How To Place A Stop Loss & Profit Target Like A Professional

Today’s article is going to give you guys a “sneak-peak” into exactly how I decide on my stop and profit target placements. I get a lot of emails asking how I decide where to place a stop or where to place a target, and while there is no one-size-fits all answer to this question, there are certain things that you should consider before entering a trade that will make determining the best stop and target placement much easier.

Today’s article is going to give you guys a “sneak-peak” into exactly how I decide on my stop and profit target placements. I get a lot of emails asking how I decide where to place a stop or where to place a target, and while there is no one-size-fits all answer to this question, there are certain things that you should consider before entering a trade that will make determining the best stop and target placement much easier.

Before we get started, let me first say that this topic of stop loss and profit target placement is really a pretty broad topic that I could write quite a lot on. Whist today’s lesson doesn’t cover every detail of stop loss and target placement, it will give you a good general overview of the most important things that go through my mind as I decide where to place my stop loss and my profit target on any one trade.

Placing stop losses

I am starting with stop loss placement for a couple of important reasons. One, you always should think about risk before reward and you should be at least two times more focused on risk per trade than you are on reward. Two, we need to determine our stop loss to then determine our position size on the trade, potential dollar loss and gain, and our R multiples. This will all become clearer as you read on if you were confused by that last sentence.

General stop loss placement theory:

When placing stops, we want to place our stop loss at a logical level, that means a level that will both tell us when our trade signal is no longer valid and that makes sense in the context of the surrounding market structure.

I like to always start with the premise that I will ‘let the market take me out’, meaning, I want the market to show me that my trade is invalid by moving to a level that nullifies the setup or changes the near-term market bias. I always look at manually closing a trade as option number 2, my first option is always to ‘set and forget’ the trade and let the market do the ‘dirty work’ without my interference. The only time I manually exit a trade before my predetermined stop gets hit is if the market shows me some convincing price action against my position. This would be a logic-based reason to manually exit a trade, rather than an emotion-based reason that most traders use to exit on.

So to recap, there are basically two logic-based methods for exiting a trade:

1) Let the market hit your predetermined stop loss which you placed as you entered the trade.

2) Exit manually because the price action has formed a signal against your position.

Exits that are emotion-based:

1) Margin call because you didn’t use a stop and the market moved so far against your position that your broker automatically closed your trade.

2) Manually closing a trade because you ‘think’ the market is going to hit your stop loss. You feel emotional because the market is moving against your position. But, there is no price action based reason to manually exit.

The purpose of a stop loss is to help you stay in a trade until the trade setup and original near-term directional bias are no longer valid. The goal of a professional trader when placing their stop loss, is to place their stop at a level that both gives the trade room to move in their favor or room to ‘breathe’, but not unnecessarily so. Basically, when you are determining the best place to put your stop loss you want to think about the closest logical level that the market would have to hit to prove your trade signal wrong. So, we don’t want to put our stop loss unnecessarily far away, but we don’t want it too close to our entry point either. We want to give the market room to breathe but also keep our stop close enough so that we get taken out of the trade as soon as possible if the market doesn’t agree with our analysis. So, you can see there is a ‘fine line’ that we need to walk when determining stop placement, and indeed I consider stop placement one of the most important aspects of placing a trade and I give each stop loss placement a lot of time and thought before I pull the trigger.

Many traders cut themselves short by placing their stop loss too close to their entry point solely because they want to trade a bigger position size. This is what I call “trading account suicide” my friends. When you place your stop too close because you want to trade a bigger position size, you are basically nullifying your trading edge, because you need to place your stop loss based on your trading signal and the surrounding market conditions, not on how much money you want to make.

If you remember only one thing from today’s lesson, let it be this: always determine your stop loss placement before determining your position size, your stop loss placement should be determined by logic, not by greed. What that means, is that you shouldn’t purposely put a small stop loss on a trade just because you want to trade a big position size. Many traders do this and it is basically like setting yourself up for a loss before the trade even starts.

