Pin Bar Forex Trading Strategy – Pin Bar Definition

An Introduction To The Pin Bar Forex Trading Strategy and How to Trade It Effectively…

An Introduction To The Pin Bar Forex Trading Strategy and How to Trade It Effectively…

The pin bar formation is a price action reversal pattern that shows that a certain level or price point in the market was rejected. Once familiarized with the pin bar formation, it is apparent from looking at any price chart just how profitable this pattern can be. Let’s go over exactly what a pin bar formation is and how you can take advantage of the pin bar strategy in the context of varying market conditions.

What is a Pin Bar?

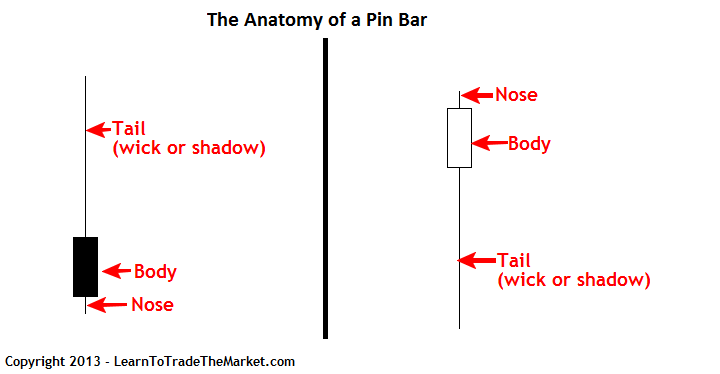

The actual pin bar itself is a bar with a long upper or lower “tail”, “wick” or “shadow” and a much smaller “body” or “real body”, you can find pin bars on any stripped-down, “naked” bar chart or candlestick chart. We use candlestick charts because they show the price action the clearest and are the most popular charts amongst professional traders. Many traders prefer the candlestick version over standard bar charts because it is generally regarded as a better visual representation of price action.

Characteristics of the Pin Bar Formation

• The pin bar should have a long upper or lower tail…the tail is also sometimes called the “wick” or the “shadow”…they all mean the same thing. It’s the “pointy” part of the pin bar that literally looks like a “tail” and that shows rejection or false break of a level.

• The area between the open and close of the pin bar is called the “body” or “real body”. It is typically colored white or another light color when the close was higher than the open and black or another dark color when the close was lower than the open.

• The open and close of the pin bar should be very close together or equal (same price), the closer the better.

• The open and close of the pin bar are near one end of the bar, the closer to the end the better.

• The shadow or tail of the pin bar sticks out (protrudes) from the surrounding price bars, the longer the tail of the pin bar the better.

• A general “rule of thumb” is that you want to see the pin bar tail be two/thirds the total pin bar length or more and the rest of the pin bar should be one/third the total pin bar length or less.

• The end opposite the tail is sometimes referred to as the “nose”

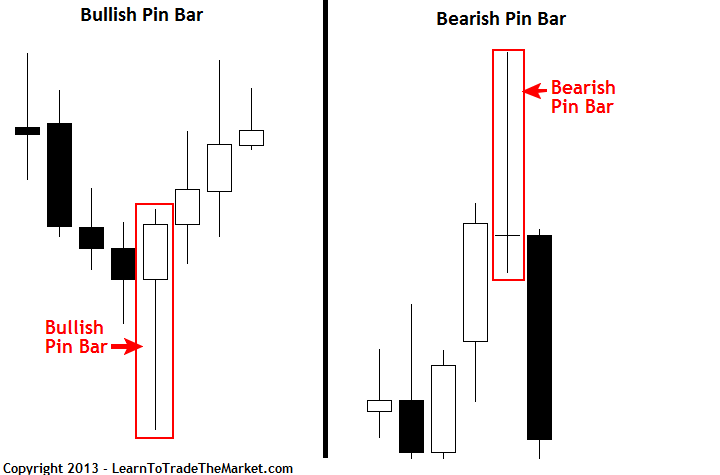

Bullish Reversal Pin Bar Formation

In a bullish pin bar reversal setup, the pin bar’s tail points down because it shows rejection of lower prices or a level of support. This setup very often leads to a rise in price.

Bearish Reversal Pin Bar Formation

In a bearish pin bar reversal setup, the pin bar’s tail points up because it shows rejection of higher prices or a level of resistance. This setup very often leads to a drop in price.

