Part 3 – How to Become a Pro Trader: Taking Off the ‘Training Wheels’

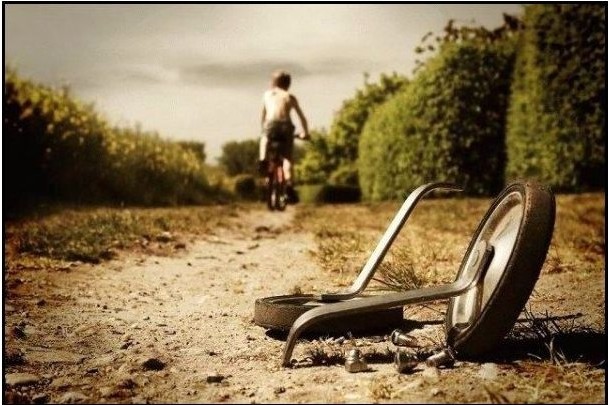

Taking Off the ‘Training Wheels’

Taking Off the ‘Training Wheels’

Last week, in Part 2 of this mini-series we discussed how to test your skills in the market. If you missed Part 2 click here.

Here’s a quick review of the points we covered last week:

Step 4: Creating and using a Forex trading plan

Step 5: Creating and using a Forex trading journal

Step 6: Demo trading your Forex trading strategy

In this week’s lesson we are going to pick up where we left off last week by getting you mentally prepared to “take off the training wheels” of demo trading. Trading with real money is significantly more intense than demo trading, thus it requires that you are aware of and accept the reality of real-money trading before you take the plunge. Most beginning traders simply dive in to the markets head first, risking their hard-earned money with no real plan in place. Hoping that you will somehow “figure it out” on the fly is not a plan; it’s what gambling traders do. Thinking that you will somehow parlay your trading account money into a small fortune within a short amount of time without any plan or strategy in place puts you on a fast-track to failure as a trader.

The truth is that reaching a point where you can honestly trade for a living without having any other job is a result of not trying to get rich quick, and of accepting the reality of what it takes to become a consistently profitable trader and doing those things consistently.

Step 7: Making the jump to live trading – Preparing yourself for the emotions

When you are demo trading the markets you naturally have no emotional problems to battle with, because you have no real money on the line. Thus, many traders do exceptionally well when demo trading only to find that their fake-money success goes out the window when they switch to real-money trading. That’s because there are drastic psychological differences between demo trading and live trading that you need to come to grips with prior to switching to a live account. Here are some points to consider before you begin risking your hard-earned money in the markets:

When you are demo trading the markets you naturally have no emotional problems to battle with, because you have no real money on the line. Thus, many traders do exceptionally well when demo trading only to find that their fake-money success goes out the window when they switch to real-money trading. That’s because there are drastic psychological differences between demo trading and live trading that you need to come to grips with prior to switching to a live account. Here are some points to consider before you begin risking your hard-earned money in the markets:

• How to trade like you did on demo – As I mentioned previously, traders usually do better on demo than they do on live accounts as a result of the fact that there is naturally no emotion in the mix when you aren’t risking real money. While it is certainly easier said than done, what you need to do on your live account is forget about the real money you are risking, here’s how you do this…

• ONLY trade money you are OK with losing – In order to not get emotional while trading with real money you need to never trade with money that you need for anything else in your life, as well as never risk more than you are truly OK with losing. If you can manage to consistently do these two things, you will experience little to no emotion on any one trade. Most traders end up trading with money they really shouldn’t be trading with, or they risk more than they are OK with losing per trade, thus they become emotional.

• Understand you CAN lose on ANY trade – You are much more likely to have a calm and objective trading mindset if you always remember that you can lose on ANY trade you take. Even if you see what you think is a “perfect” price action strategy in a very strong trending market, it can still fail. The truth is that you can never know for sure what is going to happen on any given day in the market, so if you truly accept that and believe it, there is no reason to ever risk more than you are comfortable with losing.

• Don’t get caught-up over-analyzing the markets – If you want to become a professional Forex trader you are going to have to learn how to accurately read and trade off of the daily charts first. Most traders end up taking the opposite approach; they start by trying to trade off of lower time frames like 5 minute or 15 minute charts, and then after they lose enough money they eventually figure out the daily chart is a lot more conducive to trading from a relaxed and objective mindset.