Examples of placing a stop loss based on logic:

Now, let’s go through some examples of the most logical stop loss placements for some of my price action trading strategies. These stop placements are what I consider to be the ‘safest’ for the setups being discussed, that means they gave the trade the best chance of working out and that the market must move to a logical level against your position before stopping you out. Let’s take a look:

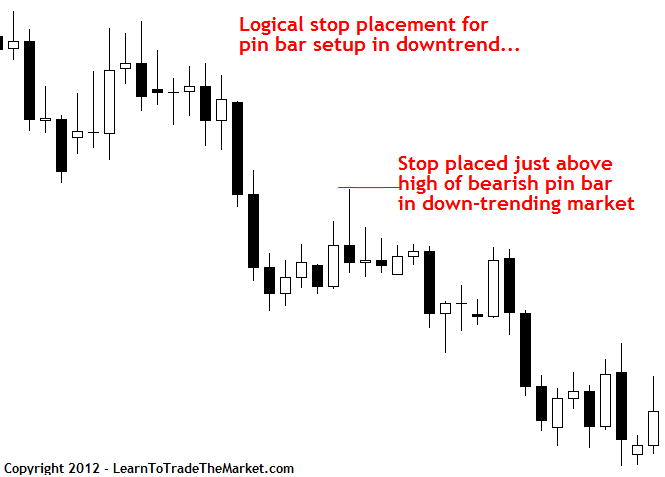

Pin bar trading strategy stop placement:

The most logical and safest place to put your stop loss on a pin bar setup is just beyond the high or low of the pin bar tail. So, in a downtrend like we see below, the stop loss would be just above the tail of the pin bar, when I say “just above” that can mean about 1 to 10 pips above the high of the pin bar tail. There are other pin bar stop loss placements discussed in my price action trading course but they are more advanced, the stop loss placement below is considered the ‘classic’ stop loss placement for a pin bar setup.

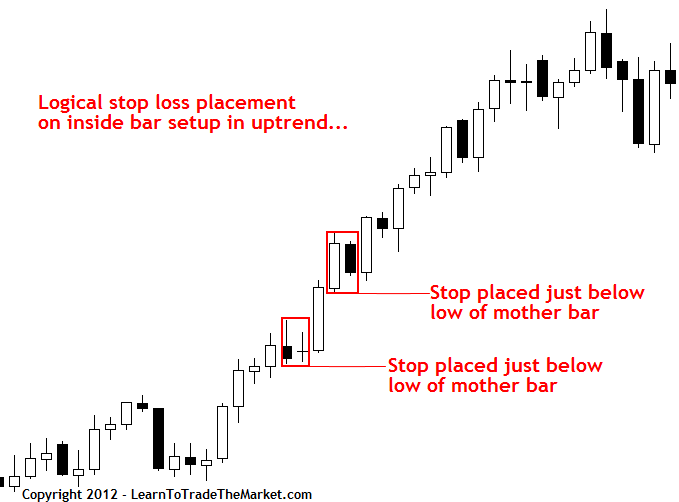

Inside bar trading strategy stop placement:

The most logical and safest place to put your stop loss on an inside bar trade setup is just beyond the mother bar high or low. If you don’t understand inside bars yet, please read this article on trading the inside bar strategy.

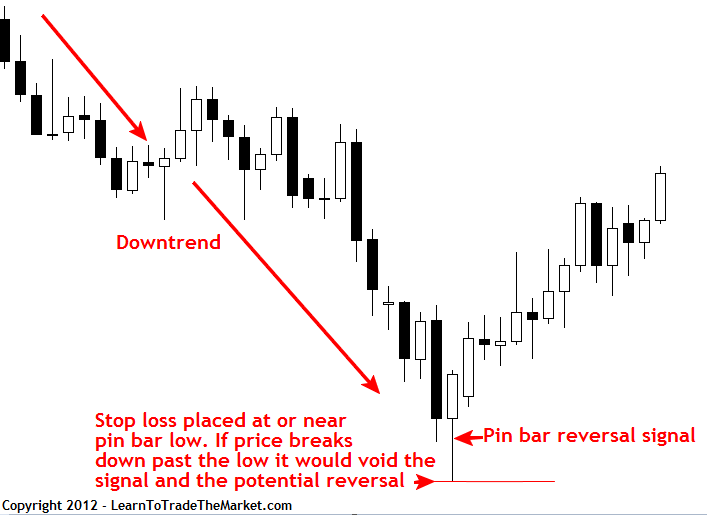

Counter-trend price action trade setup stop placement:

For a counter-trend trade setup, we want to place our stop just beyond the high or low made by the setup that signals a potential trend change. Look at the image below, we can see a downtrend was in place when we got a large bullish pin bar reversal signal. Naturally, we would want to place our stop loss just below the tail of that pin bar to make the market show us that we were wrong about a bottom being in place. This is the safest and most logical stop placement for this type of ‘bottom picking’ price action trade setup. For an uptrend reversal the stop would be placed just beyond the high of the counter-trend signal.