How to Trade a Pin Bar Formation

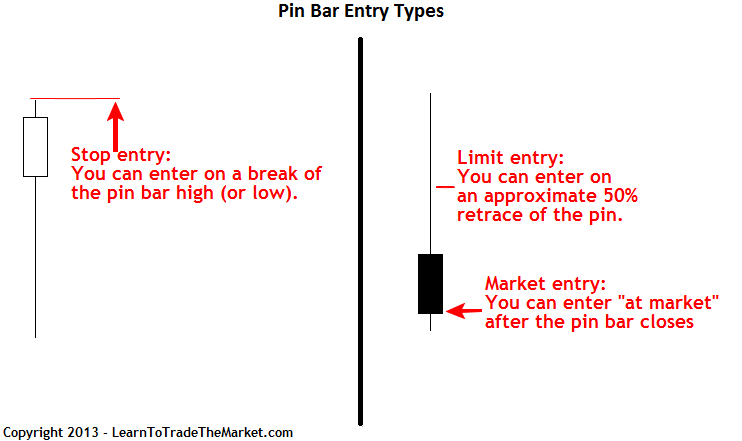

The pin bar formation is a reversal setup, and we have a few different entry possibilities for it:

“At market entry” – This means you place a “market” order which gets filled immediately after you place it, at the best “market price”. A bullish pin would get a “buy market” order and a bearish pin a “sell market” order.

“On stop entry” – This means you place a stop entry at the level you want to enter the market. The market needs to move up into your buy stop or down into your sell stop to trigger it. It’s important to note that a sell stop order must be under the current market price, including the spread, and a buy stop order must be above the current market price, including the spread. If you need more help on these “jargon” words checkout my free beginners forex course for more.

On a bullish pin bar formation, we will typically buy on a break of the high of the pin bar and set our stop loss 1 pip below the low of the tail of the pin bar. On a bearish pin bar formation, we will typically sell on a break of the low of the pin bar and place a stop loss 1 pip above the tail of the pin bar. There are other stop loss placements for my various setups taught in my advanced price action course.

“Limit entry” – This entry must be placed above the current market price for a sell and below the current market price for a buy. The basic idea is that some pin bars will retrace to around 50% of the tail, so we can look to enter there with a limit order. This provides a tight stop loss with our stop loss just above or below the pin bar high or low and a large potential risk reward on the trade as a result.

To effectively trade the pin bar formation you need to first make sure it is well-defined, (see pin bar characteristics listed at the top of this tutorial). Not all pin bar formations are created equal; it pays to only take the pin bar formations that meet the above characteristics.

Next, try to only take take pin bars that are displaying confluence with another factor. Generally, pin bars taken with the dominant daily chart trend are the most accurate. However, there are many profitable pin bars that often occur in range-bound markets or at major market turning points as well. Examples of “factors of confluence” include but are not limited to: strong support and resistance levels, Fibonacci 50% retracement levels, or moving averages.

How to trade pin bars from key chart levels

Trading Pin Bar Signals with Support and Resistance Confirmation, is perhaps one of the most effective ways to trade forex, if not thee most effective way to trade. Below, we will show some examples of trading pin bars from key levels. Follow along closely because this is likely to be one of the most powerful Forex trading strategies you will ever learn.

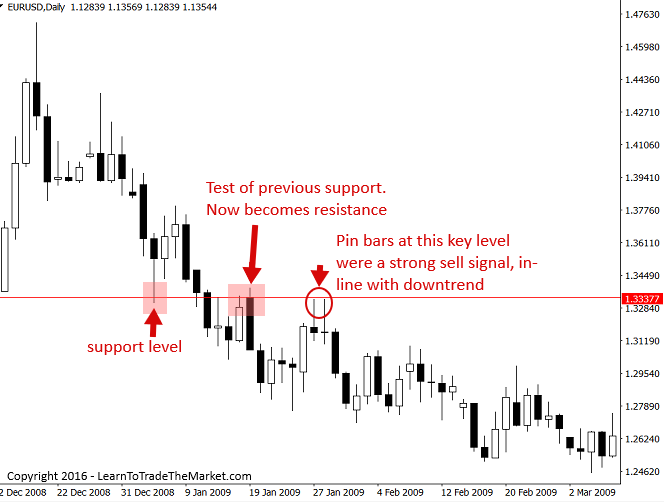

Pin bars are one of the most valuable tools that price action traders have in their Forex trading arsenal. They often form at major market turning points, correction levels, or within a trend as continuation signals. When combined with a strong support or resistance level, pin bars can be one of the most accurate trading signals available. The best pin bar setups occur near confluent levels of previous price action as the market moves in one direction and then regresses back to re-test a previous support or resistance level. We can see in this daily chart of EUR/USD two successive pin bars testing a previous support and resistance level and then resuming downward movement