• Not every trading opportunity is created equal – Understand that you shouldn’t stray from your trading edge once you start trading live. You probably traded your edge very consistently on demo, because you didn’t feel any “urge” to make money, try to recapture that same feeling when trading live and forget about the money. Over-trading is a result of feeling “pressure” and greed to trade. The more you feel these emotions the more likely you are to trade when you shouldn’t and thus lose money.

Ultimately, there is a fundamental difference in how amateur traders think vs. how professional traders think. The difference lies mainly in the amateur’s “need” to make money from their trading as well as their inability to trade emotionally undetached from any one trade. Essentially, professional traders do not become emotional from any one trade because they know their success is defined over a large sample of trades, not by one or two. Professional traders also know that the key to keeping the emotional trading demons at bay is to consistently control their risk in the market. Your trading psychology is what dictates how you interact with the market, and this psychology is almost entirely a result of how well you manage your money as you trade.

Step 8: Managing risk effectively – The KEY to successful Forex trading

As I just mentioned, risk management is the “key” to managing your emotions correctly; and thus it is also the key to becoming a successful trader and eventually a professional trader. If you practice proper risk management on every trade, it will make managing your emotions and maintaining the proper trading psychology a very simple task.

As I just mentioned, risk management is the “key” to managing your emotions correctly; and thus it is also the key to becoming a successful trader and eventually a professional trader. If you practice proper risk management on every trade, it will make managing your emotions and maintaining the proper trading psychology a very simple task.

However, most traders do not manage their risk effectively, and as a result they experience huge emotional swings in their trading, as we all as in their equity curves. To avoid the account-destroying emotional trading mistakes that most traders make, there are some specific forex money management guidelines that you can follow:

• Trade with only disposable income – I mentioned this in the previous section, but it’s worth mentioning again because it really is your first line of defense against becoming an emotional trader. If most traders would only take the time to honestly decide how much truly disposable income they have to trade with and ONLY trade with THAT money, there would be a lot more successful traders in the world.

• Understand risk / reward and position sizing – It really is amazing how many traders start risking their hard-earned money in the markets without a thorough understanding of risk reward and position sizing. If you take the time to understand the math behind the power of risk to reward ratios, it will allow you to see that you can actually lose on the majority of your trades and still make money, to learn how this is possible see this article: Case Study – Random Entry & Risk Reward in Forex Trading

Position sizing is equally important, yet many traders seem to have no idea that they can still trade a their ideal risk amount even if they need to place a large stop loss on a trade. I get questions about this everyday; “Nial how can I trade the daily charts with a small account, am I not better off trading the smaller time frames?” The answer is you simply need to reduce your position size down to meet the larger stop requirement of daily chart time frames compared to smaller time frames. There are no advantages to trading 5 minute charts on a small trading account or on any account really.

• Know what your risk-per-trade tolerance is and STICK TO IT – Professional traders know before they enter a trade how much they are going to risk on it and how much they are emotionally OK with risking on it. If you are staying up all night watching your trades, you are risking too much. You should risk an amount that truly allows you to set and forget about each trade you take, because being preoccupied with every trade you take all the time is a sure sign you are risking too much.

• Avoid taking on more risk from adding positions – Some traders like to trade multiple markets at the same time, and they will actually double or triple their normal risk while doing so. This is basically trading account suicide. First off, if you are a shorter-term swing trader like me, you are only in the markets for 1 to 3 days on average, sometimes a bit longer depending on the trade. But, there’s really no reason to be in 5 different trades at the same time unless it’s part of a long-term diversified investment strategy. If you do see a good reason to trade multiple Forex pairs at the same time, make sure you divide up your risk amongst them so that your pre-defined risk tolerance is always maintained.

• Measure risk and reward in dollars, not pips or percentages – If you are still calculating your risk and reward by percentages or pips, you need to stop. Think about it for a minute; if you risk 100 pips on a trade that doesn’t really mean anything because you can trade many different position sizes for that amount of pips. One trader might have $10 at risk on 100 pips and another trader might have $1,000 at risk on 100 pips. Thus, through position sizing, a trader can risk different dollar amounts than another for the same stop distance. So, the point is that you calculate your risk and your reward in terms of “R”, R is the dollar amount you risk per trade. Check out this article later on how to measure your trades in dollars not pips or percentages to learn more.

Finally, as you progress from the early stages of learning your trading strategy, building a trading plan, and demo trading, you will move to the “big leagues” of real money trading. I hope that the points discussed in today’s lesson provided you with some insight to get you ready. In the end, no amount of advice or insight can substitute for real trading experience, but it can help you to accept the realities of trading and let you know what to expect.