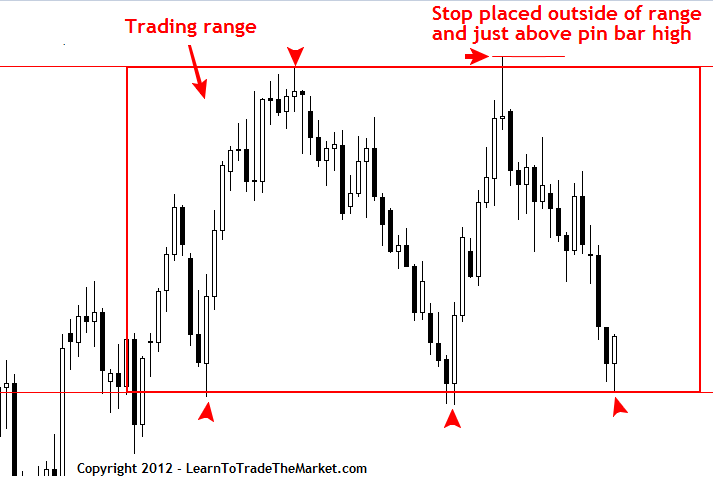

Trading range stop placement:

We often see high-probability price action setups forming at the boundary of a trading range. In situations like these, we always want to place our stop loss just above the trading range boundary or the high or low of the setup being traded…whichever is further out. For example, if we had a pin bar setup at the top of a trading range that was just slightly under the trading range resistance we would want to place our stop a little higher, just outside the resistance of the trading range, rather than just above the pin bar high. In the chart below, we didn’t have this issue; we had a nice large bearish pin bar protruding from the trading range resistance, so the best placement for the stop loss on that setup is obviously just above the pin bar high.

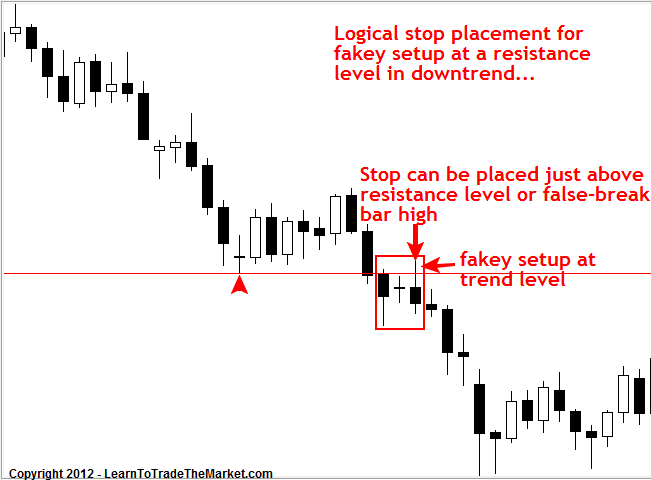

Stop placement in a trending market:

When a trending market pulls back or retraces to a level within the trend, we usually have two options. One is that we can place the stop loss just above the high or low of the pattern, as we have seen, or we can use the level and place our stop just beyond the level. We can see an example of this in the chart below with the fakey trading strategy protruding up past the resistance level in the downtrend. The most logical places for the stop would be just above the false-break high or just above the resistance level.

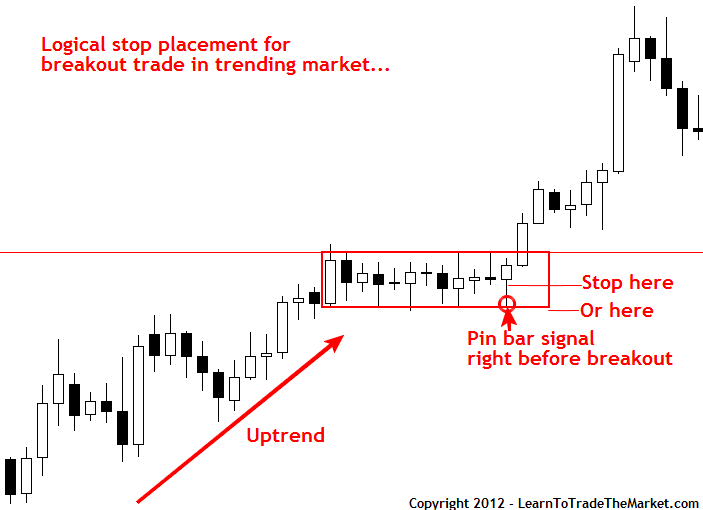

Trending market breakout play stop placement:

Often, in a trending market, we will see the market pause and consolidate in a sideways manner after the trend makes a strong move. These consolidation periods typically give rise to large breakouts in the direction of the trend, and these breakout trades can be very lucrative sometimes. There are basically two options for stop placement on a breakout trade with the trend. As we can see in the chart below, you can place your stop loss near the 50% level of the consolidation range or on the other side of the price action setup; in the example below it was a pin bar. The logic behind placing your stop loss near the 50% level of the consolidation range is that if the market comes all the way back down to that point the breakout is probably not very strong and likely to fail. This stop placement gives you a tighter stop distance which increases the potential risk reward on the trade.

Note on placing stops:

So, let’s say we have a price action trading strategy that’s very close to key level in the market. Ordinarily, the ideal stop placement for the price action setup is just above the high of the setup’s tail or the low of the setup’s tail, as we discussed above. However, since the price action setup tail high or low is very close to a key level in the market, logic would dictate that we make our stop loss a little bit larger and place it just beyond that key level, rather than at the high or low of the setup’s tail. This way, we make the market violate that key level before stopping us out, thus showing us that market sentiment has changed and that we should perhaps be looking for trades in the other direction. This is how you place your stops according to the market structure and logic, rather than from emotions like greed or fear.

Placing profit targets

Placing profit targets and exiting trades is perhaps the most technically and emotionally difficult aspect of trading. The trick is to exit a trade when you’re up a respectable profit, rather than waiting for the market to come crashing back against you and exiting out of fear. The difficulty of this is that it’s human nature to not want to exit a trade when it’s up a nice profit and moving in your favor, because it ‘feels’ like the trade will continue on in your favor and so you don’t’ want to exit at that point. The irony is that not exiting when the trade is significantly in your favor typically means you will make an emotional exit as the trade comes crashing back against your position. So, what you need to learn is that you have to take respectable profits of 1:2 risk:reward or greater when they are available, unless you have pre-determined before entering that you will try to let the trade run further.

General profit target placement theory:

After determining the most logical placement for our stop loss, our attention should then shift to finding a logical profit target placement and also to risk reward. We need to be sure a decent risk reward ratio is possible on a trade; otherwise it’s really not worth taking. Now, what I mean by that is this; you have to determine the most logical place for your stop loss, as we discussed above, and then determine the most logical place for your profit target. If after doing that, there is a decent risk reward ratio possible on the trade, it’s a trade that’s probably worth taking. However, you have to be honest with yourself here, don’t get into a game of ignoring key market levels or obvious obstacles that are in your way to achieving a decent risk reward just because you want to enter a trade.

So, what are some of the things I consider when deciding where to place my profit target? It’s really pretty simple, I am basically analyzing the overall market conditions and structure, things like support and resistance levels, major turning points in the market, bar highs and lows, etc. I try to determine if there is some key level that would make a logical profit target, or if there is some key level obstructing my trade’s path to making a decent profit.

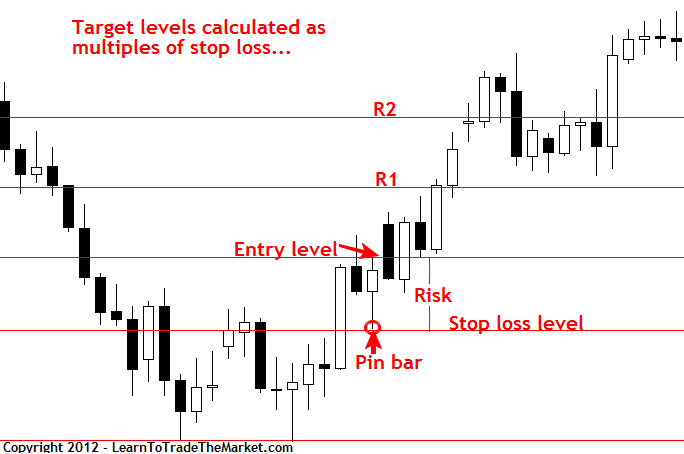

First off, let’s look at an example of how to calculate profit targets based on multiple of risk:

In the image below, we can see a pin bar setup which formed after the market began moving higher after a reversal of its previous downtrend. The stop loss was placed just below the low of the pin bar. So, at that point we have what we call 1R, or simply the dollar amount we have at risk from our entry level to the stop loss level. We can then take this 1R amount (our risk) and extended it out to find multiples of it that we can use as profit targets. If you don’t understand risk reward you should read this article on the power of risk reward, it will explain to you why it’s critical to properly utilize risk reward and to aim for risk reward ratios of 1:2 or greater.