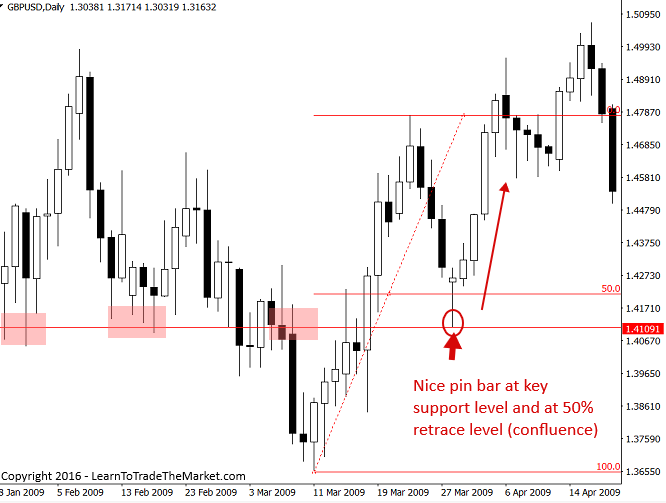

Pin bars occur in all market conditions; up trends, down trends, and range bound. The beauty of price action analysis is that it teaches you how to analyze market movement based on inherently generated data; namely price data. Reversal bars taken at confluent levels can act as a map to long-term profits in the forex market. Trader’s can design a highly profitable trading method entirely around pin bars if they so desire. The more confluence added to a pin bar formation the more accurate it becomes. We can see in this daily chart of GBP/USD below a beautiful pin far formed at a previous support/resistance level with the up trend and also at a Fibonacci 50% retrace level. The more confluence you can combine with a pin bar signal the higher its accuracy becomes.

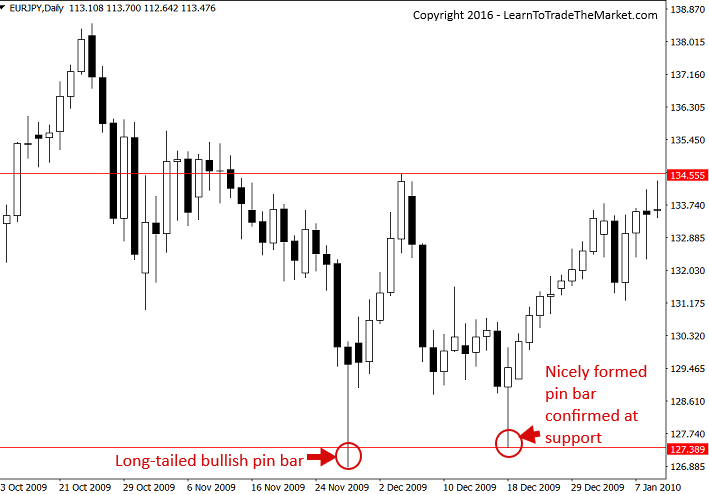

Pin bars are adaptable to ever-changing forex market conditions and can be very profitable even in ranging markets. They can be very accurate if the formation is clear and obvious and combined with solid support or resistance confirmation. We can see in the daily chart of EUR/JPY below two very well formed counter-trend pin bars that formed off support in a range bound market that netted some serious gains for traders with a keen eye for price action analysis. Pin bars of this clarity and magnitude can be entered after the close on a market order.

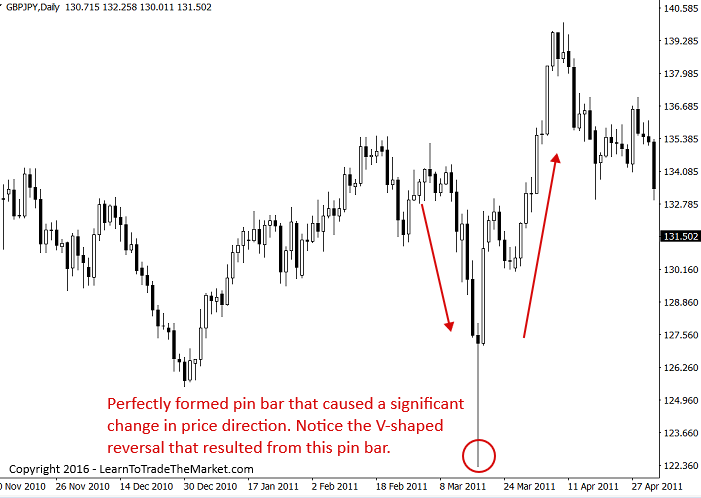

Pin bars can be taken at major market turning points counter-trend if they are very well formed. Often times long-term trend changes are set off by large pin bars that can result in some serious gains for traders aware of the potential. The daily GBP/JPY chart below demonstrates how a large, well formed pin bar can tip off traders to longer-term changes in trend direction. Often times trend changes will occur rapidly and form what is called a “V” bottom with the bottom bar being a pin bar.

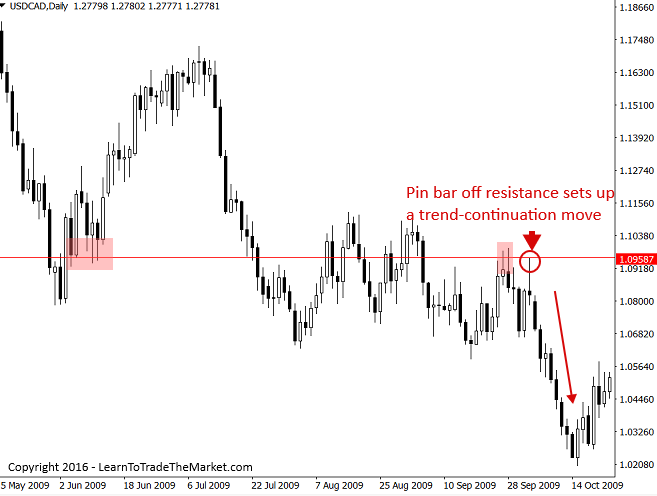

When pin bars form at the top or bottom of a consolidating market that is taking a breather after a large directional movement they can often signal trend resumption is near. In the daily chart of USD/CAD below we can see multiple pin bars formed at the top of a range bound market that was most recently in a large down trend. The last pin bar on the right side of the chart set off a very powerful move that resulted in a breakout of the range and subsequent downward trend resumption.

