Pyramid Trading Strategy – How To Turn Small Trades into Huge Trades

“Let your winners run” they always say. Great! But, HOW do I do that? How do I turn small trades into big winners? You’ve probably asked yourself this many times. As great as all these old trading aphorisms are, they do seem a bit vague and don’t really give us any specifics or details on how exactly one accomplishes the wonderful things they imply.

“Let your winners run” they always say. Great! But, HOW do I do that? How do I turn small trades into big winners? You’ve probably asked yourself this many times. As great as all these old trading aphorisms are, they do seem a bit vague and don’t really give us any specifics or details on how exactly one accomplishes the wonderful things they imply.

Today, we are going to discuss how you can turn small trades into big winners, it’s called pyramiding. You’ve probably heard of pyramiding before, generally it tends to have a negative connotation to it, but that’s just because most traders don’t understand how to pyramid properly.

Not every trade is a candidate for pyramiding, in fact most aren’t, but the ones that are can make you a lot of money, quickly. One pyramid trade that nets you a 10 to 1 winner might be the only winning trade you need for three or four months, that’s why it’s so important you understand how to pyramid properly…

Pyramiding: Playing with the market’s money

The main concept to understand behind pyramiding, is that it allows you to ‘play with the market’s money’ because as a trade moves in your favor you trail your stop loss down (or up) to lock in profit when you add another position. This basically means your overall risk on the trade stays the same or decreases as you lock in profit, but your potential profit increases, assuming you do it properly (more on this later).

However, you need to be aware that whilst the upside benefit to pyramiding is large, the risks can also be large if you don’t pyramid properly. If you do not properly trail your stop to keep the overall risk the same or less each time you add a position, you’ll be dangerously cranking up your risk to a level that could blow out your account. Also, since you’ll be trailing your stop loss perhaps tighter than you would on a non-pyramid trade, as the trade moves in your favor it increases the chances of the market snapping back against you and stopping you out of the entire position.

We only try to pyramid into a trade if we are confident that the market is in a strong ‘one way move’ with momentum. It doesn’t have to be a breakout, it just has to be a substantial move that you expect will have strong momentum behind it.

Now that we’ve discussed what it means to ‘play with the markets money’ and the potential risks in pyramiding, let’s talk about how to pyramid properly, so that you can avoid the major risks of pyramiding but still having a chance at large gains…

How to Pyramid into a position properly

The basic concept of pyramiding into a position is that you add to the position as the market moves in your favor. Your stop loss moves up or down (depending on trade direction of course) to lock in profit as you add lots / contracts. This is how you keep your overall risk at 1R whilst increasing your position size on the trade.

Thus, as you add contracts / lots, the potential profit on the trade increases exponentially, whilst initial risk (1R) remains constant. Our hope, as traders in a pyramided position, is that the market won’t then snap back and stop us out before it falls or rises further in our favor.

Think about it like this: The market makes an initial burst in your favor, perhaps to the 1R or 2R reward point, you then add another position whilst trailing the original stop loss on the first position to break even or to 1R to lock in profit. You are still exposed to a 1R risk on the second / pyramided position, but you now have double the position size because your first lot is still live.

Let’s look at an example of what a properly pyramided trade might look like, this will also give you a better idea of the math behind proper pyramiding:

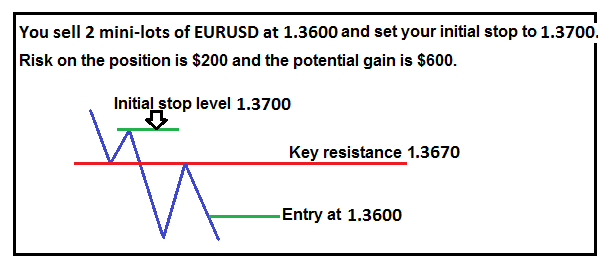

Let’s assume the EURUSD is trending lower like it has been recently. You see a solid pin bar sell signal that formed showing rejection of the 1.3670 resistance level. You decide that since price has respected this level and it’s obviously a key chart level, it’s a good place to set your stop loss just above. So you decide to put your stop loss for the trade at 1.3700, stop loss placement is very important and it’s something you should not take lightly.