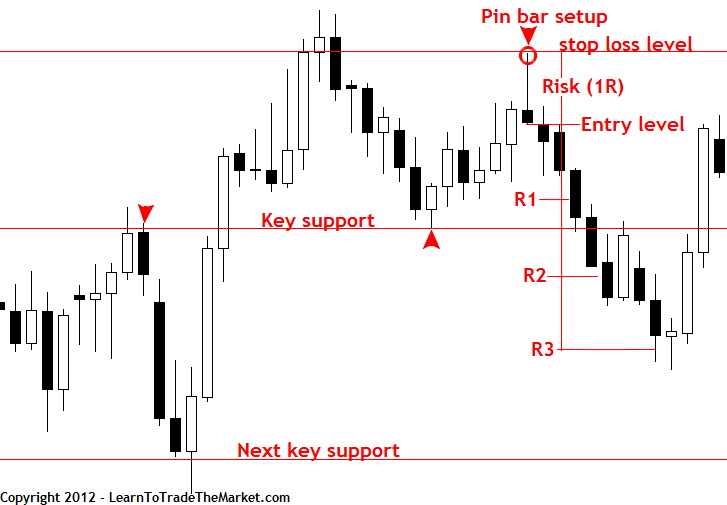

Now, let’s take this a step further and put everything we’ve learned in today’s lesson together. We are going to analyze a trade setup and discuss the stop placement on the trade, the target placement and the risk reward potential…

In the chart below, we can see an obvious pin bar reversal setup formed near a key market resistance level, indicating that a move lower was a strong possibility. The first thing I did was determine where best to place my stop loss. In this case, I elected to place it just above the pin bar high since I determined that I would no longer want to be short if the market moves up to that level.

Next, I noticed that there’s a key support a little ways down below my entry, but since the key support didn’t come in until almost 1.5 times my risk and beyond that there was no key support until much further below, I decided the trade was worth taking. Given there was a chance of a reversal after the market hit that first key support level, I pre-determined to trail my stop down to that R1 level and lock in that profit, if the market reached that level. That way I can at least make 1R whilst avoiding the potential reversal off that key support.

As it turned out, the market sailed right through the first key support and then continued moving lower to make 3R. Now, not every trade is going to work out this well, but I am trying to show you how to properly place your stop loss, calculate what your 1R risk amount is and then find the potential reward multiples of that risk whilst considering the overall surrounding market structure. The key chart levels should be used as guides for our profit targets, and if you have a key chart level coming in before the trade can reach a 1R profit, then you might want to consider not taking that trade.

When we are trying to figure out if a potential price action trade setup is worth taking, we need to work backwards to some degree. We do this by first calculating the risk and then the reward and then we take a step back and objectively view the trading setup in the context of the market structure and decide whether or not the market has a real shot at hitting our desired target(s). It’s important to remember we are doing all of this analysis and preparation prior to entering our trade, when we are objective and unemotional.

Note: There are different entry possibilities that I didn’t get into here which can affect the potential risk reward of a particular trade setup. Today’s lesson was just meant as a general guide of how to logically and effectively place stop losses and targets on select price action trade setups, I discuss different entry scenarios and more trade setups in my trading course and members’ community.

Final note:

A trader is really a business person, and each trade is a business deal. Think about Donald Trump doing a big business deal to buy a new hotel development…he is carefully weighing the risk and the reward from the deal and deciding if it’s worth taking or not. As a trader, that’s what we do too; we first consider the risk on the trade and then we consider the potential reward, how we can obtain the reward, and if it’s realistically possible to obtain it given the surrounding market structure, and then we make our final decision about the trade. Whether you have a $100 account or a $100,000 account, the process of weighing the potential risk vs. the potential reward on a trade is exactly the same, and that also goes for stop and target placement; it’s the same no matter how big or small your account is.