pin bar reversals are a great price action tool that forex traders can use in all market conditions. They are best played at confluent levels with strong support and resistance confirmation. Pin bars taken with the dominant daily trend are generally more accurate than counter trend pins. However, counter trend pins can set off long-term directional bias changes that can mean serious cash for traders with a trained eye. Pin bars work great at the tops and bottoms of range-bound markets and provide very accurate setups in these conditions.

Examples of the Pin Bar Formation in Action

Here is a daily chart of CAD/JPY, we can see numerous pin bar formations that were very well defined and worked out very nicely. Note how all the pin bar’s tails clearly protruded from the surrounding price action, showing a defined “rejection” of lower prices. All of the pin bars below have something in common that we just discussed, can you guess what it is?

If you said that all the pin bars in the above chart are “bullish pin bar setups”, then you answered the question right. Good job!

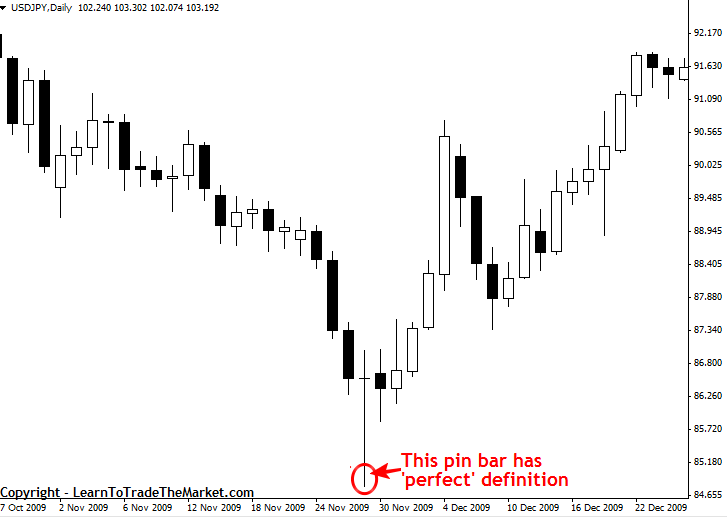

In the following daily USD/JPY chart we can see an ideal pin bar formation that resulted in a serious move and trend reversal. Sometimes pin bars like this form at significant market turning points and change the trend very quickly, like we see below. The example in the chart below is also sometimes called a “V bottom reversal”, because the reversal is so sharp it literally looks a V…

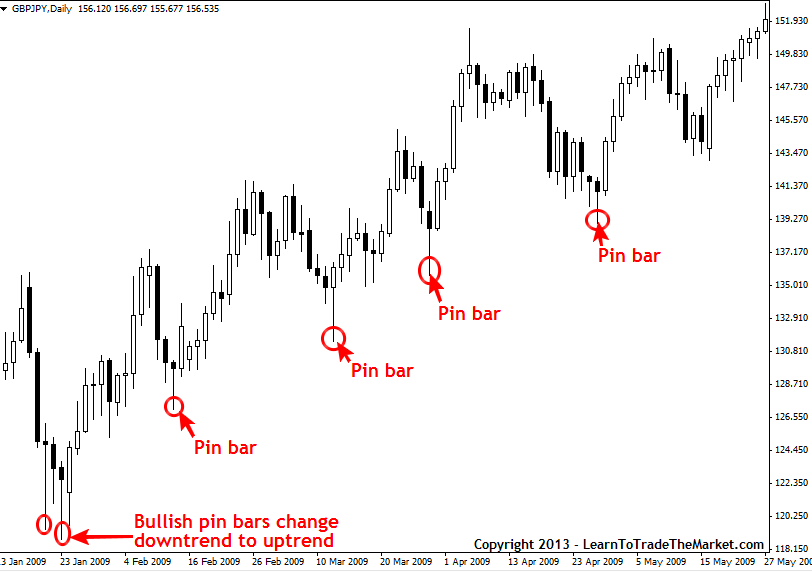

Here is an example of a trending market that formed numerous profitable pin bar setups. The following daily chart of GBP/JPY shows that pin bars taken with the dominant trend can be very accurate. Note the two pin bars on the far left of the chart that marked the start of the uptrend and then as the trend progressed we had numerous high-probability opportunities to buy into it from the bullish pin bars shown below that were in-line with the uptrend.