Next, there is no obvious / significant support that you can see until about 1.3200, so you decide to aim for a larger profit on this trade and see if the trend won’t run in your favor a bit. Your pre-defined risk on the trade is going to be $200, to keep the math simple let’s say you sold 2 mini-lots at 1.3600; 100 pip stop loss x 2 mini-lots (1 mini-lot = $1 per pip) = $200 risk.

You decide to aim for a risk reward of 1:3 on this trade, so you set your initial target at 1.3300 and you plan on adding two positions to this trade, one when you are up 100 pips and another when you’re up 200 pips. You plan on doing this because the market is trending strongly and you have a strong gut feeling that there’s a good chance the trend will continue without a large pullback.

Here is what your trade looks like at entry:

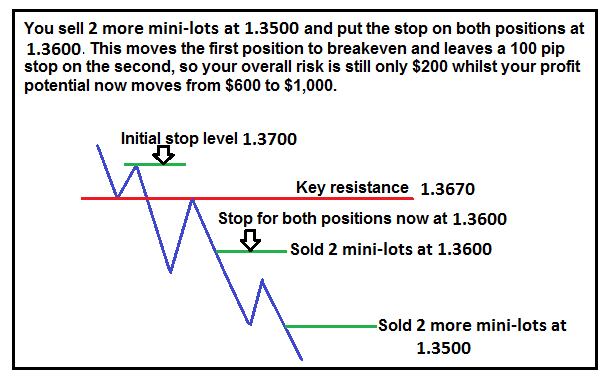

The trade falls in your favor and so you proceed as planned by adding another 2 mini-lots at 1.3500. So, your full position is now 4 mini-lots or $4 per pip, this means your potential reward on the trade is now $1,000 if price hits your target at 1.3300.

Important: Before you enter the second position, you trail down your stop loss on the first one to 1.3600, and that position is now a ‘free trade’ (at breakeven). The stop loss on your second position is also at 1.3600, thus you’re overall risk on both position is still just $200, but remember, you’ve now nearly doubled the potential profit on the trade…

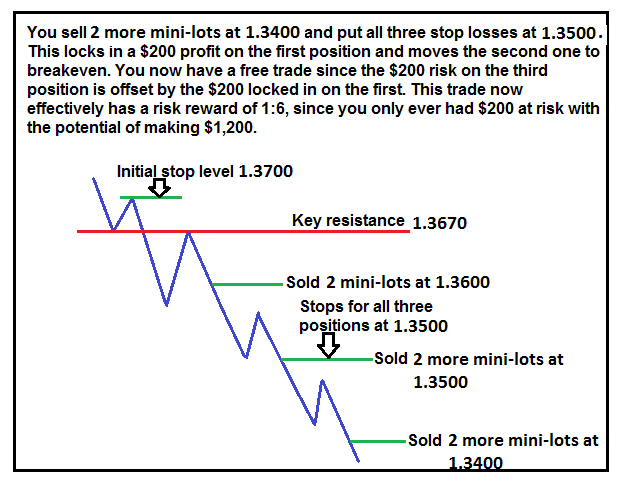

The trade keeps moving in your favor so you decide to add your final position of 2 more mini-lots. You now have a $6 per pip overall position size. You have a potential profit of $1,200, double what it was when you first entered the trade, and the best part is, your overall risk is now at $0…

How’s that possible you’re asking? You’ve trailed down the stop loss on both previous positions to 1.3500, locking in a $200 profit on the first position you entered at 1.3600 and reducing the risk on the second position to breakeven. The $200 profit you locked in on the first position thus offsets the $200 risk you added on the last position, making it a totally ‘free’ trade; that’s how you ‘play with the market’s money’…