Our number 1 concern as traders is capital preservation. That means getting the most ‘distance’ out of our trading capital. Professional traders do not waste their trading capital, they use it only when the risk reward profile of a trade setup makes sense and is logical. We always have to justify the risk we are taking on any one trade, that’s how you should think about every trade you take; justify the money you are laying on the line, and if you can’t make a good case for risking that money given the setup and market structure, then don’t take the trade. Each trade we take needs careful planning and consideration and we never want to rush to enter a trade because it’s far better to miss an opportunity than it is to jump to a conclusion that we came to emotionally rather than logically. If you want to learn more about planning stop loss placements, profit targets and some of the other concepts discussed in today’s lesson, check out my Forex price action trading course.

Good trading, Nial Fuller

Thanks Nial Fuller!!!I learned A lot from this article. I will continue to learn from you.

Thanks Nial for this great elaboration, though what i missed was when you explained about using a trailing stop to lock in your profits when uncertain whether the mkts will reverse at a key level, does a trailing stop retain you in the market if for example the mkts continued to trend in your direction even after you have taken a profit?

Great, so what is better between wider stop loss or tighter stop loss?

HI! Nial.

my question to know why this pin bar is called “mother bar”. Which role does it play.

Thanks Nial for your great work… another educational article. You are the best

Another educational lesson in my pocket. Thank you my Mentor. Salute

Very clear and simple to understand… Thanks again Nial

Well Explained, Nial.

As saying goes, I rather Not be in a Trade that I wish I was in, than be in a Trade that I wish I was out ! Think about it.

great lesson again

well illustrated

On that 7th chart I would have entered a buy order on the long-tailed pinbar at the bottom of the chart that just penetrated support. We even got a near perfect 50% retracement the next day for an ideal entry point.

good one there Mike. i would have done the same, i always wait for a good at least 45%-50% retracement before entering my trades. That gives me a good price to enter and better stop loss placement from high volatility in the market that can get me stopped out easily. I want price to suffer before stopping me out.

Very well said and guidelines to new trader and professional.

Thanks Neil. This is an area of mastery that determines if one is to be one of the 95% forex losers or 5% forex winners. Many losers put too close their stop loss and too near their take profit positions.

Very nice article. Thank you Nial!

Thanks Nial for such a good article on logical placement of stop loss and profit targets.

thanks i enjoy the tutorial

simple and clear strategic moves in placing stop loss, illustrated. continue your great work.

Very educational Article and eye opening article …………..

Thanks… Nail

Regards,

Rizwan Suleman

Thankyou Nial

You open my eyes

I realy like this one!!!! Tnx again.

Hello Nial,

Great article, very helpful.

Excellent!

Thanks Nial, this article is great reading.

Thanks Nail.

Thanks Nial for those great articles easy comprehence and implementation.

great information nail…. i never found such a important knowledge in any other website….

I have go trough with Nail lesson..1 years..practicing demo account..I am going to start with real account. Thanks Nail..you are the best trader, honesty and willing to teach every one..

Maybe a good question for traders to ask themselves before taking each trade could be “If Donald Trump was a trader, would he pull the trigger given the risk/reward of that specific trade?”

your articles are good but iam just a beginer hoping to learn more. you are really helping me, i need more. thanks.

Thanks.

Thank you.

thousand thanks sir…….how kind of u….god bless u….

Nice lesson as always. Thank you for coaching

Thanks Nial for sharing todays lesson on risk reward and stop placement.

Thanks again Nial,

Great with those examples of how you read the charts, it really helps when trying to understand how you look at different setups.

It’s very simple and also profitable when used in the right way.

And it becomes clear for me now (finally) that it is not possible to do a few things right in FX trading, all rules must be followed to be able to be profitable, I have proof for this now :-)

Great information about stop loss and price targets.

simple and clear strategic moves in placing stop loss, illustrated. continue your great work.

Great article

good good good very good , thanks sir

I am glad I stumble upon your page. I have just finish reading the bebinners course. I enjoyed it and want ti learn more cos I wish to becone a professinal trader soonest. I am ready to give it everytrhing withing my reach. Pls do accept to be my mentor.

Hi,

One question. If you are using your set & forget strategy and the target is reached, your position will be closed as set (maybe even while you are sleeping). How and when do you decide to keep your trade open to go for R2 and further?

Greetings from Holland,

Marcel

Niall, the best article you’ve published yet

Hi Nial

Excellent article as always. Ever since you wrote about ‘R’ in one of your weekly lessons I added a rule to by trading strategy that I would move my stop to a break even level once my trade had achieved R1.