Pin bar in range-bound market and at important market turning point (trend change):

In the chart example below, we can see a bearish pin bar sell signal that formed at a key level of resistance in the EURUSD. This was a good pin bar because it’s tail was clearly protruding up through the key resistance and from the surrounding price action, indicating that a strong rejection as well as false-break of an important resistance had taken place. Thus, there was a high probability of a move lower after that pin bar. Note the 50% limit sell entry that presented itself as the next bar retraced to about 50% of the pin bar’s length before the market fell significantly lower…

Pin bar in-line with trend with multiple factors of confluence:

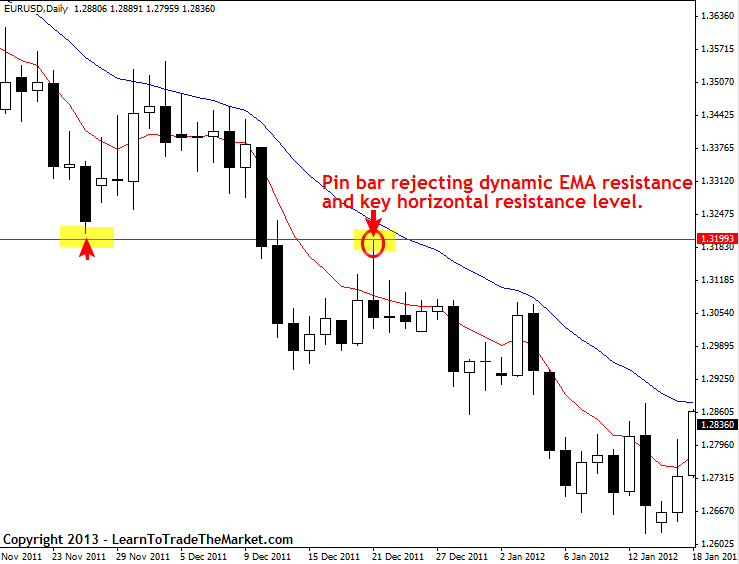

In the chart example below, we are looking at a bearish pin bar sell signal that formed in the context of a down-trending market and from a confluent area in the market. The confluence between the 8 / 21 dynamic EMA resistance layer, the horizontal resistance at 1.3200 and the downtrend, gave a lot of “weight” to the pin bar signal. When we get a well-defined pin bar like this, that has formed at a confluent area or level in the market like this, it’s a very high-probability setup…

Other names you might find pin bars described by:

There are several different names used in ‘classic’ Japanese candlestick patterns that refer to what are basically all pin bars, the terminology is just a little different. The following all qualify as pin bars and can be traded as I’ve described above:

• A bearish reversal or top reversal pin bar formation can be called a “long wicked inverted hammer”, “long wicked doji”, “long wicked gravestone”, or “shooting star”.

• A bullish reversal or bottom reversal pin bar formation can be called a “long wicked hammer”, “long wicked doji”, or “long wicked dragonfly”.

In Summary

The pin bar formation is a very valuable tool in your arsenal of Forex price action trading strategies. The best pin bar strategies occur with a confluence of signals such as support and resistance levels, dominant trend confirmation, or other ‘confirming’ factors. Look for well formed pin bar setups that meet all the characteristics listed in this tutorial and don’t take any that you don’t feel particularly confident about.

Pin bars work on all time frames but are especially powerful on the 1 hour, 4hour and daily chart time frames. It is possible to make consistent profits by only trading the pin bar formation, and you can learn more about it in my price action trading course. Upon adding this powerful setup as one of your main Forex trading strategies, you will wonder how you ever traded without it.

Thankyou Nial,

I never realised how powerful the pin bar was!

I’ve just seen a trade opening, pin bar, resistance level and trend confluence.

Will try tomorrow.

Thanks so much for such an adorable teaching .

Thanks so much for such an adorable teaching 🙏

Thank you very much for sharing this tutorial with me and I believe it can be a weapon to deal with the market

best one thanx sir you are very good as usual

I can’t be grateful enough for this tutorial. You have exposed me to a tool I’ve long overlooked.

Much app6.

Thanks

Where should I place my target profit line?

Hi

Great stuff, simple and clear to follow.

Thank you.

Great exposition 🙏👍✍️

I like ur article mr nial.(the simple the better) yes u are right

Very helpful article, tnq one million

Very clear strategy I think this is what I need to start a live account I think I will be ready very soon and thanks a lot to your powerful strategies

Something happened to me recently after I came back to study for revision about candlestick and support and resistance on this site, and I as well went straight to watch a video that Nial did on support and resistance, lo and behold, my trading level drastically changed. I’m now trading with ease and confidence. Thanks, Nial for this great work. If one clings to the way Nial draws support and resistance levels on the market chart, life would become so much easier for the person. Thanks so much, Nial. God bless you superabundantly.

Pretty good

Thanks for the insight ????????

Nail the great! you deserve more than that I will re-read it until it gets on my figure tips

this is great information sir…it is easy to understand …

wonderfull and very clear. simple and very perfect with pin bar strategy.

time to make money now. thanks alot

Thank you Sir, great contant simple and easy to understand

Great one, really appreciate u for this great information on price action on pin bar.

This is a masterpiece! Every new fx trader must not afford to miss reading price action guide before delving into trading.

Thank you Indefatigable campaigner of our time!!