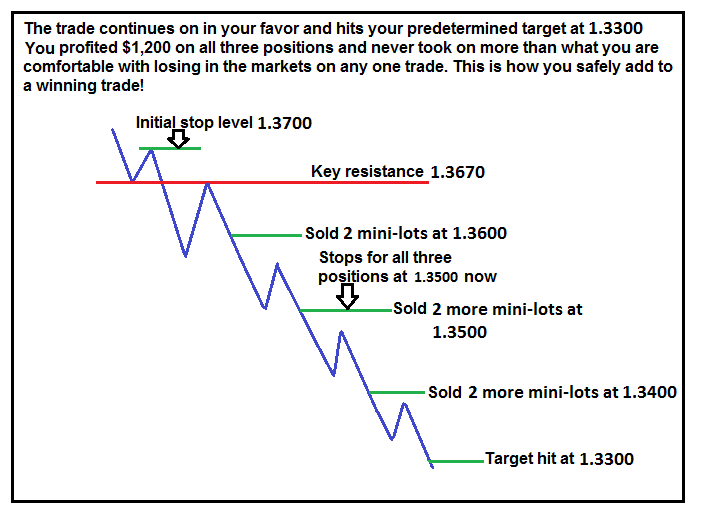

You have yet more good fortune and the trade continues falling and hits your target at 1.3300, all three positions are now closed and you’ve netted 6 times your risk, for a risk : reward of 1:6. You never had more than $200 (1R) at risk at any one time, yet you profited $1,200.

Now you understand how to pyramid your way to profits…

Final thoughts on pyramiding…

In the example above, we used a relatively low risk amount at $200 per trade for example’s sake. But, you can see how quickly pyramiding can build your profits. You have the potential to turn $1,000 risk on a trade into $10,000 in a short span of time, a 10 to 1 winner. These kinds of trades are very possible if you’re trading a clean move, that can be a large single-day move or a large move over the course of a week perhaps.

An important thing to understand is that it does take some experience to know when pyramiding into a trade may be a good idea and when it’s not. You also need to be prepared to get stopped out at breakeven, because when you’re trailing your stop loss down like we discussed above, it doesn’t take a very large retrace to knock you out of all your pyramided positions. But, if you get just one successful pyramided trade every 3 or 4 months, you’ll be doing quite well.

Another important point is to not let greed take over. You need to plan out how many positions you’ll add before you enter and when you will add them, etc. Don’t just totally ‘wing it’, or you’ll end up over-trading and possibly losing money. Each trade is unique and there are no clear and precise rules, but the concept of pyramiding and adding to winners is universal. Just BE SURE you are trailing your stop down (or up) to offset the new risk you acquire each time you add a position, or else you’ll be potentially pyramiding your losses, and you don’t want to do that.

Also, never add to a losing trade, traders often make this mistake and it’s a quick way to blow out your account. If a market is moving in your favor you can add to it as discussed above, but if it is coming back against you and moves back beyond the entries of your earlier positions, you should be getting out or your stop loss should automatically take you out.

I trust you’ve enjoyed today’s lesson on turning small trades into huge trades. To continue learning my various trading strategies and philosophies, checkout my trading course and members area for more information.

Good trading – Nial Fuller

Thank you Nial for your which tells us to make more from winners and cut short the losses.

Hi master really professionzl, technique of sniper and simplicity are Keys of succession,your lessons…for mindset Killer and see thé sound of market….thanks professor.

Reading your articles have greatly improve my Forex trading performance and career. God bless you for posting all your articles.

Thanks sir

I remember my first time successfully pyramiding it was when BoJ intervened and helped break out the uj above 84 and gradually targeted 100 as many predicted due to BoJ saying a satisfactory exchange rate being 100-105. This was truly easy money for those that payed attention to the new events and hints.

I read more than once this article just to anchor in my mind that I think the base of pyramiding is back to the art of risk management.

Thank you for obvious and great article always.

