Forex Trade Management – What to do After You Enter a Trade

Today’s article is going to provide you with some extremely important and practical  information that will help you improve your trading results immediately….

information that will help you improve your trading results immediately….

Forex trade management is arguably the most important aspect of success in the markets; it can literally make or break you. Once you learn a high probability Forex trading strategy like price action, you have to know how to manage your trades after they are live. Most traders simply ignore this essential piece of the Forex trading puzzle. By ignoring trade management or by simply not being aware of it, it is only a matter of time before you self-destruct in the market. A perfect price action trade setup can very easily turn into a losing one if you fail to manage it properly. So, without further ado, let’s dive into some practical Forex trade-management tips that you can put to work right away…

Forex Trade Management Mistakes…

Most trade management mistakes are a result of emotional decisions. How often have you found yourself entering a new position just because your current position is in profit? Or how about moving stop losses further from your entry because you are “certain” that price will turn around and move back in your favor? Have you ever moved your profit target further out as a trade moved into profit because you convinced yourself it would keep going because of XYZ reason? Maybe you take profits smaller than 2 times risk all the time or often get stopped out at breakeven only to see the market move on in your favor without you? These are all very common errors that traders make which are caused from poor or no planning and emotional decision making.

All of these errors seem pretty silly when you’re not in the market and thinking objectively. But, once you enter a trade, if you are not following a Forex trading plan and keeping track of your trades in a Forex trading journal, you are very likely to experience extreme temptation to make one or more of the above mentioned trade management mistakes. While trade management is not a concrete science or a mechanical process, there are some general guidelines you can follow and questions you can ask yourself before and during each trade which can help you manage your trades much more effectively…

Averaging In and Averaging Out…

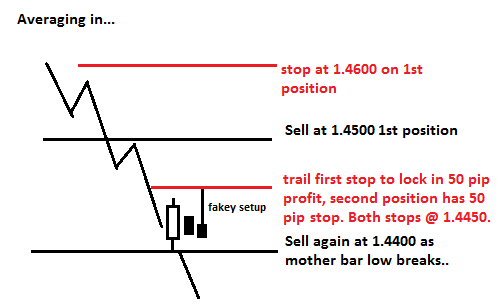

Let’s discuss adding to positions and having multiple or partial positions. First off, the decision of whether or not to add to your initial position in a trade should largely be made before you enter. You need to analyze current market conditions and decide the most logical exit strategy and whether or not adding to your initial position is logical given current market conditions. If you are entering into a strong trending market, you may decide before hand that you will try a trailing stop and try to let the trade run and add to it at logical levels as it moves in your favor. The safest way to add to a position as it moves in your favor is to average in as the market moves in your favor. Here is an explanation of averaging in…

• Averaging in means that you use your open profit to “pay for” the next trade, it allows you to add to your position in a risk-free manner, but the sacrifice is that you increase your odds of getting stopped out at breakeven. It typically is only good to try this technique in a market that is in an obviously strong up or down trend. Forget about it in trading ranges or sluggish / slow-grinding markets. Ideally you want to wait for a price action setup to form at a key level after the market has pulled back a bit, a good example of this would be if your initial position moved in your favor and then pulled back to around 50% of the way back to your entry and then formed a pin bar at a key level, or some other price action setup at a key level; this would be a logical spot to add to a position by averaging in. You want to avoid adding to a position JUST because you are in profit, ideally you want a price action-based reason to add to an already winning position.

• Here is an example of averaging in: you sell the EURUSD at 1.4500 with one mini-lot. The position quickly goes into profit by 100 pips and then forms a fakey setup in the direction of your initial position. Once your first position is up 100 pips and the market formed another price action setup giving you a reason to take on another position, you add a second mini-lot with a 50 pip stop loss, you then move down the stop loss on the first lot to lock in +50 pips. Now, if the second position turns around and hits your 50 pips stop loss, the first position will also stop you out for a 50 pips profit, stopping you at breakeven.

This is a risk-free way to add to a position that is moving strongly in your favor. However, always keep in mind it increases your odds of getting stopped out at breakeven and making no money at all, the payoff is that you could obviously make twice as much (or more) money. One important note of caution is to make sure you NEVER add to your initial position and double up your risk by not adjusting your stop on the first position. Averaging in means that you move your average entry price closer to the market price, if you double up your position and don’t trail up your stop loss, you open yourself up to substantial losses.