Good article! Thanks

I never get bored in reading the Pin Bar whenever I get time to do so…

I suggest you change the title and let’s call it “#The Power of Pin Bar Trading Strategy#????????????????

It’s a great article Nial…

One request pal… please come with an article on Fibonacci.

Thanks brother…

My name is Mr. Ochiamu Ezekiel Akunna from Nigeria. To be frank speaking, I have learnt the most profitable tools in trading Forex through your wonderful secret revelation. Mr. Nial Fuller, all your books are very excellent. Thank you very much Sir.

God bless you.

Honestly, just as according to your honest explanations, looking only on a bare price chart without indicators reveals the hidden buy/sell signals, making the chart and FX trading neat and simple, your sincere tutorial makes it obvious that you have a clean and simple mind. Your sincerity inevitably makes you trustworthy. Thaaaaanks! Mr. Fuller this is great.

Very helpful information.

I took a second wind, I saw the light.

Mr Nial, you are really a great teacher .Thank you very much .

Excellent article Mr. Nial! Thanks for a lesson!

Great strategy. thanks for the information

Well written and very clear explanation. A pleasure to read it.

Very convincing but I would like to know how you arrive at support levels and also I think the time elapsed is important and I could not follow that.

Actually am new in forex but with a little study i go through these Pin bar, i love it. Great teaching fom Nial, God bless you especially for beginners like me, thanks

Nial Fuller, you are great, greater than George Soros,stronger than jesse Livermore heavier than Ed seykota , you are the price action Emeritus of our time. I read your article on pin bar strategy and the second day i saw the pin bar on daily chart ,it came in form of Hammer confluent with support level on a down trend 20/07/2018 Gbpusd Daily ,it moves for sraight twelve hours smoothly , no pull back from 9am nigerian time , european session till 8pm nigerian time , new york session , two hours before new york close. the pin bar was very effective, i didn’t know the inportance until i read your article. Thank s.

Humbled by your comments, but I can’t say I am greater than these Legend traders.

I noticed how powerful these pin bars are also on the weekly timeframe. Thanks Nial.

Excellent piece of info…i have no idea what I have been doing without knowledge of this….I see the picture now.

Very well explained..thank you very much

Thank you Nail your Trading Course is full of detail. Just one chapter when practiced can change the quality of life of an individual.

Wow you have made me very happy today. Even as a young trader I have quickly realize that the best way to trade the market is by price action. This bin bar strategy as confirm my belief. I think this bin bar strategy would be vary effective when use with trend line and channel line.

Thank you very much.

I never thought that trading can be learnt…. i used to think it is just gambling…. but after reading this articles. I changed my opinion on that… thanq … nial fuller sir

all i want say thank you so much for this course only had tow day reading but change my live totally after 8 years losing money

Thank you dear Sir

you are really unique person in teaching forex trading in simple way, Thankx a lot

Many thanks. I will use this pinbar tactic with my EMA indicator.

m very excited about the pin bar trading strategy …your teaching is very simply with exceptional clarity. I see possibilities all the way, im so enlightened and excited about trading forex. Words are not enough to express my gratitude Sir. Tnx a lot.

BIG UP MR FULLER ,HELP FULL STAFF ALL THE TIME …

We all owe u a sincere appreciation u are an angel on wall street

very good So simple and clear explanation about the pin bar

What set up do you typically find the most profitable – the pin bar, inside bar or the fakey? You enter half way through a pin bar at the next candle, right? I noticed some people enter below for shorts (or above for longs). I suppose entering half way would enable smaller stops.

Mr Fuller, I have to say thank you for making this newbie experience so exciting and interesting. You are honest, sometimes it hurts a bit but truly it is very eye-opening. I have been reading your articles for a few weeks now but I am learning so much already and each article is encouraging and extremely informative! Patience. Patience. Patience. Thank you Mr… I look forward to this journey.

Helo Nial,i appreciate your kind generousity. i can now trade successfully.

Thanks for shaving a lot of time off of the learning curve. Great info.

Thanks nial,very well define on pin bar for price action strategy. This is a great signal for

entry.

razif

Hi Nail,

I am a newbee to forex investing, i am at the point of gathering information to make sence of the whole forex trading. i have researched several web based free tutorials and you tube videos and i must say i almost gave up until i came across your website. I must say you are the Guru. i feel so blessed to stumble upon your website whiles searching. Your website is finally the end of my searching for information. Your begginers trainig guide is so easy and simply to understand and i love the way you presented the ideas in topics. It makes so much sence as i go along. I can’t wait to read all the chapters and sign up for the lifetime membership. May God continue to guide and protect you and give you more Knowledge and wisdom. You are indeed a great teacher.

I cud have not learnt FOREX without u, Ur a genious and also unbiased, giving the details too in free website….

God bless u in abundance…… Ur the best Web Teacher

Thanks Nial, I like your way of explaining the strategy, quite easy to understand.

Thanks a lot.

You have given much to the society, your article had made me wiser than my teachers in forex,nail thank you.

Very good article

Hi Nial,

Another very good article to learn from in your clear concise format.

Thank You.