In part 4 of this mini-series (click here to view), we discuss trade management and exit strategies. These are probably the two most difficult aspects of trading, so make sure you tune in next week for some solid training on these two very important aspects of becoming a professional Forex trader. If you want more help with making the transition from demo trading to live trading, check out my members’ trading forum. There you will find a genuine group of price action traders all helping each other and discussing potential setups in real-time market conditions, for more information check out my Price Action Trading Course page here. If you have any questions or feedback you can contact me here.

It’s a shame you don’t have a donate button! I’d without a doubt donate to this

superb blog! I guess for now i’ll settle for bookmarking and

adding your RSS feed to my Google account.

I look forward to brand new updates and will talk about this site with my Facebook group.

Talk soon!

Wonderful article. Thanks!

Thank youuuuuu….Nial

Hi Nial

Great tips and advice, really loving this E-SCHOOL

It all makes perfect sense,learn from a pro to trade like a pro or even become one

I’m putting everything into practice so thank you Nial and keep up the good work

Your the best

Tom

I love this input: Understand you CAN lose on ANY trade

thank you

Thanks Nial for your great advice.

Well done Nials great advice.

thanks nial.. great job.

Hey Nial, cheers for another great article. I remember when I first started on a demo I just choose to trade a small amount of fixed dollars on each trade as I was not aiming to make money but to show consistancy in sticking to my plan. The end result is that I ended up with more profits. I took this same mentality over to live trading and risked just a very small amount on each trade, I was able to trade EXACTLY the same way and didnt see or feel anything different from how I traded on the demo. It was a great feeling and knew instantly that all new traders need to risk only an amount that they are detatched from. As I started to increase this amount I had gotten so used to it gradually that I was DESENSITISED to it. Apart from haveing a solid trading plan and sticking to it and correct money management, risk/reward. The detatchment from the money is the real silver bullet for trading for me and trading is well and truly stress free for me now.

Hi Nial,

“Most traders end up taking the opposite approach; they start by trying to trade off of lower time frames like 5 minute or 15 minute charts, and then after they lose enough money they eventually figure out the daily chart is a lot more conducive to trading from a relaxed and objective mindset”. Absolutely true and may be this is why 95% of the traders lose. Brilliant article and can’t wait to read the others.

Keep up the good work.

Regards

Thank you Nial l have been reading your article for a while now, l mean you re doing a good job keep it on. thank you

Thx for great articles Nial this is really the way to become a professional trader, all your lessons makes a lot of sense.

Thx again Nial

hi

thank you for this great post, soon I’ll be a pro trader thanks to your advice.

Awesome! Several time i’ve read this part. enjoying the series. After the end of each episode eagerly waiting for next…Thanks

many many thanks for this.

Thank Nial, this help me cut down my losses in $$$. cheers!

Best,

Ivan

Thanks Nial

Cheers

Thank you Again.

Your articles are just like affirmations.

Yes we need these all the time.

Good day

Thank You Nial, Very hit the point. Can’t wait for next…

good stuff Nial:)

Thank you Nial, looking forward to the next part.

Cheers

Tomson from Sweden

Very nice article, I think this miniseries is just great!! As Nial mentioned before, there is a lot of things we have to think about to know if we really have what it takes to become a professional trader!

I´m working on these steps, and I think I´m doing it well enough…cant wait for the Part 4.

Thanks for the lesson Nial

My great ‘Professor’, I really appreciate all your efforts in bringing this valuable lessons to us with the accompanying descriptive pictures.

great regards to your wonderful wife and nice kid.

Thank you Nial.

Another beautiful lesson Nial.

Thanks for your input.

Excellent article, thank Nial for that!

Best regards.

Pham

very very excellent advice to me.you are my god.

Great lessons and excellent advice…million thanks Nial!

Regards

Rashid

What if my broker only allows my lot size to be changed to the nearest 1,000. Should I just round down so that I am risking less than my allowable risk limit per trade? Thanks!

Really enjoying the series Nial! I’m just on the verge of moving to live trading after being profitable the last 4 months straight. Keep the advice coming!

Brilliant advice, keep it coming

Excellent Advice as always!

Keep it coming Nial!

Warm Regards,

Roger

great lessons to make great traders. thumbs fuller for the series of lessons. make more profits!!!