• Averaging out (Not A Good Idea In My Opinion), also known as “scaling out” is often talked about in the Forex trading community but it is almost always a bad idea. The main reason it is a bad is because of this; when you scale out of a position all you are doing is reducing position size as the trade moves into your favor. Sound illogical? It is. Think about it for a minute. Why would you purposely want to hold the smallest part of your position at the most profitable part of your trade? It is always better to either take full profit at a logical spot in the market, 2R multiple or greater, or trail your stop on the full position, than to try and take partial profit by scaling out. The bottom line on averaging out is that holding the least profitable part of your position at the most profitable part of the trade is not a financially wise or logical way to try and maximize your winners.

ri

Trailing Stops… (Only Use them when the market is trending)

Trailing your stop as a trade moves in your favor can be a very good Forex trade management technique. However, trailing has limitations and you don’t want to just blindly trail your stop…

• Stop trailing techniques can take many different forms. A few of the more common ones including the following: trailing your stop up as a trade moves 1 times risk in your favor, thereby reducing your risk to 0 as a trade moves 1 times risk in your favor and subsequently locking in each 1R multiple of profit.

• The 50% trail technique is also popular, in this technique you trail your stop to 50% of the distance between your entry and the newest high / low as the market moves in your favor; thereby locking in profit as the market moves in your direction, this technique generally gives a trade more room to breathe but it can also give way a lot of open profit if a trade comes back beyond the 50% level and stops you out.

• Yet another popular trailing stop technique is to trail your stop just beyond the daily 8 or 21 day EMA. The 21 day EMA typically allows your trade to run for longer since it is less likely to get hit in a strong trending market than the 8 day EMA. The 8 day EMA trail would only be used in very quickly moving / trending markets. These are by no means the ONLY ways to trail your stop, they are just examples. There really is no right or wrong way to trail your stop loss, but just keep in mind it’s not the best strategy for every market condition. You generally only want to trail in strong trending markets.

• Breakeven stops are not always a great idea because the market can whipsaw around as everyone knows; stopping you out at breakeven only to move back in your favor. What you need to realize about trailing stops to breakeven is that it can cut down your long-term gains by limiting your potential profits. Yes, you will eliminate some potential losses by moving to breakeven, but you will also eliminate some even larger rewards.

As traders, we all need to accept the risk that is an inherent part of any trade, and if you are entering the market on a sound price action trading strategy, you want to give your edge time to play out, essentially you are interfering with this edge if you move to breakeven as soon as possible. I have personally found that viewing my trades as a win or lose proposition and being totally OK with the loss, is a better way to trade long term, because you will inevitably have some winners that more than make up for your losers, and you don’t want to cut back on these winners through breakeven trades. There are times when moving to breakeven is a good idea; in very volatile markets or if you have pre-planned to trail up your stop in a logical manner like we discussed above.

Getting the Most Out of Each Trade…

The goal of any successful Forex trader is to get the most out of every trade they enter. The way that you give yourself the best chance to get the most out of every trade is by behaving in a logical and consistent manner and pre-planning all aspects of your Forex trade management.

There is a fine line between being a trader who lives in hope and being a trader who accepts the reality of the market by taking what the market offers them. Before you get into a trade you need to ask the question, “how far do I realistically think this market can move before a substantial correction occurs?” Once you master price action trading and learn to read the levels and dynamics in the market, you will be able to make a pretty accurate estimation of the potential of any setup before you enter. And keep in mind you are ALWAYS LESS EMOTIONAL before you enter a trade than at any time during it. So, you have to assume that long-term, you are going to get the most out of every trade by managing it as much as you can before you enter it, rather than trying to manage it “on the fly”.

Listen to the signal and the market conditions; if there’s a price action setup at a clean breakout level or an obvious trend with strong momentum, trailing your stop into a 1 to 4 winner may have its reward. However, in a more congested or range-bound “not-so-sure” market situation, it’s not a good idea to pray and hope, trying to milk every last dollar out of a trade. So you see, there is a certain amount of discretion involved in trade management, it’s most important to read the market conditions before you enter a trade and decide how best to manage the trade at that time while leaving open the possibility of adjusting your exit strategy if any obvious reversal signals occur in the course of the trade or if the market conditions change drastically. However, that said, it’s almost always better to plan everything beforehand and then set and forget your Forex trades. Trading in this way allows you to see how your trading edge plays out over the long-term with no “outside” interference, and it prevents you from trying to force your will on the uncontrollable market. To learn more about Forex trade management, check out my advanced Forex price action trading training here.

You may ALSO be interested in the following lessons …

Thank you so much, Nial!

This article add some useful ideas for my trading approach.

Great explanation, as always)

Thank you so much for this valuable lesson, Coach! This is just the lesson I need to learn right now. You never fail to guide your students in every way!

very good artical, thanks nial

Wonderful

Discipline is the bridge between goals and accomplishments.

Money Management

Place your trade with confidence

know your limits

Everyone can make money from winning trades.

Skill is to make profit from your lossing positions

Always trade to minimum position of your capital. Ratio 100 : 5

you can win and control your losses to winning trades.