THANK U GUYZ

Thank you very much for precious advice’s for discouraged traders like us. …. Now… Reborn…..

all i can say is

woooowww…!!!!!!

This is more than a million dollar. Thank you

Thank you Nial for making things so clear.

Your ideas are logical and make a lot of sense.

Good Hunting

Fantastic Article,

has helped me out a ton

Thank you Nial

Superb article Nial. There isn’t enough in regards to this subject over the internet. It is rather tricky to be aware of when to increase and working with a clear signal/method is helpful. I obtain I’m a bit too timid at this point but am wanting to add just once early for and There’s no doubt that this do the account actually. Maybe working with price measures or alternatively a chance of your trendline for a lower period of time.

Great article, Jessie Livermore used pyramiding and talked about how profitable it could be if used properly, I definitely want to learn this.

Thanks for this lession

good one !!!

This is really … really good lesson. I believe that Nial is very profesional in Forex Trading. Another lesson that is great is ” How to catch the Big Move in the market “. This are the lessons for profesional traders. Great Nial ….. !!

Great following Nial. Thanks for these good steps.

Thanks Nial , will look for pyramids in the future. Cheers Brian

Thanks Nial, your a legend

Brilliant as always!

thanks

I have been using this system for a long time on the daily/4hr charts, but it is not easy moving from demo to live with this!……..had to start using a cent account to get the “live” feeling. still in progress, good to know an expert uses this it gives me more confidence!

GREAT Article. really enjoyed it.

Thanks Nial. As stated Pyramiding works fantastic on trends.

The absolute key is getting your entries right and you can profit with the big boys. I always aim at the second trade being a free trade via correct position sizing – that way i don’t loose at all if i was in profit and have entered a new trade. Its amazing what you can make with the initial risked capital over the space of days/weeks……!!!!

Cool stuff Nial

Totally agree with the concept of pyramiditation, But need to be very experienced as to when to set your new stop losses as well as the new open trades. All at all, experience is the No 1 guide at trading and in order to master each sttrategy. BUT THE MOST IMPORTANT of all is the psychology to believe in your strategy up to the end and not close them earlier than the target profit, this is the most difficult part.

After master technical analysis need to master psychology….to become a super trader :)

another good article Nial!!!!

I am quite an expert in scaling out but always felt foolish when the last portion will complete 1:4 or 1:5 risk/ reward. Pyramiding seems the smarter way to go, will try this now and see how it goes. Thanks for the easy to understand step by step write up. You rock Nial.

Great article Nial. There isn’t enough about this subject on the internet. It is quite tricky to know when to add and having a clear signal/method would be helpful. I find I’m a bit too timid at the moment but am looking to add just once early on and I think this will do the account very well. Maybe using price action or alternatively a break of a trendline on a lower timeframe.

Very nice article and many thanks for sharing.

Pyramid is very similar if not same thing as ‘reverse martingale’. It’s what the turtles did!

Great Lesson.

Valuable One. We must look to add to our armery to get the maximum out of the trade . THis lesson has shown us the ways to do that, if you could more explain about psychology, when we get stuck in that like, when we add IInd or IIIrd position, market retraces and runs close to our SL, Shall we stick to plan/ or shall we cut position and re-enter if signal occurs.

Great article.I have learnt a lot. Thanks Nial

I adopted this strategy long time ago. It is great to see that something so logic it’s been embrace here now.

thank you very much for excellent article.

Excellent

Thanks a lot Nial, it is a great article & self explanatory on pyramiding which everyone should know to become very successful in trading career. Pls post more articles like this in the future.

Good article!

Nial,

Great article.

Is it OK to increase the size of let’s say 3rd pyramid position to crank up the potential profits?

Michal

Michal,

you can pyramid in as many times as you wish, provided you are still managing risk correctly and provided the chart dynamics are correct.

Nial

Great article. I am adding this to my trading chest.

Excellent strategy Nail. Thanks for sharing

Thank you for this valuable lesson :)

Excellent article as always…!!

Thanks