Hi Nial

You have done a great job in explaining the Pin Bar.

Thanks.

Noshee

Nice info man, it helps a lot!

Nial Fuller, you are truly a meticulous ,unselfish ,an Authority in Forex Trading Market ! Truly no one I mean no One has ever made Forex Trading so real and original as you,ve done on your explicit explanation solely on the use of “PIN BAR FORMATION AS A GENUINE AND RELIABLE STRATEGY TO AWAIT BEFORE ENTERING A PROFITABLE TRADE HENCEFORTH”

More grease to your elbow NIAL !! Looking forward to read more of your publications on my Email.

Thanks.Dr Isaac A A

.

Nial, your lecture on pin-bar strategy lecture is very unique and self explanatory. It gave me insight to how those

candle sticks works. thanks . God bless you Nial

like the topic, very helpful

stuffs we overlook….thanks man

Brilliant! I have seen manifestations of these ideas

Wow thanks i m gonna learn pinbar price action

Good tutorials and explained very good. Will keep coming back to this website. Particularly interested in trading on pin bar formations

Thank you so much sir for a lot of the tutorials and advices like this.

You have helped a lot of traders out there who are interested in price action.

This is great!recently i found this site which is good too.I tried and make some money with forex and getting very interested about forex now!

Very well explained. After reading about half a dozen books and watching countless videos about different forex systems , methods and strategies , I have come to conclusion that pure price action is the way to go when trading forex and will be enrolling in your course. Good job Nial..

thank you very much I will learn as much as I can

Sir, I have a huge respect for you, you are the most kind n intellectual person I have ever seen :)

thanks so much for lecture,am grateful,

how can one spot the direction of the third candlestick since it will always form after the pin bar?

what should be the size of the wick of a candle compared to the body of a candle to consider it as a good pin bar.

(Wick:Body)

OMGost!!! i love you so much! the greatest information i had ever found in the wide web world! excellent perfect job u had did :) easy to understand even for a novice like me!

Excellent

WOW! Today is my FIRST DAY as a member; as I read & study Price action w/ the pin bars and Confluence, I am identifying Pin Bars in the AUDUSD 240min live chart. What an amazing technique. Thank you.

Thank you very simple explanation.

What broker do you use? As a 24 hour market it is not easy to get proper bar/candles on Forex. Is there a broker whose platform shows candles begining at Asian session and closing at the close of US session?

Thanks, Nial.

sure!

this is one of the best lesson i have received as a trader

Wow! So simple and clear explanation about the pin bar formation.

I can tell that this is one of the best article you can find about the price action trading strategy.

love it!

this artical is realy good and gain full for knowledge

A very good article for newbies like me.

Lot of thanx.

well written , i manage to get some info about pin bar formation, thanks for this article

Awesome article. I love how easy you’re making all these lessons. I had a hard time when I was first interested in forex trading, enough to run away from ever trading. But now, I’m thinking of at least opening up a demo account and testing out these skills!

thanks a million for the knowledge.keep the good work up.

well lve never come across any vivid explanatory seminar or webinar like dis even d one i pay for therefore i will give it a trial to know if d method is still effective if so u will ever be my Mentor and my Guru thanks for d shared kwnollege. looking forward to ur e mail

very very very good tutorial about pinochhio bar in detail with examples.u r doing a noble work,keep it cotinue……thanx

Excellent article. In a flash back of my mind I clearly remember the number of pinbars formed just in front of me but I missed them by staring at them ‘cos I could not read them.

Am happy to come across this post am now becoming expert thanks

this is very useful , thank you

hi Nial,you are doing an amazing job with this blog-site…your grasp of price action is unparalleled……see you soon …..cheers

Thanks Nial for this strategy

Thanks a lot Nial, you are definitively become my Mentor :-)

Thanks for so powerfull teaching whit pin s bars .I want to know where i can read your answerd to all the questionr you receive? william.

wow……. nail.

you are the man, how much do i give in return for this tutorial that has made me millioniar.

once again thanks a million times.

Nial

Thanks for all your tips. Your professionalism and knowledge will serve the trading community well. With all the comments I’ve read your mentoring is most appreciated! I look forward to your e-mails…

Nial,

Thanks to you and your fine course it’s (Price-Action)working! Trading nickels and dimes on my micro acct and now up over $90 cum profit.

This ol (72 yrs)ex-18 wheeler is becoming one proud and appreciative trader. Thanks again! Larry

Great!! In fact, they are littered everywhere on the chart platforms. And that’s a nice and profitable discovery, thanks. Keep ’em coming.

nial,

though am still a newbie in forex and those around me have told me not to look for any indicator setup but instead learn to trade using price action and i can say that your site is still the one that i know that has done justice to that. your articles have really helped me to fine tune myself. cant wait to become your full member though this will take sone time as am still trying to put the money together.

thanks for the free info again on your site that people rarely finds out there

Thank you very much Nial Fuller. I am new in forex trading. I will make full use of this course and tips given by you.

Thanks again.