This resulted in a lot of trades being stopped out, so I have recently modified it so that I now split my trades into three parts. The first part closes out at R1, when the stops on the other two parts are moved to break-even. The second part then either gets stopped out for break-even, or goes on to achieve my target (which is set at the time my order is placed at the next obvious market structure level). The third part either gets stopped out for break-even or when it hits its trailing stop (which moves to 4 hourly swing high / low levels behind the trade level.)

So far this has delivered more positive results as often a set up will deliver R1, then retrace and from another ‘trigger’ signal (candle formation) at a similar level offering another opportunity to achieve R1 again, even if after that the market moves against the two or three valid ‘set up’ triggers

This article provides welcome confirmation that whilst I am not managing my trades from a money management perspective exactly as yourself, my method is similarly aligned

I echo all of the previous posters comments regarding thanks for your consistent dedication to providing genuine, consistent and extremely valuable trading traning and wish you, your family and all of your ‘followers’ a great weekend

best

Paul

This article is priceless , the info is instructive. Nial, you are too much!

Excellent stuff as usual. Thank you Nial.

Thanks Nial..Great post about how you place your stop loss and take profit..

This make me more clear about when should I get out from the market after make an entry.

thanks this article is of great helps

Thanks

Great methode.

Cheers

Excellent Nial, Its very easy to just listen and believe yourself. But its an eye opener when somebody else points it out!

Great article Nial, thanks for sharing your knowlegde and experience. It is always difficult for me to place a target. This article helps me a lot in trading.

No more waiting…..please…..excited by your all trading articles …..

Is it possible for you to conduct a practical “Price Action Trading Course”,in Australia.

Thanks

I love the crosswords and the detailed explanation of how to place stop loss at the right position, keep it up, nial!

Nial, Great article

Again and again, you expose your trading brain for the benefit and improvement of other traders. I really appreciate your fantastic knowledge, which you freely give. Thank you, Nial

Excellent timing – just what i needed when i needed it. Keep up the GREAT work.

Thank you Nial, good “back to basics” information here.

Very good article!

Another great lesson!

That last chart and explanation is gold. I’m sure it will improve my R.

Nial, Great article! Thanks Cherie.

nice to see that you gave so many examples.

thank you all your hard work.

Nial,

The way you present and explain yet keeping it simple, its gr8. These articles are gem to start basic understanding for a trader.

Many thanks.

Folk, it pays to read this article and the last one that Nial did “You Don’t Have To Be Right To Make Money” not just once, but over and over. Mull over it and put some real thought and what it means to you? Well done Nial as I feel that you are giving a “true” perspective on what we both know it means to be a Pro in the FX business,in a very clear and direct way, to those who are hungry and willing to put in the work.

Nial, I echo the sentiments of the previous statements; very well written and well illustrated. Nice job!

AS ALWAYS: Teaching real trading strategies and practical questions.

Thanks Nial.

Great article and well illustrated! Thanks again!

hey nial, well said!

Thanks Nial,you are “THE” man,always there when we need you to help our trading success.There is no one else on the planet like you for your support. Invaluable

Regards

Peter Miller

This info on this website from Nail is the best and most clear there is!!m Keep up the good work! ;-)

wonderful… i really like this article. Simple… miss next great contribution…

Thanks Nial, you have been an inspiration, I read all your articles

Many thanks for the article!

Good review of basic principles of R/R. It can never be stressed too much!

Great article Nial! This should be MANDATORY READING for any trader wanting to understand what it means to think and act like a professional trader!

How strange!? I had just finished reading this lesson in the archive..and was thinking how important it is..when ‘hey presto’ it appears in my inbox again just prior to NFP.!

Taking Profits from your winning trades and achieving R2 and above is something that is very important to an overall ‘winning strategy’!

Nial, absolute goldust as always. Thankyou man.

What a marvellous lesson. Niall, you have really gone to a lot of trouble here and, may I add, in your lessons over the past few weeks.

They are very much appreciated and, as I say, this one is most informative, to the point and very helpful indeed.

Thanks for your interest.

Nial

As always, really excellent material!

Many thanks.

Thanks for your article Nial. Before your article reached me I already planned this. But thanks for your article because go to know few more things about stop loss and target exit.

Regards,

Nadeem

great lesson again

Thanks Nial – great article and well illustrated