks Sir……….

Hi Nial,

It has been a great series, one that will be valuable when we read them again and again.

Thumbs up!

NIAL!,Thank you so much, for summing up the whole concept of TRADING,by putting everything on PLATE. Its only ,we and we alone,who need to follow the total concept, in true letter and spirit, THANKS & REGARDS. AMIN

Brilliant! It takes a master to turn a skill set into quantifiable steps. This set and forget is a real eye opener, as well as 2x risk and 3+x risk in strongly trending markets.

It all sounds like common sense….but you have to read the 4 lessons first to find that out!!

Great course Nial, many thanks

Thanks Nial. Great articles…

It really help me a lot to understand trading

further.

Cheers! & God Bless!

Superb articel Nial. Once someone goes live and follow their plan, they just need to have the patience to see it all play out over a period of time. I think this is where most people fail. After reading all this site and contemplating information on it, any new or losing trader will have everything they need to know to become a successful, consistantly profitable trader.

Cheers

Paul

Nial

Brilliant series “How To Become a Professional Forex Trader”.

Many thanks for your superb articles and your insight.

Cheers

Mike

Thanks Nial

Great articles

Cheers