Sebastian

Thank you very much Nial Fuller,

Question please…,

Rregarding the setup or the entry point, you told us to entr the trade as soon as we break or exceede the HIGH price or the LOW price of the Pin Bar….we will sell on a break of the low of the pin bar or buy on a break of the high of the pin bar.

We see the third bar already breaks that point above or below, but it is still on the way to be formed, not completed yet….

Shall we pull the trigger as soon as it ocurrs -I mean BREAK- or wait till the third bar is actually formed?

Kindly feed me back if possible…!

Thank again

Ismail Abdul-Aziz, Egypt

Nial,

This new member recently emailed you for guidance (structure) on how to best use the provided course materials. Your email response was fast, detailed and specific. You (100%)delivered. Wish more businesses were like this!!!!

Thanks again – Larry

thanks a $illion nail. may god continue to bless u

Thank you so much. Many time, I wonder about pin bar. I don’t know about it well. How to trade with pin bar set up,so far I know about pin bar . I appreciate for that.

an eye opener for someone who always tried to use indicators

I tried this method and I made a nice little profit . Thanks Nial

Nial,

Thanks for the article.

Do you find the pin-bars on the hourly work as good on a 4 hourly and daily charts ?

Many thanks for this.

Time to practice :-)

I am impressed with your knowledge of the forex market and your clear explanations of price action. I am a new trader that has decided to focus on the forex market. I promised myself not to waste anymore money on information and schools but I am close to making an exception for you. I realize that I must have a mentor that knows what he is doing. I have lost approx. 20% of my account in 6 months, going through the usual “hard knocks” every trader goes through. I usually learn things the hard way. I am determined to become a profitable trader. Recently, I took the “extreme ” step of taking myself out of the market and only trading on the simulator of my Trade Station account.

you are really the first person to make sence at all with a definate strategy man…….

thank you very much SIR!!!!!!

josh

south africa

I just started trading the pinbar after reading about it on this site. Its true what the article above says; ‘you will wonder how you ever traded without it’ I cant believe how my view of price action has changed so fast since looking at the higher time frames and a few powerful price paterns.

I’ve always been wondering what a pin bar is. Finally now I have a clear picture of what it is and understand how to benefit from it. Thanks Nial!

Thanks for the article in pin bar set. I begin to see more clearly the price action and begin to make more pips now. Thanks again

your simplistic and genuine approach to exposing this important technique in trading forex is quite commendable. the fact that you did not ask for money before giving this out goes a long way to highlight your sincerity in turning most of us traders who have been gambling for too long into profitable traders. you seem to have a lot of good stuffs embeded in you. i am going to be an ardent follower to you. thanks so much

Price action rocks!! am a lot more confident about my trades and profitable! Thank you Nial;-)

This is fantastic. Very easy to undersatand. Thank you

nice lessons,simple but great explanation with clearly examples.

best and simple explanation with good examples.

You’re God sent,i have toiling for months to learn what you gave us on platter of gold,more grease to your efforts.All your articles that i’ve read are true and sincere.

Thanks

The price range of the “pin bar” being within the price range of bar one and bar two or close has a strong bearing in my future observations “On the search for Pin Bars”.

hi,i’m new to this method but i find it so impressive,simple&easy to understand without using those “complicated” indicator,starting to like it,no…Love It!thanks bro!

Very nice and clear concept Nial….

nice job bro

i am going for your course

I am impressed with your knowledge of the forex market and your clear explanations of price action. I am a new trader that has decided to focus on the forex market. I promised myself not to waste anymore money on information and schools but I am close to making an exception for you. I realize that I must have a mentor that knows what he is doing. I have lost approx. 20% of my account in 6 months, going through the usual “hard knocks” every trader goes through. I usually learn things the hard way. I am determined to become a profitable trader. Recently, I took the “extreme ” step of taking myself out of the market and only trading on the simulator of my Trade Station account.

Hi Nial,

Im just heard this trading with price action ..wow! After reading this, i can’t believe its that simple..ill try it first in my trading and..wait the result next week, month…

thank for the knowledges… 1 thumbs up!!!

Hello Nial, though I am very newbie to forex I really understand your tutorial very well. It is clearly explained and it met all the points. Once again thanks for your tutorial.

Hi Nial,

Thanks for sharing, it’s a very clear and potential good strategy to look everytime.

Have a nice day…

Carlos

Nial,

Very clear explanation of the strategy. Thanks you for sharing this with us.

God bless you

Nial

Very good layout and very well explained. You da MAN !!

Thanks for these continued lessons that remind us that all we need is Price Action.

Have a great day !!

Hi Naial,

Thank you for sharing this simple and effective pin bar technical analysis. I am so benefit from it.

Thanks

Chau.N

Thanks Nial,for going into detail on how the pin bar is to be traded.Now to apply it to my new way of trading for me that is. Trading the bigger time frames has put me at ease on trading. It has allowed me to have a plan finally.

Thanks again Larry

Hi

A well-written very clear article on this strategy. I will try and identify it when I next look at a price chart and see how it turns out. I’m not trading yet – still learning.

Keep well

Henry