God Bless all

this has been some of the best, productive and easiest courses to follow, especially the money management course, and I have taken alot of courses

Very good article! Traders should mainly focus on “averaging in” as this helps to boost your earnings on nice runs. This will make a tremendous difference if done correctly.

Hi, this is ideal need 4 now

Thanks buddy!!

Cheers Nial!

Hey Nial,

Each time I’m looking for some answers as my understanding of concepts improve all I have to to do is browse through past articles to supplement what is in the course. I’m very impressed at how well you have covered all bases of fx trading from a-z! It really is all there on your site, whatever info it is you are looking for just have to go about it in a logical step by step way and have a browse through.

I’m now a paid member of your site now by the way, looking forward to any new content you may have planned on way! (Although you do have it covered pretty well already)

Cheers

Good advice Nial. I’ll try to practice what you’re preaching. Keep the tips coming.

Thanks!

thanks for this advice

This is all so very true. I have interfered in my trades much too often over the last few years and allways paid the price for it; a loss or even. I was so exited to come across Nial’s Price Action Trading Plan and have joined last week. I hope that I can write about positve trades soon. I am determent to learn plenty from Nial and become a clean chart trader. Good trading to all…. Hansjorg

Hi Nial,

Nice tutorial ! Please keep it up

Thanks, Neil. I have 8 and 21 for my setting but never use as trailing stop, this is a good idea as well. Thanks again for sharing as always wonderful articles.

Thanks Nial.

Your articles and lessons greatly influenced and formed my trading and this lesson again rebuked me to realign back to the fundamental “price action” when averaging in and compounding. As always, im grateful to you Mr. Fuller for allocating your time publishing these precious articles.

Thanks,very nice and important article.

Hi Nial,

Thanks for sharing, I think that those articles about “when you are in a trade” or “where to exit” is for me very important.

I have read very much of where and when to get in, so I guess that is the easy part know.

The problem is to know more “how long to hold on to a trade”, or “where to exit it”.

Thanks

Tomson

Tomson, I am glad these article on over trading have helped you.

Another timely lesson. Very choppy market at present and need to set appropriate targets and stick to them.

Its TOPS!!

Thanks for your continued support.

Thanks nial,Im in a gold trade at the moment from last fridays set up and Im just 6 points away from my target,I was only just this morning wondering what to from here,….this article has answered that question and many more,…..thanks.

This is an amazing article! There is so little logical information on this topic. Keep the articles coming, each one helps me become a better trader. Thank you for your continued support!!

yes, nice one nial, stop losses! very serious subject.

The last ¶ is the best :-)

I am about to revisit my trading plan so this is very timley. Thanks Nial.

Hi Nial,

Hope everything is ok.

Another great lesson as usually.

Regards,

Ricardo

Not so sure about averaging out. I’ve done pretty well with this strategy, but you have to tighten your stop every time you hit a profit target. I haven’t ever tried averaging in, so I’ll test it on a demo account.

Thanks for a great lesson!

Patrick

Good stuff,eye opening Nial,keep it up man.

Hi Nial,Thanks for this great lesson for me its a solution to emotional trading. Your teachings and lessons are extremely important as far as becoming a discplined trader is concerned.Always on the look out for these weekly lessons.A big thank you.

Nial !

Thank You so much for all this wonderful content and information. Very kind of you !

Rock on Nial !

Sam

Hi Nial,

Hope you are well. Another fantastic lesson, thank you very much.

Thanks and Regards

Gurpal

“Averaging out (Not A Good Idea In My Opinion)”

I completely agree!! I discovered this a long time ago. Most, if not all, signal providers are doing just exactly that so when they show profits the subscribers might even make a loss!!

An article on signal providers, robots, automated services, strength currency meters, expert advisers….. might be a good idea to stop the victimisation of traders.

:P

good idea Zac

funny thing -ive just been thinking about trailing stops in my price action strategy and then comes Nial with this new lesson. useful as always!

Great artcile Nial… currently in a trade was seeking 1:3 risk reward, got close but never had a trailing stop loss.. now in a loss and thinkg of closing trade… close to my stop loss.

Always good information! A good view of what to do and what not to do!!!

Thanks Nial

Great artilcle Nial on trade management, its great to have an idea when to exit.

Agree Kyle, Nial’s stuff does rock :) I am happy I joined and my trading is improving each week. Go the BLUES (we will win the next one).

Nial your lessons are ‘life changing’ for me. I am now doing much better in my trading and in my life my attitude is positive. Your teachings and lessons are extremely good, this is the best blog around for forex traders, thanks, c you soon.

Joe

Hi nial just the advice I needed right now

Some very good tips and advise in this article

Nial, superb lesson, I FINALLY joined your members group and course and loving it (the content is excellent). Cheers to you and great work :)

Glad to see this article on trade management. I see so many people exiting early on winning trades and losing out on the majority of the move.